0001040130FALSE00010401302024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 7, 2024

PetMed Express, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Florida | | 000-28827 | | 65-0680967 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

420 South Congress Avenue, Delray Beach, Florida 33445

(Address of principal executive offices) (Zip Code)

(561) 526-4444

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $.001 per share | PETS | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On February 8, 2024, PetMed Express, Inc. (the “Company”) issued a press release announcing selected preliminary unaudited financial results for the fiscal quarter ended December 31, 2023. These preliminary financial results are unaudited, based on currently available information and do not present all necessary information for a complete understanding of the Company’s financial condition as of December 31, 2023 or its results of operations for the quarter ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

The information furnished in this Item 2.02 on this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of any general incorporation language in such filing.

Item 4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On February 7, 2024, following discussions with the Company’s management and based on management’s recommendation, the Audit Committee of the Board of Directors of the Company (the “Audit Committee”), concluded that the Company’s previously issued audited consolidated financial statements as of March 31, 2023 and 2022 and for the years ended March 31, 2023, 2022, and 2021 included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2023 (the “2023 Annual Report”), and the Company’s unaudited condensed consolidated financial statements included in the Quarterly Reports on Form 10-Q for the quarterly periods within those years (the “Historical Quarterly Reports”), as well as the unaudited condensed consolidated financial statements included in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 (the “Q1 2024 Quarterly Report”) and the quarter ended September 30, 2023 (the “Q2 2024 Quarterly Report” and together with the Q1 2024 Quarterly Report, the 2023 Annual Report and the Historical Quarterly Reports, the “Reports” and all financial statements included in the Reports, collectively the “Affected Financials”), should no longer be relied upon. As a result of the foregoing determined, related press releases, shareholder communications, investor presentations or other communications describing relevant portions of the Affected Financials should no longer be relied upon.

The Audit Committee’s conclusion was based on management’s determination that the Company (1) misapplied generally accepted accounting principles relating to certain accruals for sales tax liabilities resulting from sales of the Company’s products and services to its customers and (2) incorrectly valued the deferred tax asset acquired in connection with the Company’s acquisition of PetCareRx in April 2023, in each case, impacting one or more periods described in the Reports.

As previously disclosed by the Company in the 2023 Annual Report, as a result of a sales tax assessment received by the Company in the fiscal year ended March 31, 2023, the Company evaluated its sales tax positions in various jurisdictions for potential additional sales tax exposure. Following such evaluation and after consultation with the Company’s outside consultants, the Company previously recorded an accrual for additional sales tax liabilities as at March 31, 2023 (the “Additional Sales Tax Liabilities”) based on a probable and estimable approach under Accounting Standards Codification Topic 450, Contingencies. In conjunction with the preparation of the Company's Quarterly Report on Form 10-Q for the quarterly period ended December 31, 2023, management of the Company reviewed its accounting for sales tax liabilities, including the Additional Sales Tax Liabilities, and determined that the Company should have accounted for sales tax liabilities using a legal liability approach under Accounting Standards Codification Topic 405, Liabilities, in the Affected Financials. At that time, the Company also reviewed the accounting treatment relating to its deferred tax asset acquired in connection with the acquisition of PetCareRx in April 2023 and determined that it should have applied a limitation adjustment to the net operating losses acquired.

The extent of the errors and any resulting adjustments is not yet known as the Company’s analysis has not been completed; however, the Company expects that the restatement relating to sales tax liabilities will require the Company to record a sales tax liability of between approximately $14 million and $20 million as of March 31, 2020 (reflecting the maximum potential sales tax liability as of such date). Because this liability gets adjusted in subsequent periods, the Company expects this maximum sales tax liability to be between approximately $16 million and $23 million as of March 31, 2023. The most significant impact to the income statement resulting from the restatement relating to sales tax liabilities is expected to be a decrease in general and administrative expense in the range of $6 million to $8 million for the Company’s fiscal year ended March 31, 2023, resulting from a reversal of the Additional Sales Tax Liabilities accrued as of March 31, 2023, and a corresponding increase to the Company’s net income for the same period. The Company expects that the restatement relating to its valuation of the deferred tax asset recorded in connection with the PetCareRx acquisition will increase goodwill and decrease the deferred tax asset on the Company’s balance sheet as at June 30, 2023.

While the Company believes that the foregoing description fairly summarizes the expected material impact of the restatement on the Company’s Affected Financials, the Company is unable at this time to estimate the final amounts and effects of the required restatements of the Affected Financials. The Company continues to work expeditiously to conclude its analysis and complete any required restatement of its Affected Financials as soon as practicable.

The Audit Committee, the Board of Directors, and management of the Company have begun implementing measures to enhance processes and controls and continue to evaluate appropriate remediation actions. In addition, management continues to assess the effect of any restatements on the Company’s internal controls over financial reporting and its disclosure controls and procedures. The Company expects to report one or more material weaknesses following the completion of its analysis discussed above.

Company management and the Audit Committee have discussed the matters disclosed in this Item 4.02 with the Company’s independent registered public accounting firm, RSM US LLP.

Item 7.01 Regulation FD Disclosure.

