false

FY

0001866816

0001866816

2023-01-01

2023-12-31

0001866816

OLIT:CommonStockParValue0.0001PerShareMember

2023-01-01

2023-12-31

0001866816

OLIT:RedeemableWarrantsExercisableForCommonStockAtExercisePriceOf11.50PerShareSubjectToAdjustmentMember

2023-01-01

2023-12-31

0001866816

2023-12-31

0001866816

2024-05-22

0001866816

2022-01-01

2022-12-31

0001866816

2022-12-31

0001866816

us-gaap:RelatedPartyMember

2023-12-31

0001866816

us-gaap:RelatedPartyMember

2022-12-31

0001866816

us-gaap:CommonStockMember

2021-12-31

0001866816

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001866816

us-gaap:RetainedEarningsMember

2021-12-31

0001866816

OLIT:LoanToStockholderMember

2021-12-31

0001866816

OLIT:SubscriptionReceivableMember

2021-12-31

0001866816

2021-12-31

0001866816

us-gaap:CommonStockMember

2022-12-31

0001866816

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001866816

us-gaap:RetainedEarningsMember

2022-12-31

0001866816

OLIT:LoanToStockholderMember

2022-12-31

0001866816

OLIT:SubscriptionReceivableMember

2022-12-31

0001866816

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001866816

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001866816

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001866816

OLIT:LoanToStockholderMember

2022-01-01

2022-12-31

0001866816

OLIT:SubscriptionReceivableMember

2022-01-01

2022-12-31

0001866816

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001866816

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001866816

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001866816

OLIT:LoanToStockholderMember

2023-01-01

2023-12-31

0001866816

OLIT:SubscriptionReceivableMember

2023-01-01

2023-12-31

0001866816

us-gaap:CommonStockMember

2023-12-31

0001866816

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001866816

us-gaap:RetainedEarningsMember

2023-12-31

0001866816

OLIT:LoanToStockholderMember

2023-12-31

0001866816

OLIT:SubscriptionReceivableMember

2023-12-31

0001866816

OLIT:ELRAssociatesLLCMember

2023-12-31

0001866816

OLIT:ELRAssociatesLLCMember

2022-12-31

0001866816

OLIT:ELRAssociatesLLCMember

2023-01-01

2023-12-31

0001866816

OLIT:ELRAssociatesLLCMember

2022-01-01

2022-12-31

0001866816

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

OLIT:ThreeCustomerMember

2023-01-01

2023-12-31

0001866816

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

OLIT:ThreeCustomerMember

2022-01-01

2022-12-31

0001866816

us-gaap:MachineryAndEquipmentMember

2023-12-31

0001866816

OLIT:BuildingAndLeaseholdImprovementsMember

srt:MinimumMember

2023-12-31

0001866816

OLIT:BuildingAndLeaseholdImprovementsMember

srt:MaximumMember

2023-12-31

0001866816

us-gaap:OfficeEquipmentMember

srt:MinimumMember

2023-12-31

0001866816

us-gaap:OfficeEquipmentMember

srt:MaximumMember

2023-12-31

0001866816

us-gaap:ToolsDiesAndMoldsMember

srt:MinimumMember

2023-12-31

0001866816

us-gaap:ToolsDiesAndMoldsMember

srt:MaximumMember

2023-12-31

0001866816

us-gaap:VehiclesMember

2023-12-31

0001866816

us-gaap:MachineryAndEquipmentMember

2022-12-31

0001866816

us-gaap:LandBuildingsAndImprovementsMember

2023-12-31

0001866816

us-gaap:LandBuildingsAndImprovementsMember

2022-12-31

0001866816

us-gaap:LandMember

2023-12-31

0001866816

us-gaap:LandMember

2022-12-31

0001866816

us-gaap:OfficeEquipmentMember

2023-12-31

0001866816

us-gaap:OfficeEquipmentMember

2022-12-31

0001866816

us-gaap:ToolsDiesAndMoldsMember

2023-12-31

0001866816

us-gaap:ToolsDiesAndMoldsMember

2022-12-31

0001866816

us-gaap:VehiclesMember

2022-12-31

0001866816

OLIT:AssetsNotPlacedInServiceMember

2023-12-31

0001866816

OLIT:AssetsNotPlacedInServiceMember

2022-12-31

0001866816

2023-01-01

0001866816

2022-01-01

0001866816

OLIT:ProductsMember

2023-01-01

2023-12-31

0001866816

OLIT:ProductsMember

2022-01-01

2022-12-31

0001866816

OLIT:CustomToolingMember

2023-01-01

2023-12-31

0001866816

OLIT:CustomToolingMember

2022-01-01

2022-12-31

0001866816

OLIT:NonRecurringEngineeringMember

2023-01-01

2023-12-31

0001866816

OLIT:NonRecurringEngineeringMember

2022-01-01

2022-12-31

0001866816

OLIT:ProductsMember

2023-01-01

2023-12-31

0001866816

OLIT:ProductsMember

2022-01-01

2022-12-31

0001866816

OLIT:CommunicationMember

2023-01-01

2023-12-31

0001866816

OLIT:CommunicationMember

2022-01-01

2022-12-31

0001866816

OLIT:DefenseMember

2023-01-01

2023-12-31

0001866816

OLIT:DefenseMember

2022-01-01

2022-12-31

0001866816

OLIT:MedicalMember

2023-01-01

2023-12-31

0001866816

OLIT:MedicalMember

2022-01-01

2022-12-31

0001866816

2023-11-07

0001866816

2023-11-07

2023-11-07

0001866816

OLIT:ThresholdOneMember

2023-11-07

2023-11-07

0001866816

OLIT:ThresholdTwoMember

2023-11-07

2023-11-07

0001866816

OLIT:ThresholdThreeMember

2023-11-07

2023-11-07

0001866816

srt:MinimumMember

us-gaap:MeasurementInputSharePriceMember

2023-12-31

0001866816

srt:MaximumMember

us-gaap:MeasurementInputSharePriceMember

2023-12-31

0001866816

us-gaap:MeasurementInputDiscountRateMember

srt:MinimumMember

2023-12-31

0001866816

us-gaap:MeasurementInputDiscountRateMember

srt:MaximumMember

2023-12-31

0001866816

OLIT:OmnilitAcquisitionCorpTrustMember

2023-11-07

0001866816

OLIT:OmnilitAcquisitionCorpMember

2023-11-07

0001866816

2022-01-01

2022-09-30

0001866816

us-gaap:LicensingAgreementsMember

2023-12-31

0001866816

OLIT:StockholdersMember

1999-12-31

0001866816

OLIT:StockholdersMember

2022-01-01

2022-12-31

0001866816

us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember

2023-01-01

2023-12-31

0001866816

us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember

2023-12-31

0001866816

OLIT:CitizensBankTermNotePayableMember

2023-12-31

0001866816

OLIT:CitizensBankTermNotePayableMember

2022-12-31

0001866816

OLIT:USSmallBusinessAdministrationTermNotePayableMember

2023-12-31

0001866816

OLIT:USSmallBusinessAdministrationTermNotePayableMember

2022-12-31

0001866816

OLIT:CitizensBankTermNotePayableTwoMember

2023-12-31

0001866816

OLIT:CitizensBankTermNotePayableTwoMember

2022-12-31

0001866816

OLIT:CitizensBankMortgageNotePayableMember

2023-12-31

0001866816

OLIT:CitizensBankMortgageNotePayableMember

2022-12-31

0001866816

OLIT:MAndTBankTermNotePayableMember

2023-12-31

0001866816

OLIT:MAndTBankTermNotePayableMember

2022-12-31

0001866816

OLIT:USSmallBusinessAdministrationTermNotePayableTwoMember

2023-12-31

0001866816

OLIT:USSmallBusinessAdministrationTermNotePayableTwoMember

2022-12-31

0001866816

OLIT:CitizensBankTermNotePayableMember

2023-01-01

2023-12-31

0001866816

OLIT:USSmallBusinessAdministrationTermNotePayableMember

2023-01-01

2023-12-31

0001866816

OLIT:CitizensBankTermNotePayableTwoMember

2023-01-01

2023-12-31

0001866816

OLIT:CitizensBankMortgageNotePayableMember

2023-01-01

2023-12-31

0001866816

OLIT:MAndTBankTermNotePayableMember

2023-01-01

2023-12-31

0001866816

OLIT:USSmallBusinessAdministrationTermNotePayableTwoMember

2023-01-01

2023-12-31

0001866816

OLIT:LiabilitiesMember

2023-12-31

0001866816

OLIT:LiabilitiesMember

