FALSE000170694600017069462024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 27, 2024

____________________________

Virgin Galactic Holdings, Inc.

(Exact name of registrant as specified in its charter)

____________________________ | | | | | | | | | | | | | | |

|

|

|

|

|

| Delaware | | 001-38202 | | 85-3608069 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 1700 Flight Way Tustin, California | | 92782 | |

| (Address of principal executive offices) | | (Zip Code) | |

(949) 774-7640

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) |

| Name of each exchange on which registered | |

| Common stock, $0.0001 par value per share | | SPCE | | New York Stock Exchange |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 27, 2024, Virgin Galactic Holdings, Inc. (the “Company”) issued a press release announcing certain financial and other results for the fiscal quarter and year ended December 31, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

The information furnished in this Current Report (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

|

|

|

|

|

| | Virgin Galactic Holdings, Inc. |

|

|

|

Date: February 27, 2024 | | By: | | /s/ Douglas Ahrens |

| | Name: | | Douglas Ahrens |

| | Title: | | Executive Vice President,

Chief Financial Officer and Treasurer |

Virgin Galactic Announces Fourth Quarter and Full Year 2023 Financial Results and Provides Business Update

•Successfully Flew Six Human Spaceflights in Six Months in 2023

•'Galactic 06' Mission Completed in January 2024

•Delta Class Spaceships On Track for Ground and Flight Testing in 2025 and Commercial Service in 2026

ORANGE COUNTY, CALIFORNIA. – February 27, 2024 – Virgin Galactic Holdings, Inc. (NYSE: SPCE) (“Virgin Galactic” or the "Company”) today announced its financial results for the fourth quarter and full year ended December 31, 2023 and provided a business update.

Michael Colglazier, Chief Executive Officer of Virgin Galactic said, "2023 was incredible for Virgin Galactic as years of R&D and flight test culminated in launching our commercial Spaceline and successfully flying back-to-back monthly spaceflights, each delivering an exceptional experience for our customers. Now, in 2024, we are focused on completing the build-out of our spaceship factory, delivering the first parts ahead of assembling the initial Delta ships, and positioning the company for long-term growth and profitability."

Fourth Quarter 2023 Financial Highlights

•Cash position remains strong, with cash, cash equivalents and marketable securities of $982 million as of December 31, 2023.

•Revenue of $3 million, compared to $1 million in the fourth quarter of 2022, driven by commercial spaceflights and membership fees related to future astronauts.

•GAAP total operating expenses of $117 million, compared to $154 million in the fourth quarter of 2022. Non-GAAP total operating expenses of $100 million in the fourth quarter of 2023, compared to $140 million in the fourth quarter of 2022.

•Net loss of $104 million, compared to a $151 million net loss in the fourth quarter of 2022, with the improvement primarily driven by lower operating expenses and an increase in interest income.

•Adjusted EBITDA totaled $(84) million, compared to $(133) million in the fourth quarter of 2022, primarily driven by lower operating expenses and an increase in interest income.

•Net cash used in operating activities totaled $95 million, compared to $131 million in the fourth quarter of 2022.

•Cash paid for capital expenditures totaled $18 million, compared to $4 million in the fourth quarter of 2022.

•Free cash flow totaled $(114) million, compared to $(135) million in the fourth quarter of 2022.

Full Year 2023 Financial Highlights

•Revenue of $7 million, compared to $2 million in 2022, driven by commercial spaceflights and membership fees related to future astronauts.

•Net loss of $502 million, compared to a $500 million net loss in 2022.

•GAAP total operating expenses of $538 million, compared to $502 million in 2022. Non-GAAP total operating expenses of $476 million, compared to $445 million in 2022.

•Adjusted EBITDA totaled $(427) million, compared to $(431) million in 2022.

•Net cash used in operating activities totaled $448 million, compared to $380 million in 2022.

•Cash paid for capital expenditures totaled $44 million, compared to $16 million in 2022.

•Free cash flow totaled $(493) million, compared to $(397) million in 2022.

