United States

Securities and

exchange commission

washington, d.c. 20549

FORM 6-K

report of foreign

private issuer

pursuant to rule 13a-16 or 15d-16 of

the securities exchange act of 1934

For the month of December 2023

Commission File Number 1-15224

Energy Company of Minas Gerais

(Translation of Registrant’s Name into English)

Avenida Barbacena, 1200

30190-131 Belo Horizonte, Minas Gerais, Brazil

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F a

Form 40-F ___

Index

Item Description

of Items

Forward-Looking Statements

This report contains statements about expected future events and financial

results that are forward-looking and subject to risks and uncertainties. Actual results could differ materially from those predicted in

such forward-looking statements. Factors which may cause actual results to differ materially from those discussed herein include those

risk factors set forth in our most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. CEMIG undertakes

no obligation to revise these forward-looking statements to reflect events or circumstances after the date hereof, and claims the protection

of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

COMPANHIA ENERGÉTICA DE MINAS GERAIS – CEMIG

By: /s/ Leonardo George de Magalhães .

Name:

Leonardo George de Magalhães

Title: Chief Finance and Investor Relations

Officer

Date: December 1, 2023

| 1. | Notice to the Market dated September 13, 2023 – CEMIG GT, HORIZONTES, and MANG execute a Purchase and Sale Agreement of Assets

of 15 SHPs / HGPs |

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31300040127

CEMIG GERAÇÃO E TRANSMISSÃO S.A.

PUBLICLY HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 06.981.176/0001-58

Company Registry (NIRE): 31300020550

NOTICE TO THE MARKET

CEMIG GT, HORIZONTES, and MANG execute a Purchase

and Sale Agreement of Assets of 15 SHPs / HGPs

COMPANHIA ENERGÉTICA DE MINAS GERAIS –

CEMIG (“CEMIG”), a publicly held company with shares traded on the stock exchanges of São Paulo, New York, and

Madrid, and CEMIG GERAÇÃO E TRANSMISSÃO S.A. (“CEMIG GT”), a publicly held company and a wholly-owned

subsidiary of CEMIG, hereby inform the Brazilian Securities and Exchange Commission (CVM), B3 S.A. – Brasil, Bolsa, Balcão

(“B3”), and the market in general that, further to the Notice to the Market of August 10, 2023, CEMIG GT and its wholly-owned

subsidiary HORIZONTES ENERGIA S.A. (“HORIZONTES”) executed, today, a Purchase and Sale Agreement of Assets (“PSA”)

aiming at the sale of 15 water generation SHPs / HGPs, of which 12 plants from CEMIG GT and 3 from HORIZONTES, to MANG PARTICIPAÇÕES

E AGROPECUÁRIA LTDA (“MANG”), the winner of bidding process 500-Y17124, for R$100.5 million.

The closing of the transaction is subject to compliance

with the usual conditions precedent defined in the PSA, which include obtaining the authorizations from ANEEL and the Brazilian antitrust

authority (CADE).

The aforementioned sale aims to comply with the guidelines

of CEMIG’s Strategic Planning that recommends optimizing the portfolio and capital allocation.

CEMIG and CEMIG GT reaffirm their commitment to keeping

shareholders, the market in general, and other stakeholders duly and timely informed about this matter, under the rules issued by the

CVM and the legislation in force.

Belo Horizonte, September 13, 2023.

Leonardo George de Magalhães

Chief Finance and Investor Relations Officer

| 2. | Notice to Shareholders dated September 20, 2023 – Dividends/Interest on Equity |

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY-HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31300040127

NOTICE TO SHAREHOLDERS

We hereby inform our shareholders that the Executive Board

resolved on the declaration of Interest on Equity - IoE. Detailed information about the payment is as follows:

| 1. | Gross value: R$417,974,000.00

(four hundred, seventeen million, nine hundred and seventy-four thousand reais) |

| 2. | Gross value per share: R$

0.18994289564 per share, to be paid with the mandatory minimum dividend referring to 2023, with a 15% withholding income tax, except for

shareholders exempt from said withholding, under the law in force; |

| 3. | Date “with rights”:

shareholders of record on September 25, 2023 that hold common and preferred shares will be entitled to the payment; |

| 4. | Date “ex-rights”:

09-26-2023; |

| 5. | Payment date: 2 (two) equal

installments, the first of which to be paid by June 30, 2024, and the second by December 30, 2024. |

Shareholders whose shares are not held in custody at CBLC

(Companhia Brasileira de Liquidação e Custódia) and whose registration data is outdated are advised to go to a branch

of Banco Itaú Unibanco S.A. (the institution managing CEMIG’s Registered Share System) bearing their personal documents for

the due update.

Belo Horizonte, September 20, 2023.

Leonardo George de Magalhães

Chief Financial and Investor Relations Officer

| 3. | Material Fact dated October 7, 2023 – Conclusion of the sale of the equity interest held in Baguari Energia |

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY-HELD

COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31300040127

CEMIG GERAÇÃO E TRANSMISSÃO S.A.

PUBLICLY HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 06.981.176/0001-58

Company Registry (NIRE): 31300020550

MATERIAL FACT

Conclusion of the sale of the equity interest

held in Baguari Energia

COMPANHIA ENERGÉTICA DE MINAS GERAIS –

CEMIG (“CEMIG or Company”), a publicly held company with shares traded on the stock exchanges of São Paulo, New

York, and Madrid, according to CVM Resolution 44/2021, of August 23, 2021, hereby informs to the Brazilian Securities and Exchange Commission

(CVM), B3 S.A. – Brasil, Bolsa, Balcão (“B3”) and the market in general that, further to the Material Fact disclosed

on April 14, 2023, that CEMIG GERAÇÃO E TRANSMISSÃO S.A. (“CEMIG GT”), a wholly-owned subsidiary

of Cemig, concluded, on October 06, 2023, the sale to Furnas Centrais Elétricas S.A. (“Furnas”) of all of its indirect

equity interest (34%) held in Consórcio Baguari, accounting for 69.39% of the share capital of Baguari Energia S.A. (“Baguari

Energia”).

Baguari Energia holds an interest of 49% in Consórcio

Baguari, which operates the Baguari Hydroelectric Power Plant, located in Minas Gerais, which has an installed capacity of 140 MW and

81.9 MW of physical guarantee.

The transaction totaled R$393.0 million, adjusted for

100% of the CDI from December 31, 2022 to the payment made on October 06, 2023. Dividends of R$11.6 million received on October 03, 2023,

were deducted from this amount, resulting in the receipt of the closing amount of R$421.2 million.

The sale is in line with the Company’s Strategic

Planning, which provides for the divestment of minority interests of Grupo Cemig.

Cemig reaffirms the commitment to keeping shareholders,

the market in general, and other stakeholders duly and timely informed about the developments of the sale, according to the applicable

regulation, and in compliance with the restrictions outlined in CVM rules and other applicable laws.

Belo Horizonte, October 07, 2023.

