Current Report Filing (8-k)

16 Fevereiro 2023 - 7:29PM

Edgar (US Regulatory)

false000091591300009159132023-02-162023-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM 8-K

_________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 16, 2023

_________________________________

ALBEMARLE CORPORATION

(Exact name of registrant as specified in charter)

_________________________________

| | | | | | | | | | | | | | |

| Virginia | | 001-12658 | | 54-1692118 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

4250 Congress Street, Suite 900

Charlotte, North Carolina 28209

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (980) 299-5700

Not applicable

(Former name or former address, if changed since last report.)

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a- 12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| COMMON STOCK, $.01 Par Value | | ALB | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

In the first quarter of 2023, we realigned our Lithium and Bromine global business units into a new corporate structure designed to better meet customer needs and foster talent required to deliver in a competitive global environment. The realignment was completed in the first quarter of 2023, and resulted in the following three reportable segments: (1) Energy Storage; (2) Specialties; and (3) Ketjen (formerly known as Catalysts).

The new reporting structure is consistent with the manner in which information is presently used internally by the Company’s chief operating decision maker to evaluate performance and make resource allocation decisions. Each segment has a dedicated team of sales, research and development, process engineering, manufacturing and sourcing, and business strategy personnel and has full accountability for improving execution through greater asset and market focus, agility and responsiveness.

The Company is furnishing this Current Report on Form 8-K to reflect certain historical annual and quarterly segment information for the two year period ending December 31, 2022, corresponding with the Company’s new reporting structure. A copy of this information is being furnished as Exhibit 99.1 hereto. The changes in reporting structure discussed above affect the manner in which the results of the Company’s reportable segments were previously reported. This Current Report on Form 8-K does not reclassify or restate the Company’s previously reported consolidated financial statements for any period. It should be noted that Adjusted EBITDA is a financial measure that is not required by, or presented in accordance with, accounting principles generally accepted in the United States (“GAAP”). These measures are presented here to provide additional useful measurements to review our operations, provide transparency to investors and enable period-to-period comparability of financial performance. A reconciliation of these non-GAAP financial measures to the most directly comparable financial measures calculated and reported in accordance with GAAP, is also included in this Current Report on Form 8-K. Additionally, the information presented in this Current Report on Form 8-K does not reflect events occurring after the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and should be read in conjunction with the Company’s previously filed Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and the Company’s subsequent filings with the Securities and Exchange Commission.

The information in this Current Report on Form 8-K, including Exhibit 99.1, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | |

| Number | | Exhibit |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | ALBEMARLE CORPORATION |

| | | | |

| Date: | February 16, 2023 | | By: | /s/ Scott A. Tozier |

| | | | Scott A. Tozier |

| | | | Executive Vice President and Chief Financial Officer |

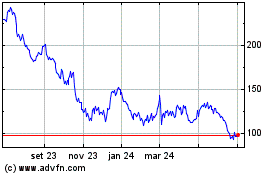

Albemarle (NYSE:ALB)

Gráfico Histórico do Ativo

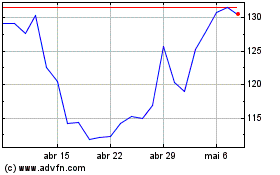

De Abr 2024 até Mai 2024

Albemarle (NYSE:ALB)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024