false

0001739614

0001739614

2024-05-24

2024-05-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of

1934

Date of Report (Date of earliest event reported):

May 24, 2024

INHIBRX, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-39452 |

82-4257312 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

11025 N. Torrey Pines Road, Suite 200

La Jolla, CA 92037

(Address of Principal Executive Offices

and Zip Code)

Registrant’s telephone number, including

area code: (858) 795-4220

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, par value $0.0001 par share |

INBX |

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 5.07 |

Submission of Matters to a Vote of Security Holders |

On May 24, 2024, Inhibrx, Inc. (the

“Company”) held a special meeting of stockholders virtually (the “Special Meeting”) in

connection with the proposals identified in the Company’s Definitive Proxy Statement on Schedule 14A filed with the U.S.

Securities and Exchange Commission (the “SEC”) on April 26, 2024 (the “Proxy Statement”).

As

of the close of business on April 24, 2024, which was the record date for the stockholders entitled to vote at the Special Meeting,

there were 52,278,007 shares of Company common stock (as defined below) issued and outstanding and eligible to vote. 41,759,402

shares, or approximately 79.88% of the shares eligible to vote, were present virtually or represented by proxy at the Special

Meeting, constituting a quorum.

Each of the proposals was approved

by the requisite votes of the Company’s stockholders. The final voting results from the Special Meeting for each proposal are set

forth below (each of which is described in more detail in the Proxy Statement).

| 1. | Proposal No. 1 – Transaction Proposal: to approve a proposal to adopt (i) the Agreement and

Plan of Merger (the “Merger Agreement”) with Aventis Inc., a Pennsylvania corporation (“Parent”) and a wholly

owned indirect subsidiary of Sanofi, and Art Acquisition Sub, Inc., a Delaware corporation (“Merger Sub”) and wholly owned

subsidiary of Parent, pursuant to which, on the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub will

merge with and into the Company (the “Merger”), with the Company surviving the Merger as a wholly owned subsidiary of Parent

and (ii) the Separation and Distribution Agreement, dated as of January 22, 2024 (the “Distribution Agreement”), which provides

for: (x) the Company effecting a pre-closing reorganization (the “Pre-Closing Reorganization”), which will generally result

in the Company owning, assuming or retaining all assets and liabilities primarily related to INBRX-101, an optimized, recombinant alpha-1

antitrypsin (“AAT”) augmentation therapy currently in a registrational trial for the treatment of patients with alpha-1 antitrypsin

deficiency (“AATD”) (the “101 Business”), and SpinCo owning, assuming or retaining those assets and liabilities

of the Company that are not primarily related to the 101 Business (the “SpinCo Business”); and (y) thereafter, but prior to

and as a condition to closing of the Merger, the Company distributing, on a pro rata basis, 92% of the issued and outstanding shares of

SpinCo common stock as of the time of the distribution (the “Spin-Off” or the “Distribution”), at a ratio of one

share of SpinCo common stock, par value $0.0001 per share, (“SpinCo common stock”) for every four shares of the Company’s

issued and outstanding common stock, par value $0.0001 per share (“Company common stock”) held on the record date for the

Spin-Off (the “Transaction Proposal”). |

The Transaction Proposal was approved

by the requisite vote of Company’s stockholders set forth in the table immediately below.

| Votes For |

Votes Against |

Votes Abstained |

Broker Non-Votes |

| 41,714,313 |

7,215 |

37,874 |

— |

| 2. | Proposal No. 2 – Adjournment

Proposal: to approve a proposal to, as permitted under the terms of the Merger Agreement, adjourn the Special Meeting, if

necessary, desirable or appropriate, to solicit additional proxies if, at the time of the Special Meeting, there are an insufficient

number of votes in favor of adopting the Transaction Proposal (the “Adjournment Proposal”); and |

Because there were sufficient

votes from the Company’s stockholders to approve the Transaction Proposal, adjournment of the Special Meeting was unnecessary and

the Adjournment Proposal was therefore not called.

