Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

06 Março 2024 - 8:12AM

Edgar (US Regulatory)

|

|

|

| Pricing Term Sheet |

|

Free Writing Prospectus |

| dated as of March 5, 2024 |

|

Filed pursuant to Rule 433 |

|

|

Relating to the |

|

|

Preliminary Prospectus Supplement dated March 4, 2024 to the |

|

|

Prospectus dated March 4, 2024 |

|

|

Registration No. 333-269815 |

Albemarle Corporation

Offering of

40,000,000

Depositary Shares (the “Depositary Shares”)

Each Representing a 1/20th Interest in a Share of

7.25% Series A Mandatory Convertible Preferred Stock

(the “Depositary Shares Offering”)

The information in this pricing term sheet relates only to the Depositary Shares Offering and should be read together with (i) the preliminary

prospectus supplement dated March 4, 2024 relating to the Depositary Shares Offering (the “Preliminary Prospectus Supplement”), including the documents incorporated by reference therein and (ii) the related

base prospectus dated March 4, 2024, each filed pursuant to Rule 424(b) under the Securities Act of 1933, as amended, Registration No. 333-269815. Terms not defined in this pricing term sheet have

the meanings given to such terms in the Preliminary Prospectus Supplement. All references to dollar amounts are references to U.S. dollars. Albemarle Corporation has increased the size of the Depositary Shares Offering to 40,000,000 Depositary

Shares (or 46,000,000 Depositary Shares if the underwriters of the Depositary Shares Offering exercise their over-allotment option in full). The final prospectus supplement relating to the Depositary Shares Offering will reflect conforming changes

relating to such increase in the size of the Depositary Shares Offering.

|

|

|

| Issuer: |

|

Albemarle Corporation |

|

|

| Ticker / Exchange for Common Stock: |

|

ALB / New York Stock Exchange (“NYSE”) |

|

|

| Trade Date: |

|

March 6, 2024 |

|

|

| Settlement Date: |

|

March 8, 2024 |

|

|

| Use of Proceeds: |

|

The Issuer expects that the net proceeds from the Depositary Shares Offering will be approximately $1.94 billion (or approximately $2.24 billion if the underwriters of the Depositary Shares Offering exercise their

over-allotment option in full), after deducting the underwriting discount and estimated offering expenses payable by the Issuer. The Issuer intends to use the proceeds from the Depositary Shares Offering for general corporate purposes, which may

include, among other uses, funding growth capital expenditures, such as the construction and expansion of lithium operations in Australia and China that are significantly progressed or near completion, and repaying the Issuer’s outstanding

commercial paper. See “Use of Proceeds” in the Preliminary Prospectus Supplement. |

|

|

| Depositary Shares Offered: |

|

40,000,000 Depositary Shares, each of which represents a 1/20th interest in a share of the Issuer’s 7.25% Series A Mandatory Convertible Preferred Stock (the “Mandatory Convertible Preferred Stock”). At

settlement of the Depositary Shares Offering, the Issuer will issue 2,000,000 shares of Mandatory Convertible Preferred Stock, subject to the underwriters’ over-allotment option. |

|

|

|

|

|

|

|

|

| Option for Underwriters to Purchase Additional Depositary Shares: |

|

6,000,000 additional Depositary Shares (corresponding to 300,000 additional shares of the Mandatory Convertible Preferred Stock), solely to cover over-allotments. |

|

|

| Public Offering Price: |

|

$50 per Depositary Share |

|

|

| Dividends: |

|

7.25% of the liquidation preference of $1,000 per share of the Mandatory Convertible Preferred Stock per year. Dividends will accumulate from

the Settlement Date and, to the extent that the Issuer is legally permitted to pay dividends and its board of directors, or an authorized committee thereof, declares a dividend payable with respect to the Mandatory Convertible Preferred Stock, the

Issuer will pay such dividends in cash or, subject to certain limitations, by delivery of shares of the Issuer’s common stock, par value $0.01 per share (the “Common Stock”) or through any combination of cash and shares of

Common Stock, as determined by the Issuer’s board of directors, or an authorized committee thereof, in its sole discretion; provided that any unpaid dividends will continue to accumulate.

