0001829576false00018295762023-11-142023-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 12, 2023

CARTER BANKSHARES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Virginia | 001-39731 | 85-3365661 |

(State or other jurisdiction

of incorporation) | (Commission

file number) | (IRS Employer

Identification No.) |

1300 Kings Mountain Road, Martinsville, Virginia 24112

(Address of Principal Executive Offices) (Zip Code)

(276) 656-1776

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value | CARE | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

Forms of restricted stock agreement and performance unit agreement for awards under the Carter Bankshares, Inc. Amended and Restated 2018 Omnibus Equity Incentive Plan, are filed herewith.

(d) Exhibits

Exhibit 10.1 Form of Time-Based Restricted Stock Agreement (for employee: LTIP) for use on and after December 14, 2023 under the Carter Bankshares, Inc. Amended and Restated 2018 Omnibus Equity Incentive Plan

Exhibit 10.2 Form of Performance Unit Agreement (for employee; LTIP) for use on and after December 14, 2023 under the Carter Bankshares, Inc. Amended and Restated 2018 Omnibus Equity Incentive Plan

Important Note Regarding Forward-Looking Statements

Certain matters discussed in this Current Report on Form 8-K constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to the Company’s financial condition, results of operations, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting the Company and its future business and operations, and specifically including information related to Carter Bank’s loans to the Justice Entities and the Lawsuit. Forward looking statements are typically identified by words or phrases such as “will likely result,” “expect,” “anticipate,” “estimate,” “forecast,” “project,” “intend,” “ believe,” “assume,” “strategy,” “trend,” “plan,” “outlook,” “outcome,” “continue,” “remain,” “potential,” “opportunity,” “comfortable,” “current,” “position,” “maintain,” “sustain,” “seek,” “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may. Although the Company believes the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements. For a discussion of factors that could affect our business and financial results, see the “Risk Factors” outlined in our periodic and current report filings with the Securities and Exchange Commission. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are made. The Company cautions you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and the Company undertakes no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | CARTER BANKSHARES, INC. |

| | (Registrant) |

| | | | | | | | |

| Date: December 12, 2023 | By: | /s/ Wendy S. Bell |

| Name: | Wendy S. Bell |

| Title: | Chief Financial Officer |

Exhibit 10.1

CARTER BANKSHARES, INC.

FORM OF

TIME-BASED RESTRICTED STOCK AGREEMENT

Granted <<Award Date>>

This Time-Based Restricted Stock Agreement (this “Agreement”) is entered into and effective as of <<Award Date>> (the “Award Date”) pursuant to Article VII of the Carter Bankshares, Inc. Amended and Restated 2018 Omnibus Equity Incentive Plan (the “Plan”), and evidences the grant of Restricted Stock and the terms, conditions and restrictions pertaining thereto (the “Award”) to <<Name>> (the “Participant”).

WHEREAS, Carter Bankshares, Inc. (the “Company”) maintains the Plan under which the Committee or the Board may, among other things, award shares of the Company’s common stock (the “Stock”) to such key employees of the Company and its Subsidiaries as the Committee or the Board may determine, subject to terms, conditions and restrictions as it may deem appropriate; and

WHEREAS, pursuant to the Plan the Committee has awarded to the Participant a restricted stock award conditioned upon the execution by the Company and the Participant of this Agreement setting forth all the terms and conditions applicable to such award;

NOW, THEREFORE, in consideration of the benefits which the Company expects to be derived from the services rendered to it and its subsidiaries by the Participant and of the covenants contained herein, the parties hereby agree as follows:

1. Award of Shares. Under the terms and conditions of the Plan, the Committee has awarded to the Participant a restricted stock award as of the Award Date covering <<NUMBER>> shares of Stock (the “Award Shares”), subject to the terms, conditions and restrictions set forth in this Agreement.

2. Period of Restriction and Vesting in the Award Shares.

a.Subject to earlier vesting or forfeiture as provided below, the period of restriction (the “Period of Restriction”) applicable to the Award Shares is the period from the Award Date through the Vesting Date provided below, provided the Participant’s employment with the Company or its subsidiaries continues through the Vesting Date: | | | | | |

Vesting Date | Percent of Award Shares Vesting |

| <<VESTING SCHEDULE>> | <<percent>>% |

b.Notwithstanding any other provision of this Agreement to the contrary (but subject to Section 13):

(i) If the Participant’s employment with the Company and its subsidiaries is terminated during the Period of Restriction due to the Participant’s death or Disability (as defined in the Plan), the Period of Restriction shall automatically terminate with respect to a Pro-Rata Portion (as defined below) of the Award Shares (rounded to the nearest whole share), and such Pro-Rata Portion of the Award Shares shall be vested and free of restrictions and freely

transferable as of the date of termination of employment, and all remaining Award Shares shall be automatically forfeited to the Company on such date.

(ii) If on or within the two (2) year period following a Change of Control (as defined in the Plan), (A) the Participant’s employment with the Company and its subsidiaries is involuntarily terminated without Cause (as defined in the Plan) during the Period of Restriction, or (B) the Participant resigns employment with the Company and its subsidiaries for Good Reason (as defined in the Plan) during the Period of Restriction, the Period of Restriction shall automatically terminate with respect to a Pro-Rata Portion of the Award Shares (rounded to the nearest whole share), and such Pro-Rata Portion of the Award Shares shall be vested and free of restrictions and freely transferable as of the date of termination of employment, and all remaining Award Shares shall be automatically forfeited to the Company on such date.