As a result of the restatement described above, the Company will experience a delay in the filing of its Quarterly Report on Form 10-Q for the quarter ended December 31, 2023 (the “Q3 2024 10-Q”) and expects to file a notification of late filing on Form 12b-25 with the SEC.

The information furnished in this Item 7.01 on this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

99.1 – Press release dated February 8, 2024.

104 – Cover Page Interactive Data File (formatted as Inline XBRL).

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this Current Report on Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements. Words such as “may,” “could,” “expect,” “project,” “outlook,” “strategy,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “strive,” “goal,” “continue,” “likely,” “will,” “would” and other similar words and expressions are intended to signify forward-looking statements. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain and are subject to various risks and uncertainties, including: the expected adjustments to the Company’s financial statements, including the estimated amount and impact of adjustments on the Company’s financial statements, and the potential for additional adjustments to the Company’s financial statements resulting from the restatement described above. The Company’s future results may also be impacted by other risk factors listed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”), including, but not limited to, the Company's Annual Report on Form 10-K for the year ended March 31, 2023, as well as other subsequent filings on Form 10-Q and periodic filings on Form 8-K. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Current Report on Form 8-K and should not be relied upon as representing the Company’s views as of any subsequent date. The Company explicitly disclaims any obligation to update any forward-looking statements, other than as may be required by law. If the Company does update one or more forward-looking statements, no inference should be made that the Company will make additional updates with respect to those or other forward-looking statements.

EXHIBIT INDEX

| | | | | | | | |

Exhibit No. | | Description |

| | |

99.1 | | |

104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 8, 2024

| | | | | | | | |

| PETMED EXPRESS, INC. |

| | |

| By: | /s/ Christine Chambers |

| Name: | Christine Chambers |

| Title: | Chief Financial Officer, Treasurer and Secretary |

Exhibit 99.1

PetMeds® Announces Selected Preliminary Third Quarter Financial Results

Company to Restate Certain Previously Issued Financial Statements Due to Correction of Errors in Accounting for Tax-Related Entries; Filing of Form 10-Q to be Delayed.

Delray Beach, Florida, February 8, 2024 – PetMed Express, Inc. (NASDAQ: PETS) (“PetMeds” or the “Company”), Your Trusted Pet Health ExpertTM, today announced its selected preliminary financial results for its third quarter ended December 31, 2023.

These preliminary financial results are unaudited, based on currently available information and do not present all necessary information for a complete understanding of the Company’s financial condition as of December 31, 2023 or its results of operations for the quarter ended December 31, 2023.

Quarterly Highlights

1.Net sales for the quarter ended December 31, 2023, are expected to be $65.3 million, compared to $58.9 million for the third quarter in the prior year, an increase of 11.0% year over year. The current quarter includes the results from the recent acquisition of PetCareRx.

2.Gross profit in the quarter ended December 31, 2023, is expected to be $17.9 million, compared to $15.2 million in the prior year period. Gross margin improved to 27.4% in the quarter ended December 31, 2023 from 25.9% in the prior year period.

3.Cash and equivalents at December 31, 2023 are expected to be $49.4 million.

“Having to restate previously issued financial statements is certainly disappointing, but the restatement is a matter of tax accounting and will have no impact on our current cash balance,” said Matt Hulett, CEO and President. “From an operational perspective, we are encouraged to see the continued growth of recurring revenue as driven by our AutoShip & Save and PetPlus programs, which represented 52.2% of revenue during the quarter, up from 42.3% for the same quarter last year.” Hulett continued, “PetMeds is on a mission to deepen our engagement with our over two million pet parents, offering them an expanded portfolio of products and services on a regular, recurring basis. The introduction of a premium food brand and a substantial enhancement to our AutoShip & Save program mark pivotal steps in our transformation.”

Restatement of Certain Historical Financial Results

As reported in the Company's Form 8-K filed today, at the recommendation of the Company’s management, the Audit Committee of the Board of Directors of the Company (the “Audit Committee”), has concluded that the Company’s previously issued audited consolidated financial statements as of March 31, 2023 and 2022 and for the years ended March 31, 2023, 2022, and 2021 included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2023 (the “2023 Annual Report”), and the Company’s unaudited condensed consolidated financial statements included in the Quarterly Reports on Form 10-Q for the quarterly periods within those years (the “Historical Quarterly Reports”), as well as the unaudited condensed consolidated financial statements included in the Company’s Quarterly Report on Form 10-Q for the three months ended June 30, 2023 (the “Q1 2024 Quarterly Report”) and the three months ended September 30, 2023 (the “Q2 2024 Quarterly Report” and together with the Q1 2024 Quarterly Report, the 2023 Annual Report and the Historical Quarterly Reports, the “Reports” and all financial statements included in the Reports, collectively the “Affected Financials”), should no longer be relied upon. As a result of the foregoing, related press releases, shareholder communications, investor presentations or other communications describing relevant portions of the Affected Financials should no longer be relied upon.

