As

filed with the Securities and Exchange Commission on May 16, 2024

Registration

No. 333-_________

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

F-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES

ACT OF 1933

| |

HITEK

GLOBAL INC. |

|

| |

(Exact

name of registrant as specified in its charter) |

|

| Cayman Islands |

|

Not Applicable |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

Unit

304, No. 30 Guanri Road, Siming District

Xiamen

City, Fujian Province, People’s Republic of China

+86

592-5395967

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Puglisi

& Associates

850

Library Avenue, Suite 204

Newark,

Delaware 19711

+1-

(302) 738-6680 — telephone

(Name,

address including zip code, and telephone number, including area code, of agent for service)

With

a copy to:

Bradley

A. Haneberg, Esq.

Haneberg

Hurlbert PLC

1111

East Main Street, Suite 2010

Richmond,

Virginia 23219

+1-804-814-2209

— telephone

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement

as determined by the registrant.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall

become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised accounting standards provided to Section 7(a)(2)(B) of

the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such

date as the Commission acting pursuant to said section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting

offers to buy these securities in any state where the offer or sale is not permitted.

Subject

to Completion, dated May 16, 2024

PROSPECTUS

$120,000,000

HITEK

GLOBAL INC.

Class

A Ordinary Shares

Hitek

Global Inc. (the “Company,” “our company,” or “we”) may offer to sell, from time to time, our Class

A ordinary shares, $0.0001 par value per share (“Class A Shares”). The aggregate offering price of the Class A Shares issued

under this prospectus may not exceed $120,000,000. The prices of the Class A Shares that we will offer will be determined

at the time of their offering and will be described in a supplement to this prospectus.

This

prospectus provides a general description of the Class A Shares we may offer. We will provide the specific terms of the offering of the

Class A Shares in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be provided

to you in connection with these offerings. You should carefully read this prospectus, the applicable prospectus supplement and any related

free writing prospectus, as well as any documents incorporated by reference before you invest in any of our securities. This

prospectus may not be used to offer or sell any Class A Shares unless accompanied by the applicable prospectus supplement.

The

Class A Shares issued under this prospectus may be offered directly or through underwriters, agents or dealers. The names of any underwriters,

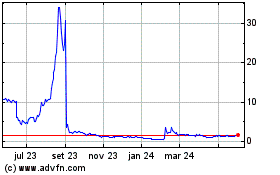

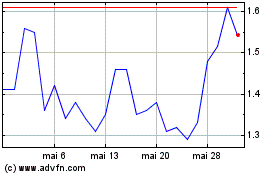

agents or dealers will be included in a supplement to this prospectus. The Class A Shares are listed on The NASDAQ Capital Market (“Nasdaq”)

under the symbol “HKIT.” On May 15, 2024, the closing price of a Class A Share on Nasdaq was $1.46.

The

aggregate market value of our outstanding Class A Shares held by non-affiliates is $8,423,271 based on 6,200,364 Class A Shares

outstanding, of which 5,769,364 shares are held by non-affiliates, and a per share price of $1.46 based on the closing sale price of

our ordinary shares as reported by the Nasdaq Capital Market on May 15, 2024. We have not offered any securities pursuant to General

Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus.

The

securities offered in this offering are of the offshore holding company Hitek Global Inc. (the “Company”), which owns equity

interests, directly or indirectly, of the operating subsidiaries. Subsidiaries conduct operations in China and the holding company does

not conduct operations in China. Unless otherwise stated, as used in this prospectus and in the context of describing our operations

and consolidated financial information, “Hitek,” “we,” “us,” “Company,” or “our”

refers to Hitek Global Inc., a Cayman Islands exempted company.

We

are an offshore holding company incorporated in the Cayman Islands. As a holding company with no material operations, our operations

were conducted in China by our subsidiaries and through contractual arrangements (“VIE Agreements”) with a variable interest

entity, Xiamen Hengda HiTek Computer Network Co., Ltd. and its subsidiaries (the “VIE”). Neither we nor our subsidiaries

own any equity interests in the VIE. The VIE Agreements enable us to consolidate the financial results of the VIE in our consolidated

financial statements under generally accepted accounting principles in the U.S. (“U.S. GAAP”), and the structure involves

unique risks to investors. The VIE structure provides contractual exposure to foreign investment in China-based companies.

This

is an offering of Class A Shares of the offshore holding company in Cayman Islands, instead of shares of the VIE in China. Therefore,

you are not investing in and may never hold equity interests in the VIE. The VIE Agreements by and among Tian Dahai (Xiamen) Information

Technology Co. Ltd. (the “WFOE”), the VIE, and the VIE’s shareholders include (i) certain power of attorney agreements

and equity interest pledge agreement, pursuant to which shareholders of the VIE pledged all of their equity interests in the VIE to WFOE

guarantee the performance of the VIE’s obligations under the exclusive technical consulting and service agreement; (ii) an exclusive

technical consulting and service agreement which allows WFOE to receive substantially all of the economic benefits from the VIE; and (iii)

certain exclusive equity interest purchase agreements which provide WFOE with an exclusive option to purchase all or part of the equity

interests in and/or assets of the VIE when and to the extent permitted by the laws of the People’s Republic of China (“PRC”).

Through the VIE Agreements among WFOE, the VIE and the VIE’s shareholders, we are deemed to have a controlling financial interest in,

and be the primary beneficiary of, the VIE for accounting purposes only and must consolidate the VIE because it met the conditions under

U.S. GAAP to consolidate the VIE.

However,

the VIE structure cannot completely replicate a foreign investment in China-based companies, as the investors will not and may never

hold equity interests in the Chinese operating entities. Instead, the VIE structure provides contractual exposure to foreign investment

in us. Because we do not hold equity interests in the VIE, we are subject to risks due to uncertainty of the interpretation and the application

of the PRC laws and regulations, including but not limited to limitation on foreign ownership of internet technology companies, regulatory

review of oversea listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the VIE Agreements

as they have not been tested in a court of law. We are also subject to the risks of uncertainty about any future actions of the PRC government

in this regard that could disallow the VIE structure, which would likely result in a material change in our operations and the value

of Class A Shares may depreciate significantly or become worthless.

The

VIE Agreements may not be effective in providing control over the VIE. We may also subject to sanctions imposed by PRC regulatory agencies

including the Chinese Securities Regulatory Commission (“CSRC”) if we fail to comply with their rules and regulations.