(iii) For purposes of this Section 2(b), a “Pro-Rata Portion” is determined by a fraction (not to exceed one), the numerator of which is the number of calendar months in the Period of Restriction during which the Participant was continuously in the employment of the Company and its subsidiaries, and the denominator of which is the number of calendar months in the Period of Restriction. The Participant will be deemed to be employed for the full calendar month that (A) includes the Award Date and (B) includes the Participant’s termination of employment under Section 2(b)(i) or 2(b)(ii) if the termination of employment occurs after the fifteenth (15th) day of a month.

(iv) No accelerated vesting shall occur except as specifically provided in Section 2(b) or as determined by the Committee in its sole discretion. No accelerated vesting provisions of the Plan, including, but not limited to, the accelerated vesting provisions of Sections 13.1, 13.2, and 13.3 of the Plan, shall apply to the Award.

(c) Except as contemplated in Section 2(a) or 2(b), the Award Shares may not be sold, transferred, pledged, assigned or otherwise alienated or hypothecated by the Participant during the Period of Restriction; provided, however, that this Section 2(c) shall not prevent transfers by will or by the applicable laws of descent and distribution, or to a Beneficiary upon the death of the Participant and provided further that the Committee may permit, in its sole discretion, transfers of Award Shares pursuant to a domestic relations order during the lifetime of the Participant.

3. Stock Certificates. The Award Shares shall be registered on the Company’s stock transfer books in the name of the Participant in book-entry or electronic form or in certificated form as determined by the Committee. During the Period of Restriction, any Award Shares issued in book-entry or electronic form shall be subject to the following legend, and any certificate(s) evidencing the Award Shares shall bear the following legend:

The sale or other transfer of the shares of stock represented by this certificate, whether voluntary, involuntary, or by operation of law, is subject to certain restrictions on transfer set forth in the Carter Bankshares, Inc. Amended and Restated 2018 Omnibus Equity Incentive Plan, in the rules and administrative procedures adopted pursuant to such Plan, and in a restricted stock agreement dated <<Award Date>>. A copy of the Plan, such rules and procedures, and such restricted stock agreement may be obtained from the Chief Financial Officer of Carter Bankshares, Inc.

4. Voting Rights. During the Period of Restriction, the Participant may exercise full voting rights with respect to all of the Award Shares.

5. Dividends and Other Distributions. During the Period of Restriction, the Participant shall be entitled to receive all dividends and other distributions paid with respect to all of the Award Shares (other than dividends or distributions that are paid in shares of Stock). If, during the Period of Restriction, any dividends or distributions paid with respect to the Award Shares are paid in shares of Stock, such shares shall be registered in the name of the Participant and such shares shall be subject to the same restrictions on vesting and transferability as the Award Shares with respect to which they were paid.

6. Forfeiture on Termination of Employment. If the Participant’s employment with the Company and its subsidiaries ceases prior to the end of the Period of Restriction and Section 2(b) does not apply or has not applied, then any Award Shares subject to restrictions at the date of such termination of employment shall be automatically forfeited to the Company upon the date of such termination of employment. For purposes of this Agreement, transfer of employment among the Company and its subsidiaries shall not be considered a termination of employment.

7. Employment. Nothing under the Plan or in this Agreement shall confer upon the Participant any right to continue in the employ of the Company or its subsidiaries or in any way affect the Company’s right to terminate the Participant’s employment without prior notice at any time for any or no reason (subject to the terms of any employment agreement between the Participant and the Company or a subsidiary).

8. Withholding Taxes. The Company or any of its subsidiaries shall have the right to retain and withhold the amount of taxes required by any government to be withheld or otherwise deducted and paid with respect to the Award Shares, provided that the Company or a subsidiary shall withhold only the minimum amount necessary to satisfy applicable statutory withholding requirements unless the Participant has elected to have an additional amount (up to the maximum allowed by law) withheld. Unless the Participant elects prior to the Vesting Date (or earlier date of accelerated vesting under Section 2(b)) to satisfy the tax withholding obligations through direct payroll deduction, the Company shall withhold a number of vested Award Shares having a Fair Market Value equal to the amount required to be withheld (including any higher amount elected by the Participant) and cancel any Shares so withheld in order to pay or reimburse the Company or a subsidiary for any such taxes, provided, however, that, in the event the Participant makes an 83(b) Election as provided in Section 9, the Participant will be deemed to have elected to satisfy the tax withholding obligations through direct payroll deduction. The value of any Shares so withheld shall be based on the Fair Market Value of the Shares on the date that the amount of tax to be withheld is determined. All elections by the Participant shall be irrevocable and be made in writing and in such manner as determined by the Committee or its delegate in advance of the Vesting Date (or earlier date of accelerated vesting under Section 2(b)).

9. Certain Tax Matters. The Participant shall provide the Company with a copy of any election made pursuant to Section 83(b) of the Internal Revenue Code of 1986, as amended from time to time, and similar provision of state law (collectively, an “83(b) Election”). If the Participant wishes to make an 83(b) Election, he must do so within a very limited period of time. The Participant acknowledges that he has been advised to consult with his tax advisor to determine if an 83(b) Election is appropriate and further acknowledges that the Participant is solely responsible for the payment of any taxes that may be due to any federal, state or local tax authority and the Company is under no obligation to ensure any such taxes are paid by the Participant.