| 3. | Proposal

No. 3 – Non-Binding Merger-Related Compensation Proposal:

to approve, on a non-binding, advisory basis, the payment of certain compensation that

may become payable to the Company’s named executive officers in connection with the

transactions contemplated by the Merger Agreement and the Distribution Agreement (the “Non-Binding

Merger-Related Compensation Proposal”). |

The

Non-Binding Merger-Related Compensation Proposal was approved by the requisite vote of the Company’s stockholders set forth

in the table immediately below.

| Votes For |

Votes Against |

Votes Abstained |

Broker Non-Votes |

| 41,250,239 |

482,880 |

26,283 |

— |

| Item 7.01 | Regulation FD Disclosure. |

On May 24, 2024, the Company issued a press release

(the “Press Release”) announcing the results of the Special Meeting. A copy of the press release is attached hereto as Exhibit

99.1 and incorporated by reference herein.

The information contained in this Item 7.01 and in Exhibit 99.1 of

this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into

any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such

filing.

The registration

statement on Form 10, as amended, filed by SpinCo with the SEC in connection with the previously announced Spin-Off, was declared effective

by the SEC on May 24, 2024. The Distribution is expected to occur at 11:59 p.m., Eastern Time, on May 29, 2024 (the “Distribution

Time”), and the Merger is expected to close on May 30, 2024, subject to the satisfaction or waiver of customary closing conditions.

Beginning on May 28, 2024 and through the Distribution Time, there

are expected to be two markets in shares of Company common stock: a “regular-way” market and an “ex-distribution”

market. Shares of the Company’s common stock that trade on the “regular-way” market are expected to trade on The Nasdaq

Global Market (“Nasdaq”) under the symbol “INBX”, with an entitlement to shares of SpinCo common stock to be distributed

pursuant to the Distribution. Shares of the Company’s common stock that trade on the “ex-distribution” market are expected

to trade on Nasdaq under the symbol “INBXV”, without an entitlement to shares of SpinCo common stock to be distributed pursuant

to the Distribution.

Beginning on May 28, 2024 and through the Distribution

Time, shares of SpinCo common stock are expected to begin trading on a “when-issued” basis on Nasdaq under the symbol “INXBV”.

On May 30, 2024, the first trading day following the consummation of the Distribution, shares of SpinCo common stock are expected to begin

trading on a “regular-way” basis on Nasdaq under the symbol “INXB.” On May 31, 2024, the first trading day following

the closing of the Merger, shares of SpinCo common stock are expected to begin trading on Nasdaq under the symbol “INBX”,

which is currently the symbol for the Company’s shares of common stock.

| Item 9.01 | Financial Statements and Exhibits. |

The information contained in this Item 9.01 and

in Exhibit 99.1 of this Current Report shall not be deemed “filed” for purposes of the Exchange Act, or otherwise subject

to the liabilities of that section, nor shall it be incorporated by reference into any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as expressly set forth by specific reference in such filing.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date:

May 24, 2024 |

|

|

| |

|

|

| |

INHIBRX, INC. |

| |

|

|

| |

By: |

/s/ Leah Pollema |

| |

Name: |

Leah Pollema |

| |

Title: |

VP, General Counsel |

Exhibit 99.1

Inhibrx Inc. Stockholders Approve Sale of INBRX-101

to Sanofi

SAN DIEGO – May 24, 2024 –

Inhibrx, Inc. (Nasdaq: INBX) (“Inhibrx,” or the “Company”) announced that, at a special meeting (the “Special

Meeting”), the Company’s stockholders approved the sale to Sanofi of all the assets and liabilities primarily related to INBRX-101,

an optimized, recombinant alpha-1 antitrypsin (“AAT”) augmentation therapy currently in a registrational trial for the treatment

of patients with alpha-1 antitrypsin deficiency (“AATD”). Immediately prior to the closing of the merger, all non-101 assets

and liabilities, including INBRX-105, INBRX-106, INBRX-109, Inhibrx’s non-101 discovery pipeline and its corporate infrastructure,

will be spun out from the Company into a new publicly traded company, Inhibrx Biosciences, Inc. (“New Inhibrx”).

