UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

ASE Technology

Holding Co., Ltd.

(Exact name of the registrant as specified in its charter)

| Taiwan, Republic of China |

001-16125 |

| (State or other jurisdiction of incorporation) |

(Commission file number) |

| |

|

26, Chin 3rd Rd., Nanzih Dist.,

Kaohsiung, Taiwan, Republic of China |

|

| (Address of principal executive offices) |

(Zip code) |

| |

|

| Joseph Tung, +886-2-6636-5678 |

(Name and telephone number, including area code,

of the person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this

form is being filed, and provide the period to which the information in this form applies:

☒

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1, 2023 to December 31,

2023.

Section 1 — Conflict Minerals

Disclosure

Item 1.01 and 1.02 Conflict Minerals

Disclosure and Report, Exhibit

Conflict Minerals Disclosure

Our Form SD and our Conflict Minerals

Report for the year ended December 31, 2023 filed as Exhibit 1.01 to this Form SD are available at

https://www.aseglobal.com/csr/responsible-procurement/conflict-minerals-compliance

Section 2 – Exhibits

Item 2.01 Exhibits

Exhibit 1.01 – Conflict Minerals

Report for the reporting period January 1, 2023 to December 31, 2023

* * * * *

SIGNATURE

ASE Technology Holding Co., Ltd.

| By: |

/s/ Jason

C.S. Chang

Jason C.S. Chang

Principal Executive Officer

|

Date: May 31, 2024 |

EXHIBIT INDEX

Exhibit

Number |

|

Description |

| 1.01 |

|

Conflict Minerals Report for the reporting period January 1, 2023 to December 31, 2023 |

Exhibit

1.01

ASE

Technology Holding Co., Ltd.

Conflict Minerals Report

For

the year ended December 31, 2023

Corporate Overview

ASE Technology Holding

Co., Ltd. (“ASEH”, “we”, “our”, or “us”) is the leading provider of semiconductor manufacturing

services in assembly and testing, and the provider of electronic manufacturing services. ASEH packages bare semiconductors into finished

semiconductors with enhanced electrical and thermal characteristics; provides testing services, including front-end engineering testing,

wafer probing and final testing services; engages in the designing, assembling, manufacturing and sale of electronic components and telecommunications

equipment motherboards and substrate production.

We have manufacturing

facilities located in Taiwan, China, Malaysia, Japan, Singapore, South Korea and the United States of America that provide packaging,

testing and materials design and production services to many semiconductor companies around the world. A typical customer engagement

involves receiving consigned silicon wafers from the customer, performing a series of manufacturing services to the wafers, and delivering

a completed, packaged integrated circuit back to the customer.

We provide a broad

range of electronic manufacturing services to a global customer base through USI Inc. and its subsidiaries (collectively “USI”)

with facilities located in Taiwan, China, Mexico, Poland, Vietnam, Africa, and Europe. In providing these services, we acquire numerous

electronic and non-electronic components, and assemble them into sub-assemblies and finished products.

Product Scope

ASEH provides solutions,

including integrated design, manufacturing, packaging, testing, and electronic and substrate manufacturing. Raw materials used in aforementioned

service or product provided by us are in the scope of this report. We determine gold, tin, tungsten or tantalum (“3TG” or

“conflict minerals”) are “necessary to the functionality or production” of a product manufactured or contracted

to be manufactured by ASEH.

| (1) | For

our packaging and materials design and production services, we typically add gold and tin

as direct materials in the manufacturing process, and we occasionally add tungsten and tantalum.

We do not use gold, tin, tungsten or tantalum in our testing services. |

| (2) | For

our electronic manufacturing services, typical materials and components which we utilize include solder (tin based),

electrolytic capacitors (tantalum bearing), integrated circuits (gold wire) and high temperature wires (tungsten). Gold, tin, tungsten

and tantalum are essential to our electronic manufacturing services. |

All packaging, materials

design and production and electronic manufacturing services we provide contain one or more of the conflict minerals: gold, tin, tungsten

or tantalum.

Reasonable Country of Origin Inquiry

We conducted a reasonable

country of origin inquiry (“RCOI”) to determine whether 3TG have originated in the Democratic Republic of the Congo (“DRC”)

or its adjoining countries (the “Covered Countries”), or are from recycled or scrap sources. Our RCOI included to:

| (1) | Identify

our suppliers who provided us with materials containing 3TG and then use the Conflict Minerals

Reporting Template (“CMRT”) developed by the Responsible Minerals Initiative

(“RMI”) to facilitate transparency of the supply chain regarding 3TG sourced

from the smelters and refiners. We identified 389 suppliers in the reporting period and used

the CMRTs to identify the Smelters or Refiners (“SoRs”) of 3TG and their origin

countries. |

| (i) | For

our packaging and materials design and production services, a total of 170 suppliers provided

us with materials containing 3TG. |

| (ii) | For

our electronic manufacturing services, we selected 219 suppliers from a total of 4,360 suppliers

who provided us with materials containing metals by the following assessment criteria: (1)

the suppliers with purchase amounts greater than US$1.2 million in 2023, which in aggregate

accounted for more than 90% of our total purchase amount, and (2) the suppliers whose conflict

minerals are used in the services we provide to our top one customer. |

| (2) | Confirm

with our suppliers that they are in compliance with our conflict minerals policy and their

covenant to disclose the source information of the smelters and refiners under the representation

letters. |

Based on our RCOI

results, we have reason to believe that the conflict minerals in our products may have originated in the Covered Countries and conflict-affected

and high-risk areas (“CAHRA”) or may not come from recycled or scrap sources. Therefore, we conducted due diligence on the

source and chain of custody of the conflict minerals in our products.

Below are the results

of our RCOI.

Packaging and Materials Design and

Production Services

Gold

During 2023, we purchased

gold for our packaging and materials design and production services from a total of 83 suppliers. None of these suppliers are SoRs, and

all these suppliers purchased gold from SoRs or from third parties. Based on the CMRTs we collected, we identified a total of 88 SoRs

from which we indirectly purchased gold in 2023 for our packaging and materials design and production services. All 83 of our gold suppliers

for our packaging and materials design and production services responded to our request to identify the SoRs from which they sourced

gold during 2023, representing 100% of our total gold expenditure.

Based on an inspection

of the list available at https://www.responsiblemineralsinitiative.org conducted on December 31, 2023, all 88 SoRs from which we indirectly

purchased gold in 2023 for our packaging and materials design and production services are participants in at least one of (i) the Responsible

Minerals Assurance Process (“RMAP”) operated by RMI, (ii) the Gold Industry—London Bullion Market Association (“LBMA”),

or (iii) the Gold Industry— Responsible Jewellery Council (“RJC”).

Tin

During 2023, we purchased

tin for our packaging and materials design and production services from a total of 96 suppliers. None of these suppliers are SoRs, and

all these suppliers purchased tin from SoRs or from other third parties. Based on the CMRTs we collected, we identified a total of 63

SoRs from which we indirectly purchased tin in 2023 for our packaging and materials design and production services. All 96 of our tin

suppliers for our packaging and materials design and production services responded to our request to identify the SoRs from which they

sourced tin during 2023, representing 100% of our total tin expenditure.

Based on an inspection

of the list available at https://www.responsiblemineralsinitiative.org conducted on December 31, 2023, all 63 SoRs from which we indirectly

purchased tin in 2023 for our packaging and materials design and production services are participants in the RMAP operated by RMI.

