0000796343false00007963432024-06-132024-06-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): June 13, 2024 (June 13, 2024)

ADOBE INC.

(Exact name of Registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 0-15175 | | 77-0019522 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

345 Park Avenue

San Jose, California 95110-2704

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (408) 536-6000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value per share | ADBE | NASDAQ Global Select Market |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On June 13, 2024, Adobe Inc. (“Adobe”) issued a press release announcing financial results for its second quarter fiscal year 2024 ended May 31, 2024. A copy of this press release is furnished and attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this report and the exhibit attached hereto are being furnished and shall not be deemed filed for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly stated by specific reference in such filing.

The attached press release includes non-GAAP adjusted or constant currency revenue growth rates, non-GAAP operating income, non-GAAP net income, non-GAAP diluted net income per share (earnings per share) and non-GAAP tax rate.

These non-GAAP measures are not in accordance with, or an alternative for, generally accepted accounting principles and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. We believe that non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures.

We use these non-GAAP financial measures in making operating decisions because we believe the measures provide meaningful supplemental information regarding our operational performance and give us a better understanding of how we should invest in research and development and fund infrastructure and go-to-market strategies. We use these measures to help us make budgeting decisions, for example, as between product development expenses and research and development, sales and marketing and general and administrative expenses and to facilitate our internal comparisons to our historical operating results. In addition, we believe these non-GAAP financial measures are useful because they allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. This allows institutional investors, the analyst community and others to better understand and evaluate our operating results and future prospects in the same manner as management and to compare operating results across accounting periods and to those of our peer companies.

We include adjusted or constant currency revenue growth rates to provide a framework for assessing how our underlying businesses have performed or are expected to perform on a year-over-year basis, excluding the effects of foreign currency rate fluctuations and the impact of our 52/53-week fiscal year, if applicable. Adjusted or constant currency revenue growth rates are calculated in constant currency by converting non-United States Dollar revenue using comparative period exchange rates and determining the change from prior period reported revenue, adjusted for any hedging effects.

In addition, we use non-GAAP financial measures which exclude:

A. Stock-based and deferred compensation expenses. Stock-based compensation expense consists of charges for employee restricted stock units, performance shares and employee stock purchases in accordance with current GAAP including stock-based compensation expense associated with any unvested options and restricted stock units assumed in connection with our acquisitions. We believe that it is useful to investors to understand the impact of the application of accounting standards pertaining to stock-based compensation to our operational performance, liquidity and our ability to invest in research and development and fund acquisitions and capital expenditures. Deferred compensation expense consists of charges associated with movements in our deferred compensation plan liability. Although stock-based compensation and deferred compensation expenses constitute ongoing and recurring expenses, such expenses are excluded from non-GAAP results because they are not expenses that typically require current cash settlement by us and because such expenses are not used by us to assess the core profitability of our business operations. We further believe these measures are useful to investors in that they allow for greater transparency to certain line items in our financial statements. In addition, excluding these items from various non-GAAP measures facilitates comparisons to our competitors’ operating results.

B. Amortization of intangibles. We recognize amortization expense of intangibles in connection with our acquisitions. Intangibles include (i) purchased technology, (ii) trademarks, (iii) customer contracts and relationships and (iv) other intangible assets. In accordance with GAAP, we amortize the fair value of the intangibles based on the pattern in which we expect the economic benefits of the intangibles will be consumed as revenue is generated. Although the intangibles generate revenue for us, we exclude this item because the expense is non-cash in nature and because we believe the non-GAAP financial measures excluding this item provide meaningful supplemental information regarding our operational performance, liquidity and our ability to invest in research and development, fund acquisitions and capital expenditures. In addition, excluding this item from various non-GAAP measures facilitates our internal comparisons to our historical operating results and comparisons to our competitors’ operating results.

C. Acquisition-related expenses. We exclude certain acquisition-related expenses, including deal costs, certain professional fees and the termination fee, associated with the Figma transaction, due to its significant base purchase price and costs to settle the transaction. Acquisition-related expenses are inconsistent in amount and are significantly impacted by the timing and nature of acquisitions. Therefore, although we may incur these types of expenses in connection with future acquisitions, such expenses are excluded from our non-GAAP financial measures because these expenses are not used by us to assess the core profitability of our business operations. Consequently, we believe the non-GAAP financial measures excluding these expenses facilitate more meaningful evaluation of the core profitability of our business operations and comparisons to our historical operating results, and allow for greater transparency to certain line items in our financial statements.