10. Administration. The Committee shall have full authority and discretion (subject only to the express provisions of the Plan) to decide all matters relating to the administration and interpretation of the Plan and this Agreement. All such Committee determinations shall be final, conclusive and binding upon the Company and the Participant.

11. Notices. Any notice to the Company required under or relating to this Agreement shall be in writing (which may be an electronic writing) and addressed to:

Carter Bankshares, Inc.

Attention: Chief Human Resources Officer

9112 Virginia Avenue

Bassett, Virginia 24055

Any notice to the Participant required under or relating to this Agreement shall be in writing (which may be an electronic writing) and addressed to the Participant at the Participant’s address as it appears on the records of the Company.

12. Governing Law. This Agreement shall be construed and administered in accordance with and governed by the laws of the Commonwealth of Virginia.

13. Securities Laws. The Company may require the Participant to make or enter into such written representations, warranties and agreements as the Committee or Board may reasonably request to comply with applicable securities laws. The Award Shares shall be subject to all applicable laws, rules and regulations and to such approvals of any governmental agencies as may be required.

14. Successors. This Agreement shall be binding upon and inure to the benefit of the successors, assigns, heirs and legal representatives of the respective parties.

15. Entire Agreement; Amendment and Termination. This Agreement contains the entire understanding of the parties. No amendment or termination of this Agreement that would be adverse to the rights of the Participant shall be made by the Board, the Committee or any plan administrator at any time without the written consent of the Participant. No amendment or termination of the Plan will adversely affect the right, title and interest of the Participant under this Agreement or to the Award granted hereunder without the written consent of the Participant.

16. Severability. The various provisions of this Agreement are severable in their entirety. Any determination of invalidity or unenforceability of any one provision shall have no effect on the continuing force and effect of the remaining provisions.

17. Capitalized Terms. Capitalized terms in this Agreement have the meaning assigned to them in the Plan, unless this Agreement provides, or the context requires, otherwise.

18. Plan and Prospectus. This Award is granted pursuant to the Plan and is subject to the terms thereof. A copy of the Plan, as well as a prospectus for the Plan, has been provided to the Participant, and the Participant acknowledges receipt thereof.

19. Clawback. The Participant hereby consents and agrees that the Award Shares are subject to repayment (i.e., clawback) to the Company and/or its subsidiaries to the extent required under any repayment or clawback policies adopted by the Board or the Committee or under any

provisions of applicable law or regulation or securities exchange listing standard, in all cases whether in effect on the date hereof or as may be adopted or amended in the future, and further consents and agrees to abide by the terms of any such policies or provisions both during and after the Participant’s employment with the Company and/or its subsidiaries.

20. Electronic Delivery and Signatures. The Participant hereby consents and agrees to electronic delivery of share(s) of Stock, Plan documents, proxy materials, annual reports and other related documents and notices regarding the Plan and the Award. If the Company establishes procedures for an electronic signature system for delivery and acceptance of this Agreement, other Plan documents or other related documents and notices, the Participant hereby consents to such procedures and agrees that his or her electronic signature is the same as, and shall have the same force and effect as, his or her manual signature. The Participant consents and agrees that any such procedures and delivery may be effected by a third party engaged by the Company to provide administrative services related to the Plan.

To evidence its grant of the Award and the terms, conditions and restrictions thereof, the Company has signed this Agreement as of the Award Date. This Agreement shall not become legally binding unless the Participant has signed this Agreement no later than the thirtieth (30th) day after the Award Date (or such later date as the Chairman of the Committee may accept). If the Participant fails to timely sign this Agreement, the Award shall be cancelled and forfeited ab initio.

| | | | | |

CARTER BANKSHARES, INC. | PARTICIPANT |

<<Name>> <<title>>

|

<<Name>> |

Date: <<AWARD DATE>> | Date: |

EXHIBIT 10.2

CARTER BANKSHARES, INC.

FORM OF

PERFORMANCE UNIT AGREEMENT

Granted <<AWARD DATE>>

This Performance Unit Agreement (this “Agreement”) is entered into and effective as of <<AWARD DATE>> (the “Award Date”) pursuant to Article XI of the Carter Bankshares, Inc. Amended and Restated 2018 Omnibus Equity Incentive Plan (the “Plan”) and evidences the grant of performance units and the terms, conditions and restrictions pertaining thereto (the “Award”) to <<NAME>> (the “Participant”).