Tungsten

During 2023, we purchased

tungsten for our packaging and materials design and production services from a total of 17 suppliers. None of these suppliers are SoRs,

and all these suppliers purchased tungsten from SoRs or from other third parties. Based on the CMRTs we collected, we identified 31 SoRs

from which we indirectly purchased tungsten for our packaging and materials design and production services in 2023. All 17 of our tungsten

suppliers for our packaging and materials design and production services responded to our request to identify the SoRs from which

they sourced tungsten during 2023, representing

100% of our total tungsten expenditure.

Based on an inspection

of the list available at https://www.responsiblemineralsinitiative.org conducted on December 31, 2023, all 31 SoRs from which we indirectly

purchased tungsten for our packaging and materials design and production services in 2023 are participants in the RMAP operated by RMI

or participants in the Tungsten Industry—Conflict Minerals Council (“TI-CMC”).

Tantalum

During 2023, we purchased

tantalum for our packaging and materials design and production services from 7 suppliers. None of these suppliers are SoRs, and all these

suppliers purchased tantalum from SoRs or from other third parties. Based on the CMRTs we collected, we identified a total of 28 SoRs

from which we indirectly purchased tantalum in 2023 for our packaging and materials design and production services. All 7 of our tantalum

suppliers for our packaging and materials design and production services responded to our request to identify the SoRs from which they

sourced tantalum during 2023, representing 100% of our total tantalum expenditure.

Based on an inspection

of the list available at https://www.responsiblemineralsinitiative.org conducted on December 31, 2023, all 28 of the SoRs from which

we indirectly purchased tantalum in 2023 for our packaging and materials design and production services are participants in the RMAP

operated by RMI.

Electronic Manufacturing Services

During 2023, we selected

219 suppliers from a total of 4,360 suppliers for our electronic manufacturing services for the purpose of identifying SoRs. The 219

suppliers were selected based on the assessment criteria mentioned in the section entitled RCOI.

Gold

Among the 219 selected

suppliers, we purchased gold for our electronic manufacturing services from 171 suppliers in 2023. None of these suppliers are SoRs,

and all these suppliers purchased gold from SoRs or from other third parties. Based on the CMRTs we collected, we identified 94 SoRs

from which we indirectly purchased gold for our electronic manufacturing services. All 171 gold suppliers responded to our request to

identify the SoRs from which they sourced gold during 2023.

Based on an inspection

of the list available at https://www.responsiblemineralsinitiative.org conducted on December 31, 2023, all 94 SoRs from which we indirectly

purchased gold for our electronic manufacturing services in 2023 are participants in at least one of (i) the RMAP operated by RMI, (ii)

the LBMA, or (iii) the RJC.

Tin

Among the 219 selected

suppliers, we purchased tin for our electronic manufacturing services from 182 suppliers in 2023. None of these suppliers are SoRs, and

all these suppliers purchased tin from SoRs or from other third parties. Based on the CMRTs we collected, we identified 68 SoRs from

which we indirectly purchased tin for our electronic manufacturing services. All 182 tin suppliers responded to our request to identify

the SoRs from which they sourced tin during 2023.

Based on an inspection

of the list available at https://www.responsiblemineralsinitiative.org conducted on December 31, 2023, all 68 SoRs from which we indirectly

purchased tin for our electronic manufacturing services in 2023 are participants in the RMAP operated by RMI.

Tungsten

Among the 219 selected

suppliers, we purchased tungsten for our electronic manufacturing services from 101 suppliers in 2023. None of these suppliers are SoRs,

and all these suppliers purchased tungsten from SoRs or from other third parties. Based on the CMRTs we collected, we identified 33 SoRs

from which we indirectly purchased tungsten for our electronic manufacturing services. All 101 tungsten suppliers responded to our request

to identify the SoRs from which they sourced tungsten during 2023.

Based on an inspection

of the list available at https://www.responsiblemineralsinitiative.org conducted on December 31, 2023, all 33 SoRs from which we indirectly

purchased tungsten for our electronic manufacturing services in

2023 are participants in either the RMAP operated by RMI or the TI-CMC program.

Tantalum

Among the 219 selected

suppliers, we purchased tantalum for our electronic manufacturing services from 85 suppliers in 2023. None of these suppliers are SoRs,

and all these suppliers purchased tantalum from SoRs or from other third parties. Based on the CMRTs we collected, we identified 35 SoRs

from which we indirectly purchased tantalum for our electronic manufacturing services. All 85 tantalum suppliers responded to our request

to identify the SoRs from which they sourced tantalum during 2023.

Based on an inspection

of the list available at https://www.responsiblemineralsinitiative.org conducted on December 31, 2023, all 35 SoRs from which we indirectly

purchased tantalum for our electronic manufacturing services in 2023 are participants in the RMAP operated by RMI.

Part I. Due Diligence

Design

of Due Diligence

ASEH designed its

due diligence measures to conform to the Organisation for Economic Co-operation and Development Due Diligence Guidance for Responsible

Supply Chains of Minerals from Conflict-Affected and High-Risk Areas: Third Edition (the “OECD Guidance”), including the

related supplements on gold, tin, tantalum and tungsten.

Due

Diligence Measures Performed

| OECD Step 1 |

Establish

strong company management systems |

| A.

Adopt and clearly communicate to suppliers and public |

The

ASE Technology Holding Co., Ltd. Corporate Policy for Sourcing Conflict Minerals is

posted on our website (and attached here as Annex A) to address our commitment to exercise

due diligence in accordance with the OECD Guidance.

Additionally,

we distribute our conflict minerals policy to each of our suppliers of conflict minerals who must agree that the policy will be complied

with and require each supplier to certify they understand our conflict minerals policy and will comply with its covenants.

|

| B.

Structure internal management to support due diligence |

Our

conflict minerals management team is a comprehensive cross-functional team under the direction

of ASEH’s Corporate Sustainability Committee which is chaired by our Principal Executive

Officer.

The team is

responsible for implementing the conflict minerals compliance mechanism, including planning, analysis, tracking, monitoring, and

communication and reporting for the business wide initiative.

|

| C.

Establish a system of controls and transparency over the mineral supply chain |

Conflict

minerals procedures are documented in our specifications system and managed by our conflict

minerals management team. The bills-of-materials required for different customer products

across all manufacturing operations are controlled by our manufacturing execution system

software.

The primary

method for gathering conflict mineral data is through the deployment and gathering of Responsible Minerals Initiative (“RMI”),

which is developed by Conflict Minerals Reporting Template (“CMRT”). We store such data and maintain other related records

for a minimum of five years in a comprehensive filing system.

Aligned with

industry practice, we utilize a conflict minerals data tool to manage a large number of suppliers’ CMRTs, auto-validates smelter

status with

updated RMI smelter list and aggregates smelter reporting for our customers.

|

| D.

Strengthen company engagement with suppliers |

ASEH’s

subsidiaries communicate our conflict minerals policy and requirements to relevant suppliers

through our website. In addition to the website, ASEH’s subsidiaries are building person-to-person

links between employees and suppliers to improve the quality and consistency of supplier

communications.

