UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

_______________________

CURRENT REPORT

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File Number: 001-39829

____________________

COGNYTE SOFTWARE LTD.

(Translation of registrant's name into English)

_______________________

33 Maskit

Herzliya Pituach

4673333, Israel

(Address of principal executive office)

indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Explanatory Note

On December 31, 2023, Cognyte Software Ltd. (the “Company”) entered into an extension and amendment (the “Credit Extension and Amendment”) to its revolving credit facility with Bank Leumi Le-Israel B.M. (as amended, the “Credit Facility”). The Company was successful in securing the Credit Extension and Amendment ahead of the scheduled expiration of the original Credit Facility on January 31, 2024. Under the Credit Extension and Amendment, the Credit Facility previously made available to the Company will be extended by two years until January 31, 2026. In addition, based on the Company’s financial objectives, current cash balance and expected cash flow, the available amount will be adjusted to $35 million from $50 million. As of this date, there are no outstanding amounts borrowed by the Company under the Credit Facility. The Credit Facility Extension and Amendment contains customary affirmative and restrictive covenants for credit facilities of this type.

The summary herein of the Credit Extension and Amendment is qualified in its entirety by reference to such agreement, which is filed as an exhibit to this Report on Form 6-K and is deemed incorporated herein by reference.

The information in this Report on Form 6-K is hereby incorporated by reference into the Company’s Registration Statement on Form S-8 (File No. 333-252565).

EXHIBIT INDEX

The following exhibit is furnished as part of this Form 6-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | COGNYTE SOFTWARE LTD. (Registrant) |

| | | |

| January 3, 2024 | | | | By: | | /s/ David Abadi |

| | | | | | David Abadi |

| | | | | | Chief Financial Officer |

AMENDMENT NO. 3 TO THE COMMITMENT LETTER

DATED DECEMBER 27, 2020

This amendment (the “Amendment No. 3”) to the Commitment Letter and Covenants Letter both dated December 27, 2020 and to Amendment No. 1 and Amendment No. 2 is entered into with effect from December 31, 2023 (“Effective Date of Amendment No. 3”).

W I T N E S S E T H

WHEREAS, the Parties have executed a Commitment Letter and a Covenants Letter both dated Decembers 20, 2020 as amended by Amendment No.1 on July 28, 2022 and Amendment No. 2 on January 31, 2023 (“Original Commitment Letter” or “OCL” or “Original Covenants Letter”).

WHEREAS, the Parties wish to amend the Original Commitment Letter as provided in this Amendment No. 3 with effect from the Effective Date of Amendment No. 3.

NOW THEREFORE, the OCL shall be amended as follows:

1. Defined Terms

Unless otherwise defined herein, capitalized terms used herein which are defined in the OCL herein as therein defined.

2. Amendments to the OCL

As of the Effective Date of Amendment No. 3, the OCL shall be amended as follows:

2.aThe first paragraph of OCL and Section 1.1 of the OCL shall be amended to reduce the amount of the CF to US$35,000,000 (Thirty-Five Million US Dollars) instead of US$50,000,000 (Fifty Million US Dollars).

2.bThe CF Term in Section 1.1 of the OCL shall be amended so that the term shall end on “January 31, 2026” (expire February 1, 2026) instead of “January 31, 2024” and the effectiveness of the Covenants Letter shall be extended as well.

2.cIn Section 1.1 following the heading “Interest” the remainder of Section 1.1 of the OCL shall be deleted.

2.dThe Company acknowledges that the interest rate of the CF was previously amended following the discontinuation of the LIBOR. A new Section 1.1A shall be inserted in the OCL as follows:

“1.1A Interest for CF

1.1A.1 The CF Loan shall bear interest equal to the Term SOFR + 3.2644% per annum.

1.1A.2 Notwithstanding the aforesaid, if the interest (i.e. the Term SOFR plus the above interest margin) shall be lower than zero %, the undischarged balance of the CF Loan shall bear interest at the rate of zero % for the applicable interest period.

The terms “SOFR”, and “Term SOFR”, shall bear the meanings ascribed to them in the then prevailing Bank form of request for credit.”

2.eSection 1 of the Original Covenants Letter shall be amended to insert a new definition:

“Net Cash” shall mean: the total net Cash and Cash Equivalents (including Cash/Cash Equivalents and short-term investments but after deduction of Funded Debt) as defined in the Financial Reports.”

2.fSection 2.1 of the Covenants Letter shall be amended so that the Top Company’s consolidated Equity shall be not lower than USD165,000,000 (One Hundred Sixty-Five Million USD) instead of USD200,000,000 (Two Hundred Million USD).

2.gSection 2.2 and section 2.2A of the Covenants Letter shall be deleted and replaced by the following:

“2.2 The Top Company shall maintain at all times on a consolidated basis Net Cash of at least USD15,000,000 (Fifteen Million USD).

The Bank will permit the Top Company to include in the computation of the end of quarter Net Cash amounts it may receive in the first 2 weeks immediately after the quarter end (i.e., received in the subsequent quarter) in respect of sales included in the prior quarters.”

2.hSection 4 of the Original Covenants Letter shall be deleted and replaced by the following:

“4. Undertaking Not to Merge

We undertake not to effect, not to undertake to effect and not to take any actions whatsoever to effect a merger of Company with another/other corporation(s) or split shares without receiving the Bank's prior written consent thereto. For this purpose, the Company undertakes to provide the Bank with all information and documents needed by the Bank, at the Bank's discretion, about the requested merger/split with respect to the requested merger, in order that the Bank may determine its position with respect to such merger/split.