We

are subject to legal and operational risks associated with the VIE’s operations in China. PRC laws and regulations governing

our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in the

VIE’s operations, significant depreciation of the value of our Class A Shares, or a complete hindrance of our ability to offer

or continue to offer our securities to investors. The PRC government initiated a series of regulatory actions and statements

to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities

market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures

to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement.

Pursuant

to the PRC Cybersecurity Law, promulgated by the Standing Committee of the National People’s Congress on November 7,

2016 and took effect on June 1, 2017, personal information and important data collected and generated by a critical information infrastructure

operator in the course of its operations in China must be stored in China, and if a critical information infrastructure operator purchases

internet products and services that affects or may affect national security, it should be subject to cybersecurity review by the Cyberspace

Administration of China (“CAC”). Due to the lack of further interpretations, the exact scope of “critical information

infrastructure operator” remains unclear. On December 28, 2021, the CAC and other relevant PRC governmental authorities jointly

promulgated the Cybersecurity Review Measures (the “CAC Revised Measures”) to replace the original Cybersecurity Review Measures.

The CAC Revised Measures took effect on February 15, 2022. Pursuant to the CAC Revised Measures, if critical information infrastructure

operators purchase network products and services, or network platform operators conduct data processing activities that affect or may

affect national security, they will be subject to cybersecurity review. On November 14, 2021, CAC published the Administration Measures

for Cyber Data Security (Draft for Public Comments) (the “Cyber Data Security Measure (Draft),” which requires cyberspace

operators with personal information of more than 1 million users who want to list abroad to file a cybersecurity review with the Office

of Cybersecurity Review. The cybersecurity review will evaluate, among others, the risk of critical information infrastructure, core

data, important data, or a large amount of personal information being influenced, controlled or maliciously used by foreign governments

and risk of network data security after going public overseas. As confirmed by our PRC counsel, Jingtian & Gongcheng, we are not

subject to cybersecurity review with the CAC in accordance with the CAC Revised Measures, because (i) we are not in possession of or

otherwise holding personal information of over one million users and it is also very unlikely that it will reach such threshold in the

near future; and (ii) as of the date of this prospectus, we have not received any notice or determination from applicable PRC governmental

authorities identifying it as a critical information infrastructure operator. However, since these statements and regulatory actions

are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new

laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact

such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list

on an U.S. exchange. On February 17, 2023, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and

Listing by Domestic Companies (the “Trial Measures”) and five supporting guidelines, which came into effect on March 31,

2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, both directly and indirectly,

shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following

its submission of initial public offerings or listing application. If a PRC company fails to complete required filing procedures or conceals

any material fact or falsifies any major content in its filing documents, such PRC company may be subject to administrative penalties,

such as order to rectify, warnings, fines, and its controlling shareholders, actual controllers, the person directly in charge and other

directly liable persons may also be subject to administrative penalties, such as warnings and fines. In addition, on February 24, 2023,

the CSRC, together with the Ministry of Finance of the PRC, the National Administration of State Secrets Protection and the National

Archives Administration of China, revised the Provisions on Strengthening Confidentiality and Archives Administration for Overseas Securities

Offering and Listing which was issued by the CSRC, National Administration of State Secrets Protection and National Archives Administration

of China in 2009 (the “Provisions”). The revised Provisions were issued under the title Provisions on Strengthening Confidentiality

and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies and came into effect on March 31, 2023

together with the Trial Measures. One of the major revisions to the revised Provisions is expanding its application to cover indirect

overseas offerings and listings, as is consistent with the Trial Measures. The revised Provisions require that, including but not limited

to (a) a domestic company that plans to, either directly or indirectly through its overseas listed entity, publicly disclose or provide

to relevant individuals or entities including securities companies, securities service providers and overseas regulators, any documents

and materials that contain state secrets or working secrets of government agencies, shall first obtain approval from competent authorities

according to law, and file with the secrecy administrative department at the same level; and (b) a domestic company that plans to, either

directly or indirectly through its overseas listed entity, publicly disclose or provide to relevant individuals and entities including

securities companies, securities service providers and overseas regulators, any other documents and materials that, if leaked, will be

detrimental to national security or public interest, shall strictly fulfill relevant procedures stipulated by applicable national regulations.

As of the date of this prospectus, as advised by Jingtian & Gongcheng, our PRC counsel, we have not received any formal inquiry,

notice, warning, sanction, or objection from the CSRC with respect to this offering. However, there remains significant uncertainty as

to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital

markets activities. If it is determined that we are subject to the Trial Measures for the listing of the Class A Shares on Nasdaq, we

may fail to obtain required approval, complete required filing or meet such requirements in a timely manner or at all, or completion

could be rescinded. Any failure or perceived failure of us to fully comply with such new regulatory requirements could significantly

limit or completely hinder our ability to offer or continue to offer securities to investors, cause significant disruption to our business

operations, and severely damage our reputation, which could materially and adversely affect our financial condition and results of operations

and could cause the value of our securities to significantly decline or be worthless.

Furthermore,

as an auditor of companies that are registered with the U.S Securities and Exchange Commission (the “SEC”) and publicly

traded in the United States and a firm registered with the U.S. Public Company Accounting Oversight Board (the “PCAOB”),

our auditor, Wei, Wei & Co., LLP, is headquartered in the United States and is required under the laws of the United States to

undergo regular inspections by the PCAOB to assess their compliance with the laws of the United States and professional standards.

Although we operate through the VIE in mainland China, a jurisdiction where the PCAOB is currently unable to conduct inspections

without the approval of the Chinese government authorities, our auditor is currently inspected fully by the PCAOB. Inspections of

other auditors conducted by the PCAOB outside mainland China have at times identified deficiencies in those auditors’ audit

procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit

quality.

Even

though our auditor, Wei, Wei & Co., LLP, is based in the United States and under full inspection by the PCAOB and we

believe it is not currently subject to the determinations by the PCAOB on December 16, 2021, if any PRC law relating

to the access of the PCAOB to auditor files were to apply to a company such as the VIE or its auditor, the PCAOB may be unable to

fully inspect our auditor, which may result in our securities being delisted or prohibited from being traded

“over-the-counter” pursuant to the Holding Foreign Companies Accountable Act and materially and adversely affect the

value and/or liquidity of your investment. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies

Accountable Act (the “AHFCAA”), and if it were enacted, would require foreign companies to comply with the PCAOB audits

within two consecutive years instead of three consecutive years, which would reduce the time before our securities may be prohibited

from trading or be delisted. On December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the

“Consolidated Appropriations Act”), was signed into law by President Biden. The Consolidated Appropriations Act

contained, among other things, an identical provision to AHFCAA, which reduces the number of consecutive non-inspection years

required for triggering the prohibitions under the HFCA Act from three years to two. Furthermore, Wei, Wei & Co., LLP is not

among the auditor firms listed on a Holding Foreign Companies Accountable Act (“HFCA Act”) Determination List, which

includes all of the auditor firms that the PCAOB is not able to inspect. There are risks and uncertainties which we cannot foresee

for the time being, and rules and regulations in the PRC can change quickly with little or no advance notice. The PRC government may

intervene or influence the VIE’s future operations in the PRC at any time, or may exert more control over offerings conducted

overseas and/or foreign investment in companies like us. The PRC government may intervene or influence the VIE’s future

operations in the PRC at any time, or may exert more control over offerings conducted overseas and/or foreign investment in

companies like us. In the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor,

then such lack of inspection could cause trading in our securities to be prohibited under the HFCA Act, and ultimately result in a

determination by a securities exchange to delist our securities.