Leonardo George de Magalhães

Chief Financial and Investor Relations Officer

| 4. | Earnings Release - 3Q2023 |

CONTENTS

| 3Q23 HIGHLIGHTS |

2 |

| CONSOLIDATED RESULTS – THIRD QUARTER 2023 |

5 |

| Profit and loss accounts |

6 |

| Results by business segment |

7 |

| CONSOLIDATED ELECTRICITY MARKET |

8 |

| Cemig’s consolidated electricity market |

8 |

| PERFORMANCE BY COMPANY |

8 |

| Cemig D |

9 |

| Billed electricity market |

9 |

| Sources and uses of electricity – MWh |

10 |

| Client base |

10 |

| Performance by sector |

10 |

| Annual Tariff Adjustment and Periodic Tariff Review |

11 |

| Quality indicators – DEC and FEC |

12 |

| Combating default |

12 |

| Energy losses |

12 |

| Cemig GT and the Cemig Holding Company (‘Cemig H’) |

14 |

| Electricity market |

14 |

| Gasmig |

15 |

| Financial results |

16 |

| Consolidated operational revenue |

16 |

| Operational costs and expenses |

18 |

| CONSOLIDATED EBITDA (IFRS and Adjusted) |

22 |

| Ebitda of Cemig D |

23 |

| Cemig GT – Ebitda |

24 |

| Finance income and expenses |

25 |

| Net profit |

26 |

| Equity income (gain/loss in non-consolidated investees) |

27 |

| Investments |

28 |

| Debt |

29 |

| Covenants – Eurobonds |

30 |

| Cemig’s long-term ratings |

31 |

| ESG – Report on performance |

32 |

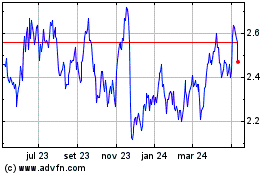

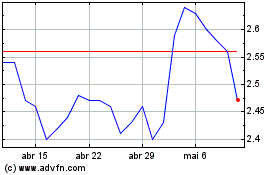

| Performance of our shares |

34 |

| Cemig’s generation plants |

36 |

| RAP: July 2023–June 2024 cycle |

37 |

| Regulatory Transmission revenue – 3Q23 |

37 |

| Complementary information |

38 |

| Cemig D |

38 |

| Cemig GT |

39 |

| Cemig, Consolidated |

40 |

| Disclaimer |

46 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 4 |  |

CONSOLIDATED

RESULTS – THIRD QUARTER 2023

Consolidated results

– 3Q23

| |

3Q23 |

3Q22 |

Change, % |

| Ebitda by company, IFRS |

|

|

|

| (R$ ’000) |

| Cemig D (IFRS) |

835,588 |

858,979 |

-2.7% |

| Cemig GT (IFRS) |

790,747 |

501,153 |

57.8% |

| Gasmig (IFRS) |

231,171 |

162,781 |

42.0% |

| Consolidated (IFRS) |

2,011,189 |

1,799,292 |

11.8% |

| |

|

|

|

| |

|

|

|

| |

3Q23 |

3Q22 |

Change, % |

| Ebitda by company, Adjusted |

|

|

|

| (R$ ’000) |

| Cemig D |

835,588 |

781,838 |

6.9% |

| Cemig GT |

744,956 |

334,859 |

122.5% |

| Consolidated |

1,964,799 |

1,535,064 |

28.0% |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 5 |  |

Profit and loss accounts

| |

3Q23 |

3Q22 |

Change, |

| Profit and loss accounts (R$ million) |

|

|

|

| NET REVENUE |

9,426,629 |

9,223,311 |

2.2% |

| |

|

|

|

| Costs |

6,268,746 |

6,631,986 |

-5.5% |

| Electricity bought for resale |

3,778,480 |

4,125,675 |

-8.4% |

| Gas purchased for resale |

527,146 |

782,453 |

-32.6% |

| Charges for use of national grid |

769,491 |

588,444 |

30.8% |

| Infrastructure construction costs |

1,193,629 |

1,135,414 |

5.1% |

| |

|

|

|

| Operating Expenses |

1,534,303 |

1,345,825 |

14.0% |

| People |

302,927 |

309,758 |

-2.2% |

| Profit shares |

43,603 |

24,518 |

77.8% |

| Post-retirement obligations |

168,786 |

163,946 |

3.0% |

| Materials |

28,478 |

34,152 |

-16.6% |

| Outsourced services |

466,584 |

409,378 |

14.0% |

| Depreciation and amortization |

316,693 |

297,607 |

6.4% |

| Operating provisions / adjustments |

99,522 |

86,428 |

15.2% |

| Impairment |

-45,791 |

37,182 |

-223.2% |

| Provisions for client default |

43,160 |

-84,852 |

-150.9% |

| Reversal of Impairment of assets |

0 |

-504 |

-100.0% |

| Other operational costs and expenses |

110,341 |

68,212 |

61.8% |

| |

|

|

|

| Net gain on disposal of asset held for sale |

- |

8,641 |

- |

| Equity gain (loss) in subsidiaries |

70,916 |

247,544 |

-71.4% |

| Net finance income (expenses) |

-214,852 |

-109,461 |

96.3% |

| Income before income tax and social contribution tax |

1,479,644 |

1,392,224 |

6.3% |

| Corporate income tax |

-242,337 |

-209,871 |

15.5% |

| |

|

|

|

| NET PROFIT FOR THE PERIOD |

1,237,307 |

1,182,353 |

4.6% |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 6 |  |

Results by business segment

| INFORMATION BY SEGMENT, 3Q23 |

| Description |

Electricity |

Gas |

Equity interests (holding co.) |

Inter-segment transactions/ reconciliation |

Total |

| Generation |

Transmission |

Trading |

Distribution |

|

| |

| NET REVENUE |

658,014 |

246,013 |

2,020,456 |

5,994,696 |

927,148 |

9,618 |

-429,316 |

9,426,629 |

| |

|

|

|

|

|

|

|

|

| COST OF ELECTRICITY AND GAS |

-38,888 |

-66 |

-1,758,373 |

-3,170,308 |

-527,146 |

-709 |

420,373 |

-5,075,117 |

| |

|

|

|

|

|

|

|

|

| OPERATIONAL COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

| People |

-34,155 |

-33,141 |

-6,054 |

-204,185 |

-15,910 |

-9,482 |

0 |

-302,927 |

| Employees’ and managers’ profit shares |

-4,206 |

-4,481 |

-858 |

-27,486 |

0 |

-13,882 |

0 |

-43,603 |

| Post-retirement obligations |

-18,310 |

-11,316 |

-2,593 |

-112,323 |

0 |

-64,749 |

0 |

-168,786 |

| Materials, Outsourced services and Other expenses (revenues) |

-57,827 |

-25,174 |

-4,819 |

-497,449 |

-18,405 |

-10,672 |

8,943 |

-605,403 |

| Depreciation and amortization |

-80,826 |

60 |

-4 |

-205,258 |

-23,769 |

-6,896 |

0 |

-316,693 |

| Operating provisions / adjustments |

38,026 |

-3,772 |

-1,497 |

-117,183 |

394 |

-12,859 |

0 |

-96,891 |

| Infrastructure construction costs |

0 |

-28,542 |

0 |

-1,030,176 |

-134,911 |

0 |

0 |

-1,193,629 |

| Total cost of operation |

-157,298 |

-106,366 |

-15,825 |

-2,194,060 |

-192,602 |

-70,724 |

8,943 |

-2,727,932 |

| |

|

|

|

|

|

|

|

|

| OPERATIONAL COSTS AND EXPENSES |

-196,186 |

-106,432 |

-1,774,198 |

-5,364,368 |

-719,748 |

-71,433 |

429,316 |

-7,803,049 |

| |

|

|

|

|

|

|

|

|

| Share of profit (loss) in non-consolidated investees |

-626 |

0 |

0 |

0 |

0 |

294,788 |

0 |

70,916 |

| Finance income (expenses) |

-28,977 |

-36,236 |

9,523 |

-99,428 |

1,205 |

-60,939 |

0 |

-214,852 |

| Income before income tax and social contribution tax |

432,225 |

103,345 |

255,781 |

530,900 |

208,604 |

-51,211 |

0 |

1,479,644 |

| Income tax and Social Contribution tax |

-93,507 |

-15,687 |

-78,275 |

-54,973 |

-69,265 |

69,370 |

0 |

-242,337 |

| |

|

|

|

|

|

|

|

|

| NET PROFIT FOR THE PERIOD |

338,718 |

87,658 |

177,506 |

475,927 |

139,339 |

18,159 |

0 |

1,237,307 |

| |

|

|

|

|

|

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 7 |  |

CONSOLIDATED ELECTRICITY MARKET

Cemig’s consolidated

electricity market

In September 2023 the Cemig

Group invoiced 9.17 million clients – an addition of approximately 178,000 clients, or a 2.0% increase in its consumer base since

the end of September 2022. Of this total number of consumers, 9,166,273 are final consumers, and/or represent Cemig’s own consumption;

and 519 are other agents in the Brazilian power sector.

These charts shows the

breakdown of the Cemig Group’s sales to final consumers in 3Q22 and 3Q23:

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 8 |  |

PERFORMANCE BY COMPANY

Cemig D

Billed electricity

market

| |

3Q23 |

3Q22 |

Change, % |

| Captive clients + Transmission service (MWh) |

|

|

|

| Residential |

2,874,159 |

2,706,219 |

6.2% |

| Industrial |

5,652,811 |

5,666,290 |

–0.2% |

| Captive market |

320,470 |

395,043 |

–18.9% |

| Transport of energy |

5,332,341 |

5,271,247 |

1.2% |

| Commercial, services and Others |

1,500,991 |

1,484,352 |

1.1% |

| Captive market |

1,008,973 |

1,061,850 |

–5.0% |

| Transport of energy |

492,018 |

422,502 |

16.5% |

| Rural |

879,384 |

933,150 |

–5.8% |

| Captive market |

867,641 |

924,189 |

–6.1% |

| Transport of energy |

11,743 |

8,961 |

31.0% |

| Public services |

844,521 |

848,819 |

–0.5% |

| Captive market |

733,652 |

848,199 |

–13.5% |

| Transport of energy |

110,869 |

620 |

17,782.1% |

| Concession holders |

88,198 |

89,145 |

–1.1% |

| Transport of energy |

88,198 |

89,145 |

–1.1% |

| Own consumption |

6,783 |

6,761 |

0.3% |

| Total |

11,846,847 |

11,734,736 |

1.0% |

| Total, captive market |

5,811,678 |

5,942,261 |

–2.2% |

| Total, energy transported for Free Clients |

6,035,169 |

5,792,475 |

4.2% |

In

3Q23, energy supplied to captive clients plus energy transported for Free Clients and distributors totaled 11,850 GWh, or 1.0% more

than in 3Q22, mainly reflecting higher consumption by residential consumers (increase of 167.9 GWh or 6.2%), reflecting a 3.2% increase

in the number of clients, and a 2.8% increase in average consumption.

