BP Profit Rose on Higher Refining Margins, Strong Oil Trading -- Update

31 Outubro 2023 - 4:55AM

Dow Jones News

By Christian Moess Laursen

BP said its third-quarter profit rose on quarter, benefiting

from higher realized refining margins and oil and gas production,

although it missed expectations.

The British oil-and-gas major said Tuesday that it made an

underlying replacement cost profit--a metric similar to net income

that U.S. oil companies report--of $3.29 billion in the three

months to the end of September, up from $2.59 billion in the

preceding quarter. This missed an averaged analysts' forecast

compiled by the company of $4.01 billion.

Boosted by a surplus cash flow of $3.11 billion, the FTSE

100-listed energy group plans to launch an additional $1.5 billion

share buyback before its fourth-quarter results, while its dividend

payout was raised to 7.27 cents from 6.006 cents a year prior.

The bulk of the trading haul came from the London-based

company's gains in its oil production and operations segment,

totaling $3.14 billion in the quarter before interest and taxes, up

from $2.78 billion in the second quarter.

Higher realized refining margins, a strong oil trading result

and higher oil and gas production also drove the gains, albeit not

enough to match the prior-year's result of $8.15 billion when high

natural-gas prices in Europe drove record profits for the world's

major energy companies.

"This has been a solid quarter supported by strong underlying

operational performance demonstrating our continued focus on

delivery," interim Chief Executive Murray Auchincloss said.

BP's net income rose on quarter to $4.89 billion from $1.79

billion.

Looking ahead, BP expects fourth-quarter oil, gas and low-carbon

energy production to be broadly flat sequentially, with

significantly lower realized refining margins.

Write to Christian Moess Laursen at christian.moess@wsj.com

(END) Dow Jones Newswires

October 31, 2023 03:40 ET (07:40 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

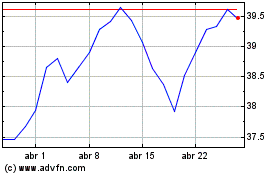

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

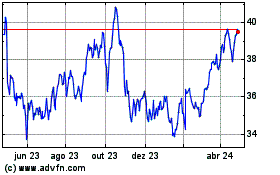

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024