0000069488false00000694882024-03-052024-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 5, 2024

Myers Industries, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

Ohio |

|

001-8524 |

|

34-0778636 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

1293 South Main Street, Akron, Ohio 44301

(Address of Principal Executive Offices, and Zip Code)

(330) 253-5592

Registrant’s Telephone Number, Including Area Code

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

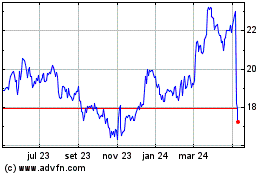

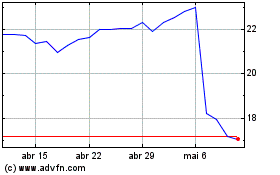

Common Stock, without par value |

|

MYE |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 5, 2024, Myers Industries, Inc. (the “Company”) issued a press release announcing earnings results for the fourth quarter ended December 31, 2023. The full text of the press release issued in connection with the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K. In addition, a copy of the presentation which will be discussed during the Company’s earnings conference call at 8:30 a.m. Eastern Time on March 5, 2024, is available on the Investor Relations section of the Company’s website at www.myersindustries.com. Information about the Company’s earnings conference call can be found in the press release attached as Exhibit 99.1 to this Current Report on Form 8-K.

Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information in this Item 2.02 and Exhibit 99.1 is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. Furthermore, the information in this Item 2.02 and Exhibit 99.1 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended (the “Securities Act”), except as may be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

As described in “Item 2.02 Results of Operations and Financial Condition” above, on March 5, 2024, the Company issued a press release announcing earnings results for the fourth quarter ended December 31, 2023. The full text of the press release issued in connection with the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K. In addition, a copy of the presentation which will be discussed during the Company’s earnings conference call at 8:30 a.m. Eastern Time on March 5, 2024, is available on the Investor Relations section of the Company’s website at www.myersindustries.com. Information about the Company’s earnings conference call can be found in the press release attached as Exhibit 99.1 to this Current Report on Form 8-K.

Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information in this Item 7.01 and Exhibit 99.1 is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section. Furthermore, the information in this Item 7.01 and Exhibit 99.1 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Myers Industries, Inc. |

|

|

|

|

|

By: |

|

/s/ Grant E. Fitz |

|

|

|

Grant E. Fitz |

|

|

|

Executive Vice President and Chief Financial Officer |

|

|

Date: March 5, 2024 |

|

Exhibit 99.1

Myers Industries Announces Fourth Quarter and Full Year 2023 Results

Self-Help Initiatives and Myers Business System Drive Solid Operating Performance

Company Initiates Fiscal Year 2024 Outlook and Expects Improved Profitability as Compared to Prior Year

Myers to Host Investor & Analyst Day Event in New York City on March 19, 2024

March 5, 2024, Akron, Ohio - Myers Industries, Inc. (NYSE: MYE), a leading manufacturer of a wide range of polymer and metal products and distributor for the tire, wheel, and under-vehicle service industry, today announced results for the fourth quarter and full year ended December 31, 2023.

In reviewing the 2023 financial results, Myers Industries’ President and CEO Mike McGaugh commented, “Although our results were not what we originally planned to deliver in 2023, we remain encouraged by the resiliency of many of our business units despite continued cyclical headwinds in several of our key end markets. Demonstrating the strength of our diverse portfolio, 2023 marked a year of continued progress and still yielded one of the top years in the history of our company for adjusted earnings per share, adjusted EBITDA, and revenue. Further, year over year operating cash flow generation increased by $13.6 million and free cash flow generation increased by $15.0 million, as we continue to benefit from early implementation of the Myers Business System to help drive Operational Excellence.”

Fourth Quarter 2023 Financial Highlights

•Net sales of $191.1 million compared to $212.8 million in the prior year period

•Gross margin of 30.0%, down 60 basis points versus the prior year period

•GAAP net income per diluted share of $0.34 compared to $0.36 in the prior year period

•Adjusted earnings per diluted share of $0.29 compared to $0.32 in the prior year period

•Cash flow provided by operations was $15.4 million and free cash flow was $11.8 million

Full Year 2023 Financial Highlights

•Net sales of $813.1 million compared to $899.5 million in the prior year period

•Gross margin of 31.9%, up 40 basis points versus the prior year period

•GAAP net income per diluted share of $1.32 compared to $1.64 in the prior year period

•Adjusted earnings per diluted share of $1.39 compared to $1.68 in the prior year period

•Cash flow provided by operations was $86.2 million and free cash flow was $63.3 million

•Subsequent to fiscal year end, closed on acquisition of Signature Systems, enhancing Myers' long-term margin and EPS growth profiles

Myers Industries’ President and CEO Mike McGaugh continued, “In closing 2023, our Material Handling segment delivered respectable fourth quarter financial results with continued strong margins in-spite of demand headwinds in RV, Marine, and Consumer end-markets. We continue to see results from our Operational Excellence and Commercial Excellence initiatives, what we call our Self-Help programs. As a result, when these cyclical end markets improve, we expect to benefit more than we have historically."

“Our Distribution segment performance in 2023 was disappointing and not reflective of our expectations for this business. Our fourth quarter results were unfavorably impacted due to a short-term decline in sales volume and revenue, primarily a transition effect of our Distribution sales organization realignment, which was implemented in the third quarter of 2023. We expect our Distribution segment to demonstrate future revenue growth and improved profitability as we build on the scale and reach achieved from the Mohawk acquisition and begin to realize the benefits from our sales organization improvements.”

“We continue to be excited about the growth and innovation projects in our Material Handling segment, many of which have a long-term growth runway. In particular, we see strong growth opportunities in Military cases, Industrial boxes, and our e-commerce sales channel. We also continue to be pleased with our progress on our Sustainability efforts, as highlighted in our third annual ESG report to be released this week.”

McGaugh continued, “We’ve made another significant step forward in expanding our branded product portfolio, increasing our end-market diversification by acquiring Signature Systems. This business is less cyclical than our traditional portfolio of businesses, but it has similar cash flow generation potential, and it moves us into faster growing markets with greater tail winds. We believe Signature Systems is a catalyst for Myers’ transformation and a growth engine for the Company.”