The

growth of 1.0% in total energy distributed comprises: an increase of 4.2% (242.7 GWh) in use of the network by free clients, and a decrease

of 2.2% (130.6 GWh) in consumption by the captive market. The lower consumption by the captive market is mainly due to one major water

and sewerage utility client migrating to the Free Market, and to clients migrating to Distributed Generation.

|

Energy distributed, by segment

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 9 |  |

Sources and

uses of electricity – MWh

| |

3Q23 |

3Q22 |

Change, % |

| Metered market – MWh |

|

|

|

| Transported for distributors |

87,590 |

88,746 |

–1.3% |

| Transported for Free Clients |

5,956,175 |

5,718,552 |

4.2% |

| Own load + Distributed generation |

8,427,677 |

8,333,677 |

1.1% |

| Consumption by captive market |

5,575,300 |

5,852,332 |

–4.7% |

| Distributed Generation market |

1,192,135 |

757,705 |

57.3% |

| Losses in distribution network |

1,660,242 |

1,723,640 |

–3.7% |

| Total volume carried |

14,471,442 |

14,140,974 |

2.3% |

Client base

In September 2023 Cemig

billed 9.16 million consumers, or 2.0% more than in September 2022.

Of this total, 2,884 were

Free Clients using the distribution network of Cemig D.

| |

3Q23 |

3Q22 |

Change, % |

| NUMBER OF CAPTIVE CLIENTS |

|

|

|

| Residential |

7,673,463 |

7,438,683 |

3.2% |

| Industrial |

28,653 |

29,398 |

–2.5% |

| Commercial, services and Others |

940,938 |

944,794 |

–0.4% |

| Rural |

428,177 |

479,882 |

–10.8% |

| Public authorities |

69,458 |

70,019 |

–0.8% |

| Public lighting |

6,554 |

7,128 |

–8.1% |

| Public services |

13,679 |

13,570 |

0.8% |

| Own consumption |

759 |

763 |

–0.5% |

| Total, captive clients |

9,161,681 |

8,984,237 |

2.0% |

| NUMBER OF FREE CLIENTS |

|

|

|

| Industrial |

1,179 |

1,055 |

11.8% |

| Commercial |

1,656 |

1,408 |

17.6% |

| Rural |

18 |

14 |

28.6% |

| Concession holder |

8 |

8 |

0.0% |

| Other |

23 |

1 |

2,200.0% |

| Total, Free Clients |

2,884 |

2,486 |

16.0% |

| Total, Captive market + Free Clients |

9,164,565 |

8,986,723 |

2.0% |

Performance by sector

Industrial:

Energy distributed to Industrial clients totaled 0.2% less in 3Q23 than in 3Q22 reflecting the slowdown

in physical industrial production, and comprised 47.7% of Cemig D’s total distribution. The greater part was energy transported

for industrial free clients (45.0%), which was 1.2% higher in volume than in 3Q22. Energy billed to captive clients was 2.7% by volume

of the total distributed, and 18.9% less in total than in 3Q22 – mainly due to migration of clients to the Free Market.

Residential:

Residential consumption was 24.3% of total energy distributed by Cemig D, and 6.2% higher than

in 3Q22. Average monthly consumption per client in the quarter was 2.8% higher than in 3Q22. The number of clients increased by 234,800

(an increase of 3.2%), partly due to migration of consumers from the Rural category in compliance with Aneel Resolution 901/2020.

Commercial

and services: Energy distributed to these consumers

was 12.7% of the total distributed by Cemig D in 3Q23, and by volume 1.1% more than in 3Q22. This increase is the result of a 5.0%

reduction in energy billed to captive clients, and an increase of 16.5% in the volume of energy transported for Free Clients. The higher

figure mainly reflects the strong increase in service activities in 2023, and the increase in retail sales. It is worth noting that the

increase in this user category happened in spite of the migration of consumers to Distributed Generation, which was the major factor

in reduction of the captive market.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 10 |  |

Rural

clients consumed 7.4% of the total energy distributed in 3Q23, by volume 5.8% less than in 3Q22, as a result

of the number of consumers in the category being 10.8% (51,700) lower – due to reclassification to other categories as required

by Aneel Normative Resolutions 901/2020 and 1000/2020.

Public

services consumed 7.1% of the energy distributed in 3Q23, a total of 0.5% lower by volume than

in 3Q22. Total captive consumption in 3Q23 was 114.5 GWh lower YoY, while the Free Market expanded by 110.2 GWh. This was mainly due to

one major client, a water and sewerage utility, migrating.

Annual Tariff Adjustment

and Periodic Tariff Review

The tariffs of Cemig

D are adjusted in May of each year; and every five years there is the Periodic Tariff Review, also in May. The aim of the Tariff Adjustment

is to pass on changes in non-manageable costs in full to the client, and to provide inflation adjustment for the manageable costs that

are specified in the Tariff Review. Manageable costs are adjusted by the IPCA inflation index, less a deduction factor known as the ‘X

Factor’, under a system using the price-cap regulatory model.

On May 22, 2023 Aneel ratified

the result of the Annual Tariff Adjustment for Cemig D, effective from May 28, 2023 to May 27, 2024, the result of which was an average

increase for consumers of 13.27%. The average effect for low-voltage clients was an increase of 15.55%, and for residential consumers

14.91%. The component of adjustment corresponding to the Company’s management costs (referred to as ‘Portion B’) was

0.66%. The ratified increase in non-manageable costs (‘Portion A’ – comprising purchase of energy, transmission, sector

charges and non-receivables) was 5.09%; the increase in the financial components of the tariff was 7.52%. The effect in the financial

component was mainly due to withdrawal of the component incorporated in the tariff adjustment process of 2022, relating to repayment to

consumers of R$ 2.81 billion in tax credits of PIS, Pasep and Cofins taxes, while the repayment to consumers incorporated in the

2023 Tariff Review was R$ 1.27 billion.

| Average effects of the Tariff Adjustment |

| High voltage – average |

8.94% |

| Low voltage – average |

15.55% |

| Average effect |

13.27% |

Comparison of the Tariff Review of 2023 with

the prior review (2018) – main points

| The five-year Tariff Review |

2018 |

2023 |

| Gross remuneration base – R$ million |

20,490 |

25,587 |

| Net Remuneration Base – R$ million |

8,906 |

15,200 |

| Average depreciation rate |

3.84% |

3.95% |

| WACC (after taxes) |

8.09% |

7.43% |

| Remuneration of ‘Special Obligations’ – R$ mn |

149 |

272 |

| CAIMI*– R$ million |

333 |

484 |

| QRR**, R$ = Annual Depreciation |

787 |

1,007 |

* CAIMI:

(Cobertura Anual de Instalações Móveis e Imóveis) – Annual support for facilities.

** QRR: ‘Regulatory Reintegration Quota’:

Gross value x annual depreciation rate.

See more details at this link:

https://www2.aneel.gov.br/aplicacoes/tarifa/arquivo/NT%2012%202023%20RTP%20Cemig.pdf

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 11 |  |

Quality indicators – DEC and FEC

The DEC indicator (Duração

Equivalente de Interrupções por Consumidor), of average outage time per consumer, was 9.89 hours in the moving window

up to September 2023. Although the target for 2023, 9.59 hours, was more challenging, the Company has addressed this aspect with major

investment in the distribution business to ensure provision of a quality service to its clients, and also to be within the regulatory

limit.

Combating default

Cemig has maintained its

high level of collection actions, achieving greater efficiency in combating default. A good indication of this is that the Receivables

Recovery Index hit a record level of 100.53% in September 2023, reflecting an increase of nearly 20% in the use of collection tools

(email, demand letters, posting on public credit records, formal protest proceedings, disconnections, and text messages).

New payment channels, and

online negotiation, made available in recent quarters (PIX instant payments, automatic debits, payments by card and app, etc.) have contributed

to increasing collection via digital channels to 62.70% of the total collected – compared with 54.72% in 3Q22. In September, 17.66%

of all collection was via the PIX nationwide instant payment system (launched 2021). This change in the collection mix reduced costs by

6.8% – a saving of R$ 3.8 million.

|

Receivables Collection Index (‘ARFA’) – %

(Collection / Billing) – 12 month moving average |

Energy losses

In the 12-month period energy

losses, at 10.57%, were compliant with the regulatory level (11.00%).