ASEH’s subsidiaries

hold several supplier seminars/workshops at multiple manufacturing facilities to announce new requirements, and provide trainings

to suppliers to enable them to better understand how to improve their conflict minerals monitoring mechanism, including smelter data

quality.

We include conflict

minerals terms in our subsidiaries’ Purchase Orders pursuant to which our suppliers agree (i) to use industry standard

efforts to ensure 3TG materials covered by the purchase order and sourced from mines in the DRC or the Covered Countries do not directly

or indirectly finance illegal militia in the above-mentioned area, (ii) to promptly notify us if any materials covered by the purchase

order do contain conflict minerals that are not DRC Conflict Free and to provide a report on the mine and/or smelter of origin of

the conflict minerals and the related chain of custody and (iii) to only supply us with materials that contain DRC Conflict Free

minerals sourced from certified DRC Conflict Free smelter and refinery programs.

|

| E.

Establish grievance mechanism |

ASEH

encourages suppliers and employees to have open and honest dialog on issues of mutual interest.

We provide the

separate email addresses for our three subgroups (ASE_CM@aseglobal.com, petition@spil.com.tw, and conflict_minerals@usiglobal.com)

for general surveys, inquiries and grievances regarding our conflict minerals program. Our conflict mineral mechanism can also be

found on our website at https://www.aseglobal.com/csr/responsible-procurement/conflict-minerals-compliance

|

| OECD

Step 2 |

Identify

and assess risk in the supply chain |

| A.

Identify risks in the supply chain |

Our

process for identifying conflict minerals risk in the supply chain is as follows:

(a)

Identify all our suppliers who provide direct materials and components which may contain conflict minerals being necessary

to the functionality or production of our products.

(b)

Conduct an annual suppliers’ survey through the CMRTs to identify the SoRs and the origin countries of conflict minerals.

|

| |

(c)

Review each received CMRT based on our internal standard procedure to check the quality

such as the suppliers’ conflict minerals policies, suppliers’ data collection

from next tier suppliers, and SoRs identification and disclosure.

(d)

For our electronic manufacturing services, due to the complexity of the supply chain, we:

·

assess the value of the annual purchase volume of all conflict minerals.

• prioritize conflict mineral sources by dollar volume to leverage impact from available analytical

resources.

|

| B.

Assess risks of adverse impacts |

(a)

Assess data gathered on the CMRTs to identify potential inconsistencies or “red

flags.”

(b) Define annual supplier risk criteria.

(c)

Carry out on-site or document audit for suppliers determined as at-risk suppliers according to the risk criteria.

(d)

Follow up as appropriate to resolve items of concern.

|

| OECD

Step 3 |

Design

and implement a strategy to respond to identified risks |

| A.

Report finding to designated senior management |

Periodic

reviews are held and status are reported to our Chief Operating Officer (“COO”), Chief Financial Officer (“CFO”),

and Chief Administrator Officer (“CAO”) who are also our Corporate Sustainability Committee members and senior management

in order for them to be aware of current conflict minerals compliance status. |

| B.

Devise and adopt a risk management plan |

Our

risk management plan includes tracking SoRs information to check if they may be from DRC,

the Covered Countries, or CAHRA, or not from scrap or recycled sources.

We compare supplier

smelter data to RMI RCOI data to identify actual smelter origins.

Additionally,

ASEH’s subsidiaries developed their own conflict minerals audit checklists to implement an on-site or document audit process.

ASEH’s subsidiaries are required to validate suppliers’ mechanisms related to important aspects of conflict minerals

management.

Finally, we continue

to work with non-compliant suppliers to obtain RMAP certification, or other independence third party audit program. Suppliers unwilling

or incapable of achieving such certification are considered to be replaced by compliant suppliers.

|

| C.

Implement the risk management plan, monitor and track performance of risk |

We

use CMRTs and the up-to-date RMAP compliant smelter lists to monitor and track our suppliers

and their SoRs information. For the compliance year 2023, our packaging and materials design

and production services received CMRTs from 100% of our conflict minerals suppliers surveyed

and electronic manufacturing services received CMRTs from 100% of our conflict minerals suppliers

surveyed.

|

| mitigation efforts and report back

to designated senior management |

We request our

suppliers to provide an updated response of their CMRTs if there is any change. We maintain a regular communication channel with

our senior management as abovementioned.

|

| D.

Undertake additional fact and risk assessments for risks requiring mitigation, or after a change of circumstances |

We

have begun supplier audits to assess the accuracy of data and statements made by larger suppliers.

This program will be broadened over time.

As a member of

the RBA and RMI, RCOI data is accessible to use and to manage our suppliers’ SoRs information.

|

| OECD

Step 4 |

Carry

out independent third-party audit of supply chain due diligence at

identified points in the supply chain |

| |

For

the compliance year 2023, ASEH has undertaken an Independent Private Sector Audit (“IPSA”)

of our Conflict Minerals Report in compliance with the requirements set forth in the SEC

Conflict Minerals Final Rule and subsequent SEC Guidance.

As a member of

RMI, we leverage the due diligence conducted on smelters by the RMAP which uses independent third-party auditors to audit the source

of the conflict minerals used by smelters.

|

| OECD

Step 5 |

Report

on supply chain due diligence. |

| |

We

report annually on our supply chain due diligence activities including the conflict minerals program in our annual sustainability

report and we file a Form SD and Conflict Minerals Report (“CMR”) for the compliance year 2023 with the U.S. Securities

and Exchange Commission on or before the May 31, 2024 deadline in compliance with the SEC Conflict Minerals Final Rule and subsequent

guidance. This information is publicly available on our website at

https://www.aseglobal.com/csr/responsible-procurement/conflict-minerals-compliance |

Part II. Due Diligence

Determination and Product Declaration

Product

Declaration

Our

RCOI results did not provide us a sufficient level of confidence to enable us to report that all our products are conflict-free. Pursuant

to Rule 13p-1 under the Securities Exchange Act of 1934, we therefore conducted additional due diligence on the source and chain of custody

of the necessary conflict minerals in our products in order to obtain reasonable and reliable evidence that the gold,

tin, tungsten or tantalum used by us in 2023 either (i)

did not directly or indirectly benefit violent organizations in the Democratic Republic of the Congo or adjacent regions or CAHRA

or (ii) came from recycled or scrap sources.

Based

on our RCOI analysis and due diligence measures described in this report, we made the following product determinations.

Packaging

and Materials Design and Production Services:

Based on the CMRTs

we received, all identified SoRs used in our packaging and materials design and production services products were certified by RMI or

were in the process of receiving RMI certificates in 2023. We

reasonably believe that such SoRs are DRC Conflict-Free.

Electronic

Manufacturing Services:

Given the large number of suppliers

for our electronic manufacturing services, we developed a sampling program to select material suppliers for the purpose of identifying

SoRs. We believe that our due diligence performed based on the sampling program is sufficient and appropriate to provide a reasonable

basis for our determination. Based on the CMRTs we received, all identified SoRs used in our electronic manufacturing services products

were certified by RMI or were in the process of receiving RMI certificates in 2023. Therefore, we reasonably believe that such SoRs are

DRC Conflict-Free.

Glossary

A glossary of abbreviations

and terms is included in Annex C.

Facilities used to Process Conflict

Minerals

A list of smelters

and refiners that sourced conflict minerals utilized in our services is provided in Annex D.