2022-12-31

0001866816

OLIT:AssetPurchaseAgreementMember

OLIT:MolexLlcMember

2023-12-11

2023-12-11

0001866816

OLIT:SWIDISCIncMember

2023-01-01

2023-12-31

0001866816

OLIT:SWIDISCIncMember

2022-01-01

2022-12-31

0001866816

us-gaap:WarrantMember

2023-12-31

0001866816

us-gaap:CommonStockMember

srt:MaximumMember

OLIT:TwentyTwentyThreeEquityIncentivePlanMember

2023-12-31

0001866816

OLIT:ELRAssociatesLLCMember

2015-07-15

2015-07-15

0001866816

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

OLIT:ThreeCustomersMember

2023-01-01

2023-12-31

0001866816

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

OLIT:ThreeCustomersMember

2023-12-31

0001866816

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

OLIT:ThreeCustomersMember

2022-01-01

2022-12-31

0001866816

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

OLIT:ThreeCustomersMember

2022-12-31

0001866816

OLIT:ELRAssociatesLLCMember

us-gaap:SubsequentEventMember

2024-03-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

OLIT:Integer

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2023

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from

Commission

file number 001-41034

SYNTEC

OPTICS HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

87-0816957 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

| 515

Lee Rd. |

|

|

| Rochester,

New York |

|

14606 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(585)

768-2513

Registrant’s

telephone number, including area code

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.0001 per share |

|

OPTX |

|

The

Nasdaq Capital Market |

| Redeemable

Warrants, exercisable for common stock at an exercise price of $11.50 per share, subject to adjustment |

|

OPTXW |

|

The

Nasdaq Capital Market |

Securities

registered pursuant to Section 12(g) of the Act: None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to Section 240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The

aggregate market value of voting stock held by non-affiliates of the Registrant on December 31, 2023, based on the closing price of $5.03

for shares of the registrant’s common stock as reported by the Nasdaq Capital Market, was approximately $184.5 million. Shares

of common stock beneficially owned by each executive officer, director, and holder of more than 10% of our common stock have been excluded

in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination

for other purposes.

As

of May 22, 2024, there were 36,688,266 shares of the registrant’s common stock, par value $0.0001 per share, issued and outstanding.

Documents

incorporated by reference:

Portions

of the registrant’s Proxy Statement relating to the 2024 Annual Meeting of Stockholders, scheduled to be filed with the Securities

and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2023, are incorporated

by reference into Part III of this Annual Report on Form 10-K.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements with respect to our

beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and future performance, and involve

known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance

or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking

statements. All statements other than statements of historical fact are statements that could be forward-looking statements. You can

identify these forward-looking statements through our use of words such as “may,” “can,” “anticipate,”

“assume,” “should,” “indicate,” “would,” “believe,” “contemplate,”

“expect,” “seek,” “estimate,” “continue,” “plan,” “point to,”

“project,” “predict,” “could,” “intend,” “target,” “potential”

and other similar words and expressions of the future.

There

are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking

statement made by us. These factors include, but are not limited to:

| |

● |

our

ability to recognize the anticipated benefits of our recent Business Combination (as defined herein), which may be affected by, among

other things, the factors listed below; |

| |

● |

our

ability to successfully increase market penetration into target markets; |

| |

● |

the

failure of the addressable markets that we intend to target to grow as expected; |

| |

● |

the

loss of any members of our senior management team or other key personnel; |

| |

● |

the

loss of any relationships with key suppliers, including suppliers in China; |

| |

● |

the

loss of any relationships with key customers; |

| |

● |

our

ability to protect our patents and other intellectual property; |

| |

● |

the

failure to successfully optimize solid-state cells or to produce commercially viable solid-state cells in a timely manner or at all,

or to scale to mass production; |

| |

● |

changes

in applicable laws or regulations; |

| |

● |

our

ability to maintain the listing of our common stock on the Nasdaq Capital Market and Public Warrants (as defined herein) on the

Nasdaq Capital Market; |

| |

● |

the

possibility that we may be adversely affected by other economic, business and/or competitive factors (including an economic slowdown

or inflationary pressures); |

| |

● |

the

impact of the COVID-19 pandemic, including any mutations or variants thereof, and its effect on business and financial conditions; |

| |

● |

our

ability to raise additional capital to fund our inorganic growth; |

| |

● |

our

ability to generate revenue from future product sales and our ability to maintain profitability; |

| |

● |

the

accuracy of our projections and estimates regarding our expenses, capital requirements, cash utilization, and need for additional

financing; |

| |

● |

developments

relating to our competitors and our industry; |

| |

● |

our

ability to engage target customers and successfully retain these customers for future orders; and |

| |

● |

our

current dependence on a single manufacturing facility. |

The

foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or

risk factors that we are faced with that may cause our actual results to differ from those anticipated in such forward-looking statements.

Please see “Part I—Item 1A—Risk Factors” for additional risks which could adversely impact our business

and financial performance.

All

forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue

reliance on any forward-looking statements, which speak only as of the date of this report or the date of the document incorporated by

reference into this report. We have no obligation, and expressly disclaims any obligation, to update, revise or correct any of the forward-looking

statements, whether as a result of new information, future events or otherwise. We have expressed our expectations, beliefs and projections

in good faith and believe they have a reasonable basis. However, we cannot assure you that our expectations, beliefs or projections will

result or be achieved or accomplished.

Part

I

Item

1. Business

All

references in this report to “Syntec Optics,” the “Company,” “we,” “us,” or

“our” mean Syntec Optics Holdings, Inc. and its subsidiaries unless stated otherwise or the context otherwise

indicates.