Highlights of our measures

to combat energy losses in 9M23 include: 288,000 inspections (76% of the total planned for 2023), and replacement of 551,000 obsolete

meters (600,000 projected for 2023). As well as these measures, Cemig plans to regularize supply for 49,000 families in low-rental communities

in 2023, using the BT Zero and 'panel bulletproofing’ methods, and replacement of 100,000 standard meters by smart meters.

(So far we currently have 296,000 smart meters installed).

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 12 |  |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 13 |  |

Cemig GT and the

Cemig Holding Company (‘Cemig H’)

Electricity market

The total volume of electricity

sold by Cemig GT and by the Cemig holding company (‘Cemig H’), excluding sales on the wholesale power exchange

(CCEE) was 0.6% higher than in 3Q22.

Cemig GT itself sold

5,799 GWh (including quota sales) in 3Q23, 22.6% less than in 3Q22. This reduction reflects the transfer of contracts for sales of electricity

to the holding company, which totaled 1,750 GWh more than in 3Q22.

The holding company

posted sales of 4,253 GWh in 3Q23. Migration of contracts from Cemig GT to Cemig H began in 3Q21, and has been gradually increasing since

then:

| |

3Q23 |

3Q22 |

Change, % |

| Cemig GT – MWh |

| Free Clients |

3,298,721 |

4,629,486 |

–28.7% |

| Industrial |

2,325,940 |

3,627,964 |

–35.9% |

| Commercial |

967,754 |

997,490 |

–3.0% |

| Rural |

5,027 |

4,032 |

24.7% |

| Free Market – traders and cooperatives |

1,429,907 |

1,774,770 |

–19.4% |

| Quota supply |

530,439 |

556,410 |

–4.7% |

| Regulated Market |

507,655 |

495,627 |

2.4% |

| Regulated Market – Cemig D |

31,999 |

32,833 |

–2.5% |

| Total, Cemig GT |

5,798,721 |

7,489,126 |

–22.6% |

| Cemig H – MWh |

|

|

|

| Free Clients |

2,265,520 |

775606 |

192.1% |

| Industrial |

1,970,109 |

710,630 |

177.2% |

| Commercial |

283,585 |

61,384 |

362.0% |

| Rural |

11,826 |

3,592 |

229.2% |

| Free Market – Traders |

1987902 |

1,727,848 |

15.1% |

| Total Cemig H |

4,253,422 |

2,503,454 |

69.9% |

| Cemig GT + H |

10,052,143 |

9,992,580 |

0.6% |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 14 |  |

Gasmig

Gasmig is the exclusive

distributor of piped natural gas for the whole of the state of Minas Gerais. It serves industrial, commercial and residential users, and

users of compressed natural gas and vehicle natural gas; and supplies gas as fuel for thermoelectric generation plants.

Its concession expires in

January 2053. Cemig owns 99.57% of Gasmig.

Gasmig’s tariff

review process was completed in April 2022. Highlights:

| § | The WACC used (real, after taxes) was reduced from 10.02%

p.a. to 8.71% p.a. |

| § | The Net Remuneration Base was increased significantly, to

R$ 3.48 billion. |

| § | The regulator recognized the cost of PMSO (Personnel, Materials,

Services and Other expenses) in full. |

| Market (’000 m³/day) |

2019 |

2020 |

2021 |

2022 |

9M22 |

9M23 |

9M22– 9M23 |

| Residential |

21.28 |

25.52 |

29.69 |

31.21 |

31.67 |

34.56 |

9.1% |

| Commercial |

47.7 |

49.14 |

56.24 |

63.34 |

62.59 |

60.3 |

-3.7% |

| Industrial (including Free Market) |

2,085.32 |

2,007.45 |

2,398.47 |

2,422.69 |

2,648.59 |

2,596.05 |

-2.0% |

| Other |

148.44 |

116.32 |

129.55 |

149.17 |

157.87 |

124.1 |

-21.4% |

| Total excluding thermoelectric generation |

2,302.74 |

2,198.43 |

2,613.95 |

2,666.41 |

2,900.72 |

2,815.01 |

-3.0% |

| Thermoelectric generation |

793.94 |

385.52 |

1,177.06 |

104.08 |

0 |

0 |

- |

| Thermoelectric generation, Free Market (contracted) |

0 |

0 |

0 |

0 |

139.16 |

1,437.31 |

932.8% |

| Total |

3,096.69 |

2,583.95 |

3,791.01 |

2,770.50 |

3,039.88 |

4,252.31 |

39.9% |

| Total volume, ’000 m³ |

3Q23 |

3Q22 |

Change, % |

| Residential |

3,410 |

3,245 |

5.1% |

| Commercial |

5,876 |

6,545 |

–10.2% |

| Industrial (including Free Market) |

237,819 |

253,068 |

–6.0% |

| Other |

11,000 |

13,936 |

–21.1% |

| Total excluding thermoelectric generation |

258,105 |

276,794 |

–6.8% |

| Thermoelectric generation |

– |

6 |

– |

| Thermoelectric generation, Free Market (distribution contracted) |

153,792 |

– |

– |

| Total |

411,897 |

276,800 |

48.8% |

In 3Q23 the volume of gas

distributed to the non-thermal market was 6.8% lower than in 3Q22 (including the contracted volume of Industrial Free Market) influenced

by a 6.0% reduction in the industrial segment and 26% reduction in the automotive segment. Considering the volume of the Thermoelectric

generation market (including the volume contracted from the free market), there was an increase of 48.8%.

The number of Gasmig’s

clients increased by 16.0% from 3Q22, to a total of 92,350 consumers in 3Q23. This growth reflects expansion of the residential client

base (addition of 12,700 clients).

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 15 |  |

Financial results

Consolidated operational revenue

| |

3Q23 |

3Q22 |

Change, % |

| R$ ’000 |

|

|

|

| Revenue from supply of electricity |

8,130,020 |

7,105,782 |

14.4% |

| Revenue from use of distribution systems (TUSD charge) |

1,125,693 |

985,150 |

14.3% |

| CVA and Other financial components in tariff adjustments |

80,237 |

-395,653 |

-120.3% |

| Reimbursement, paid to consumers, of credits of PIS, Pasep and Cofins taxes – Amount realized |

311,748 |

706,087 |

-55.8% |

| Transmission operation and maintenance revenue |

95,828 |

105,628 |

-9.3% |

| Transmission construction revenue |

39,394 |

100,492 |

-60.8% |

| Financial remuneration of transmission contractual assets |

115,693 |

50,300 |

130.0% |

| Generation indemnity revenue |

23,867 |

24783 |

-3.7% |

| Distribution construction revenue |

1,165,087 |

1,063,302 |

9.6% |

| Adjustment to expected cash flow from indemnifiable financial assets of the distribution concession |

49,577 |

-10,361 |

-578.5% |

| Gain on financial updating of Concession Grant Fee |

85,073 |

59,722 |

42.4% |

| Settlement on CCEE |

36,195 |

134,890 |

-73.2% |

| Transactions in the Surpluses Sales Mechanism (MVE) |

0 |

125,463 |

-100.0% |

| Retail supply of gas |

989,284 |

1,218,147 |

-18.8% |

| Fine for continuity indicator shortfall |

-21,480 |

-13,668 |

57.2% |

| Other operational revenues |

590,628 |

873,241 |

-32.4% |

| Taxes and charges reported as deductions from revenue |

-3,390,215 |

-2,909,994 |

16.5% |

| Net operational revenue |

9,426,629 |

9,223,311 |

2.2% |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 16 |  |

Revenue from supply of electricity

| |

3Q23 |

3Q22 |

Change, % |

| |

MWh (2) |

R$ ’000 |

Average price billed – R$/MWh (1) |

MWh (2) |

R$ ’000 |

Average price billed – R$/MWh |

MWh |

R$ ’000 |

| Residential |

2,874,159 |

2,698,430 |

938.86 |

2,706,219 |

2,079,671 |

768.48 |

6.2% |

29.8% |

| Industrial |

4,616,519 |

1,517,529 |

328.72 |

4,733,637 |

1,548,322 |

327.09 |

-2.5% |

-2.0% |

| Commercial, services and others |

2,260,311 |

1,507,626 |

667 |

2,124,316 |

1,339,523 |

630.57 |

6.4% |

12.5% |

| Rural |

884,495 |

664,428 |

751.19 |

928,222 |

541,205 |

583.06 |

-4.7% |

22.8% |

| Public authorities |

214,818 |

190,624 |

887.37 |

201,625 |

144,977 |

719.04 |

6.5% |

31.5% |

| Public lighting |

263,431 |

120,576 |

457.71 |

287,126 |

120,307 |

419 |

-8.3% |

0.2% |

| Public services |

255,403 |

203,362 |

796.24 |

359,448 |

192,393 |

535.25 |

-28.9% |

5.7% |

| Subtotal |

11,369,136 |

6,902,575 |

607.13 |

11,340,593 |

5,966,398 |

526.11 |

0.3% |

15.7% |

| Own consumption |

6,783 |

- |

- |

6,761 |

- |

- |

0.3% |

- |

| Retail supply not yet invoiced, net |

- |

91,649 |

- |

- |

61,143 |

- |

- |

49.9% |

| |

11,375,919 |

6,994,224 |

607.13 |

11,347,354 |

6,027,541 |

526.11 |

0.3% |

16.0% |

| Wholesale supply to other concession holders (3) |

4,410,689 |

1,042,287 |

236.31 |

4,597,695 |

1,037,053 |

225.56 |

-4.1% |

0.5% |

| Wholesale supply not yet invoiced, net |

- |

93,509 |

- |

- |

41,188 |

- |

- |

127.0% |

| Total |

15,786,608 |

8,130,020 |

503.48 |

15,945,049 |

7,105,782 |

439.41 |

-1.0% |

14.4% |

| (1) | The calculation of average price does not include revenue from supply not