WHEREAS, Carter Bankshares, Inc. (the “Company”) maintains the Plan under which the Committee or the Board may, among other things, make equity awards to such key employees of the Company and its Subsidiaries as the Committee or the Board may determine, subject to terms, conditions and restrictions as it may deem appropriate; and

WHEREAS, pursuant to the Plan the Committee has awarded to the Participant a performance unit award conditioned upon the execution by the Company and the Participant of this Agreement setting forth all the terms and conditions applicable to such Award;

NOW, THEREFORE, in consideration of the benefits which the Company expects to be derived from the services rendered to it and its subsidiaries by the Participant and of the covenants contained herein, the parties hereby agree as follows:

1. Award of Performance Units. Under the terms and conditions of the Plan, the Committee has awarded to the Participant a target of <<NUMBER>> performance units (the “Performance Units”) in which the Participant will have an opportunity to earn and vest from <<percent>>% to <<percent>>% over the Performance Period (as defined below) if certain performance goals are met in accordance with Section 2 and if additional service requirements are met in accordance with Section 3. A Performance Unit represents the right to receive one share of common stock, $1.00 par value per share, of the Company (the “Common Stock”) upon and to the extent of satisfaction of the requirements set forth in this Agreement. For the avoidance of doubt, no Performance Unit shall be earned unless the applicable performance and service requirements are met. The Performance Units are granted pursuant to the Plan and are subject to the provisions of the Plan, as well as the provisions of this Agreement. The Participant agrees to be bound by all of the terms, provisions, conditions and limitations of the Plan and this Agreement. To the extent the terms of the Plan and this Agreement are in conflict, the terms of the Plan shall govern.

2. Performance Vesting in the Performance Units.

a.Applicable Performance Goals: Subject in all events to the service vesting requirements and forfeiture provisions in Section 3 and the accelerated vesting provisions in Section 4, the Performance Units are subject to four <<weighting>> weighted performance-based goals established by the Committee (each a “Performance Goal”). The first Performance Goal (which includes threshold, target and stretch levels) (“Performance Goal 1”) is based on Core ROAA (as defined in Section 2(c)) and is measured by comparing the Company’s performance during the Performance Period to its Peer Group (which is based on the ABAQ Index as defined in Section

2(f) below), as set forth in the chart in Section 2(b). The second Performance Goal (which includes threshold, target and stretch levels) (“Performance Goal 2”) is based on the Core Efficiency Ratio (as defined in Section 2(d)) and is measured by comparing the Company’s performance during the Performance Period to its Peer Group as set forth in the chart in Section 2(b). The third Performance Goal (which includes threshold, target and stretch levels) (“Performance Goal 3”) is based on the Non-Performing Assets Ratio (as defined in Section 2(e)) and is measured by comparing the Company’s performance during the Performance Period to its Peer Group as set forth in the chart in Section 2(b). The fourth Performance Goal (which includes threshold, target and stretch levels) (“Performance Goal 4”) is based on TSR (as defined in Section 2(h)) and is measured by comparing the Company’s performance during the Performance Period to its Peer Group (which is based on the ABAQ Index as defined in Section 2(f) below), as set forth in the chart in Section 2(b). The level of achievement for each Performance Goal is measured by determining the Company’s performance and the performance of its Peer Group during the Performance Period and then determining the corresponding percentile rank of the Company compared to its Peer Group, in each case using The ABAQ Index Template prepared by Pearl Meyer (“ABAQ Index Template”). Then, the level of achievement percentage set forth on the chart in Section 2(b) that corresponds to the Company’s percentile ranking for such Performance Goal is multiplied by the applicable target percentage of Performance Units. If performance for the applicable Performance Goal is between threshold and target levels or between target and stretch levels, the performance level achieved will be determined by applying linear interpolation to the performance interval and then rounding to the nearest whole Performance Unit. Failure to meet threshold performance for the applicable Performance Goal for the Performance Period means no Performance Units for that Performance Goal will be payable. Performance above stretch performance for the Performance Period will not be paid additional Performance Units. The level of achievement will be calculated separately for each Performance Goal, and the level of achievement for one Performance Goal will not impact the other Performance Goals.

b.Specific Performance Requirements: The Performance Goals, percentage of target Performance Units that can be earned for each Performance Goal for the Performance Period, and the threshold, target and stretch performance levels required to earn the Performance Units based on performance during the Performance Period are as follows:

| | | | | | | | |

Performance Goals | Percentage of Target Performance Units Subject to Performance Vesting

| Percentile Ranking of Company vs. Peer Group for Performance Period

Percentage Earned Threshold % - Target % - Stretch%

|

Performance Goa1 1: Core ROAA |

<<percent>>% |

<<rank>> Percentile - <<rank>> Percentile - <<rank>> Percentile <<percent>>% - 100% - <<percent>>%* |

Performance Goal 2: Core Efficiency Ratio |

<<percent>>% |

<<rank>> Percentile - <<rank>> Percentile - <<rank>> Percentile <<percent>>% - 100% - <<percent>>%* |

Performance Goal 3: Non-Performing Assets Ratio |

<<percent>>% |

<<rank>> Percentile - <<rank>> Percentile - <<rank>> Percentile <<percent>>% - 100% - <<percent>>%* |

Performance Goal 4: TSR |

<<percent>>% |

<<rank>> Percentile - <<rank>> Percentile - <<rank>> Percentile <<percent>>% - 100% - <<percent>>%* |

* In all events, the Performance Units are also subject to the service vesting requirements in Section 3.

