Filed pursuant to Rule

424(b)(3)

Registration No. 333-276955

PROSPECTUS

BIT DIGITAL, INC.

5,000,000 ORDINARY SHARES

This prospectus relates to the reoffer and resale

of 5,000,000 Ordinary Shares, par value $0.01 per share, of Bit Digital, Inc., a Cayman Islands company (“Bit Digital,” the

“Company,” “we,” “us,” or “our”), that have been or will be acquired by certain persons

(collectively referred to as the “Selling Securityholders”), including our officers and directors who are deemed to be our

affiliates, as that term is defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), holding

restricted securities, as that term is defined in Rule 144 under the Securities Act, in connection with the reoffer and resale of Ordinary

Shares of the Company received by such persons pursuant to the exercise of options to be granted under our 2023 Omnibus Equity Incentive

Plan (the “Plan”).

The shares offered herby consist of 5,000,000

Ordinary Shares issued or issuable under the Plan.

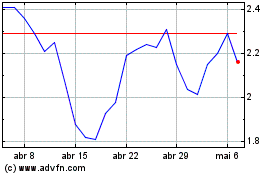

| ● | Our

Ordinary Shares are quoted on the Nasdaq Capital Market under the symbol “BTBT.” On February 7, 2024, the last reported sale

price of our Ordinary Shares on the Nasdaq Capital Market was $2.43 per share. |

The shares covered by this prospectus may be offered

and sold from time to time directly by the Selling Securityholders of Ordinary Shares issued upon the exercise of options and/or restricted

share awards (the “Awards”) granted pursuant to the Plan or through brokers on the Nasdaq Capital Market, or otherwise, at

the prices prevailing at the time of such sales. The net proceeds to the Selling Securityholders will be the proceeds received by them

upon such sales, less brokerage commissions, if any. We will pay all expenses of preparing and reproducing this prospectus but will not

receive any of the proceeds from sales by any of the Selling Securityholders, but we will receive the exercise price upon exercise of

the share options. The Selling Securityholders and any broker-dealers, agents, or underwriters through whom the shares are sold, may be

deemed “underwriters” within the meaning of the Securities Act with respect to securities offered by them, and any profits

realized or commissions received by them may be deemed underwriting compensation. See “Plan of Distribution.”

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE SHARES OFFERED HEREBY INVOLVE A SUBSTANTIAL

DEGREE OF RISK. SEE “RISK FACTORS” beginning on page 9 of this prospectus.

The date of this prospectus is February 8, 2024

No person is authorized to give any information

or to make any representations other than those contained in this prospectus in connection with any offer to sell or sale of the securities

to which this prospectus relates, and if given or made, such information or representations must not be relied upon as having been authorized.

Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, imply that there has been no change

in the facts herein set forth since the date hereof. This prospectus is not an offer to sell these securities and it is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

TABLE OF CONTENTS

You should rely only on the information contained

or incorporated by reference in this prospectus. We have not authorized any other person to provide you with different information. If

anyone provides you with different or inconsistent information, you should not rely on it.

This prospectus is not an offer to sell these

securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. You

should assume that the information appearing in this Prospectus, as well as information we have previously filed with the SEC and incorporated

by reference, is accurate only as of the date on the front of those documents.

AVAILABLE

INFORMATION

We file annual, semi-annual, quarterly (on a voluntary

basis as a foreign private issuer) and current reports and proxy statements and other information with the Securities and Exchange Commission

(“SEC”). Our public filings are available from the Internet website maintained by the SEC at http://www.sec.gov. In addition,

our Ordinary Shares are listed on the Nasdaq Capital Market. Accordingly, our reports, statements and other information may be inspected

at the offices of Nasdaq, One Liberty Plaza, 165 Broadway, New York, New York 10006.

INCORPORATION

OF documents BY REFERENCE

The SEC allows us to “incorporate by reference”

information into this prospectus, which means that we can disclose important information to investors by referring them to another document

filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus and subsequent information

that we file with the SEC will automatically update and supersede that information. Any statement contained in this prospectus or a previously

filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that

a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate by reference our documents listed

below and any future filings made by us with the SEC under Sections 13(a), 13(c) or 15(d) of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”) between the date of this prospectus and the termination of the offering of the securities

described in this prospectus. We are not, however, incorporating by reference any documents or portions thereof, whether specifically

listed below or filed in the future, which are “furnished” to the SEC that are not deemed “filed” with the SEC.

This prospectus incorporates by reference the

documents set forth below that have previously been filed with the SEC:

| 1. | Annual Report on Form

20-F for the year ended December 31, 2022, filed with the Commission on April 28, 2023; |

| 2. | Current Reports on Form 6-K as filed with the Commission

on January 26, 2024, January

24, 2024, January 19, 2024,

December 4, 2023, November

30, 2023, November 15, 2023,

November 14, 2023, November

3, 2023, September 22, 2023,

September 11, 2023, August

24, 2023, August 23, 2023,

August 15, 2023, June

22, 2023, June 12, 2023,

April 25, 2023, April

6, 2023, March 22, 2023,

January 27, 2023, January

25, 2023, January 12, 2023

and January 9, 2023 but only

to the extent that the items therein are specifically stated to be “filed” rather than “furnished” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”); and |

| 3. | The description of our Ordinary Shares contained in Bit Digital’s

Registration Statement on Form F-1 (No. 333-254060) and any amendment or report filed with the SEC for the purpose of updating. |

All documents subsequently filed by us pursuant

to Sections 13(a), 13(c) or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) prior to the filing of a post-effective

amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold shall be

deemed to be incorporated by reference in this prospectus and to be a part of this prospectus from the date of filing of such documents.

Any statement contained in a previously filed document incorporated by reference in this prospectus shall be deemed to be modified or

superseded for purposes of this prospectus to the extent that a statement in this prospectus modifies or supersedes such previous statement

and any statement contained in this prospectus shall be deemed to be modified or superseded to the extent that a statement in any document

subsequently filed, which is incorporated by reference in this prospectus, modifies or supersedes such statement. Any statement so modified

or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

A copy of any and all of the information included

in the documents that have been incorporated by reference in this prospectus (excluding exhibits thereto, unless such exhibits have been

specifically incorporated by reference into the information which this prospectus incorporates) but which are not delivered with this

prospectus will be provided by us without charge to any person to whom this prospectus is delivered, upon the oral or written request

of such person. Written requests should be directed to Bit Digital, Inc., 33 Irving Place, New York, New York 10003, Attention: Corporate

Secretary. Oral requests may be directed to the Secretary at (212) 463-5121.

FORWARD-LOOKING

STATEMENTS

This prospectus contains “forward-looking

statements” for purposes of the safe harbor provisions provided by Section 27 of the Securities Act of 1933, as amended (the “Securities

Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that represent our beliefs,

projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements,”

including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management

for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic

conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements

of assumptions underlying any of the foregoing. Words such as “may,” “will,” “should,” “could,”

“would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates” and similar expressions,

as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and

involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements,

or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements.

Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct

measurement and identification of factors affecting our business or the extent of their likely impact, and the accuracy and completeness

of the publicly available information with respect to the factors upon which our business strategy is based or the success of our business.