•Generated $484 million in gross proceeds through the issuance of 122.8 million shares of common stock as part of the Company's at-the-market offering programs.

Business Updates

•‘Galactic 07’ spaceflight mission planned for the second quarter of 2024.

•Spaceship factory in Arizona on track to open in mid-2024.

•Production schedule for the Delta Class spaceships remains on track for revenue service in 2026.

Financial Guidance

The following forward-looking statements reflect our expectations for the first quarter of 2024 as of February 27, 2024 and are subject to substantial uncertainty. Our results are based on assumptions that we believe to be reasonable as of this date, but may be materially affected by many factors, as discussed below in “Forward-Looking Statements.”

•Revenue for the first quarter of 2024 is expected to be approximately $2 million.

•Free cash flow for the first quarter of 2024 is expected to be in the range of $(125) million to $(135) million.

Non-GAAP Financial Measures

In addition to the Company's results prepared in accordance with generally accepted accounting principles in the United States (GAAP), the Company is also providing certain non-GAAP financial measures. A discussion regarding the use of non-GAAP financial measures and a reconciliation of such measures to the most directly comparable GAAP information is presented later in this press release.

Conference Call Information

Virgin Galactic will host a conference call to discuss the results at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) today. To access the conference call, parties should dial +1 888-660-6131 or +1 267-764-0185 and enter the conference ID number 4014201. The live audio webcast along with supplemental information will be accessible on the Company’s Investor Relations website at https://investors.virgingalactic.com/events-and-presentations/. A recording of the webcast will also be available following the conference call.

About Virgin Galactic Holdings

Virgin Galactic is an aerospace and space travel company, pioneering human spaceflight for private individuals and researchers with its advanced air and space vehicles. Scale and profitability are driven by next generation vehicles capable of bringing humans to space at an unprecedented frequency with an industry-leading cost structure. You can find more information at https://www.virgingalactic.com/.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this press release other than statements of historical fact, including, without limitation, statements regarding our spaceflight systems, next commercial space mission and proposed timing thereof, scaling of our future fleet, providing repeatable and reliable access to space, development of our Delta Class spaceships and proposed timeline for testing and commercial service using such spaceships, the timing of the opening of our spaceship factory in Arizona and the delivery of parts ahead of assembling the initial Delta Class spaceships, our objectives for

future operations and the Company’s financial forecasts, including first quarter 2024 expected revenue and free cash flow, and the expectation for positive cash flow and the timing thereof, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “strategy,” “future,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including but not limited to any delay in future commercial flights of our spaceflight fleet, our ability to successfully develop and test our next generation vehicles, and the time and costs associated with doing so, our expected capital requirements and the availability of additional financing, and the other factors, risks and uncertainties included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as such factors may be updated from time to time in our other filings with the Securities and Exchange Commission (the "SEC"), accessible on the SEC’s website at www.sec.gov and the Investor Relations section of our website at www.virgingalactic.com, which could cause our actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change.

Fourth Quarter 2023 Financial Results

VIRGIN GALACTIC HOLDINGS, INC.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Revenue | | $ | 2,809 | | | $ | 869 | | | $ | 6,800 | | | $ | 2,312 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Spaceline operations | | 24,338 | | | 1,169 | | | 50,538 | | | 1,906 | |

| Research and development | | 53,848 | | | 102,596 | | | 295,140 | | | 314,174 | |

| Selling, general and administrative | | 30,844 | | | 47,298 | | | 174,864 | | | 175,118 | |

| Depreciation and amortization | | 3,646 | | | 3,117 | | | 13,369 | | | 11,098 | |

| Special charges | | 4,398 | | | — | | | 4,398 | | | — | |

| Total operating expenses | | 117,074 | | | 154,180 | | | 538,309 | | | 502,296 | |

| | | | | | | | |

| Operating loss | | (114,265) | | | (153,311) | | | (531,509) | | | (499,984) | |

