false000146715400014671542023-08-182023-08-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 18, 2023

_____________________

Novan, Inc.

(Exact name of registrant as specified in its charter)

_____________________

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Delaware | | 001-37880 | | 20-4427682 | |

| (State or other jurisdiction of

incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) | |

4020 Stirrup Creek Drive, Suite 110, Durham, North Carolina 27703

(Address of principal executive offices) (Zip Code)

(919) 485-8080

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value | NOVNQ | NONE |

(1) Novan, Inc. Common Stock began trading exclusively on the over-the-counter (“OTC”) market on July 26, 2023 under the symbol “NOVNQ.”

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

As previously disclosed, on July 17, 2023, Novan, Inc. (the “Company”) and its wholly owned subsidiary, EPI Health, LLC (“EPI Health” and together with the Company, the “Debtors”) filed voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). The case is being administered under the caption In re: Novan, Inc. et al, Case No. 23-10937 (the “Chapter 11 Case”).

As previously disclosed, on July 17, 2023 prior to the filing of the Chapter 11 Case, (i) the Company and EPI Health entered into a “stalking horse” asset purchase agreement (as subsequently amended, the “Purchase Agreement”) with Ligand Pharmaceuticals Incorporated (“Ligand”) to sell substantially all of the assets of the Debtors, and (ii) the Company, EPI Health and Ligand entered into a superpriority debtor-in-possession loan and security agreement (as subsequently amended, the “DIP Loan Agreement”), pursuant to which, Ligand agreed to provide the Debtors with a secured superpriority debtor-in-possession credit facility in an aggregate principal amount of up to $15,000,000, subject to the terms and conditions set forth therein.

On August 21, 2023, Ligand and the Debtors amended the Purchase Agreement and the DIP Loan Agreement (the “Amendments”) to reflect the outcome of negotiations between Ligand, the Debtors and other interested parties in the Chapter 11 Case, including certain changes to the bidding procedures set forth in the Purchase Agreement and the DIP Loan Agreement and certain changes to the “purchased assets” and “excluded assets” under the Purchase Agreement. The Amendments contain customary representations and warranties of the parties and were subject to a number of closing conditions, including, among others, (i) the accuracy of representations and warranties of the parties and (ii) the absence of any Default or Event of Default (as defined in the DIP Loan Agreement).

The foregoing description of the Amendments does not purport to be complete and is qualified in its entirety by reference to the Amendments, copies of which are filed as Exhibits 10.1 and 10.2 hereto and are incorporated by reference herein.

Item 1.02. Termination of a Material Definitive Agreement.

EPI Health, with the approval of the Bankruptcy Court, exercised its right to terminate its Factoring Agreement dated December 1, 2023 (the "Factoring Agreement") with CSNK Working Capital Finance Corp. d/b/a Bay View Funding ("Bay View Funding"), pursuant to which EPI Health previously sold accounts receivable with recourse. In connection with the termination of the Factoring Agreement, that certain Continuing Guaranty Agreement, effective December 1, 2022, by and among Bay View Funding and the Company was also terminated. Such terminations were effective following an order being issued by the Bankruptcy Court on August 18, 2023.

Item 7.01. Regulation FD Disclosure.

On August 21, 2023, each of the Debtors filed with the Bankruptcy Court its monthly operating report for the month ended July 31, 2023 (the “Monthly Operating Reports”). The Monthly Operating Reports are attached hereto as Exhibit 99.1 and Exhibit 99.2 and are incorporated herein by reference. This Current Report on Form 8-K (including the exhibits hereto) will not be deemed an admission as to the materiality of any information required to be disclosed solely by Regulation FD. The Monthly Operating Reports and other filings with the Bankruptcy Court related to the Chapter 11 Case may be available electronically at www.kccllc.net/novan. The documents and other information available via website or elsewhere are not part of this Form 8-K and shall not be deemed incorporated herein.

The information contained in this Item 7.01 and in Exhibit 99.1 and Exhibit 99.2 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

Cautionary Statement Regarding the Monthly Operating Reports

The Company cautions investors and potential investors not to place undue reliance upon the information contained in the Monthly Operating Reports, which were not prepared for the purpose of providing the basis for an investment decision relating to any of the securities of the Company. The Monthly Operating Reports are limited in scope, cover a limited time period and have been prepared solely for the purpose of complying with the monthly reporting requirements of the Bankruptcy Court. The Monthly Operating Reports were not audited or reviewed by independent accountants, were not prepared in accordance with generally accepted accounting principles in the United States, are in a format prescribed by applicable bankruptcy laws or rules and are subject to future adjustment and reconciliation. There can be no assurance that, from the perspective of an investor or potential investor in the Company’s securities, the Monthly Operating Reports are complete. The Monthly Operating Reports also contain information for periods which are shorter or otherwise different from those required in the Company’s reports pursuant to the Exchange Act, and such information might not be indicative of the Company’s financial condition or operating results for the period that would be reflected in the Company’s financial statements or in its reports pursuant to the Exchange Act. Results set forth in the Monthly Operating Reports should not be viewed as indicative of future results.

Cautionary Information Regarding Trading in the Company’s Securities

The Company cautions that trading in the Company’s securities (including, without limitation, the Company’s common stock) during the pendency of the Chapter 11 Case is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s securities in the Chapter 11 Case. As currently contemplated under the Purchase Agreement, stockholders will not receive any payment or other distribution, and any payment or distribution to stockholders would be dependent on the results of the sale process. The Company expects that holders of shares of the Company’s common stock could experience a significant or complete loss on their investment, depending on the outcome of the Chapter 11 Case. Accordingly, the Company urges extreme caution with respect to existing and future investments in its common stock.

Cautionary Statement Regarding Forward-Looking Statements

This Form 8-K includes statements that are, or may be deemed, “forward-looking statements.” In some cases, these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or, in each case, their negative or other variations thereon or comparable terminology, although not all forward-looking statements contain these words. These forward-looking statements reflect the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to significant risks, uncertainties and assumptions that are difficult to predict and could cause actual results to differ materially and adversely from those expressed or implied in the forward-looking statements. The Company’s forward-looking statements in this Form 8-K include, but are not limited to, statements about the Company’s ability to obtain court approval from the Bankruptcy Court with respect to motions or other requests made to the Bankruptcy Court throughout the course of the Chapter 11 Case; the risks associated with the potential adverse impact of the Chapter 11 filings on the Company’s results of operations; changes in the Company’s ability to meet its financial obligations during the Chapter 11 process, to comply with the terms of the Purchase Agreement and the DIP Loan Agreement (each, as amended) and to maintain contracts that are critical to its operations; the outcome and timing of the Chapter 11 process and any potential asset sale; the effect of the Chapter 11 filings and any potential asset sale on the Company’s relationships with vendors, regulatory authorities, employees and other third parties; possible proceedings that may be brought by third parties in connection with the Chapter 11 process or the potential asset sale; uncertainty regarding obtaining Bankruptcy Court approval of a sale of the Company’s assets or other conditions to the potential asset sale; the Company’s ability to retain senior management and other key personnel; the impact and timing of cost reduction initiatives and other cost savings measures; and the delisting of the Company’s Common Stock from Nasdaq and quotation of the Common Stock on the over-the-counter market. Forward-looking statements are also subject to the risk factors and cautionary language described from time to time in the reports the Company files with the SEC, including in the Company’s most recent Annual Report on Form 10-K for the year ended December 31, 2022 and any updates thereto in the Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These risks and uncertainties may cause actual future results to be materially different than those expressed in such forward-looking statements. Any forward-looking statements that we make in this Form 8-K speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this Form 8-K or to reflect the occurrence of unanticipated events.

Item 9.01. Financial Statements and Exhibits.

EXHIBIT INDEX

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| |

| 10.1 | | |

| 10.2 | | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | Novan, Inc. |

| | | |

Date: August 24, 2023 | | | | By: | | /s/ John M. Gay |

| | | | | | John M. Gay |

| | | | | | Chief Financial Officer |

Exhibit 10.1

Execution Version

AMENDMENT NO. 2 TO ASSET PURCHASE AGREEMENT

This Amendment No. 2 to Asset Purchase Agreement (this “Amendment”) is made and entered into effective as of August 21, 2023 (the “Effective Date”) by and among Novan, Inc., a Delaware corporation (“Novan”), EPI Health, LLC, a South Carolina limited liability company (“EPI Health” and, together with Novan, “Sellers”), and Ligand Pharmaceuticals Incorporated, a Delaware corporation (together with its permitted successors, designees and assigns, “Buyer”). Buyer and Sellers are individually referred to herein as a “Party” and collectively as the “Parties”.

WHEREAS, pursuant to that certain Asset Purchase Agreement, dated as of July 17, 2023, by and among Buyer and Sellers (as amended by that Amendment No. 1, dated as of July 21, 2023, the “Purchase Agreement”), Buyer shall at the Closing acquire the Purchased Assets from Sellers and assume the Assumed Liabilities from Sellers, subject to the terms and conditions and for the consideration set forth in the Purchase Agreement; and

WHEREAS, pursuant to Section 9.5 of the Purchase Agreement, the Parties desire to amend the Purchase Agreement on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the foregoing recitals and the agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties hereby agree as follows:

1.Amendments to Purchase Agreement.

a.Definition of “Bid”. The definition of “Bid” set forth in Article I of the Purchase Agreement is hereby amended and restated in its entirety as follows:

“ “Bid” means, collectively, the Commercial Business Assets Bid and the Development Assets Bid. Buyer shall not reallocate any of the initial amounts offered in the Commercial Business Assets Bid to the initial amounts offered for the Development Assets Bid or vice versa, but for the avoidance of doubt, Buyer may increase the amount of the Commercial Business Assets Bid and/or the Development Assets Bid in subsequent bidding at Auction or otherwise with incremental consideration above the Buyer’s aggregate $15 million Purchase Price.”

b.Definition of “Commercial Business Assets Bid”. The following definition is hereby added to Article I of the Purchase Agreement:

“ “Commercial Business Assets Bid” means a bid to purchase the Commercial Business Assets by the Buyer equal to $3,000,000, which is subject to payment (a) by offset, on a dollar-for-dollar basis, against all outstanding Obligations (as defined in the DIP Facility) under the DIP Facility, and (b) with cash in the amount of the difference between $3,000,000 and all outstanding Obligations (as defined in the DIP Facility) under the DIP Facility.”

c.Definition of “Development Assets Bid”. The following definition is hereby added to Article I of the Purchase Agreement:

