UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(Rule 14d-101)

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES EXCHANGE

ACT OF 1934

ATENTO S.A.

(Name of Subject Company)

ATENTO S.A.

(Name of Person(s) Filing Statement)

Ordinary Shares, no par value

(Title of Class of Securities)

L0427L204

(CUSIP Number of Class of Securities)

Dimitrius Oliveira

Atento, S.A.

1, rue Hildegard Von Bingen, 1282, Luxembourg

Grand Duchy of Luxembourg

Email: investor_relations@atento.com

+1 (979)633-9539

(Name, Address and Telephone Number(s) of Person Authorized to Receive Notices and

Communications on Behalf of the Person(s) Filing Statement)

With a copy to:

John H. Butler

Sidley Austin LLP

787 7th Ave, NY 10019

New York, United States

(212) 839-5300

|

|

Alan G. Grinceri

Sidley Austin LLP

70 Saint Mary Axe

London, United Kingdom

+44 (20) 7360-3770 |

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

INTRODUCTION

Atento, S.A. (“Atento” or the

“Company”) is filing this Solicitation/Recommendation Statement on Schedule 14D-9 (together with any exhibits and annexes

attached hereto, this “Statement”) in connection with the tender offer by MCI Capital, LC, an Iowa limited liability company

(the “Offeror”) and a wholly owned subsidiary of MCI, LC, an Iowa limited liability company (the “Parent”), and

beneficially owned by Mark Anthony Marlowe a/k/a Anthony Marlowe (“Mr. Marlowe”) to purchase up to 1,525,000 ordinary

shares of Atento in cash at a price of $5.00 per share, without interest and less any applicable tax withholding (the “Offer Price”)

upon the terms and subject to the conditions set forth in the Offer to Purchase, dated November

18, 2022 (as may be amended or supplemented from time to time, the “Offer to Purchase”), and in the related Letter of Transmittal

(as may be amended or supplemented from time to time, the “Letter of Transmittal,” and together with the Offer to Purchase,

the “Offer”). The Offer is subject to the terms and conditions set forth in the Tender Offer Statement on Schedule TO (together

with the exhibits thereto, as amended on November 18, 2022, and as may be further amended from time to time, the “Schedule TO”),

filed by the Offeror with the Securities and Exchange Commission (the “SEC”) on November 18, 2022. According to the Offer

to Purchase, the Offer will expire at 12:00 midnight at the end of the day on December 16, 2022 (the “Expiration Date”), unless

the Offer is extended or terminated early.

If more than 1,525,000

Shares are validly tendered and not properly withdrawn prior to the expiration of the Offer, the Shares will be subject to proration as

described in the Offer to Purchase. According to the Schedule TO, the Offer is subject to numerous conditions, which include the following,

among others:

(1) the “Minimum

Condition”, there being validly tendered and not withdrawn in accordance with the terms of the Offer, 775,000 Shares, or approximately

5.0%, of the outstanding Shares;

(2) there is no law,

regulation, injunction, judgment or order by a governmental entity or court in effect that would make the Offer illegal or otherwise prohibit

the consummation of the Offer; or

(3) no change, event,

effect, occurrence or development, individually or in the aggregate, has occurred since the commencement of the Offer that has had or

would reasonably be expected to have a material adverse effect on the Company.

In addition, the

Offeror reserves the right, subject to applicable law, at any time or from time to time prior to the expiration of the Offer, in their

sole discretion, to waive or otherwise modify the terms and conditions of the Offer in any respect. The Offeror will terminate the Offer

only pursuant to the specified conditions described in the Offer to Purchase.

The Offeror’s address, as set forth

in the Offer to Purchase, is 2937 Sierra Ct. SW, Iowa City, IA 52240.

The Company does not take any

responsibility for the accuracy or completeness of any information described in this Statement contained in the Offer or the Schedule

TO.

Item 1. Subject Company Information.

Name and Address.

The

name of the subject company is Atento, S.A., a company incorporated under the laws of Luxembourg, and the address of the principal executive

office of the Company is 1, rue Hildegard Von Bingen, 1282, Luxembourg Grand Duchy of Luxembourg. The telephone number for the Company’s

principal executive office is +1 (979)633-9539.

Securities.

The title of the class of equity securities

to which this Statement relates is the Company’s ordinary shares without nominal value. As of 30 November 2022, there were outstanding

15,451,667 Shares.

