UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

________________________________________________

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

| | | | | | | | |

Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a‑12 |

SUNRUN INC.

(Name of Registrant as Specified In Its Charter) | | | | | | | | |

Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

| | |

Dear Fellow Sunrun Stockholders:

On behalf of the Compensation Committee of the Board of Directors of Sunrun Inc. (“Sunrun”), we encourage you to review this supplement, as well as the detailed information provided in the Compensation Discussion and Analysis section of Sunrun’s 2024 Proxy Statement, before you cast your vote on the proposals to be presented at Sunrun’s 2024 Annual Meeting of Stockholders.

We have prepared this supplement to provide more detail and context surrounding the extensive stakeholder outreach we undertook in 2023 and 2024 following Sunrun’s “Say-on-Pay” vote at the 2023 Annual Meeting of Stockholders, as well as to communicate several additional commitments and enhancements the Compensation Committee plans to implement going forward based on further stockholder and proxy advisor feedback.

We put tremendous value on your opinions as stockholders of the Company, and that feedback underpins the decisions we make as a Committee. This was especially true in 2023, as we conducted an even deeper level of stockholder engagement and took actions directly in response to your feedback. As described in the 2024 Proxy Statement, in 2023 our Investor Relations team and members of our executive and management teams engaged in discussions with 68% of our top 50 stockholders, representing 45% of our total shares outstanding.

Importantly, throughout our process we have facilitated the engagement of our board of directors with stockholders. In addition, our Investor Relations team offered meetings to all of our top 40 stockholders ahead of the 2023 Annual Stockholder Meeting.

In our 2024 Proxy Statement, we disclosed multiple enhancements to our 2024 executive compensation program made in direct response to stockholder feedback, including but not limited to:

•that performance-based equity awards (“PSUs”) would account for at least 55% of the total equity compensation awarded to our Named Executive Officer (“NEOs”);

•that such PSUs would incorporate multi-year performance criteria, including metrics aimed at incentivizing enhanced stockholder value, stock price appreciation, and Cash Generation in the long term;

•that our compensation framework would avoid overlapping metrics in our performance-based equity awards, and our cash bonus plan; and

•that, in light of an extraordinarily challenging macroeconomic environment and suboptimal stock performance, our CEO requested that her 2024 base salary remain unchanged, foregoing any customary increases.

In addition, in response to feedback we have received from stockholders and the major proxy advisory firms since the filing of our 2024 Proxy Statement, the Compensation Committee has made the following additional commitments and enhancements:

We are committed to making equity grants only within our ongoing annual equity incentive program.

•We will not make any special or one-time awards to Sunrun’s NEOs outside of our ongoing annual equity incentive program, except in the case of new hires or promotions, for the duration of the performance period of the Stockholder Vision Alignment PSUs, which continues through the end of fiscal year 2026.

Future performance-based equity awards will have robust performance goals and performance metrics based on stockholder feedback.

•Future metrics will incentivize stockholder value creation, stock price appreciation, and cash generation.

•Our 2024 performance-based equity awards to Sunrun’s NEOs are based on sustained Cash Generation and three-year relative TSR.

We will disclose all of our bonus plan goals.

•Future Annual Bonus Incentive Plan disclosures will include a robust description of all of the plan’s targets and achievements, including — for example — our Net Promoter Score goals.

Our stockholder engagement process for our Annual Meeting of Stockholders will include the participation of an independent member of the Board of Directors.

•Following the 2024 Annual Meeting of Stockholders, our Annual Meeting stockholder engagement process for investors holding over 1% of the Company’s stock will include the participation of an independent member of the Board of Directors upon request (participants may vary based on the topics of interest and availability).

Further, it is important to share that our 2024 annual bonus plan payout scales were revised and developed based on stockholder feedback. This change results in a significant increase in the downside if below-target performance is achieved.

Additionally, Sunrun would like to clarify that with respect to our Stock Ownership Guidelines (“SOGs”) for both our NEOs and our directors, the only equity awards that count toward the requisite holding requirements are unvested time-based RSUs. Under our SOGs policies, unearned performance-based equity awards and unexercised options do not count towards the holding requirements under any circumstances.

We believe that these commitments, clarifications, and enhancements, together with the other significant improvements made to Sunrun’s compensation program demonstrates that Sunrun has been responsive to feedback from our stockholders regarding executive compensation and is strongly committed to executive compensation governance best practices. Sunrun and our independent directors will continue to regularly engage with our stockholders on executive compensation matters and will continue to consider and address concerns and suggestions received through these stockholder engagement efforts. We believe that our regular and robust dialogue on these and other topics demonstrates our commitment to strong corporate governance.

Sunrun’s Stockholder Vision Alignment PSU Award was designed to ensure that our executives are only benefiting if our stockholders are tremendously benefiting as well, with a stock price above $45 and over $400 million of Cash Generation.

We appreciate that ISS and Glass Lewis have acknowledged that our Stockholder Vision Alignment PSUs were 100% performance-based and were designed with rigorous goals to incentivize transformational performance, all based on stockholder feedback. While we have subsequently received (and have noted) feedback that many investors disfavor the fact that these awards were granted outside of our annual compensation cycle, it is important to note that these awards have ZERO value unless we have a sustained stock price above $45 for 50 trading days at the end of the three-year performance period, and we are generating at least $2 per diluted share of cash.

For these reasons, we recommend stockholders vote FOR Proposal No. 2 approving, on an advisory basis, the compensation of our named executive officers and FOR Proposal No. 1 to re-elect all of our Class III director nominees.

Thank you very much for your continued support of Sunrun. We value your feedback and look forward to our continued dialogue.

Sincerely,

The Sunrun Compensation Committee

Katherine August-deWilde

Chair, Compensation Committee

Alan Ferber

Lead Independent Director & Compensation Committee Member

Sonita Lontoh

Compensation Committee Member

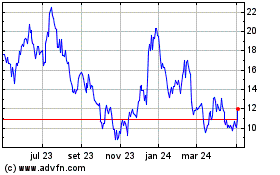

Sunrun (NASDAQ:RUN)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

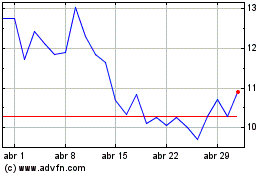

Sunrun (NASDAQ:RUN)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024