false

0001753162

0001753162

2024-05-03

2024-05-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

May 3, 2024

FATHOM

HOLDINGS INC.

(Exact name of registrant as specified in its

charter)

| |

North Carolina |

|

| |

(State or other jurisdiction of incorporation) |

|

| |

|

|

| 001-39412 |

|

82-1518164 |

| (Commission File Number) |

|

(IRS Employer Identification

No.) |

2000

Regency Parkway Drive, Suite 300,

Cary, North

Carolina 27518

(Address of principal executive offices) (Zip

Code)

Registrant's telephone number, including area

code 888-455-6040

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each Class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, No Par Value |

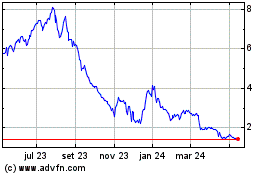

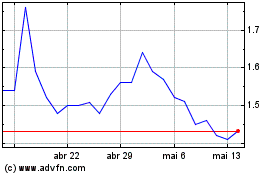

FTHM |

Nasdaq

Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On May 3, 2024, E4:9 Holdings, Inc. (the “Seller”),

a wholly-owned subsidiary of Fathom Holdings Inc. (“Fathom”), entered into an Equity Purchase Agreement (the “Purchase

Agreement”) with Dagley Insurance Agency, LLC, a wholly-owned operating subsidiary of the Seller (“DIA”), D6 Holdings,

LLC, (the “Purchaser”), and Nathan Dagley, owner of Purchaser and founder and president of DIA. Pursuant to the terms and

subject to the conditions set forth in the Purchase Agreement, the Seller has agreed to sell to the Purchaser all of the issued and outstanding

membership interests of DIA (the “Transaction”). DIA is an independent insurance brokerage, operating in 47 states and the

District of Columbia. The transaction closed on May 3, 2024.

The consideration to be paid by the Purchaser

to the Seller in connection with the Transaction is $15 million in cash, subject to certain purchase price adjustments, consisting of

(i) $8 million in cash paid at closing, (ii) $4 million in cash paid on the first anniversary of the closing date, and (iii) $3 million

in cash paid on the second anniversary of the closing date. Fathom intends to use the consideration to strengthen its financial position

and support its growth initiatives.

The Purchase Agreement contains customary representations,

warranties and covenants, as well as certain indemnification provisions, between the Seller, on the one hand, and the Purchaser and Mr.

Dagley, on the other. The Purchase Agreement contains representations and warranties that the parties made to, and are solely for the benefit

of, each other. Investors and security holders should not rely on the representations and warranties as characterizations of factual

information, since they were made only as of the date of the Purchase Agreement. Moreover, information concerning the subject matter

of such representations and warranties may change after the date of the Purchase Agreement, which subsequent information may or may not

be fully reflected in public disclosures.

The foregoing description of the Purchase Agreement

is not complete and is qualified in its entirety by reference to the Purchase Agreement, which is filed as Exhibit 2.1 hereto and is

incorporated herein by reference.

| Item 2.01 |

Completion of Acquisition or Disposition of Assets. |

The information contained in Item 1.01 is incorporated

herein by reference.

On May 6, 2024, Fathom issued a press release

announcing its entry into the Purchase Agreement. A copy of the press release is attached as Exhibit 99.1 to this Current Report and

is incorporated by reference herein.

| Item 9.01 |

Financial Statements and Exhibits. |

(b) Pro

forma financial information.

The unaudited pro forma condensed

consolidated financial statements of Fathom giving effect to the Transaction as of and for the year ended December 31, 2023, together

with the related unaudited notes to the financial statements, are included as Exhibit 99.2 to this Current Report and are incorporated

herein by reference.

(d) Exhibits.

Exhibit

Number |

|

Exhibit Description |

| |

|

|

| 2.1* |

|

Equity Purchase Agreement,

dated as of May 3, 2024, by and among E4:9 Holdings, LLC, Dagley Insurance Agency, LLC, D6 Holdings, LLC and Nathan Dagley. |

| 99.1 |

|

Press

Release, dated May 6, 2024. |

| 99.2 |

|

Unaudited Pro Forma Condensed Consolidated Financial

Statements of Fathom Holdings Inc. as of and for the year ended December 31, 2023, together with the related notes to the financial

statements. |

| 104 |

|

Inline XBRL for the cover page of this Current Report

on Form 8-K. |

* Schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation

S-K. The registrant agrees to furnish supplementally to the SEC a copy of any omitted schedule or exhibit upon request by the SEC.

Safe Harbor Disclosure

This Current Report on Form 8-K contains forward-looking

statements within the meaning of the Securities Act and of the Exchange Act that involve substantial risks and uncertainties.

All statements, other than statements of historical facts, included in this Current Report on Form 8-K regarding our strategy, future

operations, future financial position, future revenues, other financial guidance, acquisitions, projected costs, prospects, plans and

objectives of management are forward-looking statements.

Actual results could differ materially from those

projected in our forward-looking statements due to risks, uncertainties and other factors. Important factors that could affect actual

results are discussed in Fathom’s filings with the Securities and Exchange Commission including but not limited to the risks discussed

under Item 1A “Risk Factors” in Fathom’s Annual Report on Form 10-K for the year ended December 31, 2023, as well as

Fathom’s other SEC filings. Fathom undertakes no obligation to update or revise any forward-looking statements, whether as a result