On

August 26, 2022, the China Securities Regulatory Commission, the Ministry of Finance of the PRC (the “MOF”), and the PCAOB

signed a Statement of Protocol (the “Protocol”) governing inspections and investigations of audit firms based in mainland

China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting

firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the

PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to

transfer information to the SEC. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to

inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous

determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in

the future, the PCAOB Board will consider the need to issue a new determination.

Our

management monitors the cash position of each entity within our organization regularly and prepare budgets on a monthly basis to ensure

each entity has the necessary funds to fulfill its obligation for the foreseeable future and to ensure adequate liquidity. As a holding

company, we may rely on dividends and other distributions on equity paid by our subsidiary in Hong Kong, Hitek HK, and the consolidated

VIE in mainland China, for our cash and financing requirements. According to the Companies Ordinance of Hong Kong, a Hong Kong

company may only make a distribution out of profits available for distribution. In order for us to pay dividends to our shareholders,

we will rely on payments made from the VIE to WFOE, pursuant to VIE Agreements between them, and the distribution of such payments to HiTek

HK as dividends from WFOE. Certain payments from the VIE to WFOE are subject to PRC taxes, including business taxes and VAT. We intend

to keep any future earnings to re-invest in and finance the expansion of our business, and we do not anticipate that any cash dividends

will be paid or any assets will be transferred in the foreseeable future. As of the date of this prospectus, there has been no distribution

of dividends or assets among the holding company, the subsidiary or the consolidated VIE. In the future, cash proceeds raised from overseas

financing activities, including this offering, may be transferred by us to the consolidated VIE via capital contribution or shareholder

loans, as the case may be. Other than the above, we did not adopt or maintain any cash management policies and procedures as of the date

of this prospectus.

In

addition, we are an “emerging growth company” as defined under the Federal securities laws and will be subject to reduced

public company reporting requirements.

Furthermore,

we are a “controlled company” as defined under the Nasdaq Stock Market Rules because Mr. Shenping Yin, our founder, the chairman

of our board of directors and his wife, Ms. Xiaoyang Huang, our chief executive officer, will beneficially own all of the Company’s

Class B ordinary shares and will be able to exercise more than 50% of our total voting power. Therefore, we may elect not to comply with

certain corporate governance requirements of Nasdaq. Currently, we do not plan to utilize the “controlled company” exemptions

with respect to our corporate governance practice after we complete this offering.

You

should carefully read this prospectus and the documents incorporated by reference into this prospectus before investment.

Investing

in our securities being offered pursuant to this prospectus involves a high degree of risk. You should carefully read and consider the

risk factors section contained in the applicable prospectus supplement and the documents we incorporate by reference into this prospectus

to read about factors you should consider before investing in our securities.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved

of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is _______, 2024

TABLE

OF CONTENTS

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not

authorized any person to provide you with different or additional information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy

securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus

or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate

as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have

changed since those dates.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a shelf registration statement that we filed with the SEC.

By using a shelf registration statement, we may, at any time and from time to time, offer and sell up to US$120,000,000

of the securities as described in this prospectus in one or more offerings. We may also add, update or change information contained in

this prospectus by means of a prospectus supplement or by incorporating by reference information that we file or furnish to the SEC.

As allowed by the SEC rules, this prospectus and any accompanying prospectus supplement do not contain all of the information included

in the registration statement. For further information, we refer you to the registration statement, including its exhibits. Statements

contained in this prospectus or the prospectus supplement about the provisions or contents of any agreement or other document are not

necessarily complete. If the SEC’s rules and regulations require that an agreement or document be filed as an exhibit to the registration

statement, please see that agreement or document for a complete description of these matters.

You

should carefully read this document and any applicable prospectus supplement. You should also read the documents we have referred you

to under “Where You Can Find More Information About Us” and “Incorporation of Documents by Reference” below for

information on our company, the risks we face and our financial statements. The registration statement and exhibits can be read on the

SEC’s website as described under “Where You Can Find More Information About Us.”

FORWARD-LOOKING

STATEMENTS

This

prospectus and the documents incorporated by reference herein contain statements of a forward-looking nature. All statements other than

statements of historical facts are forward-looking statements. These forward-looking statements are made under the “safe harbor”

provision under Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and as defined in

the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking

statements. In some cases, these forward-looking statements can be identified by words or phrases such as “may,” “will,”

“expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,”

“believe,” “potential,” “continue,” “is/are likely to” or other similar expressions.

These forward-looking statements relate to, among others:

| |

● |

future

financial and operating results, including revenues, income, expenditures, cash balances and other financial items; |

| |

|

|

| |

● |

impact

of the COVID-19 pandemic on our business, results of operations, financial condition and cash flows; |

| |

|

|

| |

● |

our

ability to execute our growth, expansion and acquisition strategies, including our ability to meet our goals; |

| |

● |

current

and future economic and political conditions; |

| |

|

|

| |

● |

the

response of participants using ACTCS (as such term is defined herein) tax device or its supporting services to any difficulties

encountered by companies filing VAT (as such term is defined herein) through these systems; |

| |

|

|

| |

● |

changes

in the regulations of PRC government bodies and agencies relating to VAT collection procedure and ACTCS business; |

| |

|

|

| |

● |

our

ability to provide participants in projects using our services with a secure and acceptable payment method; |

| |

|

|

| |

● |

our

ability to continue to operate through the VIE structure; |

| |

|

|

| |

● |

our

capital requirements and our ability to raise any additional financing which we may require; |

| |

|

|

| |

● |

our

ability to protect our intellectual property rights and secure the right to use other intellectual property that we deem to be essential

or desirable to the conduct of our business; |

| |

|

|

| |

● |

our

ability to hire and retain qualified management personnel and key employees in order to enable us to develop our business; |

| |

|

|

| |

● |

our

ability to retain the services of Ms. Xiaoyang Huang, our Chief Executive Officer; |

| |

|

|

| |

● |

overall

industry and market performance; and |

| |

|

|

| |

● |

other

assumptions described in this prospectus underlying or relating to any forward-looking statements. |

We

have based these forward-looking statements largely on our current expectations and projections about future events and financial trends

that we believe may affect our financial condition, results of operations, business strategy and financial needs.