In this document, the expression “merger”, means - merger according to the eighth or ninth chapter of the Companies Law 5759-1999 and/or any action which results in the acquisition of the majority of the Company's assets by a person or corporation, or any action which results in the acquisition of the Company's shares granting the purchaser control of the Company and/or any action which results in the acquisition by the Company, directly or indirectly, of the majority of another corporation's assets or of another corporation's shares granting the Company control of such corporation, provided that the foregoing shall not apply in relation to an acquisition by Company of another corporation’s shares and/or assets (including by way of merger in which the Company is the surviving entity) in consideration for a purchase price below USD 40,000,000, provided, however, that the Company shall provide Bank with written notice prior to the consummation of any such acquisition.

In addition, Top Company undertakes not to take any action without the consent of the Bank which results in the acquisition by Top Company, directly or indirectly, of the majority of another corporation's assets or of another corporation's shares granting Top Company control of such corporation, provided that the foregoing shall not apply in relation to an acquisition by Top Company of another corporation’s shares and/or assets (including by way of merger in which Top Company is the surviving entity) in consideration for a purchase price below USD 40,000,000 per transaction and USD 60,000,000 in the aggregate during the CF Term.”

3. Fees

The Borrower shall pay the following fees for this Amendment No. 3:

3.1 During the period from February 1, 2024 until January 31, 2026 the Unutilization Fee in Section 4.1 of the OCL shall be 0.75% per annum (instead of 0.55% until February 1, 2024).

3.2 Legal Fees in the amount of US$, 14,200 (Fourteen Thousand and Two hundred USD) to be paid concurrently with the return of this Amendment No. 3 countersigned by the Company.

4. Effectiveness

This Amendment No. 3 shall become effective as of the Effective Date of Amendment No. 3.

5. Continuing Effect of the OCL

This Amendment No. 3 shall not constitute an amendment or waiver of any other provision of the OCL not expressly referred to herein and shall not be construed as such.

Except as expressly amended herein, the provisions of the OCL are and shall remain in full force and effect.

BANK LEUMI LE-ISRAEL B.M.

By: ________________

Bank Leumi le-Israel B.M.

Dear Sir/Madam,

We hereby confirm our agreement to the above and to entering into this Amendment No. 3 to the Original Commitment Letter dated December 27, 2020 (as amended).

Signed by:

Name: David Abadi Name: Meir Talbi

Position: CFO Position: VP Finance

Signature: /s/ David Abadi Signature: /s/ Meir Talbi

Date: Dec 31, 2023 Date: Dec 31, 2023

________________________________________

_______________________________________

Cognyte Technologies Israel Ltd. (“Company”)

Dear Sir/Madam,

We hereby confirm our agreement to the above and to entering into this Amendment No. 3 to the Original Commitment Letter dated December 27, 2020 (as amended).

Signed by:

Name: David Abadi Name: Meir Talbi

Position: CFO Position: VP Finance

Signature: /s/ David Abadi Signature: /s/ Meir Talbi

Date: Dec 31, 2023 Date: Dec 31, 2023

___________________________________

__________________________________

Cognyte Software Ltd. (“Top Company”)

I, the undersigned, Ilan Rotem, the lawyer acting for Cognyte Technologies Israel Ltd. (the “Company”), hereby confirm that the above signature composition binds the Borrower, and I confirm that the meeting of the board of directors of the Company dated _ Dec 31, 2023_ was duly held and that the entry into this Amendment No. 3 to the Original Commitment Letter and the Covenants Letter dated December 27, 2020, by the Borrower, was approved by resolutions that were duly passed in accordance with the law and with the articles of association of the Company, and that the same have been duly signed by the Chairman of the meeting.

| | | | | | | | | | | | | | | | | | | | |

| Dec 31, 2023 | | Ilan | | Rotem | | /s/ Ilan Rotem |

| Date | | Name | | Surname | | Signature |

I, the undersigned, Ilan Rotem, the lawyer acting for Cognyte Software Ltd. (the “Top Company”), hereby confirm that the above signature composition binds the Borrower, and I confirm that the meeting of the board of directors of Top Company dated _ Dec 31, 2023_ was duly held and that the entry into this Amendment No. 3 to the Original Commitment Letter and the Covenants Letter dated December 27, 2020, by Top Company, was approved by resolutions that were duly passed in accordance with the law and with the articles of association of Top Company, and that the same have been duly signed by the Chairman of the meeting.

| | | | | | | | | | | | | | | | | | | | |

| Dec 31, 2023 | | Ilan | | Rotem | | /s/ Ilan Rotem |

| Date | | Name | | Surname | | Signature |

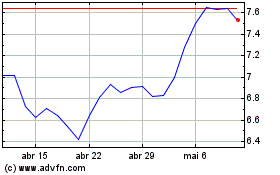

Cognyte Software (NASDAQ:CGNT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

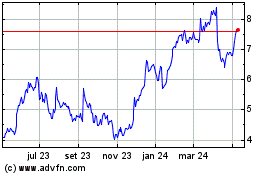

Cognyte Software (NASDAQ:CGNT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024