yet billed. |

| (2) | Information in MWh has not been reviewed by external auditors. |

| (3) | Includes Regulated Market Electricity Sale Contracts (CCEARs) and ‘bilateral

contracts’ with other agents. |

|

Consolidated volume of energy sold (GWh): –1.0% YoY

GWh |

Energy sold

to final consumers

Gross revenue from sales

to final consumers in 3Q23 was R$ 6,994.2 million, compared to R$ 6,027.5 million in 3Q22, a reduction of 16.0% YoY, in spite

of volume being 0.3% higher. The increase mainly reflects inclusion in the calculation base for ICMS tax of the targets for transmission

and distribution, as from Decree 45.572/2023, of February 2023.

Wholesale

Revenue from wholesale supply

was R$ 1,135.8 million in 3Q23, vs. R$ 1,078.2mn in 3Q22, due to the increase in the associated charges. The growth is linked

to the updating of contract values.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 17 |  |

Transmission

| |

3Q23 |

3Q22 |

Change, % |

| TRANSMISSION REVENUE (R$ ’000) |

|

|

|

| Operation and maintenance |

95,828 |

105,628 |

–9.3% |

| Construction, upgrades and improvement of infrastructure |

39,394 |

100,492 |

–60.8% |

| Financial remuneration of transmission contractual assets |

115,693 |

50,300 |

130.0% |

| Total |

250,915 |

256,420 |

–2.1% |

Transmission revenue was

2.1% lower, mainly due to the construction revenue component being 60.8% (R$ 61.1 million) lower due to lower realization of

investments in upgrades and improvements in the period, the new projects being at initial phase, with disbursements associated with the

design and decision stages, which have lower costs. Revenue from financial remuneration of transmission contractual assets, on the other

hand, was 130% higher, due to the IPCA inflation index, the basis for remuneration of the contract, being higher: +0.61% in 3Q23, compared

to 1,32% negative in 3Q22. Operation and maintenance revenue was 9.3% lower.

Gas

Gross revenue from supply

of gas in 3Q23 totaled R$ 989.3 million, compared to R$ 1,218.1 million in 3Q22.

The lower figure results

from (i) passthrough of the downward adjustment in average price of gas acquired, in the last 12 months; and (ii) lower volume

in the industrial and automotive markets, in contrast to the volume contracted in Free Market supply for thermoelectric generation.

Revenue from Use of Distribution Systems –

The TUSD charge

| |

3Q23 |

3Q22 |

Change, % |

| TUSD (R$ ’000) |

| Use of the Electricity Distribution System |

1,125,693 |

985,150 |

14.3% |

In 3Q23 revenue from the

TUSD – charged to Free Consumers on their distribution of energy – was 14.3% higher than in 3Q22. This reflects (i) volume

of energy transported for Free Clients 4.2% higher; (ii) the average tariff charged to Free Clients being 1.6% higher; and (iii) re-inclusion

in the basis for calculation of ICMS tax of transmission and distribution charges, as from February 2023.

| |

3Q23 |

3Q22 |

Change, % |

| POWER TRANSPORTED – MWh |

| Industrial |

5,332,341 |

5,271,247 |

1.2% |

| Commercial |

492,018 |

422,502 |

16.5% |

| Rural |

11,743 |

8,961 |

31.0% |

| Public services |

110,869 |

620 |

17,782% |

| Concession holders |

88,198 |

89,145 |

–1.1% |

| Total energy transported |

6,035,169 |

5,792,475 |

4.2% |

Operational costs and expenses

Operational costs and expenses

in 3Q23 totaled R$ 7.80 billion, compared to R$ 7.98 billion in 3Q22. The difference mainly reflects: (i) lower expenses

on purchase of energy (reduction of R$ 347.2 million) and gas (reduction of R$ 255.3 million), (ii) charges for use of

the national grid R$ 181.0 million higher; and (iii) provision for doubtful receivables from clients R$ 128.0 million higher,

given the reversal of R$84.8 million in 3Q22, due to a change in methodology which had a reduction effect of R$130.6 million in 3Q22.

See more details on costs and expenses in the pages below.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 18 |  |

| Operational costs and expenses |

3Q23 |

3Q22 |

Change, % |

| R$ ’000 |

|

|

|

| Electricity bought for resale |

3,778,480 |

4,125,675 |

-8.4% |

| Charges for use of national grid |

769,491 |

588,444 |

30.8% |

| Gas purchased for resale |

527,146 |

782,453 |

-32.6% |

| Construction cost |

1,193,629 |

1,135,414 |

5.1% |

| People |

302,927 |

309,758 |

-2.2% |

| Employees’ and managers’ profit shares |

43,603 |

24,518 |

77.8% |

| Post-retirement obligations |

168,786 |

163,946 |

3.0% |

| Materials |

28,478 |

34,152 |

-16.6% |

| Outsourced services |

466,584 |

409,378 |

14.0% |

| Depreciation and amortization |

316,693 |

297,607 |

6.4% |

| Operating provisions / adjustments |

99,522 |

86,428 |

15.2% |

| Impairment – reversal |

-45,791 |

37,182 |

-223.2% |

| Provisions (reversals) for client default |

43,160 |

-84,852 |

-150.9% |

| Reversal of loss expected from related party |

0 |

-504 |

-100.0% |

| Other operational costs and expenses |

110,341 |

68,212 |

61.8% |

| Total |

7,803,049 |

7,977,811 |

-2.2% |

Electricity purchased for resale

| |

3Q23 |

3Q22 |

Change, % |

| CONSOLIDATED (R$ ’000) |

|

|

|

| Electricity acquired in Free Market |

1,569,959 |

1,853,431 |

–15.3% |

| Electricity acquired in Regulated Market auctions |

979,149 |

910,654 |

7.5% |

| Distributed generation |

551,037 |

490,163 |

12.4% |

| Supply from Itaipu Binacional |

323,440 |

425,463 |

–24.0% |

| Physical guarantee quota contracts |

219,039 |

241,655 |

–9.4% |

| Individual (‘bilateral’) contracts |

128,695 |

128,054 |

0.5% |

| Proinfa |

127,894 |

151,414 |

–15.5% |

| Spot market |

107,621 |

195,796 |

–45.0% |

| Quotas for Angra I and II nuclear plants |

92,000 |

89,298 |

3.0% |

| Credits of PIS, Pasep and Cofins taxes |

–320,354 |

–360,253 |

–11.1% |

| |

3,778,480 |

4,125,675 |

–8.4% |

The expense on electricity

bought for resale in 3Q23 was R$ 3.78 billion, R$ 347.2 million (8.4%) less than in 3Q22. This arises mainly from the following

items:

| § | The costs of energy acquired in the Free Market, which are

the Company’s highest cost of purchased energy, at R$ 283.5 million, were 15.3% lower than in 3Q22. To make up a shortfall

in conventional and incentive-bearing energy, the amount purchased on the Free Market was higher in 2022. Also the average purchase price

was lower in 2023, due to conclusion of contracts in 2022 and start of new contracts at lower prices in 2023. |

| § | Expenses on purchase of electricity from Itaipu were R$ 102.0

million (24.0%) lower, mainly because the price for energy from Itaipu was reduced, from U$24.73 to U$20.23/kW, and also because the US

dollar exchange rate was 5.5% lower. |

| § | Expenses on energy acquired in the Regulated Market were

R$ 68.5 million (7.5%) higher than in 3Q22. This reflects the annual adjustments to contracts, by the IPCA inflation index, and entry

of a new auction. |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 19 |  |

| § | Expenses on Distributed Generation were R$ 60.9 million

(12.4%) higher, reflecting the increase in the number of distributed generation plants installed, and the higher quantity of energy injected

into the grid (1.192 GWh in 3Q23, vs. 758 GWh in 3Q22). |

Note that for Cemig D purchased

energy is a non-manageable cost: the difference between the amounts used as a reference for calculation of tariffs and the costs actually

incurred is compensated for in the next tariff adjustment.