Overview

Syntec

Optics believes that photon enabled technologies are more than just a trend. Syntec Optics goal is to deliver impactful solutions for optics and

photonics enabled solutions globally. We believe that the innovative design for manufacturing of our optics and photonics enabling products

is ideally suited for the demands of modern OEMs who rely on opto-electronics, light enabled devices, and intelligence that require high-precision

and reliability. Ultimately, our vertically integrated advanced manufacturing platform offers our clients across several end markets

competitively priced and disruptive light-enabled technologies and sub-systems.

Syntec

Optics was formed more than two decades ago from the aggregation of three advanced manufacturing companies (Wordingham Machine Co., Inc.,

Rochester Tool and Mold, Inc. and Syntec Technologies, Inc.) that were started in the 1980s. In 2000, Syntec Technologies, Inc created

the “doing business as” name of Syntec Optics to unify the three companies’ respective offerings under a single trade

name. Wordingham Machine Co., Inc, and Rochester Tool and Mold, Inc. became wholly owned subsidiaries of Syntec Technologies, Inc. in

2018 and the three companies legally merged in December 2022 as Syntec Optics, Inc. Syntec Optics has addressed the optical needs of

customers in defense, consumer, and biomedical industries. Over the past 20 years, Syntec has been based in the Greater Rochester, New

York area, and steadily growing and developing the unifying platform. Our intellectual property is protected with a portfolio of over

4 issued and/or pending patents, with several proprietary trade secrets surrounding our advanced manufacturing techniques. One in five

employees has been with Syntec Optics for over a decade.

Syntec

Optics is vertically integrated from design and component manufacturing for lens system assembly to imaging module integration for system

solutions. Making our own tools, molding, and nanomachining allows close interaction and recut ability, enabling special techniques to

hold tolerances to sub-micron level. Syntec has assembled a world class design for manufacturability team to augment its production team

with deep expertise to fully leverage our vertical integration from component making to optics and electronics assembly. Syntec Optics

has steadily developed variety of other complementary manufacturing techniques to provide a wide suite of horizontal capabilities including

thin films deposition coatings, glass molding, polymer molding, tool-making, mechanicals manufacturing, and nanomachining.

Syntec

became a leader in the industry by pioneering polymer-based optics and then subsequently adding glass optics and optics made from other materials including crystals and metals. Polymer-based optics provide numerous advantages compared to

incumbent glass-based optics. Polymer-based optics are smaller, lower weight, lower cost, and offer very high-performance optical solutions.

For all these reasons, Syntec is able to deliver products to our clients that are lighter, smaller, and suitable for cutting edge technology

products including the newly evolving silicon photonics industry.

Our

designs and assembly processes are developed in-house in the United States. In 2016, Syntec Optics expanded its manufacturing facility to nearly 90,000 square-feet, allowing us to increase our production capacity and offer

additional advanced manufacturing processes under one roof which provide us the ability to increase sales to existing customers and increase

penetration of our end-markets. Our facility provides a streamlined, partially autonomous production process for our current customers,

which comprises optical assembly, electro-optics assembly, polymer optics molding, glass optics molding, opto-mechanical assembly, nanomachining

and thin films coating. Our facility also provides availability to expand the number of advanced manufacturing processes to handle increased

volumes of existing and new customer orders.

Syntec

had focused on three key end markets of defense, biomedical, and consumer all with several mission-critical applications with strong

tailwinds, then also added communications in 2023. We believe these end markets to be acyclical based upon the company having positive aggregate cash flow for the past

decade in spite of economic downturns. We believe the consistency of revenues over the past decade of operations, independent of the

trends of the general economy, and the mission-critical nature of our product offerings, are our bases that these markets are

acyclical. We believe our platform is well positioned as the foundation for further organic and inorganic growth with quality

earnings and high margin offerings.

According to the SPIE Optics and Photonics 2022 Industry Report, optics

is currently enabling 11% of the global economy, from smart phone cameras and extended reality devices to low orbit satellite telescopes

to keeping our soldiers safe with night vision devices and patients healthy with intelligent light. This 11% figure represents the estimated

value of the global optics and photonics products relative to annual global gross domestic product. As the world transitions to further

adopt optically and photonically enabled products, we will continue our mission of developing innovative technology to serve these markets

with affordable high-performance products globally. We intend to continue to focus on our core competencies of providing innovative technology,

expanding our brand portfolio and providing affordable, sustainable and accessible optics and photonics enablers, all while being designed

and manufactured in the United States.

Industry

Background

For

decades, optics and photonics have been enabling end market products worldwide. Syntec’s ground-breaking work in

polymer-based optics starting in 2000 has numerous advantages over the incumbent glass-based optics used in today’s markets:

| |

● |

Cost

– Possible 50-150x savings over glass |

| |

● |

Lightweight

– Ideal for head mounted applications |

| |

● |

Design

flexibility – Greater optical surface options |

| |

● |

Bio-compatible

– Medical field benefits |

| |

● |

Ease

of assembly – Ability to design in alignment features |

| |

● |

Design

in features – Eliminate mounting hardware |

| |

● |

Performs

better than glass – Functional parameters such as clarity, focus, contrast, brightness |

| |

● |

Superior

scratch resistance – Reduce damage probability |

| |

● |

Upgradability

– Reduced replacement/retrofit field cost |

| |

● |

Repeatability

– Same quality & performance every time |

Tailwinds

have propelled Syntec’s innovative hybrid optics where outside durable glass elements are unchanged but inside elements of optical

assemblies are changed to polymers providing lighter weight advantage. Soldiers want lower weight on helmets that are now overloaded

with devices.

Addressable

Markets

Optics

and Photonics Industry Report 2020 estimated that the manufacturing sector contributes 30% of global gross domestic product (“GDP”)

annually, or an estimated $26.3 trillion, and optics and photonics comprise a substantial amount of this market. The optics and photonics

market, the value of light-enabled products and services, is estimated to be between $7 trillion and $10 trillion annually, and represents

roughly 11% of the world’s economy. This 11% figure represents the estimated value of the global optics and photonics products

relative to annual global gross domestic product. Within this end-market, it is estimated that global annual revenue for photonics-enabled

products and services had exceeded $2 trillion in 2019. Photonics touches most sectors of our economy including consumer electronics

(barcode scanners, DVD players, TV remote controls), telecommunications (fiber optics, lasers, switches), health (eye surgery, biomedical

instruments, and imaging), industrial (laser cutting and machining), Defense and Security (night vision, infrared cameras, remote sensing,

aiming) and entertainment (holography and cinema projection). We believe accelerating optics and photonics innovation will continue to

drive economic growth and increase its share of the global GDP.

The

most recent review from the Optics & Photonics 2020 Industry Report valued the 2019 photonics-enabled products and services at $2.02

trillion – an increase of 34% over the seven-year period, and a compound annual growth (CAGR) rate of 4.2%, from 2012 to 2019,

shown below by end market.

The

potential use of photonics in varied industries is fueling growth of the optics and photonics market. We believe sectors including telecom,

transportation, healthcare, energy, aerospace, security, defense & space exploration, consumer, retail, electronics, food & agriculture,

artificial intelligence software, and robotics are in the early stages of a dramatic transformation of scope and scale due to the unprecedented

developments in advanced manufacturing of optics and photonics products, sub-systems, components, and materials. Continued mobility,

intelligence, automation, sensing, and safety needs will accelerate in years to come, which will create a large market opportunity for

such enabling businesses at the forefront of optics and photonics. The global optics and photonics sectors have experienced demand increasing

use of photonics in various applications.