D. Investment gains and losses. We recognize investment gains and losses principally from realized gains or losses from the sale and exchange of marketable equity investments, other-than-temporary declines in the value of marketable and non-marketable equity securities, unrealized holding gains and losses associated with our deferred compensation plan assets, gains and losses on the sale of equity securities held indirectly through investment partnerships and gains and losses associated with the recording of equity or cost method investments to fair value upon obtaining control through a business combination, as required by GAAP. We do not actively trade publicly held securities nor do we rely on these securities positions for funding our ongoing operations. We exclude investment gains and losses on these equity securities because these items are unrelated to our ongoing business and operating results.

E. Accrued loss contingencies associated with significant litigation events. In connection with ongoing litigation or similar events, we accrue losses in the event such losses are determined to be both probable and estimable under Accounting Standards Codification (ASC) 450-20, Loss Contingencies, although such litigation may be under appeal. Upon resolution of the litigation or event, we adjust the accrual to reflect final resolution. We exclude the impact of such loss contingencies when they relate to significant events that are unrelated to our ongoing business and operating results.

F. Income tax adjustments. We apply a fixed long-term projected non-GAAP tax rate to determine our non-GAAP provision for income taxes, which can differ significantly from our GAAP provision for income taxes. In arriving at our long-term projected non-GAAP tax rate, we evaluated projections and currently available information for the three year period from fiscal 2023 through fiscal 2025 that exclude certain significant, non-recurring and period-specific income tax effects, such as tax charges in connection with acquisitions, resolution of certain income tax examinations, tax legislation, and changes to our trading structure, which helps us assess the core profitability of our business operations and compare to our historical operating results. This projected long-term non-GAAP tax rate could be subject to change for several reasons, including significant changes in our geographic earnings mix or in tax laws in major jurisdictions in which we operate. As such, we periodically re-evaluate the appropriateness of the long-term non-GAAP tax rate and may adjust for significant changes.

G. Income tax effect of the non-GAAP pre-tax adjustments from the provision for income taxes. Excluding the income tax effect of the non-GAAP pre-tax adjustments from the provision for income taxes assists investors in understanding the tax provision associated with those adjustments and the effective tax rate related to our ongoing operations.

We believe that non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our financial results as determined in accordance with GAAP and that these measures should only be used to evaluate our financial results in conjunction with the corresponding GAAP measures; therefore we qualify the use of non-GAAP financial information in a statement when non-GAAP information is presented.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| Exhibit Number | | Exhibit Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ADOBE INC. |

| | |

| | By: | /s/ DANIEL DURN |

| | | Daniel Durn |

| | | Chief Financial Officer and Executive Vice President, Finance, Technology Services and Operations |

Date: June 13, 2024

Exhibit 99.1

Investor Relations Contact

Jonathan Vaas

Adobe

ir@adobe.com

Public Relations Contact

Ashley Levine

Adobe

adobepr@adobe.com

FOR IMMEDIATE RELEASE

Adobe Reports Record Revenue in Q2 Fiscal 2024

Company raises annual targets for Digital Media net new ARR, Digital Experience subscription revenue and EPS

SAN JOSE, Calif. – June 13, 2024 – Adobe (Nasdaq:ADBE) today reported financial results for its second quarter fiscal year 2024 ended May 31, 2024.

“Adobe achieved record revenue of $5.31 billion driven by strong growth across Creative Cloud, Document Cloud and Experience Cloud,” said Shantanu Narayen, chair and CEO, Adobe. “Our highly differentiated approach to AI and innovative product delivery are attracting an expanding universe of customers and providing more value to existing users.”

“Adobe delivered outstanding Q2 results, positioning us to raise our annual targets,” said Dan Durn, executive vice president and CFO, Adobe. “Our market-leading products, strong execution and world-class financial discipline position us well for the second half of 2024 and beyond.”

Second Quarter Fiscal Year 2024 Financial Highlights

•Adobe achieved revenue of $5.31 billion in its second quarter of fiscal year 2024, which represents 10 percent year-over-year growth or 11 percent in constant currency. Diluted earnings per share was $3.49 on a GAAP basis and $4.48 on a non-GAAP basis.