“ “Development Assets Bid” means a bid to purchase the Development Assets by the Buyer equal to $12,000,000, which is subject to payment (a) by offset, on a dollar-for-dollar basis, against all outstanding Obligations (as defined in the DIP Facility) under the DIP Facility, and (b) with cash in the amount of the difference between $12,000,000 and all outstanding Obligations (as defined in the DIP Facility) under the DIP Facility.”

d.Definition of “EPI Causes of Action”. The following definition is hereby added to Article I of the Purchase Agreement:

“EPI Causes of Action” means, collectively, any claims, causes of action, demands, actions, suits, obligations, liabilities, cross-claims, counterclaims, defenses, offsets, or setoffs of any kind or character whatsoever, in each case whether known or unknown, contingent or noncontingent, matured or unmatured, suspected or unsuspected, foreseen or unforeseen, direct or indirect, choate or inchoate, existing or hereafter arising, under statute, in contract, in tort, in law, or in equity, or pursuant to any other theory of law, federal or state, whether asserted or assertable directly or derivatively in law or equity or otherwise by way of claim, counterclaim, cross-claim, third party action, action for indemnity or contribution or otherwise, in each case to the extent owned by EPI Health, other than the Purchased Avoidance Actions.”

e.Definition of “Ligand Royalty Agreement”. The following definition is hereby added to Article I of the Purchase Agreement:

“ “Ligand Royalty Agreement” means that certain Development Funding and Royalties Agreement, dated as of May 4, 2019 (as amended from time to time), to which Buyer and Novan are each a party.”

f.Definition of “Permitted Liens”. The definition of “Permitted Liens” set forth in Article I of the Purchase Agreement is hereby amended and restated in its entirety as follows:

“ “Permitted Liens” means (a) Liens for Taxes which are (i) being contested in good faith by appropriate proceedings or (ii) not due and payable as of the Closing Date and which shall be prorated or released at Closing, and, in each case of clauses (i) and (ii), for which adequate reserves have been made on the Financial Statements in accordance with GAAP and which shall be prorated or otherwise released at Closing; (b) mechanics liens and similar liens for labor, materials or supplies provided with respect to real property incurred in the Ordinary Course of Business which are being contested in good faith by appropriate proceedings for which adequate reserves have been made on the Financial Statements in accordance with GAAP and which shall be prorated or otherwise released at Closing; (c) with respect to real property, zoning, building codes and other land use Laws regulating the use or occupancy of such real property or the activities conducted thereon which are imposed by any Governmental Entity having jurisdiction over such real property which are not violated by the current use or occupancy of such real property or the operation of the business of the Sellers, except where any such violation would not, individually or in the aggregate, materially impair the use, operation or transfer of the affected property or the conduct of the business of the Sellers thereon as it is currently being conducted; (d) easements, covenants, conditions, restrictions and other similar matters affecting title to real property and other encroachments and title and survey defects that do not or would not materially impair value or the use or occupancy of such real property or materially interfere with the operation of the business of the Sellers at such real property; (e) with respect to Leasehold Improvements, any reversion or similar rights to the landlord or other third party upon expiration or termination of the applicable Lease; (f) any Liens held by Buyer pursuant to the Royalty Agreements and (g) any Liens associated with or arising in connection with any Assumed Liabilities.”

g.Definition of “Qualified Bid”. The definition of “Qualified Bid” set forth in Article I of the Purchase Agreement is hereby amended and restated in its entirety as follows:

“ “Qualified Bid” means competing bids qualified for the Auction in accordance with the Sale Procedures Order. For the avoidance of doubt, any bid for the Development Assets that does not include an express assumption and assignment of the Ligand Royalty Agreement, without modification, shall not be deemed a Qualified Bid for the Development Assets.”

h.Definition of “Purchased Avoidance Actions”. The definition of “Purchased Avoidance Actions” set forth in Article I of the Purchase Agreement is hereby amended and restated in its entirety as follows:

“ “Purchased Avoidance Actions” means all causes of action, lawsuits, claims, rights of recovery and other similar rights of any Seller, including avoidance claims or causes of action under Chapter 5 of the Bankruptcy Code relating to the business of the Sellers or the Purchased Assets, provided that Purchased Avoidance Actions shall not include: any causes of action, lawsuits, claims, rights of recovery and other similar rights of any against the Sellers’ Insiders; causes of action, lawsuits, claims, rights of recovery and other similar rights of any related to the Sellers’ acquisition of EPI Health in 2022; and causes of action, lawsuits, claims, rights of recovery and other similar rights of any EPI Causes of Action.”

i.Definition of “Reedy Creek Royalty Agreement”. The following definition is hereby added to Article I of the Purchase Agreement:

“ “Reedy Creek Royalty Agreement” means that certain Royalty and Milestone Payments Purchase Agreement, dated as of April 29, 2019, by and between Novan and Reedy Creek Investments LLC.”

j.Definition of “Royalty Agreement”. The definition of “Royalty Agreement” set forth in Article I of the Purchase Agreement is hereby deleted in its entirety, and replaced with the following definition:

“ “Royalty Agreements” means, collectively, the Ligand Royalty Agreement and the Reedy Creek Royalty Agreement.”

k.Section 2.1(l). Section 2.1(l) of the Purchase Agreement is hereby amended and restated in its entirety as follows:

“ (l) all other rights of Sellers against third parties (including suppliers, vendors, merchants, distributors, manufacturers and counterparties to leases, licensees, licensors or of any Seller arising under or related to any Assumed Contract, other Purchased Asset or Assumed Liability), including causes of action, claims, counterclaims, defenses, credits, rebates (including any vendor or supplier rebates), demands, allowances, refunds, rebates, credits, allowances, Proceedings, rights of set off, rights of recovery, rights of subrogation, rights of recoupment, rights under or with respect to express or implied guarantees, warranties, representations, covenants or indemnities made by such third parties or other similar rights, in each case at any time or in any manner arising or existing, whether choate or inchoate, known or unknown, now existing or

hereafter acquired, contingent or noncontingent, including the Purchased Avoidance Actions, but excluding (i) the EPI Causes of Action and (ii) the proceeds of all directors’ and officers’ liability insurance policies of the Sellers, including any tail insurance policies and rights of the directors and officers thereunder for coverage (i.e., advance of expenses and liability coverage with respect to claims made against such offices and directors);”

(k) Section 8.3. Section 8.3 of the Purchase Agreement and the definition of “Breakup Fee” are hereby deleted and replaced with “[Reserved].”

2.Miscellaneous.

a.Full Force and Effect; No Waiver. The Purchase Agreement shall remain in full force and effect, as amended by the terms of this Amendment, and is hereby ratified by the Parties. Nothing contained in this Amendment shall be deemed to be a waiver of any provisions of the Purchase Agreement, the Related Agreements or the DIP Loan Documents or cure any breaches or defaults under the Purchase Agreement, the Related Agreements or the DIP Loan Documents.

b.Representations and Warranties.

i.Each Party represents and warrants to the other Parties that (i) the execution, delivery and performance of this Amendment has been duly authorized by such Party and no other corporate or limited liability company action, as applicable, on the part of such Party is necessary to authorize this Amendment and (ii) this Amendment has been duly and validly executed and delivered by such Party, and constitutes a valid and legally binding obligation of such Party, enforceable in accordance with its terms and conditions, subject to applicable bankruptcy, insolvency, moratorium or other similar Laws relating to creditors’ rights and general principles of equity.

ii.Sellers hereby represent and warrant to Buyer, jointly and severally, that neither the execution and delivery of this Amendment, nor the consummation of the transactions contemplated hereby, (i) will conflict with or result in a breach of the certificate of incorporation, certificate of formation, bylaws, operating agreement or other organizational documents of any Seller, (ii) will result in the material violation of any Law to which any Seller is, or its respective assets or properties are, subject, (iii) subject to the entry of the Sale Order, will conflict in any material respect with any Assumed Contract or Assumed Permit, or (iv) subject to and assuming entry of the Sale Order, will conflict in any material respect with, or result in any material violation of or constitute a material breach or default under, any Order of any Governmental Entity applicable to the Sellers or any of the Purchased Assets.

iii.Buyer hereby represents and warrants to Sellers that neither the execution and delivery of this Amendment, nor the consummation of the transactions contemplated hereby, will (i) conflict with or result in a breach of the certificate of incorporation, bylaws, or other organizational documents, of Buyer, (ii) subject to any consents required to be obtained from any Governmental Entity, violate any Law to which Buyer is, or its assets or properties are subject, or (iii) conflict with, result in a breach of, constitute a default under, result in the acceleration of, create in any party the right to accelerate, terminate, modify or cancel any Contract to which Buyer is a party or by which it is bound, except, in the case of either clause (ii) or (iii), for such conflicts, breaches, defaults, accelerations or rights as would not, individually or in the aggregate, reasonably be expected to prevent, materially delay or materially impair to the ability of Buyer to consummate the transactions contemplated by this Amendment. Buyer is not required to give any notice to, make any filing with, or obtain any authorization, consent or approval of any Governmental Entity in order for the Parties to consummate the transactions contemplated by this Amendment, except where the failure to give notice, file or obtain such authorization, consent or approval would not, individually or in the aggregate, reasonably be expected to prevent, materially delay or materially impair to the ability of Buyer to consummate the transactions contemplated by this Amendment.

c. Capitalized Terms. Capitalized terms used but not defined herein (including capitalized terms used in the recitals hereto) shall have the meanings ascribed to them in the Purchase Agreement. Upon and following the Effective Date all applicable defined terms referencing the Purchase Agreement in each of the Purchase Agreement, the Related Agreements and the DIP Loan Documents shall mean the Purchase Agreement, as amended by this Amendment.

d. Binding. This Amendment shall be binding upon and inure to the benefit of the Parties and their respective successors and permitted assigns.

e. Entire Agreement. The Purchase Agreement (including the schedules and exhibits thereto and other documents specifically referred to therein), as amended by this Amendment, and the Related Agreements constitute the entire agreement among the Parties and supersede any prior understandings, agreements or representations (whether written or oral) by or among the Parties, written or oral, with respect to the subject matter hereof.

f. Counterparts. This Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

g. Governing Law. This Amendment shall in all aspects be governed by and construed in accordance with the internal Laws of the State of Delaware without giving effect to any choice or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause the application of the Laws of any jurisdiction other than the State of Delaware, and the obligations, rights and remedies of the Parties shall be determined in accordance with such Laws.

