Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

22 Janeiro 2024 - 8:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission file number: 001-39278

Kingsoft Cloud Holdings Limited

(Exact Name of Registrant as Specified in Its

Charter)

Building D, Xiaomi Science and Technology Park,

No. 33 Xierqi Middle Road,

Haidian District

Beijing, 100085, the People’s Republic

of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F

x Form 40-F

¨

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Kingsoft Cloud Holdings Limited |

| |

|

|

| Date: January 22, 2024 |

By: |

/s/ Haijian He |

| |

|

Name: Haijian He |

| |

|

Title: Chief Financial Officer and Director |

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

Kingsoft

Cloud Holdings Limited

金山云控股有限公司

(Incorporated

in the Cayman Islands with limited liability)

(Stock

Code: 3896)

(Nasdaq

Stock Ticker: KC)

GRANT

OF RESTRICTED SHARE UNITS

PURSUANT

TO THE 2021 SHARE INCENTIVE PLAN

Pursuant to Rule 17.06A,

17.06B and 17.06C of the Listing Rules, the Board announces that on January 19, 2024 (United States time), the Company granted 3,142,275

RSUs to certain employee participants in accordance with the terms of the 2021 Share Incentive Plan and subject to acceptance, representing

3,142,275 underlying Shares (approximately 209,485 ADSs, as rounded down to the nearest whole ADS) and approximately 0.08% of the total

issued Shares of the Company in issue as at the date of this announcement.

Details of Grant of RSUs

| Grant Date: |

|

January 19, 2024 (United States time) |

| |

|

|

| Total number of RSUs granted: |

|

3,142,275 RSUs granted to 7 employees of the Group |

| |

|

|

| Number of underlying Shares or ADSs: |

|

3,142,275 Shares or approximately 209,485 ADSs (as round down to the nearest whole ADS) |

| |

|

|

| Purchase price: |

|

US$0.01 per Share |

| |

|

|

| Closing price of the Shares on the date of the Grant: |

|

US$2.62 per ADS, for ADSs traded on the Nasdaq Global Select Market on January 18, 2024 (United States time), being the trading day immediately preceding the Grant Date. |

| |

|

|

| |

|

HK$1.39 per Share for Shares traded on the Stock Exchange on January 19, 2024 (Hong Kong time). |

| |

|

|

| Vesting period: |

|

Such 3,142,275 RSUs shall vest by batches from the first anniversary to the fifth anniversary of the respective vesting commencement dates, as specified in the relevant grant letters, including 628,455 RSUs with a vesting period shorter than 12 months. |

| |

|

In accordance with

Company’s corporate policies, RSUs are granted centrally in certain specific months of each financial year. Thus, as permitted by

the 2021 Share Incentive Plan, to make up for the time loss in vesting period for some of the grants for reason that their respective

vesting commencement dates preceded each corporate centralized grant dates, certain batches of RSUs granted may have a shorter vesting

period compared to those of other batches having a respective vesting commencement date closer to the centralised grant date. |

| |

|

|

| Performance target: |

|

The

vesting of RSUs under the Grants is not subject to any performance target. |

| |

|

|

| Clawback mechanism: |

|

In

the event that: |

| (a) | a Grantee ceases to be a selected participant by reason of (i) the termination of such Grantee’s employment or contractual

engagement with the Group for cause or without notice, (ii) termination of such Grantee’s employment or contractual engagement

with the Group as a result of such Grantee being convicted of a criminal offence involving such Grantee’s integrity or honesty,

(iii) termination of such Grantee’s employment or contractual engagement with the Group as a result of such Grantee undergoing

a regulatory or administrative penalty by a competent authority; or |

| (b) | in the reasonable opinion of the Board, a Grantee has engaged in serious misconduct or breached the terms of the 2021 Share Incentive

Plan in any material respect, |

| |

|

then the Board may make a determination at its absolute discretion that: (A) any awards issued but not yet exercised shall immediately lapse, regardless of whether such awards have vested, and (B) with respect to any Shares issued to such Grantee pursuant to any awards granted under the 2021 Share Incentive Plan, such Grantee shall be required to transfer back to the Company or its nominee (1) the equivalent number of Shares, (2) an amount in cash equal to the market value of such Shares, or (3) a combination of (1) and (2). |

| |

|

|

Arrangement

for the Group to provide financial assistance to a Grantee to facilitate the purchase of Shares:

|

|

None |

To the best of the Directors’

knowledge, information and belief having made all reasonable enquiry, none of the Grantees is (i) a Director, a chief executive,

a substantial shareholder of the Company, or an associate of any of them; (ii) a participant with options and awards granted and

to be granted exceeding the 1% individual limit under Rule 17.03D of the Listing Rules; or (iii) a related entity participant

or service provider with options and awards granted and to be granted in any 12-month period exceeding 0.1% of the total issued Shares.

None of the grant will be subject to approval by the Shareholders.

As at the date of this announcement,

after the Grant above, 222,941,228 underlying Shares will be available for future grants under the Scheme Mandate Limit, and 38,052,848

underlying Shares will be available for future grants under the Service Provider Sublimit.