of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

FATHOM HOLDINGS INC. |

| |

|

| Date: May 9, 2024 |

/s/ Marco Fregenal |

| |

Marco Fregenal |

| |

President and Chief Executive Officer |

Exhibit 2.1

EQUITY

PURCHASE AGREEMENT

By and among

E4:9

Holdings, LLC,

Dagley

Insurance Agency, LLC,

D6

Holdings, LLC

and

NATHAN DAGLEY

Dated as of May 3, 2024

TABLE OF CONTENTS

Page

| ARTICLE 1 CERTAIN DEFINITIONS |

1 |

| 1.1 |

Certain Definitions |

1 |

| 1.2 |

Interpretation; Drafting |

1 |

| ARTICLE 2 THE ACQUISITION |

2 |

| 2.1 |

Acquisition of Interests |

2 |

| 2.2 |

Purchase Price |

2 |

| 2.3 |

Purchase Price Adjustment |

3 |

| ARTICLE 3 EFFECTIVE TIME; THE CLOSING |

5 |

| 3.1 |

Effective Time |

5 |

| 3.2 |

Time and Place of Closing |

5 |

| 3.3 |

Closing Deliveries of the Company and the Seller |

5 |

| 3.4 |

Closing Deliveries of Purchaser |

6 |

| ARTICLE 4 REPRESENTATIONS AND WARRANTIES OF THE SELLER |

7 |

| 4.1 |

Authorization of Agreement |

7 |

| 4.2 |

Conflicts; Consent of Third Parties |

7 |

| 4.3 |

Ownership and Transfer of Interests |

8 |

| ARTICLE 5 REPRESENTATIONS AND WARRANTIES OF THE COMPANY AND THE SELLER |

8 |

| 5.1 |

Existence and Qualification; Capitalization |

8 |

| 5.2 |

Subsidiaries |

9 |

| 5.3 |

Authority |

9 |

| 5.4 |

No Conflicts |

9 |

| 5.5 |

Taxes |

9 |

| 5.6 |

Brokers and Intermediaries |

9 |

| 5.7 |

No Other Representations and Warranties |

10 |

| ARTICLE 6 REPRESENTATIONS AND WARRANTIES OF PURCHASER |

11 |

| 6.1 |

Existence and Qualification |

11 |

| 6.2 |

Authority |

12 |

| 6.3 |

No Conflicts |

12 |

| 6.4 |

Litigation |

12 |

| 6.5 |

Knowledge of Breaches |

12 |

| 6.6 |

Brokers and Intermediaries |

12 |

| 6.7 |

Non-Reliance; No Additional Seller Representations |

12 |

| ARTICLE 7 ADDITIONAL COVENANTS AND AGREEMENTS OF PARTIES |

13 |

| 7.1 |

Approvals; Further Assurances |

13 |

| 7.2 |

Post-Closing Tax Matters |

13 |

| 7.3 |

Release |

17 |

| ARTICLE 8 INDEMNIFICATION |

18 |

| 8.1 |

Survival of Representations and Warranties |

18 |

| 8.2 |

Indemnification |

19 |

| 8.3 |

Indemnification Procedures |

20 |

| 8.4 |

Limitations on Indemnification for Breaches of Representations and Warranties |

21 |

| 8.5 |

Purchase Price Adjustments |

23 |

| 8.6 |

Payment of Claims; Setoff |

23 |

| ARTICLE 9 MISCELLANEOUS |

23 |

| 9.1 |

Conflict Waiver; Attorney-Client Privilege |

23 |

| 9.2 |

Notices |

24 |

| 9.3 |

Binding Effect; Assignment |

24 |

| 9.4 |

Complete Agreement |

25 |

| 9.5 |

Modifications and Waivers |

25 |

| 9.6 |

Counterparts |

25 |

| 9.7 |

Severability |

25 |

| 9.8 |

Governing Law; Consent to Jurisdiction, Waiver of Jury Trial |

25 |

| 9.9 |

Public Announcements |

26 |

| ANNEX A |

Defined Terms |

| ANNEX B |

Notice Addresses |

| |

|

| EXHIBIT A |

Form of Assignment and Power |

| EXHIBIT B |

Form of Occupancy Agreement |

| EXHIBIT C |

Form of Lease Termination Agreement |

| EXHIBIT D |

Form of Transition Services Agreement |

| EXHIBIT E |

Asset Allocation Methodology |

EQUITY PURCHASE AGREEMENT

THIS EQUITY PURCHASE AGREEMENT

(this “Agreement”) is made effective as of May 3, 2024, by and among E4:9 Holdings, LLC, a Delaware limited

liability company (the “Seller”); Dagley Insurance Agency, LLC, a Texas limited liability company (the “Company”);

D6 Holdings, LLC, a Texas limited liability company (“Purchaser”) and Nathan Dagley, an individual resident

of Texas (“Dagley”). Purchaser, the Company, the Seller, and Dagley are sometimes individually referred to herein

as a “Party” or collectively referred to herein as the “Parties.”

W

I T N E S S E T H:

WHEREAS, the Seller

owns all of the issued and outstanding membership interests of the Company (the “Interests”), which constitutes

all of the issued and outstanding Equity Securities of the Company; and

WHEREAS, the Seller

desires to sell to Purchaser, and Purchaser desires to purchase from the Seller, the Interests for the Purchase Price, upon the terms

and conditions hereinafter set forth (the “Acquisition”).

NOW THEREFORE, in consideration

of the mutual covenants, representations, warranties and agreements herein contained, and of other good and valuable consideration, the

receipt and sufficiency of which are hereby acknowledged, Purchaser, the Company and the Seller hereby agree as follows:

ARTICLE 1

CERTAIN DEFINITIONS

1.1

Certain Definitions. Unless the context otherwise requires, capitalized terms used in this Agreement will

have the meanings set forth herein or in Annex A attached hereto, which is incorporated herein and made a part hereof.

1.2

Interpretation; Drafting. All Schedules, Annexes and Exhibits annexed hereto or referred to herein are

hereby incorporated in and made a part of this Agreement as if set forth in full herein. The headings preceding the text of Articles and

Sections included in this Agreement and the headings to Schedules, Annexes and Exhibits attached to this Agreement are for convenience

only and will not be deemed part of this Agreement or be given any effect in interpreting this Agreement. The use of the masculine, feminine

or neuter gender or the singular or plural form of words herein will not limit any provision of this Agreement. The use of the terms “including”

or “include” will in all cases herein mean “including, without limitation” or “include, without limitation,”

respectively. Reference to any Person includes such Person’s successors and assigns to the extent such successors and assigns are

permitted by the terms of this Agreement. Reference to a Person in a particular capacity excludes such Person in any other capacity or

individually. Reference to any specific Governmental Entity or specific statutory or regulatory provisions shall include any successor

Governmental Entity or successor statute or regulation, as the case may be. Reference to any agreement (including this Agreement), document

or instrument means such agreement, document or instrument as amended or modified and in effect from time to time in accordance with the

terms thereof and, if applicable, the terms hereof. Underscored references to Articles, Sections, paragraphs, clauses, Schedules, Annexes

or Exhibits will refer to those portions of this Agreement. The use of the terms “hereunder,” “hereof,” “hereto”

and words of similar import will refer to this Agreement as a whole and not to any particular Article, Section, paragraph or clause of,

or Schedule, Annex or Exhibit to, this Agreement. The Parties hereto have participated jointly in the negotiation and drafting of this

Agreement and, in the event any ambiguity or question of intent or interpretation arises, this Agreement will be construed as jointly

drafted by the Parties hereto and no presumption or burden of proof will arise favoring or disfavoring any Party by virtue of the authorship

of any provision of this Agreement.

ARTICLE 2

THE ACQUISITION

2.1

Acquisition of Interests. Upon all of the terms and subject to all of the conditions of this Agreement,

at the Closing, as more particularly set forth below, the Seller will sell, transfer and deliver to Purchaser, and Purchaser will purchase

and acquire from the Seller, all of the Interests, free and clear of any Liens other than Permitted Liens.

2.2

Purchase Price. In consideration for the sale, transfer and delivery of the Interests pursuant to Section

2.1, and upon the terms and conditions set forth herein, Purchaser will pay or cause to be paid to the Seller cash consideration in

the amounts set forth in this ARTICLE 2. The aggregate consideration to be paid by Purchaser for the Interests (the “Purchase

Price”) will be the sum of (i) the Final Closing Cash Consideration (as adjusted pursuant to Section 2.3), (ii)

Four Million Dollars ($4,000,000) payable on the date that is the first anniversary of the Closing Date (the “Second Payment”),

and (iii) Three Million Dollars ($3,000,000) payable on the date that is the second anniversary of the Closing Date (the “Third

Payment”, together with the Second Payment, the “Future Payments”).

(a)

Initial Closing Cash Consideration. The Purchase Price to be paid at Closing by Purchaser for the Interests will

be equal to:

(i)

Eight Million Dollars ($8,000,000) (the “Closing Cash Base Amount”);

(ii)

plus the amount by which the Estimated Company Cash exceeds the Target Cash Amount;

(iii)

less the amount by which the Target Cash Amount exceeds the Estimated Company Cash;

(iv)

less the amount of Estimated Company Indebtedness;

(v)

less the amount of Estimated Company Transaction Expenses; and

(vi)

less the Purchaser Reimbursement Expenses.

The aggregate amount of items

(ii) – (vi) above is referred to herein as the “Closing Cash Adjustment”, and such amount, together with

the amount of the Closing Cash Base Amount, is referred to herein as the “Initial Closing Cash Consideration”.

The Initial Closing Cash Consideration will be subject to further adjustment after the Closing pursuant to Section 2.3. For the

avoidance of doubt, the aggregate Closing Cash Adjustment may be a positive or a negative number.

(b)

Purchase Price and Closing Payments. Subject to the terms and conditions set forth herein, as consideration for

the Interests in the Company:

(i)

Purchaser will pay in cash at Closing, by wire transfer of immediately available funds on behalf of the Company, the

Estimated Company Indebtedness as set forth on the Estimated Closing Statement.

(ii)

Purchaser will pay off in cash at Closing, by wire transfer of immediately available funds on behalf of the Company,

the Company Transaction Expenses as set forth on the Estimated Closing Statement.

(iii)

Purchaser will pay to the Seller at Closing, by wire transfer of immediately available funds, an amount in cash equal

to the Initial Closing Cash Consideration.