Item 2. Identity and Background of Filing Person.

The name, business address and business

telephone number of Atento, which is the subject company and the person filing this Schedule 14D-9, are set forth in “Item 1. Subject

Company Information — Name and Address” above.

This Schedule 14D-9 relates to the Offer

by MCI Capital, LC to purchase up to a total of 1,525,000 of the outstanding ordinary shares, no par value per share, of Atento, which

represents approximately 9.9% of the issued and outstanding Shares of the Company as of June 30, 2022, from all holders of Shares, at

the Offer Price, as described above. The Offer is being made on the terms and subject to the conditions set forth in the Schedule TO.

Item 3. Past Contacts, Transactions, Negotiations and Agreements.

Except

as described in this Statement, on the date of the filing of this Statement, there is no material agreement, arrangement or understanding

or any actual or potential conflict of interest between the Company and its affiliates and: (i) the Company’s executive officers,

directors or affiliates; or (ii) the Offeror, its executive officers, directors or affiliates. The information set forth in the sections

in the Company’s Annual Report on Form 20-F for the year ended December 31, 2021 filed with the SEC on May 2, 2022 (the “Form

20-F”) that are titled “Item 6.A. Directors and Senior Management,” “Item 6.B. Compensation,” “Item

6.C. Board Practices,” “Item 6.E. Share Ownership,” “Item 7.A Major Shareholders” and “Item 7.B. Related

Party Transactions” and the Company’s reports on Form 6-K furnished to the SEC on May 5, 2022, June 7, 2022 (including exhibit

10.1 thereto), June 13, 2022, July 5, 2022, September 7, 2022 under the heading “Extension to lock-up agreement with main institutional

shareholders” (including exhibits 10.1, 10.2, 10.3 and 10.4 thereto), and November 30, 2022 are incorporated herein by reference.

Item 4. The Solicitation/Recommendation.

Solicitation Recommendation of the Board of Directors.

Rule 14e-2 under the Exchange Act

requires that Atento, as the subject company of the Offer, make a statement as to its position with respect to the Offer. At a meeting

held on November 25, 2022, the Board of Atento met to discuss the Offer and unanimously adopted resolutions to express no opinion and

to remain neutral toward the Offer.

The Company and the Board urge each Shareholder

to make his, her or its own decision as to whether to tender its Shares and, if so, how many Shares to tender. Each shareholder should

carefully read the Offer to Purchase, the Letter of Transmittal and other materials related to the Offer, and this Statement before making

any decision regarding tendering its Shares and make such decision based on all of the available information, including the adequacy of

the Offer Price in light of the recent market prices of the Ordinary Shares, the shareholder’s own investment objectives, investment

time horizon, diversification needs, risk tolerance, liquidity needs and individual tax circumstances, and the shareholder’s views

as to the Company’s prospects and outlook as well as the current economic, business and political climate. In making its determination

to express no opinion and to remain neutral with respect to the Offer, the Board considered that the Offer provides holders of Shares

with certain potential benefits, as well as certain potential disadvantages, as described in further detail under “Reasons for the

Recommendation” below.

Reasons for the Recommendation.

In order to analyze the Offer and make

an informed decision with respect to the Offer, the Board consulted with Atento’s senior management and external advisors in evaluating

the Offer.

As part of its evaluation and decision

process, the Board considered a number of factors, including the following:

| · | Financial and Business Information. The Board took into

account the historical and current financial condition, results of operations, business and prospects of the Company; the current geopolitical

situation; national and international economic conditions; and conditions in the markets and industries in which the Company operates

or owns interests. |

| · | Potential Future Increase in Share Value. The Board believes

that stockholders who tender their shares will forego the potential opportunity to benefit from long-term appreciation in the value of

their investment in Atento.

|

| · | Historical stock prices. The Shares are listed for trading

on NYSE under the symbol “ATTO”. On December 2, the last reported sale price of the Company’s Shares on NYSE was $5.60

per Share. The Offer price of $5.00 is below the most recent closing price of $5.60 as of the date of this Schedule 14D-9 and is -59.97%

of the last 200 days Simple Moving Average for the Company’s Shares, although there can be no assurance that at the expiration of

the Offer or the time of payment for the Shares in the Offer that the market price will still be above the Offer price or that after the