The

Optics & Photonics 2020 Industry Report estimated revenue growth for five of the top areas based on CAGR from 2012 to 2019. These areas

are listed below, as examples of verticals that we intend to focus on:

| |

● |

Sensing,

monitoring, and control (+10%), autonomous systems and the internet-of-things continued to create demand for a wide variety

of photonic sensors. Self-driving cars, drones, and other robotics systems utilize a wide range of photonic sensors and imaging systems,

some of which are increasingly benefiting from embedded artificial intelligence. Developments in the emerging field of quantum technology

should drive major advances in metrology, sensing, communications, and computing, creating what we believe will be a multitude of

new opportunities in photonics. |

| |

● |

Advanced

manufacturing (+8%), gains in this segment were led by lasers for materials processing while robotics and vision technologies

maintained their momentum as did implementation of 3D printing/additive manufacturing. Photonics-based production tools including

lasers, optical metrology, and machine vision combined with adoption of rapid prototyping and Industry 4.0 are driving big manufacturing

changes in industries like aerospace and automobiles. |

| |

|

|

| |

● |

Semiconductor

processing (+8%), driven by demand for optical processing and metrology equipment. Opto-electronics and mobility, integrated

photonics circuits are beginning to address applications that were typically addressed by integrated electronic circuits. POC Biosensing,

terabit internet, lidar based radar, and telecom are areas that are being disrupted due to reduced cost, size, weight, and power

consumption while still improving performance and reliability. Design, develop, and manufacturing processes are similar to micro-electronics.

Integrated photonics is envisioned to play the role in industry 4.0 what electronic integrated circuits did in industry 3.0. |

| |

|

|

| |

● |

BioMedical

(+13%), growth in diagnostic imaging, digital pathology, in vitro diagnostics, and point-of-care diagnostics led broad-based

gains across this segment. Food safety testing also saw a significant uptick. Looking ahead, cost-effective photonics-based diagnostic

and therapeutic biomedical devices are achieving higher market penetration. |

| |

|

|

| |

● |

Defense,

safety, and security (+10%), driven by gains in more than 30 sub-segments combined with substantial upswings in video surveillance,

perimeter security and sensing, and investment in equipment for directed energy systems. Infrared systems, hyperspectral imaging,

and laser-based countermeasures are all deployed, while laser weapons are emerging as a real near-term possibility. We believe there

may be increased demand for aiming, scoping, and targeting using optics and photonics. |

Revolutionary

Advanced Manufacturing Tailwinds

This

fourth industrial revolution (“Industry 4.0”), which encompasses the internet-of-things and smart manufacturing, marries

physical production and operations with digital technology, machine learning / artificial intelligence and big data to create a more

holistic and connected ecosystem for companies that focus on manufacturing and supply chain management. As Industry 4.0 continues to

bring changes in manufacturing, technological advancements leading to innovative photonics-enabled products, and photonics are improving

manufacturing performance with photonics-enabled technology. We expect Industry 4.0 to transform production by driving faster, more flexible

and more efficient processes which will be monetized by companies through the production of higher-quality goods at reduced costs.

Beyond

the traditional industrial automation, new transforming products from unmanned aircrafts and driverless cars, smart robots in the operating

rooms and artificial intelligence of organ and tissue imaging, to augmented and virtual reality increasingly require optics and photonics

imagers, sensors, and detectors. We expect this trend to be especially pronounced in the United States, which has seen automation as

a way to be globally competitive in spite of rising wages.

Optics

and photonics are an integral aspect of the ongoing advancement of traditional manufacturing and industrial practices. Optics and photonics

can reduce cost, size, weight, and power consumption in all spheres of technology that is making us smarter. These include our content,

its context, inter-connection for exchange, and various types of content – from imaging to detection and sensing.

Syntec

Platform Overview

Our

unifying platform is a key differentiator. We believe the unifying platform is an aggregation of horizontal and vertical optics and photonics

capabilities that span through the value-chain across materials, spectrum and advanced manufacturing processes. This unifying platform

works by providing customers with several manufacturing capabilities in one location that saves time and reduces logistical burdens and

costs. Adding with the acquisition of Wordingham in 1999 to the base platform of Syntec brought precision machining capabilities for

difficult to manufacture mechanical components for optics and photonics. The acquisition of Rochester Tool and Mold provided control

over making very precise tools for molded polymer components and molded glass components in hybrid systems. Close collaboration of these

acquired entities began in 2000 and then all three acquired companies moved into one building in the city of Rochester by 2016. Investments

from the cash flow and the unification was achieved to offer customers vertical and horizontal integrated critical capabilities under

one-roof for mission critical sub-system solutions with well demonstrated metrology in both clean room optics and electro-optics assemblies.

Thin film coating laboratory and glass molding technique was developed from grounds up organically to further support the optical element

performances. Altogether, such a vertically and horizontal integrated company offers a further unification platform for consolidation

through further acquisition in a fragmented industry of advanced manufacturers for mission critical application of optics and photonics

even beyond biomedical, defense, and consumer end markets.

Syntec

Optics has built its brand over two decades and is known as a leader to OEMs in optics and photonics sub-systems production. We won the

Accelerator Award in 2004 from Raytheon by meeting the challenge of delivering alpha and beta samples fast and ramping up production

in groundbreaking manufacturing of components and sub-systems for laser guides for missiles. The dome was made from glass-filled polymer

that replaced Sapphire for domes that had to not only meet high optical performance expected from windows, but be light weight, less

expensive and rapidly scale. Ever since, we have ramped up rapidly many devices ranging from blood analyzers for patients in hospitals

to night vison goggles to keep soldiers safe. The brand has been very visible at the pivotal show for optics and photonics solution providers

annually in San Francisco’s Photonics West trade show.

We

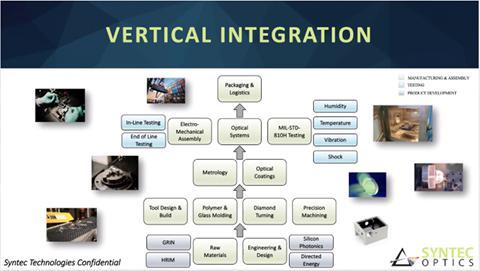

currently offer a number of vertically integrated advanced manufacturing processes that deliver to our customers optically enabled products

serving mission critical applications.

