0001834584FALSE00018345842024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

January 30, 2024

COUPANG, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40115 | | 27-2810505 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

720 Olive Way, Suite 600

Seattle, Washington 98101

(Address of principle executive offices, including zip code)

(206) 333-3839

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Class A Common Stock, par value $0.0001 per share | | CPNG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 Completion of Acquisition or Disposition of Assets

As previously announced, on December 18, 2023, Coupang, Inc. (the “Company”), and certain funds managed and/or advised by Greenoaks Capital Partners, LLC (“Greenoaks”) established a limited partnership named Surpique LP (f/k/a Athena Topco LP), a Delaware limited partnership (“Surpique LP”), for the purpose of acquiring all of the business and assets of Farfetch Holdings plc, a public limited company organized under the laws of England and Wales (“Farfetch PLC”), a leading global marketplace for the luxury fashion industry.

On December 18, 2023, Surpique LP also entered into (i) a Transaction Support Agreement (the “Support Agreement”), by and among, inter alios, Surpique LP, Farfetch PLC, Farfetch Limited, the existing parent of Farfetch PLC, and an ad hoc group of lenders (the “AHG”) holding in excess of 80% of the approximately $600 million aggregate principal amount of outstanding term loans (the “Term Loans”) under the existing credit agreement of Farfetch PLC and certain of its direct and/or indirect subsidiaries, dated October 20, 2022 (as amended and/or restated as of such date, the “Credit Agreement”) and (ii) a committed first lien delayed draw term loan facility in an aggregate principal amount of up to $500 million (the “Bridge Loan Facility”) with Farfetch PLC and certain of its direct and/or indirect subsidiaries (the loans drawn on the Bridge Loan Facility from time to time, collectively, the “Bridge Loans”). Between December 18, 2023 and January 30, 2024, Surpique LP advanced an aggregate of $150 million to the Farfetch group in Bridge Loans, of which 80.1% were funded by the Company and 19.9% were funded by Greenoaks.

Pursuant to the terms of the Support Agreement, a marketing process of all the assets of Farfetch PLC (the “Farfetch Business”) was undertaken on behalf of Farfetch PLC following the signing of the Support Agreement. Following the completion of the marketing process, the directors of Farfetch PLC appointed administrators from AlixPartners UK LLP, who upon appointment entered into a Sale and Purchase Agreement, dated as of January 30, 2024 (the “SPA”), with Surpique Acquisition Limited, a private limited company organized under the laws of England and Wales and an indirect, wholly owned subsidiary of Surpique LP (“Surpique Acquisition”), in connection with which:

•Surpique Acquisition acquired the Farfetch Business (the “Sale”);

•Surpique Holdings Limited, a private limited company organized under the laws of England and Wales and the owner of all of the outstanding equity interests in Surpique Acquisition (“Surpique Holdings”), and Surpique Acquisition acceded to the Credit Agreement and, thereafter, entered into the Amended Credit Agreement (as defined below);

•Surpique LP (i) contributed approximately $300 million to the Farfetch Business, consisting of approximately $150 million in cash and the termination of the approximately $150 million aggregate outstanding principal and interest under the Bridge Loans, and (ii) committed to provide to the Farfetch Business up to an additional $200 million, at Surpique Acquisition’s option within 12-months of the closing of the Sale, the net proceeds of which will be applied to meet transaction costs and otherwise will be made available for the working capital and general corporate needs of the Farfetch Business and its consolidated entities, with such contribution and commitment funded 80.1% and 19.9% by the Company and Greenoaks, respectively;

•The obligors under the Term Loans made an offer to repurchase 10% of the outstanding principal amount of the Term Loans at par, pro rata amongst the lenders of the Term Loans following the closing of the Sale, which resulted in approximately $57.5 million of aggregate principal amount of the Term Loans being repurchased, leaving approximately $575.4 million aggregate principal amount remaining outstanding under the Term Loans following such repurchase, net of capitalized transaction fees; and

•The Bridge Loan Facility was terminated.

The terms of the SPA contain customary covenants, undertakings and conditions for an arrangement of this type.