You

should read these statements in conjunction with the risks discussed under the heading “Risk Factors” included in the applicable

prospectus supplement or under similar headings in other documents which are incorporated by reference in this prospectus. Moreover,

we operate in an emerging and evolving environment. New risks may emerge from time to time, and it is not possible for our management

to predict all risks, nor can we assess the impact of such risks on our business or the extent to which any risk, or combination of risks,

may cause actual results to differ materially from those contained in any forward-looking statements. The forward-looking statements

made in this prospectus and the documents incorporated by reference herein relate only to events or information as of the date on which

the statements are made in this prospectus and such incorporated documents. Except as required by law, we undertake no obligation to

update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect

the occurrence of unanticipated events. You should read this prospectus and the documents incorporated by reference herein and have filed

as exhibits to this prospectus and the incorporated documents, completely and with the understanding that our actual future results may

be materially different from what we expect.

OUR

COMPANY

We

are an offshore holding company incorporated in the Cayman Islands. As a holding company with no material operations, our operations

were conducted in China by (i) Haitian Weilai, our indirect subsidiary, (ii) the VIE, Hitek and the VIE’s subsidiaries, Huasheng

and Huoerguosi. Neither we nor our subsidiaries own any equity interests in the VIE. WFOE, the VIE and the shareholders of the VIE entered

into a series of contractual arrangements (the “VIE Agreements”) pursuant to which we are able to consolidate the financial

results of the VIE in our consolidated financial statements because we are deemed as the primary beneficial of the VIE under generally

accepted accounting principles in the U.S. (“U.S. GAAP”), and this structure involves unique risks to investors.

The

following diagram illustrates our corporate structure as of the date of this annual report. All percentages in the following diagram

reflect the voting ownership interests instead of the equity interests held by each of our shareholders given that each holder of Class

B Ordinary Shares will be entitled to 15 votes per one Class B Ordinary Share, and each holder of Class A Shares will be entitled to

one vote per one Class A Share:

The

VIE Agreements included: Exclusive Technical Consulting and Service Agreement, Equity Interest Pledge Agreement, Exclusive Equity Interests

Purchase Agreement, and Powers of Attorney. None of the agreements has been tested in a court of law. Through the VIE Agreements among

WFOE, the VIE and the VIE’s shareholders, we are deemed to have a controlling financial interest in, and be the primary beneficiary

of, the VIE for accounting purposes only and must consolidate the VIE because it met the conditions under U.S. GAAP to consolidate the

VIE. However, the VIE structure cannot completely replicate a foreign investment in China-based companies, as the investors will not

and may never hold equity interests in the Chinese operating entities. Instead, the VIE structure provides contractual exposure to foreign

investment in us.

Because

we do not hold equity interests in the VIE, we are subject to risks due to uncertainty of the interpretation and the application of the

PRC laws and regulations, including but not limited to limitation on foreign ownership of internet technology companies, regulatory review

of oversea listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the VIE Agreements. We are

also subject to the risks of uncertainty about any future actions of the PRC government in this regard that could disallow the VIE structure,

which would likely result in a material change in our operations and the value of the Class A Shares may depreciate significantly or

become worthless.

We

are subject to certain legal and operational risks associated with the VIE’s operations in China. PRC laws and regulations governing

our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in the

VIE’s operations, significant depreciation of the value of our Class A Shares, or a complete hindrance of our ability to offer

or continue to offer our securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements

to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities

market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures

to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory

actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing

or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential

impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments

and list on an U.S. exchange

We

cannot assure you the PRC courts or regulatory authorities may not determine our corporate structure and VIE Agreements violate

PRC laws, rules or regulations. If the PRC courts or regulatory authorities determine our contractual arrangements are in violation

of applicable PRC laws, rules or regulations, the VIE Agreements will become invalid or unenforceable, and the VIE will not be treated

as a VIE and we will not be entitled to treat the VIE’s assets, liabilities and results of operations as our assets, liabilities

and results of operations, which could effectively eliminate the assets, revenue and net income of the VIE from our balance sheet, which

would most likely require us to cease conducting our business and would result in the delisting of our Class A Shares from the Nasdaq

Capital Market after this offering and a significant impairment in the market value of our Class A Shares. If the VIE structure is determined

to be in violation of any existing or future PRC laws, rules or regulations, or if our WFOE or the VIE fails to obtain or maintain any

of the required governmental permits or approvals, the relevant PRC regulatory authorities would have broad discretion in dealing with

such violations, including: imposing fines on the WFOE or the VIE, revoking the business and operating licenses of WFOE or the VIE, discontinuing

or restricting the operations of WFOE or the VIE; imposing conditions or requirements with which we, WFOE, or the VIE may not be able

to comply; requiring us, WFOE, or the VIE to restructure the relevant ownership structure or operations which may significantly impair

the rights of the holders of our Class A Shares in the equity of the VIE; and restricting or prohibiting our use of the proceeds from

our initial public offering to finance our business and operations in China.

Business

Overview

We

are an information technology (“IT”) consulting and solutions service provider focusing on delivering services to business

in various industry sectors in China. As of the date of prospectus, we have two lines of businesses—1) services to small and medium

businesses, which consists of Anti-Counterfeiting Tax Control System (“ACTCS”) tax devices, including Golden Tax Disk (“GTD”)

and printers, ACTCS services, and IT services, and 2) services to large businesses, which consists of hardware sales and software sales.

We expect to actively develop our system integration services and online service platform in the near future. Our vision is to become

a one-stop consulting destination for holistic IT and other business consulting services in China.

The

VIE is authorized to carry out the sales of GTD and a market leader in the Xiamen metropolitan area with respect to ACTCS tax

devices and services since 1996. We provide our customers with the necessary ACTCS for their value added tax (“VAT”) reporting,

collection and processing. VAT reporting is mandatory for all business enterprises in China. The ACTCS is one of the two major VAT control

systems that a business entity may choose to comply with the VAT reporting requirements. Developed by the PRC government, ACTCS was intended

to effectively eliminate counterfeit invoices, providing accurate and complete tax information for the regional and national audit system.

