Infineon Undervalued Former Chip Unit Qimonda by $1.88 Billion, Court Expert Says

09 Janeiro 2024 - 5:07AM

Dow Jones News

By David Sachs

Infineon Technologies undervalued its defunct memory-chip

business, Qimonda, by 1.72 billion euros ($1.88 billion) during its

carve-out for a public listing, the German semiconductor company

said, citing a court-appointed expert's decision in a legal dispute

spanning 14 years.

Qimonda, a memory-chip company in which Infineon owned a

majority stake, filed for insolvency in 2009, three years after its

public listing. Insolvency administrator Michael Jaffe later sued

Infineon in Munich district court, claiming that Qimonda was

entitled to a reimbursement because Infineon omitted certain

declarations during the carve-out.

Infineon said late Monday that the expert pegged Qimonda's

foreign business at minus EUR1.045 billion and its domestic

business at minus EUR72.3 million, but that the sum does not equate

to a liability for Infineon.

"The submission of the opinion represents an interim step in the

pending legal dispute," the company said. "The amount of potential

liability of Infineon depends on other aspects."

Jaffe did not immediately respond to a request for comment.

Infineon said it is unclear when a decision by the court will be

reached.

As of Sept. 30, Infineon said it has recognized EUR212 million

in provisions related to the lawsuit with Qimonda.

Write to David Sachs at david.sachs@wsj.com

(END) Dow Jones Newswires

January 09, 2024 02:52 ET (07:52 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

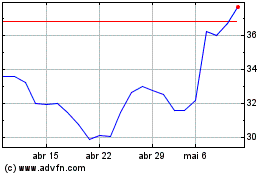

Infineon Technologies (TG:IFX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Infineon Technologies (TG:IFX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024