2.3

Purchase Price Adjustment.

(a)

No less than three (3) Business Days prior to the Closing Date, the Company will deliver a statement to Purchaser (the

“Estimated Closing Statement”) containing (i) an estimated balance sheet of the Company as of 11:59 p.m. on

the day immediately prior to the Closing Date, (ii) the Estimated Company Cash, Estimated Company Indebtedness and Estimated Company Transaction

Expenses, and (iii) a calculation of the Initial Closing Cash Consideration calculated with reference thereto. The Estimated Closing Statement

and the calculations and determinations related thereto will be prepared in good faith from the Company’s books and records and

calculated in accordance with the Accounting Principles.

(b)

Within sixty (60) days following the Closing Date, Purchaser shall cause to be prepared and delivered to the Seller

a statement (the “Closing Statement”) containing (i) the actual balance sheet of the Company as of 11:59 p.m.

on the day immediately prior to the Closing Date, (ii) the actual amounts of Company Cash, Company Indebtedness and Company Transaction

Expenses as of such time, and (iii) a calculation of the Final Closing Cash Consideration. The Closing Statement and the calculations

and determinations related thereto will be prepared in good faith from the Company’s books and records and calculated in accordance

with the Accounting Principles.

(c)

If the Seller disagrees with any aspect of the Closing Statement, the Seller may, within thirty (30) days after receipt

of the Closing Statement, deliver to Purchaser a written notice setting forth in reasonable detail any dispute that the Seller has with

respect to the Closing Statement and the basis for such dispute (a “Closing Date Dispute”). If the Seller does

not so notify Purchaser of a dispute with respect to the Closing Statement within such thirty (30)-day period, such Closing Statement

will be final, conclusive and binding on the Parties. In the event of any notification of a dispute, Purchaser and the Seller will negotiate

in good faith to resolve such dispute.

(d)

If Purchaser and the Seller, notwithstanding such good faith effort, fail to resolve such dispute within fifteen (15)

days after the Seller notifies Purchaser of his objections, then Purchaser and the Seller jointly will engage a nationally or regionally

recognized accounting firm that is not presently providing and has not provided either party or their Affiliates with services in the

last four (4) years as mutually agreed upon by Purchaser and the Seller (the “Arbitration Firm”) to resolve

such dispute. As promptly as practicable thereafter, Purchaser and the Seller will prepare and submit presentations to the Arbitration

Firm (the “Dispute Presentations”). Purchaser and the Seller will cause the Arbitration Firm to promptly resolve

only those items remaining in dispute between the Parties in accordance with the provisions of this ARTICLE 2 within the range

of the difference between Purchaser’s position with respect thereto and the Seller’s position with respect thereto based solely

upon the information set forth in the Dispute Presentations. The costs of any fees and expenses of the Arbitration Firm and of any enforcement

of the determination thereof, will be borne by the Parties in inverse proportion as they may prevail on the matters resolved by the Arbitration

Firm, which proportionate allocation will be calculated on an aggregate basis based on the relative dollar values of the amounts in dispute

and will be determined by the Arbitration Firm at the time the determination of such firm is rendered on the merits of the matters submitted.

All determinations made by the Arbitration Firm will be final, conclusive and binding on the Parties.

(e)

If the Final Closing Cash Consideration (as finally determined pursuant to Section 2.3(c) or Section 2.3(d))

is less than the Initial Closing Cash Consideration (the amount of such deficiency is referred to herein as the “Deficiency”),

then an aggregate amount in cash equal to the Deficiency will be payable to Purchaser by the Seller by wire transfer of immediately available

funds no later than ten (10) Business Days following the date on which the Final Closing Cash Consideration is finally determined pursuant

to Section 2.3(c) or Section 2.3(d).

(f)

If the Final Closing Cash Consideration (as finally determined pursuant to Section 2.3(c) or Section 2.3(d))

is greater than the Initial Closing Cash Consideration, then Purchaser shall pay or cause to be paid to the Seller an aggregate amount

equal to such excess by wire transfer of immediately available funds no later than ten (10) Business Days following the date on which

the Final Closing Cash Consideration is finally determined pursuant to Section 2.3(c) or Section 2.3(d).

(g)

Any adjustments made pursuant to this Section 2.3 shall be treated as an adjustment to the Purchase Price, except

to the extent that applicable Tax Law does not permit such treatment, and the Parties agree to file their Tax Returns accordingly, except

as otherwise required by a change in applicable Law after the Closing Date or a Final Determination.

(h)

For purposes of complying with the terms set forth in this Section 2.3, each Party shall reasonably cooperate

with and make available to the other Party and its respective accountants and other representatives all information, records, data and

working papers, and shall permit access to its records, facilities and personnel, as may be reasonably requested in connection with this

Section 2.3, including the resolution of any Closing Date Dispute.

ARTICLE 3

EFFECTIVE TIME; THE CLOSING

3.1

Effective Time. The Acquisition will be effected by the transfer and delivery of the Interests, as contemplated

by Section 2.1, at the Closing to be held on the Closing Date provided for in Section 3.2 hereof. The Parties agree that

the Closing will be effective and deemed for all purposes to have occurred as of 12:01 a.m., Eastern time, on the Closing Date (the “Effective

Time”) and title to the Interests will be deemed to have transferred to the Purchaser effective as of the Effective Time.

3.2

Time and Place of Closing. The closing of the transactions contemplated hereby (the “Closing”)

will take place via the electronic transmittal of executed documents on the date hereof (the “Closing Date”).

3.3

Closing Deliveries of the Company and the Seller. At the Closing, the Company and the Seller shall deliver,

or cause to be delivered, to Purchaser the following:

(a)

a certificate, dated as of the date hereof, signed by the Secretary of Company and in form and substance reasonably

satisfactory to the Purchaser, certifying (i) the names of Company’s officers authorized to sign this Agreement and the other

documents, instruments or certificates to be delivered pursuant to this Agreement by Company, together with true specimen signatures of

such officers; (ii) that the copies of the certificate of formation and limited liability company agreement, each as amended to date,

of the Company attached thereto are true, correct and complete; and (iii) that the copies of the resolutions (or written consents,

in lieu thereof) of the Company attached thereto evidencing the approval of this Agreement and the other matters contemplated hereby and

thereby were duly adopted and are in full force and effect;

(b)

a certificate, dated as of the date hereof, signed by the Secretary of the Seller and in form and substance reasonably

satisfactory to the Purchaser, certifying (i) the names of the Seller’s officers authorized to sign this Agreement and the

other documents, instruments or certificates to be delivered pursuant to this Agreement by the Seller, together with true specimen signatures

of such officers; (ii) that the copies of the certificate of formation and limited liability company agreement, each as amended to date,

of the Seller attached thereto are true, correct and complete; and (iii) that the copies of the resolutions (or written consents,

in lieu thereof) of the Seller attached thereto evidencing the approval of this Agreement and the other matters contemplated hereby and

thereby were duly adopted and are in full force and effect;

(c)

the Company’s books and records;

(d)

a duly executed membership interest assignment and power evidencing the sale, assignment, transfer, and conveyance of

the Interests to Purchaser, in the form attached hereto as Exhibit A, duly executed by the Seller (the “Assignment

and Power”);

(e)

a written resignation from the following managers or officers of the Company: Paul Marsh and James Smith.

(f)

payoff letters or final invoices in a form reasonably satisfactory to Purchaser from each of the parties to which any

of the Estimated Company Indebtedness or to which any Estimated Company Transaction Expenses are payable by the Company, as set forth

in the Estimated Closing Statement.

(g)

a Certificate of Fact of the Company dated within five (5) Business Days of the Closing Date, certified by the Secretary

of State of the State of Texas.

