Cigarette Giant BAT Sees $31.5 Billion Write-Down on US Brands

06 Dezembro 2023 - 7:37AM

Dow Jones News

By Joe Hoppe

British American Tobacco expects a one-off impairment of $31.5

billion this year due to pressure on some of its traditional

cigarette brands in the U.S., as it shifts focus to smokeless

products.

The FTSE 100 cigarette maker--which houses the Kent, Dunhill and

Lucky Strike brands among its portfolio--said macroeconomic

pressures on its traditional cigarette business performance in the

U.S. and investments in its noncombustibles business would lead to

an accounting noncash adjusting impairment charge of around GBP25

billion.

It said the adjustment mainly relates to some of its acquired

U.S. cigarette brands, and it will now assess their carrying value

and useful economic lives over an estimated period of 30 years. It

plans to start amortization of the remaining value of its U.S.

cigarette brands from January.

The brands being written down include Newport, Pall Mall, Camel

and Natural American Spirit, a company spokesperson confirmed.

The company attributed the slump in U.S. sales to economic

challenges, as some customers switched to cheaper, nonpremium

brands, and a rise in illegal disposal vapes. It said it expects

these headwinds to persist into 2024.

Global tobacco volumes are forecast to slump 3% in 2023, the

company added.

BAT said it plans to generate up to 50% of its revenue from

noncombustibles by 2035, covering products like vapes and

tobacco-free nicotine pouches, and would continue to invest in the

sector into 2024.

On the back of the strategy shift and U.S. pressures, it expects

low single-digit growth in revenue and adjusted profit from

operations on an organic basis for the upcoming year.

It then expects a progressive improvement to 3%-5% revenue

growth and mid single-digit adjusted profit from operations by

2026.

"I am confident that the choices we are making today will drive

our long-term success and deliver sustainable value for all of our

stakeholders," Chief Executive Tadeu Marroco said.

For this year, the company said it expects revenue growth at the

low end of its previously guided 3%-5% range at constant currency.

It further expects mid single-figure adjusted diluted earnings per

share growth on a constant-currency basis, including around a 2%

transactional foreign-exchange headwind.

It reported strong volume and revenue growth in new categories,

which it expects to be broadly breakeven, two years ahead of

schedule.

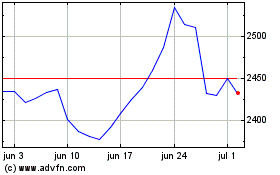

Shares at 0952 GMT were down 197.5 pence, or 7.9%, at 2,290.5

pence.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

December 06, 2023 05:22 ET (10:22 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

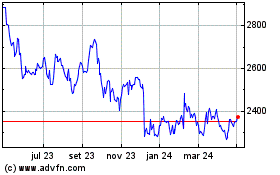

British American Tobacco (LSE:BATS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

British American Tobacco (LSE:BATS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024