| | | | | | | | |

| Interest income | | 13,644 | | | 6,175 | | | 42,234 | | | 12,502 | |

| Interest expense | | (3,224) | | | (3,206) | | | (12,872) | | | (12,130) | |

| Other income, net | | 99 | | | 51 | | | 263 | | | 58 | |

| Loss before income taxes | | (103,746) | | | (150,291) | | | (501,884) | | | (499,554) | |

| Income tax expense | | 238 | | | 529 | | | 453 | | | 598 | |

| Net loss | | (103,984) | | | (150,820) | | | (502,337) | | | (500,152) | |

| Other comprehensive income (loss): | | | | | | | | |

| Foreign currency translation adjustment | | 72 | | | 168 | | | 81 | | | (146) | |

| Unrealized gain (loss) on marketable securities | | 1,608 | | | 2,916 | | | 7,616 | | | (5,311) | |

| Total comprehensive loss | | $ | (102,304) | | | $ | (147,736) | | | $ | (494,640) | | | $ | (505,609) | |

| | | | | | | | |

| | | | | | | | |

| Net loss per share: | | | | | | | | |

| Basic and diluted | | $ | (0.26) | | | $ | (0.55) | | | $ | (1.49) | | | $ | (1.89) | |

| | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | |

| Basic and diluted | | 399,766 | | | 274,902 | | | 337,262 | | | 263,947 | |

VIRGIN GALACTIC HOLDINGS, INC.

Condensed Consolidated Balance Sheets

(In thousands) | | | | | | | | | | | | | | | | | |

| | | |

| | | December 31, |

| | | 2023 | | | | 2022 |

| Assets | | | | | | | |

| Current assets: | | | | | | | |

| Cash and cash equivalents | | | $ | 216,799 | | | | | $ | 302,291 | |

| Restricted cash | | | 36,793 | | | | | 40,336 | |

| Marketable securities, short-term | | | 657,238 | | | | | 606,716 | |

| Inventories | | | 16,301 | | | | | 24,043 | |

| Prepaid expenses and other current assets | | | 23,698 | | | | | 28,228 | |

| Total current assets | | | 950,829 | | | | | 1,001,614 | |

| Marketable securities, long-term | | | 71,596 | | | | | 30,392 | |

| Property, plant and equipment, net | | | 93,806 | | | | | 53,658 | |

| Other non-current assets | | | 63,286 | | | | | 54,274 | |

| Total assets | | | $ | 1,179,517 | | | | | $ | 1,139,938 | |

| Liabilities and Stockholders' Equity | | | | | | | |

| Current liabilities: | | | | | | | |

| Accounts payable | | | $ | 32,415 | | | | | $ | 16,326 | |

| Accrued liabilities | | | 50,863 | | | | | 61,848 | |

| Customer deposits | | | 97,841 | | | | | 102,647 | |

| Other current liabilities | | | 4,541 | | | | | 3,232 | |

| Total current liabilities | | | 185,660 | | | | | 184,053 | |

| Non-current liabilities: | | | | | | | |

| Convertible senior notes, net | | | 417,886 | | | | | 415,720 | |

| Other long-term liabilities | | | 70,495 | | | | | 59,942 | |

| Total liabilities | | | 674,041 | | | | | 659,715 | |

| Stockholders' Equity | | | | | | | |

| Common stock | | | 40 | | | | | 28 | |

| Additional paid-in capital | | | 2,631,197 | | | | | 2,111,316 | |

| Accumulated deficit | | | (2,126,132) | | | | | (1,623,795) | |

Accumulated other comprehensive income (loss) | | | 371 | | | | | (7,326) | |

| Total stockholders' equity | | | 505,476 | | | | | 480,223 | |

| Total liabilities and stockholders' equity | | | $ | 1,179,517 | | | | | $ | 1,139,938 | |

VIRGIN GALACTIC HOLDINGS, INC.