McGaugh concluded, “In 2023, we continued to improve our company; quite frankly, it is unrecognizable from the one I joined in the spring of 2020. We are confident that the progress we’ve made in our Commercial Excellence and Operational Excellence over the past few years, coupled with our leading brands in diverse end markets and our acquisition of Signature System, will serve as a solid foundation for meaningful shareholder value creation as we advance through our three-horizon strategy.”

Fourth Quarter 2023 Financial Summary

|

|

|

|

|

|

|

|

|

Quarter Ended December 31, |

(Dollars in thousands, except per share data) |

|

2023 |

|

2022 |

|

% Inc

(Dec) |

Net sales |

|

$191,077 |

|

$212,840 |

|

(10.2)% |

Gross profit |

|

$57,232 |

|

$65,074 |

|

(12.1)% |

Gross margin |

|

30.0% |

|

30.6% |

|

|

Operating income |

|

$18,603 |

|

$17,022 |

|

9.3% |

Net income |

|

$12,539 |

|

$13,428 |

|

(6.6)% |

Net income per diluted share |

|

$0.34 |

|

$0.36 |

|

(5.6)% |

|

|

|

|

|

|

|

Adjusted operating income |

|

$15,893 |

|

$16,485 |

|

(3.6)% |

Adjusted net income |

|

$10,889 |

|

$11,797 |

|

(7.7)% |

Adjusted earnings per diluted share |

|

$0.29 |

|

$0.32 |

|

(9.4)% |

Adjusted EBITDA |

|

$21,775 |

|

$22,101 |

|

(1.5)% |

Net sales were $191.1 million, a decrease of $21.8 million, or 10.2%, compared with $212.8 million for the fourth quarter of 2022. The decrease was the result of lower volume/pricing in certain targeted areas in the Material Handling segment and lower volume in Distribution.

Gross profit decreased $7.8 million, or 12.1% to $57.2 million, as the contribution from lower raw material costs was not enough to offset lower volumes and pricing. Gross margin declined 60 basis points to 30.0% compared with 30.6% for the fourth quarter of 2022. Selling, general and administrative expenses decreased $8.7 million, or 18.3% to $38.7 million due to lower professional services and incentive compensation. SG&A as a percentage of sales decreased to 20.3%, compared with 22.3% in the same period last year. Net income per diluted share was $0.34, compared with $0.36 for the fourth quarter of 2022. Adjusted earnings per diluted share were $0.29, compared with $0.32 for the fourth quarter of 2022.

Fourth Quarter 2023 Segment Results

(Dollar amounts in the segment tables below are reported in millions)

Material Handling

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

Op Income |

|

Op Income Margin |

|

Adj EBITDA |

|

Adj EBITDA Margin |

Q4 2023 Results |

$126.9 |

|

$29.9 |

|

23.6% |

|

$28.4 |

|

22.4% |

Q4 2022 Results |

$142.2 |

|

$20.9 |

|

14.7% |

|

$25.5 |

|

18.0% |

$ Increase (decrease) vs prior year |

($15.3) |

|

$9.1 |

|

|

|

|

$2.9 |

|

|

|

% Increase (decrease) vs prior year |

(10.8)% |

|

43.5% |

|

+890 |

bps |

|

11.2% |

|

+440 |

bps |

Items in this table may not recalculate due to rounding

Net sales for the Material Handling segment were $126.9 million, a decrease of $15.3 million, or 10.8%, compared with $142.2 million for the fourth quarter of 2022. Net sales decreased in the vehicle, food & beverage and consumer end markets, with the greatest reduction in demand for RV products, marine products, agriculture, and fuel container products, due in part to a slower hurricane season. Operating income increased 43.5% to $29.9 million, compared with $20.9 million in the fourth quarter of 2022. Operating income margin increased to 23.6% compared with 14.7% for the fourth quarter of 2022. Adjusted EBITDA margin improved by 440 basis points, primarily attributed to self-help initiatives, but partially dampened by a decrease in sales volume and pricing. Adjusted EBITDA increased 11.2% to $28.4 million, compared with $25.5 million in the fourth quarter of 2022. SG&A expenses were lower year-over-year, primarily due to a decrease in professional services and an insurance recovery of legal fees.

Distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

Op Income |

|

Op Income Margin |

|

Adj EBITDA |

|

Adj EBITDA Margin |

Q4 2023 Results |

$64.2 |

|

$0.3 |

|

0.5% |

|

$1.2 |

|

1.8% |

Q4 2022 Results |

$70.6 |

|

$3.4 |

|

4.8% |

|

$5.0 |

|

7.0% |

$ Increase (decrease) vs prior year |

($6.4) |

|

($3.1) |

|

|

|

|

($3.8) |

|

|

|

% Increase (decrease) vs prior year |

(9.1)% |

|

(90.0)% |

|

-430 |

bps |

|

(76.4)% |

|

-520 |

bps |

Items in this table may not recalculate due to rounding

Net sales for the Distribution segment were $64.2 million, a decrease of $6.4 million, or 9.1%, compared with $70.6 million for the fourth quarter of 2022. Operating income decreased $3.1 million to $0.3 million, compared with $3.4 million for the fourth quarter of 2022. Adjusted EBITDA decreased 76.4% to $1.2 million, compared with $5.0 million in the fourth quarter of 2022. The decrease in operating income and adjusted EBITDA was primarily due to lower volume and an unfavorable sale mix. The decrease in SG&A expenses was primarily the result of lower incentive compensation. The Distribution segment's operating income margin was 0.5% compared with 4.8% for the fourth quarter of 2022. The Distribution segment’s adjusted EBITDA margin was 1.8%, compared with 7.0% for the fourth quarter of 2022. The Distribution Segment continues to implement pricing actions to counter cost inflation and improve margin.