Forward-looking statements should not be read

as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our

performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are

made and management’s belief as of that time with respect to future events and are subject to risks and uncertainties that could

cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important

factors that could cause such differences include, but are not limited to, those factors discussed under the headings “Risk Factors”

and elsewhere in this prospectus.

PROSPECTUS

SUMMARY

This summary highlights certain information

contained elsewhere or incorporated by reference in this prospectus. This summary does not contain all of the information that you should

consider before deciding to invest in our Ordinary Shares. You should read this entire prospectus carefully, including our financial statements

and related notes thereto and the other documents incorporated by reference in this prospectus and the risks described under “Risk

Factors” beginning on page 9. We note that our actual results and future events may differ significantly based upon a number of

factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date

on the cover of this prospectus.

All references to “we,” “us,”

“our,” “Company,” “Registrant” or similar terms used in this prospectus refer to Bit Digital, Inc.

(formerly known as Golden Bull Limited), a Cayman Islands exempted company (“Bit Digital”), including its consolidated subsidiaries,

unless the context otherwise indicates. We currently conduct our business through, Bit Digital Hong Kong Limited and Bit Digital Strategies

Limited, Hong Kong companies; Bit Digital Singapore Pte Ltd.; Bit Digital U.S.A. Inc., a Delaware corporation, and our operating entity

in the United States; Bit Digital Canada, Inc., our operating entity in Canada; Bit Digital AI Inc., the parent company of Bit Digital

Iceland Ehf, our operating entity in Iceland; and Bit Digital Investment Management Limited, a BVI business company..

“PRC” or “China” refers

to the People’s Republic of China, excluding, for the purpose of this prospectus, Taiwan, Hong Kong and Macau, “RMB”

or “Renminbi” refers to the legal currency of China and “$”, “US$” or “U.S. Dollars” refers

to the legal currency of the United States.

No action is being taken in any jurisdiction

outside the United States to permit a public offering of the securities or possession or distribution of this prospectus in that jurisdiction.

Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about

and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

The Company may be subject to various legal

and operational risks as a result of its previously being a China-based Issuer with a substantial amount of the Company’s operations

previously in China and Hong Kong. See “Risk Factors – Risks Related to Previously Operating in China – We may be subject

to fines and penalties for operating in China without registration” and “We may be subject to fines and penalties for our

prior mining activities in mainland China”. As a result of our prior structure of an offshore issuer with a variable interest entity

(“VIE”) which are the concern of the SEC as to China-based Issuers, we set forth under “Risk Factors” some of

the risks and uncertainties concerning the Company’s prior operations, however, we do not have and will not have a VIE structure

and do not intend to have a mainland China subsidiary (hereinafter, a “WFOE”):

The Company’s auditor, Audit Alliance LLP,

is PCAOB registered and based in Singapore. Under the Holding Foreign Companies Accountable Act (the “HFCAA”), the PCAOB is

permitted to inspect our independent public accounting firm. However, if the PCAOB later determines that it cannot inspect or fully investigate

our auditor, trading in our securities may be prohibited under the HFCAA, and, as a result, Nasdaq may determine to delist our securities.

Our Company

Bit Digital, Inc. is a sustainable digital infrastructure

platform for digital assets and artificial intelligence (“AI”) infrastructure headquartered in New York City. Our bitcoin

mining operations are located in the U.S., Canada and Iceland. The Company has also established a business line, through Bit Digital Iceland

Ehf, a subsidiary of Bit Digital AI, that offers specialized cloud-infrastructure services for artificial intelligence applications.

We commenced business in February 2020. We initiated

limited Ethereum mining operations in January 2022 and discontinued the operations by September 2022, due to Ethereum blockchain

switching from proof-of-work (“PoW”) consensus mechanism to proof-of-stake (“PoS”) validation. Our mining operations,

hosted by third-party providers, use specialized computers, known as miners, to generate digital assets. Our miners use application specific

integrated circuit (“ASIC”) chips. These chips enable the miners to apply high computational power, expressed as “hash

rate”, to provide transaction verification services (generally known as “solving a block”) which helps support the blockchain.

For every block added, the blockchain provides an award equal to a set number of digital assets per block. Miners with a greater hash

rate generally have a higher chance of solving a block and receiving an award.

We operate our mining assets with the primary

intent of accumulating digital assets which we may sell for fiat currency from time to time depending on market conditions and management’s

determination of our cash flow needs, exchange for other digital assets. Our mining strategy has been to mine bitcoins as quickly and

as many as possible given the fixed supply of bitcoins. In view of historically long delivery lead times to purchase miners from manufacturers

like Bitmain Technologies Limited (“Bitmain”) and MicroBT Electronics Technology Co., Ltd (“MicroBT”), and other

considerations, we may choose to acquire miners on the spot market, which can typically result in delivery within a few weeks.

We have signed service agreements with third-party

hosting partners in North America and Iceland. These partners operate specialized mining data centers, where they install and operate

the miners and provide IT consulting, maintenance, and repair work on site for us. Our mining facilities in New York are maintained by

Coinmint LLC (“Coinmint”) and Digihost Technologies Inc. (“Digihost”). Our mining facility in Texas is maintained

by Dory Creek, LLC (“Dory Creek”). Our mining facility in Kentucky is maintained by Soluna Computing, Inc (“Soluna”).

Our mining facility in Canada is maintained by Blockbreakers Inc. (“Blockbreakers”). Our mining facility in Iceland is maintained

by GreenBlocks Ehf, an Icelandic private limited company (“GreenBlocks”). We have relocated some miners from our Texas and

Nebraska facilities, once under Compute North LLC’s maintenance before a third-party takeover preceding their 2022 bankruptcy to

facilities operated by Coinmint in New York. We have relocated those miners from our Georgia mining facility, previously maintained by

Core Scientific, Inc to one of Coinmint’s facilities. We have relocated some miners from Blockfusion USA, Inc. (“Blockfusion”)

facilities to Digihost and Soluna after our service agreement with Blockfusion ended in September 2023. From time to time, the Company

may change partnerships with hosting facilities to recalibrate its Bitcoin mining operations. These terminations are strategic, targeting

reduced operational costs, enhanced energy efficiency for a smaller carbon footprint, increased flexibility in operational control, and

minimized geopolitical risks. While a short-term decrease in mining output might occur, we expect these changes to yield long-term operational

improvements.

We are a sustainability-focused digital asset

mining company. On June 24, 2021, we signed the Crypto Climate Accord, a private sector-led initiative that aims to decarbonize the crypto

and blockchain sectors. On December 7, 2021, we became a member of the Bitcoin Mining Council (“BMC”), joining MicroStrategy

and other founding members to promote transparency, share best practices, and educate the public on the benefits of bitcoin and bitcoin

mining.

ETH Staking Business

In the fourth quarter of 2022, we formally commenced

Ethereum staking operations. We intend to delegate or stake our ETH holdings to an Ethereum validator node to help secure and strengthen

the blockchain network. Stakers are compensated for this commitment in the form of a reward of the native network token.