Conflict Minerals Country of Origin

A list of countries

where conflict minerals were mined or extracted is listed in Annex E. These minerals may have been smelted or refined in the country

of extraction or in facilities around the world.

Part III – Continuous Improvements

| • | Be

aware of regulatory changes (e.g., RMI and OECD guidance), and adjust our policy in a timely

manner if necessary. |

| • | Improve

our conflict minerals validation process when accepting new suppliers. |

| • | Work

with our new and current suppliers to confirm that they understand and comply with ASEH’s

conflict minerals policy and requirements. |

| • | Establish

our conflict minerals data collection system with advanced management and analytical functionalities

in the near future. |

| • | Strengthen

education and trainings for our manufacturing facilities and relevant employees. |

| • | Work

with our suppliers to improve the suppliers’ data accuracy and completeness and ensure

that the smelters and refiners they source conflict minerals from in our supply chain are

actively participating or progressing toward RMAP listing or other independence third party

audit programs. |

| • | In

addition to gold, tin, tantalum and tungsten, we plan to gradually add cobalt, mica and more

minerals from CAHRAs to the scope of investigation to check if they comply with the RMI’s

standards. |

| • | Assess

suppliers’ due diligence processes through on-site audits so as to assist suppliers

to build up and improve their internal management systems. |

| • | Annually

hold supplier seminars to assist suppliers with their conflict minerals programs. |

| • | Actively

participate in the RMI and other key industry association and stakeholders’ responsible

sourcing initiatives. |

Part IV – Independent Private

Sector Audit

We obtained an independent

private sector audit by KPMG. The independent accountant’s report is set forth in Annex B.

Annex A –ASE Technology Holding

Co., Ltd. Corporate Policy for Sourcing Conflict Minerals

The mining and distribution of “conflict

minerals”1 originating from the Democratic Republic

of the Congo (the “DRC”) are sometimes controlled by violent organizations in order to fund conflict in that country and

adjacent regions. Our industry supply chains are inadvertently subject to metals derived from these conflict minerals which can be introduced

through the metals we use such as gold, tin, tantalum and tungsten. ASE Technology Holding Co., Ltd. and its subsidiaries (collectively,

“ASE Technology Holding “) is dedicated to the elimination of these conflict minerals in our supply chain and to using only

responsibly sourced “conflict-free minerals”2.

We expect our suppliers to source conflict-free minerals from smelters or refineries that have been certified by an independent third

party audit program to fulfill our objective. It is also our objective to support the continued use of conflict-free minerals from the

DRC and its adjacent regions such that responsible mining3

is not diminished. We exercise due diligence with our suppliers on the origin and supply chain of minerals in accordance with the “OECD

Due Diligence for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas” to establish conflict minerals

management mechanism.

To protect the human rights, health and

environment for workers in the material production areas, we commit to widening the scope of investigation and information disclosure;

in addition to gold, tin, tantalum and tungsten, more minerals (such as cobalt and mica) will be included gradually from conflict-affected

and high-risk areas (“CAHRAs”) in accordance with the Responsible Minerals Initiative (“RMI”) standards. ASE

Technology Holding requires suppliers must support this policy by the following guidelines and widen their scope of investigations and

disclosures to continuously strengthen our responsible sourcing programs.

| (a) | Being

diligent in their assessment and validation of their supply chains to ensure ASE Technology

Holding’s objectives of a transparent supply chain and conflict-free purchases are

inputs to the services and products we produce. |

| (b) | Be

in compliance at all times with all regional and international regulations for conflict minerals. |

| (c) | Be

in compliance at all times with industry standards for the sourcing and reporting of conflict

minerals. |

| (d) | Being

diligent and accurate in their formal assurances of conflict-free minerals provided to us. |

1

“Conflict minerals” are columbite-tantalite (coltan), cassiterite, gold, wolframite, or their derivatives as defined in the

Dodd-Frank Act section 1502 and SEC Rule 13p-1 under the Securities Exchange Act of 1934.

2

“Conflict-free minerals” are conflict minerals that through their distribution directly or indirectly do not benefit violent

organizations in the Democratic Republic of the Congo and its adjacent regions.

3

“Responsible mining” is taking the social and environmental responsibility for the mining procedure.

Annex B –Independent Accountants’

Report

Independent Accountants’

Report

To the Board of Directors and Shareholders

of ASE Technology Holding Co., Ltd.:

We have examined:

| • | whether

the design of ASE Technology Holding Co., Ltd. (the “Company”) due diligence

framework as set forth in the section titled “Part I. Due Diligence” of the Company’s

Conflict Minerals Report for the reporting period from January 1 to December 31, 2023 (the

“Conflict Minerals Report”), is in conformity, in all material respects, with

the criteria set forth in the Organisation of Economic Co-operation and Development Due Diligence

Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas,

Third Edition 2016 (“OECD Due Diligence Guidance”), and |

| • | whether

the Company’s description of the due diligence measures it performed, as set forth

in the section titled “Part I. Due Diligence” of the Company’s Conflict

Minerals Report, is consistent, in all material respects, with the due diligence process

that the Company undertook. |

Management from the Company is responsible

for the design of the Company’s due diligence framework and the description of the Company’s due diligence measures set forth

in the Conflict Minerals Report, and performance of the due diligence measures. Our responsibility is to express an opinion on the design

of the Company’s due diligence framework and on the description of the due diligence measures the Company performed, based on our

examination.

Our examination was conducted in accordance

with attestation standards established by the American Institute of Certified Public Accountants and the standards applicable to attestation

engagements contained in Government Auditing Standards, issued by the Comptroller General of the United States. Those standards require

that we plan and perform the examination to obtain reasonable assurance about whether the design of the Company’s due diligence

framework is in conformity with the OECD Due Diligence Guidance and whether the description of the due diligence measures the Company

performed is consistent with the due diligence process that the Company undertook, in all material respects. An examination involves

performing procedures to obtain evidence about the design of the Company’s due diligence framework and the description of the due

diligence measures the Company performed. The nature, timing and extent of the procedures selected depend on our professional judgment,

including an assessment of the risks of material misstatement of the design of the Company’s due diligence framework and the description

of the due diligence measures the Company performed. We believe that the evidence we obtained is sufficient and appropriate to provide

a reasonable basis for our opinion.

Our examination was not conducted for

the purpose of evaluating:

| • | The

consistency of the due diligence measures that the Company performed with either the design

of the Company’s due diligence framework or the OECD Due Diligence Guidance; |

| • | The

completeness of the Company’s description of the due diligence measures performed; |

| • | The

suitability of the design or operating effectiveness of the Company’s due diligence

process; |

| • | Whether

a third party can determine from the Conflict Minerals Report if the due diligence measures the Company performed

are consistent with the OECD Due Diligence Guidance; |

| • | The

Company’s reasonable country of origin inquiry (RCOI), including the suitability of

the design of the RCOI, its operating effectiveness, or the results thereof; or |

| • | The

Company’s conclusions about the source or chain of custody of its conflict minerals,

those products subject to due diligence, or the DRC Conflict Free status of its products. |

Accordingly, we do not express an opinion

or any other form of assurance on the aforementioned matters or any other matters included in any section of the Conflict Minerals Report

other than the section titled “Part I. Due Diligence.”