Full Year 2023 Financial Summary

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

(Dollars in thousands, except per share data) |

|

2023 |

|

2022 |

|

% Inc

(Dec) |

Net sales |

|

$813,067 |

|

$899,547 |

|

(9.6)% |

Gross profit |

|

$259,086 |

|

$283,366 |

|

(8.6)% |

Gross margin |

|

31.9% |

|

31.5% |

|

|

Operating income |

|

$72,405 |

|

$83,941 |

|

(13.7)% |

Net income |

|

$48,867 |

|

$60,267 |

|

(18.9)% |

Net income per diluted share |

|

$1.32 |

|

$1.64 |

|

(19.5)% |

|

|

|

|

|

|

|

Adjusted operating income |

|

$75,261 |

|

$87,947 |

|

(14.4)% |

Adjusted net income |

|

$51,684 |

|

$61,662 |

|

(16.2)% |

Adjusted earnings per diluted share |

|

$1.39 |

|

$1.68 |

|

(17.3)% |

Adjusted EBITDA |

|

$98,047 |

|

$109,163 |

|

(10.2)% |

Net sales for the full year of 2023 were $813.1 million, a decrease of $86.5 million, or 9.6%, compared with $899.5 million for the full year of 2022. The decrease was the result of lower volume and pricing in certain areas in the Material Handling segment, partially offset by higher sales in the Distribution segment largely from incremental sales of $23.1 million from Mohawk Rubber acquisition.

Gross profit decreased $24.3 million, or 8.6% to $259.1 million, as the contribution from lower raw material costs was not enough to offset lower volumes and pricing. Gross margin expanded 40 basis points to 31.9% compared with 31.5% for the full year of 2022. Selling, general and administrative expenses decreased $12.6 million, or 6.3% to $186.9 million due to lower incentive compensation, commissions and facility costs. SG&A as a percentage of sales increased to 23.0%, compared with 22.2% in the same period last year. Net income per diluted share was $1.32, compared with $1.64 for the full year of 2022. Adjusted earnings per diluted share were $1.39, compared with $1.68 for the full year of 2022.

Full Year 2023 Segment Results

(Dollar amounts in the segment tables below are reported in millions)

Material Handling

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

Op Income |

|

Op Income Margin |

|

Adj EBITDA |

|

Adj EBITDA Margin |

Full Year 2023 Results |

$555.3 |

|

$100.1 |

|

18.0% |

|

$113.8 |

|

20.5% |

Full Year 2022 Results |

$647.6 |

|

$104.1 |

|

16.1% |

|

$122.9 |

|

19.0% |

$ Increase (decrease) vs prior year |

($92.4) |

|

($4.0) |

|

|

|

|

($9.1) |

|

|

|

% Increase (decrease) vs prior year |

(14.3)% |

|

(3.8)% |

|

+190 |

bps |

|

(7.4)% |

|

+150 |

bps |

Items in this table may not recalculate due to rounding

Net sales for the Material Handling segment were $555.3 million, a decrease of $92.4 million, or 14.3%, compared with $647.6 million for the full year of 2022. Net sales decreased in the vehicle, industrial, food & beverage and consumer end markets, with the greatest reduction in demand for RV products, marine, construction products, and fuel container products, due in part to a slower hurricane season. Operating income decreased 3.8% to $100.1 million, compared with $104.1 million in the full year of 2022. Operating income margin increased to 18.0% compared with 16.1% for the full year of 2022. Adjusted EBITDA margin improved by 150 basis points, primarily attributed to self-help initiatives, but partially dampened by a decrease in sales volume. Adjusted EBITDA decreased 7.4% to $113.8 million, compared with $122.9 million in the full year of 2022. Lower sales volume and pricing more than offset lower raw material costs. SG&A expenses were lower year-over-year, primarily due to a decrease in professional services and insurance recovery of legal fees.

Distribution

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

Op Income |

|

Op Income Margin |

|

Adj EBITDA |

|

Adj EBITDA Margin |

Full Year 2023 Results |

$257.9 |

|

$11.0 |

|

4.3% |

|

$15.9 |

|

6.2% |

Full Year 2022 Results |

$252.0 |

|

$15.9 |

|

6.3% |

|

$19.7 |

|

7.8% |

$ Increase (decrease) vs prior year |

$5.9 |

|

($4.9) |

|

|

|

|

($3.9) |

|

|

|

% Increase (decrease) vs prior year |

2.3% |

|

(30.9)% |

|

-200 |

bps |

|

(19.6)% |

|

-160 |

bps |

Items in this table may not recalculate due to rounding

Net sales for the Distribution segment were $257.9 million, an increase of $5.9 million, or 2.3%, compared with $252.0 million for the full year of 2022. Operating income decreased $4.9 million to $11.0 million, compared with $15.9 million for the full year of 2022. Adjusted EBITDA decreased 19.6% to $15.9 million, compared with $19.7 million in the full year of 2022. The decrease in operating income and adjusted EBITDA was primarily due to lower volume/mix and higher SG&A. The increase in SG&A expenses was primarily the result of the Mohawk Rubber acquisition and higher salaries. The Distribution segment's operating income margin was 4.3% compared with 6.3% for the full year of 2022. The Distribution segment’s adjusted EBITDA margin was 6.2%, compared with 7.8% for the full year of 2022. The Distribution Segment continues to implement pricing actions to counter cost inflation and improve margin.

Balance Sheet & Cash Flow

As of December 31, 2023, the Company’s cash on hand totaled $30.3 million. Total debt as of December 31, 2023 was $67.2 million.

For the fourth quarter of 2023, cash flow provided by operations was $15.4 million and free cash flow was $11.8 million, compared with cash flow provided by operations of $21.9 million and free cash flow of $15.2 million for the fourth quarter of 2022. For the full year of 2023, cash flow provided by operations was $86.2 million and free cash flow was $63.3 million, compared with cash flow provided by operations of $72.6 million and free cash flow of $48.3 million for the full year of 2022. The increase in cash flow was driven primarily by a decrease in working capital. Capital expenditures for the fourth quarter of 2023 were $3.6 million, compared with $6.7 million for the fourth quarter of 2022. Capital expenditures for the full year of 2023 were $22.9 million, compared with $24.3 million for the full year of 2022.

Closing of Previously Announced Acquisition of Signature Systems

On February 8, 2024, the Company announced that it completed its acquisition of Signature Systems (“Signature”), which was previously announced on January 2, 2024.

The cash transaction of $350 million was funded through an Amendment to Myers’ existing $250 million revolving credit facility and a new $400 million 5-year senior secured term loan A facility. The term loan A facility was upsized by $50.0 million since the Signature Systems transaction was initially announced. As of closing, the Company’s net leverage ratio was approximately 3.0x, which is within management’s target range. Future financial results of Signature Systems are expected to be disclosed within Myers’ Material Handling segment.