Please see Appendix B for a Sample Calculation.

a.“Core ROAA” shall mean (i) the sum of Quarterly Core ROAA for each quarter during the Performance Period (ii) divided by 12. “Quarterly Core ROAA” shall mean Core Net Income for the applicable quarter divided by Total Assets for the applicable quarter. “Core Net Income” for the Company shall mean the Core Net Income (Non-GAAP) of the Company for the applicable quarter as reported in the Company’s quarterly earnings releases, which is Net Income (GAAP) as adjusted for Gains/Losses on Sales of Securities, Gains/Losses on Sales and Write-downs of Bank Premises, Losses on Sales and Write-downs of Other Real Estate Owned (“OREO”) and other non-recurring income and expenses. “Core Net Income” for each of the companies in the Peer Group shall mean the equivalent measure as reported by the company for the applicable quarter as determined in the ABAQ Index Template. For this purpose, “Total Assets” for the Company shall mean the Total Assets of the Company as of the last day of the applicable quarter as reported in the Company’s quarterly earnings releases. “Total Assets” for each of the companies in the Peer Group shall mean Total Assets as of such dates as reported by the company as determined in the ABAQ Index Template.

b.“Core Efficiency Ratio” shall mean (i) the sum of Quarterly Core Efficiency Ratios for each quarter during the Performance Period (ii) divided by 12. “Quarterly Core Efficiency Ratio” shall mean Core Noninterest Expense for the applicable quarter divided by the sum of Core Net Interest Income plus Core Noninterest Income for the applicable quarter. “Core Noninterest

Expense” for the Company shall mean Core Noninterest Expense (Non-GAAP) of the Company for the applicable quarter as reported in the Company’s quarterly earnings releases, which is Noninterest Expense (GAAP) as adjusted for Losses on Sales and Write-downs of Bank Premises, Losses on Sales and Write-downs of OREO and other non-recurring expenses. “Core Noninterest Expense” for each of the companies in the Peer Group shall mean the equivalent measure as reported by the company for the applicable quarter as determined in the ABAQ Index Template. “Core Net Interest Income” for the Company shall mean Net Interest Income (FTE) (Non-GAAP) of the Company for the applicable quarter as reported in the Company’s quarterly earnings releases, which is Net Interest Income (GAAP) presented on a taxable equivalent basis. “Core Net Interest Income” for each of the companies in the Peer Group shall mean the equivalent measure as reported by the company for the applicable quarter as determined in the ABAQ Index Template. “Core Noninterest Income” for the Company shall mean the Core Noninterest Income (Non-GAAP) of the Company for the applicable quarter as reported in the Company’s quarterly earnings releases, which is Noninterest Income (GAAP) as adjusted for Gains/Losses on Sales of Securities, Gains/Losses on Sales of Branches, OREO income and other non-recurring fees and income. “Core Noninterest Income” for each of the companies in the Peer Group shall mean the equivalent measure as reported by the company for the applicable quarter as determined in the ABAQ Index Template.

c.“Non-Performing Assets Ratio” shall mean Total Average Non-Performing Assets for the Performance Period divided by Total Average Assets for the Performance Period. “Total Average Non-Performing Assets” for the Company shall mean (i) the sum of Total Nonperforming Assets (GAAP) of the Company as of the last day of each quarter in the Performance Period as reported in the Company’s quarterly earnings releases, (ii) divided by 12. “Total Average Non-Performing Assets” for each of the companies in the Peer Group shall mean the equivalent calculation for each company based on Total Non-Performing Assets as reported by the company as of such dates as determined in the ABAQ Index Template. For this purpose, “Total Average Assets” for the Company shall mean (i) the sum of the Total Assets of the Company as of the last day of each quarter in the Performance Period as reported in the Company’s quarterly earnings releases, (ii) divided by 12. “Total Average Assets” for each of the companies in the Peer Group shall mean the equivalent calculation for each company based on Total Assets as reported by the company as of such dates as determined in the ABAQ Index Template.

d.“Peer Group” shall mean the companies listed on the ABAQ Index on the first business day of the Performance Period (see Appendix A). “ABAQ Index” shall mean the ABAQ index of publicly traded community banking companies. If a company is removed from the ABAQ Index during the Performance Period, then the company remains in the Peer Group and is ranked in the ABAQ Index Template for the Performance Period but with performance measured through the end of the quarter that ends on or immediately before the date of its removal and by calculating performance for any Performance Goal component that is divided by 12 by instead dividing by the number of quarters for which performance is measured. If a company is in the ABAQ Index during the Performance Period but fails to report performance for the last quarter of the Performance Period at least fifteen (15) calendar days before the Committee certifies the level of achievement in accordance with Section 2(i), then the company remains in the Peer Group and is ranked in the ABAQ Index Template for the Performance Period but with performance measured through the end of the quarter for which performance was reported and by calculating performance for any Performance Goal component that is divided by 12 by instead dividing by the number of quarters for which performance is measured.

e.“Performance Period” shall mean <<date>> through <<date>>.

f.“TSR” shall mean, with respect the Company or any company in the Peer Group, as applicable, the appreciation of the price of a share of common stock during the Performance Period, plus any Dividends Paid on a share of common stock during such Performance Period, calculated as follows: (i) the sum of (x) the Ending Stock Price minus the Beginning Stock Price, plus (y) the amount of any Dividends Paid cumulatively over the Performance Period, divided by (ii) the Beginning Stock Price. “Beginning Stock Price” shall mean the closing price of a share of the applicable common stock on the last trading day immediately preceding the first day of the Performance Period. “Ending Stock Price” shall mean the closing price of a share of the applicable common stock (as adjusted to reflect stock splits, spin-offs, and similar transactions that occurred during the Performance Period, as appropriate) on the last trading day of the Performance Period. “Dividends Paid” shall mean all dividends paid on a share of applicable common stock with respect to an ex-dividend date that occurs during the Performance Period (whether or not the dividend payment date occurs during the Performance Period), which shall be deemed to have been reinvested in the underlying share of common stock and shall include dividends paid with respect to such reinvested dividends, appropriately adjusted to reflect stock splits, spin-offs, and similar transactions.