| |

3Q23 |

3Q22 |

Change, % |

| Cemig D (R$ ’000) |

|

|

|

| Supply acquired in auctions on the Regulated Market |

1,010,691 |

925,614 |

9.2% |

| Distributed generation |

551,036 |

490,163 |

12.4% |

| Supply from Itaipu Binacional |

323,440 |

425,463 |

–24.0% |

| Physical guarantee quota contracts |

219,654 |

254,182 |

–13.6% |

| Individual (‘bilateral’) contracts |

128,695 |

128,054 |

0.5% |

| Proinfa |

127,894 |

151,414 |

–15.5% |

| Quotas for Angra I and II nuclear plants |

92,000 |

89,298 |

3.0% |

| Spot market – CCEE |

80,826 |

184,796 |

–56.3% |

| Credits of PIS, Pasep and Cofins taxes |

–173,189 |

–188,486 |

–8.1% |

| |

2,361,047 |

2,460,498 |

–4.0% |

Charges for use of the transmission network

and other system charges

Charges for use of the transmission

network in 3Q23 totaled R$ 769.5 million, 30.8% higher year-on-year. The difference primarily reflects entry into operation of Reserve

Energy contracts under the Simplified Competitive Procedure (PCS) of 2021, with a consequent increase in the reserve energy charges in

the period. This is a non-manageable cost in the distribution business: the difference between the amounts used as a reference for calculation

of tariffs and the costs actually incurred is compensated for in the next tariff adjustment.

Gas purchased for resale

The expense on acquisition

of gas in 3Q23 was R$ 527.1 million, or 32.6% less than in 3Q22. This reflects the reduction in the price of gas acquired for resale.

Outsourced services

The

expense on outsourced services was 14.0% higher than in 3Q22. The main factor was an increase of R$ 29.0 million (22.5%) in expenses

on maintenance and conservation of facilities and equipment, (mainly, increase in the value of the services contracted, plus a higher

volume of preventive maintenance services in 2023, and an increase of R$ 11.5 million (40.7%) in expenses on information technology.

Provisions for client

default

The provision for expected

losses due to client default in 3Q23 was R$ 43.1 million, compared to R$ 84.8 million reversal in 3Q22, mainly reflecting (i) changes

in the measurement of these losses put in place in 3Q22, to be more compatible with actual performance of default by the Company’s

clients in practice, and (ii) an increase in settlement of regular debts by clients.

Impairment

On the sale of the small

hydroelectric plants and small generation centers (PCHs and CGHs) in the public auction held on August 10, 2023, there was a reversal

in 3Q23 of R$ 45.8 million of the provisions made for impairment in 1Q23. On the other hand, a provision of R$ 37.2 million

was recognized in 3Q22 for impairment of receivables from the client White Martins.

Post-retirement

obligations

The impact of the Company’s

post-retirement obligations on operational profit in 3Q23 was an expense of R$ 168.8 million, compared to an expense of R$ 163.9

million in 3Q22.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 20 |  |

People

Expense on personnel in

3Q23 was R$ 302.9 million, 2.2% less than in 3Q22, even after the 6.46% increase in salaries under the Collective Work Agreement

of November 2022. In part this reflects the number of employees being 2.5% lower in 3Q23.

|

Cost of personnel

R$ million, excluding voluntary severance agreements |

|

Number of employees – by company |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 21 |  |

CONSOLIDATED EBITDA

(IFRS and Adjusted)

Ebitda is a non-accounting

measure prepared by the Company, reconciled with its consolidated financial statements in accordance with the specifications in CVM Circular

SNC/SEP 01/2007 and CVM Resolution 156 of June 23, 2022. It comprises: Net profit adjusted for the effects of: (i) Net financial

revenue (expenses), (ii) Depreciation and amortization, and (iii) Income tax and the Social Contribution tax. Ebitda is not a measure

recognized by Brazilian GAAP nor by IFRS; it does not have a standard meaning; and it may be non-comparable with measures with similar

titles provided by other companies. Cemig publishes Ebitda because it uses it to measure its own performance. Ebitda should not be considered

in isolation or as a substitute for net profit or operational profit, nor as an indicator of operational performance or cash flow, nor

to measure liquidity nor the capacity for payment of debt. (2) The Company adjusts the Ebitda calculated in accordance with CVM Instruction

156/2022, to exclude items which, by their nature, do not contribute to information on the potential for gross cash flow generation since

they are extraordinary items.

| Consolidated 3Q23 Ebitda |

| 3Q23 Ebitda – R$ ’000 |

Generation |

Transmission |

Trading |

Distribution |

Gas |

Holding co. and equity interests |

Total |

| Profit (loss) for the period |

338,718 |

87,658 |

177,506 |

475,927 |

139,339 |

18,159 |

1,237,307 |

| Income tax and Social Contribution tax |

93,507 |

15,687 |

78,275 |

54,973 |

69,265 |

-69,370 |

242,337 |

| Finance income (expenses) |

28,977 |

36,236 |

-9,523 |

99,428 |

-1,205 |

60,939 |

214,852 |

| Depreciation and amortization |

80,826 |

-60 |

4 |

205,258 |

23,769 |

6,896 |

316,693 |

| Ebitda (CVM Resolution 156) |

542,028 |

139,521 |

246,262 |

835,586 |

231,168 |

16,624 |

2,011,189 |

| Net profit attributed to non-controlling stockholders |

- |

- |

- |

- |

-599 |

- |

-599 |

| Reversal of impairment of assets – Small Hydro Plants held for sale |

-45,791 |

- |

- |

- |

|

- |

-45,791 |

| Adjusted Ebitda |

496,237 |

139,521 |

246,262 |

835,586 |

230,569 |

16,624 |

1,964,799 |

| |

|

|

|

|

|

|

|

| Consolidated 3Q22 Ebitda |

| 3Q22 Ebitda – R$ ’000 |

Generation |

Transmission |

Trading |

Distribution |

Gas |

Holding co. and equity interests |

Total |

| Profit (loss) for the period |

12,378 |

88,740 |

102,888 |

506,930 |

112,814 |

358,603 |

1,182,353 |

| Income tax and the Social Contribution tax |

64,662 |

58,301 |

27,053 |

175,268 |

48,991 |

-164,404 |

209,871 |

| Finance income (expenses) |

46,242 |

28,656 |

-6,414 |

-11,466 |

-22,043 |

74,486 |

109,461 |

| Depreciation and amortization |

82,280 |

1 |

4 |

188,247 |

23,018 |

4,057 |

297,607 |

| Ebitda (CVM Resolution 156) |

205,562 |

175,698 |

123,531 |

858,979 |

162,780 |

272,742 |

1,799,292 |

| Net profit attributed to non-controlling stockholders |

- |

- |

- |

- |

-485 |

- |

-485 |

| Gain on disposal of investments |

- |

- |

- |

- |

- |

-504 |

-504 |

| Reversal of tax provision – social security contributions on profit sharing |

-40,648 |

-37,360 |

-6,839 |

-42,433 |

- |

-8,834 |

-136,114 |

| Increasing tax provision – ‘Anuênio’ indemnity |

16,475 |

15,142 |

2,772 |

95,861 |

- |

3,581 |

133,831 |

| Put option – SAAG |

- |

- |

- |

- |

- |

-34,748 |

-34,748 |

| Change in client default provision |

- |

- |

- |

-130,569 |

- |

- |

-130,569 |

| Impairment |

- |

- |

37,182 |

- |

- |

- |

37,182 |

| Gain from agreement between FIP Melbourne and AGPar |

- |

- |

- |

- |

- |

-132,821 |

-132,821 |

| Adjusted Ebitda |

181,389 |

153,480 |

156,646 |

781,838 |

162,295 |

99,416 |

1,535,064 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 22 |  |

Ebitda of Cemig D

| |

3Q23 |

3Q22 |

Change, % |

| Cemig D Ebitda – R$ ’000 |

|

|

|

| Net profit for the period |

475,927 |

506,928 |

-6.1% |

| Income tax and Social Contribution tax |

54,973 |

175,269 |

-68.6% |

| Net finance revenue (expense) |

99,429 |

-11,465 |

- |

| Amortization |

205,259 |

188,247 |

9.0% |

| = Ebitda (1) |

835,588 |

858,979 |

-2.7% |

| Reversal of tax provision – social security contributions on profit sharing |

- |

-42,433 |

- |

| Tax provisions – Anuênio indemnity |

- |

95,861 |

- |

| Change in client default estimation method |

- |

-130,569 |

- |

| = Adjusted Ebitda (2) |

835,588 |

781,838 |

6.9% |

Cemig D posted Ebitda of

R$ 835.6 million, 6.9% more than the adjusted Ebitda of 3Q22. The main effects on Ebitda in the quarter were:

| § | Total volume of energy distributed 1.0% higher YoY (comprising

distribution to the captive market 2.2% lower, and distribution to the Free Market 4.2% higher). |

| § | The average tariff increase of 13.3% at the end of May 2023, with full effect

in this period. |

| § | Performance better than the regulatory parameters: |

| o | Energy losses, at 10.57%, lower than the regulatory threshold (11.00%),

and better than in 3Q22. |

| o | In 9M23 Opex was 4.7% lower than the regulatory level – and |

| o | Ebitda was 7.6% higher than the regulatory level. |

| § | Higher provision for non-payment by clients: R$ 41.1

million in 3Q23, vs. a reversal of R$ 82.2 million in 3Q22 – the 2022 figure reflected a change in the method of calculation,

to give a more faithful estimate of expected losses, by increasing the period for 100% write-off of client receivables from 12 to 24 months.