Chief Financial Officer Grant Fitz commented, “As a reminder, this transaction is expected to be neutral to slightly dilutive to US GAAP EPS in fiscal year 2024, but we anticipate Signature will deliver earnings accretion of between $0.20 and $0.30 in 2025, and between $0.40 and $0.50 in 2026, with the potential for additional meaningful earnings accretion beyond 2026. We also expect annualized run-rate operational and cost synergies of $8 million will be fully captured by 2025,with additional synergies to be realized once Signature has an opportunity to leverage the Myers Business System. Finally, we remind investors that we anticipate reducing our net leverage ratio below 2.0x within two years of closing of this transaction, which would enable continued acquisitive growth.

2024 Investor Day

The Company will host an Investor and Analyst Day on Tuesday, March 19th, 2024 at The Harvard Club in New York City. The event will feature a showcase of Myers’ diverse product portfolio and will be accompanied by presentations from members of Myers’ executive management that will outline the Company’s long-term strategy and outlook.

2024 Outlook

Based on current exchange rates, market outlook, and business forecast, the Company provided the following outlook for fiscal 2024:

•Net sales growth of 15% - 20%

•Net income per diluted share in the range of $1.03 to $1.23*

•Adjusted earnings per diluted share range of $1.30 to $1.45*

•Capital expenditures to be in the range of $35 to $40 million

•Effective tax rate to approximate 25%

* Subject to completion of purchase accounting for the February 8, 2024 acquisition of Signature Systems, which could have positive or negative impact on EPS metrics related to depreciation and amortization.

We will continue to monitor market conditions and provide updates as we progress throughout the year

Conference Call Details

The Company will host an earnings conference call and webcast for investors and analysts on Tuesday, March 5, 2024, at 8:30 a.m. EDT. The call is anticipated to last less than one hour and may be accessed using the following online participation registration link: https://www.netroadshow.com/events/login?show=fc15d634&confId=59274 .Upon registering, each participant will be provided with call details and a registrant ID. Reminders will also be sent to registered participants via email. Alternatively, the conference call will be available via a live webcast. To access the live webcast or a replay, visit the Company's website www.myersindustries.com and click on the Investor Relations tab. An archived replay of the call will also be available on the site shortly after the event. To listen to the telephone replay, callers should dial: (US Local) 1-929-458-6194 or (US Toll-Free) 1-866-813-9403 Access Code: 269707.

Use of Non-GAAP Financial Measures

The Company uses certain non-GAAP measures in this release. Adjusted operating income (loss), adjusted operating income margin, adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted EBITDA margin, adjusted net income, adjusted earnings per diluted share (adjusted EPS), and free cash flow are non-GAAP financial measures and are intended to serve as a supplement to results provided in accordance with accounting principles generally accepted in the United States. Myers Industries believes that such information provides an additional measurement and consistent historical comparison of the Company’s performance. A reconciliation of the non-GAAP financial measures to the most directly comparable GAAP measures is available in this news release.

About Myers Industries

Myers Industries, Inc. is a manufacturer of sustainable plastic and metal products for industrial, agricultural, automotive, commercial, and consumer markets. The Company is also the largest distributor of tools, equipment and supplies for the tire, wheel, and under-vehicle service industry in the United States. Visit www.myersindustries.com to learn more.

Caution on Forward-Looking Statements

Statements in this release include contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including information regarding the Company’s financial outlook, future plans, objectives, business prospects and anticipated financial performance. Forward-looking statements can be identified by words such as “will,” “believe,” “anticipate,” “expect,” “estimate,” “intend,” “plan,” or variations of these words, or similar expressions. These forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, these statements inherently involve a wide range of inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. The Company’s actual actions, results, and financial condition may differ materially from what is expressed or implied by the forward-looking statements.

Specific factors that could cause such a difference on our business, financial position, results of operations and/or liquidity include, without limitation, raw material availability, increases in raw material costs, or other production costs; risks associated with our strategic growth initiatives or the failure to achieve the anticipated benefits of such initiatives; unanticipated downturn in business relationships with customers or their purchases; competitive pressures on sales and pricing; changes in the markets for the Company’s business segments; changes in trends and demands in the markets in which the Company competes; operational problems at our manufacturing facilities or unexpected failures at those facilities; future economic and financial conditions in the United States and around the world; inability of the Company to meet future capital requirements; claims, litigation and regulatory actions against the Company; changes in laws and regulations affecting the Company; impacts from the novel coronavirus (“COVID-19”) pandemic; and other risks and uncertainties detailed from time to time in the Company’s filings with the SEC, including without limitation, the risk factors disclosed in Item 1A, “Risk Factors,” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. Given these factors, as well as other variables that may affect our operating results, readers should not rely on forward-looking statements, assume that past financial performance will be a reliable indicator of future performance, nor use historical trends to anticipate results or trends in future periods. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date thereof. The Company expressly disclaims any obligation or intention to provide updates to the forward-looking statements and the estimates and assumptions associated with them.

Contact: Meghan Beringer, Senior Director Investor Relations, 252-536-5651

M-INV

Source: Myers Industries, Inc.

MYERS INDUSTRIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(Dollars in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