In our opinion,

| • | the

design of the Company’s due diligence framework for the reporting period from January

1 to December 31, 2023, as set forth in the Company’s Conflict Minerals Report, is

in conformity, in all material respects, with the OECD Due Diligence Guidance, and |

| • | the

Company’s description of the due diligence measures it performed for the reporting

period from January 1 to December 31, 2023 as set forth in its Conflict Minerals Report,

is consistent, in all material respects, with the due diligence process that the Company

undertook. |

/s/ KPMG

Taipei, Taiwan (the Republic of China)

May 31, 2024

Annex C – Glossary

| Term |

Explanation

|

| ASEH |

ASE Technology Holding Co.,

Ltd. |

| CMRT |

Conflict Minerals Reporting

Template |

| DRC

Conflict-Free |

DRC Conflict-free minerals

are conflict minerals that, through their mining or distribution, directly or indirectly, do not benefit violent organizations in

the Democratic Republic of the Congo and its adjacent regions |

| LBMA |

London Bullion Market Association |

| OECD |

Organisation for Economic

Co-operation and Development |

| RBA |

Responsible Business Alliance |

| RCOI |

Reasonable Country of Origin

Inquiry |

| RJC |

Responsible Jewellery Council |

| RMAP |

Responsible Minerals Assurance

Process |

| RMI |

Responsible Minerals Initiative |

| SoRs |

Smelters or Refiners |

| TI-CMC |

Tungsten Industry—Conflict

Minerals Council |

| CAHRA |

Conflict-affected and high-risk

areas |

Annex D – Smelter List

| Metal |

Smelter

Identification

Number |

Smelter

or Refiner Name |

Smelter

Country |

| Gold |

CID000015 |

Advanced

Chemical Company |

UNITED

STATES OF AMERICA |

| Gold |

CID000019 |

Aida

Chemical Industries Co., Ltd. |

JAPAN |

| Gold |

CID000035 |

Agosi

AG |

GERMANY |

| Gold |

CID000041 |

Almalyk

Mining and Metallurgical Complex (AMMC) |

UZBEKISTAN |

| Gold |

CID000058 |

AngloGold

Ashanti Corrego do Sitio Mineracao |

BRAZIL |

| Gold |

CID000077 |

Argor-Heraeus

S.A. |

SWITZERLAND |

| Gold |

CID000082 |

Asahi

Pretec Corp. |

JAPAN |

| Gold |

CID000090 |

Asaka

Riken Co., Ltd. |

JAPAN |

| Gold |

CID000113 |

Aurubis

AG |

GERMANY |

| Gold |

CID000128 |

Bangko

Sentral ng Pilipinas (Central Bank of the Philippines) |

PHILIPPINES |

| Gold |

CID000157 |

Boliden

Ronnskar |

SWEDEN |

| Gold |

CID000176 |

C. Hafner

GmbH + Co. KG |

GERMANY |

| Gold |

CID000185 |

CCR

Refinery - Glencore Canada Corporation |

CANADA |

| Gold |

CID000233 |

Chimet

S.p.A. |

ITALY |

| Gold |

CID000264 |

Chugai

Mining |

JAPAN |

| Gold |

CID000359 |

DSC

(Do Sung Corporation) |

KOREA,

REPUBLIC OF KOREA |

| Gold |

CID000401 |

Dowa |

JAPAN |

| Gold |

CID000425 |

Eco-System

Recycling Co., Ltd. East Plant |

JAPAN |

| Gold |

CID000689 |

LT Metal

Ltd. |

KOREA,

REPUBLIC OF KOREA |

| Gold |

CID000694 |

Heimerle

+ Meule GmbH |

GERMANY |

| Gold |

CID000707 |

Heraeus

Metals Hong Kong Ltd. |

CHINA |

| Gold |

CID000711 |

Heraeus

Germany GmbH Co. KG |

GERMANY |

| Gold |

CID000801 |

Inner

Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. |

CHINA |

| Gold |

CID000807 |

Ishifuku

Metal Industry Co., Ltd. |

JAPAN |

| Gold |

CID000814 |

Istanbul

Gold Refinery |

TURKEY |

| Gold |

CID000823 |

Japan

Mint |

JAPAN |

| Gold |

CID000855 |

Jiangxi

Copper Co., Ltd. |

CHINA |

| Gold |

CID000920 |

Asahi

Refining USA Inc. |

UNITED

STATES OF AMERICA |

| Gold |

CID000924 |

Asahi

Refining Canada Ltd. |

CANADA |

| Gold |

CID000937 |

JX Nippon

Mining & Metals Co., Ltd. |

JAPAN |

| Gold |

CID000957 |

Kazzinc |

KAZAKHSTAN |

| Gold |

CID000969 |

Kennecott

Utah Copper LLC |

UNITED

STATES OF AMERICA |

| Gold |

CID000981 |

Kojima

Chemicals Co., Ltd. |

JAPAN |

| Gold |

CID001078 |

LS MnM

Inc. |

KOREA,

REPUBLIC OF KOREA |

| Gold |

CID001113 |

Materion |

UNITED

STATES OF AMERICA |

| Gold |

CID001119 |

Matsuda

Sangyo Co., Ltd. |

JAPAN |

| Gold |

CID001147 |

Metalor

Technologies (Suzhou) Ltd. |

CHINA |

| Gold |

CID001149 |

Metalor

Technologies (Hong Kong) Ltd. |

CHINA |

| Gold |

CID001152 |

Metalor

Technologies (Singapore) Pte., Ltd. |

SINGAPORE |

| Metal |

Smelter

Identification

Number |

Smelter

or Refiner Name |

Smelter

Country |

| Gold |

CID001153 |

Metalor

Technologies S.A. |

SWITZERLAND |

| Gold |

CID001157 |

Metalor

USA Refining Corporation |

UNITED

STATES OF AMERICA |

| Gold |

CID001161 |

Metalurgica

Met-Mex Penoles S.A. De C.V. |

MEXICO |

| Gold |

CID001188 |

Mitsubishi

Materials Corporation |

JAPAN |

| Gold |

CID001193 |

Mitsui

Mining and Smelting Co., Ltd. |

JAPAN |

| Gold |

CID001220 |

Nadir

Metal Rafineri San. Ve Tic. A.S. |

TURKEY |

| Gold |

CID001236 |

Navoi

Mining and Metallurgical Combinat |

UZBEKISTAN |

| Gold |

CID001259 |

Nihon

Material Co., Ltd. |

JAPAN |

| Gold |

CID001325 |

Ohura

Precious Metal Industry Co., Ltd. |

JAPAN |

| Gold |

CID001352 |

MKS

PAMP S.A. |

SWITZERLAND |

| Gold |

CID001397 |

PT Aneka

Tambang (Persero) Tbk |

INDONESIA |

| Gold |

CID001498 |

PX Precinox

S.A. |

SWITZERLAND |

| Gold |

CID001512 |

Rand

Refinery (Pty) Ltd. |

SOUTH

AFRICA |

| Gold |

CID001534 |

Royal

Canadian Mint |

CANADA |

| Gold |

CID001585 |

SEMPSA

Joyeria Plateria S.A. |

SPAIN |

| Gold |

CID001622 |

Shandong

Zhaojin Gold & Silver Refinery Co., Ltd. |

CHINA |

| Gold |

CID001736 |

Sichuan