[Signature Page Follows]

SIGNATURE PAGE TO

AMENDMENT NO. 2 TO ASSET PURCHASE AGREEMENT

IN WITNESS WHEREOF, the Parties hereto have executed this Amendment as of the date first above written.

SELLERS:

NOVAN, INC.

By: /s/ Paula Brown Stafford

Name: Paula Brown Stafford

Title: President and CEO

EPI HEALTH, LLC

By: /s/ Paula Brown Stafford

Name: Paula Brown Stafford

Title: CEO

[Signature Page to Amendment No. 2 to Asset Purchase Agreement]

SIGNATURE PAGE TO

AMENDMENT NO. 2 TO ASSET PURCHASE AGREEMENT

IN WITNESS WHEREOF, the Parties hereto have executed this Amendment as of the date first above written.

BUYER:

LIGAND PHARMACEUTICALS

INCORPORATED

By: /s/ Matthew Korenberg

Name: Matthew Korenberg

Title: President and Chief Operating Officer

[Signature Page to Amendment No. 2 to Asset Purchase Agreement]

Exhibit 10.2

Execution Version

OMNIBUS AMENDMENT NO. 1 TO FEE LETTER AND AMENDMENT NO. 2

TO SUPERPRIORITY DEBTOR IN POSSESSION LOAN AND SECURITY AGREEMENT

This OMNIBUS AMENDMENT NO. 1 TO FEE LETTER AND AMENDMENT NO. 2 TO SUPERPRIORITY DEBTOR IN POSSESSION LOAN AND SECURITY AGREEMENT, dated as of August 21, 2023 (this “Amendment”), is by and among NOVAN, INC., a Delaware corporation, EPI HEALTH, LLC, a South Carolina limited liability company (“EPI” and, together with Novan, each, a “Borrower” and collectively, the “Borrowers”), LIGAND PHARMACEUTICALS, INCORPORATED, a Delaware corporation (together with its successors and assigns, “Lender”). For purposes of this Amendment, all terms used herein which are not otherwise defined herein, including but not limited to those terms used in the recitals hereto, shall have the respective meanings assigned thereto in the Amended Loan Agreement (as defined below).

WHEREAS, Lender and the Borrowers have entered into financing arrangements pursuant to which Lender has made and shall make Loans and provide other financial accommodations to the Borrowers as set forth in (i) the Superpriority Debtor in Possession Loan and Security Agreement, dated as of July 17, 2023 (as amended by that certain Amendment No. 1 to Superpriority Debtor in Possession Loan and Security Agreement, dated as of July 21, 2023, and as in effect prior to the effectiveness of this Amendment, the “Loan Agreement”, and as the same is further amended by this Amendment and as may be further amended, restated, supplemented or otherwise modified from time to time, the “Amended Loan Agreement”), by and among Lender and the Borrowers, (ii) the Fee Letter, dated as of July 17, 2023, by and among the Borrowers and Lender (the “Fee Letter”, as the same is further amended by this Amendment and as may be further amended, restated, supplemented or otherwise modified from time to time, the “Amended Fee Letter”) and (iii) the other Loan Documents, including, without limitation, this Amendment; and

WHEREAS, to accommodate the Bankruptcy Court’s hearing calendar and the scheduling of a hearing on August 21, 2023 to consider entry of the Final DIP Order, the parties to the Loan Agreement have agreed to amend certain provisions of the Loan Agreement, as provided more fully herein.

NOW THEREFORE, in consideration of the foregoing premises and the mutual agreements and covenants contained in the Loan Agreement and herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

Section 1. Amendments to the Loan Agreement. Effective as of the Amendment No. 2 Effective Date (as defined below), the Loan Agreement shall be amended as follows:

1.01. The following defined terms and their corresponding definitions are hereby added to Section 1.1 of the Loan Agreement in their entirety in the appropriate alphabetical order:

“Avoidance Actions” means, collectively, any and all claims and causes of action under sections 502(d), 544, 545, 547, 548 and 550 of the Bankruptcy Code, or any other avoidance actions under the Bankruptcy Code.

“Causes of Action” means, collectively, any claims, causes of action, demands, actions, suits, obligations, liabilities, cross-claims, counterclaims, defenses, offsets, or setoffs of any kind or character whatsoever, in each case whether known or unknown, contingent or noncontingent, matured or unmatured, suspected or unsuspected, foreseen or unforeseen, direct or indirect, choate or inchoate, existing or hereafter arising, under statute, in contract, in tort, in law, or in equity, or pursuant to any other theory of law, federal or state, whether asserted or assertable directly or derivatively in law or equity or otherwise by way of claim, counterclaim, cross-claim, third party action, action for indemnity or contribution or otherwise.

“Bay View Factoring Settlement Proceeds” means all proceeds received by Borrowers from Bay View pursuant to the Motion to Approve Compromise under Rule 9019 // Debtors Motion for Entry of an Order Pursuant to 11 U.S.C. §§ 105(a) and 363(b) and Fed. R. Bankr. P. 9019 Approving Settlement with CSNK Working Capital Finance Corp. d/b/a Bay View Funding.

1.02. The definition of “Collateral” in the Loan Agreement is hereby amended by inserting the following after “foregoing” in clause (s) thereof:

“(other than respect to clause (r)),”.

1.03. The definition of “Sale Milestone” in the Loan Agreement is hereby amended and restated in its entirety:

“Sale Milestone” has the meaning assigned in Section 7.9(3).

1.04. The Loan Agreement is hereby amended by amending and restating the definition of “Excluded Assets” as follows:

““Excluded Assets” means, collectively, (i) any of such Borrowers’ right, title or interest in any lease, license, contract, property right or agreement to which such Borrower is a party or any of its right, title or interest thereunder to the extent, but only to the extent, that such a grant (A) would, under the express terms of such lease, license, contract or agreement result in a breach of the terms of, or constitute a default under, such lease, license, contract or agreement or (B) violate any law applicable thereto or principles of equity, (ii) any property of a Borrower to the extent and for so long as the grant of a security interest pursuant to this Agreement in such Borrower’s right, title or interest therein (A) is prohibited by any applicable law, or (B) requires a consent pursuant to any law that has not been obtained from any Governmental Authority, (iii) any “intent-to-use” application for registration of a trademark filed pursuant to Section 1(b) of the Lanham Act, 15 U.S.C. § 1051, prior to the filing of a “Statement of Use” pursuant to Section 1(d) of the Lanham Act or an “Amendment to Allege Use” pursuant to Section 1(c) of the Lanham Act with respect thereto, solely to the extent, if any, that and solely during the period, if any, in which, the grant of a security interest therein would impair the validity or enforceability of any registration that issues from such intent-to-use application under applicable federal law, (iv) any Excluded Account, (v) any (A) Causes of Action or (B) proceeds of Avoidance Actions owned by EPI, (vi) any proceeds of all directors’ and officers’ liability insurance policies of Borrowers, including (A) any tail insurance policies and (B) any rights of the directors and officers thereunder for coverage (i.e., advancement of expenses and liability coverage with respect to claims made against such officers and directors), and (vii) solely upon the satisfaction of the Sale Milestones on a timely basis pursuant to the DIP Orders (A) any accounts receivables owed to or collected by EPI on and after the Petition Date on behalf of prepetition amounts owed and (B) any Bay View Factoring Settlement Proceeds; provided that with respect to the foregoing clauses (i) (ii) and (iii), such security interest shall attach immediately and automatically when such prohibition, termination right or consent requirement is repealed, rescinded or otherwise ceases to be effective, when such consent is obtained, or such filing has been made; provided, however, that (I) Excluded Assets shall not include any Proceeds of property described above (unless such Proceeds would otherwise constitute Excluded Assets) and (II) any Excluded Assets that ceases to be Excluded Assets shall automatically, without the action of any other Person, become Collateral.”.

1.05. Section 2.7(6) of the Loan Agreement is hereby amended by deleting the reference to “$50,000” therein and substituting “$200,000” therefor.

1.06. Section 7.9(1) of the Loan Agreement is hereby amended by deleting the period (.) at the end of the first sentence therein and adding the following language after the word “buyer”:

“; provided, however, that the foregoing consultation rights shall be effective to the extent Lender is no longer a bidder in the Sale Transaction, and to the extent the Lender is a bidder, such consultation rights shall be at the Borrowers’ discretion.”.

1.07. Section 10.1(2) of the Loan Agreement is hereby amended by amending and restating clause (i) of the second sentence therein as follows:

“pursuant to Section 364(c)(2) of the Bankruptcy Code, a perfected first priority Lien on the Collateral that is otherwise unencumbered as of the commencement of the Cases, including upon entry of the Final DIP Order, Avoidance Actions or the proceeds therefrom (other than the proceeds therefrom owned by EPI);”.

Section 2. Amendments to the Fee Letter. Effective as of the Amendment No. 2 Effective Date, the Fee Letter is hereby amended by:

(a) deleting paragraph 2 in its entirety; and

(b) amending and restating the paragraph thereafter as follows:

“Each Borrower expressly acknowledges and understands that Lender has agreed to disburse the Loans in reliance on the agreements of such Borrower herein and that Lender would not have agreed to disburse the Loans without such agreements of such Borrower.”

Section 3. Representations and Warranties. Each Borrower, jointly and severally, hereby represents and warrants to the Lender as follows, which representations and warranties are continuing and shall survive the execution and delivery hereof:

3.01 Corporate Power and Authority. Each Borrower has the corporate or other organizational power and authority to execute and deliver this Amendment and carry out the terms and provisions of this Amendment, the

Amended Loan Agreement and the Amended Fee Letter and has taken all necessary corporate or other organizational action to authorize the execution, delivery and performance of this Amendment and the performance of the Amended Loan Agreement and the Amended Fee Letter. Each Borrower has duly executed and delivered this Amendment, and this Amendment, the Amended Loan Agreement and the Amended Fee Letter constitute the valid and binding agreements of such Borrower enforceable in accordance with their respective terms, subject to applicable bankruptcy, insolvency, fraudulent conveyance, moratorium, reorganization and other similar laws relating to or affecting creditors’ rights generally and general principles of equity (whether considered in a proceeding in equity or law).