(h)

duly executed IRS Form W-9 from the Seller;

(i)

a Joint Use and Occupancy Agreement for the real property located at 23114 Seven Meadows Parkway, Katy, Texas 77494

(the “Katy Location”) in the form attached hereto as Exhibit B (the “Occupancy Agreement”),

duly executed by Fathom Holdings and the Company;

(j)

a Lease Termination Agreement for the real property located at 8000 Coit Road, Suite 500 Plano, Texas 75025 in the form

attached hereto as Exhibit C (the “Lease Termination Agreement”), duly executed by G3 COIT, LLCand the

Company;

(k)

a Transition Services Agreement in the form attached hereto as Exhibit D (the “TSA”),

duly executed by Seller; and

(l)

such other documents, instruments, certificates, consents and other agreements as Purchaser may reasonably require to

effect the transactions contemplated by this Agreement to be consummated as of the Closing.

3.4

Closing Deliveries of Purchaser. At the Closing, Purchaser shall deliver, or cause to be delivered, to

the Seller the following:

(a)

payment of the Initial Closing Cash Consideration in accordance with Section 2.2;

(b)

a certificate, dated as of the date hereof, signed by the Secretary of Purchaser and in form and substance reasonably

satisfactory to the Seller, certifying (i) the names of Purchaser’s officers authorized to sign this Agreement and the other

documents, instruments or certificates to be delivered pursuant to this Agreement by Purchaser, together with true specimen signatures

of such officers; (ii) that the copies of the certificate of formation and limited liability company agreement , each as amended to date,

of Purchaser attached thereto are true, correct and complete; and (iii) that the copies of the resolutions (or written consents,

in lieu thereof) of Purchaser attached thereto evidencing the approval of this Agreement and the other matters contemplated hereby and

thereby were duly adopted and are in full force and effect;

(c)

a Certificate of Fact of Purchaser dated within five (5) Business Days of the Closing Date, certified by the Secretary

of State of the State of Texas; and

(d)

invoices evidencing the total amount of the Purchaser Reimbursement Expenses;

(e)

the Occupancy Agreement, duly executed by Dagley Enterprises, LLC;

(f)

the TSA, duly executed by Purchaser; and

(g)

such other documents, instruments, certificates, consents and other agreements as Seller or Company may reasonably require

to effect the transactions contemplated by this Agreement to be consummated as of the Closing.

ARTICLE 4

REPRESENTATIONS

AND WARRANTIES REGARDING THE SELLER

The Seller hereby represents

and warrants to Purchaser as of the Closing Date that:

4.1

Organization; Authority. The Seller is a limited liability company duly organized, validly existing and

in good standing under the laws of the State of Delaware and has all requisite company power, authority and legal capacity to execute

and deliver this Agreement and each other agreement, document, or instrument or certificate contemplated by this Agreement to be executed

by the Seller in connection with the consummation of the transactions contemplated by this Agreement (the “Seller Documents”),

and to consummate the transactions contemplated hereby and thereby. This Agreement has been, and each of the Seller Documents will be

at or prior to the Closing, duly and validly executed and delivered by the Seller, and (assuming due authorization, execution and delivery

by Purchaser) this Agreement constitutes, and each of the Seller Documents when so executed and delivered will constitute, legal, valid

and binding obligations of the Seller, enforceable against the Seller in accordance with its terms, except as enforceability may be limited

by bankruptcy Laws, other similar Laws affecting creditors’ rights and general principles of equity affecting the availability of

specific performance and other equitable remedies (regardless of whether enforcement is sought in a proceeding at law or in equity).

4.2

Conflicts; Consent of Third Parties.

(a)

None of the execution and delivery by the Seller of this Agreement or the Seller Documents, the consummation by such

Seller of the transactions contemplated hereby or thereby, or compliance by the Seller with any of the provisions hereof or thereof will

conflict with, or result in any violation of or default (with or without notice or lapse of time, or both) under, or give rise to a right

of termination or cancellation under any provision of (i) the charter or by-laws of the Seller; (ii) any Contract to which any Seller

is a party or by which any of the properties or assets of such Seller are bound; or (iii) any applicable Law, except in the cases of clauses

(ii) and (iii), where the conflict, violation, default, acceleration or failure to give notice or obtain consent would not have a Material

Adverse Effect.

(b)

No consent, waiver, approval, order, permit, authorization of, or declaration or filing with, or notification to,

any person is required on the part of such Seller in connection with the execution and delivery of this Agreement, the Seller Documents,

the compliance by such Seller with any of the provisions hereof or thereof, or the consummation of the transactions contemplated hereby

or thereby, except where the failure to make or obtain such consent, waiver, approval, permit, authorization, declaration, filing, or

notification would not have a Material Adverse Effect.

4.3

Ownership and Transfer of Interests. The Seller is the record and beneficial owner of the Interests, free

and clear of any and all Liens, other than Permitted Liens. The Seller has the power and authority to sell, transfer, assign and deliver

the Interests as provided in this Agreement, and such delivery will convey to Purchaser good and marketable title to such Interests, free

and clear of any and all Liens, other than any transfer restrictions imposed by reason of the issuance of securities without registration

under federal and state securities Laws.

ARTICLE 5

REPRESENTATIONS AND WARRANTIES REGARDING THE Company

The Company and the Seller,

jointly and severally, represent and warrant to Purchaser that the statements contained in this ARTICLE 5 are true and correct

as of the Closing Date, except (i) as set forth in the schedules, exhibits, and annexes to the Merger Agreement, or (ii) as otherwise

disclosed or identified in any reports, schedules, forms, statements, prospectuses, and other documents filed with or furnished to the

SEC by Fathom Holdings and publicly available prior to the date hereof.

5.1

Existence and Qualification; Capitalization.

(a)

The Company is a limited liability company duly organized, validly existing and in good standing under the laws of the

State of Texas, and has full power and authority to carry on its business as presently conducted. The Company is duly qualified or licensed

as a foreign limited liability company to do business, and is in good standing, in each jurisdiction where the character of its properties

or assets owned, leased or operated by it or the nature of its activities makes such qualification or licensing necessary. The Company

has provided or made available to Purchaser true and complete copies of all Organizational Documents of the Company.

(b)

The Interests represent all issued and outstanding membership interests of the Company. Except for the Interests, there

are no other securities of the Company that are authorized, issued, outstanding, or reserved or committed for issuance. The Interests

were duly authorized and validly issued, and are fully paid and non-assessable and are not subject to preemptive rights or rights of first

refusal created by statute, the Company’s Organizational Documents or any agreement to which either the Company or any Seller is

a party or by which any of them is bound, and have been issued in compliance with the Securities Act of 1933, as amended, and all other

applicable federal, state and foreign security Laws. The Company has not granted to any Person, and no Person has, (i) any Contract,

warrant or option to purchase any membership interest of the Company, or (ii) any other conversion right or right to purchase, subscribe

for or receive an issuance of, any membership interest of the Company. There are no declared or accrued but unpaid distributions with

regard to the Interests.

(c)

During the Ownership Period, (i) the Company has never adopted or maintained any plan providing for equity compensation

of any person or otherwise committing to the issuance of any Equity Securities, (ii) the Company has not granted any options to purchase

any Equity Securities of the Company or any other type of equity award, (iii) there are no outstanding, and the Company has never issued

any, Equity Securities other than the Interests, and (iv) the Company is not a party to, and there are no, voting trusts, proxies, or

other agreements or understandings with respect to the Equity Securities of the Company.

5.2

Subsidiaries. The Company does not own any Subsidiary or have any controlling interest in any Person.

The Company does not own (of record or beneficially) any direct or indirect equity ownership, participation or similar interest in any

Person.

5.3

Authority. The Company has all requisite company power and authority to enter into this Agreement and

to perform its obligations hereunder and to consummate the transactions contemplated hereby. The execution, delivery and performance by

the Company of this Agreement, and the consummation by the Company of the transactions contemplated hereby, have been duly authorized

by all necessary limited liability company action on the part of the Company. This Agreement constitutes the valid and binding obligation

of the Company enforceable against the Company in accordance with its terms, except as enforceability may be limited by bankruptcy Laws,

other similar Laws affecting creditors’ rights and general principles of equity affecting the availability of specific performance

and other equitable remedies (regardless of whether enforcement is sought in a proceeding at law or in equity).