Tianze Precious Metals Co., Ltd. |

CHINA |

| Gold |

CID001761 |

Solar

Applied Materials Technology Corp. |

TAIWAN |

| Gold |

CID001798 |

Sumitomo

Metal Mining Co., Ltd. |

JAPAN |

| Gold |

CID001875 |

Tanaka

Kikinzoku Kogyo K.K. |

JAPAN |

| Gold |

CID001916 |

Shandong

Gold Smelting Co., Ltd. |

CHINA |

| Gold |

CID001938 |

Tokuriki

Honten Co., Ltd. |

JAPAN |

| Gold |

CID001955 |

Torecom |

KOREA,

REPUBLIC OF KOREA |

| Gold |

CID001980 |

Umicore

S.A. Business Unit Precious Metals Refining |

BELGIUM |

| Gold |

CID001993 |

United

Precious Metal Refining, Inc. |

UNITED

STATES OF AMERICA |

| Gold |

CID002003 |

Valcambi

S.A. |

SWITZERLAND |

| Gold |

CID002030 |

Western

Australian Mint (T/a The Perth Mint) |

AUSTRALIA |

| Gold |

CID002100 |

Yamakin

Co., Ltd. |

JAPAN |

| Gold |

CID002129 |

Yokohama

Metal Co., Ltd. |

JAPAN |

| Gold |

CID002224 |

Zhongyuan

Gold Smelter of Zhongjin Gold Corporation |

CHINA |

| Gold |

CID002243 |

Gold

Refinery of Zijin Mining Group Co., Ltd. |

CHINA |

| Gold |

CID002290 |

SAFINA

A.S. |

CZECHIA |

| Gold |

CID002459 |

Geib

Refining Corporation |

UNITED

STATES OF AMERICA |

| Gold |

CID002509 |

MMTC-PAMP

India Pvt., Ltd. |

INDIA |

| Gold |

CID002511 |

KGHM

Polska Miedz Spolka Akcyjna |

POLAND |

| Gold |

CID002580 |

T.C.A

S.p.A |

ITALY |

| Gold |

CID002582 |

REMONDIS

PMR B.V. |

NETHERLANDS |

| Gold |

CID002605 |

Korea

Zinc Co., Ltd. |

KOREA,

REPUBLIC OF KOREA |

| Gold |

CID002615 |

TOO

Tau-Ken-Altyn |

KAZAKHSTAN |

| Gold |

CID002708 |

Abington

Reldan Metals, LLC |

UNITED

STATES OF AMERICA |

| Gold |

CID002762 |

L'Orfebre

S.A. |

ANDORRA |

| Gold |

CID002765 |

Italpreziosi |

ITALY |

| Metal |

Smelter

Identification

Number |

Smelter

or Refiner Name |

Smelter

Country |

| Gold |

CID002778 |

WIELAND

Edelmetalle GmbH |

GERMANY |

| Gold |

CID002779 |

Ogussa

Osterreichische Gold- und Silber-Scheideanstalt GmbH |

AUSTRIA |

| Gold |

CID002852 |

GGC

Gujrat Gold Centre Pvt. Ltd. |

INDIA |

| Gold |

CID002918 |

SungEel

HiMetal Co., Ltd. |

KOREA,

REPUBLIC OF KOREA |

| Gold |

CID002919 |

Planta

Recuperadora de Metales SpA |

CHILE |

| Gold |

CID003189 |

NH Recytech

Company |

KOREA,

REPUBLIC OF KOREA |

| Gold |

CID003424 |

Eco-System

Recycling Co., Ltd. North Plant |

JAPAN |

| Gold |

CID003425 |

Eco-System

Recycling Co., Ltd. West Plant |

JAPAN |

| Gold |

CID003461 |

Augmont

Enterprises Private Limited |

INDIA |

| Gold |

CID003529 |

Sancus

ZFS (L’Orfebre, SA) |

COLOMBIA |

| Gold |

CID003575 |

Metal

Concentrators SA (Pty) Ltd. |

SOUTH

AFRICA |

| Gold |

CID003615 |

WEEEREFINING |

FRANCE |

| Gold |

CID003641 |

Gold

by Gold Colombia |

COLOMBIA |

| Tin |

CID000228 |

Chenzhou

Yunxiang Mining and Metallurgy Co., Ltd. |

CHINA |

| Tin |

CID000292 |

Alpha |

UNITED

STATES OF AMERICA |

| Tin |

CID000309 |

PT Aries

Kencana Sejahtera |

INDONESIA |

| Tin |

CID000313 |

PT Premium

Tin Indonesia |

INDONESIA |

| Tin |

CID000402 |

Dowa |

JAPAN |

| Tin |

CID000438 |

EM Vinto |

BOLIVIA

(PLURINATIONAL STATE OF) |

| Tin |

CID000448 |

Estanho

de Rondonia S.A. |

BRAZIL |

| Tin |

CID000468 |

Fenix

Metals |

POLAND |

| Tin |

CID000538 |

Gejiu

Non-Ferrous Metal Processing Co., Ltd. |

CHINA |

| Tin |

CID001070 |

China

Tin Group Co., Ltd. |

CHINA |

| Tin |

CID001105 |

Malaysia

Smelting Corporation (MSC) |

MALAYSIA |

| Tin |

CID001142 |

Metallic

Resources, Inc. |

UNITED

STATES OF AMERICA |

| Tin |

CID001173 |

Mineracao

Taboca S.A. |

BRAZIL |

| Tin |

CID001182 |

Minsur |

PERU |

| Tin |

CID001191 |

Mitsubishi

Materials Corporation |

JAPAN |

| Tin |

CID001231 |

Jiangxi

New Nanshan Technology Ltd. |

CHINA |

| Tin |

CID001314 |

O.M.

Manufacturing (Thailand) Co., Ltd. |

THAILAND |

| Tin |

CID001337 |

Operaciones

Metalurgicas S.A. |

BOLIVIA

(PLURINATIONAL STATE OF) |

| Tin |

CID001399 |

PT Artha

Cipta Langgeng |

INDONESIA |

| Tin |

CID001402 |

PT Babel

Inti Perkasa |

INDONESIA |

| Tin |

CID001406 |

PT Babel

Surya Alam Lestari |

INDONESIA |

| Tin |

CID001421 |

PT Belitung

Industri Sejahtera |

INDONESIA |

| Tin |

CID001428 |

PT Bukit

Timah |

INDONESIA |

| Tin |

CID001453 |

PT Mitra

Stania Prima |

INDONESIA |

| Tin |

CID001458 |

PT Prima

Timah Utama |

INDONESIA |

| Tin |

CID001460 |

PT Refined

Bangka Tin |

INDONESIA |

| Tin |

CID001463 |

PT Sariwiguna

Binasentosa |

INDONESIA |

| Metal |

Smelter

Identification

Number |

Smelter

or Refiner Name |

Smelter

Country |

| Tin |

CID001468 |

PT

Stanindo Inti Perkasa |

INDONESIA |

| Tin |

CID001477 |

PT Timah

Tbk Kundur |

INDONESIA |

| Tin |

CID001482 |

PT Timah

Tbk Mentok |

INDONESIA |

| Tin |

CID001486 |

PT Timah

Nusantara |

INDONESIA |

| Tin |

CID001490 |

PT Tinindo

Inter Nusa |

INDONESIA |

| Tin |

CID001493 |

PT Tommy

Utama |

INDONESIA |

| Tin |

CID001539 |

Rui

Da Hung |

TAIWAN |

| Tin |

CID001898 |

Thaisarco |

THAILAND |

| Tin |

CID002036 |

White

Solder Metalurgia e Mineracao Ltda. |

BRAZIL |

| Tin |

CID002158 |

Yunnan

Chengfeng Non-ferrous Metals Co., Ltd. |

CHINA |

| Tin |

CID002180 |

Tin

Smelting Branch of Yunnan Tin Co., Ltd. |

CHINA |

| Tin |

CID002455 |

CV Venus

Inti Perkasa |

INDONESIA |

| Tin |

CID002468 |

Magnu's

Minerais Metais e Ligas Ltda. |

BRAZIL |

| Tin |

CID002503 |

PT ATD

Makmur Mandiri Jaya |

INDONESIA |

| Tin |

CID002517 |

O.M.