|

Year Ended |

|

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

Net sales |

|

$ |

191,077 |

|

|

$ |

212,840 |

|

|

$ |

813,067 |

|

|

$ |

899,547 |

|

Cost of sales |

|

|

133,845 |

|

|

|

147,766 |

|

|

|

553,981 |

|

|

|

616,181 |

|

Gross profit |

|

|

57,232 |

|

|

|

65,074 |

|

|

|

259,086 |

|

|

|

283,366 |

|

Selling, general and administrative expenses |

|

|

38,746 |

|

|

|

47,423 |

|

|

|

186,876 |

|

|

|

199,489 |

|

(Gain) loss on disposal of fixed assets |

|

|

(117 |

) |

|

|

26 |

|

|

|

(195 |

) |

|

|

(667 |

) |

Other (income) expenses |

|

|

— |

|

|

|

603 |

|

|

|

— |

|

|

|

603 |

|

Operating income (loss) |

|

|

18,603 |

|

|

|

17,022 |

|

|

|

72,405 |

|

|

|

83,941 |

|

Interest expense, net |

|

|

1,374 |

|

|

|

1,654 |

|

|

|

6,349 |

|

|

|

5,731 |

|

Income (loss) before income taxes |

|

|

17,229 |

|

|

|

15,368 |

|

|

|

66,056 |

|

|

|

78,210 |

|

Income tax expense (benefit) |

|

|

4,690 |

|

|

|

1,940 |

|

|

|

17,189 |

|

|

|

17,943 |

|

Net income (loss) |

|

$ |

12,539 |

|

|

$ |

13,428 |

|

|

$ |

48,867 |

|

|

$ |

60,267 |

|

Net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.34 |

|

|

$ |

0.37 |

|

|

$ |

1.33 |

|

|

$ |

1.66 |

|

Diluted |

|

$ |

0.34 |

|

|

$ |

0.36 |

|

|

$ |

1.32 |

|

|

$ |

1.64 |

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

36,840,253 |

|

|

|

36,495,362 |

|

|

|

36,744,560 |

|

|

|

36,411,389 |

|

Diluted |

|

|

37,142,056 |

|

|

|

36,853,237 |

|

|

|

37,095,568 |

|

|

|

36,790,839 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MYERS INDUSTRIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (UNAUDITED)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

Assets |

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash |

|

$ |

30,290 |

|

|

$ |

23,139 |

|

Trade accounts receivable, net |

|

|

113,907 |

|

|

|

126,184 |

|

Other accounts receivable, net |

|

|

14,726 |

|

|

|

7,532 |

|

Inventories, net |

|

|

90,844 |

|

|

|

93,351 |

|

Other current assets |

|

|

6,854 |

|

|

|

7,001 |

|

Total Current Assets |

|

|

256,621 |

|

|

|

257,207 |

|

Property, plant, & equipment, net |

|

|

107,933 |

|

|

|

101,566 |

|

Right of use asset - operating leases |

|

|

27,989 |

|

|

|

28,908 |

|

Deferred income taxes |

|

|

209 |

|

|

|

129 |

|

Other assets |

|

|

148,879 |

|

|

|

154,824 |

|

Total Assets |

|

$ |

541,631 |

|

|

$ |

542,634 |

|

Liabilities & Shareholders' Equity |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

79,050 |

|

|

$ |

73,536 |

|

Accrued expenses |

|

|

53,523 |

|

|

|

57,531 |

|

Operating lease liability - short-term |

|

|

5,943 |

|

|

|

6,177 |

|

Finance lease liability - short-term |

|

|

593 |

|

|

|

518 |

|

Long-term debt - current portion |

|

|

25,998 |

|

|

|

- |

|

Total Current Liabilities |

|

|

165,107 |

|

|

|

137,762 |

|

Long-term debt |

|

|

31,989 |

|

|

|

93,962 |

|

Operating lease liability - long-term |

|

|

22,352 |

|

|

|

22,786 |

|

Finance lease liability - long-term |

|

|

8,615 |

|

|

|

8,919 |

|

Other liabilities |

|

|

12,108 |

|

|

|

15,270 |

|

Deferred income taxes |

|

|

8,660 |

|

|

|

7,508 |

|

Total Shareholders' Equity |

|

|

292,800 |

|

|

|

256,427 |

|

Total Liabilities & Shareholders' Equity |

|

$ |

541,631 |

|

|

$ |

542,634 |

|

MYERS INDUSTRIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Cash Flows From Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

12,539 |

|

|

$ |

13,428 |

|

|

$ |

48,867 |

|

|

$ |

60,267 |

|

Adjustments to reconcile net income to net cash

provided by (used for) operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

5,882 |

|

|

|

5,616 |

|

|

|

22,786 |

|

|

|

21,216 |

|

Amortization of deferred financing costs |

|

|

79 |

|

|

|

78 |

|

|

|

313 |

|

|

|

441 |

|

Non-cash stock-based compensation expense |

|

|

1,593 |

|

|

|

2,268 |

|

|

|

6,671 |

|

|

|

7,436 |

|

(Gain) loss on disposal of fixed assets |

|

|

(117 |

) |

|

|

26 |

|

|

|

(195 |

) |

|

|

(667 |

) |

Deferred taxes |

|

|

1,039 |

|

|

|

2,072 |

|

|

|

1,039 |

|

|

|

2,072 |

|

Other |

|

|

(1,529 |

) |

|

|

1,228 |

|

|

|

944 |

|

|

|

1,520 |

|

Cash flows provided by (used for) working capital |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable - trade and other, net |

|

|

(11,108 |

) |

|

|

(4,874 |

) |

|

|

2,656 |

|

|

|

(23,625 |

) |

Inventories |

|

|

5,535 |

|

|

|

14,971 |

|

|

|

2,630 |

|

|

|

7,955 |

|

Prepaid expenses and other current assets |

|

|

2,204 |

|

|

|

3,503 |

|

|

|

151 |

|

|

|

(1,409 |

) |

Accounts payable and accrued expenses |

|

|

(717 |

) |

|

|

(16,454 |

) |

|

|

310 |

|

|

|

(2,585 |

) |

Net cash provided by (used for) operating activities |

|

|

15,400 |

|

|

|

21,862 |

|

|

|

86,172 |

|

|

|

72,621 |

|

Cash Flows From Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(3,563 |

) |

|

|

(6,677 |

) |

|

|

(22,855 |

) |

|

|

(24,292 |

) |

Acquisition of business, net of cash acquired |

|

|

— |

|

|

|

(3,373 |

) |

|

|

(160 |

) |

|

|

(27,626 |

) |

Proceeds from sale of property, plant, and equipment |

|

|

116 |

|

|

|

12 |

|

|

|

258 |

|

|

|

1,537 |

|

Net cash provided by (used for) investing activities |

|

|

(3,447 |

) |

|

|

(10,038 |

) |

|

|

(22,757 |

) |

|

|

(50,381 |

) |

Cash Flows From Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Net borrowings (repayments) from revolving credit facility |

