Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

22 Setembro 2023 - 6:22PM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

September 2023

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One)

Form 20-F x Form 40-F ¨

|

Press Release |

|

Vale pays semi-annual remuneration on its participating debentures

Rio de Janeiro, September 22nd,

2023 – Vale S.A. (“Vale”) informs that it will pay the semi-annual remuneration on its participating debentures (“debentures”)

on October 2nd, 2023, in the gross amount of R$ 1.378039458 per debenture, totaling R$ 535,449,710.83 to holders of debentures

with a position registered in custody with B3 S.A. - Brasil, Bolsa, Balcão (“B3”) and/or with Banco Bradesco S.A. (“Bradesco”),

on the closing of September 29th, 2023.

This amount includes the following payments:

(i) the premium associated with iron ore product sales, R$ 520,172,384.17; (ii) the premium associated with copper concentrate product

sales, R$ 15,206,976.01 and (iii) premium on the sale of mining rights, R$ 70,350.65.

The financial settlement will be on October

3rd, 2023, through B3 or Bradesco, according to the debentures custody agent. Withholding income tax will be charged on the amount paid

to holders of the debentures, at the rate applicable to fixed income from financial investments. The tax rate will vary according to each

investors individual situation, with exemption exclusively for those who can provide unequivocal, legal proof of their tax-exempt status.

Gustavo Duarte Pimenta

Executive Vice President, Finance and Investor

Relations

For further information, please contact:

Vale.RI@vale.com

Ivan Fadel: ivan.fadel@vale.com

Luciana Oliveti: luciana.oliveti@vale.com

Mariana Rocha: mariana.rocha@vale.com

Pedro Terra: pedro.terra@vale.com

This press release may include statements that

present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve

various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include

factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital

markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global

competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those

forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão

de Valores Mobiliários (CVM) and in particular the factors discussed under “Forward-Looking Statements” and “Risk

Factors” in Vale’s annual report on Form 20-F.

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Vale S.A.

(Registrant) |

| |

|

| |

By: |

/s/ Ivan Fadel |

| Date: September 22, 2023 |

|

Head of Investor Relations |

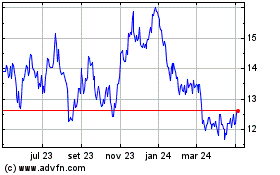

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

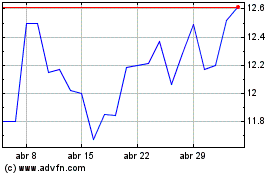

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025