Moody's 3Q Net Up Sharply on Strong Rating, Research Demand

25 Outubro 2023 - 8:56AM

Dow Jones News

By Rob Curran

Moody's Corp. posted a 28% increase in third-quarter net income

amid strong demand for its bond-rating and financial research

products.

The New York credit-ratings and research firm said earnings rose

to $389 million, or $2.11 a share, for the quarter ended Sept. 30,

up from $303 million, or $1.65 a share, a year earlier. Excluding

certain items, Moody's logged third-quarter adjusted earnings of

$2.43, well above the average analyst estimate of $2.30 a share, as

tallied by FactSet.

Third-quarter revenue rose 15% to $1.47 billion, exceeding the

average analyst target of $1.46 billion, as tabulated by FactSet.

Growth was broad-based. Revenue at its Moody's Analytics research

unit rose 13% to $776 million during the three-month period.

Revenue at the Moody's Investors Service credit-ratings unit rose

18% to $696 million, as the firm experienced the strongest demand

for bank-loan ratings since early 2022.

Corporate bond issuance began to slow in 2022 in anticipation of

rising interest rates, which has made debt more expensive to

carry.

Moody's reiterated its projection for 2023 adjusted earnings and

revenue growth. The credit-ratings firm continues to expect

adjusted earnings per share between $9.75 and $10.25 on revenue

growth in the high-single-digit percent range.

Write to Rob Curran at rob.curran@wsj.com

(END) Dow Jones Newswires

October 25, 2023 07:41 ET (11:41 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

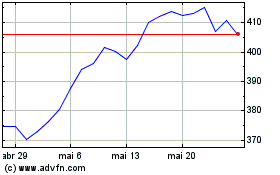

Moodys (NYSE:MCO)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Moodys (NYSE:MCO)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024