|

|

(2,000 |

) |

|

|

(4,000 |

) |

|

|

(36,000 |

) |

|

|

3,000 |

|

Payments on finance lease |

|

|

(139 |

) |

|

|

(126 |

) |

|

|

(542 |

) |

|

|

(500 |

) |

Cash dividends paid |

|

|

(4,974 |

) |

|

|

(4,925 |

) |

|

|

(20,240 |

) |

|

|

(19,797 |

) |

Proceeds from issuance of common stock |

|

|

390 |

|

|

|

261 |

|

|

|

2,338 |

|

|

|

2,320 |

|

Shares withheld for employee taxes on equity awards |

|

|

(17 |

) |

|

|

(1 |

) |

|

|

(2,072 |

) |

|

|

(451 |

) |

Deferred financing fees |

|

|

— |

|

|

|

(171 |

) |

|

|

— |

|

|

|

(889 |

) |

Net cash provided by (used for) financing activities |

|

|

(6,740 |

) |

|

|

(8,962 |

) |

|

|

(56,516 |

) |

|

|

(16,317 |

) |

Foreign exchange rate effect on cash |

|

|

309 |

|

|

|

(147 |

) |

|

|

252 |

|

|

|

(439 |

) |

Net increase (decrease) in cash |

|

|

5,522 |

|

|

|

2,715 |

|

|

|

7,151 |

|

|

|

5,484 |

|

Beginning Cash |

|

|

24,768 |

|

|

|

20,424 |

|

|

|

23,139 |

|

|

|

17,655 |

|

Ending Cash |

|

$ |

30,290 |

|

|

$ |

23,139 |

|

|

$ |

30,290 |

|

|

$ |

23,139 |

|

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

GROSS PROFIT, OPERATING INCOME AND EBITDA (UNAUDITED)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended December 31, 2023 |

|

|

|

Material Handling |

|

|

Distribution |

|

|

Segment Total |

|

|

Corporate & Other |

|

|

Total |

|

Net sales |

|

$ |

126,918 |

|

|

$ |

64,182 |

|

|

$ |

191,100 |

|

|

$ |

(23 |

) |

|

$ |

191,077 |

|

Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,539 |

|

Net income margin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

57,232 |

|

Add: Restructuring expenses and other adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

240 |

|

Adjusted gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

57,472 |

|

Gross margin as adjusted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

29,931 |

|

|

|

339 |

|

|

|

30,270 |

|

|

|

(11,667 |

) |

|

|

18,603 |

|

Operating income margin |

|

|

23.6 |

% |

|

|

0.5 |

% |

|

|

15.8 |

% |

|

n/a |

|

|

|

9.7 |

% |

Add: Restructuring expenses and other adjustments |

|

|

231 |

|

|

|

61 |

|

|

|

292 |

|

|

|

— |

|

|

|

292 |

|

Add: Acquisition and integration costs |

|

|

— |

|

|

|

79 |

|

|

|

79 |

|

|

|

2,619 |

|

|

|

2,698 |

|

Less: Insurance recovery of legal fees(3) |

|

|

(6,700 |

) |

|

|

— |

|

|

|

(6,700 |

) |

|

|

— |

|

|

|

(6,700 |

) |

Add: Environmental reserves, net(2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,000 |

|

|

|

1,000 |

|

Adjusted operating income (loss)(1) |

|

|

23,462 |

|

|

|

479 |

|

|

|

23,941 |

|

|

|

(8,048 |

) |

|

|

15,893 |

|

Adjusted operating income margin |

|

|

18.5 |

% |

|

|

0.7 |

% |

|

|

12.5 |

% |

|

n/a |

|

|

|

8.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Depreciation and amortization |

|

|

4,922 |

|

|

|

692 |

|

|

|

5,614 |

|

|

|

268 |

|

|

|

5,882 |

|

Adjusted EBITDA |

|

$ |

28,384 |

|

|

$ |

1,171 |

|

|

$ |

29,555 |

|

|

$ |

(7,780 |

) |

|

$ |

21,775 |

|

Adjusted EBITDA margin |

|

|

22.4 |

% |

|

|

1.8 |

% |

|

|

15.5 |

% |

|

n/a |

|

|

|

11.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes gross profit adjustments of $240 and SG&A adjustments of $(2,950) |

|

(2) Includes environmental charges of $2,700 net of probable insurance recoveries of $1,700 |

|

(3) Includes total insurance recovery of $10,000 net of recoverable expenses incurred in the current year of $3,300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended December 31, 2022 |

|

|

|

Material Handling |

|

|

Distribution |

|

|

Segment Total |

|

|

Corporate & Other |

|

|

Total |

|

Net sales |

|

$ |

142,235 |

|

|

$ |

70,614 |

|

|

$ |

212,849 |

|

|

$ |

(9 |

) |

|

$ |

212,840 |

|

Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,428 |

|

Net income margin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

65,074 |

|

Add: Restructuring expenses and other adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

94 |

|

Adjusted gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

65,168 |

|

Gross margin as adjusted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

20,863 |

|

|

|

3,393 |

|

|

|

24,256 |

|

|

|

(7,234 |

) |

|

|

17,022 |

|

Operating income margin |

|

|

14.7 |

% |

|

|

4.8 |

% |

|

|

11.4 |

% |

|

n/a |

|

|

|

8.0 |

% |

Add: Restructuring expenses and other adjustments |

|

|

94 |

|

|

|

— |

|

|

|

94 |

|

|

|

— |

|

|

|

94 |

|

Add: Acquisition and integration costs |

|

|

— |

|

|

|

106 |

|

|

|

106 |

|

|

|

60 |

|

|

|

166 |

|

Add: Impairment of investment in legacy joint venture |

|

|

— |

|

|

|

603 |

|

|

|

603 |

|

|

|

— |

|

|

|

603 |

|

Less: Environmental reserves, net(2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,400 |