Our native staking operations are enhanced by

a partnership with Blockdaemon, a leading institutional-grade blockchain infrastructure company for node management and staking. In the

fourth quarter of 2022, following a similar mechanism to native Ethereum staking, we also participated in liquid staking via Portara protocol

(formerly known as Harbour), the liquid staking protocol developed by Blockdaemon and StakeWise and the first of its kind tailored to

institutions. With the introduction of staked ETH withdrawals in April 2023, we have reassessed our Ethereum network staking approaches,

weighing the advantages of traditional staking against liquid staking solutions. The withdrawal feature in native staking, coupled with

yields that are on par with those of liquid staking, has encouraged us to expand our collaborations with other service providers in this

domain. As a result, we have terminated all liquid staking activities with StakeWise in the third quarter, reclaiming all staked Ethereum

along with the accumulated rewards. As of September 30, 2023, only two nodes are maintained with Blockdaemon to continue our native staking

operations.

In addition, since the first quarter of 2023,

we started native staking with Marsprotocol and participated in liquid staking via Liquid Collective protocol on Coinbase platform. Liquid

staking allows participants to achieve greater capital efficiency by utilizing their staked ETH as collateral and trading their staked

ETH tokens on the secondary market.

Miner Deployments

During the three and nine months ended September

30, 2023, we continued to work with our hosting partners to deploy our miners in North America and Iceland.

During the second quarter of 2023, the Company

deployed an additional 3,600 miners at one of Coinmint’s hosting facilities.

During the third quarter of 2023, the Company

deployed an additional 310 miners at Digihost’s hosting facility.

During the third quarter of 2023, the Company

deployed an additional 1,890 miners at one of Coinmint’s hosting facilities.

During the second and third quarter of 2023, the

Company deployed 3,300 miners at GreenBlocks hosting facility.

As of September 30, 2023, the Company’s

active hash rate totals approximately 1.2 EH/s, with operations in North America and Iceland.

Power and Hosting Overview

During the three and nine months ended September

30, 2023, our hosting partners continued to prepare sites to deliver our contracted hosting capacity, bringing additional power online

for our miners.

The Company’s subsidiary, Bit Digital Canada,

Inc., entered into a Mining Services Agreement effective September 1, 2022, for Blockbreakers, Inc. to provide five (5) MW of incremental

hosting capacity at its facility in Canada. The facility utilizes an energy source that is primarily hydroelectric.

On May 8, 2023, the Company entered into a Master

Mining Services Agreement with Blockbreakers, pursuant to which Blockbreakers, Inc. agreed to provide the Company with four (4) MW of

additional mining capacity at its hosting facility in Canada. The agreement is for two (2) years automatically renewable for additional

one (1) year terms unless either party gives at least sixty (60) days’ advance written notice. The performance fee is 15%. Additionally,

Bit Digital has secured a side letter agreement with Blockbreakers, granting the Company the right of first refusal for any future mining

hosting services offered by Blockbreakers in Canada. This new agreement brings the Company’s total contracted hosting capacity with

Blockbreakers to approximately 9 MW. As of September 30, 2023, Blockbreakers provided approximately 3.3 MW of capacity for our miners

at their facility.

On June 7, 2022, we entered into a Master Mining

Services Agreement (the “MMSA”) with Coinmint LLC, pursuant to which Coinmint will provide the required mining colocation

services for a one-year period automatically renewing for three-month periods unless earlier terminated. The Company will pay Coinmint

electricity costs, plus operating costs required to operate the Company’s mining equipment, as well as a performance fee equal to

27.5% of profit, subject to a ten percent (10%) reduction if Coinmint fails to provide uptime of ninety-eight (98%) percent or better

for any period. We are not privy to the emissions rate at the Coinmint facility or at any other hosting facility. However, the Coinmint

facility operates in an upstate New York region that reportedly utilizes power that is 99% emissions-free, as determined based on the

2023 Load & Capacity Data Report published by the New York Independent System Operator, Inc. (“NYISO”).

On April 5, 2023, the Company entered into a letter

agreement and MMSA Amendment with Coinmint pursuant to which Coinmint agreed to provide the Company with up to ten (10) MW of additional

mining capacity to energize the Company’s mining equipment at Coinmint’s hosting facility in Plattsburgh, New York. The agreement

is for two (2) years automatically renewable for three (3) months unless not renewed by either party on at least ninety (90) days prior

written notice. The performance fees under this letter agreement range from 30% to 33% of profit. This new agreement brings the Company’s

total contracted hosting capacity with Coinmint to approximately 30 MW at this facility.

On April 27, 2023, the Company entered into a

letter agreement and MMSA Amendment with Coinmint pursuant to which Coinmint agreed to provide the Company with up to ten (10) MW of additional

mining capacity to energize the Company’s mining equipment at Coinmint’s hosting facility in Massena, New York. The agreement

is for one (1) year automatically renewable for three (3) months unless not renewed by either party on at least ninety (90) days prior

written notice. The performance fees under this letter agreement are 33% of profit. This new agreement brings the Company’s total

contracted hosting capacity with Coinmint to approximately 40 MW. As of September 30, 2023, Coinmint provided approximately 37.3

MW of capacity for our miners at their facilities.

In June 2021, we entered into a strategic co-mining

agreement with Digihost Technologies in North America. Pursuant to the terms of the agreement, Digihost provides certain premises to Bit

Digital for the purpose of the operation and storage of a 20 MW bitcoin mining system to be delivered by Bit Digital. Digihost provides

services to maintain the premises for a term of two years. Digihost shall also be entitled to 20% of the profit generated by the miners.

In April 2023, we renewed the co-mining agreement

with Digihost, previously executed in June 2021. Pursuant to the terms of the new agreement, Digihost provides certain premises to Bit

Digital for the purpose of the operation and storage of an up to 20 MW bitcoin mining system to be delivered by Bit Digital. Digihost

also provides services to maintain the premises for a term of two years, automatically renewing for a period of one (1) year. Digihost

shall also be entitled to 30% of the profit generated by the miners. As of September 30, 2023, Digihost provided approximately 3.0 MW

of capacity for our miners at their facility.

On May 9, 2023 (“Effective Date”),

the Company entered into a Term Loan Facility and Security Agreement (“Loan Agreement”) with GreenBlocks. Pursuant to the

Loan Agreement, GreenBlocks has requested the Company to extend one or more loans (“advances”) under a senior secured term

loan facility in an aggregate outstanding principal amount not to exceed $5 million. The interest rate of the Loan Agreement is 0% and

advances are to be repaid on the maturity date, which is the thirty-nine-month anniversary of the Effective Date. GreenBlocks will exclusively

use the advances to buy miners that will be operated for the benefit of the Company at a facility in Iceland, with an overall capacity

of 8.25 MW. To secure the prompt payment of advances, the Company has been granted a continuing first priority lien and security interest

in all of GreenBlocks’s rights, title and interest to the financed miners. The miners are the sole property of GreenBlocks, of which

they are responsible for the purchase, installation, operation, and maintenance.