3.02 No Violation. The execution, delivery and performance by any Borrower of this Amendment and the performance of the Amended Loan Agreement and the Amended Fee Letter, and compliance with the terms and provisions thereof, will not (i) contravene any applicable provision of any material Applicable Law of any Governmental Authority, (ii) result in any breach of any of the terms, covenants, conditions or provisions of, or constitute a default under, or result in the creation or imposition of (or the obligation to create or impose) any Lien upon any of the property or assets of any Borrower (other than Permitted Liens and Liens created under the Loan Documents) pursuant to (A) the terms of any material indenture, loan agreement, lease agreement, mortgage or deed of trust, or (B) any other Material Contract, in the case of either clause (ii)(A) or (ii)(B), to which any Borrower is a party or by which it or any of its property or assets is bound, or (iii) violate any provision of the Organization Documents of any Borrower, except with respect to any conflict, breach or contravention or default (but not creation of Liens) referred to in clause (ii), to the extent that such conflict, breach, contravention or default could not reasonably be expected to have a Material Adverse Effect.

Section 4. Conditions Precedent. This Amendment shall not become effective until each of the following conditions is satisfied (or waived by Lender) (such date, the “Amendment No. 2 Effective Date”):

4.01 The Lender shall have received counterparts of this Amendment duly executed by Lender and each Borrower signatory hereto;

4.02 The representations and warranties contained in this Amendment, the Amended Loan Agreement and in all other Loan Documents are true and correct on and as of the Amendment No. 2 Effective Date in all material respects, except to the extent that any such representation and warranty is qualified by materiality, “Material Adverse Effect” or other similar qualification, such representation and warranty shall be true and correct in all respects;

4.03 The Lender shall have received and approved in its sole discretion, a revised Final DIP Order, Bidding Procedures, Bidding Procedures Order and Asset Purchase Agreement; and

4.04 No Default or Event of Default shall have occurred or is continuing.

Section 5. Miscellaneous.

5.01 No Waiver or Modification. Nothing contained herein shall be deemed to constitute a waiver of compliance with any term or condition contained in the Loan Agreement or any other Loan Document or constitute a course of conduct or dealing among the parties. The Lender reserves all rights, privileges and remedies under the Loan Documents. Except as expressly amended hereby, the Loan Agreement and other Loan Documents remain unmodified and in full force and effect in accordance with their respective terms and are hereby ratified and confirmed in all respects.

5.02 Loan Document. This Amendment shall constitute a Loan Document under and as defined in the Amended Loan Agreement. All references in the Loan Documents to the Loan Agreement shall be deemed to be references to the Loan Agreement as amended hereby.

5.03 Waiver of Jury Trial; Venue; Governing Law. Sections 11.17 and 11.20 of the Loan Agreement are incorporated herein by this reference and made applicable as if set forth herein in full, mutatis mutandis.

5.04 Counterparts. This Amendment may be executed in any number of separate counterparts, each of which shall collectively and separately constitute one agreement. Delivery of an executed signature page of this Amendment by facsimile transmission, PDF (portable document format) or other electronic transmission shall be as effective as delivery of a manually executed counterpart hereof. The words “execution,” “execute”, “signed,” “signature,” and words of like import in or related to any document to be signed in connection with this Amendment, the Loan Agreement and the Loan Documents shall be deemed to include electronic signatures, the electronic matching of assignment terms and contract formations on electronic platforms approved by the Borrowers, or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as

provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act.

5.05 Headings. Section headings in this Amendment are included herein for convenience of reference only and shall not affect the interpretation of this Amendment.

5.06 Binding Effect; Assignment. This Amendment shall be binding upon and inure to the benefit of the Borrowers, the Lender and their respective successors and assigns in accordance with the terms of the Loan Agreement.

5.07 Integration. This Amendment, the Amended Loan Agreement, the Amended Fee Letter and the other Loan Documents incorporate all negotiations of the parties hereto with respect to the subject matter hereof and thereof and are the final expression and agreement of the parties hereto and thereto with respect to the subject matter hereof and thereof. This Amendment, the Amended Loan Agreement, the Amended Fee Letter and the other Loan Documents represent the agreement of the parties hereto with respect to the subject matter hereof and thereof, and there are no promises, undertakings, representations or warranties by any party hereto or thereto relative to the subject matter hereof or thereof not expressly set forth or referred to herein or therein.

5.08 Reaffirmation. Each Borrower as debtor, grantor, pledgor, guarantor, assignor, or in any other similar capacity in which such Borrower grants liens or security interests in its property or otherwise acts as accommodation party or guarantor, as the case may be, hereby (i) ratifies and reaffirms all of its payment and performance obligations, contingent or otherwise, under each Loan Document to which it is a party (after giving effect hereto) and (ii) to the extent such Borrower granted liens on or security interests in any of its property pursuant to any such Loan Document as security for or otherwise guaranteed such Borrower’s Obligations under or with respect to the Loan Documents, ratifies and reaffirms such guarantee and grant of security interests and liens and confirms and agrees that such security interests and liens hereafter secure all of the Obligations as amended hereby.

[Remainder of the page intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed by their respective officers thereunto duly authorized, as of the date first above written.

LIGAND PHARMACEUTICALS, INCORPORATED, a

Delaware corporation, as Lender

By: /s/ Matthew Korenberg

Name: Matthew Korenberg

Title: President and Chief Operating Officer

Signature Page to Omnibus Amendment No. 1 to Fee Letter and Amendment No. 2 to DIP Loan and Security Agreement]

NOVAN, INC. a Delaware corporation, as a Borrower

By: /s/ Paula Brown Stafford

Name: Paula Brown Stafford

Title: President and CEO

EPI HEALTH, LLC, a South Carolina limited liability

company, as a Borrower

By: /s/ Paula Brown Stafford

Name: Paula Brown Stafford

Title: CEO

Signature Page to Omnibus Amendment No. 1 to Fee Letter and Amendment No. 2 to DIP Loan and Security Agreement]

UST Form 11-MOR (12/01/2021) 1 UNITED STATES BANKRUPTCY COURT DISTRICT OF Delaware In Re. Novan, Inc. Debtor(s) § § § § Case No. 23-10937 Lead Case No. 23-10937 Jointly Administered Monthly Operating Report Chapter 11 Reporting Period Ended: 07/31/2023 Petition Date: 07/17/2023 Months Pending: 0 Industry Classification: 3 2 5 4 Reporting Method: Accrual Basis Cash Basis Debtor's Full-Time Employees (current): 37 Debtor's Full-Time Employees (as of date of order for relief): 37 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Signature of Responsible Party Printed Name of Responsible Party Date Address /s/ Scott Jones 08/21/2023 Scott Jones Morris, Nichols, Arsht & Tunnell LLP 1201 North Market Street, PO Box 1347 Wilmington, DE 19899-1347 STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. § 1320.4(a)(2) applies. Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 1 of 17 Exhibit 99.1

