TotalEnergies Plans to Increase Shareholder Returns, Oil-and-Gas Production

27 Setembro 2023 - 10:41AM

Dow Jones News

By Giulia Petroni

TotalEnergies plans to boost shareholder distributions and

increase its oil-and-gas production as part of its newly released

strategy.

The French major said Wednesday that it expects to return around

44% of cash flow from operations to shareholders in the current

year and allocate $1.5 billion from divestment proceeds of Canadian

assets to share buybacks, reaching $9 billion.

It also increased the distribution guidance to more than 40% of

CFFO beyond 2023, with net investments of $16 billion-$18 billion

per year over the 2024-28 period.

TotalEnergies said it plans to grow its oil-and-gas production

by 2% to 3% a year over the next five years, mainly from liquefied

natural gas. The oil-and-gas business is expected to generate more

than $3 billion of additional underlying cash flow in 2028 compared

to 2023 levels at constant prices, it said.

In regards to its low-carbon portfolio, the company said it aims

to increase power generation to more than 100 terawatt-hours by

2030 by investing $4 billion per year. It also plans to increase

cash flow to more than $4 billion by 2028 from around $2 billion in

2023.

The company said it is building a portfolio that combines

renewables, combined-cycle power plants and storage, with the aim

to achieve a return on average capital employed of around 12%.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

September 27, 2023 09:26 ET (13:26 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

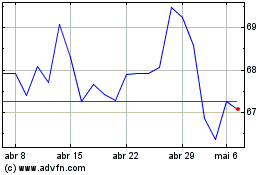

TotalEnergies (EU:TTE)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

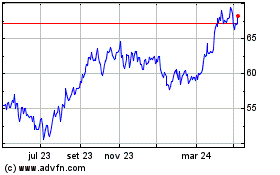

TotalEnergies (EU:TTE)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024