Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

24 Outubro 2023 - 4:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: October, 2023

Commission file number: 001-38350

Lithium Americas (Argentina) Corp.

(Translation of Registrant's name into English)

900 West Hastings Street, Suite 300,

Vancouver, British Columbia,

Canada V6C 1E5

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [ ] Form 40-F [X]

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Lithium Americas (Argentina) Corp.

|

|

|

(Registrant)

|

|

|

|

|

|

By:

|

"John Kanellitsas"

|

|

|

Name:

|

John Kanellitsas

|

|

|

Title:

|

President and Interim Chief Executive Officer

|

Dated: October 24, 2023

Notice to Holders

LITHIUM AMERICAS (ARGENTINA) CORP.

1.75% Convertible Senior Notes due 2027

CUSIP Nos.: 53680QAA61

NOTE: THIS NOTICE CONTAINS IMPORTANT INFORMATION THAT IS OF INTEREST TO

THE REGISTERED AND BENEFICIAL OWNERS OF THE SUBJECT NOTES. IF

APPLICABLE, ALL DEPOSITORIES, CUSTODIANS, AND OTHER INTERMEDIARIES

RECEIVING THIS NOTICE ARE REQUESTED TO EXPEDITE RE-TRANSMITTAL TO

BENEFICIAL OWNERS OF THE NOTES IN A TIMELY MANNER.

Lithium Americas (Argentina) Corp. (formerly known as Lithium Americas Corp.) ("Corporation") is party to an Indenture dated December 6, 2021 (the "Indenture"), between the Company and Computershare Trust Company N.A., as trustee (the "Trustee"), pursuant to which the Company issued its 1.75% Convertible Senior Notes due 2027 (the "Notes"). Capitalized terms used herein but not otherwise defined shall have the respective meanings given such terms in the Indenture.

On October 3, 2023, the Company implemented by way of a plan of arrangement under the laws of British Columbia (the "Arrangement"), a reorganization resulting in the separation of its North American and Argentine business units into two independent public companies as follows:

- The Company became an Argentina focused lithium company owning the Company's interest in its Argentine lithium assets, including the near full-production Caucharí-Olaroz lithium brine project in Jujuy, Argentina; and

- The Company created a new North America focused lithium company ("New LAC") owning the Thacker Pass lithium project in Humboldt County, Nevada and the Company's North American investments.

Under the Arrangement, the Company's shareholders retained their proportionate interest in shares of the Company, and received by way of distribution (the "Spin-Off"), newly issued shares of New LAC in proportion to their then-current ownership of the Company. The Spin-Off was also completed on October 3, 2023. As part of the Arrangement, the Company changed its name to Lithium Americas (Argentina) Corp.

The Spin-Off will result in an adjustment to the Conversion Rate for the Notes pursuant to Section 14.04(c) of the Indenture. Pursuant to Section 14.04(c) of the Indenture, the Conversion Rate is required to be adjusted as of the close of business on the last Trading Day of the 10-Trading Day period beginning on, and including, the Ex-Dividend Date for the Spin-Off (October 4, 2023) based on the Last Reported Sale Prices of the Company's Common Shares and New LAC's common shares during such 10-Trading Day period. The New York Stock Exchange informed the Company that the Company's Common Shares began trading regular way on October 4, 2023.

As a result of the Spin-Off and in accordance with Section 14.04(c) of the Indenture summarized above, the Conversion Rate for the Notes has been adjusted to 52.6019 Common Shares of the Company per $1,000 principal amount of Notes, effective at 5:00 p.m., New York City time, on October 17, 2023. Prior to such adjustment, the Conversion Rate for the Notes previously in effect was 21.2307 Common Shares per $1,000 principal amount of Notes.

_____________________________

1 The CUSIP numbers appearing herein has been included solely for the convenience of the Holders. Neither the Company nor the Trustee assumes any responsibility for the selection or use of such CUSIP number and makes no representation as to the correctness of the CUSIP number.

Conversion rights with respect to the Notes are subject, in all respects, to the terms and conditions of the Indenture, the Notes, this notice and any related notice materials, as amended and supplemented from time to time.

For further information contact:

Investor Relations

Telephone: 778-656-0759

Email: ir@lithium-argentina.com

Website: www.lithium-argentina.com

| Dated: October 17, 2023 |

|

| |

By: Lithium Americas (Argentina) Corp. |

cc: Computershare Trust Company N.A.

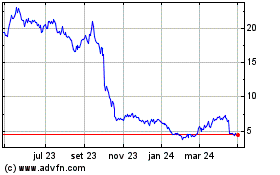

Lithium Americas (NYSE:LAC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

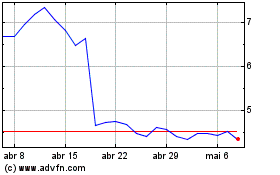

Lithium Americas (NYSE:LAC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025