Offer expires or is terminated that the market price will remain above the Offer price. |

| · | Liquidity and Trading Volume. The Board believes that the

historically limited trading volume for the Shares on the NYSE and the corresponding liquidity challenges that a stockholder could face

in attempting to sell a significant number of Shares on the NYSE should be taken into account in evaluating the Offer. In addition, the

purchase of Shares by the Offeror pursuant to the Offer will reduce the number of Shares that might otherwise trade publicly and may reduce

the number of holders of Shares, which could in turn affect the liquidity and price volatility of the remaining Shares held by the public. |

| · | Form of Consideration. The Offer is for a fixed price per

share in cash, which the Board believes will provide price certainty and immediate liquidity for shareholders who desire liquidity without

the incurrence of any brokerage commissions. |

| |

· |

Reported Purpose of the Offer. The purpose of the Offer as stated by the Offeror is to obtain

an ownership position in the Company and not to acquire or influence control of the business of the Company, so the Board believes that

the Offer should not entail any relevant change in the Company’s control or management. That notwithstanding, the Company cannot

anticipate any future potential actions of the Offeror to increase its number of shares or change its plans with respect to the Company.

In addition to the above, the rights of a shareholder holding more than 10% of the voting rights of a company under Luxembourg law should

be considered for the purpose of evaluating potential actions that the Offeror could take if it eventually exceeds that percentage. Those

rights include, among others, the right to request convening general shareholders’ meetings and to add points to the agenda. |

Intent to Tender.

To the knowledge

of Atento, after reasonable inquiry, none of the directors, officers, affiliates or subsidiaries of the Company, to the extent they beneficially

own any Shares, currently intends to sell or tender in the Offer Shares beneficially owned by them. The intention of any Company director

to not tender Shares that they hold pursuant to the Offer is a personal investment decision based upon such director’s particular

circumstances and is not, and should not be construed as, an opinion on the Offer by the Board.

Item 5. Persons/Assets, Retained, Employed, Compensated

or Used.

The Company

has engaged Okapi Partners, LLC (“Okapi”) to provide advisory, consulting and solicitation services in connection with, among

other things, the Offer. The Company has agreed to pay customary compensation for such services. In addition,

the Company has arranged to reimburse Okapi for its reasonable out-of-pocket expenses and to indemnify it against certain liabilities

arising from or in connection with the engagement.

Except

as set forth above, neither the Company nor any person acting on its behalf has or currently intends to employ, retain or compensate any

person to make solicitations or recommendations to the security holders of the Company with respect to the Offer.

Item 6. Interest in Securities of the Subject

Company.

To the knowledge of Atento, after reasonable

inquiry, none of Atento, their respective executive officers or directors, or any majority-owned subsidiary of Atento has effected any

transaction in Shares during the past sixty (60) days.

Item 7. Purposes of the Transaction and Plans or Proposals.

The

Company routinely maintains contact with other participants in its industry regarding a wide range of business transactions. It has not

ceased, and has no intention of ceasing, such activity as a result of the Offer. The Company’s policy has been, and continues to

be, not to disclose the existence or content of any such discussions with third parties (except as may be required by law) as any such

disclosure could jeopardize any future negotiations that the Company may conduct.

Except

as set forth in this Statement, the Company is not undertaking or engaged in any negotiations in response to the Offer that relate to

or would result in (a) a tender offer for or other acquisition of the Company’s securities by the Company, any subsidiary of

the Company, or any other person; (b) any extraordinary transaction, such as a merger, reorganization, or liquidation, involving

the Company or any subsidiary of the Company; (c) any purchase, sale, or transfer of a material amount of assets of the Company or

any subsidiary of the Company; or (d) any material change in the present dividend rate or policy, indebtedness, or capitalization

of the Company.

Except

as set forth in this Statement or in the exhibits to this Statement or as incorporated in this Statement by reference, to the knowledge

of the Company, there are no transactions, resolutions of the Board, agreements in principle, or signed contracts in each case in response

to the Offer that relate to one or more of the events referred to in the preceding paragraph.

Item 8. Additional Information.

Regulatory Approvals.

Except

as set forth in this Statement and the exhibits to this Statement, the Company is not aware of any material filing, approval or other

action by or with any governmental, administrative or regulatory authority or agency that would be required for the Offeror to acquire

or own the Shares pursuant to the Offer.

Appraisal Rights.

Appraisal

rights are not available to holders of Shares in connection with the Offer.

