0001020859FALSE00010208592024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 29, 2024

| | | | | | | | |

| UNITED NATURAL FOODS, INC. |

| (Exact name of registrant as specified in its charter) |

| | |

Delaware (State or other jurisdiction of incorporation) | 001-15723 (Commission File Number) | 05-0376157 (IRS Employer Identification No.) |

| | |

313 Iron Horse Way, Providence, RI 02908 |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (401) 528-8634

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 | UNFI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 29, 2024, the Board of Directors (the “Board”) of United Natural Foods, Inc. (the “Company”) appointed Giorgio Matteo Tarditi, 51, to the role of President and Chief Financial Officer, effective April 15, 2024 (the “Effective Date”).

Mr. Tarditi most recently served as Group Financial Planning & Analysis Leader, GE Corporate, of the The General Electric Company (“GE”) since July 2021, where he developed financial and operating structures to support the creation of three GE independent companies. He served as Chief Financial Officer of GE Renewable Energies from January 2019 to June 2021, Chief Financial Officer of GE Power Services from December 2017 to December 2018. During Mr. Tarditi’s over 26-year tenure at GE, he also served as Vice President, Power Integration Leader, where he led operational integration of business segments, CFO of several divisions and held a variety of financial planning & analysis and other finance roles. Mr. Tarditi holds an MSc in Finance and Business Administration from Universita Bocconi in Milan, Italy.

In connection with Mr. Tarditi’s appointment as the Company’s President and Chief Financial Officer, the Company provided Mr. Tarditi with an offer letter (the “Offer Letter”), pursuant to which Mr. Tarditi will receive an annual base salary of $800,000 and an annual cash bonus with a value of 100% of his base salary based on achievement of certain fiscal year goals and objectives, which will be prorated for the 2024 fiscal year based on his start date. Mr. Tarditi’s annual equity award will be targeted at $2,000,000 beginning with the fiscal 2025 award, which award will be in the form of time-based restricted stock units (“RSUs”) and performance-based restricted stock units (“PSUs”), in the same proportion and on the same or similar terms as the long-term incentive awards granted to similarly situated executives of the Company and further subject to the terms and conditions of the respective award agreements evidencing the grant. In addition, Mr. Tarditi will receive prorated new hire equity award in an amount of approximately $1,371,585, based on proration from the last annual equity award date, consisting of 40% RSUs and 60% PSUs, and having the same terms and conditions as the fiscal 2024 awards granted to the Company’s other executive officers. He will receive an additional $500,000 sign-on equity award in the form of RSUs that will vest ratably over three years on the anniversary of the grant date. Mr. Tarditi will receive a $250,000 cash sign-on bonus, payable ninety (90) days after his start date. Mr. Tarditi may participate in the Company’s health and wellness and retirement benefit plans and programs in accordance with the terms of such plans.

In addition, the Company intends to enter into a Severance Agreement, Change in Control Agreement, and Indemnification Agreement with Mr. Tarditi in connection with his appointment as President and Chief Financial Officer, each of which is substantially consistent with the agreements entered into with the Company’s other similarly situated executive officers.

The foregoing description of the terms and conditions of the Offer Letter is qualified in its entirety by reference to the agreement, a copy of which is filed herewith as Exhibit 10.1. A summary of the material terms of the form of Severance Agreement is included in the Company’s Current Report on Form 8-K filed on September 27, 2022, and a copy of the form of Severance Agreement is filed with the Company’s Annual Report on Form 10-K for the year ended July 30, 2022 filed on September 27, 2022, each of which is incorporated herein by reference. A summary of the material terms of the form of Change in Control Agreement is included in, and a copy of the form of Change in Control Agreement is filed with, the Company’s Current Report on Form 8-K filed on November 8, 2018, which is incorporated herein by reference. The Indemnification Agreement will be filed with the Company’s Quarterly Report on Form 10-Q for the fiscal period ending January 27, 2024.

There are no arrangements or understandings between Mr. Tarditi and any other person pursuant to which he was named President and Chief Financial Officer of the Company and no family relationships among any of the Company’s directors or executive officers and Mr. Tarditi. There are no transactions involving the Company and Mr. Tarditi that the Company would be required to report pursuant to Item 404(a) of Regulation S-K in connection with his appointment as President and Chief Financial Officer.