The expected dividend payable on the first Dividend Payment Date is approximately $17.12

per share of Mandatory Convertible Preferred Stock (equivalent to approximately $0.856 per Depositary Share). Each subsequent dividend is expected to be $18.125 per share of Mandatory Convertible Preferred Stock (equivalent to $0.90625 per

Depositary Share). |

|

|

| Dividend Record Dates: |

|

The February 15, May 15, August 15 and November 15 immediately preceding the relevant Dividend Payment Date. |

|

|

| Dividend Payment Dates: |

|

March 1, June 1, September 1 and December 1 of each year, commencing on, and including, June 1, 2024 and ending on, and including, March 1, 2027. |

|

|

| Mandatory Conversion Date: |

|

The second business day immediately following the last trading day of the 20 consecutive trading day period beginning on, and including, the 21st scheduled trading day immediately preceding March 1, 2027. |

|

|

| Initial Price: |

|

Equal to $1,000, divided by the Maximum Conversion Rate, rounded to the nearest $0.0001, which initially is $109.4092. |

|

|

| Threshold Appreciation Price: |

|

Equal to $1,000, divided by the Minimum Conversion Rate, rounded to the nearest $0.0001, which initially is $131.2680 and represents a premium of approximately 20% over the Initial Price. |

|

|

| Floor Price: |

|

$38.29 (approximately 35% of the Initial Price), subject to adjustment as described in the Preliminary Prospectus Supplement. |

|

|

| Conversion Rate per Share of Mandatory Convertible Preferred Stock: |

|

The conversion rate for each share of Mandatory Convertible Preferred Stock will not be more than 9.1400 shares of Common Stock and not less than 7.6180 shares of Common Stock (respectively, the “Maximum Conversion

Rate” and “Minimum Conversion Rate”), depending on the applicable market value (as defined in the Preliminary Prospectus Supplement) of the Common Stock, as described below and subject to certain anti-dilution adjustments.

Correspondingly, the conversion rate per Depositary Share will be not more than 0.4570 shares of Common Stock and not less than 0.3809 shares of Common Stock. |

|

|

|

|

The following table illustrates the conversion rate per share of the Mandatory Convertible Preferred Stock, subject to certain anti-dilution adjustments described in the Preliminary Prospectus Supplement, based on the applicable

market value of the Common Stock: |

2

|

|

|

| Applicable Market Value of

the Common Stock |

|

Conversion Rate per Share of

Mandatory Convertible

Preferred Stock |

| Greater than the Threshold Appreciation Price

Equal to or less than the Threshold Appreciation

Price but greater than or equal to the Initial Price

Less than the Initial Price |

|

7.6180 shares of Common Stock

Between 7.6180 and 9.1400 shares of Common Stock, determined by dividing $1,000 by the

applicable market value 9.1400 shares of Common Stock |

|

|

|

|

|

The following table illustrates the conversion rate per Depositary Share, subject to certain anti-dilution adjustments described in the Preliminary Prospectus Supplement, based on the applicable market value of the Common

Stock: |

|

|

|

| Applicable Market Value of

the Common Stock |

|

Conversion Rate per

Depositary Share |

| Greater than the Threshold Appreciation Price

Equal to or less than the Threshold Appreciation

Price but greater than or equal to the Initial Price

Less than the Initial Price |

|

0.3809 shares of Common Stock

Between 0.3809 and 0.4570 shares of Common Stock, determined by dividing $50 by the

applicable market value 0.4570 shares of Common Stock |

|

|

|

| Optional Conversion: |

|

Other than during a fundamental change conversion period (as defined in the Preliminary Prospectus Supplement), at any time prior to March 1, 2027, a holder of Mandatory Convertible Preferred Stock may elect to convert such

holder’s shares of Mandatory Convertible Preferred Stock, in whole or in part, at the Minimum Conversion Rate of 7.6180 shares of Common Stock per share of Mandatory Convertible Preferred Stock (equivalent to 0.3809 shares of Common Stock per