In preparing our 2023 Annual Report, we determined that an accrual for sales tax contingencies was required. As such, we recorded a sales tax accrual in the second and fourth quarters of fiscal year 2023 based on a determination that the sales tax liability was probable and estimable, and that such treatment was in accordance with what we believed to be the appropriate guidance from generally accepted accounting principles (GAAP). In the third quarter of fiscal year 2024, the Company reviewed, in conjunction with its auditors, RSM US LLP, the accounting treatment related to its previously reported sales tax accruals as well as the accounting treatment related to the deferred tax asset associated with the Company’s acquisition of PetCareRx in April 2023. As a result of this review, the Audit Committee concluded, based on management’s determination, that the Company incorrectly applied GAAP as it relates to the sales tax liability included in the periods contained in the Affected Financials, and that it improperly valued the deferred tax asset and goodwill reported in the first and second quarter of fiscal year 2024.

Expected Impact; Increase in Net Income for FY 2023, and Increase in Recorded Tax Liability Starting in FY 2020

The Company expects the impact of the restatement to affect multiple periods. The most significant impact to the income statement is expected to be a decrease to general and administrative expense for fiscal year 2023 in the range of $6 million to $8 million and a corresponding increase in net income for the same period. This amount was originally recorded as a

sales tax liability based on a probable and estimable approach, in fiscal year 2023, rather than the correct, legal liability approach, under which the sales tax liability would have been recorded for periods included in the Affected Financials.

The restatement is expected to require the Company to revise and record a sales tax liability of approximately $14 to $20 million as of March 31, 2020 (reflecting the maximum potential sales tax liability as of such date). Because this liability gets adjusted in subsequent periods, as of March 31, 2023, we expect to record a maximum potential sales tax liability of approximately $16 to $23 million, and the liability is adjusted as amounts are settled or released in subsequent periods. While the Company believes that the foregoing description fairly represents the expected impact of the restatement on the Company’s prior financial statements as it relates to the sales-tax accrual, further adjustments may arise, and the Affected Financials as restated will reflect any such additional adjustments.

In addition, the Company has determined that the accounting related to the valuation of the carried forward net operating loss resulted in an overstated deferred tax asset reported at June 30 and September 30, 2023 related to the PetCareRx acquisition and will also be revised. This will increase goodwill and decrease the deferred tax asset on the balance sheet at such dates. This revision is a result of a technical tax matter surrounding the limitation adjustment to the net operating losses acquired.

No Expected Impact on Fiscal Year 2024 Revenue, Cost of Goods Sold, or Cash

The restatement is not expected to have an impact on the Company’s fiscal year 2024 revenue or cost of goods sold and does not impact cash.

“As soon as these technical accounting issues were identified, the PetMeds internal team immediately took action, in conjunction with our auditors, RSM, to identify the potential impact on past financial statements,” said Christine Chambers, Chief Financial Officer of PetMeds. “The restatement, while unfortunate, is not expected to impact our day to day business operations or strategic priorities. As we look ahead, we remain confident in our strategy and ability to drive long-term value.”

Next Steps

As a result of the level of administrative effort and time associated with completing the restatement, the Company will experience a delay in the filing of its Quarterly Report on Form 10-Q for the quarter ended December 31, 2023 (the Q3 Fiscal Year 2024 10-Q) and expects to file a notification of late filing on Form 12b-25 with the SEC on or before February 9, 2024.

Conference Call

This afternoon the Company will host a conference call to review selected preliminary third quarter financial results.

Time: 4:30 P.M. Eastern Time, February 8, 2024

Public call dial in (877) 407-0791 (toll free) or (201) 689-8563.

Webcast stream link: https://investors.petmeds.com/overview/default.aspx for those who wish to stream the call via webcast.

Replay: Available until November 13, 2023, at 11:59 P.M Eastern Time.

To access the replay, call (844) 512-2921 (toll free) or (412) 317-6671 and enter passcode 13741999.

About PetMeds

Founded in 1996, PetMeds is Your Trusted Pet Health Expert™, providing prescription and non-prescription medications, food, supplements, supplies and vet services for dogs, cats, and horses at competitive prices direct to the consumer through its 1-800-PetMeds toll free number and through its website at www.petmeds.com.

This press release may contain “forward-looking” statements, as defined in the Private Securities Litigation Reform Act of 1995 or by the Securities and Exchange Commission, that involve a number of risks and uncertainties, including the Company’s ability to meet the objectives included in its business plan. Important factors that could cause results to differ materially from those indicated by such “forward-looking” statements are set forth in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section in the Company’s Annual Report on Form 10-K for the year ended March 31, 2023. The Company’s future results may also be impacted by other risk factors listed from time to time in its SEC filings, including, but not limited to, the Company's Form 10-Qs and its Annual Reports on Form 10-K.

PETMEDS INVESTOR RELATIONS CONTACT

Brian M. Prenoveau, CFA

MZ Group

561-489-5315

investor@petmeds.com

PETMEDS MEDIA CONTACT

Mary Eva Tredway

Butin PR

maryeva@butinpr.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

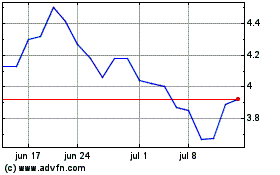

PetMed Express (NASDAQ:PETS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

PetMed Express (NASDAQ:PETS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024