Condensed Consolidated Statements of Cash Flows

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | | |

| Net loss | | $ | (103,984) | | | $ | (150,820) | | | $ | (502,337) | | | $ | (500,152) | |

| Stock-based compensation | | 8,660 | | | 11,221 | | | 44,258 | | | 45,709 | |

| Depreciation and amortization | | 3,646 | | | 3,117 | | | 13,369 | | | 11,098 | |

| Amortization of debt issuance costs | | 548 | | | 532 | | | 2,166 | | | 1,998 | |

| Other non-cash items | | (7,076) | | | 544 | | | (13,576) | | | 10,800 | |

| Change in operating assets and liabilities: | | | | | | | | |

| Inventories | | 761 | | | (1,192) | | | 4,757 | | | 5,625 | |

| Other current and non-current assets | | 1,501 | | | (5,063) | | | 11,798 | | | (2,810) | |

| Accounts payable and accrued liabilities | | 581 | | | 11,323 | | | (2,360) | | | 35,151 | |

| Customer deposits | | (82) | | | (1,324) | | | (4,806) | | | 11,784 | |

| Other current and long-term liabilities | | 136 | | | 420 | | | (1,462) | | | 556 | |

| Net cash used in operating activities | | (95,309) | | | (131,242) | | | (448,193) | | | (380,241) | |

| Cash flows from investing activities: | | | | | | | | |

| Capital expenditures | | (18,368) | | | (4,183) | | | (44,309) | | | (16,489) | |

| Purchases of marketable securities | | (136,886) | | | (99,620) | | | (1,009,836) | | | (704,565) | |

| Proceeds from maturities and calls of marketable securities | | 235,526 | | | 140,277 | | | 937,872 | | | 434,889 | |

| Net cash provided by (used in) investing activities | | 80,272 | | | 36,474 | | | (116,273) | | | (286,165) | |

| Cash flows from financing activities: | | | | | | | | |

| Payments of finance lease obligations | | (60) | | | (102) | | | (235) | | | (234) | |

| Proceeds from convertible senior notes | | — | | | — | | | — | | | 425,000 | |

| Debt issuance costs | | — | | | — | | | — | | | (11,278) | |

| Purchase of capped call | | — | | | — | | | — | | | (52,318) | |

| Repayment of commercial loan | | — | | | — | | | — | | | (310) | |

| Proceeds from issuance of common stock | | — | | | 3,753 | | | 484,145 | | | 103,326 | |

| Proceeds from issuance of common stock pursuant to stock options exercised | | — | | | — | | | — | | | 49 | |

| Withholding taxes paid on behalf of employees on net settled stock-based awards | | (239) | | | (505) | | | (3,240) | | | (3,984) | |

| Transaction costs related to issuance of common stock | | (133) | | | (111) | | | (5,239) | | | (1,248) | |

| Net cash provided by (used in) financing activities | | (432) | | | 3,035 | | | 475,431 | | | 459,003 | |

| Net decrease in cash, cash equivalents and restricted cash | | (15,469) | | | (91,733) | | | (89,035) | | | (207,403) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cash, cash equivalents and restricted cash at beginning of period | | 269,061 | | | 434,360 | | | 342,627 | | | 550,030 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 253,592 | | | $ | 342,627 | | | $ | 253,592 | | | $ | 342,627 | |

| | | | | | | | |

| Cash and cash equivalents | | $ | 216,799 | | | $ | 302,291 | | | $ | 216,799 | | | $ | 302,291 | |

| Restricted cash | | 36,793 | | | 40,336 | | | 36,793 | | | 40,336 | |

| Cash, cash equivalents and restricted cash | | $ | 253,592 | | | $ | 342,627 | | | $ | 253,592 | | | $ | 342,627 | |

USE OF NON-GAAP FINANCIAL MEASURES

This press release references certain financial measures that are not prepared in accordance with generally accepted accounting principles in the United States (GAAP), including total non-GAAP operating expenses, Adjusted EBITDA and free cash flow. The Company defines total non-GAAP operating expenses as total operating expenses other than stock-based compensation, depreciation and amortization and certain other items the Company believes are not indicative of its core operating performance. The Company defines Adjusted EBITDA as earnings before interest expense, income taxes, depreciation and amortization, stock-based compensation, and certain other items the Company believes are not indicative of its core operating performance. The Company defines free cash flow as net cash provided by operating activities less capital expenditures. None of these non-GAAP financial measures is a substitute for or superior to measures prepared in accordance with GAAP and should not be considered as an alternative to any other measures derived in accordance with GAAP.