•GAAP operating income in the second quarter was $1.89 billion and non-GAAP operating income was $2.44 billion. GAAP net income was $1.57 billion and non-GAAP net income was $2.02 billion.

•Cash flows from operations were $1.94 billion.

•Remaining Performance Obligations (“RPO”) exiting the quarter were $17.86 billion.

•Adobe repurchased approximately 4.6 million shares during the quarter.

Second Quarter Fiscal Year 2024 Business Segment Highlights

•Digital Media segment revenue was $3.91 billion, which represents 11 percent year-over-year growth or 12 percent in constant currency. Creative revenue grew to $3.13 billion, representing 10 percent year-over-year growth or 11 percent in constant currency. Document Cloud revenue was $782 million, representing 19 percent year-over-year growth as reported and in constant currency.

•Net new Digital Media Annualized Recurring Revenue (“ARR”) was $487 million, exiting the quarter with Digital Media ARR of $16.25 billion. Creative ARR grew to $13.11 billion and Document Cloud ARR grew to $3.15 billion.

•Digital Experience segment revenue was $1.33 billion, representing 9 percent year-over-year growth as reported and in constant currency. Digital Experience subscription revenue was $1.20 billion, representing 13 percent year-over-year growth as reported and in constant currency.

Financial Targets

Adobe is providing third quarter targets and updated fiscal year 2024 targets. These targets factor in current expectations for the macroeconomic environment and FX outlook.

The following table summarizes Adobe’s third quarter fiscal year 2024 targets:

| | | | | | | | |

| Total revenue | $5.33 billion to $5.38 billion |

| Digital Media net new ARR | ~$460 million |

| Digital Media segment revenue | $3.95 billion to $3.98 billion |

| Digital Experience segment revenue | $1.325 billion to $1.345 billion |

| Digital Experience subscription revenue | $1.20 billion to $1.22 billion |

| Tax rate | GAAP: ~18.0% | Non-GAAP: ~18.5% |

Earnings per share1 | GAAP: $3.45 to $3.50 | Non-GAAP: $4.50 to $4.55 |

The following table summarizes Adobe’s updated fiscal year 2024 targets:

| | | | | | | | |

| Total revenue | $21.40 billion to $21.50 billion |

| Digital Media net new ARR | ~$1.95 billion |

| Digital Media segment revenue | $15.80 billion to $15.85 billion |

| Digital Experience segment revenue | $5.325 billion to $5.375 billion |

| Digital Experience subscription revenue | $4.775 billion to $4.825 billion |

| Tax rate | GAAP: ~20.5% | Non-GAAP: ~18.5% |

Earnings per share1 | GAAP: $11.80 to $12.00 | Non-GAAP: $18.00 to $18.20 |

1Targets assume diluted share count of ~447 million for third quarter and ~449 million for fiscal year 2024.

Adobe to Host Conference Call

Adobe will webcast its second quarter fiscal year 2024 earnings conference call today at 2:00 p.m. Pacific Time from its investor relations website: http://www.adobe.com/ADBE. Earnings documents, including Adobe management’s prepared conference call remarks with slides and an investor datasheet are posted to Adobe’s Investor Relations Website in advance of the conference call for reference.

