Aston Martin Lagonda Global Conducts GBP575.8 Million Rights Issue -- Update

05 Setembro 2022 - 4:17AM

Dow Jones News

By Kyle Morris

Aston Martin Lagonda Global Holdings PLC said Monday that it is

conducting a rights issue worth around 575.8 million pounds ($662.9

million), with the proceeds to be used to pay down debt and support

future growth.

The U.K. luxury-car maker said the 4-for-1 fully committed and

underwritten rights issue consists of 559 million new shares of 103

pence each, a discount of 79% to the closing price on Sept. 2.

The company said it has irrevocable commitments from Saudi

Arabia's Public Investment Fund, the Yew Tree Consortium and

Mercedes-Benz AG to take up their full entitlements, amounting to

44.7% of the issue.

The rights issue marks the final part of the around GBP653.8

million capital raised unveiled on July 15, the company said. On

July 15, it said that it would raise GBP653 million via a

discounted share placing and use the proceeds to meaningfully

deleverage the balance sheet and expedite long-term growth.

Aston Martin said the actions follow a review of the capital

requirements by the board and should support improvements in gross

margin and meaningful earnings before interest, taxes, depreciation

and amortization growth, as well as a reduction in leverage.

Write to Kyle Morris at kyle.morris@dowjones.com

(END) Dow Jones Newswires

September 05, 2022 03:02 ET (07:02 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

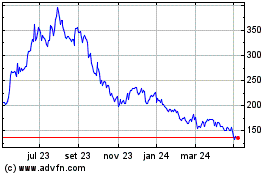

Aston Martin Lagonda Glo... (LSE:AML)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

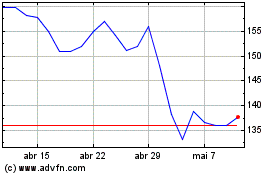

Aston Martin Lagonda Glo... (LSE:AML)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024