The Company believes that presenting these non-GAAP financial measures provides useful supplemental information to investors about the Company in understanding and evaluating its operating results, enhancing the overall understanding of its past performance and future prospects, and allowing for greater transparency with respect to key financial metrics used by its management in financial and operational-decision making. However, there are a number of limitations related to the use of non-GAAP measures and their nearest GAAP equivalents. For example, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore any non-GAAP measures the Company uses may not be directly comparable to similarly titled measures of other companies.

A reconciliation of total operating expenses to total non-GAAP operating expenses for the three months ended December 31, 2023 and 2022 and years ended December 31, 2023 and 2022, respectively, is set forth below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Total operating expenses | | $ | 117,074 | | | $ | 154,180 | | | $ | 538,309 | | | $ | 502,296 | |

| Stock-based compensation | | 8,660 | | | 11,221 | | | 44,258 | | | 45,709 | |

| Depreciation and amortization | | 3,646 | | | 3,117 | | | 13,369 | | | 11,098 | |

Special charges(1) | | 4,398 | | | — | | | 4,398 | | | — | |

Total non-GAAP operating expenses | | $ | 100,370 | | | $ | 139,842 | | | $ | 476,284 | | | $ | 445,489 | |

(1) Special charges includes severance and related benefit costs in connection with the Company's workforce reduction.

A reconciliation of net loss to Adjusted EBITDA for the three months ended December 31, 2023 and 2022 and years ended December 31, 2023 and 2022, respectively, is set forth below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net loss | | $ | (103,984) | | | $ | (150,820) | | | $ | (502,337) | | | $ | (500,152) | |

| Interest expense | | 3,224 | | | 3,206 | | | 12,872 | | | 12,130 | |

| Income tax expense | | 238 | | | 529 | | | 453 | | | 598 | |

| Depreciation and amortization | | 3,646 | | | 3,117 | | | 13,369 | | | 11,098 | |

| Stock-based compensation | | 8,660 | | | 11,221 | | | 44,258 | | | 45,709 | |

Special charges(1) | | 4,398 | | | — | | | 4,398 | | | — | |

| Adjusted EBITDA | | $ | (83,818) | | | $ | (132,747) | | | $ | (426,987) | | | $ | (430,617) | |

(1) Special charges includes severance and related benefit costs in connection with the Company's workforce reduction.

The following table reconciles net cash used in operating activities to free cash flow for the three months ended December 31, 2023 and 2022 and years ended December 31, 2023 and 2022, respectively (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net cash used in operating activities | | $ | (95,309) | | | $ | (131,242) | | | $ | (448,193) | | | $ | (380,241) | |

| Capital expenditures | | (18,368) | | | (4,183) | | | (44,309) | | | (16,489) | |

| Free cash flow | | $ | (113,677) | | | $ | (135,425) | | | $ | (492,502) | | | $ | (396,730) | |

The following table reconciles forecasted net cash used in operating activities to forecasted free cash flow for the three months ended March 31, 2024 (in thousands):

| | | | | | | | |

| | Forecasted Range |

| | |

| Net cash used in operating activities | | $(85,000)-$(90,000) |

| Capital expenditures | | (40,000)-(45,000) |

| Free cash flow | | $(125,000)-$(135,000) |

_______________For media inquiries:

Aleanna Crane - Vice President, Communications

news@virgingalactic.com

575.800.4422

For investor inquiries:

Eric Cerny - Vice President, Investor Relations

vg-ir@virgingalactic.com

949.774.7637

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

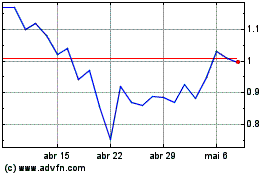

Virgin Galactic (NYSE:SPCE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Virgin Galactic (NYSE:SPCE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024