Forward-Looking Statements, Non-GAAP and Other Disclosures

In addition to historical information, this press release contains “forward-looking statements” within the meaning of applicable securities laws, including statements related to our business, strategy, artificial intelligence and innovation momentum; our market opportunity and future growth; market trends; current macroeconomic conditions; fluctuations in foreign currency exchange rates; strategic investments; customer success; revenue; operating margin; and annualized recurring revenue; tax rate on a GAAP and non-GAAP basis; earnings per share on a GAAP and non-GAAP basis; and share count. Each of the forward-looking statements we make in this press release involves risks, uncertainties and assumptions based on information available to us as of the date of this press release. Such risks and uncertainties, many of which relate to matters beyond our control, could cause actual results to differ materially from these forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to: failure to innovate effectively and meet customer needs; issues relating to development and use of AI; failure to realize the anticipated benefits of investments or acquisitions; failure to compete effectively; damage to our reputation or brands; service interruptions or failures in information technology systems by us or third parties; security incidents; failure to effectively develop, manage and maintain critical third-party business relationships; risks associated with being a multinational corporation and adverse macroeconomic conditions; failure to recruit and retain key personnel; complex sales cycles; changes in, and compliance with, global laws and regulations, including those related to information security and privacy; failure to protect our intellectual property; litigation, regulatory inquiries and intellectual property infringement claims; changes in tax regulations; complex government procurement processes; risks related to fluctuations in or the timing of revenue recognition from our subscription offerings; fluctuations in foreign currency exchange rates; impairment charges; our existing and future debt obligations; catastrophic events; and fluctuations in our stock price. Further information on these and other factors are discussed in the section titled “Risk Factors” in Adobe’s most recently filed Annual Report on Form 10-K and Adobe's most recently filed Quarterly Reports on Form 10-Q. The risks described in this press release and in Adobe’s filings with the U.S. Securities and Exchange Commission should be carefully reviewed.

Undue reliance should not be placed on the financial information set forth in this press release, which reflects estimates based on information available at this time. These amounts could differ from actual reported amounts stated in Adobe’s Quarterly Report on Form 10-Q for our fiscal

quarter ended May 31, 2024, which Adobe expects to file in June 2024. Adobe assumes no obligation to, and does not currently intend to, update these forward-looking statements.

A reconciliation between GAAP and non-GAAP earnings results and financial targets and a statement regarding use of non-GAAP financial information are provided at the end of this press release and on Adobe’s investor relations website.

About Adobe

Adobe is changing the world through personalized digital experiences. For more information, visit www.adobe.com.

###

©2024 Adobe. All rights reserved. Adobe, Creative Cloud, Document Cloud and the Adobe logo are either registered trademarks or trademarks of Adobe (or one of its subsidiaries) in the United States and/or other countries. All other trademarks are the property of their respective owners.

Condensed Consolidated Statements of Income

(In millions, except per share data; unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| May 31, 2024 | | June 2, 2023 | | May 31, 2024 | | June 2, 2023 |

| Revenue: | | | | | | | |

| Subscription | $ | 5,060 | | | $ | 4,517 | | | $ | 9,976 | | | $ | 8,890 | |

| Product | 104 | | | 130 | | | 223 | | | 250 | |

| Services and other | 145 | | | 169 | | | 292 | | | 331 | |

| Total revenue | 5,309 | | | 4,816 | | | 10,491 | | | 9,471 | |

| | | | | | | |

| Cost of revenue: | | | | | | | |

| Subscription | 456 | | | 436 | | | 911 | | | 870 | |

| Product | 8 | | | 8 | | | 13 | | | 16 | |

| Services and other | 134 | | | 128 | | | 264 | | | 254 | |

| Total cost of revenue | 598 | | | 572 | | | 1,188 | | | 1,140 | |

| | | | | | | |

| Gross profit | 4,711 | | | 4,244 | | | 9,303 | | | 8,331 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Research and development | 984 | | | 876 | | | 1,923 | | | 1,703 | |

| Sales and marketing | 1,445 | | | 1,345 | | | 2,797 | | | 2,646 | |

| General and administrative | 355 | | | 357 | | | 707 | | | 688 | |

| | | | | | | |

Acquisition termination fee | — | | | — | | | 1,000 | | | — | |

| Amortization of intangibles | 42 | | | 42 | | | 84 | | | 84 | |

| Total operating expenses | 2,826 | | | 2,620 | | | 6,511 | | | 5,121 | |

| | | | | | | |

| Operating income | 1,885 | | | 1,624 | | | 2,792 | | | 3,210 | |

| | | | | | | |

| Non-operating income (expense): | | | | | | | |

| Interest expense | (41) | | | (26) | | | (68) | | | (58) | |

| Investment gains (losses), net | 4 | | | 5 | | | 22 | | | 6 | |

| Other income (expense), net | 82 | | | 47 | | | 152 | | | 90 | |

| Total non-operating income (expense), net | 45 | | | 26 | | | 106 | | | 38 | |

| Income before income taxes | 1,930 | | | 1,650 | | | 2,898 | | | 3,248 | |

| Provision for income taxes | 357 | | | 355 | | | 705 | | | 706 | |

| Net income | $ | 1,573 | | | $ | 1,295 | | | $ | 2,193 | | | $ | 2,542 | |

| Basic net income per share | $ | 3.50 | | | $ | 2.83 | | | $ | 4.86 | | | $ | 5.55 | |

| Shares used to compute basic net income per share | 449 | | | 458 | | | 451 | | | 458 | |

| Diluted net income per share | $ | 3.49 | | | $ | 2.82 | | | $ | 4.83 | | | $ | 5.54 | |

| Shares used to compute diluted net income per share | 451 | | | 459 | | | 454 | | | 459 | |