Syntec’s

vertical integration strategy delivers many advantages, including greater economies of scale, lower variable production costs, decreased

logistics costs and quality concerns. Advantages of vertical integration specific at Syntec include:

Positive

differentiation is created.

| |

● |

Vertical

integration creates predictability because more information is available to our team internally. There is more access to supply chain

and production inputs. By being in more control, from start to finish, Syntec can function with stability and adapt quickly to changes

so that the most effective and profitable results can be achieved. |

Asset

investments can focus on specialization.

| |

● |

Instead

of seeking vendors and contractors with specific skill sets, vertical integration allows us to invest into internal assets that can

specialize in the skill set that is required. This allows us to differentiate ourselves from others within its industry, creating

a specific brand message and value proposition that resonates consistently with our customer base. |

Transaction

costs are lower throughout the supply chain.

| |

● |

With

a high level of vertical integration, we can reduce the transaction costs that occur throughout our supply chain. This is done by

removing cascaded margins imposed when dealing with suppliers and vendors that are not part of our integrated process. |

Quality

assurance can be built into the system.

| |

● |

Vertical

integration allows us to put more eyes on the quality of what is being produced. From the initial supply to the final sale, a better

Q/A process within our system creates a value proposition that is more reliable. In return, greater customer satisfaction occurs,

which builds brand loyalty and return revenues. |

It

opens new markets.

| |

● |

Vertical

Integration can open new markets to the business. By partnering with or purchasing other vendors, proprietary information, property,

or technologies can create local access that may have been otherwise unavailable. When this occurs, more profits can be achieved

with a broader base of business to pursue. |

| |

● |

For

the years ended December 31, 2023 and 2022, we had $29.4 million and $27.8 million in sales, respectively. Over time, we have increased total sales through a combination of increasing penetration

of currently served end-markets, adding new end-markets and increasing the number of advanced manufacturing processes within our

unifying platform. |

Our

Competitive Strengths

We

believe that we possess the largest share in the markets we operate in, due to our following business strengths, which distinguish us

in this competitive landscape and position us to capitalize on the anticipated continued growth in the optics and photonics enabled market:

| |

○ |

Premier

Polymer-Based Optics Technology. Each of our innovative optics features custom designed components to enhance optical clarity

and performance in its particular application or setting. Syntec has assembled a world class optical and opto-mechanical design team

capable of executing on the most challenging design projects. |

| |

○ |

Extensive,

Growing Patent Portfolio. We have developed and filed patent applications on commercially relevant aspects of our business

including optical systems and production processes. To date, we have owned three active issued patents, with an additional one patent

applications pending on manufacturing techniques in the United States. |

| |

○ |

Proven

Go-To-Market Strategy. We have successfully established a direct-to-business platform and have developed strong working relationships

with Tier 1 manufacturers and major OEMs, custom designing products for new and existing applications. |

| |

○ |

Established

Customer Base with Brand Recognition. We have a growing customer base featuring OEMs, distributors, Tier 1 suppliers across

diverse end markets and mission critical applications in Defense, Consumer and BioMed. The quality of our products has helped drive

adoption from additional end markets in low earth satellite communication with visibility for future growth through further expansion

of our existing relationships. |

| |

○ |

High

Quality Manufacturing Process. Unlike competitors that outsource their manufacturing processes, our optics are designed,

assembled and tested in the United States, ensuring that our manufacturing process is thoroughly tested, and our optics are of the

highest quality. |

| |

○ |

Drop-In

Replacement. Our optics modules are largely designed to be “drop-in replacements” for traditional glass-based

optics, which means that they are designed to fit into existing frames with little or no adjustments. Our target applications are

enabling mission critical devices in demanding environments. We offer a full line of compatible components and accessories to simplify

the replacement process and provide customer service to ensure a seamless transition to Low SwaP-C optics. Over their lifetime, our

optics are significantly cheaper from both an absolute cost and a cost per optic perspective. These lifetime costs, at current costs

and capacity, will naturally drop as we continue to take advantage of economies of scale. |

Our

Growth Strategy

We

intend to leverage our competitive strengths, technology leadership and market share position to pursue our growth strategy through the

following:

| |

○ |

Expand

Product Offerings. In the short-term, our aim is to further diversify our product offerings to give consumers, as well as

OEMs and distributors, more options for additional applications. This will be accelerated by the expansion of our production capacity

through organic and inorganic growth. |

| |

○ |

Expand

End Markets. Syntec Optics plans to further consolidate the fragmented photonics industry by expanding our portfolio of our

existing, U.S.-based, advanced manufacturing processes of making thin-film coated glass, crystal, or polymer components and their

housings, which are ultimately assembled into high performance hybrid electro-optics sub-systems. By doing so, Syntec Optics plans

to grow to the new end markets of communications and sensing. Syntec entered the communications end market in 2023. Syntec Optics is currently engaged as a supplier for a U.S. Department of Commerce’s National

Institute of Standards and Technology (NIST) funded research and development project for the sensing end market. The communication

end market is characterized by the use of optics and photonics for data transmittal and reception of information, including, for

example, satellite communications and other associated applications. The sensing end-market is characterized by the use of optics

and photonics to detect scattered light or light with an altered refractive index due to the presence of a medium within a wide range

of potential applications, including, for example, disease detection and other associated applications. |

| |

○ |

Commercialize

Optics and Photonics Enabling Technology. We believe optics and photonics enabling technologies offer significant advantages

to glass optics and electronics enabled products currently on the market, with the potential to be lighter, smaller, higher-performing

and cheaper. |

Our

core growth strategy also involves inorganic growth with complementary businesses to augment our existing unifying platform. Syntec plans

to run a disciplined process to arrive at a targeted list of companies it would like to acquire. Selected companies will have a good

management team and ownership that can apply industry findings to build the next great public company that enables light. Such a company

shall serve as a platform to add more diverse end-markets, achieve stable earnings growth, and build an R&D pipeline that brings

sustainable future growth.

Optics

and photonics companies are not clearly categorized in a small number of SIC codes but Syntec’s long-term relationships with companies

led to a list of 100+ SICs where optics and photonics companies live. Quality of earnings, financial reporting, forecasting, controls,

and systems will also be use in selection process for the roll-up.

Our

Products and Technology

Syntec

has built a solid foundation over many decades of developing new processes that produce various geometries and shapes of optical

elements used in both visible and IR spectrums. Syntec started with custom polymer optics to find a foothold and then expanded into

various materials for the Biomedical, Defense & Security, and Consumer/Industrial sectors. In 2023 it added communications as an

additional end-market. Syntec is at the forefront of innovation in single point diamond turning and has been pushing the frontiers

of polymer and other materials for use in a wide variety of optics applications and requiring tight tolerances.

Syntec’s

pioneering polymer-based optics provided numerous advantages compared to incumbent products, such as glass-based optics.

Polymer-based optics are smaller sized, lower weight, lower in power consumption, and a high cost-effective optical solution.

Polymer-based optics use polymers throughout the fabrication process which offers high production volume and fast repeatability.

Other advantages of polymers are their high impact resistance; polymers do not split like glass, making this type of optics highly

durable and cost effective in applications such as heads-up displays, goggles, and biomedical disposable optics. Another key

advantage we offer customers is fast prototyping. While advanced molding techniques are used for high volume productions and beta

samples, we use nanomachining of polymers and other materials for quick alpha samples. We further increased the competitive

advantage by providing lower cost by manufacturing in-house lower cost glass molded glass. Often in cameras or optics sub-systems,

glass and polymer elements are combined a lower cost solution yet durable and higher performance.

Thanks

to their low density or low weight by volume, polymers are well adapted for making cutting-edge-technology products lighter and smaller.

