Report of Foreign Issuer (6-k)

03 Julho 2017 - 7:11AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2017

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

———————————————————————————————————

|

|

(Translation of registrant’s name into English)

|

|

|

Avenida República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

|

———————————————————————————————————

(Address of principal executive office)

|

|

|

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: [

x

] Form 20-F [

] Form 40-F

|

|

|

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [

]

|

|

|

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [

]

|

|

|

|

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: [

] Yes [

x

] No

|

|

|

|

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

n/a

|

|

|

Liquigás sale process

Rio de Janeiro, June 30, 2017 - Petróleo Brasileiro S.A. – Petrobras, pursuant

to the material facts of 11/17/2016 and 1/31/2017, concerning the sale process

of Liquigás Distribuidora S.A., a wholly-owned Petrobras subsidiary, to

Companhia Ultragaz S.A., a subsidiary of Ultrapar Participações S.A., informs

that the General Superintendence of the Administrative Council for Economic

Defense (CADE) published a dispatch today declaring the Act of Concentration to

be complex and ordering the execution of a few diligences.

The declaration of complexity is procedural act defined in article 56 of Law No.

12,529/2011 and in article 160 of CADE Internal Rules, which enables the

Superintendence to order the execution of complementary instruction, specifying

the diligences to be carried out, and furthermore granting the competition

authority the ability to request the extension of the deadline by up to 90 days,

thus altering the deadline for transaction analysis from 240 to 330 days.

The main diligences ordered were: (i) await for miscellaneous information

already requested that will ground the analysis by the General Superintendence

and by the CADE’s Department of Economic Studies (DEE) in the preparation of a

quantitative study on the impacts to competition arising from the transaction;

(ii) request data from cylinder manufacturers; (iii) request data from

competitors and clients on LPG as the propellant in aerosols; (iv) request the

parties to demonstrate the measures to be adopted so the alleged economic

efficiencies generated by the transaction are shared with consumers.

Petrobras will continue to collaborate with CADE in order to obtain the approval

of the transaction within the legal deadline, and keep the market informed of

any relevant decision.

In addition to the approval by CADE, the completion of the transaction is still

subject to compliance with other usual preceding conditions.

_______________________________________________________________

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investor Relations Department I e-mail:

petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro,

RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, that are subject to risks and uncertainties.

The forward-looking statements, which address the Company’s expected business

and financial performance, among other matters, contain words such as “believe,”

“expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,”

“will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions.

Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date on which they are made. There is no

assurance that the expected events, trends or results will actually occur. We

undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information or future events or for any

other reason.

The Company’s actual results could differ materially from those expressed or

forecast in any forward-looking statements as a result of a variety of

assumptions and factors. These factors include, but are not limited to, the

following: (i) failure to comply with laws or regulations, including fraudulent

activity, corruption, and bribery; (ii) the outcome of ongoing corruption

investigations and any new facts or information that may arise in relation to

the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk

management policies and procedures, including operational risk; and (iv)

litigation, such as class actions or proceedings brought by governmental and

regulatory agencies. A description of other factors can be found in the

Company’s Annual Report on Form 20-F for the year ended December 31, 2016, and

the Company’s other filings with the U.S. Securities and Exchange Commission.

SIGNATURES

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

|

|

|

|

|

Date: June 30, 2017

|

By:

|

/s/ Ivan de Souza Monteiro

|

|

|

Name:

|

Ivan de Souza Monteiro

|

|

|

Title:

|

Chief Financial Officer and Investor Relations Officer

|

|

|

|

|

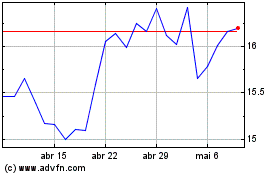

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024