5.4

No Conflicts. Neither the execution, delivery and performance of this Agreement, nor the consummation

of the transactions provided for herein, will (a) conflict with or result in a breach of the Organizational Document of the Company, (b) conflict

with, result in a breach of, constitute a default or event of default (or an event that might, with the passage of time or the giving

of notice or both, constitute a default or event of default) under any of the terms, conditions or provisions of any Contract to which

the Company is a party or by which the Company is bound, (c) result in a violation of any applicable law, ordinance, regulation,

permit, authorization or decree or order of any court or other governmental agency applicable to the Company or requires any consent,

waiver, approval or authorization of, or registration or filing with, any Governmental Entity or other third party, (d) create or impose

any Lien (other than Permitted Liens) on any of the Company’s assets; except in the cases of clauses (b) and (c), where the

conflict, violation, default, or failure to give notice or obtain consent would not have a Material Adverse Effect.

5.5

Litigation. During the Ownership Period, there has been no (a) material suit, action, claim, arbitration

or other legal, administrative or regulatory proceeding or investigation, whether at law or in equity, or before or by any Governmental

Entity pending or threatened in writing against or relating to the Company, or (b) outstanding judgment, order, writ, injunction or decree,

or application, request or motion therefor, of any Governmental Entity, that questions the legality or propriety of the transactions contemplated

by this Agreement or that would reasonably be expected to prevent, hinder or delay the consummation of the transactions contemplated hereby.

5.6

Compliance with Laws. During the Ownership Period, (i) the Company has not been in material violation

of, or material default under, any Law applicable to the Company or the business of the Company, and (ii) the Company has not received

any written notices of any suspected, potential or actual violation with respect to, any Law applicable to the Company.

5.7

No Material Adverse Events. Since January 1, 2024, there has been no Material Adverse Effect.

5.8

Taxes.

(a)

During the Ownership Period, the Company has duly filed or cause to be filed (taking into account any extensions of

time to file) all income and other material Tax Returns required to be filed by it, and all such Tax Returns are true, correct and complete

in all material respects.

(b)

The Company has given or otherwise made available to Purchaser true, correct and complete copies of all income and other

material Tax Returns, examination reports and statements of deficiencies (including, in each case, any amendments thereto) of the Company

for the Ownership Period.

(c)

All income or other material Taxes due and owing by the Company for the Ownership Period have been fully paid, whether

or not shown on any Tax Return.

(d)

All material Taxes that the Company is obligated to deduct, collect, or withhold from amounts owing to any employee,

member, creditor, customer or other Person during the Ownership Period have been fully deducted, collected, or withheld and paid or remitted

to the appropriate taxing authority. During the Ownership Period, the Company has complied in all material respects with all Tax information

reporting provisions of all applicable Tax Laws.

(e)

During the Ownership Period, the Company has not been the subject of any audit, judicial or administrative proceeding,

or other examination of Taxes by any taxing authority, and no such uncompleted audit, proceeding, or other examination is pending or has

been threatened in writing by a taxing authority as of the date hereof. All deficiencies for Taxes asserted or assessed against the Company

during the Ownership Period have been fully paid. Any adjustment of Taxes of the Company made by the IRS during the Ownership Period,

which adjustment is required to be reported to the appropriate state, local, or foreign taxing authorities, has been so reported.

(f)

During the Ownership Period, the Company has not been a party to, nor has any obligation under, any Tax Sharing Agreement.

At all times during the Ownership Period, the Company has been classified for U.S. federal income Tax purposes as a disregarded entity

within the meaning of Regulations Section 301.7701-2(a).

(g)

There are no outstanding agreements extending or waiving the statutory period of limitations applicable to any claim

for, or the period for the collection or assessment or reassessment of, Taxes due from the Company for the Ownership Period, and no request

for any such waiver or extension is currently pending. The Company is not currently the beneficiary of any extension of time within which

to file any Tax Return related to the Ownership Period.

(h)

No written claim has been made during the Ownership Period by any taxing authority in a jurisdiction where the Company

does not currently file Tax Returns or pay Taxes that the Company is or may be required to file Tax Returns in that jurisdiction.

(i)

During the Ownership Period, the Company has not requested, executed or entered into any closing agreement, private

letter ruling, technical advice memorandum or similar agreement or ruling relating to Taxes with any taxing authority.

(j)

During the Ownership Period, the Company has not participated in, and has no liability or obligation with respect to,

any transaction that is or is substantially similar to a “reportable transaction” within the meaning of Section 6707A(c)(1)

of the Code and Regulations Section 1.6011-4(b) (or any similar provision of state, local or non-U.S. Tax Law).

(k)

Except for Permitted Liens, there are no Liens for Taxes related to the Ownership Period upon the assets or properties

of the Company.

(l)

No power of attorney that has been granted with respect to any matter relating to Taxes of the Company during the Ownership

Period is currently in force.

(m)

As of the Closing Date, the Company does not have any direct or indirect interest in any trust, partnership, corporation,

limited liability company, or other business entity that is treated as a separate taxpayer for U.S. federal income Tax purposes.

5.9

Brokers and Intermediaries. None of the Company, the Seller, or any of their respective officers, managers,

employees or Affiliates have employed any broker, finder, advisor or intermediary in connection with the transactions contemplated by

this Agreement that would be entitled to a broker’s, finder’s or similar fee or commission in connection therewith or upon

the consummation thereof. Purchaser will have no responsibility or liability for any fees, expenses or commissions payable to any agent,

representative, investment banker or broker of the Company or the Seller.

5.10

No Other Representations and Warranties . Except for the representations and warranties contained in ARTICLE

4 and this ARTICLE 5, none of the Seller, its representatives, the Company or any other Person has made or makes any other

express or implied representation or warranty, either written or oral, on behalf of the Company or the Seller.

ARTICLE 6

REPRESENTATIONS AND WARRANTIES OF PURCHASER

Purchaser represents and warrants

to the Company and the Seller as of the Closing Date that:

6.1

Existence and Qualification. Purchaser is a limited liability company duly incorporated, validly existing

and in good standing under the laws of the State of Texas with all requisite power and authority, corporate and otherwise, to carry on

its business as presently conducted.

6.2

Authority. Purchaser has all requisite limited liability company power and authority to enter into this

Agreement and to perform its obligations hereunder. Dagley has all requisite power, authority, and competency to enter into this Agreement

and to perform its obligations hereunder. The execution, delivery and performance of this Agreement have been duly and validly authorized

by all necessary limited liability company and other action on the part of Purchaser. This Agreement constitutes a valid and binding obligation

of Purchaser and Dagley enforceable against each of them in accordance with its terms, except as enforceability may be limited by bankruptcy

Laws, other similar Laws affecting creditors’ rights and general principles of equity affecting the availability of specific performance

and other equitable remedies (regardless of whether enforcement is sought in a proceeding at law or in equity).

6.3

No Conflicts. Neither the execution, delivery and performance of this Agreement, nor the consummation

of the transactions provided for herein, will (a) conflict with or result in a breach of the certificate of formation or limited liability

company agreement, as amended, of Purchaser, (b) conflict with, result in a breach of, constitute a default or event of default (or an

event that might, with the passage of time or the giving of notice or both, constitute a default or event of default) under any of the

terms, conditions or provisions of any agreement or instrument to which Purchaser or Dagley is a party or by which Purchaser or Dagley

is bound, or (c) result in a violation of any applicable law, ordinance, regulation, permit, authorization or decree or order of any court

or other governmental agency applicable to Purchaser or Dagley or requires any consent, waiver, approval or authorization of, or registration

or filing with, any Governmental Entity or other third party; except in the cases of clauses (b) and (c), where the conflict, violation,

default, or failure to give notice or obtain consent would reasonably be expected to prevent, hinder or delay the consummation of the

transactions contemplated hereby.