In connection with the appointment of Mr. Tarditi, John W. Howard will no longer serve as the Company’s Chief Financial Officer, effective on the Effective Date. Mr. Howard will serve as Advisor to the President and Chief Financial Officer until May 31, 2024, at which time, Mr. Howard will separate from the Company. J. Alexander Miller Douglas, who currently holds the role of Chief Executive Officer and President, will continue to serve as the Company’s Chief Executive Officer and a member of the Board.

Because his separation results in a qualifying termination, Mr. Howard will receive severance benefits to which he is entitled pursuant to the terms of the Amended and Restated Severance Agreement by and between the Company and Mr. Howard, effective as of October 23, 2022 (“Howard Severance Agreement”). The Howard Severance Agreement contains certain restrictive covenants that will remain in place for the period of time contemplated by the Howard Severance Agreement as well as a release of claims and waiver against the Company. Mr. Howard’s outstanding equity awards will vest on a prorated basis as provided for upon a Separation from Service without Cause, as set forth in the Company’s Second Amended and Restated 2020 Equity Incentive Plan.

Item 7.01 Regulation FD Disclosure.

A copy of the press release announcing the leadership changes, including those described above in Item 5.02, issued by the Company on March 6, 2024 is being furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K. Exhibit 99.1 shall not be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| UNITED NATURAL FOODS, INC. |

| |

| By: | /s/ Mahrukh Hussain |

| Name: | Mahrukh Hussain |

| Title: | General Counsel and Corporate Secretary |

Date: March 6, 2024

February 29, 2024

Matteo Tarditi

Boston, MA

Dear Matteo,

I am pleased to extend this employment opportunity as President & CFO reporting directly to me. Your first day of employment with UNFI (the “Company”), and the effective date of this letter will be on or about April 15, 2024. This offer is contingent upon the successful completion of a pre-employment background check and form I-9.

The following information outlines the details of your new position with the Company:

•Base Salary: You will be paid an annual salary of $800,000. Your salary will be paid on a bi-weekly basis in accordance with the Company’s payroll practices. Pay dates currently occur every other Friday.

•Sign on Bonus: You will be awarded a one-time sign-on bonus of $250,000 payable after ninety (90) days of your date of hire.

•Annual Merit: Our annual performance review cycle takes place at the end of the fiscal year which runs from August through July. Company executives are reviewed by the board of directors, annually. You may be eligible to receive a merit increase in September 2025.

•Insurance Coverage: Your effective date for insurance coverage (medical, dental, vision, life, accidental death/ dismemberment, short-term disability, and long-term disability and FSA) will be the first of the month following 30 days of employment.

•Flexible Paid Time Off: The Company believes that it is important for all associates to take time off to re-energize. We also believe that associates should take responsibility for managing the integration of work and life by managing the needs of the business and their own personal need to spend time away from work rejuvenating. Associates are encouraged to take time off as needed. Time off is not accrued or tracked. UNFI also offers seven (7) paid holidays and 1 additional floating holiday pursuant to Company policy.

•401K: You will be eligible to participate in the Company’s 401(k) Plan after 30 days of service if you meet the age requirement of 21 or older. Shortly after 30 days of service, you will be automatically enrolled to contribute 3% of your eligible pay unless you take action. You will receive a notice to your home address indicating your automatic enrollment date and you can either change your contribution rate, elect to contribute on an after-tax Roth basis, or opt-out prior to becoming automatically enrolled. After 6 months of employment and age 21 or older, the Company will match 50% of the first 8% of eligible compensation contributed to the Company’s 401(k) Plan per pay period. The Plan has a three-year cliff vesting schedule which applies to Company matching contributions and begins on your date of hire. If you are a rehire, you will not go through the automatic enrollment process.

•Annual Incentive Program: You will be eligible to participate in UNFI’s Annual Incentive Plan (AIP) targeted at 100% of your base salary with the ability to earn up to 150% of your target. The payout is based on achievement of certain fiscal year goals and objectives and may be higher or lower based on

factors such as performance, impact to the organization and leader discretion. Your participation in UNFI’s AIP will be prorated based on your role and start date within the current fiscal year. This annual incentive will be payable in conjunction with all year-end incentive payments.

