UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

Under The Securities Exchange Act of 1934

(Amendment No. 31)*

| The St. Joe Company |

| (Name of Issuer) |

| Common Stock |

| (Title of Class of Securities) |

|

Bruce R. Berkowitz

c/o Fairholme Capital Management, L.L.C.

5966 South Dixie Highway, Suite 300

South Miami, FL 33143

(305) 358-3000 |

|

(Name, Address and Telephone Number of Person Authorized

to Receive

Notices and Communications) |

| May 3, 2024 |

| (Date of Event Which Requires Filing of this Statement) |

| If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of ss.240.13D-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [__]. |

| |

| Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent. |

____________

* The remainder of this cover page shall be

filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of

this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act")

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Fairholme Capital Management, L.L.C. |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

| |

|

(a) |

[_] |

| |

|

(b) |

[X] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

|

[_] |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

| |

|

|

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

18,788,124 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

[_] |

| |

|

|

| |

20,162,581 |

|

|

11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING |

|

| |

PERSON

|

|

| |

20,162,581 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES |

|

| |

CERTAIN SHARES* |

|

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

34.5% |

|

| 14. |

TYPE OF REPORTING PERSON* |

|

| |

|

|

| |

IA |

|

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Bruce R. Berkowitz |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

| |

|

(a) |

[_] |

| |

|

(b) |

[X] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

|

[_] |

| |

|

|

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

United States of America |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

| |

|

|

| 7. |

SOLE VOTING POWER |

|

| |

|

|

| |

1,909,967 |

|

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

18,788,124 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

1,909,967 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

[_] |

| |

|

|

| |

20,162,581 |

|

|

11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING |

|

| |

PERSON

|

|

| |

22,072,548 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES |

|

| |

CERTAIN SHARES* |

|

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

37.8% |

|

| 14. |

TYPE OF REPORTING PERSON* |

|

| |

|

|

| |

IN, HC |

|

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Fairholme Funds, Inc. |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

| |

|

(a) |

[_] |

| |

|

(b) |

[X] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

|

[_] |

| |

|

|

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Maryland |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

| |

|

|

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

18,788,124 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

[_] |

| |

|

|

| |

18,788,124 |

|

|

11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING |

|

| |

PERSON

|

|

| |

18,788,124 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES |

|

| |

CERTAIN SHARES* |

|

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

32.2% |

|

| 14. |

TYPE OF REPORTING PERSON* |

|

| |

|

|

| |

IV |

|

| Item 1. |

Security and Issuer. |

|

| |

|

|

| |

The name of the issuer is The St. Joe Company (the "Issuer"). The address of the Issuer's offices is 130 Richard Jackson Boulevard, Suite 200, Panama City Beach, Florida 32407. This Schedule 13D relates to the Issuer's Common Stock (the "Shares"). |

|

| |

|

|

| Item 2. |

Identity and Background. |

|

| |

|

|

| |

(a-c, f) This Schedule 13D is being filed jointly

by Fairholme Capital Management, L.L.C., a Delaware limited liability company ("Fairholme"), The Fairholme Fund, a series of

Fairholme Funds, Inc., a Maryland investment company (the "Fund") and Bruce R. Berkowitz, a United States citizen (collectively

with Fairholme and the Fund, the "Reporting Persons").

The principal business address of the Reporting Persons

is 5966 South Dixie Highway,

Suite 300 South Miami, FL 33143.

Bruce R. Berkowitz is the chief investment officer

of Fairholme, an investment management firm that serves as the investment adviser to the Fund and other advisory accounts.

(d) None of the Reporting Persons has, during the

last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) None of the Reporting Persons has, during the

last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of

such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities

subject to, Federal or state securities laws or finding any violation with respect to such laws.

|

| Item 3. |

Source and Amount of Funds or Other Consideration. |

|

| |

No material changes from the Schedule 13D filed by

the Reporting Persons on October 14, 2010.

|

|

| |

|

|

| Item 4. |

Purpose of Transaction. |

|

No material changes from the Schedule

13D filed by the Reporting Persons on April 26, 2017.

| Item 5. |

Interest in Securities of the Issuer. |

|

| |

|

|

(a-e) As of the date hereof, Fairholme

may be deemed to be the beneficial owner of 20,162,581 Shares (34.5%) of the Issuer, the Fund may be deemed to be the beneficial owner

of 18,788,124 Shares (32.2%) of the Issuer and Mr. Berkowitz may be deemed to be the beneficial owner of 22,072,548 Shares (37.8%) of

the Issuer, based upon the 58,397,506 Shares outstanding as of April 22, 2024, according to the Form 10-Q filed by the Issuer on April

24, 2024.

Fairholme has the sole power to

vote or direct the vote of 0 Shares, the Fund has the sole power to vote or direct the vote of 0 Shares and Bruce R. Berkowitz has the

sole power to vote or direct the vote of 1,909,967 Shares to which this filing relates. Fairholme has the shared power to vote or direct

the vote of 18,788,124 Shares, the Fund has the shared power to vote or direct the vote of 18,788,124 Shares and Mr. Berkowitz has the

shared power to vote or direct the vote of 18,788,124 Shares to which this filing relates.