6.4

Litigation. There is no (a) material suit, action, claim, arbitration or other legal, administrative or

regulatory proceeding or investigation, whether at law or in equity, or before or by any Governmental Entity pending or, to the knowledge

of Purchaser, threatened against or relating to Purchaser, or (b) outstanding judgment, order, writ, injunction or decree, or application,

request or motion therefor, of any Governmental Entity, that questions the legality or propriety of the transactions contemplated by this

Agreement or that would reasonably be expected to prevent, hinder or delay the consummation of the transactions contemplated hereby.

6.5

Knowledge of Breaches. Neither Purchaser nor Dagley has any Knowledge of any facts or circumstances that

constitute, or with the passage of time would constitute, a breach of any of the Seller’s or the Company’s representations

and warranties set forth in ARTICLE 5.

6.6

Brokers and Intermediaries. Purchaser has not employed any broker, finder, advisor or intermediary in

connection with the transactions contemplated by this Agreement that would be entitled to a broker’s, finder’s or similar

fee or commission in connection therewith or upon the consummation thereof.

6.7

Non-Reliance; No Additional Seller Representations. Neither Purchaser nor Dagley is relying on, and has

not relied on, any representations or warranties whatsoever regarding the subject matter of this Agreement, whether written, oral, express

or implied, except for the representations and warranties of the Seller and the Company set forth in ARTICLE 4 and ARTICLE 5

of this Agreement. Further, Purchaser acknowledges that neither the Seller nor the Company has made, and neither is making, any representations

or warranties whatsoever regarding the subject matter of this Agreement, whether written, oral, express or implied, except for the representations

and warranties of the Seller and the Company set forth in ARTICLE 4 and ARTICLE 5 of this Agreement.

ARTICLE 7

ADDITIONAL COVENANTS AND

AGREEMENTS OF PARTIES

7.1

Approvals; Further Assurances. On and after the Closing Date, Purchaser, Dagley, the Company and the Seller

will (a) provide such further assurances to each other, (b) execute and deliver all such further instruments and papers, (c) provide such

records and information and (d) take such further action as may be appropriate to carry out the transactions contemplated by, and to accomplish

the purposes of this Agreement.

7.2

Post-Closing Tax Matters.

(a)

Tax Apportionment. In the case of any Straddle Period, Taxes of the Company shall be apportioned to the pre-Closing

period and thus treated as being Pre-Closing Taxes as follows: (i) in the case of Taxes measured by income, receipts (including sales

and use Taxes), or employment or payroll, based on an interim closing of the books as of the close of business at the end of the day immediately

before the Closing Date (and for such purpose, the taxable period of any partnership, including any limited liability company taxed as

a partnership for federal income Tax purposes, or other pass-through entity in which the Company holds a beneficial interest shall be

deemed to terminate at such time), and (ii) in the case of other Taxes, based on the proportion of the Taxes for the entire taxable period

that equals the ratio of (A) the number of days from the start of such period through the end of the day immediately before the Closing

Date, to (B) the entire number of days in such Straddle Period. In applying this subsection, (I) exemptions, allowances, or

deductions that are calculated on an annual basis will be allocated to the period ending on the day immediately before the Closing Date

in the same proportion as the number of calendar days during the taxable period through such date bears to the total number of calendar

days in the entire taxable period, and (II) any carryover of Tax credits, losses, or other Tax attributes from prior taxable periods

to a Straddle Period shall be applied first to the portion of the Straddle Period before the Closing Date, to the greatest extent usable

or permitted under applicable Law, before being applied to any portion of the Straddle Period after the Effective Time.

(b)

Seller Prepared Returns. The Seller shall, at its own cost, be responsible for preparing all income Tax Returns

of the Company for all Tax periods of the Company ending on or before the Closing Date that have not been filed before the Closing (the

“Seller Prepared Returns”). The Seller Prepared Returns shall be prepared and completed in accordance with the

past practice of the Company, to the extent permitted by applicable Law, and shall not reflect a position that is not supportable on at

least a “more likely than not” basis. The Seller shall provide the Purchaser with a draft of all Seller Prepared Returns not

less than thirty (30) days prior to the due date thereof for the Purchaser’s review and comment, and the Seller will consider in

good faith Purchaser’s reasonable comments that are provided within twenty (20) days after the Seller’s delivery of the draft

Tax Return. Notwithstanding anything to the contrary in this Agreement, and for the avoidance of doubt, nothing in this Agreement will

give Purchaser any review, approval, or other rights with respect to (i) any Tax Returns of Seller or (ii) any consolidated

or combined Tax Returns that include the Seller and/or any of its Affiliates, even if the Company or its income, assets, or activities

will be included within such a consolidated or combined Tax Return.

(c)

Purchaser Prepared Returns. With respect to all Tax Returns (other than income Tax Returns) of the Company for

periods ending on or before or including the Closing Date, Purchaser shall, at its own cost, timely prepare and file or cause to be prepared

and filed all such Tax Returns and shall pay or cause to be paid the Taxes shown as due on such Tax Returns (each, a “Purchaser

Prepared Return”). Such Purchaser Prepared Returns shall be prepared and completed in a manner consistent with prior practice

to the greatest extent permitted by Law and shall not reflect a position that is not supportable on at least a “more likely than

not” basis. At least thirty (30) days in the case of income Tax Returns, and fifteen (15) days in the case of non-income Tax Returns,

prior to the due date of any Purchaser Prepared Return that relates to a Pre-Closing Taxable Period or Straddle Period that may give rise

to an indemnification claim pursuant to Section 8.2(a)(iii), Purchaser shall provide a draft of such Purchaser Prepared Return

to the Seller for its review and approval (not to be unreasonably withheld, conditioned or delayed), and Purchaser shall make such changes

to such Purchaser Prepared Returns as are reasonably requested by Purchaser. The Seller and Purchaser shall attempt in good faith to resolve

any disagreement regarding such Purchaser Prepared Returns prior to the due date for filing. If the Purchaser and Seller cannot resolve

any disagreement within thirty (30) days, the dispute resolution provisions set forth in Section 2.3(d) shall apply mutatis

mutandis.

(d)

Payment of Taxes. With respect to any Tax Returns filed by the Company for any taxable period (or portions thereof)

ending on or before the Closing Date (a “Pre-Closing Taxable Period”), or for any Straddle Periods, the Seller

shall be responsible for the Pre-Closing Taxes due in respect of such Tax Returns to the extent not reflected in the determination of

the Final Closing Cash Consideration (each such amount, a “Final Return Deficiency”). The Seller shall pay any

Final Return Deficiency to Purchaser no later than the later to occur of (i) five (5) Business Days prior to the date on which the

applicable Tax Return is due, and (ii) five (5) Business Days after Purchaser has provided notice to the Seller of the amount of

the Final Return Deficiency with respect to such Tax Return, except that such period shall be extended for any period during which, and

to the extent of any Taxes for which, the Seller is in good faith disputing all or any amount of the Tax liability to be reported on such

Tax Return.

(e)

Tax Audits and Contests. Purchaser and the Company, on the one hand, and the Seller, on the other hand, shall

promptly notify each other upon, and in any event within ten (10) days following, receipt by any such party of written notice of any audit,

claim for refund, or administrative or judicial proceeding involving any asserted Tax liability or refund with respect to the Company

for any taxable period ending on or before or including the Closing Date (any such audit, claim for refund, or proceeding relating to

an asserted Tax liability or refund of the Company referred to herein as a “Tax Contest”). Any failure to so

notify the other party of any Tax Contest shall not relieve such other party of any liability with respect to such Tax Contest except

to the extent such party was actually and materially prejudiced as a result thereof.