On May 9, 2023, the Company entered into a Computation

Capacity Services Agreement (“Agreement”) with GreenBlocks. Pursuant to the Agreement, GreenBlocks will provide computational

capacity services and other necessary ancillary services, such as operation, management, and maintenance, at the facility in Iceland for

a term of two (2) years. GreenBlocks will own and operate the miners financed through the Loan Agreement for the purpose of providing

Computational Capacity of up to 8.25 MW. The Company will pay power costs of five cents ($0.05) per kilowatt hour, a Pod fee of $22,000

per pod per month, and a depreciation fee equal to 1/36 of the facility size per month. The performance fees under this agreement are

20%. The Company submitted to Greenblocks a deposit in the amount of $1,052,100, which was exclusively for the purpose of paying the landlord

of the facility for hosting space.

On June 1, 2023, the Company and GreenBlocks entered

the Omnibus Amendment to Loan Documents and Other Agreements (“Omnibus Amendment”). This amendment revised both the Loan Agreement

and the Computation Capacity Services Agreement previously entered on May 9, 2023. While the core terms remained consistent, notable modifications

pertained to the facility size and contracted capacity. Specifically, the facility size was increased from $5 million to $6.7 million.

Moreover, GreenBlocks agreed to expand the computation capacity to approximately 10.7 MW. Advances of $6.4 million have been financed

by the Company to GreenBlocks. As of September 30, 2023, GreenBlocks provided approximately 10.6 MW of capacity for our miners at their

facility.

In October 2023, we entered into a strategic co-location

agreement with Soluna Computing, Inc. (“Soluna”) for a term of one year automatically renewing on a month-to-month basis unless

terminated by either party. Pursuant to the terms of the agreement, Soluna provides certain required mining colocation services to Bit

Digital for the purpose of the operation and storage of an up to 4.4 MW bitcoin mining system to be delivered by Bit Digital. Soluna shall

also be entitled to 42.5% of the net profit generated by the miners.

In November 2023, we entered into a hosting services

agreement with Dory Creek, LLC (“Dory Creek”) for a term of one year automatically renewing on an annual basis unless terminated

by either party by giving a 30-day prior notice to the other Party in writing. Pursuant to the terms of the agreement, Dory Creek provides

maintenance and operation services to Bit Digital to support 17.5MW of capacity. Dory Creek shall also be entitled to 30% of the net profit

generated by the miners. Bit Digital shall have the first right, but not obligation, to accept services for any extra capacity under the

terms of this Agreement.

In May 2022, our hosting partner Blockfusion advised

us that the substation at its Niagara Falls, NY facility was damaged by an explosion and fire, and power was cut off to approximately

2,515 of the Company’s bitcoin miners and approximately 710 ETH miners that had been operating at the site immediately prior to

the incident. The explosion and fire are believed to have been caused by faulty equipment owned by the power utility. Blockfusion and

the Company have entered into a common interest agreement to jointly pursue any claims evolving from the explosion and fire. Prior to

the incident, our facility with Blockfusion in Niagara Falls, provided approximately 9.4 MW to power our miners. Power was restored to

the facility in September 2022. However, we received a notice dated October 4, 2022, from the City of Niagara Falls, which ordered

the cease and desist from any cryptocurrency mining or related operations at the facility until such time as Blockfusion complies with

Section 1303.2.8 of the City of Niagara Falls Zoning Ordinance (the “Ordinance”), in addition to all other City ordinances

and codes. Blockfusion has advised us that the Ordinance came into practical effect on October 1, 2022, following the expiration of a

related moratorium on September 30, 2022. Blockfusion has further advised that it has submitted applications for new permits based

on the Ordinance’s new standards and that the permits may take several months to process. Pursuant to the Mining Services Agreement

between Bit Digital and Blockfusion dated August 25, 2021, Blockfusion represents, warrants and covenants that it “possesses, and

will maintain, all licenses, registrations, authorizations and approvals required by any governmental agency, regulatory authority or

other party necessary for it to operate its business and engage in the business relating to its provision of the Services.” On October

5, 2022, Bit Digital further advised Blockfusion that it expects it to comply with directives of the Notice. Our service agreement with

Blockfusion ended in September 2023.

Miner Fleet Update and Overview

As of September 30, 2023, we had 46,852 miners

owned or operating (in Iceland) for bitcoin mining and 730 ETH miners, with a total maximum hash rate of 3.7 EH/s and 0.3 TH/s, respectively.

On April 28, 2023, we entered into a purchase

agreement with an unaffiliated seller of bitcoin mining computers, from whom we acquired 3,600 S19 miners. As of the date of this report,

all miners have been delivered.

On May 12, 2023, we entered into a purchase agreement

with an unaffiliated seller of bitcoin mining computers, from whom we acquired 2,200 S19J Pro+ miners. As of the date of this report,

all miners have been delivered.

On June 21, 2023, we entered into a purchase agreement

with an unaffiliated seller of bitcoin mining computers, from whom we acquired 1,100 S19 Pro+ miners. As of the date of this report, all

miners have been delivered.

In October 2023, we entered into a purchase agreement

with an unaffiliated seller of bitcoin mining computers, from whom we acquired 3,630 S19K Pro miners. As of the date of this report, the

miners have not been delivered.

Bitcoin Production

From the inception of our bitcoin mining business

in February 2020 to September 30, 2023, we earned an aggregate of 5,906.4 bitcoins.

The following table presents our bitcoin mining activities for the

nine months ended September 30, 2023:

| | |

Number of

bitcoins | | |

Amount (1) | |

| Balance at December 31, 2022 | |

| 946.3 | | |

$ | 15,796,147 | |

| Receipt of BTC from mining services | |

| 1,083.5 | | |

| 28,441,394 | |

| Exchange of BTC into ETH | |

| (549.2 | ) | |

| (9,732,283 | ) |

| Sales of and payments made in BTC | |

| (663.2 | ) | |

| (12,008,138 | ) |

| Receipt of BTC from other income | |

| 3.4 | | |

| 95,222 | |

| Impairment of BTC | |

| - | | |

| (4,011,342 | ) |

| Balance at September 30, 2023 | |

| 820.8 | | |

$ | 18,581,000 | |

| (1) | Receipt

of digital assets from mining services are the product of the number of bitcoins received multiplied by the bitcoin price obtained from

CoinMarketCap, calculated on a daily basis. Sales of digital assets are the actual amount received from sales. |

Environmental, Social and Governance

Sustainability is a major strategic focus for

us. Several of our mining locations in the US and Canada provide access to partially carbon-free energy and other sustainability-related

solutions, in varying amounts depending on location, including components of hydroelectric, solar, wind, nuclear and other carbon-free

generation sources, based on information provided by our hosts and publicly available data, which we believe helps mitigate the environmental

impact of our operations. We work with an independent ESG (Environmental, Social and Governance) consultant to self-monitor and adopt

an environmental policy to help us to improve our percentage of green electricity and other sustainability initiatives. As we continue

to align ourselves with the future of technology and business, we are dedicated to continuously enhancing sustainability, which we believe

future-proofs our operations and the larger bitcoin network.

We believe that the bitcoin network and the mining

that powers it are important inventions in human progress. The process of problem-solving and verifying bitcoin transactions using advanced

computers is energy intensive, and scrutiny has been applied to the industry for this reason. It follows that the environmental costs

of mining bitcoin should be surveyed and mitigated by every company in our fast-growing sector. We aim to contribute to the acceleration

of bitcoin’s decarbonization and act as a role model in our industry, responsibly stewarding digital assets.

