0001299709false00012997092024-06-042024-06-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 4, 2024

Axos Financial, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

|

| | |

| Delaware | 001-37709 | 33-0867444 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (IRS Employer Identification

Number) |

9205 West Russell Road, Ste 400

Las Vegas, NV 89148

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (858) 649-2218

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value | AX | New York Stock Exchange |

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Information

A recently released report, by a self-described short-seller, made a series of misleading, incomplete, and false allegations centered on the quality of Axos’ commercial real estate loan portfolio.

This report contains a series of inaccuracies and innuendo that include false, incomplete and misleading allegedly factual information with respect to specific loans, incomplete or inaccurate descriptions of loan structures, failure to accurately describe the Axos lending counterparty, failure to mention guarantors or fund partners that provide significant support to the Axos credit position, as well as inaccurate discussions of loans that that have already been repaid but not represented in the report as having been repaid.

We provided a detailed credit update on our last earnings call and there has not been any material change in credit performance as of today. As Axos disclosed in its investor presentation filed as Exhibit 99 to its Form 8-K filed with the Securities and Exchange Commission on May 7, 2024, its largest commercial real estate portfolio, CRE Specialty lending, with $5.22 billion dollars of outstanding balances as of March 31st, 2024 is a business that works almost exclusively through fund relationships, including many of the largest real estate funds in the world, such as Carlyle, the Related Group, Fortress Investment Group, Madison Realty Capital and others.

When working with its fund partners, Axos structures the credits to take the most senior secured position in these loans. As a result of this structure, for Axos to lose any principal on these loans, the Axos fund partners would first have to lose the entire principal value of their position. In other words, the fund partners bear significant risk of loss from their investments prior to any risk of loss to Axos. This structure provides Axos strong collateral protection even in adverse market scenarios.

As of March 31, 2024, the weighted average LTV of the Axos CRE Specialty Portfolio is 40%.

The other large commercial real estate exposure is Multifamily mortgages. These mortgages are generally full warm-body recourse to the underlying borrower and originated at an average loan-to-value ratio of 55% as of March 31, 2024. The short-

seller refers to loan repricing risk associated with this portfolio. A significant portion of the portfolio has already repriced with increased prepayment speed among loans that have repriced.

Axos also provides lines of credit to its fund partners. These lines of credit are secured by multiple assets, have low advance rates, are cross-collateralized, and can, depending upon the circumstances, have direct recourse to the fund itself. Selecting any one asset on a multi-asset line of credit, as was done in this short-seller report, does not accurately portray the underlying risk of the facility.

Additional data correcting some of the inaccuracies and misstatements in the report are provided below. The volume of inaccuracies and confidentiality obligations prevent addressing all of the inaccuracies, but a sufficient level of detail is provided to demonstrate that the report is not reliable.

1.147-35 95th Ave. Jamaica, Queens.

Axos loaned money to a joint venture between Slate & Carlyle group, the well-known publicly traded alternative asset manager, secured by a mortgage made by Slate & Carlyle for the completion of the construction of a multifamily apartment building. The report misstates the identity of the Axos borrower, which is the Slate & Carlyle joint-venture, not the property developer. The Axos loan-to-value is approximately 40% of the as-complete value based upon the appraisal performed at origination. The short-seller stated that the property was not yet leased, implying a weakness in the underlying project. However, the project is 98% complete, and does not yet have a certificate of occupancy. Based upon CoStar, the multifamily vacancy in this sub-market is low with strong demand for new apartment units in the area.

2. 960 Franklin Avenue, Brooklyn, NY

The short-seller indicated that Axos loaned up to $91 million on a “newly stalled development on 960 Franklin Avenue.” Since the sponsor purchased the property in April of 2024, less than two months ago, multiple permits including demolition permits have been issued and work is commencing, the reference to the project being stalled is not accurate. Also, the reference to the $91 million dollar loan is misleading as Axos would only advance monies on approved construction cost after the underlying sponsor funds all required equity into the project.

Axos advanced $24.75 million on a $45.0 million initial advance of a loan owned by a vehicle managed by G4 Capital Partners, which is supported by several asset managers with over $16 billion of assets under management. On April 22nd, 2024, the underlying land was purchased for $64 million dollars representing 38% of the purchase price. The Axos loan to the G4 managed borrower is secured by the asset manager’s mortgage and other credit enhancements, including a partial repayment guaranty from the sponsor who acquired the property. Based on the appraisal, the as-complete value of the to-be built 289-unit residential condominium project will be approximately 48%.