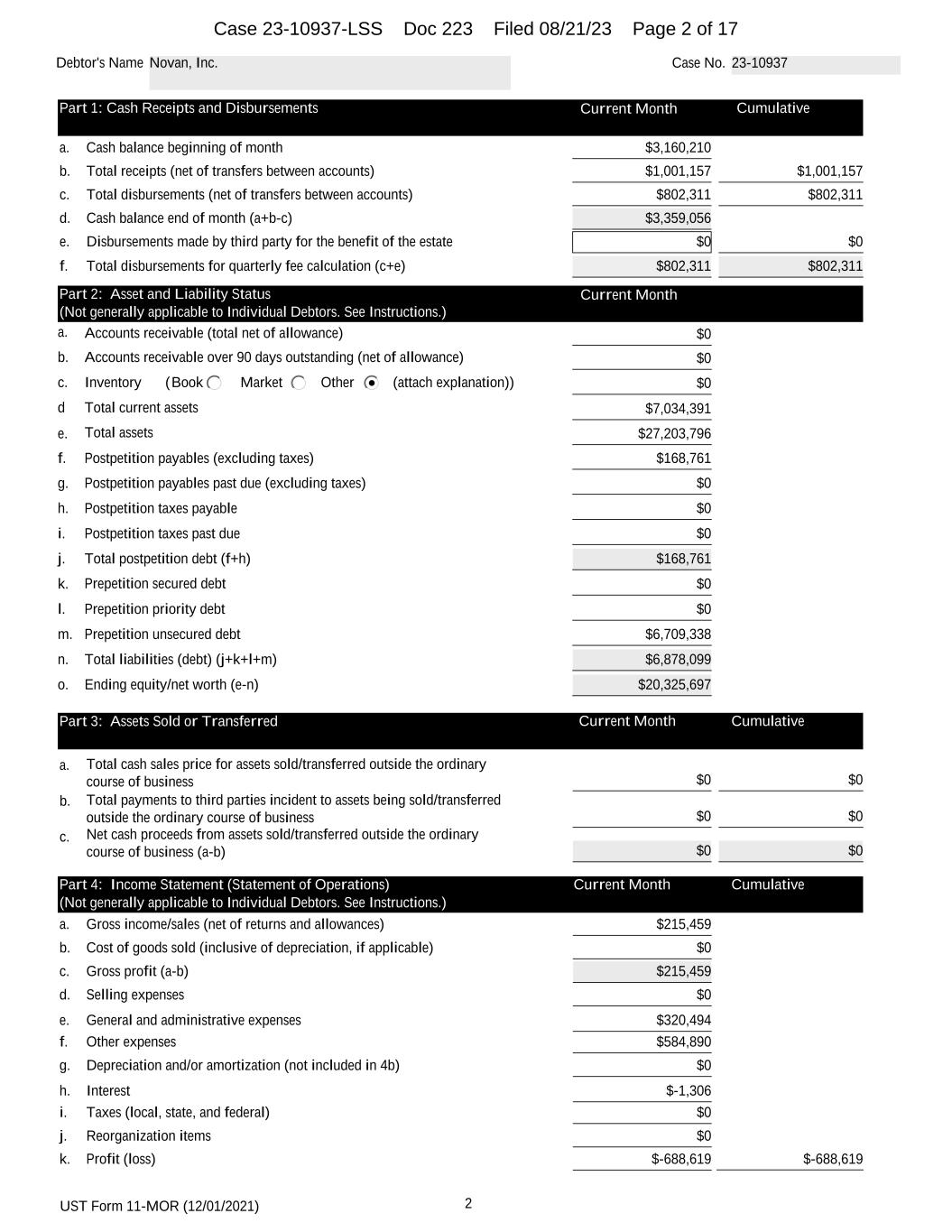

UST Form 11-MOR (12/01/2021) 2 Debtor's Name Novan, Inc. Case No. 23-10937 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month $3,160,210 b. Total receipts (net of transfers between accounts) $1,001,157 $1,001,157 c. Total disbursements (net of transfers between accounts) $802,311 $802,311 d. Cash balance end of month (a+b-c) $3,359,056 e. Disbursements made by third party for the benefit of the estate $0 $0 f. Total disbursements for quarterly fee calculation (c+e) $802,311 $802,311 Part 2: Asset and Liability Status Current Month (Not generally applicable to Individual Debtors. See Instructions.) a. Accounts receivable (total net of allowance) $0 b. Accounts receivable over 90 days outstanding (net of allowance) $0 c. Inventory ( (attach explanation))Book Market Other $0 d Total current assets $7,034,391 e. Total assets $27,203,796 f. Postpetition payables (excluding taxes) $168,761 g. Postpetition payables past due (excluding taxes) $0 h. Postpetition taxes payable $0 i. Postpetition taxes past due $0 j. Total postpetition debt (f+h) $168,761 k. Prepetition secured debt $0 l. Prepetition priority debt $0 m. Prepetition unsecured debt $6,709,338 n. Total liabilities (debt) (j+k+l+m) $6,878,099 o. Ending equity/net worth (e-n) $20,325,697 Part 3: Assets Sold or Transferred Current Month Cumulative a. Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 b. Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business $0 $0 c. Net cash proceeds from assets sold/transferred outside the ordinary course of business (a-b) $0 $0 Part 4: Income Statement (Statement of Operations) Current Month Cumulative (Not generally applicable to Individual Debtors. See Instructions.) a. Gross income/sales (net of returns and allowances) $215,459 b. Cost of goods sold (inclusive of depreciation, if applicable) $0 c. Gross profit (a-b) $215,459 d. Selling expenses $0 e. General and administrative expenses $320,494 f. Other expenses $584,890 g. Depreciation and/or amortization (not included in 4b) $0 h. Interest $-1,306 i. Taxes (local, state, and federal) $0 j. Reorganization items $0 k. Profit (loss) $-688,619 $-688,619 Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 2 of 17

UST Form 11-MOR (12/01/2021) 3 Debtor's Name Novan, Inc. Case No. 23-10937 Part 5: Professional Fees and Expenses Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total Itemized Breakdown by Firm Firm Name Role i ii iii iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 3 of 17

UST Form 11-MOR (12/01/2021) 4 Debtor's Name Novan, Inc. Case No. 23-10937 xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 4 of 17

UST Form 11-MOR (12/01/2021) 5 Debtor's Name Novan, Inc. Case No. 23-10937 lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total Itemized Breakdown by Firm Firm Name Role i ii iii iv v vi vii viii ix x xi xii xiii xiv Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 5 of 17

UST Form 11-MOR (12/01/2021) 6 Debtor's Name Novan, Inc. Case No. 23-10937 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 6 of 17

UST Form 11-MOR (12/01/2021) 7 Debtor's Name Novan, Inc. Case No. 23-10937 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 7 of 17

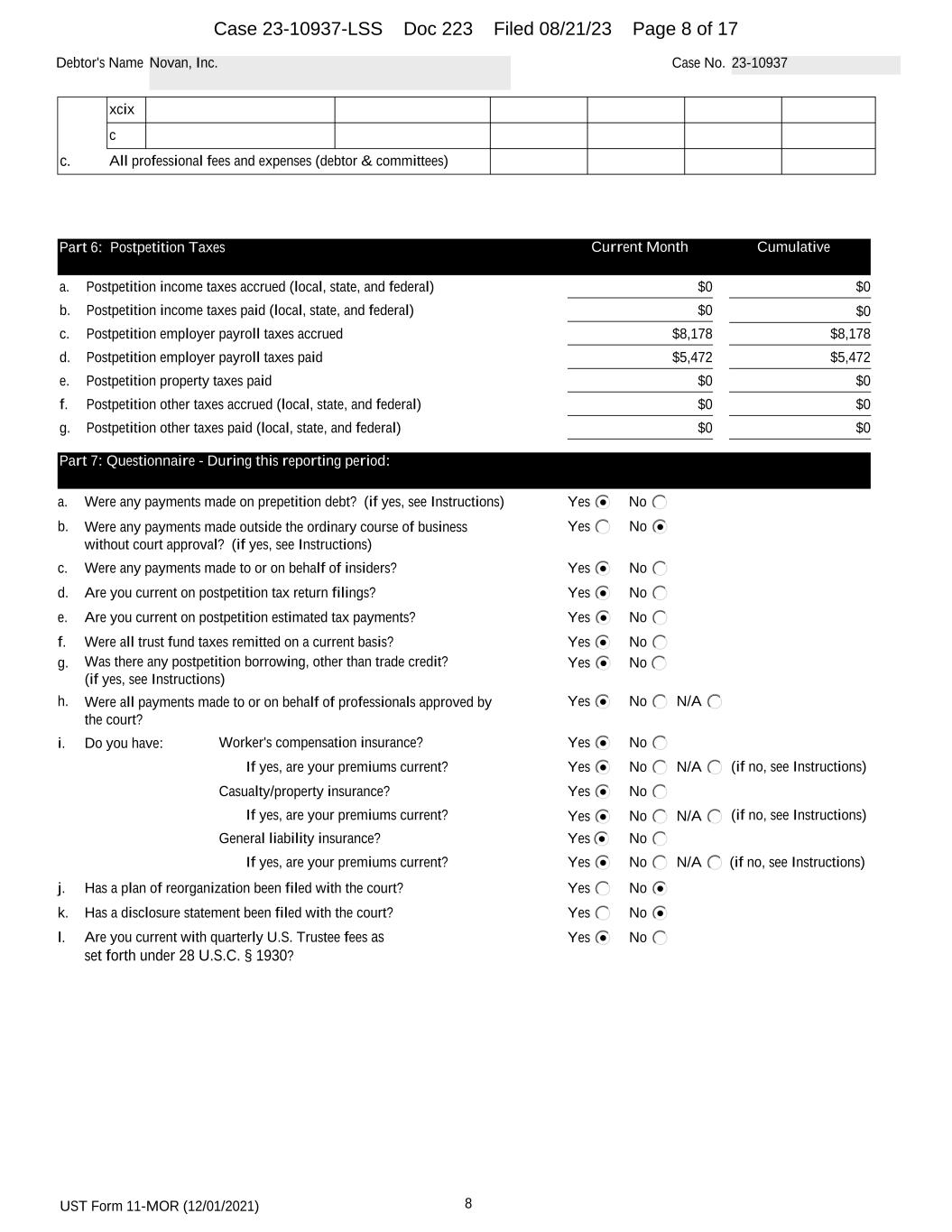

UST Form 11-MOR (12/01/2021) 8 Debtor's Name Novan, Inc. Case No. 23-10937 xcix c c. All professional fees and expenses (debtor & committees) Part 6: Postpetition Taxes Current Month Cumulative a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $8,178 $8,178 d. Postpetition employer payroll taxes paid $5,472 $5,472 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) $0 $0 Part 7: Questionnaire - During this reporting period: a. Were any payments made on prepetition debt? (if yes, see Instructions) Yes No b. Yes NoWere any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) c. Yes NoWere any payments made to or on behalf of insiders? d. Yes NoAre you current on postpetition tax return filings? e. Yes NoAre you current on postpetition estimated tax payments? f. Were all trust fund taxes remitted on a current basis? Yes No g. Yes NoWas there any postpetition borrowing, other than trade credit? (if yes, see Instructions) h. Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) Casualty/property insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) General liability insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? Yes No k. Has a disclosure statement been filed with the court? Yes No l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. § 1930? Yes No Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 8 of 17

UST Form 11-MOR (12/01/2021) 9 Debtor's Name Novan, Inc. Case No. 23-10937 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages $0 b. Gross income (receipts) from self-employment $0 c. Gross income from all other sources $0 d. Total income in the reporting period (a+b+c) $0 e. Payroll deductions $0 f. Self-employment related expenses $0 g. Living expenses $0 h. All other expenses $0 i. Total expenses in the reporting period (e+f+g+h) $0 j. Difference between total income and total expenses (d-i) $0 k. List the total amount of all postpetition debts that are past due $0 l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C § 101(14A)? Yes No m. Yes No N/AIf yes, have you made all Domestic Support Obligation payments? Privacy Act Statement 28 U.S.C. § 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. §§ 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. § 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST-001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. § 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ Amy Borbet Signature of Responsible Party Corporate Controller Printed Name of Responsible Party 08/21/2023 DateTitle Amy Borbet Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 9 of 17

UST Form 11-MOR (12/01/2021) 10 Debtor's Name Novan, Inc. Case No. 23-10937 PageOnePartOne PageOnePartTwo PageTwoPartOne PageTwoPartTwo Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 10 of 17

UST Form 11-MOR (12/01/2021) 11 Debtor's Name Novan, Inc. Case No. 23-10937 Bankruptcy51to100 NonBankruptcy1to50 NonBankruptcy51to100 Bankruptcy1to50 Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 11 of 17

UST Form 11-MOR (12/01/2021) 12 Debtor's Name Novan, Inc. Case No. 23-10937 PageFour PageThree Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 12 of 17

In re: Novan, Inc. Case No. 23-10937 Balance Sheet As of July 31, 2023 Cash and cash equivalents 3,359,056$ Prepaid expenses and other current assets 3,675,335 TOTAL CURRENT ASSETS 7,034,391 Restricted cash 582,703 Property and equipment, net 13,563,453 Intangible assets, net 75,000 Other assets 164,325 Right-of-use lease asset 1,728,262 Goodwill 4,055,662 TOTAL ASSETS 27,203,796$ Accounts payable 3,033,745$ Accrued expenses 3,844,354 Deferred revenue, current portion 2,585,508 Research and development service obligation liability, current portion 115,598 Operating lease liabilities, current portion 272,375 TOTAL CURRENT LIABILITIES 9,851,580 Deferred revenue, net of current portion 6,570,290 Ligand bridge and DIP loan 3,805,000 Research and development service obligation liability, net of current portion 25,000,000 Operating lease liabilities, net of current portion 3,484,097 Contingent Consideration due to EPG for purchase, net of current portion 2,352,961 Other long-term liabilities 112,000 Due to/from EPI Health, LLC 13,613,694 [1] TOTAL LIABILITIES 64,789,622 Common Stock 3,683 Additional paid-in capital 291,393,658 Treasury stock (155,268) Accumulated deficit (328,827,899) TOTAL EQUITY (DEFICIT) (37,585,826) TOTAL LIABILITIES & EQUITY (DEFICIT) 27,203,796$ Footnote: [1] This line item includes an intercompany balance related to goodwill totaling $4.1 million, presented in total Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 13 of 17