Certain Forward-Looking Statements.

The

information contained in this Schedule 14D-9 is as of December 5, 2022. The Company is not obligated, and does not intend, to update these

forward-looking statements to reflect events or circumstances after the date of this document, except as required by law.

This

Schedule 14D-9 and the materials incorporated by reference herein includes “forward-looking” statements, which are statements

that relate to the Company’s and the Offeror’s and their respective affiliates’ future plans, earnings, objectives,

expectations and performance, potential benefits of the Offer, the parties’ ability to satisfy the conditions to the consummation of the tender

offer, as well as any facts or assumptions underlying these statements, that do not relate to historical or current fact. Actual results

may differ materially from the results expressed or implied in these forward-looking statements due to various risks, uncertainties or

other factors. These forward looking statements are generally identified by words or phrases, such as “anticipate”, “estimate”,

“plan”, “project”, “expect”, “believe”, “intend”, “foresee”, “forecast”,

“will”, “may”, “should,” “outlook,” “continue,” “intend,” “aim”

and similar words or phrases.

Risks

and uncertainties include, among other things, (a) risks related to the satisfaction or waiver of the conditions to the Offeror’s

obligation to accept for payment and pay for the Shares; (b) the failure of the proposed Offer to close for any other reason;

(c) uncertainties as to how many of the Company’s shareholders will tender their Shares; (d) the possibility that competing

offers may be made; (e) risks related to disruption of management’s attention from the Company’s ongoing business operations

due to these transactions; (f) the outcome of any legal proceedings, regulatory proceedings or enforcement matters that may

be instituted against the Company and others relating to the Offer; (g) the risk that the pendency of the proposed Offer disrupts

the Company’s current plans and operations; (h) the effect of the announcement of the proposed Offer on the Company’s

relationships with its customers, operating results and business generally; and (i) the amount of the costs, fees, expenses

and charges related to the Offer. You should consider these factors carefully in evaluating the forward-looking statements. Many of these

risks and uncertainties are beyond the Company’s control.

For

a more detailed discussion of these and other risk factors, see the Risk Factors sections of the Company’s Annual Report on Form 20-F

for the year ended December 31, 2021, filed with the SEC on May 2, 2022 and in any subsequently filed Current Reports on Form 6-K

filed by the Company with the SEC. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as

of their dates.

Item 9. Exhibits

The

following exhibits are incorporated by reference as part of this Statement:

| Exhibit No. |

|

Description |

| (e)(1) |

|

Sections entitled “Item 6.A. Directors and Senior Management,” “Item 6.B. Compensation,” “Item 6.C. Board Practices,” “Item 6.E. Share Ownership,” “Item 7.A Major Shareholders” and “Item 7.B. Related Party Transactions” of the Company’s Annual Report on Form 20-F for the year ended December 31, 2021 (incorporated herein by reference to the Form 20-F filed with the SEC on May 2, 2022). |

| (e)(2) |

|

Sections

entitled “Item 6.A.

Directors and Senior Management,” “Item 6.B. Compensation,” “Item 6.C. Board Practices,” “Item

6.E. Share Ownership,” “Item 7.A Major Shareholders” and “Item 7.B. Related Party Transactions” of

the Company's Annual Report on Form 20-F for the year ended December 31, 2021 (incorporated herein by reference to the Form 20-F

filed with the SEC on May 2, 2022) and the Company’s reports on Form 6-K furnished to the SEC on May

5, 2022, June 7,

2022 (including exhibit 10.1 thereto), June

13, 2022, July 5,

2022, September

7, 2022 under the heading “Extension to lock-up agreement with main institutional shareholders” (including exhibits

10.1, 10.2, 10.3 and 10.4 thereto), and November

30, 2022 are incorporated herein by reference. |

SIGNATURE

After reasonable inquiry and to the best of its knowledge and belief, the undersigned certifies that the information set forth in this

statement is true, complete and correct.

| |

ATENTO S.A. |

| Date: December 5, 2022 |

By: /s/ Dimitrius Oliveira

Name: Dimitrius Oliveira

Title: Chief Executive Officer |

| |

|

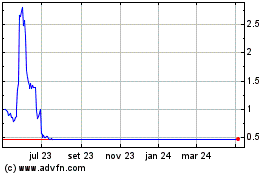

Atento (NYSE:ATTO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Atento (NYSE:ATTO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024