The final voting results will be filed in a Current

Report on Form 8-K with the U.S. Securities and Exchange Commission (“SEC”).

Subject to the terms of the definitive agreements

announced on January 23, 2024, Sanofi will acquire all outstanding shares of Inhibrx through a merger with an indirect wholly owned subsidiary

of Sanofi (the “Merger”), and in turn, each Inhibrx stockholder (a) as of the date of the closing of the Merger will receive:

(i) $30.00 per share in cash and (ii) one contingent value right per share, representing the right to receive a contingent payment of

$5.00 in cash upon the achievement of a regulatory milestone and (b) as of May 17, 2024, will receive one SEC-registered, publicly listed,

share of New Inhibrx per every four shares of Inhibrx common stock held. In addition, in connection with the transactions, Sanofi will

assume and retire Inhibrx’s outstanding third party debt, and New Inhibrx will be funded with at least $200 million in cash, with

Sanofi retaining an equity interest in New Inhibrx of 8% of outstanding shares of New Inhibrx common stock as of the date of the distribution

of New Inhibrx shares.

The Company expects to announce consummation

of the transactions within the coming days, subject to the satisfaction or waiver of certain customary closing conditions. Upon closing

of the transactions, Inhibrx’s common stock will be delisted from The Nasdaq Global Market and deregistered under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and Inhibrx will no longer file periodic reports with the SEC on account

of the Company’s common stock.

About Inhibrx, Inc.

Inhibrx is a clinical-stage biopharmaceutical

company focused on developing a broad pipeline of novel biologic therapeutic candidates in oncology and orphan diseases. Inhibrx utilizes

diverse methods of protein engineering to address the specific requirements of complex target and disease biology, including its proprietary

protein engineering platforms. For more information, please visit www.inhibrx.com.

About Sanofi

Sanofi is an innovative global healthcare company,

driven by one purpose: chase the miracles of science to improve people’s lives. Sanofi’s team, across some 100 countries,

is dedicated to transforming the practice of medicine by working to turn the impossible into the possible. Sanofi provides potentially

life-changing treatment options and life-saving vaccine protection to millions of people globally, while putting sustainability and social

responsibility at the center of its ambitions.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains forward-looking statements

about Sanofi’s proposed acquisition of the Company and INBRX-101, and the Company’s related spin-off of the assets and liabilities

associated with INBRX-105, INBRX-106 and INBRX-109, its existing pipeline and corporate infrastructure, which involve substantial

risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such

risks and uncertainties include, among other things, risks related to the satisfaction or waiver of the conditions to closing the proposed

acquisition (including the failure to obtain necessary regulatory approvals) in the anticipated timeframe or at all, including the possibility

that the proposed acquisition does not close; the possibility that competing offers may be made; risks related to the ability to realize

the anticipated benefits of the proposed acquisition, including the possibility that the expected benefits from the acquisition will not

be realized or will not be realized within the expected time period; the risk that the integration of the Company and Sanofi will be more

difficult, time consuming or costly than expected; risks and costs relating to the separation of the assets and liabilities associated

with INBRX-105, INBRX-106 and INBRX-109 and the consummation of the spin-off in the anticipated timeframe or at all; changes to the

configuration of the INBRX-105, INBRX-106 and INBRX-109 businesses included in the separation if implemented; disruption from the

transaction making it more difficult to maintain business and operational relationships; risks related to diverting management’s

attention from the Company’s ongoing business operation; negative effects of this announcement or the consummation of the proposed

transaction on the market price of the Company’s shares of common stock and/or operating results; significant transaction costs;

risks associated with the discovery of unknown liabilities prior to or after the closing of the proposed transactions; the risk of litigation

and/or regulatory actions related to the proposed transactions or the Company’s business; other business effects and uncertainties,

including the effects of industry, market, business, economic, political or regulatory conditions; the conflicts in the Ukraine and the

