Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

08 Maio 2024 - 5:49PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433 of the Securities

Act of 1933

Issuer Free Writing Prospectus dated May 8, 2024

Relating to Preliminary Prospectus Supplement

dated May 8, 2024

Registration No. 333-278243

AG Mortgage Investment Trust, Inc.

$65,000,000

9.500% Senior Notes due 2029

Pricing Term Sheet

May 8, 2024

| Issuer: |

AG Mortgage Investment Trust, Inc., a Maryland corporation (the “Company”) |

| |

|

| Title of the Securities: |

9.500% Senior Notes due 2029 |

| |

|

| Type of Offering: |

SEC Registered |

| |

|

| Principal Amount: |

$65,000,000 |

| |

|

| Over-Allotment Option: |

There is no option to purchase any additional amount of Notes |

| |

|

| Type of Note: |

Fixed rate note |

| |

|

| Stated Maturity Date: |

May 15, 2029 |

| |

|

| Interest Rate: |

9.500% |

| |

|

| Trade Date: |

May 8, 2024 |

| |

|

| Settlement Date: |

May 15, 2024 (T + 5)** |

| |

|

| Interest Payment Dates: |

Each February 15, May 15, August 15 and November 15, commencing on August 15, 2024. If an interest payment date falls on a non-business day, the applicable interest payment will be made on the next business day and no additional interest will accrue as a result of such delayed payment |

| |

|

| Interest Periods: |

The initial interest period will be the period from and including May 15, 2024, to, but excluding, the initial interest payment date, and the subsequent interest periods will be the periods from and including an interest payment date to, but excluding, the next interest payment date or the stated maturity date, as the case may be |

| Day Count Basis: |

360-day year of twelve 30-day months |

| |

|

| Issue Price: |

$25.00 |

| |

|

| Price to Issuer: |

$24.2125 |

| |

|

| Net Proceeds to the Issuer, before Expenses: |

$62,952,500 |

| |

|

| Denominations: |

$25.00 and integral multiples of $25.00 in excess thereof |

| |

|

| Optional Redemption: |

The Notes may be redeemed in whole or in part at any time or from time to time at the Company’s option on or after May 15, 2026, upon not less than 30 days nor more than 60 days written notice to holders prior to the redemption date, at a redemption price equal to 100% of the outstanding principal amount of the Notes to be redeemed plus accrued and unpaid interest to, but excluding, the redemption date |

| |

|

| CUSIP / ISIN: |

CUSIP: 001228709

ISIN: US0012287092 |

| |

|

| Rating:* |

BBB- (Egan-Jones) |

| |

|

| Listing: |

The Company intends to apply to list the Notes on the New York Stock Exchange under the trading symbol “MITP” and expects trading of the Notes to commence within 30 days after the original issue date |

| |

|

| Joint Book-Running Managers: |

Morgan Stanley & Co. LLC, RBC Capital Markets, LLC, UBS Securities LLC, Wells Fargo Securities, LLC, Keefe, Bruyette & Woods, Inc. and Piper Sandler & Co. |

| |

|

| Trustee: |

U.S. Bank Trust Company, National Association |

| * | Note: A securities rating is not a recommendation to buy, sell

or hold securities and may be subject to revision or withdrawal at any time. |

| ** | Under Rule 15c6-1 of the Securities Exchange Act of 1934, as

amended, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly

agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to their delivery will be required, by virtue of the fact

that the Notes will initially settle T+5, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed

settlement. Purchasers of the Notes who wish to trade the Notes prior to their date of delivery should consult their own advisors. |

This communication is intended for the sole use of the person to

whom it is provided by the issuer.

The issuer has filed a registration statement (including a base prospectus

dated April 9, 2024) and a preliminary prospectus supplement dated May 8, 2024 with the Securities and Exchange Commission (“SEC”)

for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement

and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering.

You may get these documents for free by visiting EDGAR on the SEC Web

site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange

to send you the prospectus and related preliminary prospectus supplement if you request them from Morgan Stanley & Co. LLC by calling

1-800-584-6837, RBC Capital Markets, LLC by calling 1-866-375-6829 or by emailing rbcnyfixedincomeprospectus@rbccm.com, UBS Securities

LLC by calling 1-888-827-7275, Wells Fargo Securities, LLC by calling 1-800-645-3751 or by emailing wfscustomerservice@wellsfargo.com,

Keefe, Bruyette & Woods, Inc. by calling 1-800-966-1559 or Piper Sandler & Co. by emailing fsg-dcm@psc.com.

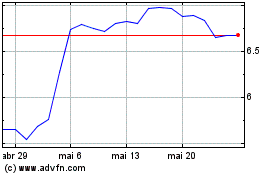

AG Mortgage Investment (NYSE:MITT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AG Mortgage Investment (NYSE:MITT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024