UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October, 2023

Commission File Number 001-36671

Atento S.A.

(Translation of Registrant's name into English)

1, rue Hildegard Von Bingen, 1282, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F: x Form 40-F: o

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

Results of 2023 Annual

General Meeting of Shareholders of the Company

Atento S.A. (the “Company”)

held its 2023 Annual General Meeting of Shareholders (the “Annual Meeting”) on October 19, 2023 at the offices of Loyens

& Loeff Luxembourg S.à r.l. at 18-20, rue Edward Steichen, L-2540 Luxembourg, Grand Duchy of Luxembourg. A total of 10,746,409

of the Company’s ordinary shares, representing approximately 73.60% of the ordinary shares outstanding and eligible to vote and

constituting a quorum, were voted at the Meeting.

The Company’s shareholders

approved each of the items submitted for approval at the Annual Meeting, as follows:

| 1. | Approval of the report with respect to the previously declared conflicts

of interests (“the Special Report”) and request of specific discharge to each Director of the Company, the Board of Directors

and the Company with respect to such declared conflicts of interests |

Decision to approve the

Special Report and grant discharge to each Director of the Company, the Board of Directors and the Company with respect to such declared

conflicts of interests.

| 2. | Approval of the audited annual accounts of the Company for the financial

year ended on December 31, 2022 (the “2022 Annual Accounts”) |

Decision to approve the

2022 Annual Accounts, consisting of the balance sheet, the profit and loss account, and the notes to the annual accounts, for the Company’s

financial year ended on December 31, 2022.

| 3. | Approval of the audit report of the Company with respect to the 2022

Annual Accounts prepared by Deloitte Audit in their capacity as independent auditor (réviseur d’entreprises agréé)

of the Company |

Decision to approve the

2022 Audit Report relating to the 2022 Annual Accounts as prepared by Deloitte Audit in its capacity as independent auditor (réviseur

d’entreprises agréé) of the Company.

| 4. | Allocation of results – decision to compensate the losses with

the profits brought forward by the Company in relation to the previous financial years and bring forward the remaining loss made by the

Company in relation to the 2022 financial year to the next financial year |

Decision to compensate

the losses in relation to the 2022 financial year, corresponding to an aggregate amount of twelve million five hundred five thousand five

hundred sixteen euros and twenty-six eurocents (EUR -12,505,516.26) with the profits brought forward by the Company in relation to previous

financial years, corresponding to an aggregate amount of nine million two hundred thirty-one thousand four hundred three euros and ninety-one

eurocents (EUR 9,231,403.91), such that the profits brought forward by the Company are reduced to zero euro (EUR 0).

Further decision to bring

forward the remaining portion of the losses made by the Company in relation to the 2022 financial year in an aggregate amount of three

million two hundred seventy-four thousand one hundred twelve euros and thirty-five eurocents (EUR -3,274,112.35) to the next financial

year.

| 5. | Discharge of the members of the Board of Directors of the Company for

all and any actions taken for the 2022 financial year |

Decision to grant full

discharge (quitus) to all the members of the Board for all actions in the performance of their duties and respective mandates in

connection with the financial year ended December 31, 2022.

| 6. | Interim discharge to the Board of Directors of the Company for all and

any actions taken for the period from 1 January 2023 to the date of this annual general meeting, such interim discharge to become final

on presentation of the next financial statements to the general meeting, save in the event of fraud or gross misconduct |

Decision to grant interim

discharge to all the members of the Board with respect to the performance of their duties and respective mandates for the period from

1 January 2023 to the date of this annual general meeting, such actions to include all and any steps taken by the board in approving or

implementing any group restructuring, such interim discharge to become automatically final on presentation of the next financial statements

to the general meeting, save in the event of fraud or gross misconduct.

| 7. | Approval of the audited consolidated accounts of the Company for the

financial year ended on December 31, 2022 (the “2022 Consolidated Accounts”) |

Decision to approve the

2022 Consolidated Accounts, consisting of the consolidated balance sheet, the consolidated profit and loss account, and the consolidated

notes to the annual accounts, for the Company’s financial year ended on December 31, 2022.

| 8. | Approval of the Management Consolidated Report in relation to the 2022

Consolidated Accounts |

Decision to approve the

2022 Management Consolidated Report.

| 9. | Approval of the Audit Report in relation to the 2022 Consolidated Accounts |

Decision to approve the

2022 Audit Report relating to the 2022 Consolidated Accounts as prepared by Deloitte Audit in its capacity as independent auditor (réviseur

d’entreprises agréé) of the Company.