The effect of the change in method in 3Q22 was R$ 130.6 million. |

| § | New Replacement Value (Valor Novo de Reposição

– VNR) R$ 59.9 million higher: R$ 49.6 million in 3Q23, and R$ 10.3 million in 3Q22 |

| § | The total of Other expenses was R$ 29.7 million

higher, mainly due to a higher expense on de-activation of assets, and regulatory compensations paid to clients. |

Other non-recurring effects in 3Q22

| § | Reversal, of R$ 42.4 million, of a tax provision related

to social security contributions on payment of profit shares. |

| § | Recognition of a tax provision of R$ 95.8 million for

the legal action disputing charging of the Social Security contribution on ‘Anuênios’ (payments relating to time of

service). |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 23 |  |

Cemig GT – Ebitda

| Cemig GT 3Q23 Ebitda |

|

|

|

|

|

| Ebitda (R$ ’000) |

Generation |

Transmission |

Trading |

Equity interests |

Total |

| Profit (loss) for the period |

340,291 |

85,786 |

86,237 |

-22,300 |

490,014 |

| Income tax and Social Contribution tax |

93,508 |

15,023 |

31,259 |

-27,154 |

112,636 |

| Finance income (expenses) |

28,977 |

36,518 |

-9,524 |

51,296 |

107,267 |

| Depreciation and amortization |

80,825 |

- |

5 |

- |

80,830 |

| Ebitda as per CVM Resolution 156 |

543,601 |

137,327 |

107,977 |

1,842 |

790,747 |

| – Reversal of Impairment of assets Small Hydro Plants held for sale |

-45,791 |

- |

- |

- |

-45,791 |

| Adjusted Ebitda |

497,810 |

137,327 |

107,977 |

1,842 |

744,956 |

| |

|

|

|

|

|

| Cemig GT 3Q22 Ebitda |

|

|

|

|

|

| Ebitda (R$ ’000) |

Generation |

Transmission |

Trading |

Equity interests |

Total |

| Profit (loss) for the period |

12,954 |

83,332 |

-61,807 |

216,763 |

251,242 |

| Income tax and Social Contribution tax |

64,662 |

55,555 |

-57,791 |

-41,878 |

20,548 |

| Finance income (expenses) |

46,242 |

29,014 |

-6,414 |

78,233 |

147,075 |

| Depreciation and amortization |

82,283 |

- |

5 |

- |

82,288 |

| Ebitda as per CVM Resolution 156 |

206,141 |

167,901 |

-126,007 |

253,118 |

501,153 |

| Reversal of tax provision - social security contributions on profit sharing |

-28,874 |

-29,494 |

-5,068 |

-4,016 |

-67,451 |

| + Impairment |

- |

- |

37,182 |

- |

37,182 |

| + Tax provisions – ‘Anuênio’ indemnity |

13,503 |

13,793 |

2,370 |

1,878 |

31,544 |

| - Put option – SAAG |

- |

- |

- |

-34,748 |

-34,748 |

| – Gain from agreement between FIP Melbourne and AGPar |

- |

- |

- |

-132,821 |

-132,821 |

| Adjusted Ebitda |

190,770 |

152,200 |

-91,523 |

83,411 |

334,859 |

The Ebitda of Cemig GT in

3Q23 was R$ 790.7 million, 57.8% higher than in 3Q22. Adjusted Ebitda was 122.5% higher, YoY. Factors in the higher Ebitda include:

| § | Higher profit from trading of energy, as a result of (i) the

Company’s successful strategy (sale at moments of higher price, providing a higher margin); and (ii) continuing transfer of contracts

to the holding company – in this quarter there was migration of contracts with higher price. |

| § | Higher revenue from updating of (i) the amount of the

Concession Grant Fee (+R$ 25.4 million), and (ii) financial remuneration of transmission contractual assets (+R$ 72.7 million),

mainly reflecting the higher IPCA inflation index: +0.61% in 3Q23, and negative (–1.32%) in 3Q22; while (iii) the margin on

transmission construction was lower (–R$ 19.2 million) reducing transmission revenue, due to a lower volume of investment executed

in the quarter. |

| § | Reversal of a provision of R$ 45.8 million for impairment

of the Small Hydro Plants held for sale, after the successful sale of these assets in the auction held in 3Q23. |

| § | Lower equity income (share of gain/loss in non-consolidated

investees), at R$ 12.3 million in 3Q23, compared to R$ 175.1 million in 3Q22. The major positive effect in 3Q22 was R$ 132.8

million related to the payment made by AGPar to FIP Melbourne (holder of an interest in Santo Antônio), under the

agreement resulting from a successful arbitration. |

Other

effects in 3Q22:

| § | Reversal in 3Q22 of R$ 14.7 million relating to the

SAAG put option, reflecting the adjustment of R$ 34.7 to liabilities after the agreement with AGPar. |

| § | Provision of R$ 37 million for impairment, to take

account of challenge by a client of an amount charged. |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 24 |  |

| § | Reversal, of R$ 67.4 million, of a tax provision related

to social security contributions on payment of profit shares. |

| § | Tax provision of R$ 31.5 million for the legal action

on application of Social Security contributions to ‘anuênio’ (time of service) indemnity payments. |

Finance income

and expenses

| |

3Q23 |

3Q22 |

Change, % |

| (R$ ’000) |

|

|

|

| Finance income |

345,678 |

411,748 |

–16.0% |

| Finance expenses |

–560,530 |

–521,209 |

–7.5% |

| Finance income (expenses) |

–214,852 |

–109,461 |

–96.3% |

For 3Q23 Cemig reports Net

financial expenses of R$ 214.8 million, compared to Net financial expenses of R$ 109.5 million in 3Q22. This mainly reflects

the following factors:

| § | Costs of loans and debentures R$ 45.7 million higher

than in 3Q22, reflecting an increase of approximately 7% in gross debt, |

| § | Higher net monetary updating loans and debentures: an expense

of R$ 26.8 million in 3Q23, compared to a gain (revenue) of R$ 10.2 million in 3Q22. This is mainly due to the difference in

levels of the IPCA inflation index (the main indexor used for updating the Company’s debts) between the two periods – it was

1.32% negative in 3Q22, but 0.61% positive in 3Q23. |

| § | Monetary updating on the balances of CVA and Other

financial components in tariff increases: an expense of R$ 11.0 million in 3Q23, compared to a gain (revenue) of R$ 38.2

million in 3Q22. This is due to a lower amount of CVA items being ratified in the 2023 tariff increase process than in 2022. |

| § | In 3Q23 the US dollar appreciated by 3.9% against the Real,

compared to appreciation of 3.2% in 3Q22, generating an expense of R$ 142.5 million in 3Q23, compared to an expense of R$ 168.6

million in 3Q22. |

| § | The fair value of the financial instrument contracted to

protect risks related to the Eurobonds increased by R$ 102.4 million in 3Q23. This compares to recognition of an increase of R$ 100.1

million in 3Q22 – reflecting a rise in the yield curve compared to expectation of an increase in the Real/US$ exchange rate. |

Eurobonds

– Effect in the quarter (R$ ’000)

| |

3Q23 |

3Q22 |

| Effect of FX variation on the debt |

–142,451 |

–168,600 |

| Effect of the hedge |

102,428 |

100,087 |

| Net effect in Financial income (expenses) |

–40,023 |

–68,513 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 25 |  |

Net profit

Cemig reports net profit

of R$ 1,237 million in 3Q23, compared to net profit of R$ 1,182 million in 3Q22.

Adjusted net profit in 3Q23

was R$ 1,233 million, compared to R$ 1,028 million in 2Q22.