(i)

For any Tax Contest relating to a Pre-Closing Taxable Period, the Seller shall have the primary right to control all

proceedings and may make all decisions taken in connection with such Tax Contest (including selection of counsel or any accounting firm)

at the Seller’s expense. The Seller shall promptly notify Purchaser if it decides to control the defense or settlement of any Tax

Contest for a Pre-Closing Taxable Period that the Seller is entitled to control pursuant to this Agreement. No Tax Contest for a Pre-Closing

Taxable Period for which the Seller is entitled to control the proceedings may be settled without the prior written consent of Purchaser,

such consent not to be unreasonably withheld, conditioned or delayed. Subject to the foregoing, in the case of a Tax Contest for a Pre-Closing

Taxable Period for which the Seller controls the proceedings, Purchaser may participate in such proceedings (including through its own

counsel or accounting firm) at Purchaser’s expense.

(ii)

Purchaser shall have the primary right to represent the Company’s interests and control all proceedings and may

make all decisions taken in connection with a Tax Contest for any Pre-Closing Taxable Period or Straddle Period other than those for which

Seller has exercised its control right pursuant to the foregoing provisions of this Section 7.2, including the selection and engagement

of counsel or an accounting firm of Purchaser’s choice at Purchaser’s expense. In the case of a Tax Contest for a Pre-Closing

Taxable Period or Straddle Period for which Purchaser controls the proceedings, (A) the Seller may participate in such proceedings

(including through his own counsel or accounting firm) at the Seller’s expense, and (B) Purchaser shall not settle or compromise

any Tax Contest for which the Seller has an indemnification obligation without the Seller’s consent (such consent not to be unreasonably

withheld, conditioned, or delayed). Purchaser shall have the sole right to defend the Company with respect to any issue, and settle or

compromise any issue, arising in connection with any Tax Contest to the extent Purchaser has have agreed in writing to forego any indemnification

under this Agreement with respect to such issue.

(iii)

Purchaser, the Seller, the Company and each of their respective Affiliates shall reasonably cooperate with each other

in contesting any Tax Contest in accordance with this subsection and shall keep each other reasonably informed concerning the progress

of proceedings related to Tax Contests for Pre-Closing Taxable Periods and Straddle Periods.

(iv)

To the extent that there is any inconsistency between this Section 7.2(e) and Section 8.3 as it relates

to any matters relating to Taxes, this Section 7.2(e) shall govern.

(f)

Cooperation. The Seller, Purchaser, and their respective Affiliates shall, and Purchaser shall cause the Company

to, cooperate fully, as and to the extent reasonably requested by one another, in connection with the filing of Tax Returns pursuant to

this Section or relating to the Company for any taxable period ending on or before or including the Closing Date, any Tax Contest or other

proceeding with respect to Taxes, and other Tax matters addressed by this Section. Such cooperation shall include the retention and (upon

another party’s request) the provision or furnishing, upon request, as promptly as practicable, of records and information that

may be reasonably relevant to any such Tax matters pertaining to the Company and making employees and third-party advisors available on

a mutually convenient basis to provide additional information and explanation of any material provided hereunder as is reasonably necessary

for the filing of any Tax Returns, the preparation, prosecution, defense or conduct of any Tax Contest, or the making of any election

relating to Taxes. The Seller and Purchaser shall reasonably cooperate with each other in the conduct of any Tax Contest, and each shall

execute and deliver such powers of attorney and other documents as are necessary to carry out the intent of Section 7.2(e). Any

information obtained under this Section 7.2 shall be kept confidential, except as may be otherwise necessary in connection with

the filing of Tax Returns, in the conduct of a tax Contest or other Tax proceeding or as otherwise required by applicable Law.

(g)

Intended Tax Treatment. The parties acknowledge that, for U.S. federal and applicable state income Tax purposes,

Purchaser’s acquisition from the Seller of the Interests in the Company will be treated as a purchase of all of the assets of the

Company and assumption of all the liabilities of the Company as of the Effective Time (the “Intended Tax Treatment”).

Each Party agrees that neither it nor any of its Affiliates shall file any income Tax Return in a manner that is inconsistent with the

Intended Tax Treatment, except upon a contrary final Determination relating to income Taxes by an applicable Governmental Entity.

(h)

Purchase Price Allocation. Purchaser and the Seller agree to allocate the purchase price for the Interests and

any assumed liabilities of the Company (plus any other relevant items) among the assets of the Company for all relevant income Tax purposes

in accordance with the allocation methodology attached hereto as Exhibit E. Within forty-five (45) days following the determination

of the Final Closing Cash Consideration under Section 2.3, the Seller shall prepare and deliver to Purchaser, a draft of an allocation

schedule (the “Allocation Schedule”) applying such methodology. Purchaser shall have the right to review the

draft Allocation Schedule, and Purchaser shall notify the Seller in writing of any objections within fifteen (15) Business Days after

its receipt thereof. The Seller and Purchaser shall negotiate in good faith to attempt to resolve any disagreements with respect to the

Allocation Schedule. If the Seller and Purchaser are unable to agree upon the Allocation Schedule within 30 days (or such later date as

they mutually agree) after the date on which the Seller delivers the draft Allocation Schedule to Purchaser, then any dispute shall be

resolved by the Arbitration Firm in accordance with the provisions and terms of Section 2.3 for settling disputes thereunder, applied

mutatis mutandis, and the determination of the Arbitration Firm shall be final and binding on the Parties. Purchaser and the Seller

will file all income Tax Returns and statements, forms, and schedules in connection therewith in a manner consistent with the final Allocation

Schedule as determined pursuant to this Section 7.2(h) (and any revisions thereto that are mutually agreed upon or resolved as

provided herein), and they will not take any position contrary thereto unless required to do so by an applicable Final Determination or

other requirements of Law.

(i)

Transfer Taxes. Purchaser will pay any transfer, stamp, documentary, sales, use, registration, value-added and

other similar Taxes (including any real property transfer Taxes) incurred in connection with the Acquisition (collectively, “Transfer

Taxes”). Purchaser agrees to file in a timely manner all necessary documents (including but not limited to, all Tax Returns)

with respect to the Transfer Taxes and provide the Seller with evidence satisfactory to Purchaser that such Transfer Taxes have been timely

paid in full.

7.3

Release.

(a)

For and in consideration of the amount to be paid to the Seller under this Agreement, and the additional covenants and

promises set forth in this Agreement, the Seller, on behalf of its managers, officers, employees, Affiliates, members, representatives,

successors and permitted assigns (the “Seller Releasing Parties”), hereby fully, finally and irrevocably release,

acquit and forever discharge the Company and the officers, managers, members, trustees, representatives, employees, principals, agents,

Affiliates, parents, subsidiaries, predecessors, successors, assigns, beneficiaries, heirs, executors, personal or legal representatives,

insurers and attorneys of any of them (collectively, the “Company Released Parties”) from any and all commitments,

actions, debts, claims, counterclaims, suits, causes of action, damages, demands, liabilities, obligations, costs, expenses, and compensation

of every kind and nature whatsoever, past, present, or future, at law or in equity, whether known or unknown, contingent or otherwise

(collectively, “Causes of Action”), which such Seller Releasing Parties, or any of them, had, has, or may have

had at any time in the past until and including the date of this Agreement against the Company Released Parties, or any of them, including,

but not limited to, any claims which relate to or arise out of such Seller Releasing Parties’ prior relationship with the Company

or its or his rights or status as an equityholder, officer, manager, employee or consultant of the Company; provided, however,

that the foregoing will not apply to (i) the obligations of the Company Released Parties to the Seller Releasing Parties arising out of

or relating to this Agreement and/or the transactions contemplated hereby, and (ii) any Cause of Action that any of the Seller Releasing

Parties may have against any of the Company Released Parties for a felony or for any other crime (whether a felony or a misdemeanor) which

has, as one of its elements, an act of theft or unlawful taking by whatever means or of whatever nature, fraud, misconduct, gross negligence,

embezzlement, or theft.