On January 30, 2024, Surpique Acquisition, Farfetch US Holdings, Inc., GLAS USA LLC (as successor in interest to JPMorgan Chase Bank, N.A.) as Administrative Agent, Wilmington Trust, National Association, as Collateral Agent and the lenders party thereto entered into the Fifth Amendment to Credit Agreement, Accession and Fee Agreement (the “Fifth Amendment”), which amends the Credit Agreement (as amended by the Fifth Amendment, the “Amended Credit Agreement”). The Term Loans under the Amended Credit Agreement mature on October 20, 2027 (unless payable earlier in accordance with the terms of the Amended Credit Agreement). Repayment of the Term Loans are due in quarterly installments of approximately 0.25%, payable on the last

Business Day (as defined in the Amended Credit Agreement) of each fiscal quarter and on the Maturity Date. The Term Loans bear interest at a rate equal to, at the Borrower’s option, either the Base Rate (as defined in the Amended Credit Agreement) plus 5.25% per annum or Term SOFR (as defined in the Amended Credit Agreement) plus 6.25% per annum, which exposes Surpique Acquisition and its subsidiaries to interest rate risk. A Term Loan borrowed in Base Rate is subject to a 0% floor and a Term loan borrowed in Term SOFR is subject to a 0.50% floor.

The Amended Credit Agreement contains customary negative covenants, including, but not limited to, restrictions on Surpique Acquisition's and its restricted subsidiaries’ ability to incur additional debt, make investments, make distributions, dispose of assets, repay junior debt and enter into certain types of related party transactions. These restrictions may restrict Surpique Acquisition’s and its restricted subsidiaries' current and future operations, particularly the ability to respond to certain changes in the business or industry, or take future actions. Pursuant to the Amended Credit Agreement and related security agreements, Surpique Acquisition and its restricted subsidiaries granted the lenders a security interest in a substantial portion of its assets. The obligations under the Amended Credit Agreement are also guaranteed by Surpique Acquisition and its restricted subsidiaries. Additionally, pursuant to certain security agreements, Surpique Holdings granted the lenders a limited security interest in certain of its assets.

Following the closing of the transactions described above, the Company will have an 80.1% equity interest, and funds advised or managed by Greenoaks will have a 19.9% equity interest, in Surpique LP. Surpique LP is managed by its general partner, which is managed by a board of managers, with the Company having the right to appoint two managers and with Greenoaks having the right to appoint one manager. Each party has customary consent and approval rights over actions of the board of managers.

Mr. Neil Mehta, a member of the Company’s Board of Directors and the Lead Independent Director, founded and has served as a Managing Partner of Greenoaks since April 2012. In addition, Greenoaks and certain funds and accounts to which Greenoaks serves as the investment adviser and related persons or entities, including Mr. Mehta, collectively own approximately 4.4% of the Company’s Class A common stock.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of the Registrant.

The information disclosed in Item 2.01 above pertaining to borrowings under the Amended Credit Agreement is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On January 31, 2024, the Company issued a press release announcing the transactions described above. A copy of such press release is furnished herewith as Exhibit 99.1.

Forward-Looking Statements

This report may contain statements that may be deemed to be “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Act”), that are intended to enjoy the protection of the safe harbor for forward-looking statements provided by the Act as well as protections afforded by other federal securities laws, including statements regarding the timing, consummation and anticipated benefits of the transactions described herein. The Company has based the forward-looking statements contained in this report on its current expectations. Actual results and outcomes could differ materially for a variety of reasons, including, among others: (i) the risk that the transaction may adversely affect the Company’s business and the price of the common stock of the Company, (ii) the effect of the transaction on the Company or Farfetch Business’ relationships, operating results, and business generally, (iii) risks that the transaction disrupts current the Company’s plans and operations and potential difficulties in employee retention at both companies as a result of the transaction, (iv) risks related to diverting management’s attention from the Company’s existing business operations, (v) the outcome of any legal proceedings that may be instituted against the Company or Farfetch Business related to the transaction, (vi) the ability of the Company to successfully integrate Farfetch’s operations and technology, and (vii) the ability of the Company to implement its plans, forecasts, and other expectations with respect to the combined company’s business after the completion of the proposed acquisition and realize additional opportunities for growth and innovation. For additional information on other potential risks and uncertainties that could cause actual results to differ from the results predicted, please see our most recent Annual Report on Form 10-K and subsequent filings. All forward-looking statements in this report are based on information available to the Company and assumptions and beliefs as of the date hereof, and the Company disclaims any obligation to update any forward-looking statements, except as required by law. The Company may not actually achieve the plans, intentions, or expectations disclosed in its forward-looking statements, and you should not place undue reliance on the Company’s forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired

The financial statements required by this item, if any, will be filed by an amendment to this Current Report on Form 8-K no later than 71 calendar days after the date this Current Report on Form 8-K is required to be filed.

(b) Pro Forma Financial Information

The pro forma financial information required by this item, if any, will be filed by an amendment to this Current Report on Form 8-K no later than 71 calendar days after the date this Current Report on Form 8-K is required to be filed.