Manufacturing Philippines, Inc. |

PHILIPPINES |

| Tin |

CID002570 |

CV Ayi

Jaya |

INDONESIA |

| Tin |

CID002593 |

PT Rajehan

Ariq |

INDONESIA |

| Tin |

CID002696 |

PT Cipta

Persada Mulia |

INDONESIA |

| Tin |

CID002706 |

Resind

Industria e Comercio Ltda. |

BRAZIL |

| Tin |

CID002756 |

Super

Ligas |

BRAZIL |

| Tin |

CID002773 |

Aurubis

Beerse |

BELGIUM |

| Tin |

CID002774 |

Aurubis

Berango |

SPAIN |

| Tin |

CID002776 |

PT

Bangka Prima Tin |

INDONESIA |

| Tin |

CID002816 |

PT Sukses

Inti Makmur (SIM) |

INDONESIA |

| Tin |

CID002835 |

PT Menara

Cipta Mulia |

INDONESIA |

| Tin |

CID002844 |

HuiChang

Hill Tin Industry Co., Ltd. |

CHINA |

| Tin |

CID003116 |

Guangdong

Hanhe Non-Ferrous Metal Co., Ltd. |

CHINA |

| Tin |

CID003190 |

Chifeng

Dajingzi Tin Industry Co., Ltd. |

CHINA |

| Tin |

CID003205 |

PT Bangka

Serumpun |

INDONESIA |

| Tin |

CID003325 |

Tin

Technology & Refining |

UNITED

STATES OF AMERICA |

| Tin |

CID003381 |

PT Rajawali

Rimba Perkasa |

INDONESIA |

| Tin |

CID003387 |

Luna

Smelter, Ltd. |

RWANDA |

| Tin |

CID003409 |

Precious

Minerals and Smelting Limited |

INDIA |

| Tin |

CID003449 |

PT Mitra

Sukses Globalindo |

INDONESIA |

| Tin |

CID003486 |

CRM

Fundicao De Metais E Comercio De Equipamentos Eletronicos Do Brasil Ltda |

BRAZIL |

| Tin |

CID003524 |

CRM

Synergies |

SPAIN |

| Tin |

CID003582 |

Fabrica

Auricchio Industria e Comercio Ltda. |

BRAZIL |

| Tin |

CID003831 |

DS Myanmar |

Myanmar |

| Tin |

CID003868 |

PT Putera

Sarana Shakti (PT PSS) |

INDONESIA |

| Tin |

CID003397 |

Yunnan

Yunfan Non-ferrous Metals Co., Ltd. |

CHINA |

| Metal |

Smelter

Identification

Number |

Smelter

or Refiner Name |

Smelter

Country |

| Tin |

CID004065 |

Mining

Minerals Resources SARL |

Congo,

Democratic Republic of the Congo |

| Tantalum |

CID000211 |

Changsha

South Tantalum Niobium Co., Ltd. |

CHINA |

| Tantalum |

CID000291 |

Guangdong

Rising Rare Metals-EO Materials Ltd. |

CHINA |

| Tantalum |

CID000460 |

F&X

Electro-Materials Ltd. |

CHINA |

| Tantalum |

CID000616 |

XIMEI

RESOURCES (GUANGDONG) LIMITED |

CHINA |

| Tantalum |

CID000914 |

JiuJiang

JinXin Nonferrous Metals Co., Ltd. |

CHINA |

| Tantalum |

CID000917 |

Jiujiang

Tanbre Co., Ltd. |

CHINA |

| Tantalum |

CID001076 |

AMG

Brasil |

BRAZIL |

| Tantalum |

CID001163 |

Metallurgical

Products India Pvt., Ltd. |

INDIA |

| Tantalum |

CID001175 |

Mineracao

Taboca S.A. |

BRAZIL |

| Tantalum |

CID001192 |

Mitsui

Mining and Smelting Co., Ltd. |

JAPAN |

| Tantalum |

CID001200 |

NPM

Silmet AS |

ESTONIA |

| Tantalum |

CID001277 |

Ningxia

Orient Tantalum Industry Co., Ltd. |

CHINA |

| Tantalum |

CID001508 |

QuantumClean |

UNITED

STATES OF AMERICA |

| Tantalum |

CID001522 |

Yanling

Jincheng Tantalum & Niobium Co., Ltd. |

CHINA |

| Tantalum |

CID001869 |

Taki

Chemical Co., Ltd. |

JAPAN |

| Tantalum |

CID001891 |

Telex

Metals |

UNITED

STATES OF AMERICA |

| Tantalum |

CID001969 |

Ulba

Metallurgical Plant JSC |

KAZAKHSTAN |

| Tantalum |

CID002492 |

Hengyang

King Xing Lifeng New Materials Co., Ltd. |

CHINA |

| Tantalum |

CID002504 |

D Block

Metals, LLC |

UNITED

STATES OF AMERICA |

| Tantalum |

CID002505 |

FIR

Metals & Resource Ltd. |

CHINA |

| Tantalum |

CID002506 |

Jiujiang

Zhongao Tantalum & Niobium Co., Ltd. |

CHINA |

| Tantalum |

CID002508 |

XinXing

HaoRong Electronic Material Co., Ltd. |

CHINA |

| Tantalum |

CID002512 |

Jiangxi

Dinghai Tantalum & Niobium Co., Ltd. |

CHINA |

| Tantalum |

CID002539 |

KEMET

de Mexico |

MEXICO |

| Tantalum |

CID002544 |

TANIOBIS

Co., Ltd. |

THAILAND |

| Tantalum |

CID002545 |

TANIOBIS

GmbH |

GERMANY |

| Tantalum |

CID002548 |

Materion

Newton Inc. |

UNITED

STATES OF AMERICA |

| Tantalum |

CID002549 |

TANIOBIS

Japan Co., Ltd. |

JAPAN |

| Tantalum |

CID002550 |

TANIOBIS

Smelting GmbH & Co. KG |

GERMANY |

| Tantalum |

CID002557 |

Global

Advanced Metals Boyertown |

UNITED

STATES OF AMERICA |

| Tantalum |

CID002558 |

Global

Advanced Metals Aizu |

JAPAN |

| Tantalum |

CID002707 |

Resind

Industria e Comercio Ltda. |

BRAZIL |

| Tantalum |

CID002842 |

Jiangxi

Tuohong New Raw Material |

CHINA |

| Tantalum |

CID003583 |

RFH

Yancheng Jinye New Material Technology Co., Ltd. |

CHINA |

| Tantalum |

CID004054 |

PowerX

Ltd. |

RWANDA |

| Tungsten |

CID000004 |

A.L.M.T.