) |

|

|

(1,400 |

) |

Adjusted operating income (loss)(1) |

|

|

20,957 |

|

|

|

4,102 |

|

|

|

25,059 |

|

|

|

(8,574 |

) |

|

|

16,485 |

|

Adjusted operating income margin |

|

|

14.7 |

% |

|

|

5.8 |

% |

|

|

11.8 |

% |

|

n/a |

|

|

|

7.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Depreciation and amortization |

|

|

4,575 |

|

|

|

860 |

|

|

|

5,435 |

|

|

|

181 |

|

|

|

5,616 |

|

Adjusted EBITDA |

|

$ |

25,532 |

|

|

$ |

4,962 |

|

|

$ |

30,494 |

|

|

$ |

(8,393 |

) |

|

$ |

22,101 |

|

Adjusted EBITDA margin |

|

|

18.0 |

% |

|

|

7.0 |

% |

|

|

14.3 |

% |

|

n/a |

|

|

|

10.4 |

% |

|

|

(1) Includes gross profit adjustments of $94 and SG&A adjustments of $(631) |

|

(2) Includes environmental charges of $4,600 net of probable insurance recoveries of $6,000 |

|

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

GROSS PROFIT, OPERATING INCOME AND EBITDA (UNAUDITED)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2023 |

|

|

|

Material Handling |

|

|

Distribution |

|

|

Segment Total |

|

|

Corporate & Other |

|

|

Total |

|

Net sales |

|

$ |

555,259 |

|

|

$ |

257,875 |

|

|

$ |

813,134 |

|

|

$ |

(67 |

) |

|

$ |

813,067 |

|

Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48,867 |

|

Net income margin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

259,086 |

|

Add: Restructuring expenses and other adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

829 |

|

Adjusted gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

259,915 |

|

Gross margin as adjusted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

100,088 |

|

|

|

10,967 |

|

|

|

111,055 |

|

|

|

(38,650 |

) |

|

|

72,405 |

|

Operating income margin |

|

|

18.0 |

% |

|

|

4.3 |

% |

|

|

13.7 |

% |

|

n/a |

|

|

|

8.9 |

% |

Add: Executive severance costs |

|

|

— |

|

|

|

410 |

|

|

|

410 |

|

|

|

289 |

|

|

|

699 |

|

Add: Restructuring expenses and other adjustments |

|

|

1,456 |

|

|

|

914 |

|

|

|

2,370 |

|

|

|

166 |

|

|

|

2,536 |

|

Add: Acquisition and integration costs |

|

|

— |

|

|

|

376 |

|

|

|

376 |

|

|

|

2,745 |

|

|

|

3,121 |

|

Less: Insurance recovery of legal fees(3) |

|

|

(6,700 |

) |

|

|

— |

|

|

|

(6,700 |

) |

|

|

— |

|

|

|

(6,700 |

) |

Add: Environmental reserves, net(2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,200 |

|

|

|

3,200 |

|

Adjusted operating income (loss)(1) |

|

|

94,844 |

|

|

|

12,667 |

|

|

|

107,511 |

|

|

|

(32,250 |

) |

|

|

75,261 |

|

Adjusted operating income margin |

|

|

17.1 |

% |

|

|

4.9 |

% |

|

|

13.2 |

% |

|

n/a |

|

|

|

9.3 |

% |

Add: Depreciation and amortization |

|

|

18,917 |

|

|

|

3,197 |

|

|

|

22,114 |

|

|

|

672 |

|

|

|

22,786 |

|

Adjusted EBITDA |

|

$ |

113,761 |

|

|

$ |

15,864 |

|

|

$ |

129,625 |

|

|

$ |

(31,578 |

) |

|

$ |

98,047 |

|

Adjusted EBITDA margin |

|

|

20.5 |

% |

|

|

6.2 |

% |

|

|

15.9 |

% |

|

n/a |

|

|

|

12.1 |

% |

|

|

(1) Includes gross profit adjustments of $829 and SG&A adjustments of $2,027 |

|

(2) Includes environmental charges of $6,500 net of probable insurance recoveries of $3,300 |

|

(3) Includes total insurance recovery of $10,000 net of recoverable expenses incurred in the current period of $3,300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2022 |

|

|

|

Material Handling |

|

|

Distribution |

|

|

Segment Total |

|

|

Corporate & Other |

|

|

Total |

|

Net sales |

|

$ |

647,619 |

|

|

$ |

251,966 |

|

|

$ |

899,585 |

|

|

$ |

(38 |

) |

|

$ |

899,547 |

|

Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60,267 |

|

Net income margin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

283,366 |

|

Add: Restructuring expenses and other adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

744 |

|

Adjusted gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

284,110 |

|

Gross margin as adjusted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

104,079 |

|

|

|

15,862 |

|

|

|

119,941 |

|

|

|

(36,000 |

) |

|

|

83,941 |

|

Operating income margin |

|

|

16.1 |

% |

|

|

6.3 |

% |

|

|

13.3 |

% |

|

n/a |

|

|

|

9.3 |

% |

Add: Restructuring expenses and other adjustments |

|

|

744 |

|

|

|

— |

|

|

|

744 |

|

|

|

— |

|

|

|

744 |

|

Add: Acquisition and integration costs |

|

|

— |

|

|

|

377 |

|

|

|

377 |

|

|

|

621 |

|

|

|

998 |

|

Add: Loss on sale of assets |

|

|

261 |

|

|

|

— |

|

|

|

261 |

|

|

|

— |

|

|

|

261 |

|

Add: Impairment of investment in legacy joint venture |

|

|

— |

|

|

|

603 |

|

|

|

603 |

|

|

|

— |

|

|

|

603 |

|

Add: Environmental reserves, net(2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,400 |

|

|

|

1,400 |

|

Adjusted operating income (loss)(1) |

|

|

105,084 |

|

|

|

16,842 |

|

|

|

121,926 |

|

|

|

(33,979 |

) |

|

|

87,947 |

|

Adjusted operating income margin |

|

|

16.2 |

% |

|

|

6.7 |

% |

|

|

13.6 |

% |

|

n/a |

|

|

|

9.8 |

% |

Add: Depreciation and amortization |

|

|

17,814 |

|

|

|

2,889 |

|

|

|

20,703 |

|

|

|

513 |

|

|

|

21,216 |

|

Adjusted EBITDA |

|

$ |

122,898 |

|

|

$ |

19,731 |

|

|

$ |

142,629 |

|

|

$ |

(33,466 |

) |

|

$ |

109,163 |

|

Adjusted EBITDA margin |

|

|

19.0 |

% |

|

|

7.8 |

% |

|

|

15.9 |

% |

|

n/a |

|

|

|

12.1 |

% |

|

|

(1) Includes gross profit adjustments of $744 and SG&A adjustments of $3,262 |

|

(2) Includes environmental charges of $7,400 net of probable insurance recoveries of $6,000 |

|

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

ADJUSTED OPERATING INCOME, ADJUSTED EBITDA AND FREE CASH FLOW (UNAUDITED)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Adjusted operating income (loss) reconciliation: |