(b)

Purchaser, on behalf of its managers, officers, employees, Affiliates, members, representatives, successors and permitted

assigns and Dagley (the “Purchaser Releasing Parties”), each hereby fully, finally and irrevocably release,

acquit and forever discharge the Seller, Fathom Holdings and their respective officers, managers, members, trustees, representatives,

employees, principals, agents, Affiliates, parents, subsidiaries, predecessors, successors, assigns, beneficiaries, heirs, executors,

personal or legal representatives, insurers and attorneys (collectively, the “Seller Released Parties”) from

any and all Causes of Action which such Purchaser Releasing Parties, or any of them, had, has, or may have had at any time in the past

until and including the date of this Agreement against the Seller Released Parties or any of them; provided, however, that

the foregoing will not apply to the obligations of the Seller Released Parties to the Purchaser Releasing Parties arising out of or relating

to this Agreement and/or the transactions contemplated hereby.

7.4

Other Agreements.

(a)

To the extent permitted by applicable Law, for a period of four (4) years after the Closing, Fathom Holdings and its

current direct and indirect subsidiaries as of the Effective Time (“Seller Affiliates”) shall continue to introduce

the clients of the Seller Affiliates to the Company and utilize the Company’s insurances services consistent with past practices

(the “Seller Affiliates Obligation”), provided that (i) if any such subsidiary ceases to be a direct

or indirect subsidiary of Fathom Holdings the obligations set forth in this section shall terminate with respect to such subsidiary, (ii)

the Company shall perform such insurance services (a) in accordance with applicable Law, (b) in good faith, and (c) at a level of quality

substantially similar to the level of quality at which such services were provided by the Company in the 12 months immediately prior to

the Effective Date (collectively, the “Service Standard”), and (iii) in the event the Company fails to perform

such insurance services in accordance with the Service Standard, Seller Affiliates shall not be obligated to perform the Seller Affiliates

Obligation.

(b)

After the Closing, for a period of four (4) years the Company shall have access and the option to contract with Real

Systems Sales Results, LP (“RSSR”) to call on purchased leads post-Closing for a prevailing market rate cost

charged by RSSR to the Company.

(c)

To the extent permitted by applicable law and by Seller’s insurance providers, the Seller shall add the Company

as an additional insured party to the Seller’s insurance policies with respect to the Katy Location effective as of the Closing

and maintain the Company as an insured party under such insurance policies until August 31, 2025.

(d)

All stock previously awarded to any employees of the Company from Seller or Seller’s Affiliate that remains unvested

will be retained by such employees and allowed to vest, including all stock compensation deferred by such employees.

(e)

At or prior to Closing, Seller shall cancel and extinguish, or cause to be cancelled or extinguished, all liabilities

of the Company owed to Seller and any of its Affiliates (the “Intercompany Payables”), and the parties agree

neither the Company nor Purchaser shall have any obligation to pay any Intercompany Payables to Seller or any of its Affiliates.

(f)

At or prior to Closing, the Company shall cancel and extinguish, or cause to be cancelled or extinguished, all liabilities

of Seller or any of its Affiliates owed to the Company (the “Intercompany Receivables”), and the parties agree

neither Seller or any of its Affiliates shall have any obligation to pay any Intercompany Receivables to the Company or any of its Affiliates.

(g)

Each of Dagley and Purchaser agrees that neither Dagley nor Purchaser nor any of their respective Affiliates (including,

following the Effective Time, the Company) shall, without the prior written consent of Fathom Holdings, (i) incur any additional indebtedness

or (ii) enter into any agreement that, in each case, would subordinate Purchaser’s payment obligations hereunder or otherwise prevent

or prohibit the payment of such payment obligations when due, including, but not limited to, the payment obligations set forth in Section

2.2(a) and the payment of any amounts owed pursuant to Article 8 other than those limitations as are set forth in that certain

Subordination Agreement dated as of the date hereof by and between Westfield Bank, FSB, Seller, Purchaser, the Company, and Dagley.

ARTICLE 8

Indemnification

8.1

Survival of Representations and Warranties. The representations and warranties of the Parties contained

in this Agreement (other than the Fundamental Representations) will survive the Closing in full force and effect for twelve (12) months

after the Closing, and the Fundamental Representations will survive the Closing in full force and effect until thirty (30) days after

the expiration of the applicable statute of limitations (in each case, the applicable “Survival Period”); and

provided, further, that any obligations under Sections 8.2(a)(i) and 8.2(b)(i) will not terminate with respect

to any Losses as to which the Person to be indemnified has given notice (stating in reasonable detail, to the extent practicable, the

basis of the claim for indemnification) to the Indemnifying Party in accordance with Section 8.3(a) before the termination of the

applicable Survival Period.

8.2

Indemnification.

(a)

Subject to the limitations set forth in Section 8.4, the Seller hereby agrees to indemnify Purchaser, the Company,

and their respective directors, officers, employees, Affiliates, shareholders, representatives, successors and permitted assigns (each

individually, a “Purchaser Indemnified Party” and collectively, the “Purchaser Indemnified Parties”)

from and against, and pay to the applicable Purchaser Indemnified Parties the amount of, any and all losses, liabilities, claims, obligations,

deficiencies, demands, judgments, damages, interest, fines, penalties, suits, actions, causes of action, assessments, awards, costs and

expenses (including costs of investigation and defense and reasonable attorneys’ and other professionals’ fees), whether or

not involving a third party claim; but in all cases excluding exemplary, consequential, or punitive damages except to the extent such

damages are paid in relation to a Third Party Claim (individually, a “Loss” and, collectively, “Losses”)

arising out of or relating to any of the following:

(i)

any breach or inaccuracy of any representation or warranty made by the Seller or the Company in this Agreement;

(ii)

any breach of any covenant or agreement on the part of the Seller or the Company under this Agreement; and

(iii)

(A) any and all Taxes of the Seller for any taxable period after the Merger Date, and (B) any and all Taxes of the Company

attributable to the Ownership Period, including the portion of any Straddle Period through the Effective Time, as calculated in accordance

with Section 7.2(a) (the Taxes described in clauses (A) and (B) collectively, “Pre-Closing Taxes”).

(b)

Subject to the limitations set forth in Section 8.4, Purchaser and Dagley hereby agree, jointly and severally,

to indemnify the Seller and its directors, officers, employees, Affiliates, shareholders, representatives, successors and permitted assigns

(each individually, a “Seller Indemnified Party” and collectively, the “Seller Indemnified Parties”

and, each of the Seller Indemnified Parties and the Purchaser Indemnified Parties being an “Indemnified Party”)

from and against, and pay to the applicable Seller Indemnified Parties the amount of any and all Losses to the extent arising out of any

of the following:

(i)

any breach or inaccuracy of any representation or warranty made by Purchaser in this Agreement; and

(ii)

any breach of any covenant or agreement on the part of Purchaser or Dagley under this Agreement.

(c)

The Seller shall not be liable under this ARTICLE 8 for any Losses based upon or arising out of any inaccuracy

in or breach of any of the representations or warranties of the Seller or the Company contained in this Agreement if Purchaser or Dagley

had Knowledge of such inaccuracy or breach prior to the Closing or if such inaccuracy or breach is caused by the action of Dagley or any

other employee or officer of the Company acting under the direction of Dagley.

8.3

Indemnification Procedures.

(a)

The Indemnified Party seeking indemnification hereunder (a “Claimant”) will promptly give

notice to the Parties from which indemnification is claimed (the “Indemnifying Party”) of any demand, suit,

assertion of liability or claim. If the claim relates to an action, suit or proceeding filed by another Person against the Claimant (a

“Third Party Claim”), then such notice shall be given by the Claimant within thirty (30) days after written

notice of such action, suit or proceeding is given to the Claimant and shall include true, correct and complete copies of all suit, service