Polymers are between two and half and five times lighter than comparable glass products and are suitable for difficult and sophisticated

refractive, reflective, and diffractive substrates with spherical, aspherical, and cylindrical prescriptions, thus reducing the number

of optical components needed in a given optical system. Molding is the most repeatable, consistent, and economical way to produce complex-shaped

optics in large volume or to integrate them onto a common substrate. Optical-grade polymers exhibit high light transmittance and are

comparable to high-grade glasses. The optical-grade polymer market is growing rapidly; new polymers with low birefringence as well as

higher and more stable refractive indices are available, offering design flexibility not possible with glass optics on their own.

Customers

Our

components are used in a variety of applications ranging from biometric, imaging, illumination, scanning, projection, blood analysis,

point of care diagnosis and fingerprint identification. Our components are also used in from DNA sequencing, laser cutting, thermal imaging,

to retinal eye scanning, military and blood analysis. By investing in new technology and reliable equipment Syntec Optics provides low-cost

precision solutions for challenging optical needs.

We

have deep, long-standing relationships with many of our customers. Our customers primarily utilize our products for defense and security,

optical diagnosis and imaging and projection lenses and heads-up displays. We work directly with customers to ensure compatibility with

existing designs and collaborate on custom design for new applications.

| |

○ |

Defense

Optics – night vision goggles, missile systems and military LED lighting are just a few examples of the mission critical

components used by our defense and security customers |

| |

○ |

Biophotonics

– blood gas analyzer, bacteria analyzer and HIV detectors are used in medical procedures |

| |

○ |

Communication

Optics – low earth orbit satellite transmitters, receivers and high-precision mirrors are used in high-speed data transmission

processes |

We

continue to seek to grow our customer base within our existing segments; however, we also believe that our products are well suited to

address the needs in additional segments, including semiconductor, communication, advanced manufacturing, sensing, lighting Solar-PV,

and displays and we will seek to expand our market share in these segments in the future.

Facilities

Our

corporate headquarters is in an approximately 90 thousand square foot facility that we lease in Rochester, New York.

The lease expires in May 2025, and we have the option to extend for an additional five-year period. We believe we will be able to obtain

additional space on commercially reasonable terms.

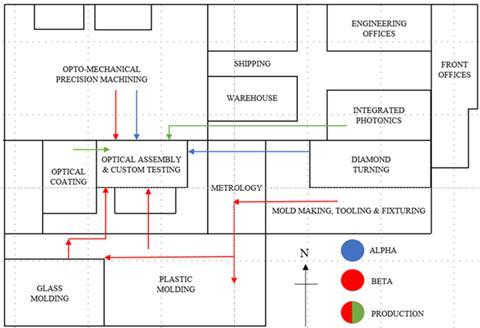

Our

manufacturing departments and respective activity is shown below. In addition, the flow of materials and knowledge between departments

for Alpha, Beta, and production are shown in the facilities chart.

Supplier

Relationships

We

have a well-established global supply chain that underlies the sourcing of the components of our products, although we source domestically

whenever possible. We follow a lean manufacturing process and align our purchases with customer backlog. We prefer to pre-order in advance

for the year to ensure adequate supply. For nearly all our components, we ensure that we have alternate suppliers available. As a result

of our long-standing relationships with our suppliers, we are able to source materials on favorable terms within reasonable lead-times.

Sales

and Marketing

Our

proven sales and marketing strategy has allowed us to penetrate our current end markets efficiently. We use a variety of methods to educate

consumers on the benefits of optics and photonics-enabled technologies and why they are a better investment compared to electronically

enabled technologies found in our target end markets today. Through information found on our website and social media platforms that

educate consumers on the benefits of optics and photonics-enabled technologies, we assist consumers on how they may benefit from the

advanced manufacturing processes and technologies that we offer.

We

use a multi-pronged sales and marketing strategy to ensure that the Syntec Optics brand is at the forefront of its respective end markets.

We have established strong relationships, particularly in the defense and biomedical industries through participation in trade shows

and other sponsored industry events, which have allowed us to reach customers to ensure we are aware of evolving customer preferences.

We are then able to leverage this customer feedback to collaborate on custom designs for new and existing applications.

We

value our customer relationships. Our website and our customer service are key elements to our sales strategy. Our website enables customers

to purchase off the shelf optics and provides access to a range of product information, technical benefits, and advanced manufacturing

services. We have a team of experts dedicated to supporting our customers’ sales, technical and service needs.

Competition

Syntec

is a vertically integrated advanced manufacturer of optics and photonics. At the public company level, competitors may have Syntec’s

suite of advanced manufacturing techniques under its corporate umbrella, but not likely under the same roof. This differentiation allows

Syntec to successfully serve OEM and Tier 1 suppliers in the Defense, Biomedical and Consumer/Industrial end markets.

Advanced

manufacturers in the optics and photonics space enable end-products generally through a combination of materials, electromagnetic spectrum

or processes. Many of Syntec’s competitors specialize in aspects of these three areas and may not have in-house capabilities across

all three areas. For example, some of Syntec’s competitors specialize in precision motion optics, vision specialists, high-resolution

spectral cameras, electro-optical aerospace systems and or machine vision systems. Syntec can provide solutions to each of these specialty

areas by deploying its highly trained employee base and its patented intellectual property and trade secret processes.

In

certain instances, Syntec may collaborate on design and development of mission critical sub-components in its competitors’ products

given its broad advanced manufacturing capabilities. Syntec is excited to bring its unifying value proposition to the public market.

Intellectual

Property

The

success of our business and our technology leadership is supported by our proprietary optics and photonics enabling advanced manufacturing

processes and technologies. We have received patents and filed patent applications in the United States and other jurisdictions to provide

protection for our technology. We rely upon a combination of patent, trademark and trade secret laws in the United States and other jurisdictions,

as well as license agreements and other contractual protections, to establish, maintain and enforce rights in our proprietary technologies.

In addition, we seek to protect our intellectual property rights through non-disclosure and invention assignment agreements with our

employees and consultants and through non-disclosure agreements with business partners and other third parties.

As

of December 31, 2023 and as of December 31, 2022, we owned three active issued patents and one pending patent applications. The patents and patent applications

cover the United States. We periodically review and update our patent portfolio to protect our products and newly developed

technologies.

US

Patent 9192298B2 “Contact lens for intraocular pressure measurement” is an active worldwide application patent that is assigned

to and owned by Syntec Optics. The patent was granted November 2015 and expires April 2034.

US

Patent 10052731B2 “Flycutter having forced air cleaning” is an active worldwide application patent that is assigned to and

owned by Syntec Optics. The patent was granted August 2018 and expires December 2036.

US

Patent 11383414B2 “Parts degating apparatus using laser” is an active worldwide application patent that is assigned to and

owned by Syntec Optics. The patent was granted July 2022 and expires August 2040.

US

Patent Provisional 63/449,362 “Imaging Apparatus with Thermal Augmentation” is a provisional United States application. The

provisional patent application was filed on March 2, 2023.

We

periodically review our development efforts to assess the existence and patentability of new intellectual property. We pursue the registration

of our domain names and trademarks and service marks in the United States and other jurisdictions.

