false000146715400014671542023-07-212023-07-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 21, 2023

_____________________

Novan, Inc.

(Exact name of registrant as specified in its charter)

_____________________

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Delaware | | 001-37880 | | 20-4427682 | |

| (State or other jurisdiction of

incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) | |

4020 Stirrup Creek Drive, Suite 110, Durham, North Carolina 27703

(Address of principal executive offices) (Zip Code)

(919) 485-8080

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value | NOVNQ1 | The Nasdaq Stock Market LLC |

(1) On July 26, 2023, our common stock was suspended from trading on the Nasdaq Capital Market (“Nasdaq”). Our common stock is expected to begin trading on the over-the-counter (“OTC”) market under the symbol “NOVNQ.”

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

As previously disclosed, on July 17, 2023, Novan, Inc. (the “Company”) filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). The case is being administered under the caption In re: Novan, Inc. et al, Case No. 23-10937 (the “Chapter 11 Case”).

As previously disclosed, on July 17, 2023 prior to the filing of the Chapter 11 Case, (i) the Company and EPI Health entered into a “stalking horse” asset purchase agreement (the “Purchase Agreement”) with Ligand Pharmaceuticals Incorporated (“Ligand”) to sell substantially all of the assets of the Company and its subsidiaries, and (ii) the Company, EPI Health and Ligan entered into a superpriority debtor-in-possession loan and security agreement (the “DIP Loan Agreement”), pursuant to which, Ligand agreed to provide the Company with a secured superpriority debtor-in-possession credit facility in an aggregate principal amount of up to $15,000,000, subject to the terms and conditions set forth therein.

The Purchase Agreement and the DIP Loan Agreement set forth certain milestones in connection with the Chapter 11 Case, and provide that amounts under the DIP Loan Agreement may be made available from time to time up to $2,500,000 (the “Interim Loans”) prior to entry of the final order by the Bankruptcy Court related to the DIP Loan Agreement. On July 21, 2023, the parties amended the Purchase Agreement and the DIP Loan Agreement (the “Amendments”) to extend certain milestones to accommodate the Bankruptcy Court’s hearing calendar and to increase the potential amount of Interim Loans up to $3,500,000.

The Amendments contain customary representations and warranties of the parties and was subject to a number of closing conditions, including, among others, (i) the accuracy of representations and warranties of the parties and (ii) the absence of any Default or Event of Default (as defined in the DIP Loan Agreement).

Additional Information on the Chapter 11 Case

Additional information about the Chapter 11 Case, including access to Bankruptcy Court documents, is available online at www.kccllc.net/novan. The documents and other information available via website or elsewhere are not part of this Form 8-K and shall not be deemed incorporated therein.

Cautionary Information Regarding Trading in the Company’s Securities

The Company cautions that trading in the Company’s securities (including, without limitation, the Company’s common stock) during the pendency of the Chapter 11 Case is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s securities in the Chapter 11 Case. As currently contemplated under the Purchase Agreement, stockholders will not receive any payment or other distribution, and any payment or distribution to stockholders would be dependent on the results of the sale process. The Company expects that holders of shares of the Company’s common stock could experience a significant or complete loss on their investment, depending on the outcome of the Chapter 11 Case. Accordingly, the Company urges extreme caution with respect to existing and future investments in its common stock.

Cautionary Statement Regarding Forward-Looking Statements

This Form 8-K includes statements that are, or may be deemed, “forward-looking statements.” In some cases, these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or, in each case, their negative or other variations thereon or comparable terminology, although not all forward-looking statements contain these words. These forward-looking statements reflect the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity and the development of the industry in which we operate may differ materially from the forward-looking statements contained herein. Any forward-looking statements that we make in this Form 8-K speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this Form 8-K or to reflect the occurrence of unanticipated events. The Company’s forward-looking statements in this Form 8-K include, but are not limited to, statements about the Company’s plans to pursue a sale of the business or assets pursuant to chapter 11 of the U.S. Bankruptcy Code and the timing and structure of any such sales and ability to satisfy closing conditions; the Company’s intention to continue operations during the Chapter 11 Case; the Company’s belief that the sale process will be in the best interest of the Company and its stakeholders; and other statements regarding the Company’s strategy and future operations, performance and prospects among others. These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects. There can be no assurance that future developments affecting the Company will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the Company’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the risks associated with the potential adverse impact of the Chapter 11 filings on the Company’s results of operations; changes in the Company’s ability to meet its financial obligations during the Chapter 11 process, to comply with the terms of the Purchase Agreement and the DIP Loan Agreement (each, as amended) and to maintain contracts that are critical to its operations; the outcome and timing of the Chapter 11 process and any potential asset sale; the effect of the Chapter 11 filings and any potential asset sale on the Company’s relationships with vendors, regulatory authorities, employees and other third parties; possible proceedings that may be brought by third parties in connection with the Chapter 11 process or the potential asset sale; and uncertainty regarding obtaining Bankruptcy Court approval of a sale of the Company’s assets or other conditions to the potential asset sale, including the bidding procedures agreed by the parties.

Item 9.01. Financial Statements and Exhibits.

EXHIBIT INDEX

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | Novan, Inc. |

| | | |

Date: July 26, 2023 | | | | By: | | /s/ John M. Gay |

| | | | | | John M. Gay |

| | | | | | Chief Financial Officer |

v3.23.2

Cover

|

Jul. 21, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 21, 2023

|

| Entity Registrant Name |

Novan, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37880

|

| Entity Tax Identification Number |

20-4427682

|

| Entity Address, Address Line One |

4020 Stirrup Creek Drive, Suite 110

|

| Entity Address, City or Town |

Durham

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27703

|

| City Area Code |

919

|

| Local Phone Number |

485-8080

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

NOVNQ1

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001467154

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

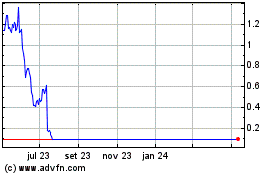

Novan (NASDAQ:NOVN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Novan (NASDAQ:NOVN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024