(d) Exhibits.

| | | | | |

| Exhibit Number | Description of Exhibit |

| 99.1 | |

| 104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| COUPANG, INC. (REGISTRANT) |

| |

| By: | /s/ Harold Rogers |

| Harold Rogers |

| General Counsel and Chief Administrative Officer |

Dated: January 31, 2024

Coupang Completes Acquisition of Farfetch

SEATTLE AND LONDON – JANUARY 31, 2024 – Coupang, Inc. announced today that it has completed the acquisition of the assets of global online luxury company Farfetch Holdings plc. By providing access to $500M in capital, this acquisition allows Farfetch to continue delivering exceptional services for its brand and boutique partners, and to more than four million customers around the world. By leveraging Coupang’s operational excellence and innovative logistics, Farfetch is now well-positioned to pursue steady and thoughtful growth.

About Coupang

Coupang, a Fortune 200 company listed on the New York Stock Exchange (NYSE: CPNG), is one of the largest retailers in the world. Its mission is to revolutionize the lives of its customers and create a world where people wonder, "How did we ever live without Coupang?" Coupang offers a variety of services, including same-day and dawn delivery of merchandise, delivery of prepared foods through Coupang Eats, fintech through Coupang Pay, and video streaming through Coupang Play. Coupang is headquartered in the United States, with operations and support services performed in markets including South Korea, Taiwan, Singapore, China, and India.

FORWARD-LOOKING STATEMENTS

This press release may be deemed to contain forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words "will," "believes," "plans," "anticipates," "expects," "estimates," "strives," "goal," "intends," "may," "endeavors," "continues," "projects," "seeks," or "targets," or the negative of these terms or other comparable terminology, as well as similar expressions) should be considered to be forward-looking statements, although not all forward-looking statements contain these identifying words. Readers should not place undue reliance on these forward-looking statements, as these statements are the management's beliefs and assumptions, many of which, by their nature, are inherently uncertain, and outside of the management's control. Factors that may cause actual results to differ materially from those in any forward‑looking statements include, without limitation, (i) the effect of the announcement or the transaction on Coupang or Farfetch’s business relationships, operating results, growth, and business generally, (ii) risks that the transaction disrupts current Coupang’s plans and operations and potential difficulties in employee retention at both companies as a result of the transaction, (iii) risks related to diverting management’s attention from Coupang’s ongoing business operations, (iv) the outcome of any legal proceedings that may be instituted against Coupang or Farfetch related to the transaction, (v) the ability of Coupang to successfully integrate Farfetch’s operations and technology, and (vi) the ability of Coupang to implement its plans, forecasts, and other expectations with respect to the combined company’s business after the completion of the acquisition and realize additional opportunities for growth and innovation; and other risks, uncertainties and factors relating to Coupang's operations and financial performance discussed in its filings with the SEC. For additional information on other potential risks and uncertainties that could cause actual results to differ from the results predicted, please see our most recent Annual Report on Form 10-K and subsequent filings. All forward-looking statements in this press release or related management commentary are based on information available to Coupang and assumptions and beliefs as of the date hereof, and we disclaim any obligation to update any forward-looking statements, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements.

| | | | | | | | | | | | | | |

| Media Contact: | | | | |

| Coupang PR | | | | |

| press@coupang.com | | | | |

Cover

|

Jan. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 30, 2024

|

| Entity Registrant Name |

COUPANG, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40115

|

| Entity Tax Identification Number |

27-2810505

|

| Entity Address, Address Line One |

720 Olive Way

|

| Entity Address, City or Town |

Seattle

|

| Entity Address, Postal Zip Code |

98101

|

| City Area Code |

206

|

| Local Phone Number |

333-3839

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

CPNG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001834584

|

| Amendment Flag |

false

|

| Entity Addresses [Line Items] |

|

| Entity Address, State or Province |

WA

|

| Local Phone Number |

333-3839

|

| Entity Address, Address Line One |

720 Olive Way

|

| Entity Address, City or Town |

Seattle

|

| Entity Address, Postal Zip Code |

98101

|

| City Area Code |

206

|

| Entity Address, Address Line Two |

Suite 600

|

| Document Period End Date |

Jan. 30, 2024

|

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 30, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

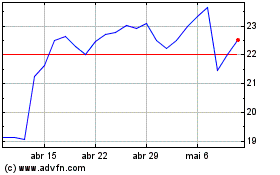

Coupang (NYSE:CPNG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Coupang (NYSE:CPNG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024