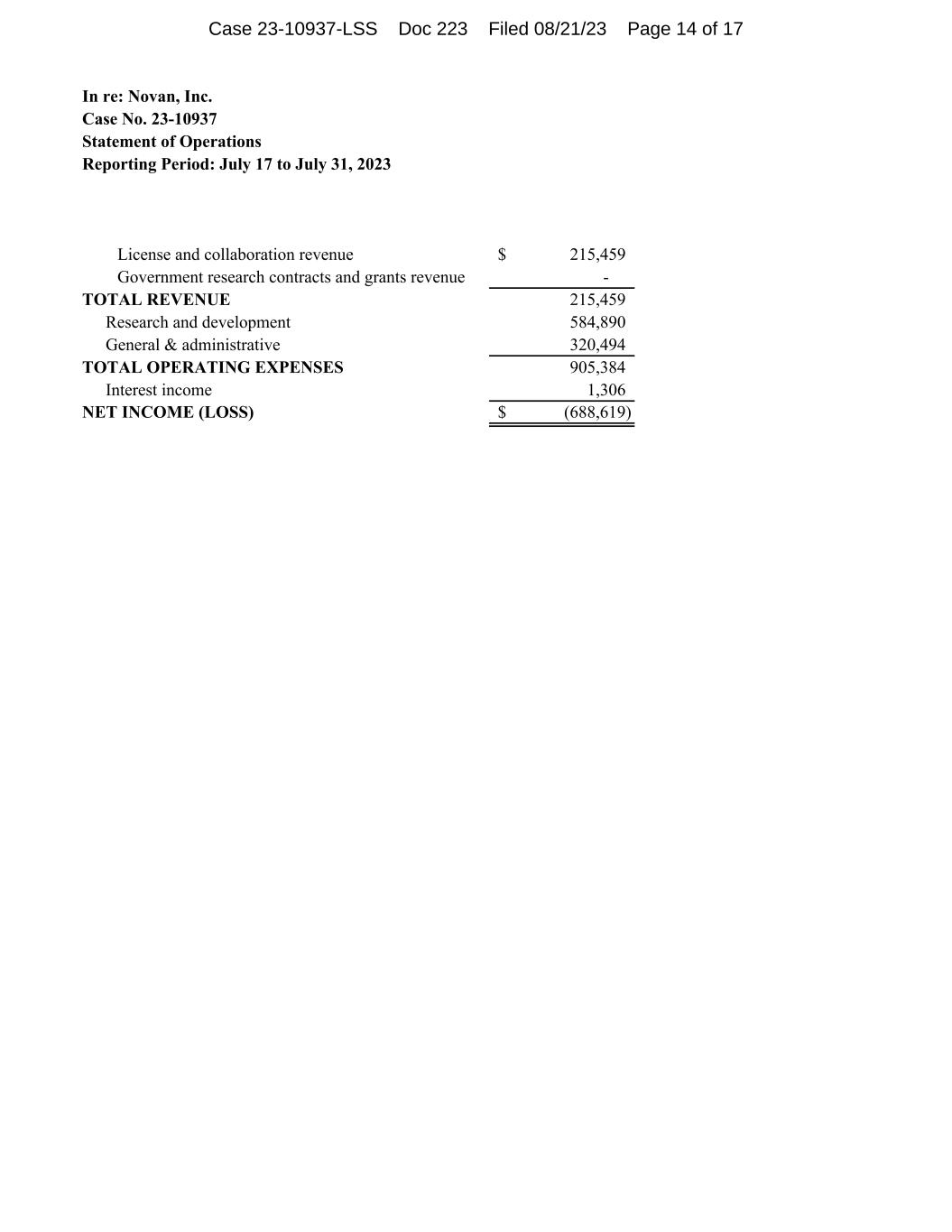

In re: Novan, Inc. Case No. 23-10937 Statement of Operations Reporting Period: July 17 to July 31, 2023 License and collaboration revenue 215,459$ Government research contracts and grants revenue - TOTAL REVENUE 215,459 Research and development 584,890 General & administrative 320,494 TOTAL OPERATING EXPENSES 905,384 Interest income 1,306 NET INCOME (LOSS) (688,619)$ Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 14 of 17

In re: Novan, Inc. Case No. 23‐10937 Statement of Cash Receipts and Disbursements Summary (Cash Basis) Reporting Period: July 17 to July 31, 2023 BEGINNING CASH BALANCE 3,160,210$ Receipts: DIP funding from Ligand Pharmaceuticals 1,000,000 Interest income 1,157 TOTAL RECEIPTS 1,001,157 Operating Disbursements: Payroll and benefits 266,615 Employee insurance 67,637 Rent and utilities 72,014 Intellectual property activities 22,000 Manufacturing and QA services 13,968 Facility and information technology services 54,839 Activities and services related to lead R&D asset (SB206) 278,652 Transfers to EPI Health, LLC 26,399 Bank fees and other misc. 187 TOTAL DISBURSEMENTS 802,311 NET CASH FLOW 198,846 ENDING CASH BALANCE 3,359,056$ Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 15 of 17

In re: Novan, Inc. Case No. 23-10937 Summary of Cash Book Balances As of July 31, 2023 Cash and cash equivalents Account Description Bank Account Number Last 4 Digits Book Balance as of 7/31/2023 Investment FICA/Stone Castle 1607 -$ Investment Silicon Valley Bank 9620 - Sweep Silicon Valley Bank 1484 - Operational Silicon Valley Bank 7949 41,535 Payroll Silicon Valley Bank 9616 - Investment Account Raymond James Y011 6,858 Operational PNC Bank 0299 3,302,103 Operational PNC Bank 3407 (185) Payroll PNC Bank 2423 - Collateral/Unrestricted (Letter of Credit) PNC Bank 3374 8,744$ 3,359,056$ Restricted Cash, current Account Description Bank Account Number Last 4 Digits Book Balance as of 7/31/2023 Collateral/Restricted (Letter of Credit) PNC Bank 3374 582,703$ Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 16 of 17

In re: Novan, Inc. Case No. 23-10937 Additional Information Reporting Period: July 17 to July 31, 2023 Supplemental Information All Bank Statements and Bank Reconciliations for the Reporting Period /s/ Amy Borbet August 21, 2023 Signature of Authorized Individual Date Amy Borbet Corporate Controller Printed Name of Authorized Individual Title of Authorized Individual Part 7: Questionnaire a. Were any payment made on prepetition debt? Yes The Debtor hereby submits this attestation regarding bank account reconciliations in lieu of providing copies of bank statements, bank reconciliations and journal entries during July 2023. The Debtor's standard practice is to ensure that bank reconciliations are completed before closing the books each reporting period. I attest that each of the Debtor's bank accounts have been reconciled in accordance with its standard practice. All payments made on account prepetition debt during the month of July 2023 (and included in the disbursements reported herein) were authorized under “first day” orders entered by the United States Bankruptcy Court for the District of Delaware. These payments are not itemized, but will be provided to the Office of the United States Trustee upon request. The individual detail of these payments is not included in this document but will be made available to the Office of the United States Trustee upon request. Case 23-10937-LSS Doc 223 Filed 08/21/23 Page 17 of 17

UST Form 11-MOR (12/01/2021) 1 UNITED STATES BANKRUPTCY COURT DISTRICT OF Delaware In Re. EPI Health, LLC Debtor(s) § § § § Case No. 23-10938 Lead Case No. 23-10937 Jointly Administered Monthly Operating Report Chapter 11 Reporting Period Ended: 07/31/2023 Petition Date: 07/17/2023 Months Pending: 0 Industry Classification: 4 2 4 2 Reporting Method: Accrual Basis Cash Basis Debtor's Full-Time Employees (current): 1 Debtor's Full-Time Employees (as of date of order for relief): 1 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Signature of Responsible Party Printed Name of Responsible Party Date Address /s/ Scott Jones 08/21/2023 Scott Jones Morris, Nichols, Arsht & Tunnell LLP 1201 North Market Street, PO Box 1347 Wilmington, DE 19899-1347 STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. § 1320.4(a)(2) applies. Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 1 of 17 Exhibit 99.2