Middle East; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies; and future business combinations

or disposals. Important factors, risks and uncertainties that could cause actual results to differ materially from such forward looking

statements also include but are not limited to the initiation, timing, progress and results of the Company’s research and development

programs as well as the Company’s preclinical studies and clinical trials; the Company’s ability to advance therapeutic candidates

into, and successfully complete, clinical trials; the Company’s interpretation of initial, interim or preliminary data from the

Company’s clinical trials, including interpretations regarding disease control and disease response; the timing or likelihood of

regulatory filings and approvals, including whether any product candidate, receives approval from the FDA, or similar regulatory authority,

for an accelerated approval process; the commercialization of the Company’s therapeutic candidates, if approved; the pricing, coverage

and reimbursement of the Company’s therapeutic candidates, if approved; the Company’s ability to utilize the Company’s

technology platform to generate and advance additional therapeutic candidates; the implementation of the Company’s business model

and strategic plans for the Company’s business and therapeutic candidates; the Company’s ability to successfully manufacture

the Company’s therapeutic candidates for clinical trials and commercial use, if approved; the Company’s ability to contract

with third-party suppliers and manufacturers and their ability to perform adequately; the scope of protection the Company is able to establish

and maintain for intellectual property rights covering the Company’s therapeutic candidates; the Company’s ability to enter

into strategic partnerships and the potential benefits of such partnerships; the Company’s estimates regarding expenses, capital

requirements and needs for additional financing; the ability to raise funds needed to satisfy the Company’s capital requirements,

which may depend on financial, economic and market conditions and other factors, over which the Company may have no or limited control;

the Company’s financial performance; the Company’s and the Company’s third party partners’ and service providers’

ability to continue operations and advance the Company’s therapeutic candidates through clinical trials and the ability of the Company’s

third party manufacturers to provide the required raw materials, antibodies and other biologics for the Company’s preclinical research

and clinical trials in light of current market conditions or any pandemics, regional conflicts, sanctions, labor conditions, geopolitical

events, natural disasters or extreme weather events; the ability to retain the continued service of the Company’s key professionals

and to identify, hire and retain additional qualified professionals; and developments relating to the Company’s competitors and

the Company’s industry; and other risks described from time to time in the “Risk Factors” section of its filings with

the SEC, including those described in its Annual Report on Form 10-K, as well as its Quarterly Reports on Form 10-Q, and supplemented

from time to time by its Current Reports on Form 8-K. You are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof, and the Company undertakes no obligation to update these statements to reflect events that occur

or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement,

which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Additional Information and Where to Find It

In connection with the proposed acquisition,

the Company has filed documents with the SEC relating to the proposed acquisition. The definitive proxy statement was filed with the

SEC on April 26, 2024 and has been mailed to the Company’s stockholders in connection with the proposed acquisition. This communication

is not a substitute for the proxy statement or any other document that may be filed by the Company with the SEC. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ANY OTHER DOCUMENTS THAT HAVE BEEN OR WILL BE FILED WITH THE SEC IN CONNECTION

WITH THE PROPOSED ACQUISITION AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

ACQUISITION. Investors and security holders may obtain free copies of these documents and other related documents filed with the SEC

at the SEC’s web site at www.sec.gov or on the Company’s website at https://www.inhibrx.com.

v3.24.1.1.u2

Cover

|

May 24, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 24, 2024

|

| Entity File Number |

001-39452

|

| Entity Registrant Name |

INHIBRX, INC.

|

| Entity Central Index Key |

0001739614

|

| Entity Tax Identification Number |

82-4257312

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

11025 N. Torrey Pines Road

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

La Jolla

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92037

|

| City Area Code |

858

|

| Local Phone Number |

795-4220

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 par share

|

| Trading Symbol |

INBX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

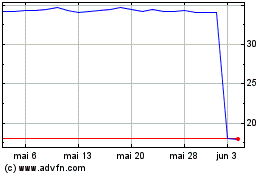

Inhibrx Biosciences (NASDAQ:INBX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Inhibrx Biosciences (NASDAQ:INBX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024