Condensed Consolidated Balance Sheets

(In millions; unaudited) | | | | | | | | | | | |

| May 31, 2024 | | December 1, 2023 |

| ASSETS | | | |

| | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 7,660 | | | $ | 7,141 | |

| Short-term investments | 405 | | | 701 | |

Trade receivables, net of allowances for doubtful accounts of $19 and $16, respectively | 1,612 | | | 2,224 | |

| Prepaid expenses and other current assets | 1,346 | | | 1,018 | |

| Total current assets | 11,023 | | | 11,084 | |

| | | |

| Property and equipment, net | 1,969 | | | 2,030 | |

| Operating lease right-of-use assets, net | 381 | | | 358 | |

| Goodwill | 12,803 | | | 12,805 | |

| Other intangibles, net | 933 | | | 1,088 | |

| | | |

| Deferred income taxes | 1,436 | | | 1,191 | |

| Other assets | 1,462 | | | 1,223 | |

| Total assets | $ | 30,007 | | | $ | 29,779 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| | | |

| Current liabilities: | | | |

| Trade payables | $ | 357 | | | $ | 314 | |

| Accrued expenses | 1,899 | | | 1,942 | |

| Debt | 1,498 | | | — | |

| Deferred revenue | 5,558 | | | 5,837 | |

| Income taxes payable | 95 | | | 85 | |

| Operating lease liabilities | 67 | | | 73 | |

| Total current liabilities | 9,474 | | | 8,251 | |

| | | |

| Long-term liabilities: | | | |

| Debt | 4,127 | | | 3,634 | |

| Deferred revenue | 128 | | | 113 | |

| Income taxes payable | 591 | | | 514 | |

| | | |

| Operating lease liabilities | 398 | | | 373 | |

| Other liabilities | 446 | | | 376 | |

| Total liabilities | 15,164 | | | 13,261 | |

| | | |

| Stockholders’ equity: | | | |

| Preferred stock | — | | | — | |

| Common stock | — | | | — | |

| Additional paid-in capital | 12,504 | | | 11,586 | |

| Retained earnings | 35,227 | | | 33,346 | |

| Accumulated other comprehensive income (loss) | (276) | | | (285) | |

| Treasury stock, at cost | (32,612) | | | (28,129) | |

| Total stockholders’ equity | 14,843 | | | 16,518 | |

| Total liabilities and stockholders’ equity | $ | 30,007 | | | $ | 29,779 | |

Condensed Consolidated Statements of Cash Flows

(In millions; unaudited) | | | | | | | | | | | |

| Three Months Ended |

| May 31, 2024 | | June 2, 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 1,573 | | | $ | 1,295 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation, amortization and accretion | 214 | | | 220 | |

| Stock-based compensation | 467 | | | 433 | |

| | | |

| Unrealized investment (gains) losses, net | (1) | | | (5) | |

| Other non-cash adjustments | (98) | | | (102) | |

| Changes in deferred revenue | (424) | | | (96) | |

| Changes in other operating assets and liabilities | 209 | | | 394 | |

| Net cash provided by operating activities | 1,940 | | | 2,139 | |

| | | |

| Cash flows from investing activities: | | | |

| Purchases, sales and maturities of short-term investments, net | 163 | | | 446 | |

| Purchases of property and equipment | (41) | | | (121) | |

| | | |

| Purchases and sales of long-term investments, intangibles and other assets, net | (11) | | | (3) | |

| | | |

Net cash provided by investing activities | 111 | | | 322 | |

| | | |

| Cash flows from financing activities: | | | |

| Repurchases of common stock | (2,500) | | | (1,000) | |

Taxes paid related to net share settlement of equity awards, net of proceeds from treasury stock re-issuances | (135) | | | (102) | |