Corp. |

JAPAN |

| Tungsten |

CID000105 |

Kennametal

Huntsville |

UNITED

STATES OF AMERICA |

| Tungsten |

CID000218 |

Guangdong

Xianglu Tungsten Co., Ltd. |

CHINA |

| Tungsten |

CID000258 |

Chongyi

Zhangyuan Tungsten Co., Ltd. |

CHINA |

| Tungsten |

CID000568 |

Global

Tungsten & Powders Corp. |

UNITED

STATES OF AMERICA |

| Metal |

Smelter

Identification

Number |

Smelter or Refiner

Name |

Smelter Country |

| Tungsten |

CID000766 |

Hunan

Chenzhou Mining Co., Ltd. |

CHINA |

| Tungsten |

CID000825 |

Japan

New Metals Co., Ltd. |

JAPAN |

| Tungsten |

CID000966 |

Kennametal

Fallon |

UNITED

STATES OF AMERICA |

| Tungsten |

CID002044 |

Wolfram

Bergbau und Hutten AG |

AUSTRIA |

| Tungsten |

CID002082 |

Xiamen

Tungsten Co., Ltd. |

CHINA |

| Tungsten |

CID002315 |

Ganzhou

Jiangwu Ferrotungsten Co., Ltd. |

CHINA |

| Tungsten |

CID002316 |

Jiangxi

Yaosheng Tungsten Co., Ltd. |

CHINA |

| Tungsten |

CID002317 |

Jiangxi

Xinsheng Tungsten Industry Co., Ltd. |

CHINA |

| Tungsten |

CID002318 |

Jiangxi

Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. |

CHINA |

| Tungsten |

CID002319 |

Malipo

Haiyu Tungsten Co., Ltd. |

CHINA |

| Tungsten |

CID002320 |

Xiamen

Tungsten (H.C.) Co., Ltd. |

CHINA |

| Tungsten |

CID002321 |

Jiangxi

Gan Bei Tungsten Co., Ltd. |

CHINA |

| Tungsten |

CID002494 |

Ganzhou

Seadragon W & Mo Co., Ltd. |

CHINA |

| Tungsten |

CID002502 |

Asia

Tungsten Products Vietnam Ltd. |

VIETNAM |

| Tungsten |

CID002513 |

Hunan

Shizhuyuan Nonferrous Metals Co., Ltd. Chenzhou Tungsten Products Branch |

CHINA |

| Tungsten |

CID002541 |

H.C.

Starck Tungsten GmbH |

GERMANY |

| Tungsten |

CID002542 |

TANIOBIS

Smelting GmbH & Co. KG |

GERMANY |

| Tungsten |

CID002543 |

Masan

High-Tech Materials |

VIETNAM |

| Tungsten |

CID002551 |

Jiangwu

H.C. Starck Tungsten Products Co., Ltd. |

CHINA |

| Tungsten |

CID002589 |

Niagara

Refining LLC |

UNITED

STATES OF AMERICA |

| Tungsten |

CID002641 |

China

Molybdenum Tungsten Co., Ltd. |

CHINA |

| Tungsten |

CID002645 |

Ganzhou

Haichuang Tungsten Co., Ltd. |

CHINA |

| Tungsten |

CID002827 |

Philippine

Chuangxin Industrial Co., Inc. |

PHILIPPINES |

| Tungsten |

CID003407 |

Lianyou

Metals Co., Ltd. |

TAIWAN |

| Tungsten |

CID003417 |

Hubei

Green Tungsten Co., Ltd. |

CHINA |

| Tungsten |

CID003468 |

Cronimet

Brasil Ltda |

BRAZIL |

| Tungsten |

CID003609 |

Fujian

Xinlu Tungsten Co., Ltd. |

CHINA |

| Tungsten |

CID003993 |

Tungsten

Vietnam Joint Stock Company |

VIETNAM |

Annex E – Countries of Origin

of Conflict Minerals

It

is likely that we used conflict minerals from many of the following sources as well as some that are not identified.

| Algeria |

Finland |

Mexico |

Tajikistan |

| Andorra |

France |

Monaco |

Tanzania |

| Antigua

and Barbuda |

French Guiana |

Mongolia |

Thailand |

| Argentina |

Georgia |

Morocco |

Trinidad and Tobago |

| Australia |

Germany |

Mozambique |

Tunisia |

| Austria |

Ghana |

Myanmar |

Turkey |

| Azerbaijan |

Greece |

Namibia |

Turks and Caicos |

| Bahamas |

Grenada |

Netherlands |

Ukraine |

| Bangladesh |

Guatemala |

New Zealand |

United Arab Emirates |

| Barbados |

Guinea |

Nicaragua |

United Kingdom of Great Britain

and Northern Ireland |

| Belarus |

Guyana |

Niger |

United States of America |

| Belgium |

Honduras |

Nigeria |

Uruguay |

| Benin |

Hong Kong |

Norway |

Uzbekistan |

| Bolivia |

Hungary |

Oman |

Vietnam |

| Bosnia

& Herzegovina |

Iceland |

Pakistan |

Zimbabwe |

| Botswana |

India |

Panama |

|

| Brazil |

Indonesia |

Papua New Guinea |

|

| Bulgaria |

Ireland |

Peru |

|

| Burkina

Faso |

Israel |

Philippines |

|

| Burundi |

Italy |

Poland |

|

| Cambodia |

Jamaica |

Portugal |

|

| Cameroon |

Japan |

Puerto Rico |

|

| Canada |

Jordan |

Romania |

|

| Cayman

Islands |

Kazakhstan |

Russia |

|

| Chile |

Kenya |

Rwanda |

|

| China

|

Korea, Republic of Korea |

Saint Kitts and Nevis |

|

| Colombia |

Kuwait |

Saudi Arabia |

|

| Congo,

Democratic Republic of the Congo |

Kyrgyzstan |

Senegal |

|

| Costa

Rica |

Laos People's Democratic

Republic |

Serbia |

|

| Cote

d'Ivoire |

Latvia |

Sierra Leone |

|

| Croatia |

Lebanon |

Singapore |

|

| Curacao |

Liberia |

Sint Maarten |

|

| Cyprus |

Liechtenstein |

Slovakia |

|

| Czech

Republic |

Lithuania |

Slovenia |

|

| Denmark |

Luxembourg |

South Africa |

|

| Dominican

Republic |

Macao |

Spain |

|

| Ecuador |

Madagascar |

St Vincent and Grenadines |

|

| Egypt |

Malaysia |

Sudan |

|

| El

Salvador |

Mali |

Suriname |

|

| Estonia |

Malta |

Sweden |

|

| Ethiopia |

Mauritania |

Switzerland |

|

| Fiji |

Mauritius |

Taiwan |

|

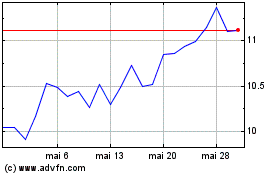

ASE Technology (NYSE:ASX)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

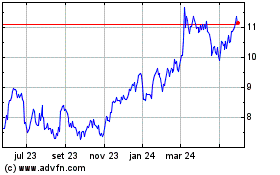

ASE Technology (NYSE:ASX)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024