Reasons for and Benefits of

the Grant of RSUs

The purpose of the Grants is to

(i) promote the success and enhance the value of the Company by linking the personal interests of the Grantees to those of the Shareholders

and by providing such individuals with an incentive for outstanding performance to generate superior returns to the Shareholders; and

(ii) provide flexibility to the Company in its ability to motivate, attract, and retain the services of the directors and employees

of the Group, and the service providers of the Group upon whose judgment, interest and special effort the successful conduct of the Company’s

operation is largely dependent. It is considered that the Grants will provide incentives to the employees of the Group to further contribute

to the Group and to align their interests with the best interests of the Company and the Shareholders as a whole.

DEFINITIONS

In this announcement, the following

expressions have the meanings set out below unless the context otherwise requires:

| “2021 Share Incentive Plan” |

|

the share incentive plan of our Company adopted on November 15, 2021, as amended from time to time with the latest amendments being made on December 20, 2022; |

| |

|

|

| “ADS(s)” |

|

American Depositary Shares, each representing 15 Shares; |

| |

|

|

| “associate(s)” |

|

shall have the meaning ascribed to it under the Listing Rules; |

| |

|

|

| “Board” |

|

the board of Directors; |

| |

|

|

| “Company” |

|

Kingsoft Cloud Holdings Limited, an exempted company with limited liability incorporated in the Cayman Islands on January 3, 2012, the ADS(s) of which were listed on the Nasdaq Global Market in May 2020 and the ordinary Shares of which were listed on the Mainboard of the Stock Exchange in December 2022; |

| |

|

|

| “Director(s)” |

|

the director(s) of the Company; |

| |

|

|

| “Grant(s)” |

|

the grant of an aggregate of 3,142,275 RSUs to 7 Grantees in accordance with the terms of the 2021 Share Incentive Plan on January 19, 2024 (United States time); |

| |

|

|

| “Grant Date” |

|

January 19, 2024 (United States time); |

| |

|

|

| “Grantee(s)” |

|

7 employees who are granted with a total of 3,142,275 RSUs under the 2021 Share Incentive Plan; |

| “Group” |

|

our Company, its subsidiaries and the consolidated affiliated entities from time to time; |

| |

|

|

| “HK$” |

|

Hong Kong dollars, the lawful currency of Hong Kong; |

| |

|

|

| “Listing Rules” |

|

the Rules Governing the Listing of Securities on the Stock Exchange, as amended, supplemented or otherwise modified from time to time; |

| |

|

|

| “RSU(s)” |

|

restricted share units; |

| |

|

|

| “Scheme Mandate Limit” |

|

the limit on total number of Share which may be issued upon the exercise of all awards and options that may be granted pursuant to the 2021 Share Incentive Plan and any other share schemes of the Company in aggregate, which shall not exceed ten percent (10%) of the total number of Shares in issue immediately upon the listing of the Company’s Shares on the Stock Exchange, being 380,528,480 Shares; |

| |

|

|

| “Service Provider Sublimit” |

|

a sublimit under the Scheme Mandate Limit of Share which may be issued upon the exercise of all awards and options that may be granted to service provider participants pursuant to the 2021 Share Incentive Plan and any other share schemes of the Company in aggregate, which shall not exceed one percent (1.0%) of the total number of Shares in issue immediately upon the listing of the Company’s Shares on the Stock Exchange, being 38,052,848 Shares; |

| |

|

|

| “Share(s)” |

|

ordinary share(s) in the share capital of our Company with a par value of US$0.001 each; |

| |

|

|

| “Shareholder(s)” |

|

the holder(s) of the Share(s); |

| |

|

|

| “Stock Exchange” |

|

The Stock Exchange of Hong Kong Limited; |

| |

|

|

| “subsidiary” or “subsidiaries” |

|

shall have the meaning ascribed to it under the Listing Rules; |

| |

|

|

| “US$” |

|

United States dollars, the lawful currency of the United States; and |

| |

|

|

| “%” |

|

per cent. |

| |

By order of the Board |

| |

Kingsoft Cloud Holdings Limited

Mr. Zou Tao |

| |

Executive Director, Vice

Chairman of the Board and acting Chief Executive Officer |

Hong Kong, January 22, 2024

As

at the date of this announcement, the board of directors of the Company comprises Mr. Lei Jun as Chairman and non-executive

director, Mr. Zou Tao as Vice Chairman and executive director, Mr. He

Haijian as executive director, Dr. Qiu Ruiheng as non-executive director,

and Mr. Yu Mingto, Mr. Wang

Hang and Ms. Qu Jingyuan as independent non-executive directors.

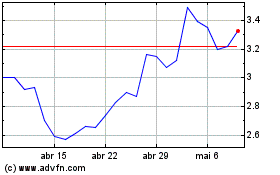

Kingsoft Cloud (NASDAQ:KC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

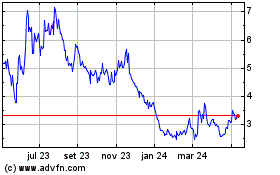

Kingsoft Cloud (NASDAQ:KC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024