We are authorized by the State Taxation Bureau, Xiamen Branch, as one of the first ACTCS service providers in the Xiamen metropolitan

area. GTD is an ACTCS device necessary for normal operation of ACTCS software. The purchase of GTD is allowed only in conjunction with

the use of the ACTCS software and its supporting services. Since 1996, we have been the number one ACTCS services provider for

Xiamen business enterprises according to the data compiled by Xiamen Province Taxation Bureau.

Complementing

our physical service center, we started developing online service center in 2018 to enable tens of thousands of businesses in the Xiamen

metropolitan area to securely process VAT reporting and payment from their desktop virtually anytime and anywhere. Currently, our customers

range from small, medium to large enterprises across industries in the Xiamen metropolitan area.

In

April 2021, WFOE established a wholly-owned subsidiary, Xiamen Haitian Weilai Technology Co., Ltd. (“Haitian Weilai”) under

the laws of the PRC. The strategy purpose of establishing the new subsidiary is for the integration of tax invoicing management services

from the VIE to Haitian Weilai.

As

part of the services provided to large businesses, the VIE currently sells its Communication Interface System (“CIS”), its

self-developed software which provides embedded system interface solutions for large businesses. CIS is a universal embedded interface

system used in petrochemical and coal businesses to collect industrial, electricity, facility pressure and temperature statistics and

convert to readable format for analytical purposes.

As

part of our services provided to large businesses, Huasheng sold hardware such as laptops, printers, desktop computers and associated

accessories, together with certain internet servers, cameras and monitors. Huasheng’s major business strategy in its market was

to connect and source through exclusive relationships with manufacturers so that Huasheng could offer competitively priced hardware.

Huasheng has established its online support system in the beginning of 2018. The online system further enhanced Huasheng’s customer

experience, which is complemented by highly trained professionals and attractive physical store environment. From the beginning of 2022,

Huasheng transferred the above business to the VIE.

CORPORATE

INFORMATION

Our

principal executive offices are located at Unit 304, No. 30 Guanri Road, Siming District, Xiamen City, Fujian Province, PRC. Our telephone number at this address is +86 592-5395967. Our registered office in the Cayman

Islands is located at the offices of Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman

Islands. Our agent for service of process in the United States is Puglisi & Associates, located at 850 Library Avenue, Suite

204, Newark, Delaware 19711.

The

SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that

file electronically with the SEC at www.sec.gov. You can also find information on our website at http://www.xmhitek.com. The information

contained on our website is not a part of this prospectus.

As

a foreign private issuer, we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content

of proxy statements, and our executive officers, directors and principal shareholders are exempt from the reporting and short-swing profit

recovery provisions contained in Section 16 of the Exchange Act. In addition, we will not be required under the Exchange Act to

file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered

under the Exchange Act.

RISK

FACTORS

Any

investment in our securities involves a high degree of risk. You should carefully consider the risk factors discussed or incorporated

by reference in the applicable prospectus supplement, together with all the other information contained in the prospectus supplement

or incorporated by reference in this prospectus. You should also consider the risks and uncertainties discussed under the heading “Risk

Factors” in our annual report on Form 20-F for the fiscal year ended December 31, 2023, which is incorporated by reference

in this prospectus, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the

future.

USE

OF PROCEEDS

We

intend to use the net proceeds from the sale of the securities we offer as set forth in the applicable prospectus supplement(s).

DESCRIPTION

OF SHARE CAPITAL

We

are a Cayman Islands company and our affairs are governed by our memorandum and articles of association and the Companies Act (As Revised)

of the Cayman Islands, which we refer to as the Companies Act below. The following description of our memorandum and articles of association,

as amended and restated from time to time, are summaries and do not purport to be complete.

As

of May 16, 2024, our authorized share capital consists of $50,000 divided into 500,000,000 shares, par value US$0.0001

per share, comprised of 431,808,000 Class A Shares, 58,192,000 Class B Ordinary Shares, and 10,000,000 preference shares.

Our

directors may, in their absolute discretion and without the approval of our shareholders, create and designate out of the unissued preference

shares of our company one or more classes or series of preference shares, comprising such number of preference shares, and having such

designations, powers, preferences, privileges and other rights, including dividend rights, voting rights, conversion rights, terms of

redemption and liquidation preferences, as our directors may determine. As of the date hereof, there are 6,200,364 Class A Shares and

8,192,000 Class B Ordinary Shares issued and outstanding. The following are summaries of material provisions of our amended and restated

memorandum and articles of association and the Companies Act insofar as they relate to the material terms of our Class A Shares and Class

B Ordinary Shares.

Ordinary

shares

Dividends.

Subject to any rights and restrictions of any other class or series of shares, our board of directors may, from time to time, declare

dividends on the shares issued and authorize payment of the dividends out of our lawfully available funds. No dividends shall be declared

by the board out of our company except the following:

| |

● |

“share

premium account,” which represents the excess of the price paid to our company on issue of its shares over the par or “nominal”

value of those shares, which is similar to the U.S. concept of additional paid in capital. |

However,

no dividend shall bear interest against the Company.

Voting

Rights. Holders of Class A Shares and Class B Ordinary Shares have the same rights except for voting and conversion rights as

set forth in our memorandum and articles of association. In respect of matters requiring a vote of all shareholders, each holder of Class

A Shares will be entitled to one vote per one Class A Share and each holder of Class B Ordinary Shares will be entitled to 15 votes per

one Class B Ordinary Share. The Class B Ordinary Shares are convertible into Class A Shares at any time after issuance at the option

of the holder on a one-to-one basis.

On

a show of hands, every shareholder who is present in person and every person representing a shareholder by proxy shall have one vote

for each Class A Share and 15 votes for each Class B Ordinary Share of which he or the person represented by proxy is the holder. On

a poll, a Class A shareholder shall have one vote for each Class A Share he holds whereas a Class B Ordinary shareholder shall have 15

votes for each Class B Ordinary Share he holds, unless any share carries special voting rights. In addition, all shareholders holding

shares of a particular class are entitled to vote at a meeting of the holders of that class of shares. Votes may be given either personally

or by proxy.

Any

ordinary resolution to be made by the shareholders requires the affirmative vote of a simple majority of the votes cast in a general

meeting, while a special resolution requires the affirmative vote of no less than two-thirds of the votes cast.

Under

Cayman Islands law, some matters, such as amending the memorandum and articles of association, changing the name or resolving to be registered

by way of continuation in a jurisdiction outside the Cayman Islands, require approval of shareholders by a special resolution.