| 10. | Discharge of auditor of the Company |

Decision to grant full

discharge (quitus) to Deloitte Audit for the performance of its mandate of independent auditor (réviseur d’entreprises

agréé) of the Company for, and in connection with, the financial year ended on December 31, 2022.

| 11. | Renewal of the mandate of Deloitte Audit, as independent auditor (réviseur

d’entreprises agréé) of the Company |

Decision to renew the

mandate of Deloitte Audit, as independent auditor (réviseur d’entreprises agréé) of the Company, until

the annual general meeting to be held in 2025.

| 12. | Renewal of the mandate of Mr. John Madden, as class III director of the

Company |

Decision to renew, with

immediate effect, of the mandate of Mr. John Madden, as class III director of the Company, until the annual general meeting to be held

in 2026.

| 13. | Acknowledgement of the resignation, with effect as of August 7, 2023,

of Mr. Roberto Rittes de Oliveira Silva, as class III director of the Company, the resignation Mr. Camargo Antenor, as class II director

of the Company with effect as of 7 march 2023 and the early termination of Mr. Carlos López-Abadía as class II director

of the Company with effect as of 1 December 2022 and approval, confirmation and, to the extent necessary, ratification of (i) (a) the

co-optation, with effect as of May 16, 2023, of Mr. Mark Nelson-Smith as class II director of the Company as adopted by the Board during

its meeting held on May 16, 2023 and (b) his appointment for a period expiring at annual general meeting to be held in 2025, and (ii)

(a) the co-optation, with effect as of 30 November 2022, of Mr. Dimitrius Rogerio De Oliveira, as class II director of the Company as adopted

by the Board during its meeting held on November 30, 2022 and (b) his appointment for a period expiring at the annual general meeting

to be held in 2025 |

Decision to acknowledge

the resignation, with effect as of August 7, 2023, of Mr. Roberto Rittes de Oliveira Silva, as class III director of the Company, the

resignation Mr. Camargo Antenor, as class II director of the Company with effect as of 7 march 2023 and the early termination of Mr. Carlos

López-Abadía as class II director of the Company with effect as of 1 December 2022 and approval, confirmation and, to the

extent necessary, ratification of (i) (a) the co-optation, with effect as of May 16, 2023, of Mr. Mark Nelson-Smith as class II director

of the Company as adopted by the Board during its meeting held on May 16, 2023 and (b) his appointment for a period expiring at annual

general meeting to be held in 2025, and (ii) (a) the co-optation, with effect as of 30 November 2022, of Mr. Dimitrius Rogerio De Oliveira,

as class II director of the Company as adopted by the Board during its meeting held on November 30, 2022 and (b) his appointment for a

period expiring at the annual general meeting to be held in 2025.

| 14. | Approval of the 2023 annual aggregate maximum amount of the remuneration

of the members of the Board in their capacity as such |

Decision for an indefinite

term as long as the Company’s general meeting of shareholders does not approve anything to the contrary, to fix the maximum global

amount of Board members’ remuneration for the year ending December 31, 2023 in their capacity as such at five hundred forty six

thousand two hundred twenty four US Dollars (US$ 546.224) of which one hundred and ninety one thousand and two US Dollars (US$ 191.002)

will be paid in cash, and three hundred fifty five thousand two hundred twenty two US Dollars (US$ 355.222) will correspond to equity

compensation, granted pursuant to the existing incentive plan of the Company or subsequent incentive plans of the Company, as may be disclosed

from time to time by the Company.

Decision to authorize

and empower any director of the Company, as well as any employee of Alter Domus, Ms. Virginia Beltramini Trapero, Mr Sergio Ricardo Ribeiro

Passos and Ms. Estibaliz Medina Urturi (each of them, an Authorised Signatory), each acting individually and severally, on behalf of the

Company, to file the 2022 Annual Accounts and 2022 Consolidated Accounts with the Luxembourg Register of Commerce and Companies (R.C.S.

Luxembourg), as well as to execute, deliver and perform any action or formality (including, but not limited to, any filings) deemed necessary

or useful in relation to the implementation and filing as required of the above resolutions, notably, but not only, in connection with

the Renewals, the Resignation[s], the Confirmations, and the accounts’ approvals (including, but not limited to, the filing of any

tax returns in relation to the 2022 Annual Accounts and 2022 Consolidated Accounts).

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: October 20, 2023 |

ATENTO S.A.

By: /s/ Dimitrius Oliveira

Name: Dimitrius Oliveira

Title: Chief Executive Officer |

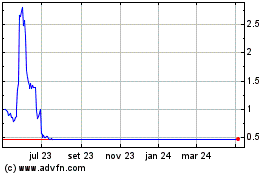

Atento (NYSE:ATTO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Atento (NYSE:ATTO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024