Depositary Share), subject to adjustment as described in the Preliminary Prospectus Supplement. Because each Depositary Share represents a 1/20th fractional interest in a share of Mandatory Convertible Preferred Stock, a holder of Depositary Shares

may convert its Depositary Shares only in lots of 20 Depositary Shares. |

3

|

|

|

| Fundamental Change: |

|

If a fundamental change (as defined in the Preliminary Prospectus Supplement) occurs on or prior to March 1, 2027, holders of the

Mandatory Convertible Preferred Stock will have the right to convert their shares of Mandatory Convertible Preferred Stock, in whole or in part, into shares of Common Stock at the fundamental change conversion rate (as defined in the Preliminary

Prospectus Supplement) during the period beginning on, and including, the effective date (as defined in the Preliminary Prospectus Supplement) of such fundamental change and ending on, and including, the earlier of (a) the date that is 20

calendar days after such effective date (or, if later, the date that is 20 calendar days after holders receive notice of such fundamental change) and (b) March 1, 2027. For the avoidance of doubt, the period described in the immediately

preceding sentence may not end on a date that is later than March 1, 2027. The

following table sets forth the fundamental change conversion rate per share of Mandatory Convertible Preferred Stock based on the effective date of the fundamental change and the stock price (as defined in the Preliminary Prospectus Supplement) in

the fundamental change: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Stock Price |

|

| Effective Date |

|

$30.00 |

|

|

$45.00 |

|

|

$60.00 |

|

|

$75.00 |

|

|

$90.00 |

|

|

$105.00 |

|

|

$109.41 |

|

|

$120.00 |

|

|

$131.27 |

|

|

$140.00 |

|

|

$160.00 |

|

|

$180.00 |

|

|

$200.00 |

|

|

$220.00 |

|

| March 8, 2024 |

|

|

7.4620 |

|

|

|

7.6780 |

|

|

|

7.6860 |

|

|

|

7.6460 |

|

|

|

7.5980 |

|

|

|

7.5560 |

|

|

|

7.5460 |

|

|

|

7.5213 |

|

|

|

7.5000 |

|

|

|

7.4880 |

|

|

|

7.4640 |

|

|

|

7.4480 |

|

|

|

7.4360 |

|

|

|

7.4300 |

|

| March 1, 2025 |

|

|

8.0320 |

|

|

|

8.1600 |

|

|

|

8.1020 |

|

|

|

7.9980 |

|

|

|

7.8920 |

|

|

|

7.8000 |

|

|

|

7.7760 |

|

|

|

7.7253 |

|

|

|

7.6820 |

|

|

|

7.6520 |

|

|

|

7.5980 |

|

|

|

7.5620 |

|

|

|

7.5380 |

|

|

|

7.5200 |

|

| March 1, 2026 |

|

|

8.6060 |

|

|

|

8.6980 |

|

|

|

8.6240 |

|

|

|

8.4660 |

|

|

|

8.2820 |

|

|

|

8.1100 |

|

|

|

8.0660 |

|

|

|

7.9673 |

|

|

|

7.8780 |

|

|

|

7.8220 |

|

|

|

7.7220 |

|

|

|

7.6560 |

|

|

|

7.6140 |

|

|

|

7.5880 |

|

| March 1, 2027 |

|

|

9.1400 |

|

|

|

9.1400 |

|

|

|

9.1400 |

|

|

|

9.1400 |

|

|

|

9.1400 |

|

|

|

9.1400 |

|

|

|

9.1400 |

|

|

|

8.3333 |

|

|

|

7.6180 |

|

|

|

7.6180 |

|

|

|

7.6180 |

|

|

|

7.6180 |

|

|

|

7.6180 |

|

|

|

7.6180 |

|

|

|

|

|

|

The exact stock price and effective date may not be set forth on the table, in which case:

• if the stock price is

between two stock prices on the table or the effective date is between two effective dates on the table, the fundamental change conversion rate per share of Mandatory Convertible Preferred Stock will be determined by straight-line interpolation

between the fundamental change conversion rates per share of Mandatory Convertible Preferred Stock set forth for the higher and lower stock prices and the earlier and later effective dates, as applicable, based on a

365-day or 366-day year, as applicable;

• if the stock price is in excess of $220.00 per share (subject to adjustment in the same

manner as the stock prices in the column headings of the table above as described in the Preliminary Prospectus Supplement), then the fundamental change conversion rate per share of Mandatory Convertible Preferred Stock will be the Minimum

Conversion Rate; and

• if the stock price is less than $30.00 per share (subject to adjustment in the same manner

as the stock prices in the column headings of the table above as described in the Preliminary Prospectus Supplement), then the fundamental change conversion rate per share of Mandatory Convertible Preferred Stock will be the Maximum Conversion

Rate. |

|

|

|

|

The following table sets forth the fundamental change conversion rate per Depositary Share based on the effective date of the fundamental change and the stock price in the fundamental change: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Stock Price |

|

| Effective Date |

|

$30.00 |

|

|

$45.00 |

|

|

$60.00 |

|

|

$75.00 |

|

|

$90.00 |

|

|

$105.00 |

|

|

$109.41 |

|

|

$120.00 |

|

|

$131.27 |

|

|

$140.00 |

|

|

$160.00 |

|

|

$180.00 |

|

|

$200.00 |

|

|

$220.00 |

|

| March 8, 2024 |

|

|

0.3731 |

|

|

|

0.3839 |

|

|

|

0.3843 |

|

|

|

0.3823 |

|

|

|

0.3799 |

|

|

|

0.3778 |

|

|

|

0.3773 |

|

|

|

0.3761 |

|

|

|

0.3750 |

|

|

|

0.3744 |

|

|

|

0.3732 |

|

|

|

0.3724 |

|

|

|

0.3718 |

|

|

|

0.3715 |

|

| March 1, 2025 |

|

|

0.4016 |

|

|

|

0.4080 |

|

|

|

0.4051 |

|

|

|

0.3999 |

|

|

|

0.3946 |

|

|

|

0.3900 |

|

|

|

0.3888 |

|

|

|

0.3863 |

|

|

|

0.3841 |

|

|

|

0.3826 |

|

|

|

0.3799 |

|

|

|

0.3781 |

|

|

|

0.3769 |

|

|

|

0.3760 |

|

| March 1, 2026 |

|

|

0.4303 |

|

|

|

0.4349 |

|

|

|

0.4312 |

|

|

|

0.4233 |

|

|

|

0.4141 |

|

|

|

0.4055 |

|

|

|

0.4033 |

|

|

|

0.3984 |

|

|

|

0.3939 |

|

|

|

0.3911 |

|

|

|

0.3861 |

|

|

|

0.3828 |

|

|

|

0.3807 |

|

|

|

0.3794 |

|

| March 1, 2027 |

|

|

0.4570 |

|

|

|

0.4570 |

|

|

|

0.4570 |

|

|

|

0.4570 |

|

|

|

0.4570 |

|

|

|

0.4570 |

|

|

|

0.4570 |

|

|

|

0.4167 |

|

|

|

0.3809 |

|

|

|

0.3809 |

|

|

|

0.3809 |

|

|

|

0.3809 |

|

|

|

0.3809 |

|

|

|

0.3809 |

|

4

|

|

|

|

|

The exact stock price and effective date may not be set forth on the table, in which case:

• if the stock price is

between two stock prices on the table or the effective date is between two effective dates on the table, the fundamental change conversion rate per Depositary Share will be determined by straight-line interpolation between the fundamental change

conversion rates per Depositary Share set forth for the higher and lower stock prices and the earlier and later effective dates, as applicable, based on a 365-day or

366-day year, as applicable;

• if the stock price is in excess of $220.00 per share (subject to adjustment in the same

manner as the stock prices in the column headings of the table above as described in the Preliminary Prospectus Supplement), then the fundamental change conversion rate per Depositary Share will be the Minimum Conversion Rate, divided by 20;

and • if the stock

price is less than $30.00 per share (subject to adjustment in the same manner as the stock prices in the column headings of the table above as described in the Preliminary Prospectus Supplement), then the fundamental change conversion rate per

Depositary Share will be the Maximum Conversion Rate, divided by 20. |

|

|

|

|

Because each Depositary Share represents a 1/20th fractional interest in a share of Mandatory Convertible Preferred Stock, a holder of Depositary Shares may convert its Depositary Shares upon the occurrence of a fundamental change

only in lots of 20 Depositary Shares. |

|

|

| Discount Rate for Purposes of Fundamental Change Dividend Make-Whole Amount: |

|

The discount rate for purposes of determining the fundamental change dividend make-whole amount (as defined in the Preliminary Prospectus Supplement) is 7.5% per annum. |

|

|

| Listing: |

|

The Issuer intends to apply to list the Depositary Shares on the NYSE under the symbol “ALB PR A.” No assurance can be given that the Depositary Shares will be listed or that any such application for listing will be

approved. |

|

|

| CUSIP / ISIN for the Depositary Shares: |

|

012653 200 / US0126532003 |

|

|

| CUSIP / ISIN for the Mandatory Convertible Preferred Stock: |

|

012653 309 / US0126533092 |

|

|

| Book-Running Managers: |

|

J.P. Morgan Securities LLC BofA Securities,

Inc. |

|

|

| Bookrunners: |

|

HSBC Securities (USA) Inc. Mizuho Securities

USA LLC Santander US Capital Markets LLC Jefferies LLC

Truist Securities, Inc. |

|

|

| Co-Managers: |

|

Goldman Sachs & Co. LLC MUFG

Securities Americas Inc. U.S. Bancorp Investments, Inc. Loop

Capital Markets LLC Siebert Williams Shank & Co., LLC (acting on behalf of Northern Trust) |

5

The Issuer has filed a registration statement, as amended by Post-Effective Amendment No. 1 (including a prospectus and related preliminary prospectus

supplement) with the U.S. Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the Preliminary Prospectus Supplement, the related base prospectus in that

registration statement and the other documents the Issuer has filed with the SEC for more complete information about the Issuer and the Depositary Shares Offering. You may get these documents for free by visiting EDGAR on the SEC’s website at

http://www.sec.gov. Alternatively, copies may be obtained from (i) J.P. Morgan Securities LLC, Attention: Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, telephone: 1-866-803-9204, or (ii) BofA Securities, Inc., Attn: Prospectus Department, NC1-022-02-25, 201 North Tryon Street, Charlotte, NC 28255-0001, email: dg.prospectus_requests@bofa.com.

This communication should be read in conjunction with the Preliminary Prospectus Supplement and the related base prospectus. The information in this

communication supersedes the information in the Preliminary Prospectus Supplement and the related base prospectus to the extent it is inconsistent with the information in such preliminary prospectus supplement or the related base prospectus.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER

NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

6

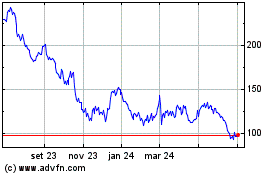

Albemarle (NYSE:ALB)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

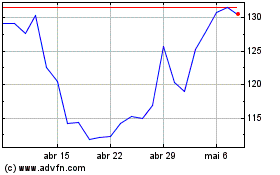

Albemarle (NYSE:ALB)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024