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

$ |

18,603 |

|

|

$ |

17,022 |

|

|

$ |

72,405 |

|

|

$ |

83,941 |

|

Executive severance costs |

|

|

— |

|

|

|

— |

|

|

|

699 |

|

|

|

— |

|

Restructuring expenses and other adjustments |

|

|

292 |

|

|

|

94 |

|

|

|

2,536 |

|

|

|

744 |

|

Acquisition and integration costs |

|

|

2,698 |

|

|

|

166 |

|

|

|

3,121 |

|

|

|

998 |

|

Insurance recovery of legal fees |

|

|

(6,700 |

) |

|

|

— |

|

|

|

(6,700 |

) |

|

|

— |

|

Loss on sale of assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

261 |

|

Impairment of investment in legacy joint venture |

|

|

— |

|

|

|

603 |

|

|

|

— |

|

|

|

603 |

|

Environmental reserves, net |

|

|

1,000 |

|

|

|

(1,400 |

) |

|

|

3,200 |

|

|

|

1,400 |

|

Adjusted operating income (loss) |

|

$ |

15,893 |

|

|

$ |

16,485 |

|

|

$ |

75,261 |

|

|

$ |

87,947 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA reconciliation: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

12,539 |

|

|

$ |

13,428 |

|

|

$ |

48,867 |

|

|

$ |

60,267 |

|

Income tax expense (benefit) |

|

|

4,690 |

|

|

|

1,940 |

|

|

|

17,189 |

|

|

|

17,943 |

|

Interest expense, net |

|

|

1,374 |

|

|

|

1,654 |

|

|

|

6,349 |

|

|

|

5,731 |

|

Operating income (loss) |

|

|

18,603 |

|

|

|

17,022 |

|

|

|

72,405 |

|

|

|

83,941 |

|

Depreciation and amortization |

|

|

5,882 |

|

|

|

5,616 |

|

|

|

22,786 |

|

|

|

21,216 |

|

Executive severance costs |

|

|

— |

|

|

|

— |

|

|

|

699 |

|

|

|

— |

|

Restructuring expenses and other adjustments |

|

|

292 |

|

|

|

94 |

|

|

|

2,536 |

|

|

|

744 |

|

Acquisition and integration costs |

|

|

2,698 |

|

|

|

166 |

|

|

|

3,121 |

|

|

|

998 |

|

Insurance recovery of legal fees |

|

|

(6,700 |

) |

|

|

— |

|

|

|

(6,700 |

) |

|

|

— |

|

Loss on sale of assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

261 |

|

Impairment of investment in legacy joint venture |

|

|

— |

|

|

|

603 |

|

|

|

— |

|

|

|

603 |

|

Environmental reserves, net |

|

|

1,000 |

|

|

|

(1,400 |

) |

|

|

3,200 |

|

|

|

1,400 |

|

Adjusted EBITDA |

|

$ |

21,775 |

|

|

$ |

22,101 |

|

|

$ |

98,047 |

|

|

$ |

109,163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free cash flow reconciliation: |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used for) operating activities |

|

$ |

15,400 |

|

|

$ |

21,862 |

|

|

$ |

86,172 |

|

|

$ |

72,621 |

|

Capital expenditures |

|

|

(3,563 |

) |

|

|

(6,677 |

) |

|

|

(22,855 |

) |

|

|

(24,292 |

) |

Free cash flow |

|

$ |

11,837 |

|

|

$ |

15,185 |

|

|

$ |

63,317 |

|

|

$ |

48,329 |

|

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER DILUTED SHARE (UNAUDITED)

(Dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Adjusted net income (loss) reconciliation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

12,539 |

|

|

$ |

13,428 |

|

|

$ |

48,867 |

|

|

$ |

60,267 |

|

|

Income tax expense (benefit) |

|

|

4,690 |

|

|

|

1,940 |

|

|

|

17,189 |

|

|

|

17,943 |

|

|

Income (loss) before income taxes |

|

|

17,229 |

|

|

|

15,368 |

|

|

|

66,056 |

|

|

|

78,210 |

|

|

Executive severance costs |

|

|

— |

|

|

|

— |

|

|

|

699 |

|

|

|

— |

|

|

Restructuring expenses and other adjustments |

|

|

292 |

|

|

|

94 |

|

|

|

2,536 |

|

|

|

744 |

|

|

Acquisition and integration costs |

|

|

2,698 |

|

|

|

166 |

|

|

|

3,121 |

|

|

|

998 |

|

|

Insurance recovery of legal fees |

|

|

(6,700 |

) |

|

|

— |

|

|

|

(6,700 |

) |

|

|

— |

|

|

Loss on sale of assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

261 |

|

|

Impairment of investment in legacy joint venture |

|

|

— |

|

|

|

603 |

|

|

|

— |

|

|

|

603 |

|

|

Environmental reserves, net |

|

|

1,000 |

|

|

|

(1,400 |

) |

|

|

3,200 |

|

|

|

1,400 |

|

|

Adjusted income (loss) before income taxes |

|

|

14,519 |

|

|

|

14,831 |

|

|

|

68,912 |

|

|

|

82,216 |

|

|

Income tax expense, as adjusted (1) |

|

|

(3,630 |

) |

|

|

(3,034 |

) |

|

|

(17,228 |

) |

|

|

(20,554 |

) |

|

Adjusted net income (loss) |

|

$ |

10,889 |

|

|

$ |

11,797 |

|

|

$ |

51,684 |

|

|

$ |

61,662 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted earnings per diluted share reconciliation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common diluted share |

|

$ |

0.34 |

|

|

$ |

0.36 |

|

|

$ |

1.32 |

|

|

$ |

1.64 |

|

|

Executive severance costs |

|

|

— |

|

|

|

— |

|

|

|

0.02 |

|

|

|

— |

|

|

Restructuring expenses and other adjustments |

|

|

0.00 |

|

|

|

0.00 |