Fairholme has the sole power to

dispose or direct the disposition of 0 Shares, the Fund has the sole power to dispose or direct the disposition of 0 Shares and Mr. Berkowitz

has the sole power to dispose or direct the disposition of 1,909,967 Shares to which this filing relates. Fairholme has the shared power

to dispose or direct the disposition of 20,162,581 Shares, the Fund has the shared power to dispose or direct the disposition of 18,788,124

Shares and Mr. Berkowitz has the shared power to dispose or direct the disposition of 20,162,581 Shares to which this filing relates.

The

transactions effected in the Shares during the past 60 days are set forth in Exhibit

B and each transaction was an open-market transaction.

The Reporting Persons specifically

disclaim beneficial ownership in the Shares reported herein except to the extent of their pecuniary interest therein.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

|

| |

|

|

| |

No material changes from the Schedule 13D filed by the Reporting Persons on April 26, 2017. |

|

| |

|

|

| Item 7. |

Material to be Filed as Exhibits. |

|

| Exhibit A |

Joint Filing Statement |

|

| |

|

|

| Exhibit B |

A description of the transactions in the Shares that were

effected by the Reporting Persons during the 60 days prior to the date of this filing. |

|

| |

|

|

| |

|

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

May 7, 2024 |

| |

(Date)

|

| |

Fairholme Capital Management, L.L.C. |

| |

|

| |

By: /s/ Erica K. Kapahi |

| |

Chief Compliance Officer |

| |

|

| |

|

| |

Bruce R. Berkowitz |

| |

|

| |

By: /s/ Erica K. Kapahi |

| |

(Attorney-in-fact) |

| |

|

| |

|

| |

Fairholme Funds, Inc.

|

| |

By: /s/ Erica K. Kapahi |

| |

Chief Compliance Officer

Fairholme Capital Management, L.L.C. |

| |

|

| |

|

| |

|

The original statement shall be signed by each person

on whose behalf the statement is filed or his authorized representative. If the statement is signed on behalf of a person by his authorized

representative other than an executive officer or general partner of the filing person, evidence of the representative's authority to

sign on behalf of such person shall be filed with the statement, provided, however, that a power of attorney for this purpose which is

already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the statement shall

be typed or printed beneath his signature.

Note. Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See s.240.13d-7 for other parties for whom copies are to be

sent.

Attention: Intentional misstatements or omissions

of fact constitute Federal criminal violations (see 18 U.S.C. 1001).

Exhibit A

AGREEMENT

The undersigned agree that this Schedule 13D/A dated

May 7, 2024 relating to the Common Stock of The St. Joe Company shall be filed on behalf of the undersigned.

| |

May 7, 2024 |

| |

(Date) |

| |

|

| |

Fairholme Capital Management, L.L.C. |

| |

|

| |

By: /s/ Erica K. Kapahi |

| |

Chief Compliance Officer |

| |

|

| |

|

| |

Bruce R. Berkowitz |

| |

|

| |

By: /s/ Erica K. Kapahi |

| |

(Attorney-in-fact) |

| |

|

| |

|

| |

Fairholme Funds, Inc.

|

| |

By: /s/ Erica K. Kapahi |

| |

Chief Compliance Officer

Fairholme Capital Management, L.L.C. |

LIMITED POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS,

that the undersigned constitutes and appoints Erica K. Kapahi, his true and lawful attorney-in-fact and agent, with full power of substitution

and resubstitution, for him and in his capacity as the controlling person of the sole member of Fairholme Capital Management, L.L.C.,

for the sole purpose of signing on his behalf any and all Regulatory Filings under the Securities Act of 1933, the Securities Exchange

Act of 1934, the Investment Advisers Act of 1940 and any amendments and supplements thereto, and to file the same, with all exhibits thereto,

and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent,

full power and authority to do and perform each and every act and thing requisite and necessary to accomplish the above, as fully as to

all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent,

and may lawfully do or cause to be done by virtue hereof. This Power of Attorney shall continue effective until revoked by me at any time.

Dated this 9th day of April, 2020.

Fairholme Capital Management, L.L.C.

By: Fairholme Holdings, LLC, Sole Member

| By: /s/ Bruce R. Berkowitz |

|

| Bruce R. Berkowitz, Controlling Person |

|

Exhibit B

Transactions In Shares

By Accounts Advised By Fairholme Capital Management, L.L.C.

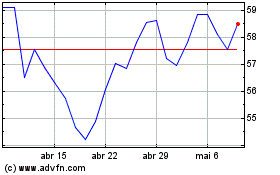

| Date |

Action |

Shares

|

Price |

| 3/4/2024 |

SELL |

7,300 |

$

54.28 |

| 4/26/2024 |

SELL |

1,500 |

$

59.19 |

| 4/29/2024 |

SELL |

2,600 |

$

59.05 |

| 5/3/2024 |

SELL |

57,000 |

$

58.26 |

| 5/6/2024 |

SELL |

36,600 |

$

58.96 |

| 5/7/2024 |

SELL |

342,900 |

$

58.29 |

St Joe (NYSE:JOE)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

St Joe (NYSE:JOE)

Gráfico Histórico do Ativo

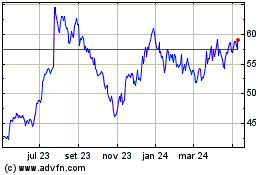

De Nov 2023 até Nov 2024