We work with Apex Group Ltd, an independent ESG

consultancy, with the goal of becoming one the first publicly-listed bitcoin miners to receive an independent ESG rating on our operations,

which we anticipate will provide transparency on the environmental sustainability of our operations, as well as other metrics. Apex’s

ESG Ratings & Advisory tools allow us to benchmark our ESG performance against international standards and our peers to identify opportunities

for improvement and progress over time. We believe this is an integral approach to improving our sustainability practices and mitigating

our environmental impact. By measuring the sustainability and footprint of Bit Digital’s mining, we are able to develop targets

to continuously improve as we shift towards our goal of 100% clean energy usage.

On December 7, 2021, the Company became a member

of the Bitcoin Mining Council (“BMC”), joining MicroStrategy and other founding members to promote transparency, share best

practices, and educate the public on the benefits of bitcoin and bitcoin mining.

COVID-19

In March 2020, the World Health Organization declared

the COVID-19 outbreak (“COVID-19”) a global pandemic. While all restrictions have been lifted, we continue to monitor the

situation and the possible effects on our financial condition, liquidity, operations, suppliers and industry, and may take further actions

that alter our operations and business practices as may be required by federal, state or local authorities or that we determine are in

the best interests of our partners, customers, suppliers, vendors, employees and shareholders.

Additionally, we have evaluated the potential

impact of the COVID-19 outbreak on our financial statements, including, but not limited to, the impairment of long-lived assets and valuation

of digital assets. Where applicable, we have incorporated judgments and estimates of the expected impact of COVID-19 in the preparation

of the financial statements based on information currently available. Based on our current assessment, we do not expect any material impact

on our long-term strategic plans, operations and liquidity.

Recent Events

In October 2023, the Company announced the launch

of a new business line through Bit Digital Iceland Ehf, a subsidiary of Bit Digital AI, Inc., that will provide specialized infrastructure

to support generative artificial intelligence (“AI”) workstreams. This represents a material expansion from our core business

into an industry with robust demand and growth expectations. Importantly, we were able to secure an anchor customer for this business

without devoting incremental resources towards customer acquisition. This business line aims to provide a non-correlated income stream

that is intended to help the Company weather potential downturns in its core bitcoin mining and ETH staking businesses and intends to

make the Company more financially flexible through the 2024 “halving”. Revenue for the initial contract commenced in January

2024, and we are confident that we can materially scale the business with the necessary financial resources.” The Company has commenced

Bit Digital AI operations by signing service agreements with a customer to support their GPU-accelerated workloads. Under the agreements,

Bit Digital will provide the customer with rental services for 2,048 GPUs. Concurrently, Bit Digital has agreed to purchase the required

GPUs and has funded the initial deposit for the purchase order.

In October 2023, Bit Digital finalized an agreement

with Soluna Computing, Inc (“Soluna”) for 4.4 megawatts of incremental hosting capacity at Project Sophie in Kentucky to power

its miners for an initial contract term of twelve months.

In November 2023, Bit Digital finalized an agreement

with Bitdeer Technologies Group for 17.5 megawatts (“MW”) of incremental hosting capacity to power its miners at a location

in Texas. The initial term of the contract is twelve months with automatic one-year renewals. Additionally, Bit Digital will have the

first right for an additional 17.5 MW of capacity that may be brought online by the operator. Bit Digital will fill the capacity with

miners from its existing fleet and with new miner purchases. Approximately 900 S19j Pro units from the Company’s existing fleet

have already been delivered to the facility and are actively hashing. The Company has purchased approximately 3,600 S19k Pro mining units

that are expected to be delivered to the facility by late-November 2023. The remaining capacity will be filled with future miner purchase

orders.

The

Offering

This reoffer prospectus relates to the reoffer

and resale of an aggregate of 5,000,000 Ordinary Shares, par value $0.01 per share, by certain Selling Securityholders, including our

officers and directors, who are deemed to be affiliates of the Company, that are issuable upon the exercise of options to be granted pursuant

to our Plan and shares underlying Awards. We will not receive any proceeds from the sale of the shares sold by the Selling Securityholders,

but we will receive the exercise price upon exercise of the share options, other than for any cashless exercise of options.

If subsequent to the date of this reoffer prospectus,

we grant any awards under the Plan to any persons who are affiliates of the Company, we would supplement this reoffer prospectus with

the names of such affiliates and the amount(s) of shares to be reoffered by them as Selling Securityholders.

Foreign Private Issuer Status

We are a foreign private issuer within the meaning

of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain

provisions applicable to United States domestic public companies. For example:

| |

● |

we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; |

| |

|

|

| |

● |

for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; |

| |

|

|

| |

● |

we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

| |

|

|

| |

● |

we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; |

| |

|

|

| |

● |

we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and |

| |

|

|

| |

● |

Our insiders are not required to comply with Section 16 of the Exchange Act requiring such individuals, and entities to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

Corporate Information

Our principal

executive offices are located at 33 Irving Place, New York, New York 10003. Our telephone number at this address is +1 (212) 463-5121. Our

office in Hong Kong is located at Room 3603, Tower 2 Metro Plaza, Hong Kong, China. Our registered office in the Cayman Islands is located

at Corporate Filing Services Ltd., 3rd Floor, Harbour Centre, 103 South Church Street, George Town, Grand Cayman, KY 1-1002, Cayman Islands.

Our office in Singapore is located at 21 Floor, 88 Market Street, Capital Spring, S048948. Our office in Iceland is located at Skogarhlid

12, 105 Reykjavik, Iceland. Our agent for service of process in the United States is Corporation Service Company, 19 West 44th Street,

Suite 201, New York, NY 10036. The Company’s legal advisers are as follows: in the PRC: Tian Yuan Law Firm, Suite 509, Tower A,

Corporate Square, 35 Financial Street, Xicheng District, Beijing, 100032 China; in the Cayman Islands: Ogier (Cayman) LLP, 89 Nexus Way,

Camana Bay, Grand Cayman, Cayman Islands KY1-9009; and in the United States: Davidoff Hutcher & Citron LLP, 605 Third Avenue, New

York, New York 10158. Our Auditors are: Audit Alliance, LLP, 20 Maxwell Road #11-09, Maxwell House, Singapore 069113, see “Experts.”

Investors should contact us for any inquiries through the address and telephone number of our principal executive offices.

RISK

FACTORS

An investment in our

Ordinary Shares involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with

all other information contained in this prospectus, including the matters discussed under the heading “Forward-Looking Statements”

before you decide to invest in our Ordinary Shares. The Company may be subject to various legal and operational risks as a result

of its previously being a China-based Issuer with substantial amounts of the Company’s operations previously in China and Hong Kong.

The legal and regulatory environment in China is in many respects different from the United States. These risks and others could result

in a material change in the value of our securities and/or significantly limit or completely limit or completely hinder our ability to

offer or continue to offer our securities to investors and cause the value of such securities to significantly decline or be worthless.

If any of the following risks, or any other risks and uncertainties that are not presently foreseeable to us, actually occur, our business,

financial condition, results of operations, liquidity and our future growth prospects could be materially and adversely affected.

General Risks

We have a history

of operating losses, and we may not be able to sustain profitability; we have recently shifted our digital assets business, and we may

not be continuously successful in this business.