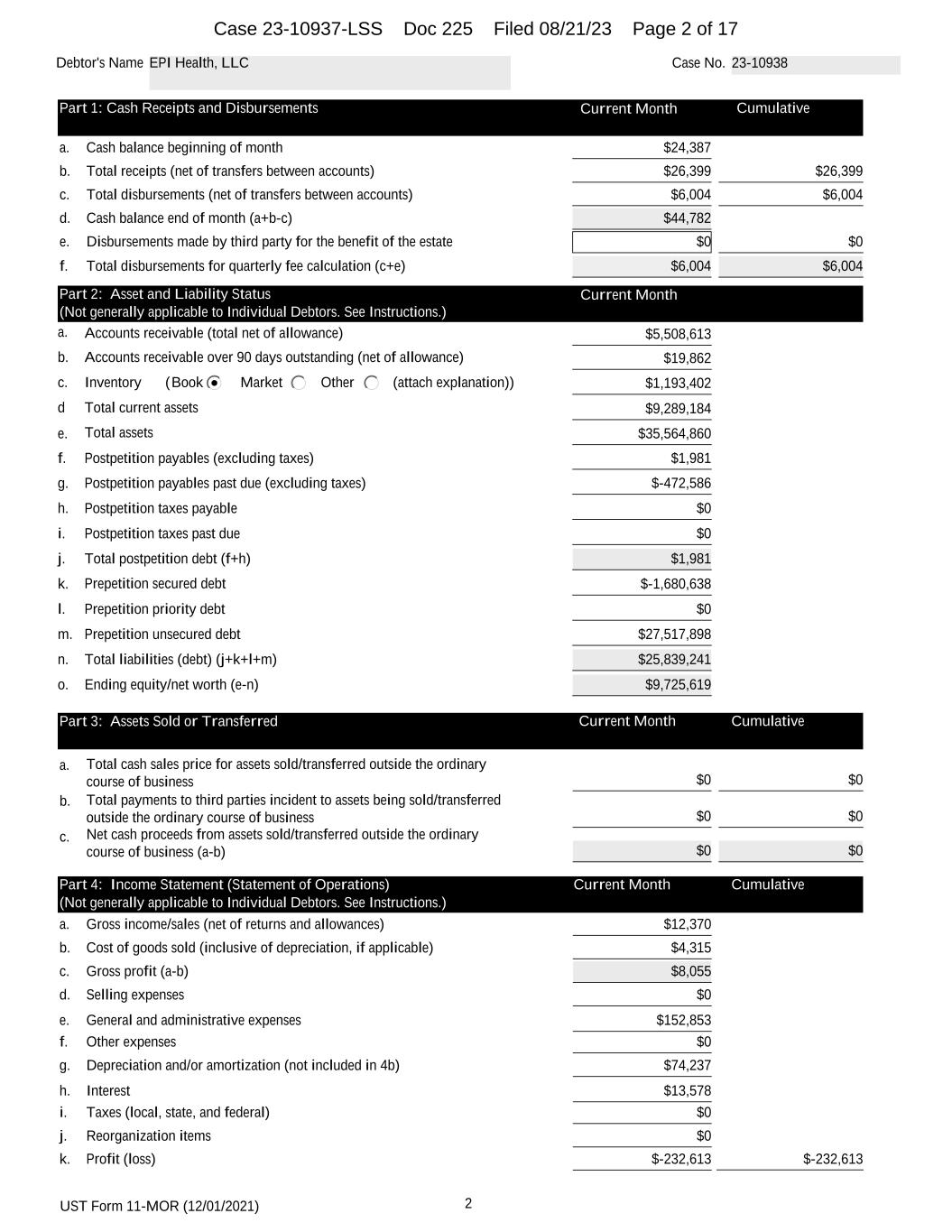

UST Form 11-MOR (12/01/2021) 2 Debtor's Name EPI Health, LLC Case No. 23-10938 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month $24,387 b. Total receipts (net of transfers between accounts) $26,399 $26,399 c. Total disbursements (net of transfers between accounts) $6,004 $6,004 d. Cash balance end of month (a+b-c) $44,782 e. Disbursements made by third party for the benefit of the estate $0 $0 f. Total disbursements for quarterly fee calculation (c+e) $6,004 $6,004 Part 2: Asset and Liability Status Current Month (Not generally applicable to Individual Debtors. See Instructions.) a. Accounts receivable (total net of allowance) $5,508,613 b. Accounts receivable over 90 days outstanding (net of allowance) $19,862 c. Inventory ( (attach explanation))Book Market Other $1,193,402 d Total current assets $9,289,184 e. Total assets $35,564,860 f. Postpetition payables (excluding taxes) $1,981 g. Postpetition payables past due (excluding taxes) $-472,586 h. Postpetition taxes payable $0 i. Postpetition taxes past due $0 j. Total postpetition debt (f+h) $1,981 k. Prepetition secured debt $-1,680,638 l. Prepetition priority debt $0 m. Prepetition unsecured debt $27,517,898 n. Total liabilities (debt) (j+k+l+m) $25,839,241 o. Ending equity/net worth (e-n) $9,725,619 Part 3: Assets Sold or Transferred Current Month Cumulative a. Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 b. Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business $0 $0 c. Net cash proceeds from assets sold/transferred outside the ordinary course of business (a-b) $0 $0 Part 4: Income Statement (Statement of Operations) Current Month Cumulative (Not generally applicable to Individual Debtors. See Instructions.) a. Gross income/sales (net of returns and allowances) $12,370 b. Cost of goods sold (inclusive of depreciation, if applicable) $4,315 c. Gross profit (a-b) $8,055 d. Selling expenses $0 e. General and administrative expenses $152,853 f. Other expenses $0 g. Depreciation and/or amortization (not included in 4b) $74,237 h. Interest $13,578 i. Taxes (local, state, and federal) $0 j. Reorganization items $0 k. Profit (loss) $-232,613 $-232,613 Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 2 of 17

UST Form 11-MOR (12/01/2021) 3 Debtor's Name EPI Health, LLC Case No. 23-10938 Part 5: Professional Fees and Expenses Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total Itemized Breakdown by Firm Firm Name Role i ii iii iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 3 of 17

UST Form 11-MOR (12/01/2021) 4 Debtor's Name EPI Health, LLC Case No. 23-10938 xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 4 of 17

UST Form 11-MOR (12/01/2021) 5 Debtor's Name EPI Health, LLC Case No. 23-10938 lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total Itemized Breakdown by Firm Firm Name Role i ii iii iv v vi vii viii ix x xi xii xiii xiv Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 5 of 17

UST Form 11-MOR (12/01/2021) 6 Debtor's Name EPI Health, LLC Case No. 23-10938 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 6 of 17

UST Form 11-MOR (12/01/2021) 7 Debtor's Name EPI Health, LLC Case No. 23-10938 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 7 of 17

UST Form 11-MOR (12/01/2021) 8 Debtor's Name EPI Health, LLC Case No. 23-10938 xcix c c. All professional fees and expenses (debtor & committees) Part 6: Postpetition Taxes Current Month Cumulative a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $354 $354 d. Postpetition employer payroll taxes paid $2,156 $2,156 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) $0 $0 Part 7: Questionnaire - During this reporting period: a. Were any payments made on prepetition debt? (if yes, see Instructions) Yes No b. Yes NoWere any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) c. Yes NoWere any payments made to or on behalf of insiders? d. Yes NoAre you current on postpetition tax return filings? e. Yes NoAre you current on postpetition estimated tax payments? f. Were all trust fund taxes remitted on a current basis? Yes No g. Yes NoWas there any postpetition borrowing, other than trade credit? (if yes, see Instructions) h. Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) Casualty/property insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) General liability insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? Yes No k. Has a disclosure statement been filed with the court? Yes No l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. § 1930? Yes No Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 8 of 17

UST Form 11-MOR (12/01/2021) 9 Debtor's Name EPI Health, LLC Case No. 23-10938 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages $0 b. Gross income (receipts) from self-employment $0 c. Gross income from all other sources $0 d. Total income in the reporting period (a+b+c) $0 e. Payroll deductions $0 f. Self-employment related expenses $0 g. Living expenses $0 h. All other expenses $0 i. Total expenses in the reporting period (e+f+g+h) $0 j. Difference between total income and total expenses (d-i) $0 k. List the total amount of all postpetition debts that are past due $0 l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C § 101(14A)? Yes No m. Yes No N/AIf yes, have you made all Domestic Support Obligation payments? Privacy Act Statement 28 U.S.C. § 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. §§ 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. § 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST-001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. § 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ Amy Borbet Signature of Responsible Party Corporate Controller Printed Name of Responsible Party 08/21/2023 DateTitle Amy Borbet Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 9 of 17

UST Form 11-MOR (12/01/2021) 10 Debtor's Name EPI Health, LLC Case No. 23-10938 PageOnePartOne PageOnePartTwo PageTwoPartOne PageTwoPartTwo Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 10 of 17

UST Form 11-MOR (12/01/2021) 11 Debtor's Name EPI Health, LLC Case No. 23-10938 Bankruptcy51to100 NonBankruptcy1to50 NonBankruptcy51to100 Bankruptcy1to50 Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 11 of 17

UST Form 11-MOR (12/01/2021) 12 Debtor's Name EPI Health, LLC Case No. 23-10938 PageFour PageThree Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 12 of 17

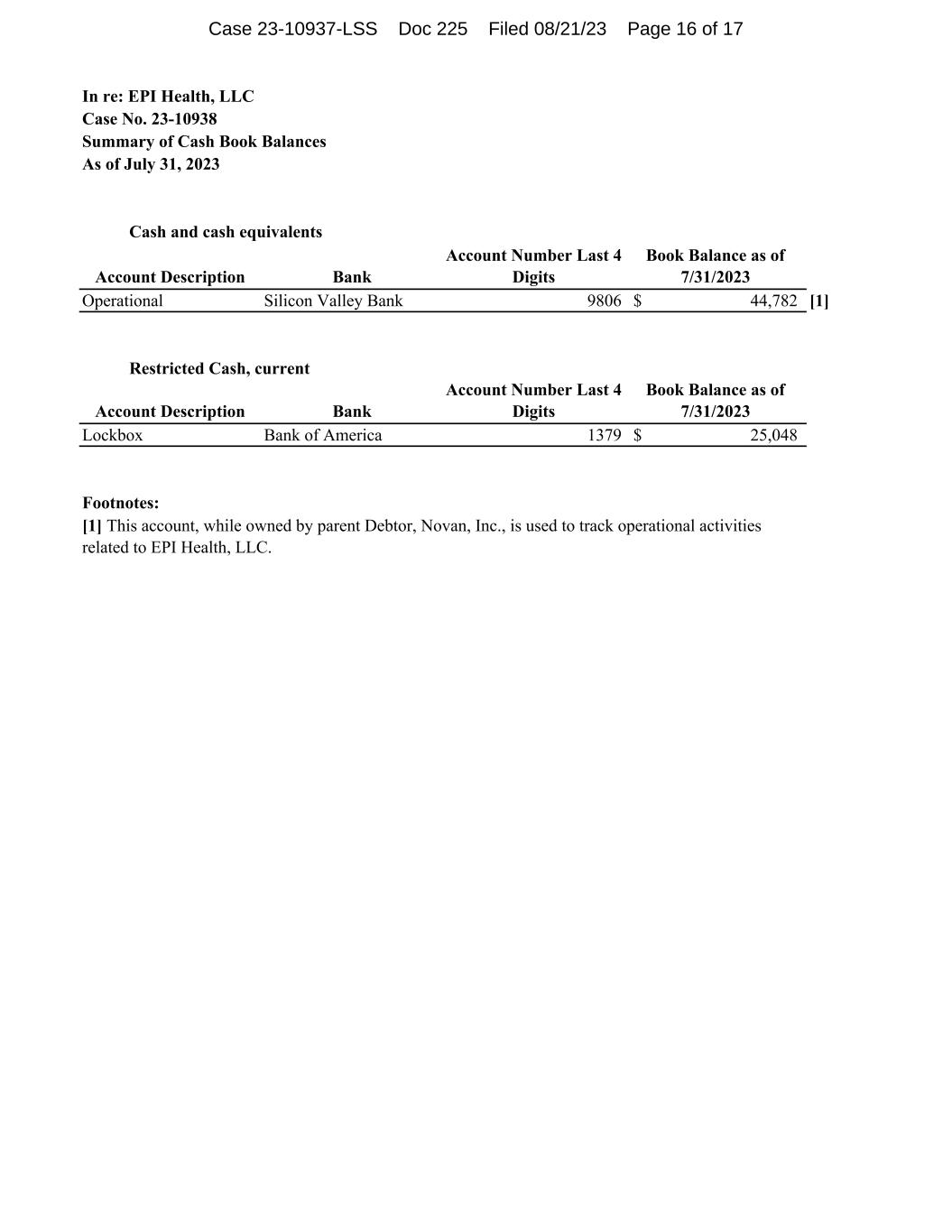

In re: EPI Health, LLC Case No. 23-10938 Balance Sheet As of July 31, 2023 Cash and cash equivalents 44,782$ Restricted Cash, current 25,048 Trade accounts receivable, net 5,508,613 Inventory, net 1,193,402 Prepaid expenses and other current assets 2,517,339 TOTAL CURRENT ASSETS 9,289,184 Intangible Assets, Net 26,275,676 TOTAL ASSETS 35,564,860$ Accounts payable 20,086,816$ Accrued expenses 7,433,113 Notes payable, current portion (2,153,223) [1] TOTAL CURRENT LIABILITIES 25,366,706 Other long-term liabilities 494,607 Due to/from Novan, Inc. (13,623,835) [2] TOTAL LIABILITIES 12,237,478 Additional paid-in capital 32,045,966 Accumulated deficit (8,718,584) TOTAL EQUITY 23,327,382 TOTAL LIABILITIES & EQUITY 35,564,860$ Footnote: [1] This line item is associated with the factoring facility with Bayview Funding. As of July 31, 2023, this amount is currently in a receivable position subject to receipt upon termination of the agreement. [2] This line item includes an intercompany balance related to goodwill totaling $4.1 million. Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 13 of 17

