0001829576false00018295762023-11-142023-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 14, 2023

CARTER BANKSHARES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Virginia | 001-39731 | 85-3365661 |

(State or other jurisdiction

of incorporation) | (Commission

file number) | (IRS Employer

Identification No.) |

1300 Kings Mountain Road, Martinsville, Virginia 24112

(Address of Principal Executive Offices) (Zip Code)

(276) 656-1776

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value | CARE | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01 OTHER EVENTS.

Carter Bankshares, Inc. Issues Statement Regarding Lawsuit Filed in West Virginia by West Virginia Governor Justice and Related Entities

In order to provide further clarity, Carter Bankshares, Inc. (the “Company”) is providing additional information relating to the lawsuit filed in the United States District Court for the Southern District of West Virginia on November 10, 2023 (the “Lawsuit”) by West Virginia Governor James C. Justice, II, his wife Cathy Justice, his son James C. Justice, III and various related entities that he and/or they own and control (the “Justice Entities” and together with the named individuals, the “Justice Parties”) against Carter Bank & Trust (“Carter Bank”) and its directors. Significant portions of the Lawsuit have been redacted. The Company and Carter Bank will review an unredacted copy as soon as it is available, and may provide additional information at that time.

Various Justice Entities have been customers of Carter Bank for many years. Beginning approximately seven years ago, Carter Bank began to seek to reduce its credit exposure to the Justice Entities and repeatedly informed the Justice Entities of Carter Bank’s goal of reducing its credit exposure to the Justice Entities. At numerous times over the ensuing years, Carter Bank worked with the Justice Entities in restructuring and/or extending various of the Justice Entities’ loans, including a restructuring agreement reached by Carter Bank and the Justice Entities in 2021 after the Justice Entities filed a similar federal court lawsuit against Carter Bank. In addition, on approximately a dozen occasions, the Justice Entities executed, in connection with restructurings and/or extensions, agreements reaffirming the legality, validity and binding nature of the respective terms of their loan obligations to Carter Bank and releasing Carter Bank from any and all claims and causes of action the Justice Entities might have. The most recent of these release and reaffirmation agreements was executed in February 2023, shortly before Carter Bank’s loans to the Justice Entities matured in accordance with their terms in April 2023.

The factual allegations in the redacted Lawsuit regarding the relationship between the parties are false and misleading. They largely recite the factual allegations included in the lawsuit filed against Carter Bank by the Justice Parties in the same court in May 2021. That lawsuit was dismissed in September, 2021 with prejudice to the Justice Parties’ right to bring it again.

Banks have an obligation to their shareholders and the financial system to collect in full all amounts that are due and owing to them. Carter Bank is no different from any other bank in this regard. As with all customers, the Justice Entities have an obligation to repay all amounts due and owing in a full and timely manner as agreed upon in the various loan documents governing their loans with Carter Bank. The Justice Entities did not meet that obligation. Carter Bank believes that it is fully secured on all loans it has outstanding to the Justice Entities, with collateral pledged to Carter Bank including The Greenbrier Resort and related facilities and real estate. All of those loans are also backed by personal guarantees from James C. Justice, II and his wife, Cathy Justice. A number of them are also backed by personal guarantees from James C. Justice, III, Mr. Justice’s son.

Carter Bank believes that it is no coincidence that the Lawsuit was filed on November 10, 2023, the day that federal courts in West Virginia were closed in observance of Veterans Day, in anticipation of a hearing scheduled for November 15, 2023 relating to Carter Bank’s collection actions (the “Collection Actions”) against certain of the Justice Entities, James C. Justice, II, his wife, Cathy Justice, and his son, James C. Justice, III. Carter Bank firmly believes that the Lawsuit reflects an effort by the Justice Entities to avoid repayment of their obligations in accordance with the agreed-upon terms in the various loan documents existing between the parties, and an attempt to use litigation in federal court to delay the Collection Actions.

The Company and Carter Bank deny the allegations contained in the redacted Lawsuit and intend to defend vigorously all claims asserted in the Lawsuit, pursue vigorously the Collection Actions, and defend vigorously the validity and enforceability of the release and reaffirmation agreements executed by the Justice Parties and the confessions of judgment against certain of the Justice Parties. Based on information presently available to the Company and Carter Bank, the Company believes that Carter Bank has meritorious defenses to all allegations contained in the redacted Lawsuit; however, because the Lawsuit is in its early stages, and because the Company and Carter Bank have not had an opportunity to review an unredacted copy of the Lawsuit, no prediction can be made as to the ultimate outcome thereof. In addition, in light of other pending claims against and litigation involving certain of the Justice Parties, Carter Bank is evaluating whether other creditors of one or more Justice Parties may attempt to assert claims against Carter Bank or its interests that relate to historical transactions with the Justice Parties.

Important Note Regarding Forward-Looking Statements

Certain matters discussed in this Current Report on Form 8-K constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to the Company’s financial condition, results of operations, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting the Company and its future business and operations, and specifically including information related to Carter Bank’s loans to the Justice Entities and the Lawsuit. Forward looking statements are typically identified by words or phrases such as “will likely result,” “expect,” “anticipate,” “estimate,” “forecast,” “project,” “intend,” “ believe,” “assume,” “strategy,” “trend,” “plan,” “outlook,” “outcome,” “continue,” “remain,” “potential,” “opportunity,” “comfortable,” “current,” “position,” “maintain,” “sustain,” “seek,” “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may. Although the Company believes the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements. For a discussion of factors that could affect our business and financial results, see the “Risk Factors” outlined in our periodic and current report filings with the Securities and Exchange Commission. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are made. The Company cautions you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and the Company undertakes no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | CARTER BANKSHARES, INC. |

| | (Registrant) |

| | | | | | | | |

| Date: November 14, 2023 | By: | /s/ Wendy S. Bell |

| Name: | Wendy S. Bell |

| Title: | Chief Financial Officer |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

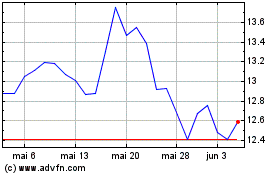

Carter Bankshares (NASDAQ:CARE)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Carter Bankshares (NASDAQ:CARE)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024