We experienced profitability

from our continuing bitcoin mining operations in 2021. However, as a result of the decline in value of bitcoin and the corresponding decline

in revenue from digital assets mining, we recognized a net loss of $105,296,603 for the year ended December 31, 2022, which included

a $24,654,267 impairment of digital assets and a $50,038,650 impairment of property and equipment. We recognized a net loss of $11,869,453

for the nine months ended September 30, 2023, representing a change of $24.7 million from a net loss of $36.6 million for the nine months

ended September 30, 2022. We may continue to incur losses and may have additional impairment of digital assets, as we continue to work

to shift and grow our digital assets business. Our operations are focused on our bitcoin mining business located at our bitcoin mining

facilities in the United States, Canada and Iceland, as well as our Ethereum staking operations. Our current business, including our growth

strategy for our business, involves an industry that is itself new and constantly evolving and is subject risks, many of which are discussed

below. See “Digital Assets Related Risks” below.

Our results of

operations may fluctuate significantly and may not fully reflect the underlying performance of our business.

Our results of operations,

including the levels of our net revenues, expenses, net loss and other key metrics, may vary significantly in the future due to a variety

of factors, some of which are outside of our control, and period-to-period comparisons of our operating results may not be meaningful,

especially given our limited bitcoin mining operating history. We terminated all bitcoin mining operations in China in June 2021. Our

results of operations for the year ended December 31, 2022 were adversely affected by the material decrease in bitcoins mined, including,

in part, due to the need to migrate and replace a portion of our miners. We have migrated all miners to the United States by the end of

November 2021 and expected to have had them and any newly purchased miners operational by year end 2022. However, as a result of adverse

factors described below, there can be no assurance we will again achieve the level of profitability we experienced in late 2020 or the

first quarter of 2021.

The results for any one

quarter are not necessarily an indication of future performance. Fluctuations in quarterly results may adversely affect the market price

of our Ordinary Shares. Factors that may cause fluctuations in our annual financial results include:

| |

● |

the amount and timing of operating expenses related to our new business operations and infrastructure; |

| |

● |

fluctuations in the price of digital assets; and |

| |

● |

general economic, industry and market conditions. |

We may acquire

other businesses, form joint ventures or acquire other companies or businesses that could negatively affect our operating results, dilute

our shareholders’ ownership, increase our debt or cause us to incur significant expense; notwithstanding the foregoing, our growth

may depend on our success in uncovering and completing such transactions.

We seek to enter digital

assets mining related businesses around the globe. However, we cannot offer any assurance that acquisitions of businesses, assets and/or

entering into strategic alliances or joint ventures will be successful. We may not be able to find suitable partners or acquisition candidates

and may not be able to complete such transactions on favorable terms, if at all. If we make any acquisitions, we may not be able to integrate

these acquisitions successfully into our existing infrastructure. In addition, in the event we acquire any existing businesses we could

assume unknown or contingent liabilities.

Any future acquisitions

also could result in the issuance of shares, incurrence of debt, contingent liabilities or future write-offs of intangible assets or goodwill,

any of which could have a negative impact on our cash flows, financial condition and results of operations. Integration of an acquired

company may also disrupt ongoing operations and require management resources that otherwise would be focused on developing and expanding

our existing business. We may experience losses related to potential investments in other companies, which could harm our financial condition

and results of operations. Further, we may not realize the anticipated benefits of any acquisition, strategic alliance or joint venture

if such investments do not materialize.

To finance any acquisitions

or joint ventures, we may choose to issue Ordinary Shares, preferred shares or a combination of debt and equity as consideration, which

could significantly dilute the ownership of our existing shareholders or provide rights to such preferred shareholders in priority over

our Ordinary Shareholders. Additional funds may not be available on terms that are favorable to us, or at all. If the price of our Ordinary

Shares is low or volatile, we may not be able to acquire other companies or fund a joint venture project using shares as consideration.

Our new services and changes to existing

services could fail to attract or retain users or generate revenue and profits, or otherwise adversely affect our business.

Our ability to retain, increase, and engage our

user base and to increase our revenue depends heavily on our ability to continue to evolve our existing services and to create successful

new services, both independently and in conjunction with developers or other third parties. We may introduce significant changes to our

existing services or acquire or introduce new and unproven services, including using technologies with which we have little or no prior

development or operating experience. For example, we are making significant investments in artificial intelligence (AI) initiatives,

including providing computing capacity to support AI. These efforts, including the introduction of new services or changes to existing

services, may result in new or enhanced governmental or regulatory scrutiny, litigation, ethical concerns, or other complications that

could adversely affect our business, reputation, or financial results. If our new services fail to engage users or developers, or if our

business plans are unsuccessful, we may fail to attract or retain users or to generate sufficient revenue, operating margin, or other

value to justify our investments, and our business may be adversely affected.

From time to time

we may evaluate and potentially consummate strategic investments, combinations, acquisitions or alliances, which could require significant

management attention, disrupt our business and adversely affect our financial results.

We may evaluate and consider

strategic investments, combinations, acquisitions or alliances in the bitcoin mining or other digital assets businesses. These transactions

could be material to our financial condition and results of operations if consummated. If we are able to identify an appropriate business

opportunity, we may not be able to successfully consummate the transaction and, even if we do consummate such a transaction, we may be

unable to obtain the benefits or avoid the difficulties and risks of such transaction.

Strategic investments

or acquisitions will involve risks commonly encountered in business relationships, including:

| |

● |

difficulties in assimilating and integrating the operations, personnel, systems, data, technologies, products and services of the acquired business; |

| |

● |

inability of the acquired technologies, products or businesses to achieve expected levels of revenue, profitability, productivity or other benefits; |

| |

● |

difficulties in retaining, training, motivating and integrating key personnel; |

| |

● |

diversion of management’s time and resources from our normal daily operations; |

| |

● |

difficulties in successfully incorporating licensed or acquired technology and rights into our businesses; |

| |

● |

difficulties in maintaining uniform standards, controls, procedures and policies within the combined organizations; |

| |

● |

difficulties in retaining relationships with customers, employees and suppliers of the acquired business; |

| |

● |

risks of entering markets, in parts of the United States, in which we have limited or no prior experience; |

| |

● |

regulatory risks, including remaining in good standing with existing regulatory bodies or receiving any necessary pre-closing or post-closing approvals, as well as being subject to new regulators with oversight over an acquired business; assumption of contractual obligations that contain terms that are not beneficial to us, require us to license or waive intellectual property rights or increase our risk for liability; |

| |

● |

failure to successfully further develop the acquired technology; |

| |

● |

liability for activities of the acquired business before the acquisition, including intellectual property infringement claims, violations of laws, commercial disputes, tax liabilities and other known and unknown liabilities; |

| |

● |

potential disruptions to our ongoing businesses; and |

| |

● |

unexpected costs and unknown risks and liabilities associated with strategic investments or acquisitions. |

We may not make any investments

or acquisitions, or any future investments or acquisitions may not be successful, may not benefit our business strategy, may not generate

sufficient revenues to offset the associated acquisition costs or may not otherwise result in the intended benefits. In addition, we cannot

assure you that any future investment in or acquisition of new businesses or technology will achieve market acceptance or prove to be

profitable.