•Equity Incentive Program: Subject to approval by the Compensation Committee, you will be eligible to participate in the Company’s Long-Term Incentive Program starting in fiscal year 2025 (commencing August 4, 2024). The equity target for your role is expected to be $2,000,000, however the actual value of your grant may be higher or lower than that amount based on factors such as performance, impact to the organization and leader discretion. The Company will grant you a long-term incentive award at the same time and on the same terms as long-term incentive awards are granted to similarly situated associates of the Company and on a date on which the Company is not subject to a blackout period under its Insider Trading Policy (expected December). Most recently these awards were granted in a combination of 40% restricted stock units (RSUs) (three-year ratable vesting) and 60% performance stock units (PSUs) (with three-year cliff vesting and subject to achievement of pre-set performance objectives). The Company, at its discretion, from time to time may change, modify, amend, or terminate this incentive plan, policy, program, or award value.

•One-Time Prorated Equity Award: Since your start date is after the annual grant this fiscal year, you are eligible for a prorated new hire award (estimated at $1,371,585 with 60% PSUs and 40% RSUs). This award will be granted on or about the first trading date following your Start Date on which the Company is not subject to a blackout period under its Insider Trading Policy. The award will be prorated for the number of days worked between the most recent grant date and the 365 days following such date. For example, if you worked 180 days during the 365-day cycle, you would be eligible for ~49% of your annual equity target noted above. This award will be subject to the terms and conditions of the equity incentive plan pursuant to which the award is granted and the terms and conditions of the award agreement evidencing the award.

•Additional One-Time Inducement Grant: You will also be granted a one-time restricted stock unit award with a grant date value of $500,000 and such award will be granted by the Company on or about the first trading date following the Start Date on which the Company is not subject to a blackout period under its Insider Trading Policy. These units will vest ratably over three years on each anniversary of the grant date. This equity award will be subject to the terms and conditions of the equity incentive plan pursuant to which the award is granted and the terms and conditions of the award agreement evidencing the award.

•Restrictive Covenants: By accepting this offer of employment, and effective as of the first day of your employment with the Company, you agree to be bound by the terms and conditions set forth in Section IV, “Restrictive Covenants,” of UNFI’s Annual Incentive Program (AIP). These terms and conditions contain important legal rights and must be accessed at https://www.sec.gov/Archives/edgar/data/1020859/000102085923000048/ex1036-amendedannualincent.htm before you can accept this offer. Please read the Restrictive Covenants carefully and consult legal counsel, if necessary, to ensure you fully understand these provisions. You agree that the compensation described in this offer constitutes mutually-agreed upon consideration for the Restrictive Covenants.

•Severance: You will be entitled to severance benefits consistent with similarly situation officers, which benefits will include the following and be documented in a Severance Agreement substantially in the form of Severance Agreement filed on the Company’s Form 8-K dated December 7, 2022. In the event of any inconsistency between the terms of the Severance Agreement and those described herein, the terms of the Severance Agreement shall control. If the Company terminates your employment without Cause, or you resign for Good Reason, then the Company shall continue to pay you your base salary in effect as of the date of such termination or resignation for a period of one (1) year, subject to applicable withholding and deductions and a lump sum payment in an amount equal to one (1) times your annual incentive (annual bonus) based on performance at target levels of performance. In addition, the Company shall pay you, subject to applicable withholding and deductions, any Earned Incentive Compensation (as defined in the form of Severance Agreement), when such Earned Incentive Compensation would otherwise be payable, if the Employee’s employment was not terminated. If the Company terminates your employment without Cause, or you resign for Good Reason, the Company shall also pay you a lump sum of $35,000 that you may use to procure group health plan coverage for yourself and your eligible dependents or otherwise.

The severance benefits described herein shall be subject to terms and conditions similar to those applicable in the employment arrangements of other similarly situated Company officers.

•Change in Control: You will be entitled to severance benefits in connection with a Change in Control consistent with similarly situated officers, which benefits will include the following and be documented in a Change in Control Agreement substantially in the form of Change in Control Agreement filed on the Company’s Form 8-K dated November 8, 2018. In the event of any inconsistency between the terms of the Change in Control Agreement and those described herein, the terms of the Change in Control Agreement shall control. If your employment is terminated without Cause within two years following a Change in Control, or if you resign for Good Reason within such two year period, then the Company shall pay you, in a lump sum, an amount equal to two times the sum of (a) your base salary in effect as of the date of such termination or resignation (or, if greater, the base salary set forth in this letter) plus (b) your annual incentive bonus payment at target levels of performance, which total amount shall be subject to applicable withholding and deductions and shall be paid within sixty (60) days of such termination or resignation. In addition, if your employment is terminated without Cause within two years following a Change in Control, or if you resign for Good Reason within such two-year period, you shall be entitled to your annual incentive bonus payment, prorated for your time of employment, based on actual performance and payable at the time it would otherwise be paid had your employment not terminated, subject to applicable withholding and deductions. The LTI Grant, and any other equity or equity-based awards will become fully vested following a Change in Control (with all performance-based criteria deemed met at target levels of performance) upon your termination of employment if your employment is terminated by the Company without Cause or if you resign for Good Reason within two years after a Change in Control. If the Company terminates your employment without Cause, or you resign for Good Reason, within two years after a Change in Control, the Company shall also pay you a lump sum of $105,000 that you may use to procure group health plan coverage for yourself and your eligible dependents or otherwise.

The Change in Control severance benefits described herein shall be subject to terms and conditions similar to those applicable in the employment arrangements of other similarly situated Company officers.

This letter incorporates by reference the restrictive covenants set forth in the Severance Agreement and Change in Control Agreement.

This letter states the full terms of our offer of employment and supersedes all previous offers or other communications by any representative of the company regarding the terms of your employment. Notwithstanding the foregoing, our offer of employment is contingent upon, and will not be binding upon the Company or you until the satisfaction of the conditions set forth in the first paragraph of this letter and the commencement of your employment with the Company.

If you agree with the terms of employment described above, please sign and return to the undersigned a copy of this letter to me by March 1. 2024. We look forward to you joining UNFI and are confident your skills and expertise will make an immediate contribution to the growth of our company.

Sincerely,

Sandy Douglas

| | | | | | | | | | | | | | |

/s/ Giorgio Matteo Tarditi | | | March 1, 2024 | |

Matteo Tarditi | | | Date | |

United Natural Foods Names

Giorgio Matteo Tarditi President and Chief Financial Officer

Former GE Executive to help accelerate performance, value creation, and customer- and

supplier-focused transformation

PROVIDENCE, R.I. – (March 6, 2024) – United Natural Foods, Inc. (NYSE: UNFI) (the “Company” or “UNFI”) today announced that Giorgio “Matteo” Tarditi has been named President and Chief Financial Officer (CFO), effective April 15. He succeeds John W. Howard, UNFI’s current Chief Financial Officer, who will leave the Company following a transition period.

Sandy Douglas, CEO and President of UNFI, said: “Matteo is a proven executive who, over the course of his more than 26 years at GE, served as CFO for seven business units, including Renewable Energy and Energy Connections as externally reported segments, and large divisions of the Power, Oil & Gas, Aerospace, and Healthcare businesses. His deep financial expertise and knowledge of these businesses enabled him to successfully drive operational excellence, efficiency, and increased productivity in complex transformations and M&A integrations. A certified Lean Six Sigma Black Belt, he also led the development and implementation of processes that have increased forecast accuracy, accountability, and continuous improvement. We are pleased to welcome Matteo to our team and look forward to his contributions.

“We also want to thank John Howard for his years of dedicated service and leadership. John played an instrumental role in the integration efforts following the 2018 SUPERVALU acquisition and in helping UNFI navigate the challenges of the global pandemic. I have greatly appreciated his counsel since I joined UNFI.”

In his new role, Mr. Tarditi will oversee corporate finance, treasury, strategy, financial planning and analysis, tax, accounting, investor relations, risk management, and shared services.

“I am thrilled to join UNFI’s talented team, renowned for its customer-centric and collaborative culture,” said Tarditi. “I am excited by the opportunity to contribute to the mission of feeding families across North America and to support the customer- and supplier-driven strategy and transformation plan for the company. I look forward to leading the finance organization and partnering with the people who make UNFI the market leader and a company that delivers profitable growth and value creation for shareholders.”

Mr. Tarditi began his career with GE in 1997 and held positions of increasing responsibility in Healthcare, where he served as CFO of GE Healthcare Japan from 2005 to 2007; in GE Aerospace, where he served as CFO of Avio Aero—GE Aviation from 2013 to 2015; in GE Oil & Gas, where he served as CFO, Drilling and Production from 2010 to 2013; in GE Grid Solutions, where he served as CFO from 2015-2016; in GE Energy Connections, where he served as CFO from 2016 to 2017; in GE Power Services, where he served as CFO in 2018; in GE Renewable Energies, where he served as CFO from 2019 to 2021; and in GE Corporate, where he served as Group Financial Planning & Analysis Leader from 2021 to present.

A frequent speaker on global leadership, turnarounds, mergers and acquisitions, and talent motivation, Mr. Tarditi holds a Master of Science degree in Finance and Business Administration from Universita Bocconi in Milan, Italy.

About UNFI

UNFI is North America's premier grocery wholesaler delivering the widest variety of fresh, branded, and owned brand products to more than 30,000 locations throughout North America, including natural product superstores, independent retailers, conventional supermarket chains, ecommerce providers, and food service customers. UNFI also provides a broad range of value-added services and segmented marketing expertise, including proprietary technology, data, market insights, and shelf management to help customers and suppliers build their businesses and brands. As the largest full-service grocery partner in North America, UNFI is committed to building a food system that is better for all and is uniquely positioned to deliver great food, more choices, and fresh thinking to customers. To learn more about how UNFI is delivering value for its stakeholders, visit www.unfi.com.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: Statements in this press release regarding the Company’s business that are not historical facts are “forward-looking statements” that involve risks and uncertainties and are based on current expectations and management estimates; actual results may differ materially. The risks and uncertainties which could impact these statements include those described in the Company’s filings under the Securities Exchange Act of 1934, as amended, including its annual report on Form 10-K for the year ended July 29, 2023 filed with the SEC on September 26, 2023 and other filings the Company makes with the SEC. Any forward-looking statements are made pursuant to the Private Securities Litigation Reform Act of 1995 and, as such, speak only as of the date made. The Company is not undertaking to update any information contained in this press release to reflect subsequently occurring events or circumstances. Any estimates of future results of operations are based on a number of assumptions, many of which are outside the Company’s control and should not be construed in any manner as a guarantee that such results will in fact occur. These estimates are subject to change and could differ materially from final reported results.

For UNFI Investors:

Kristyn Farahmand

401-213-2160

kristyn.farahmand@unfi.com

-or-

Steve Bloomquist

952-828-4144

steve.j.bloomquist@unfi.com

For Media:

UNFI

Charles Davis

215-539-1696

cdavis@unfi.com

v3.24.0.1

Document and Entity Information

|

Feb. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 29, 2024

|

| Entity Registrant Name |

UNITED NATURAL FOODS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-15723

|

| Entity Tax Identification Number |

05-0376157

|

| Entity Address, Address Line One |

313 Iron Horse Way,

|

| Entity Address, City or Town |

Providence,

|

| Entity Address, State or Province |

RI

|

| Entity Address, Postal Zip Code |

02908

|

| City Area Code |

401

|

| Local Phone Number |

528-8634

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01

|

| Trading Symbol |

UNFI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001020859

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

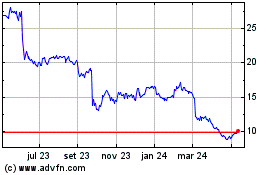

United Natural Foods (NYSE:UNFI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

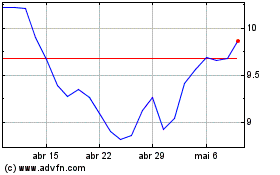

United Natural Foods (NYSE:UNFI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024