There

are no limitations on non-residents or foreign shareholders in the memorandum and articles of association to hold or exercise voting

rights on the Class A Shares or Class B Ordinary Shares imposed by foreign law or by the charter or other constituent document of our

company. However, no person will be entitled to vote at any general meeting or at any separate meeting of the holders of the Class A

Shares or Class B Ordinary Shares unless the person is registered as of the record date for such meeting and unless all calls or other

sums presently payable by the person in respect of Class A Shares or Class B Ordinary Shares in the Company have been paid.

Winding

Up; Liquidation. Upon the winding up of our company, after the full amount that holders of any issued shares ranking senior to

the Class A Shares or Class B Ordinary Shares as to distribution on liquidation or winding up are entitled to receive has been paid or

set aside for payment, the holders of our Class A Shares or Class B Ordinary Shares are entitled to receive any remaining assets of the

Company available for distribution as determined by the liquidator. The assets received by the holders of our Class A Shares or Class

B Ordinary Shares in a liquidation may consist in whole or in part of property, which is not required to be of the same kind for all

shareholders.

Calls

on Ordinary Shares and Forfeiture of Ordinary Shares. Our board of directors may from time to time make calls upon shareholders

for any amounts unpaid on their Class A Shares or Class B Ordinary Shares in a notice served to such shareholders at least 14 days prior

to the specified time and place of payment. Any Class A Shares or Class B Ordinary Shares that have been called upon and remain unpaid

are subject to forfeiture.

Redemption

of Ordinary Shares. We may issue shares that are, or at its option or at the option of the holders are, subject to redemption

on such terms and in such manner as it may, before the issue of the shares, determine. Under the Companies Act, shares of a Cayman Islands

company may be redeemed or repurchased out of profits of the company, out of the proceeds of a fresh issue of shares made for that purpose

or out of capital, provided the memorandum and articles of association authorize this and it has the ability to pay its debts as they

come due in the ordinary course of business.

No

Preemptive Rights. Holders of Class A Shares or Class B Ordinary Shares will have no preemptive or preferential right to purchase

any securities of our company.

Variation

of Rights Attaching to Shares. If at any time the share capital is divided into different classes of shares, the rights attaching

to any class (unless otherwise provided by the terms of issue of the shares of that class) may, subject to the memorandum and articles

of association, be varied or abrogated with the consent in writing of the holders of three-fourth of the issued shares of that class

or with the sanction of a special resolution passed at a general meeting of the holders of the shares of that class.

Anti-Takeover

Provisions. Some provisions of our current memorandum and articles of association may discourage, delay or prevent a change of

control of our company or management that shareholders may consider favorable, including provisions that authorize our board of directors

to issue preference shares in one or more Class And to designate the price, rights, preferences, privileges and restrictions of such

preference shares without any further vote or action by our shareholders.

Exempted

Company. We are an exempted company with limited liability under the Companies Act. The Companies Act distinguishes between ordinary

resident companies and exempted companies. Any company that is registered in the Cayman Islands but conducts business mainly outside

of the Cayman Islands may apply to be registered as an exempted company. The requirements for an exempted company are essentially the

same as for an ordinary company except that an exempted company:

| |

● |

does

not have to file an annual return of its shareholders with the Registrar of Companies; |

| |

|

|

| |

● |

is

not required to open its register of members for inspection; |

| |

|

|

| |

● |

does

not have to hold an annual general meeting; |

| |

|

|

| |

● |

may

issue shares with no par value; |

| |

|

|

| |

● |

may

obtain an undertaking against the imposition of any future taxation (such undertakings are usually given for 20 years in the first

instance); |

| |

|

|

| |

● |

may

register by way of continuation in another jurisdiction and be deregistered in the Cayman Islands; |

| |

|

|

| |

● |

may

register as a limited duration company; and |

| |

|

|

| |

● |

may

register as a segregated portfolio company. |

“Limited

liability” means that the liability of each shareholder is limited to the amount unpaid by the shareholder on the shares of

the company (except in exceptional circumstances, such as involving fraud, the establishment of an agency relationship or an illegal

or improper purpose or other circumstances in which a court may be prepared to pierce or lift the corporate veil).

Register

of Members

Under

Cayman Islands law, we must keep a register of members and there shall be entered therein:

| |

(a) |

the

names and addresses of the members, a statement of the shares held by each member, and of the amount paid or agreed to be considered

as paid, on the shares of each member; |

| |

(b) |

the

date on which the name of any person was entered on the register as a member; |

| |

(c) |

the

date on which any person ceased to be a member; and |

| (d) | whether voting rights are attached to the share in issue. |

Under

Cayman Islands law, the register of members of our company is prima facie evidence of the matters set out therein (i.e. the register

of members will raise a presumption of fact on the matters referred to above unless rebutted) and a member registered in the register

of members shall be deemed as a matter of Cayman Islands law to have legal title to the shares as set against its name in the register

of members. Upon the closing of this public offering, the register of members shall be immediately updated to reflect the issue of shares

by us. Once our register of members has been updated, the shareholders recorded in the register of members shall be deemed to have legal

title to the shares set against their name.

However,

there are certain limited circumstances where an application may be made to a Cayman Islands court for a determination on whether the

register of members reflects the correct legal position. Further, the Cayman Islands court has the power to order that the register of

members maintained by a company should be rectified where it considers that the register of members does not reflect the correct legal

position. If an application for an order for rectification of the register of members were made in respect of our Class A Shares or Class

B Ordinary Shares, then the validity of such shares may be subject to re-examination by a Cayman Islands court.

Preference

shares

Our

amended and restated memorandum and articles of association authorizes the issuance of 10,000,000 preference shares with such designation,

rights and preferences as may be determined from time to time by our board of directors. Accordingly, our board of directors is empowered,

without shareholder approval, to issue preference shares with dividend, liquidation, redemption, voting or other rights which could adversely

affect the voting power or other rights of the holders of our Class A Shares and Class B Ordinary Shares. We may issue some or all of

the preference shares to effect a business combination. In addition, the preference shares could be utilized as a method of discouraging,

delaying or preventing a change in control of us. Although we do not currently intend to issue any preference shares, we cannot assure

you that we will not do so in the future.

Certain

Differences in Corporate Law

Cayman

Islands companies are governed by the Companies Act. The Companies Act is modeled on English Law but does not follow recent English Law

statutory enactments, and differs from laws applicable to United States corporations and their shareholders. Set forth below is a summary

of the material differences between the provisions of the Companies Act applicable to us and the laws applicable to companies incorporated

in the United States and their shareholders.