Government

Regulations

We

currently operate from a dedicated leased manufacturing facility located in Rochester, New York. We have never owned any facility at

which we operated. Operations at our facilities are subject to a variety of environmental, health and safety regulations, including those

governing the generation, handling, storage, use transportation, and disposal of hazardous materials. To conduct our operations, we have

to obtain environmental, health and safety permits and registrations and prepare plans. We are subject to inspections and possible citations

by federal, state, and local environmental, health, and safety regulators. We have policies in place to assure compliance with our obligations

(for example, machine guarding, hot work, hazardous material management and transportation). We train our employees and conduct audits

of our operations to assess our fulfillment of these policies.

We

are also subject to laws imposing liability for the clean up and release of hazardous substances. Under the law, we can be liable even

if we did not cause a release on real property that we lease. We believe we have taken commercially reasonable steps to avoid such liability

with respect to our current leased facilities.

Environmental

Matters

We

are subject to domestic and foreign environmental laws and regulations governing our operations, including, but not limited to, emissions

into the air and water and the use, handling, disposal and remediation of hazardous substances. A certain risk of environmental liability

is inherent in our production activities, operation of our systems and the disposal of our systems. These laws and regulations govern,

among other things, the generation, use, storage, registration, handling and disposal of chemicals and waste materials, the presence

of specified substances in electrical products, the emission and discharge of hazardous materials into the ground, air or water, the

clean up of contaminated sites, including any contamination that results from spills due to our failure to properly dispose of chemicals

and other waste materials and the health and safety of our employees.

Export

and Trade Matters

We

are subject to anti-corruption laws and regulations imposed by governments around the world with jurisdiction over our operations, including

the U.S. Foreign Corrupt Practices Act, as well as the laws of the countries where we do business. We are also subject to various trade

restrictions, including trade and economic sanctions and export controls, imposed by governments around the world with jurisdiction over

our operations. For example, in accordance with trade sanctions administered by the U.S. Department of Treasury’s Office of Foreign

Assets Control and export controls administered by the U.S. Department of Commerce, we are prohibited from engaging in transactions involving

certain persons and certain designated countries or territories, including Cuba, Iran, Syria, North Korea and the Crimea Region of Ukraine.

In addition, our systems may be subject to export regulations that can involve significant compliance time and may add additional overhead

cost to our systems. In recent years the United States government has a renewed focus on export matters. For example, the Export Control

Reform Act of 2018 and regulatory guidance thereunder have imposed additional controls and may result in the imposition of further additional

controls, on the export of certain “emerging and foundational technologies.” Our current and future systems may be subject

to these heightened regulations, which could increase our compliance costs.

See

“Risk Factors—We are subject to U.S. and foreign anti-corruption and anti-money laundering laws and regulations and could

face criminal liability and other serious consequences for violations, which could adversely affect our business, financial condition

and results of operations” for additional information about the anti-corruption and anti-money laundering laws that may affect

our business.

Legal

Proceedings

We

may be subject from time to time to various claims, lawsuits and other legal and administrative proceedings arising in the ordinary course

of business. Some of these claims, lawsuits and other proceedings may involve highly complex issues that are subject to substantial uncertainties,

and could result in damages, fines, penalties, non-monetary sanctions or relief. We intend to recognize provisions for claims or pending

litigation when we determine that an unfavorable outcome is probable, and the amount of loss can be reasonably estimated. Due to the

inherent uncertain nature of litigation, the ultimate outcome or actual cost of settlement may materially vary from estimates.

See

“Risk Factors—Any future litigation against us could be costly and time-consuming to defend.”

Employees

and Human Capital Resources

As

of December 31, 2023, we have 148 employees. We have adopted our Code of Ethics to support and protect our culture, and

we strive to create a workplace culture in line with our values: “Integrity”, “Humility”, “Innovation”,

“Discipline”, and “Continuous Improvement” and help our customers “Change the way the world views itself,

one optic at a time.” As part of our initiative to retain and develop our talent, we focus on these key areas:

| ○ |

Safety

– Employees are regularly educated on safety around their workspaces, and employees participate in volunteer roles

on a safety committee, and in emergency readiness roles. We have a dedicated safety coordinator who tracks and measures our performance

and helps us benchmark our safety programs against our peers. |

| ○ |

Diversity,

Equity & Inclusion – Our culture has benefitted from the diversity of our workforce from the very beginning. Inclusion

and equity are “baked into the bricks” of our values, which our employees demonstrate every day. Our human resource department

and all our corporate officers and directors have an open-door policy and are able to constructively communicate with employees to

resolve issues when they arise. |

| |

|

| ○ |

Collaboration

– As we grow, opportunities for cross-functional collaboration may not be as organic as they used to be. We have responded

to that challenge by staying mindful and acting intentionally to gather cross-functional input on new initiatives and continuous

improvement efforts. |

| |

|

| ○ |

Continuous

Improvement – We apply continuous improvement measure to processes as well as people. We encourage professional development

of our employees, through ongoing learning, credentialing, and collaboration with their industry peers. |

Attracting

and retaining high quality talent at every level of our business is crucial to our continuing success. We have developed relationships

with the University of Rochester to further our recruitment reach. We provide competitive compensation and benefit packages, including

performance-based compensation that rewards individual and organizational achievements.

The

Business Combination

On

November 7, 2023 (the “Closing Date”), Syntec Optics Holdings, Inc., a Delaware corporation (the “Company”)

(f/k/a OmniLit Acquisition Corp. (“OmniLit”)), consummated the previously announced merger (the “Closing”)

pursuant to the Business Combination Agreement, dated May 9, 2023, (the “Business Combination Agreement”), by and

among OmniLit, Optics Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of OmniLit (“Merger Sub”),

and Syntec Optics, Inc., a Delaware corporation (“Legacy Syntec”). OmniLit’s stockholders approved the Transactions

(as defined below) at an annual meeting of stockholders held on October 31, 2023 (the “Annual Meeting”).

Pursuant

to the Business Combination Agreement, Merger Sub merged with and into Legacy Syntec (the “Merger” and, together with

the other transactions contemplated by the Business Combination Agreement, the “Transactions”), with Legacy Syntec

continuing as the surviving corporation in the Merger and a wholly-owned subsidiary of OmniLit. On the Closing Date, the registrant changed

its name from OmniLit Acquisition Corp. to Syntec Optics Holdings, Inc.

Merger

Consideration

At

the Closing, by virtue of the Merger and without any action on the part of OmniLit, Merger Sub, Legacy Syntec or the holders of any of

the following securities:

| |

(a) |

Each

outstanding share of Legacy Syntec’s common stock, par value $0.001 per share (“Legacy Syntec Common Stock”),

converted into (i) a certain number of shares of the Company’s common stock, par value $0.0001 per share (“Common

Stock”), totaling 31,600,000 shares (including the conversion and assumption of the options to purchase shares of Legacy

Syntec Common Stock described below), which is equal to (x) $316,000,000 divided by (y) $10.00 (the “Merger Consideration”)

and (ii) the contingent right to receive Earnout Shares (as defined below) (which may be zero) following the Closing. |

Earnout

Merger Consideration

In

addition to the Merger Consideration set forth above, additional contingent shares (“Contingent Earnout Shares”) may

be payable to each holder of shares of Legacy Syntec Common Stock in the Merger, subject to achieving specified milestones, up to an

aggregate of 26,000,000 additional shares of Common Stock in three tranches.