3. 962 Franklin Avenue, Brooklyn, NY

The author indicates that Axos lent up to $48.2 million to build an apartment block in Brooklyn; however, there are multiple inaccuracies in this depiction. The loan was originated by Fortress Investment and is pledged to an Axos cross-collateralized facility to Fortress Investment Group, a global asset manager with over $45 billion in assets under management. The loan mentioned by the short-seller has a loan allocation of approximately $20MM in this cross-collateralized facility - 58% lower than what is stated in the article. The loan is cross-collaterlized with other assets and loans and the Axos facility is further supported by a partial repayment guaranty from Fortress. Fortress benefits from a personal repayment guarantee from the high net worth owner’s of Fortress’s borrower. As of June 2024, the blended loan-to-value across the entire facility stands at approximately 44% excluding any consideration of the partial recourse to Fortress.

4. 2226 3rd Ave., Harlem.

This is a senior secured loan to a credit vehicle managed by the Related Group, one of the country’s largest developers. At origination the as-completed LTV was 18.3% per the appraisal. The short seller misstated the Axos borrowing relationships. The Axos loan represents approximately 56% of the investment made by the Related Group’s credit vehicle, which is the Axos borrower.

5. 429 W. 36th (ZD Jasper is developer).

The short-seller incorrectly stated that Axos lent $35 million to Z.D. Gasper for the development of a 12 story apartment block. This is inaccurate. The loan to Z.D. Gasper was made by Bridge City. Axos has a real estate lender finance facility to Bridge City with seven cross-collateralized assets on the line all of which are performing. One of those assets is the loan to Z.D. Gasper and it is advanced at approximately $24 million dollars. Bridge City’s borrower has received a number of the required permits/approvals to develop the property into a 52-unit, 12 story apartment building, including zoning approval and demolition

approval. The Bridge City borrower was disparaged by the short-seller, but has development experience and significant liquidity.

6. 106 W. 56th St (“The Six”).

The Axos loan is not to the sponsor of The Six, but rather Cirrus Partners, a firm supported by multi-billion-dollar fund managers. The Axos outstanding balance is approximately $60.6 million as of June 4th, 2024 on a project with more than $179 million in historic costs. In November of 2023, Axos received a paydown of approximately $10 million from its borrower, the vehicle managed by Cirrus. Although the property is around 50% leased, the sponsor is actively negotiating multiple leases for the property at rents above the Axos underwritten amounts.

7. A&D Mortgage & Commerce Mortgage

The report mistakenly describes warehouse lines to A&D Mortgage & Commerce Mortgage as “hospital lines.” A&D Mortgage is a large mortgage company with many warehouse lines from multiple other banks. This warehouse line was fully repaid and closed in September of 2020 with no current outstanding exposure. The Commerce Mortgage line in in good standing.

This Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, as amended (“Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing. The information in this Form 8-K is presented as of June 4, 2024, and the Registrant does not assume any obligation to update such information in the future.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

|

| | | | |

| | | Axos Financial, Inc. |

| | |

| | | |

| Date: | June 4, 2024 | By: | /s/ Derrick K. Walsh | |

| | | | Derrick K. Walsh |

| | | | EVP and Chief Financial Officer |

v3.24.1.1.u2

Cover Page

|

Jun. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 04, 2024

|

| Entity Registrant Name |

Axos Financial, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37709

|

| Entity Tax Identification Number |

33-0867444

|

| Entity Address, Address Line One |

9205 West Russell Road, Ste 400

|

| Entity Address, City or Town |

Las Vegas

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89148

|

| City Area Code |

858

|

| Local Phone Number |

649-2218

|

| Title of 12(b) Security |

Common stock, $0.01 par value

|

| Trading Symbol |

AX

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001299709

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

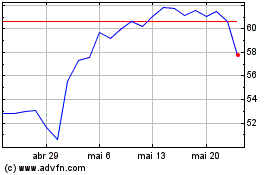

Axos Financial (NYSE:AX)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

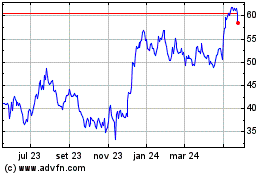

Axos Financial (NYSE:AX)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024