Mergers

and Similar Arrangements.

In

certain circumstances, the Companies Act allows for mergers or consolidations between two Cayman Islands companies, or between a Cayman

Islands company and a company incorporated in another jurisdiction (provided that is facilitated by the laws of that other jurisdiction).

Where

the merger or consolidation is between two Cayman Islands companies, the directors of each company must approve a written plan of merger

or consolidation containing certain prescribed information. That plan or merger or consolidation must then be authorized by either (a)

a special resolution (usually a majority of 66.6% in value) of the shareholders of each company; or (b) such other authorization, if

any, as may be specified in such constituent company’s articles of association. No shareholder resolution is required for a merger

between a parent company (i.e., a company that owns at least 90% of the issued shares of each class in a subsidiary company) and its

subsidiary company. The consent of each holder of a fixed or floating security interest of a constituent company must be obtained unless

the court waives such requirement. If the Cayman Islands Registrar of Companies is satisfied that the requirements of the Companies Act

(which includes certain other formalities) have been complied with, the Registrar of Companies will register the plan of merger or consolidation.

Where

the merger or consolidation involves a foreign company, the procedure is similar, save that with respect to the foreign company, the

director of the Cayman Islands company is required to make a declaration to the effect that, having made due enquiry, he is of the opinion

that the requirements set out below have been met: (i) that the merger or consolidation is permitted or not prohibited by the constitutional

documents of the foreign company and by the laws of the jurisdiction in which the foreign company is incorporated, and that those laws

and any requirements of those constitutional documents have been or will be complied with; (ii) that no petition or other similar proceeding

has been filed and remains outstanding or order made or resolution adopted to wind up or liquidate the foreign company in any jurisdictions;

(iii) that no receiver, trustee, administrator or other similar person has been appointed in any jurisdiction and is acting in respect

of the foreign company, its affairs or its property or any part thereof; (iv) that no scheme, order, compromise or other similar arrangement

has been entered into or made in any jurisdiction whereby the rights of creditors of the foreign company are and continue to be suspended

or restricted.

Where

the surviving company is the Cayman Islands company, the director of the Cayman Islands company is further required to make a declaration

to the effect that, having made due enquiry, he is of the opinion that the requirements set out below have been met: (i) that the foreign

company is able to pay its debts as they fall due and that the merger or consolidated is bona fide and not intended to defraud unsecured

creditors of the foreign company; (ii) that in respect of the transfer of any security interest granted by the foreign company to the

surviving or consolidated company (a) consent or approval to the transfer has been obtained, released or waived; (b) the transfer is

permitted by and has been approved in accordance with the constitutional documents of the foreign company; and (c) the laws of the jurisdiction

of the foreign company with respect to the transfer have been or will be complied with; (iii) that the foreign company will, upon the

merger or consolidation becoming effective, cease to be incorporated, registered or exist under the laws of the relevant foreign jurisdiction;

and (iv) that there is no other reason why it would be against the public interest to permit the merger or consolidation.

Where

the above procedures are adopted, the Companies Act provides for a right of dissenting shareholders to be paid a payment of the fair

value of his shares upon their dissenting to the merger or consolidation if they follow a prescribed procedure. In essence, that procedure

is as follows (a) the shareholder must give his written objection to the merger or consolidation to the constituent company before the

vote on the merger or consolidation, including a statement that the shareholder proposes to demand payment for his shares if the merger

or consolidation is authorized by the vote; (b) within 20 days following the date on which the merger or consolidation is approved by

the shareholders, the constituent company must give written notice to each shareholder who made a written objection; (c) a shareholder

must within 20 days following receipt of such notice from the constituent company, give the constituent company a written notice of his

intention to dissent including, among other details, a demand for payment of the fair value of his shares; (d) within seven days following

the date of the expiration of the period set out in paragraph (b) above or seven days following the date on which the plan of merger

or consolidation is filed, whichever is later, the constituent company, the surviving company or the consolidated company must make a

written offer to each dissenting shareholder to purchase his shares at a price that the company determines is the fair value and if the

company and the shareholder agree the price within 30 days following the date on which the offer was made, the company must pay the shareholder

such amount; if the company and the shareholder fail to agree a price within such 30 day period, within 20 days following the date on

which such 30 day period expires, the company (and any dissenting shareholder) must file a petition with the Cayman Islands Grand Court

to determine the fair value and such petition must be accompanied by a list of the names and addresses of the dissenting shareholders

with whom agreements as to the fair value of their shares have not been reached by the company. At the hearing of that petition, the

court has the power to determine the fair value of the shares together with a fair rate of interest, if any, to be paid by the company

upon the amount determined to be the fair value. Any dissenting shareholder whose name appears on the list filed by the company may participate

fully in all proceedings until the determination of fair value is reached. These rights of a dissenting shareholder are not available

in certain circumstances, for example, to dissenters holding shares of any class in respect of which an open market exists on a recognized

stock exchange or recognized interdealer quotation system at the relevant date or where the consideration for such shares to be contributed

are shares of any company listed on a national securities exchange or shares of the surviving or consolidated company.

Moreover,

Cayman Islands law also has separate statutory provisions that facilitate the reconstruction or amalgamation of companies in certain

circumstances, schemes of arrangement will generally be more suited for complex mergers or other transactions involving widely held companies,

commonly referred to in the Cayman Islands as a “scheme of arrangement” which may be tantamount to a merger. In the event

that a merger was sought pursuant to a scheme of arrangement (the procedure of which are more rigorous and take longer to complete than

the procedures typically required to consummate a merger in the United States), the arrangement in question must be approved by a majority

in number of each class of shareholders and creditors with whom the arrangement is to be made and who must in addition represent three-fourths

in value of each such class of shareholders or creditors, as the case may be, that are present and voting either in person or by proxy

at a meeting, or meeting summoned for that purpose. The convening of the meetings and subsequently the terms of the arrangement must

be sanctioned by the Grand Court of the Cayman Islands. While a dissenting shareholder would have the right to express to the court the

view that the transaction should not be approved, the court can be expected to approve the arrangement if it satisfies itself that:

| |

● |

we

are not proposing to act illegally or beyond the scope of our corporate authority and the statutory provisions as to majority vote

have been complied with; |

| |

● |

the

shareholders have been fairly represented at the meeting in question; |

| |

● |

the

arrangement is such as a businessman would reasonably approve; and |

| |

● |

the

arrangement is not one that would more properly be sanctioned under some other provision of the Companies Act or that would amount

to a “fraud on the minority.” |

If

a scheme of arrangement or takeover offer (as described below) is approved, any dissenting shareholder would have no rights comparable

to appraisal rights, which would otherwise ordinarily be available to dissenting shareholders of U.S. corporations, providing

rights to receive payment in cash for the judicially determined value of the shares.