g.Determination and Certification of Performance Achievement: Subject to the provisions of Section 5, the Committee will certify the level of achievement of the Performance Goals following the end of the Performance Period. Any Performance Units that are not, based on the Committee’s determination, performance vested for the Performance Period, shall be automatically forfeited to the Company and cancelled as of the last day of the Performance Period. The Performance Units that performance vest shall remain subject to the service vesting requirements in Section 3. For the avoidance of doubt, except as specifically provided otherwise in Section 4, no Performance Units can vest unless and until (i) the applicable Performance Goal in Section 2(b) is met for the Performance Period and (ii) the service vesting requirement in Section 3 is met. Payment of any vested Performance Units shall be paid as provided in Section 5.

3. Service Vesting of Performance Units. In addition to the performance requirements provided in Section 2, subject to the accelerated vesting provisions of Section 4, the Participant must be employed with the Company or a subsidiary on the Normal Payment Date (as defined in Section 5) to vest in the Performance Units. If the Participant is employed on the Normal Payment Date, the Participant will vest in the Performance Units to the extent the Performance Goals were achieved. If the Participant’s employment with the Company and its subsidiaries ceases for any reason, whether by the Company or by the Participant, prior to the Normal Payment Date, and Section 4 does not apply or has not applied, then all Performance Units that have not been previously forfeited and cancelled shall not be earned and shall be automatically forfeited to the Company and cancelled on the date of such termination of employment. For purposes of this Agreement, transfer of employment among the Company and its subsidiaries shall not be considered a termination of employment.

4. Accelerated Vesting of Performance Units.

a.Notwithstanding any other provision of this Agreement to the contrary (but subject to Section 15):

(i) If the Participant’s employment with the Company and its subsidiaries is terminated before the Normal Payment Date due to the Participant’s death or due to the Participant’s Disability (as defined in the Plan), the Performance Period shall automatically terminate and a Pro-Rata Portion (as defined below) of the Performance Units (rounded to the nearest

whole unit) eligible to vest during that Performance Period shall become vested and nonforfeitable as of the date of termination of employment to the extent the Performance Goals have been met (measured as of the last day of the quarter immediately preceding the date of termination of employment) and shall be payable under Section 5, and all remaining Performance Units that have not previously vested or been forfeited and cancelled shall be automatically forfeited to the Company and cancelled.

(ii) If the Participant’s employment with the Company and its subsidiaries is terminated after <<date>> but before the Normal Payment Date due to either (A) the termination of the Participant’s employment other than for Cause (as defined in the Plan) by the Company or (B) the Participant’s resignation other than when Cause for termination is present, and other than due to the Participant’s death or Participant’s Disability, the Performance Units eligible to vest during that Performance Period shall become vested and nonforfeitable as of the date of termination of employment to the extent the Performance Goals for that Performance Period have been met and shall be payable under Section 5, and all remaining Performance Units that have not previously vested or been forfeited and cancelled shall be automatically forfeited to the Company and cancelled.

(iii) Upon a Change of Control (as defined in the Plan) prior to the Normal Payment Date and subject to the discretion of the Committee in Article XV of the Plan, a Pro-Rata Portion of the Performance Units (rounded to the nearest whole unit) eligible to vest during that Performance Period shall become vested and nonforfeitable as of the date of the Change of Control, provided the Participant is employed with the Company or a Subsidiary on the date of such Change of Control, to the extent the Performance Goals for the Performance Period have been met (measured as of the last day of the quarter immediately preceding the date of the Change of Control) and shall be payable under Section 5, and all remaining Performance Units that have not previously vested or been forfeited and cancelled shall be automatically forfeited to the Company and cancelled.

(iv) For purposes of Section 4(a)(i) and 4(a)(iii), a “Pro-Rata Portion” is determined by a fraction (not to exceed one), the numerator of which is the number of calendar months in the Performance Period (A) if Section 4(a)(i) applies, during which the Participant was continuously in the employment of the Company and its subsidiaries or (B) if Section 4(a)(iii) applies, prior to the date of the Change of Control, and the denominator of which is the number of calendar months in the Performance Period. The Participant will be deemed to be employed for the full calendar month that (A) includes the Award Date and (B) includes the Participant’s termination of employment under Section 4(a)(i) if the Participant’s termination of employment under Section 4(a)(i) occurs after the fifteenth (15th) day of a month. The Change of Control will be deemed to occur on the last day of the month if the Change of Control under Section 4(a)(iii) occurs after the fifteenth (15th) day of a month.

a.No accelerated vesting shall occur except as specifically provided in Section 4(a) or as determined by the Committee in its sole discretion. No accelerated vesting provisions of the Plan, including, but not limited to, the accelerated vesting provisions of Sections 13.1, 13.2, and 13.3 of the Plan, shall apply to the Award.

5. Payment of Performance Units in Shares. The Company shall pay the Performance Units that have become vested under Sections 2 through 4 in shares of Common Stock (the “Award Shares”) within seventy (70) days following the earliest to occur of (a) <<date>> or (b) to the extent accelerated vesting has been triggered under Section 4(a)(i) or (ii), the date of termination of employment under Section 4(a)(i) or (ii) or (c) to the extent accelerated vesting has been triggered under Section 4(a)(iii), the date of the Change of Control under Section 4(a)(iii) (the “Payment Trigger Event”). The payment date that is within seventy (70) days following <<date>> is referred to in this Agreement as the “Normal Payment Date”. The Committee will certify performance for the Performance Period within forty-five (45) days following the Payment Trigger Event and payment will be initiated on the date of the Committee’s

certification. Payment initiation means that the share issuance process is initiated by the Company although actual issuance of the Award Shares may occur up to twenty-five (25) days following the date that Committee certification occurs, as determined by the Committee or its delegate in its sole discretion. The Award Shares will be issued in the name of and delivered to the Participant via book-entry or electronic delivery or in certificated form as determined by the Committee or its delegate and will be freely transferable by the Participant. Notwithstanding any other provision of this Agreement, the issuance and delivery of the Award Shares under this Section 5 shall be subject to the requirements of Section 15, including restrictions on transfer as provided therein to the extent applicable.

6. No Transfer Rights. The Participant shall have no rights to or with respect to the Performance Units or the Common Stock underlying such Performance Units except as specifically set forth in this Agreement. The Performance Units shall not be sold, assigned, transferred, pledged, hypothecated or otherwise disposed of, other than by will, the laws of descent and distribution or pursuant to a beneficiary designation made under the Plan. No right or benefit hereunder shall in any manner be liable for or subject to any debts, contracts, liabilities, or torts of the Participant.

7. No Rights of a Shareholder. The Participant shall not have any rights of a shareholder of the Company with respect to the Performance Units and Award Shares unless and until the Award Shares are issued to the Participant.

8. Dividend Equivalents. To the extent the Performance Units have not been forfeited and the Award Shares have not yet been paid under Section 5, if the Participant is employed on the record date for any dividends and other distributions with respect to the Common Stock that are paid in Common Stock or other securities of the Company to the holders of the Common Stock (the “Stock Dividends”), the Participant shall be granted additional Performance Units equal to the Stock Dividends that the Participant would have received if the Performance Units were actual shares of Common Stock, and such additional Performance Units shall be subject to the same restrictions on transferability, forfeiture, performance and service vesting, certification, payment (as Award Shares) and withholding provisions as the Performance Units to which such additional Performance Units relate. To the extent the Performance Units have not been forfeited and the Award Shares have not yet been paid under Section 5, if the Participant is employed on the record date for any dividends and other distributions with respect to the Common Stock that are paid in cash to the holders of the Common Stock (the “Cash Dividends”), the Participant shall be credited with an amount equal to the Cash Dividends that would have been paid on the Performance Units had they been shares of Common Stock (the “Cash Dividend Equivalents”). Such amounts shall be credited to a hypothetical account and held by the Company until payable in cash or forfeited pursuant hereto. No interest shall accrue on the Cash Dividend Equivalents or otherwise be paid with respect to the holding period. The Cash Dividend Equivalents shall be subject to the same restrictions on transferability, forfeiture, performance and service vesting, certification, payment and withholding provisions as the Performance Units with respect to which they were paid; provided, however, that the Cash Dividend Equivalents shall be paid in cash, not Award Shares, at the time set forth in Section 5 (including the seventy (70)-day payment window provided therein).

9. Employment. Nothing under the Plan or in this Agreement shall confer upon the Participant any right to continue in the employ of the Company or its subsidiaries or in any way affect the Company’s right to terminate the Participant’s employment without prior notice at any time for any or no reason

(subject to the terms of any employment agreement between the Participant and the Company or a subsidiary).

10. Withholding Taxes. The Company or any of its subsidiaries shall have the right to retain and withhold the amount of taxes required by any government to be withheld or otherwise deducted and paid with respect to the Award, provided that the Company or a subsidiary shall withhold only the minimum amount necessary to satisfy applicable statutory withholding requirements unless the Participant has elected to have an additional amount (up to the maximum allowed by law) withheld. Unless the Participant elects prior to vesting to satisfy the tax withholding obligations with regard to the Award Shares through direct payroll deduction, the Company shall withhold a number of Award Shares having a Fair Market Value equal to the amount required to be withheld (including any higher amount elected by the Participant) and cancel any Award Shares so withheld in order to pay or reimburse the Company or a subsidiary for any such taxes. The value of any Award Shares so withheld shall be based on the Fair Market Value of the Common Stock on the date that the amount of tax to be withheld is determined. Applicable withholding with regard to Cash Dividend Equivalents shall be in cash and withheld through direct payroll deduction. All elections by the Participant shall be irrevocable and be made in writing and in such manner as determined by the Committee or its delegate in advance of the applicable vesting date.

11. Section 409A Exemption. Notwithstanding any other provision of this Agreement, it is intended that payments hereunder will not be considered deferred compensation within the meaning of Section 409A of the Internal Revenue Code (“Section 409A”) and will satisfy the short-term deferral exemption under Section 409A. To that end, all payments under this Agreement shall be made no later than two and one-half (2 ½) months following the end of the later of (a) the Participant’s tax year or (b) the Company’s tax year, in each case during which the Award is no longer subject to a substantial risk of forfeiture. For purposes of this Agreement, all rights to payments hereunder shall be treated as rights to receive a series of separate payments and benefits to the fullest extent allowed by Section 409A. Notwithstanding the foregoing, should any payment made in accordance with this Agreement be determined to be a payment from a nonqualified deferred compensation plan subject to Section 409A (“409A Payment”), then such payment shall be made in accordance with Section 409A. Also, any such payment to a “specified employee” (as defined under Section 409A) that is payable in connection with the Participant’s “separation from service” (as defined under Section 409A), and that is not exempt from Section 409A as a short-term deferral or otherwise, to the extent necessary to avoid the imposition of taxes under Section 409A, shall be paid in a lump sum on the earlier of the date that is six (6) months and one day after the Participant’s date of separation from service or the date of the Participant’s death. Neither the Company nor any subsidiary nor the Committee nor any delegate makes any commitment or guarantee that any federal or state or other tax treatment will apply or be available to any person eligible for benefits under this Agreement.

12. Administration. The Committee shall have full authority and discretion (subject only to the express provisions of the Plan) to decide all matters relating to the administration and interpretation of the Plan and this Agreement. All such Committee determinations shall be final, conclusive and binding upon the Company and the Participant.

13. Notices. Any notice to the Company required under or relating to this Agreement shall be in writing (which may be an electronic writing) and addressed to:

Carter Bankshares, Inc.

Attention: Chief Human Resources Officer

9112 Virginia Avenue

Bassett, Virginia 24055

Any notice to the Participant required under or relating to this Agreement shall be in writing (which may be an electronic writing) and addressed to the Participant at the Participant’s address as it appears on the records of the Company.

14. Governing Law. This Agreement shall be construed and administered in accordance with and governed by the laws of the Commonwealth of Virginia to the extent federal law does not supersede and preempt Virginia law.

15. Securities Laws. The Company may require the Participant to make or enter into such written representations, warranties and agreements as the Committee or Board may reasonably request to comply with applicable securities laws. The Performance Units and Award Shares shall be subject to all applicable laws, rules and regulations and to such approvals of any governmental agencies as may be required.

16. Successors. This Agreement shall be binding upon and inure to the benefit of the successors, assigns, heirs and legal representatives of the respective parties.

17. Entire Agreement; Amendment and Termination. This Agreement contains the entire understanding of the parties. This Agreement may be amended or terminated with the written agreement of both parties; provided, however, that the Board or the Committee may unilaterally amend or terminate this Agreement if such amendment or termination is not adverse to the rights of the Participants (including, but not limited to, a unilateral amendment to accelerate vesting and payment of the Award). No amendment or termination of the Plan will adversely affect the right, title and interest of the Participant under this Agreement or to the Award granted hereunder without the written consent of the Participant.

18. Severability. The various provisions of this Agreement are severable in their entirety. Any determination of invalidity or unenforceability of any one provision shall have no effect on the continuing force and effect of the remaining provisions.

19. Capitalized Terms. Capitalized terms in this Agreement have the meaning assigned to them in the Plan, unless this Agreement provides, or the context requires, otherwise.

20. Plan and Prospectus. The Award is granted pursuant to the Plan and is subject to the terms thereof. A copy of the Plan, as well as a prospectus for the Plan, has been provided to the Participant, and the Participant acknowledges receipt thereof.

21. Clawback. The Participant hereby consents and agrees that the Award Shares are subject to repayment (i.e., clawback) to the Company and/or its subsidiaries to the extent required under any repayment or clawback policies adopted by the Board or the Committee or under any provisions of applicable law or regulation or securities exchange listing standard, in all cases whether in effect on the date hereof or as may be adopted or amended in the future, and further consents and agrees to abide by the terms of any such policies or provisions both during and after the Participant’s employment with the Company and/or its subsidiaries.

22. Electronic Delivery and Signatures. The Participant hereby consents and agrees to electronic delivery of share(s) of Common Stock, Plan documents, proxy materials, annual

reports and other related documents and notices regarding the Plan and the Award. If the Company establishes procedures for an electronic signature system for delivery and acceptance of this Agreement, other Plan documents or other related documents and notices, the Participant hereby consents to such procedures and agrees that his or her electronic signature is the same as, and shall have the same force and effect as, his or her manual signature. The Participant consents and agrees that any such procedures and delivery may be effected by a third party engaged by the Company to provide administrative services related to the Plan.

To evidence its grant of the Award and the terms, conditions and restrictions thereof, the Company has signed this Agreement as of the Award Date. This Agreement shall not become legally binding unless the Participant has signed this Agreement no later than the thirtieth (30th) day after the Award Date (or such later date as the Chairman of the Committee may accept). If the Participant fails to timely sign this Agreement, the Award shall be forfeited to the Company and cancelled ab initio.

CARTER BANKSHARES, INC. PARTICIPANT

<<NAME>> <<NAME>>

<<TITLE>>

Date: <<AWARD DATE>> Date:

Appendix A – Peer Group

<<peer group>>

Appendix B – Sample Hypothetical Calculations

<<sample hypothetical calculations>>

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

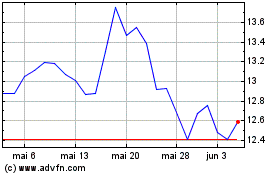

Carter Bankshares (NASDAQ:CARE)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Carter Bankshares (NASDAQ:CARE)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024