The loss of any

member of our management team, our inability to execute an effective succession plan, or our inability to attract and retain qualified

personnel could adversely affect our business.

Our success and future

growth will depend to a significant degree on the skills and services of our management team, including Mr. Sam Tabar, our Chief Executive

Officer, and Mr. Erke Huang, our Chief Financial Officer. We will need to continue to grow our management in order to alleviate pressure

on our existing team and in order to continue to develop our business. If our management team, including any new hires that we may make,

fails to work together effectively and to execute our plans and strategies on a timely basis, our business could be harmed. Furthermore,

if we fail to execute an effective contingency or succession plan with the loss of any member of management, the loss of such management

personnel may significantly disrupt our business.

The loss of key members

of management could inhibit our growth prospects. Our future success also depends in large part on our ability to attract, retain and

motivate key management and operating personnel. As we continue to develop and expand our operations, we may require personnel with different

skills and experiences, and who have a sound understanding of our business and the bitcoin industry. The market for highly qualified personnel

in this industry is very competitive, and we may be unable to attract or retain such personnel. If we are unable to attract or retain

such personnel, our business could be harmed.

We incur significant

costs and demands upon management and accounting and finance resources as a result of complying with the laws and regulations affecting

public companies; if we fail to maintain proper and effective internal controls, our ability to produce accurate and timely financial

statements and otherwise make timely and accurate public disclosure could be impaired, which could harm our operating results, our ability

to operate our business and our reputation.

As a public reporting

company, we are required to, among other things, maintain a system of effective internal control over financial reporting. Ensuring that

we have adequate internal financial and accounting controls and procedures in place so that we can produce accurate financial statements

on a timely basis is a costly and time-consuming effort that needs to be re-evaluated frequently. Substantial work will continue to be

required to further implement, document, assess, test and remediate our system of internal controls. As of December 31, 2022, our disclosure

controls and procedures were not effective and management determined that we did not maintain effective internal control over financial

reporting due to certain significant deficiencies and material weaknesses. Management is undertaking actions to remediate the material

weaknesses, but there is no assurance they will be remediated this year.

If our internal control

over financial reporting or our disclosure controls are not effective, we may be unable to issue our financial statements in a timely

manner, we may be unable to obtain the required audit or review of our financial statements by our independent registered public accounting

firm in a timely manner or we may be otherwise unable to comply with the periodic reporting requirements of the SEC, our Ordinary Shares

listing on Nasdaq could be suspended or terminated and our share price could materially suffer. In addition, we or members of our management

could be subject to investigation and sanction by the SEC and other regulatory authorities and to shareholder lawsuits, which could impose

significant additional costs on us and divert management attention.

If we cannot maintain

our corporate culture as we grow, we could lose the innovation, collaboration and focus that contribute to our business.

We believe that a critical

component of our success is our corporate culture, which we believe fosters innovation, encourages teamwork and cultivates creativity.

As we continue to grow, we may find it difficult to maintain these valuable aspects of our corporate culture. Any failure to preserve

our culture could negatively impact our future success, including our ability to attract and retain employees, encourage innovation and

teamwork and effectively focus on and pursue our corporate objectives.

We do not have

any business interruption or disruption insurance coverage.

Currently, we do not

have any business liability or disruption insurance to cover our operations, other than director’s and officer’s liability

insurance. We have determined that the costs of insuring for these risks and the difficulties associated with acquiring such insurance

on commercially reasonable terms make it impractical for us to have such insurance. Any uninsured business disruptions may result in our

incurring substantial costs and the diversion of resources, which could have an adverse effect on our results of operations and financial

condition.

If we are unable

to successfully continue our digital assets business plan, it would affect our financial and business condition and results of operations.

There are various risks

related to execution of our digital assets business plans. These efforts include the risk that these efforts may not provide the expected

benefits in our anticipated time frame, if at all, and may prove costlier than expected; and the risk of adverse effects to our business,

results of operations and liquidity if past and future undertakings, and the associated changes to our business, do not prove to be cost

effective or do not result in the cost savings and other benefits at the levels that we anticipate. The execution of our business plan,

and the timing of any related initiatives, are subject to change at any time based on management’s subjective evaluation of our

overall business needs. If we are unable to successfully execute our business plan, whether due to failure to realize the anticipated

benefits from our business initiatives in the anticipated time frame or otherwise, we may be unable to achieve our financial targets.

Failure to manage

our liquidity and cash flows may materially and adversely affect our financial conditions and results of operations. As a result, we may

need additional capital, and financing may not be available on terms acceptable to us, or at all.

Since May 20, 2021, we

drew down an aggregate of $80 million under the Ionics Purchase Agreement and also raised $80 million of gross proceeds in our September

2021 private placement. We incurred a net loss of $11,869,453 for the nine months ended September 30, 2023. We incurred a net loss of

$105,296,603 for the year ended December 31, 2022, which included a $24,654,267 impairment of digital assets and a $50,038,650 impairment

of property and equipment. We had negative cash flows from our operating activities of $23,234,474, $8,496,028, $17,351,892 and $971,690

for the nine months ended September 30, 2023, and the years ended December 31, 2022, 2021 and 2020, respectively. Negative cash flow during

fiscal year 2022 resulted, in part, from a net loss of approximately $105 million, including $27,829,730 of depreciation of property and

equipment and $50,038,650 of impairment of property and equipment. Negative cash flow during fiscal 2021 resulted, in part, from $13,113,964

of depreciation of property and equipment and $20,461,318 of share-based compensation related to restricted share units. We cannot

assure you our business model will allow us to continue to generate positive cash, given our substantial expenses in relation to our revenue

at this stage of our Company’s development. Our inability to offset our expenses with adequate revenue will adversely affect our

liquidity, financial condition and results of operations. Although we have adequate cash on hand and have drawn down on an effective $500

million at the market shelf registration statement and anticipated cash flows from operating activities are expected to be sufficient

to meet our anticipated working capital requirements and capital expenditures in the ordinary course of business for the next 12 months,

we cannot assure you that will be the case. We expect to need additional cash resources in the future as we wish to pursue opportunities

for investment, acquisition, capital expenditure or similar actions in order to implement our business plan. The issuance and sale of

additional equity would result in further dilution to our shareholders. The incurrence of indebtedness would result in increased fixed

obligations and could result in operating covenants that would restrict our operations. We cannot assure you that financing will be available

in amounts or on terms acceptable to us, if at all.

Our cash balances

are held at a number of financial institutions that expose us to their credit risk

We maintain our cash

and cash equivalents at financial or other intermediary institutions. The combined account balances at each institution typically exceed

FDIC insurance coverage of $250,000 per depositor, and, as a result, there is a concentration of credit risk related to amounts on deposit

in excess of FDIC insurance coverage. At September 30, 2023, substantially all of our cash and cash equivalent balances held at financial

institutions exceeded FDIC insured limits. While we did not have any direct exposure to Silicon Valley Bank, Signature Bank, or First

Republic, which suffered severe liquidity losses during 2023, if other banks and financial institutions enter receivership or become insolvent

in the future in response to financial conditions affecting the banking system and financial markets, our ability, and the ability of

our customers, clients and vendors, to access existing cash, cash equivalents and investments, or to access existing or enter into new

banking arrangements or facilities, may be threatened and could have a material adverse effect on our business and financial condition.

Digital Assets Related Risks

Our results of

operations are expected to be impacted by significant fluctuation of digital asset prices

The price of bitcoin

has experienced significant fluctuations over its existence and may continue to fluctuate significantly in the future. Bitcoin prices

ranged from approximately $3,792 per coin as of December 31, 2018; $7,220 per coin as of December 31, 2019; $28,922 per coin as of December

31, 2020; to $46,306 per coin as of December 31, 2021, a low of $15,599.05 as of November 21, 2022 and a high of $48,086.84 as of March

28, 2022, and a low of $16,521.13 as of January 1, 2023 and a high of $44,705.52 as of December 26, 2023 according to CoinMarketCap. The

price of ETH has likewise experienced significant fluctuation over its existence since we started the ETH staking business in the fourth

quarter of 2022. Ethereum prices ranged from a low of $896.11 as of June 18, 2022 and a high of $3,876.79 as of January 4, 2022, and a

low of $1,192.89 as of January 1, 2023 and a high of $2,401.76 as of December 9, 2023 according to CoinMarketCap.

We expect our results

of operations to continue to be affected by the digital asset prices as most of our revenue has been from bitcoin mining production. As

of December 26, 2023, the price of bitcoin has increased to $42,520.40 according to CoinMarketCap. The reductions in the price of bitcoin,

during year ended December 31, 2022, had a material and adverse effect on our results of operations and financial condition. We cannot

assure you that the bitcoin price will remain high enough to sustain our operation or that the bitcoin price will not decline significantly

in the future. Certain of our mining operations are costly and we have not yet powered back on, as it is not economical to do so. Fluctuations

in the digital asset prices can have had and are expected to continue to have an immediate impact on the trading price of our Ordinary

Shares even before our financial performance is affected, if at all.

Various factors, mostly

beyond our control, could impact the bitcoin price. For example, the bankruptcy filings and regulatory proceedings described below, as

well as the usage of bitcoins in the retail and commercial marketplace is relatively low in comparison with the usage for speculation,

which contributes to bitcoin’s price volatility. Additionally, the reward for bitcoin mining will decline over time, with the last

halving event occurred in May 2020 and next one to occur in or about April 2024, which may further contribute to bitcoin price volatility.

Our operating results

have and will significantly fluctuate due to the highly volatile nature of digital assets.

All of our sources of

revenue are dependent on digital assets and the broader crypto-economy. Due to the highly volatile nature and the prices of digital assets,

our operating results have, and will continue to, fluctuate significantly from quarter to quarter in accordance with market sentiments

and movements in the broader digital assets economy. Our operating results will continue to fluctuate significantly as a result of a variety

of factors, many of which are unpredictable and in certain instances are outside of our control, including, but not limited to:

| |

● |

our ability to continue to mine bitcoin and acceptance of digital assets as a result of reputational harm from bankruptcies and regulatory proceedings; |

| |

● |

changes in the legislative or regulatory environment, or actions by governments or regulators, including fines, orders, or consent decrees; |

| |

● |

regulatory changes that impact our ability to mine various digital assets; |

| |

● |

our ability to diversify and grow our business; |

| |

● |

investments we make in the development of our business as well as technology offered to our industry partners and sales and marketing; |

| |

● |

mining new digital assets in compliance with the Federal securities laws and other compliance regulations; |

| |

● |

macroeconomic conditions; |

| |

● |

adverse legal proceedings or regulatory enforcement actions, judgments, settlements, or other legal proceeding and enforcement-related costs; |

| |

● |

increases in operating expenses that we expect to incur to grow and expand our operations and to remain competitive; |

| |

● |

breaches of security or privacy; |

| |

● |

our ability to attract and retain talent; and |

| |

● |

our ability to compete with our competitors. |

As a result of these

factors, it is difficult for us to forecast growth trends accurately and our business and future prospects are difficult to evaluate,

particularly in the short term. In view of the rapidly evolving nature of our business and the digital assets industry, period-to-period

comparisons of our operating results may not be meaningful, and you should not rely upon them as an indication of future performance.

Quarterly and annual expenses reflected in our financial statements may be significantly different from historical or projected rates.

Our operating results in one or more future quarters may fall below the expectations of securities analysts and investors. As a result,

the trading price of our Ordinary Shares may increase or decrease significantly.

Our future success

continues to depend, in part, upon the value of bitcoin, which the value of bitcoin may be subject to pricing risk and has historically

been subject to wide swings.

Our operating results

continue to depend, in part, upon the value of bitcoin. Specifically, our revenues from our bitcoin mining operations are principally

based upon two factors: (1) the number of bitcoin rewards we successfully mine and (2) the value of bitcoin. We also receive transaction

fees paid in bitcoin by participants who initiated transactions associated with new blocks that we mine. In addition, our operating results

are directly impacted by changes in the value of bitcoin, because under the value measurement model, both realized and unrealized changes

are reflected in our statement of operations (i.e., we will be marking bitcoin to fair value each quarter). This means that our operating

results are subject to swings based upon increases or decreases in the value of bitcoin. Furthermore, our strategy has focused primarily

on bitcoin (as opposed to other digital assets). Further, our current application-specific integrated circuit (“ASIC”) machines

(which we refer to as “miners”) are principally utilized for mining bitcoin and bitcoin cash and cannot mine other digital

assets, such as ETH, that are not mined utilizing the “SHA-256 algorithm.” If other digital assets were to achieve acceptance

at the expense of bitcoin or bitcoin cash (a variant form of bitcoin created in 2017 by a hard fork of the bitcoin blockchain) causing

the value of bitcoin or bitcoin cash to decline, or if bitcoin were to switch its proof of work algorithm from SHA-256 to another algorithm

for which our miners are not specialized, or the value of bitcoin or bitcoin cash were to decline for other reasons, particularly if such

decline were significant or over an extended period of time, our operating results would be adversely affected, and there could be a material

adverse effect on our ability to continue as a going concern or to pursue our business strategy at all, which could have a material adverse

effect on our business, prospects or operations, and harm investors.

Bitcoin and other digital

asset prices, which have historically been volatile and are impacted by a variety of factors (including those discussed in the previous

risk factor), are determined primarily using data from various exchanges, over-the-counter markets and derivative platforms. As described

above, the digital assets industry has been negatively affected by recent bankruptcies. Furthermore, such prices may be subject to factors

such as those that impact commodities, more so than business activities, which could be subjected to additional influence from fraudulent

or illegitimate actors, real or perceived scarcity, and political, economic, regulatory or other conditions. Pricing may be the result

of, and may continue to result in, speculation regarding future appreciation in the value of digital assets, or our share price, inflating

and making their market prices more volatile or creating “bubble” type risks for both bitcoin and our Ordinary Shares.

Unfavorable Digital

Asset Market Conditions

The prices of digital

assets, including bitcoin, have experienced substantial volatility, as described above. During the year 2022, a number of companies in

the digital assets industry have declared bankruptcy, including Core Scientific, Celsius Network, Voyager Digital Ltd., Three Arrows Capital,