Squeeze-out

Provisions.

When

a takeover offer is made and accepted by holders of 90% of the shares to whom the offer relates within four months, the offeror may,

within a two-month period, require the holders of the remaining shares to transfer such shares on the terms of the offer. An objection

can be made to the Grand Court of the Cayman Islands but this is unlikely to succeed unless there is evidence of fraud, bad faith, collusion

or inequitable treatment of the shareholders.

Further,

transactions similar to a merger, reconstruction and/or an amalgamation may in some circumstances be achieved through other means to

these statutory provisions, such as a share capital exchange, asset acquisition or control, through contractual arrangements, of an operating

business.

Shareholders’

Suits.

Maples

and Calder (Cayman ) LLP, our Cayman Islands legal counsel, is not aware of any reported class action having been brought in a

Cayman Islands court. Derivative actions have been brought in the Cayman Islands courts, and the Cayman Islands courts have

confirmed the availability for such actions. In most cases, we will be the proper plaintiff in any claim based on a breach of duty

owed to us, and a claim against (for example) our officers or directors usually may not be brought by a shareholder. However, based

both on Cayman Islands authorities and on English authorities, which would in all likelihood be of persuasive authority and be

applied by a court in the Cayman Islands, exceptions to the foregoing principle apply in circumstances in which:

| |

● |

a

company is acting, or proposing to act, illegally or beyond the scope of its authority; |

| |

● |

the

act complained of, although not beyond the scope of the authority, could be effected if duly authorized by more than the number of

votes which have actually been obtained; or |

| |

● |

those

who control the company are perpetrating a “fraud on the minority.” |

A

shareholder may have a direct right of action against us where the individual rights of that shareholder have been infringed or are about

to be infringed.

Enforcement

of civil liabilities.

The

Cayman Islands has a different body of securities laws as compared to the United States and may provide less protection to investors.

Additionally, Cayman Islands companies may not have standing to sue before the Federal courts of the United States.

We

were advised by Maples and Calder (Cayman) LLP, our Cayman Islands legal counsel, that the courts of the Cayman Islands are unlikely

(i) to recognize or enforce against us judgments of courts of the U.S. predicated upon the civil liability provisions of the federal

securities laws of the U.S. or any state; and (ii) in original actions brought in the Cayman Islands, to impose liabilities against

us predicated upon the civil liability provisions of the federal securities laws of the U.S. or any state, so far as the liabilities

imposed by those provisions are penal in nature. In those circumstances, although there is no statutory enforcement in the Cayman

Islands of judgments obtained in the U.S., the courts of the Cayman Islands will recognize and enforce a foreign money judgment of a

foreign court of competent jurisdiction without retrial on the merits based on the principle that a judgment of a competent foreign

court imposes upon the judgment debtor an obligation to pay the sum for which judgment has been given provided certain conditions

are met. For a foreign judgment to be enforced in the Cayman Islands, such judgment must be final and conclusive and for a

liquidated sum, and must not be in respect of taxes or a fine or penalty, inconsistent with a Cayman Islands judgment in respect of

the same matter, impeachable on the grounds of fraud or obtained in a manner, and or be of a kind the enforcement of which is,

contrary to natural justice or the public policy of the Cayman Islands (awards of punitive or multiple damages may well be held to

be contrary to public policy). A Cayman Islands Court may stay enforcement proceedings if concurrent proceedings are being brought

elsewhere.

Special

Considerations for Exempted Companies.

We

are an exempted company with limited liability under the Companies Act. The Companies Act distinguishes between ordinary resident companies

and exempted companies. Any company that is registered in the Cayman Islands but conducts business mainly outside of the Cayman Islands

may apply to be registered as an exempted company. The requirements for an exempted company are essentially the same as for an ordinary

company except for the exemptions and privileges listed below:

| |

● |

annual

reporting requirements are minimal and consist mainly of a statement that the company has conducted its operations mainly outside

of the Cayman Islands and has complied with the provisions of the Companies Act; |

| |

● |

an

exempted company’s register of members is not open to inspection; |

| |

● |

an

exempted company does not have to hold an annual general meeting; |

| |

● |

an

exempted company may issue negotiable or bearer shares or shares with no par value; |

| |

● |

an

exempted company may obtain an undertaking against the imposition of any future taxation (such undertakings are usually given for

20 years in the first instance); |

| |

● |

an

exempted company may register by way of continuation in another jurisdiction and be deregistered in the Cayman Islands; |

| |

● |

an

exempted company may register as a limited duration company; and |

| |

● |

an

exempted company may register as a segregated portfolio company. |

“Limited liability” means that

the liability of each shareholder is limited to the amount unpaid by the shareholder on the shares of the company (except in

exceptional circumstances, such as involving fraud, the establishment of an agency relationship or

an illegal or improper purpose or

other circumstances in which a court may be prepared to pierce or lift the corporate veil).

Vstock

Transfer, LLC is the transfer agent and registrar for our Class A Shares and Class B Ordinary Shares. Its principal office is at 18 Lafayette

Place, Woodmere, New York 11598.

ENFORCEABILITY

OF CIVIL LIABILITIES

We

are a Cayman Islands company incorporated on November 3, 2017 as an exempted company with limited liability. Exempted companies are Cayman

Islands companies wishing to conduct business outside the Cayman Islands and, as such, are exempted from complying with certain provisions

of the Companies Act. As an exempted company, we have applied for and received a tax exemption undertaking from the Cayman Islands government

that, in accordance with section 6 of the Tax Concessions Law (As Revised) of the Cayman Islands, for a period of 20 years from the date

of the undertaking, no law which is enacted in the Cayman Islands imposing any tax to be levied on profits, income, gains or appreciations

shall apply to us or our operations and, in addition, that no tax to be levied on profits, income, gains or appreciations or which is

in the nature of estate duty or inheritance tax shall be payable (i) on or in respect of our shares, debentures or other obligations

or (ii) by way of the withholding in whole or in part of a payment of dividend or other distribution of income or capital by us to our

shareholders or a payment of principal or interest or other sums due under a debenture or other obligation of us.

All

of our assets are located in the PRC. In addition, a majority of our directors and officers are nationals or residents of the PRC and

all or a substantial portion of their assets are located outside the United States. As a result, it may be difficult for investors to