| Proceeds from issuance of debt | 1,997 | | | — | |

| | | |

| Other financing activities, net | (4) | | | 22 | |

| | | |

| Net cash used for financing activities | (642) | | | (1,080) | |

| Effect of exchange rate changes on cash and cash equivalents | (3) | | | 3 | |

| Net change in cash and cash equivalents | 1,406 | | | 1,384 | |

| Cash and cash equivalents at beginning of period | 6,254 | | | 4,072 | |

| Cash and cash equivalents at end of period | $ | 7,660 | | | $ | 5,456 | |

Non-GAAP Results

The following table shows Adobe’s GAAP results reconciled to non-GAAP results included in this release.

| | | | | | | | | | | | | | | | | | | | | |

(In millions, except per share data) | Three Months Ended | | |

| May 31,

2024 | | June 2,

2023 | | March 1,

2024 | | | | |

| Operating income: | | | | | | | | | |

| | | | | | | | | |

| GAAP operating income | $ | 1,885 | | | $ | 1,624 | | | $ | 907 | | | | | |

| Stock-based and deferred compensation expense | 472 | | | 439 | | | 469 | | | | | |

| | | | | | | | | |

| Amortization of intangibles | 84 | | | 95 | | | 83 | | | | | |

Acquisition-related expenses (*) | — | | | 22 | | | 1,007 | | | | | |

Loss contingency (**) | — | | | — | | | 1 | | | | | |

| Non-GAAP operating income | $ | 2,441 | | | $ | 2,180 | | | $ | 2,467 | | | | | |

| | | | | | | | | |

| Net income: | | | | | | | | | |

| | | | | | | | | |

| GAAP net income | $ | 1,573 | | | $ | 1,295 | | | $ | 620 | | | | | |

| Stock-based and deferred compensation expense | 472 | | | 439 | | | 469 | | | | | |

| | | | | | | | | |

| Amortization of intangibles | 84 | | | 95 | | | 83 | | | | | |

Acquisition-related expenses (*) | — | | | 22 | | | 1,007 | | | | | |

Loss contingency (**) | — | | | — | | | 1 | | | | | |

| Investment (gains) losses, net | (4) | | | (5) | | | (18) | | | | | |

| Income tax adjustments | (102) | | | (52) | | | (116) | | | | | |

| Non-GAAP net income | $ | 2,023 | | | $ | 1,794 | | | $ | 2,046 | | | | | |

| | | | | | | | | |

| Diluted net income per share: | | | | | | | | | |

| | | | | | | | | |

| GAAP diluted net income per share | $ | 3.49 | | | $ | 2.82 | | | $ | 1.36 | | | | | |

| Stock-based and deferred compensation expense | 1.04 | | | 0.96 | | | 1.03 | | | | | |

| | | | | | | | | |

| Amortization of intangibles | 0.19 | | | 0.21 | | | 0.18 | | | | | |

Acquisition-related expenses (*) | — | | | 0.05 | | | 2.21 | | | | | |

| | | | | | | | | |

| Investment (gains) losses, net | (0.01) | | | (0.01) | | | (0.04) | | | | | |

| Income tax adjustments | (0.23) | | | (0.12) | | | (0.26) | | | | | |

| Non-GAAP diluted net income per share | $ | 4.48 | | | $ | 3.91 | | | $ | 4.48 | | | | | |

| | | | | | | | | |

Shares used to compute diluted net income per share | 451 | | | 459 | | | 456 | | | | | |

(*) Associated with the Figma transaction, and includes deal costs, certain professional fees and the termination fee