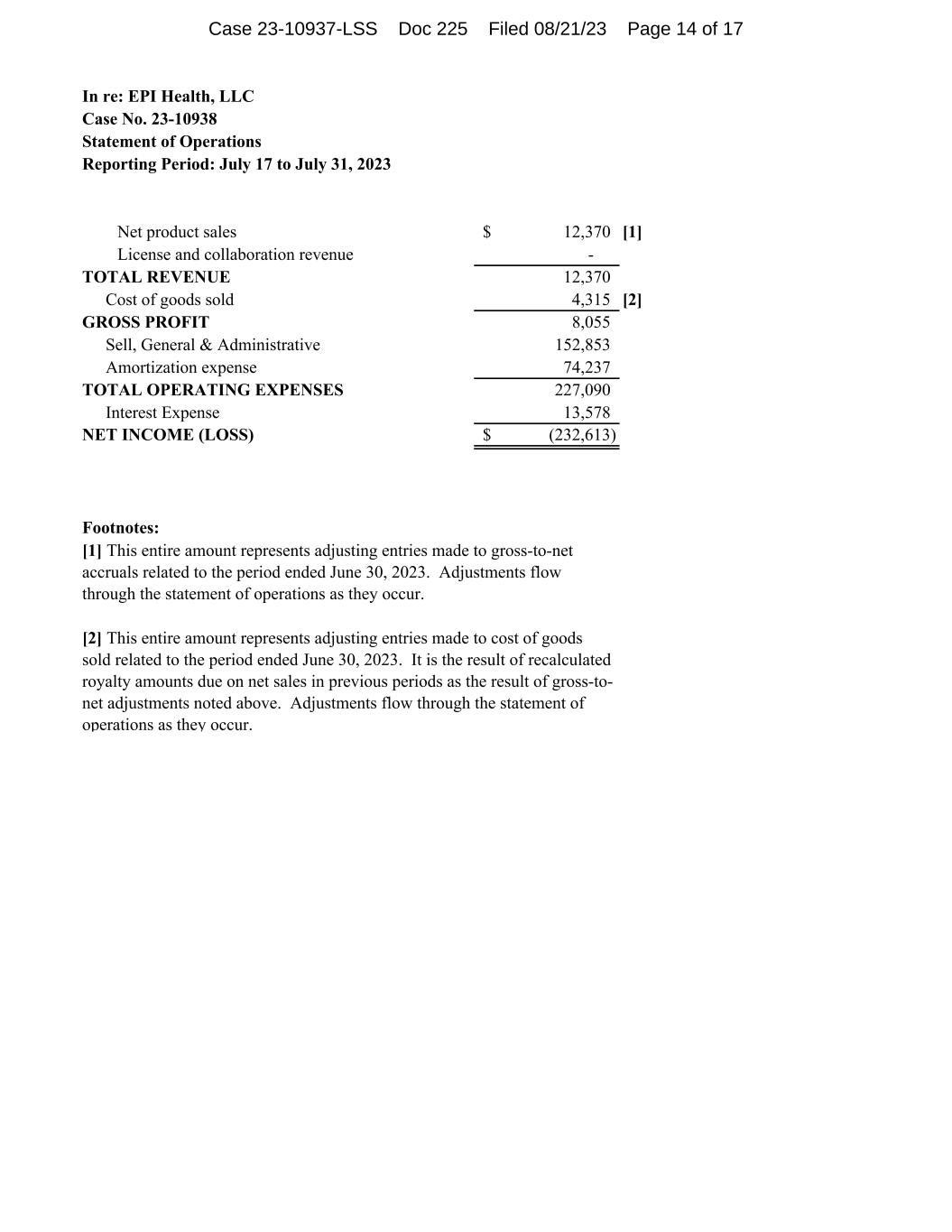

In re: EPI Health, LLC Case No. 23-10938 Statement of Operations Reporting Period: July 17 to July 31, 2023 Net product sales 12,370$ [1] License and collaboration revenue - TOTAL REVENUE 12,370 Cost of goods sold 4,315 [2] GROSS PROFIT 8,055 Sell, General & Administrative 152,853 Amortization expense 74,237 TOTAL OPERATING EXPENSES 227,090 Interest Expense 13,578 NET INCOME (LOSS) (232,613)$ Footnotes: [1] This entire amount represents adjusting entries made to gross-to-net accruals related to the period ended June 30, 2023. Adjustments flow through the statement of operations as they occur. [2] This entire amount represents adjusting entries made to cost of goods sold related to the period ended June 30, 2023. It is the result of recalculated royalty amounts due on net sales in previous periods as the result of gross-to- net adjustments noted above. Adjustments flow through the statement of operations as they occur. Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 14 of 17

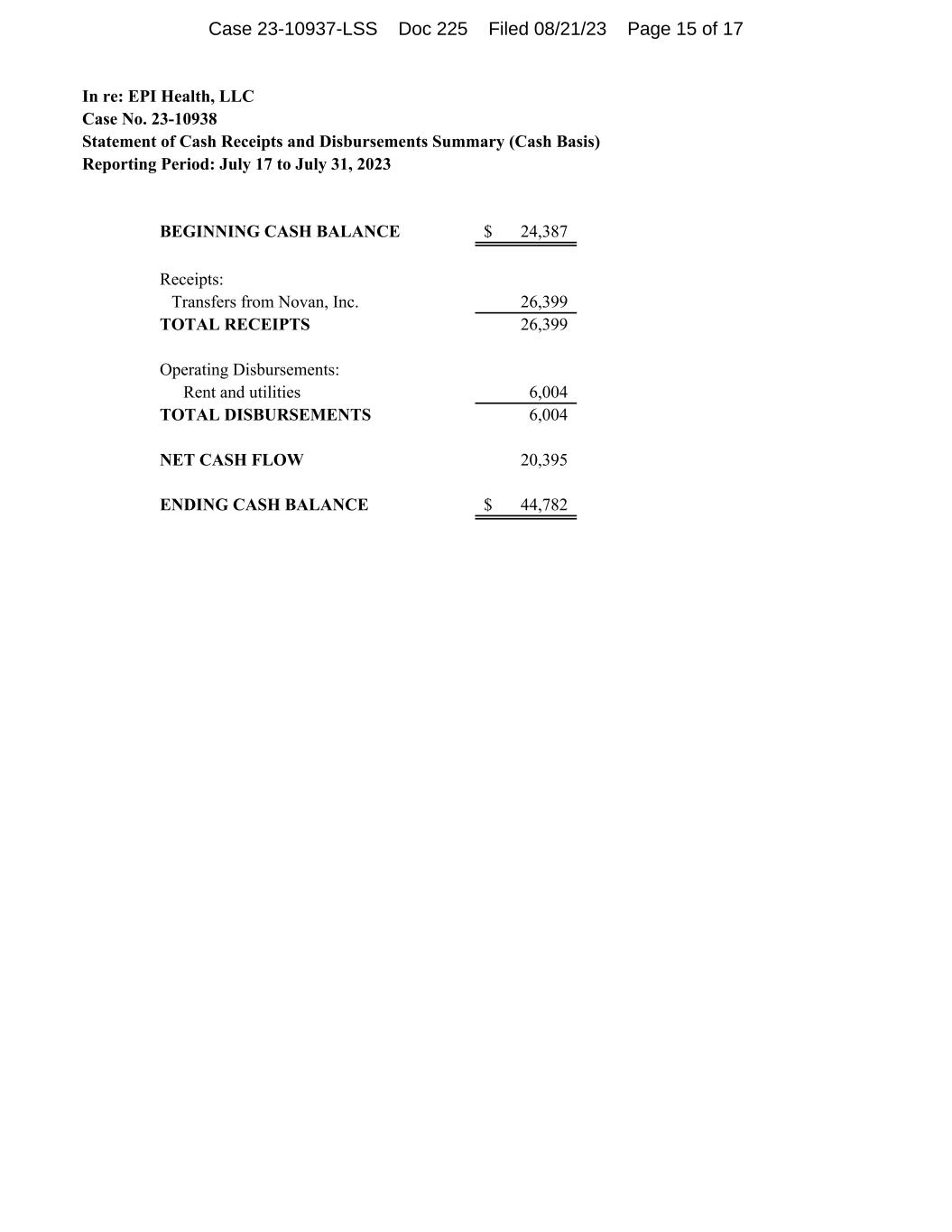

In re: EPI Health, LLC Case No. 23-10938 Statement of Cash Receipts and Disbursements Summary (Cash Basis) Reporting Period: July 17 to July 31, 2023 BEGINNING CASH BALANCE 24,387$ Receipts: Transfers from Novan, Inc. 26,399 TOTAL RECEIPTS 26,399 Operating Disbursements: Rent and utilities 6,004 TOTAL DISBURSEMENTS 6,004 NET CASH FLOW 20,395 ENDING CASH BALANCE 44,782$ Case 23-10937-LSS Doc 225 Filed 08/21/23 Page 15 of 17