Syntec Optics Holdings, Inc.

will issue 26,000,000 additional shares of Common Stock (the “Contingent Earnout”) to Legacy Syntec’s existing stockholders

at the Closing, which Contingent Earnout shares will vest upon achievement of the targets set forth in Section 3.4(b) of the Business

Combination Agreement. The Contingent Earnout shares will vest upon the Company’s Common Stock achieving the following stock trading

price thresholds (the “Contingent Earnout Trigger Price”) following the Closing: one-third (1/3rd) at $12.50 per

share, one-third (1/3rd) at $14.00 per share, and one-third (1/3rd) at $15.50 per share (as adjusted for stock

splits, stock dividends, reorganizations, recapitalizations and the like). The Contingent Earnout shares which remain unvested as of

the date five (5) years from the Closing (the “Earnout Period”) will be deemed cancelled and no longer subject to vesting.

The achievement of the Contingent Earnout Trigger Price will be based on either (a) the closing price of the Company’s common stock

equaling or exceeding the specified threshold for twenty (20) trading days within any thirty (30)-trading day period following the Closing,

or (b) upon the consummation of a change of control transaction in which the per share price implied in such change of control transaction

is greater than or equal to the applicable threshold. All Contingent Earnout shares will be issued pro rata to Legacy Syntec stockholders

in proportion to their owned shares of Legacy Syntec common stock immediately prior to the Closing.

Syntec

Optics Holdings, Inc. will issue up to 2,000,000 shares of Common Stock (the “Performance-based-Earnout”) to

members of the management team of the Company from time to time, to the extent determined by the Board of Directors in its sole

discretion, to be issued as restricted stock units or incentive equity grants pursuant to the Incentive Plan described below. The

Performance-based Earnout shares shall be awarded by the Board of Directors based on achieving the following performance thresholds

following the Closing: one-half (1/2) at achieving revenue of $75 million and adjusted EBITDA of $22.6 million based on 2024

financial audited statements, and one-half (1/2) at achieving revenue of $196 million and adjusted EBITDA of $50.6 million based on

the 2025 financial audit statement.

A

description of the Merger and the terms of the Business Combination Agreement are included in the proxy statement/prospectus, dated October

5, 2023 (the “Proxy Statement/Prospectus”) as filed with the Securities and Exchange Commission (the “SEC”)

in the section entitled “Proposal No. 1 — The Business Combination Proposal” of the Proxy Statement/Prospectus.

The

foregoing description of the Business Combination Agreement is a summary only and is qualified in its entirety by the full text of the

Business Combination Agreement, a copy of which is attached hereto as Exhibit 2.1, which are incorporated herein by reference.

Capitalized

terms used but not defined in this Report have the meanings set forth in the Proxy Statement/Prospectus.

Item

1.01 Entry into a Material Definitive Agreement.

Debt

Financing

Loan

Agreement

Syntec

Optics Holdings, Inc. refinanced its existing loans with a similar structure but more favorable terms. Pursuant to the terms of the

new Credit Agreement with the lender, the proceeds of the refinancing were used (i) to payoff on the Closing Date prior

indebtedness, and (ii) to pay any fees associated with transactions contemplated under the Credit Agreement. The payoff of prior

indebtedness included, (i) payoff for line of credit with the outgoing lender in the amount of approximately $6,092,560, (ii) payoff

for term loan in the amount of approximately $1,109,789, and (iii) payoff for mortgage loan in the amount of approximately $863,607.

The

new revolving credit facility increased the revolving line of credit from $8,000,000 to $10,000,000 with maturity date 3 years from Closing.

The interest rate decreased from 310 basis points to 225 basis points added to one month term Secured Overnight Financing Rate (SOFR) adjusting daily. The term loan facility

was set at up to $1,775,000 at the same rate option as line of credit and maturity up to 5 years from Closing. An additional facility

for equipment line was added with a $5,000,000 discretionary loan/lease limit with the same interest rate option and maturity 7 years

from Closing. At the time of refinancing, mortgage facility was paid off from the new open line of credit until a new mortgage facility

is set up with 7 year maturity from Closing and same interest rate option.

Usual

and customary facility of this type, size and purpose also included minimum fixed charge ratio greater than equal to 1.10x along with

maximum leverage ratio of 3.5x (up from 3.0x with the outgoing lender). Usual and customary negative covenants were also included.

The

foregoing description of the refinancing is a summary only and is qualified in its entirety by the full text of the Credit Agreement,

copies of which are attached hereto as Exhibit 10.12 and are incorporated herein by reference.

Warrant

Agreements

The

shares issuable upon exercise of the Warrants have customary registration rights, which are contained in the respective forms of the

Warrants, requiring the Company to file and keep effective a resale registration statement registering the resale of the shares of Common

Stock underlying the Warrants.

The

foregoing description of the Warrants is a summary only and is qualified in its entirety by reference to the full text of the Warrants,

copies of which are attached hereto as Exhibit 4.4, respectively, and are incorporated herein by reference.

Related

Agreements

Concurrently

with the execution of the Business Combination Agreement, OmniLit, Legacy Syntec and the Sponsor entered into a sponsor support agreement,

a copy of which is attached as Exhibit 10.4 and is incorporated herein by reference.

Indemnification

of Directors and Officers

On

the Closing Date, in connection with the consummation of the Transactions, the Company entered into indemnification agreements with each

of its directors and executive officers. These agreements, among other things, will require the Company to indemnify the Company’s

directors and executive officers for certain expenses, including attorneys’ fees, judgments and fines incurred by a director or

executive officer in any action or proceeding arising out of their services as one of the Company’s directors or executive officers

or any other company or enterprise to which the person provides services at the Company’s request.

The

foregoing description of the indemnification agreements does not purport to be complete and is qualified in its entirety by reference

to the full text of the form of indemnification agreement, a copy of which is attached hereto as Exhibit 10.7 and is incorporated herein

by reference.

Registration

Rights Agreement

On

the Closing Date, in connection with the consummation of the Transactions, the Company entered into the Amended and Restated Registration

Rights Agreement (the “Registration Rights Agreement”) with the Sponsor, OmniLit’s officers, directors, initial

stockholders, non-redemption agreement investors (collectively, the “Insiders”) and certain Legacy Syntec stockholders.

The

foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference

to the full text of the Registration Rights Agreement, a copy of which is attached hereto as Exhibit 4.6 and is incorporated herein

by reference.

Other

Agreements

On December 11, 2023,

we entered into an asset purchase agreement (the “APA”) with Molex, a Delaware corporation (“Molex”),

pursuant to which we acquired machinery and equipment from Molex as set forth in the APA for a purchase price of approximately

$560,000, which was the approximated fair market value.

Recent

Developments

None.

Corporate

Information

The

mailing address of our principal executive office is 515 Lee Rd., Rochester, New York 14606, and our telephone number is (585) 768-2513.

We

file periodic reports, proxy statements and other information with the SEC. Such reports, proxy statements and other information may

be obtained, free of charge, by visiting the SEC’s website at www.sec.gov that contains all of the reports, proxy and information

statements, and other information that we electronically file or furnish to the SEC. We also maintain a website at www.syntecoptics.com