Factors in this result principally

include:

| § | A higher result from trading in energy by Cemig GT

and the holding company of approximately 40%, resulting from (i) a differentiated strategy, and (ii) higher margin. |

| § | Total energy distributed by Cemig D

1.0% higher, and an improved results in Costs, Ebitda and energy losses compared to the regulatory threshold.

|

| § | Profit of Gasmig 24% higher than in 3Q22, due to

higher volume contracted, and higher margin. |

| § | Reversal of the impairment posted for the Small Hydro Plants

(PCHs) held for sale, after the successful auction of these assets – contributing a positive effect of R$ 29.3 million to net

profit. |

| § | Equity income (gain/loss in equity value of non-controlled

subsidiaries) was R$ 176.6 million lower, reflecting the positive effect in 3Q22 of R$ 132.8 million from the payment by AGPar

to FIP Melbourne (holder of an interest in Santo Antônio) relating to the successful arbitration judgment. |

| § | The agreement between AGPar and FIP Melbourne had a further

effect of R$ 23 million on the profit for 3Q22, via the SAAG put option. |

| § | Combined negative effect of R$ 26.4 million on the

debt in US dollars and the hedge instrument, in 3Q23, which compares with a negative effect of R$ 45.2 million in 3Q22. |

Other

effects in the prior year (3Q22)

| § | Adjustment of the method for calculating the default provision,

to better reflect the estimate of expected losses, with positive effect of R$ 86 million on net profit. |

| § | Positive effect of R$ 90 million from reversal of tax

provisions due to cancellation of notices of infringement of Social Security liabilities on profit shares, with the chances of loss being

adjusted from ‘probable’ to ‘possible’. |

| § | The contingency for Social Security liability for anuênio

(time of service) indemnity payments was reclassified, with a negative impact of R$ 88 million. |

| § | Impairment provision relating to a challenge by a client

of an amount charged, with negative effect of R$ 25 million net profit. |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 26 |  |

Equity income (gain/loss in non-consolidated

investees)

| |

3Q23 |

3Q22 |

Change R$ ’000 |

| EQUITY INCOME (R$ ’000) * |

|

|

|

| Taesa |

58,196 |

63,986 |

–5,790 |

| Aliança Geração |

33,621 |

28,819 |

4,802 |

| Paracambi |

3,942 |

4,756 |

–814 |

| Hidrelétrica Pipoca |

3,006 |

4,663 |

–1,657 |

| Hidrelétrica Cachoeirão |

2,906 |

4,016 |

–1,110 |

| Guanhães Energia |

2,291 |

721 |

1,570 |

| Cemig Sim (Equity holdings) |

993 |

9,006 |

–8,013 |

| FIP Melbourne (Santo Antônio plant) |

0 |

142,133 |

–142,133 |

| Baguari Energia |

0 |

7,564 |

–7,564 |

| Retiro Baixo |

0 |

3797 |

-3,797 |

| Belo Monte (Aliança Norte and Amazônia Energia) |

–34,039 |

–21,937 |

–12,102 |

| Other |

0 |

20 |

–20 |

| Total |

70,916 |

247,544 |

–176,628 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 27 |  |

Investments

Cemig

invested a total of R$ 3.3 billion in the first 9 months of 2023 – 48.6% more than in 9M22. The investment realized

in 3Q23 was R$ 1.6 billion.

Works

on the Boa Esperança and Jusante solar generation plants are 80% complete – underlining Cemig’s intention

to expand generation capacity from renewable sources.

Gasmig’s

Centro-Oeste project is scheduled to invest R$ 780 million in construction of 300 km of pipeline network. R$ 207 million

had been invested by September 2023.

Execution of the largest investment program in Cemig’s

history will modernize and improve reliability of Cemig’s electricity system, as part of its strategic plan of focusing on Minas

Gerais and its core businesses, providing ever-improving service to the client.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 28 |  |

Debt

| CONSOLIDATED (R$ ’000) |

Sep. 2023 |

Dec. 2022 |

Change, % |

| Gross debt |

12,105,914 |

10,579,498 |

14.4% |

| Cash and equivalents + Securities |

4,168,072 |

3,318,838 |

25.6% |

| Net debt |

7,937,842 |

7,260,660 |

9.3% |

| Debt in foreign currency |

3,911,139 |

3,959,805 |

–1.2% |

| |

|

|

|

| CEMIG GT – R$ ’000 |

Sep. 2023 |

Dec. 2022 |

Change, % |

| Gross debt |

4,954,690 |

4,959,066 |

-0.1% |

| Cash and equivalents + Securities |

1,736,389 |

1,650,444 |

5.2% |

| Net debt |

3,218,301 |

3,308,622 |

–2.7% |

| Debt in foreign currency |

3,911,139 |

3,959,805 |

–1.2% |

| |

|

|

|

| CEMIG D (R$ ’000) |

Sep. 2023 |

Dec. 2022 |

Change, % |

| Gross debt |

6,099,168 |

4,575,998 |

33.3% |

| Cash and equivalents + Securities |

1,231,156 |

721,469 |

70.6% |

| Net debt |

4,868,012 |

3,854,529 |

26.3% |

| Debt in foreign currency |

0 |

0 |

– |

|

Debt amortization timetable

R$ mn |

In 9M23 Cemig amortized

debt of R$ 719.8 million, of which R$ 699.8 million in Cemig D – which in June completed its 9th debenture

issue, for R$ 2 billion. This issue pays the CDI rate +2.05%, with settlement in two installments, 50% in May 2025 and 50% in May

2026.

| |

3Q23 |

2023 |

| DEBT AMORTIZED – R$ ’000 |

|

|

| Cemig GT |

0 |

0 |

| Cemig D |

135,509 |

699,848 |

| Other |

20,000 |

20,000 |

| Total |

155,509 |

719,848 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 29 |  |

Covenants –

Eurobonds

| Last 12 months |

Sep. 2023 |

|

2022 |

| R$ mn |

GT |

H |

|

GT |

H |

| net income (loss) |

1,990 |

5,287 |

|

2,085 |

4,094 |

| financial results net |

179 |

351 |

|

477 |

1,567 |

| income tax and social contribution |

446 |

1,148 |

|

118 |

26 |

| depreciation and amortization |

324 |

1,235 |

|

328 |

1,182 |

| minority interest result |

-178 |

-367 |

|

-519 |

-843 |

| provisions for the variation in value of put option obligations |

18 |

18 |

|

36 |

36 |

| non-operating result (which includes any gains on asset sales and any asset write-off or impairments) |

-106 |

-225 |

|

119 |

83 |

| any non-cash expenses and non-cash charges, to the extent that they are nonrecurring |

1 |

2 |

|

-35 |

830 |

| any non-cash credits and gains increasing net income, to the extent that they are non-recurring |

0 |

-128 |

|

0 |

-209 |

| non-cash revenues related to transmission and generation indemnification |

-521 |

-529 |

|

-561 |

-575 |

| cash dividends received from minority investments (as measured in the statement of cash flows) |

170 |

506 |

|

258 |

708 |

| monetary updating of concession grant fees |

-429 |

-429 |

|

-467 |

-467 |

| cash inflows related to concession grant fees |

329 |

329 |

|

309 |

309 |

| cash inflows related to transmission revenue for cost of capital coverage |

705 |

713 |

|

601 |

607 |

| Covenant EBITDA |

2,928 |

7,911 |

|

2,749 |

7,348 |

| |

|

|

|

|

|

| Last 12 months |

Sep. 2023 |

|

2022 |

| Last 12 months - R$ mn |

GT |

H |

|

GT |

H |

| consolidated Indebtedness |

4,955 |

12,106 |

|

4,959 |

10,579 |

| Derivative financial instruments |

-337 |

-337 |

|

-612 |

-612 |

| Debt contracts with Forluz |

150 |

664 |

|

181 |

799 |

| The carrying liability of any put option obligation |

0 |

0 |

|

720 |

720 |

| Consolidated cash and cash equivalents and consolidated marketable securities recorded as current assets. |

-1,736 |

-4,168 |

|

-1,650 |

-3,319 |

| Covenant Net Debt |

3,032 |

8,265 |

|

3,598 |

8,167 |

| |

|

|

|

|

|

| Covenant Net Debt to Covenant EBITDA Ratio |

1.04 |

1.04 |

|

1.31 |

1.11 |

| Limit Covenant Net Debt to Covenant EBITDA Ratio |

2.50 |

3.00 |

|

2.50 |

3.00 |

| Total Secured Debt (R$ mn) |

- |

0 |

|

- |

74 |

| Total Secured Debt to Covenant EBITDA Ratio |

- |

0.00 |

|

- |

0.01 |

| Limit Covenant Net Debt to Covenant EBITDA Ratio |

- |

1.75 |

|

- |

1.75 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 30 |  |

Cemig’s long-term

ratings

Cemig’s ratings have

improved significantly in recent years, and are currently at their highest-ever level.

In 2021 the three principal

rating agencies upgraded their ratings for Cemig.

In April 2022, Moody’s again upgraded its rating for Cemig, this time by one notch.

Details in this table: