Walmart Cuts Outlook, Sees Headwinds From Exchange Rates -- Currency Comment

25 Julho 2022 - 6:44PM

Dow Jones News

By Jennifer Tershak

Walmart Inc. cut its outlook for the second quarter and year,

citing pricing actions aimed at improving inventory levels at

Walmart and Sam's Club in the U.S.

On currency and sales guidance:

"Consolidated net sales growth for the second quarter and full

year is expected to be about 7.5% and 4.5%, respectively. Excluding

divestitures, consolidated net sales growth for the full year is

expected to be about 5.5%."

"Net sales include a headwind from currency of about $1 billion

in the second quarter. Based on current exchange rates, the company

expects a $1.8 billion headwind in the second half of the

year."

On customer spending:

"The increasing levels of food and fuel inflation are affecting

how customers spend, and while we've made good progress clearing

hardline categories, apparel in Walmart U.S. is requiring more

markdown dollars. We're now anticipating more pressure on general

merchandise in the back half," said Doug McMillon, president and

CEO.

Write to Jennifer Tershak at jennifer.tershak@wsj.com

(END) Dow Jones Newswires

July 25, 2022 17:29 ET (21:29 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

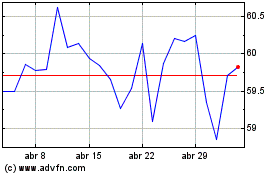

Walmart (NYSE:WMT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

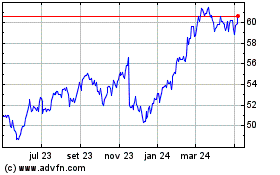

Walmart (NYSE:WMT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024