(**) Associated with an IP litigation matter

Reconciliation of GAAP to Non-GAAP Financial Targets

The following tables show Adobe's third quarter fiscal year 2024 financial targets reconciled to non-GAAP financial targets included in this release.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Shares in millions) | Third Quarter Fiscal 2024 |

| Low | | | | High |

| Diluted net income per share: | | | | | |

| | | | | |

| GAAP diluted net income per share | $ | 3.45 | | | | | | | | $ | 3.50 | | |

Stock-based and deferred compensation expense | | 1.12 | | | | | | | | | 1.12 | | |

| Amortization of intangibles | | 0.19 | | | | | | | | | 0.19 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Income tax adjustments | | (0.26) | | | | | | | | | (0.26) | | |

| Non-GAAP diluted net income per share | $ | 4.50 | | | | | | | | $ | 4.55 | | |

| | | | | |

| Shares used to compute diluted net income per share | 447 | | | | | | | 447 | | |

| | | | | | | | | | | |

| Third Quarter Fiscal 2024 |

| Effective income tax rate: | |

| |

| GAAP effective income tax rate | | 18.0 | | % |

Stock-based and deferred compensation expense | | (1.3) | | |

| Amortization of intangibles | | (0.2) | | |

| | | |

| Income tax adjustments | | 2.0 | | |

Non-GAAP effective income tax rate (***) | | 18.5 | | % |

(***) Represents Adobe’s fixed long-term non-GAAP tax rate based on projections and currently available information through fiscal 2025

Reconciliation of GAAP to Non-GAAP Financial Targets (continued)

The following tables show Adobe's updated annual fiscal year 2024 financial targets reconciled to non-GAAP financial targets included in this release.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Shares in millions) | Fiscal Year 2024 |

| Low | | | | High |

| Diluted net income per share: | | | | | |

| | | | | |

| GAAP diluted net income per share | $ | 11.80 | | | | | | | | $ | 12.00 | | |

Stock-based and deferred compensation expense | | 4.25 | | | | | | | | | 4.25 | | |

| Amortization of intangibles | | 0.74 | | | | | | | | | 0.74 | | |

Acquisition-related expenses (*) | | 2.24 | | | | | | | | | 2.24 | | |

Loss contingency (**) | | 0.01 | | | | | | | | | 0.01 | | |

| Income tax adjustments | | (1.04) | | | | | | | | | (1.04) | | |

| Non-GAAP diluted net income per share | $ | 18.00 | | | | | | | | $ | 18.20 | | |

| | | | | |

| Shares used to compute diluted net income per share | 449 | | | | | | | 449 | | |

| | | | | | | | | | | |

| Fiscal Year 2024 |

| Effective income tax rate: | |

| |

| GAAP effective income tax rate | | 20.5 | | % |

Stock-based and deferred compensation expense | | (1.3) | | |

| Amortization of intangibles | | (0.2) | | |

Acquisition-related expenses (*) | | (2.5) | | |

| Income tax adjustments | | 2.0 | | |

Non-GAAP effective income tax rate (***) | | 18.5 | | % |

(*) Associated with the Figma transaction, and includes deal costs, certain professional fees and the termination fee

(**) Associated with an IP litigation matter

(***) Represents Adobe’s fixed long-term non-GAAP tax rate based on projections and currently available information through fiscal 2025

Use of Non-GAAP Financial Information

Adobe continues to provide all information required in accordance with GAAP, but believes evaluating its ongoing operating results may not be as useful if an investor is limited to reviewing only GAAP financial measures. Adobe uses non-GAAP financial information to evaluate its ongoing operations and for internal planning and forecasting purposes. Adobe's management does not itself, nor does it suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Adobe presents such non-GAAP financial measures in reporting its financial results to provide investors with an additional tool to evaluate Adobe's operating results. Adobe believes these non-GAAP financial measures are useful because they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making. This allows institutional investors, the analyst community and others to better understand and evaluate our operating results and future prospects in the same manner as management.

Adobe's management believes it is useful for itself and investors to review, as applicable, both GAAP information as well as non-GAAP measures, which may exclude items such as stock-based and deferred compensation expenses, amortization of intangibles, investment gains and losses, income tax adjustments, and the income tax effect of the non-GAAP pre-tax adjustments from the provision for income taxes. Adobe uses these non-GAAP measures in order to assess the performance of Adobe's business and for planning and forecasting in subsequent periods. Whenever such a non-GAAP measure is used, Adobe provides a reconciliation of the non-GAAP financial measure to the most closely applicable GAAP financial measure. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measure as detailed above.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

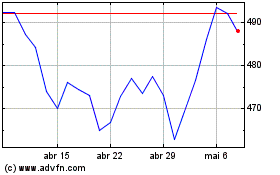

Adobe (NASDAQ:ADBE)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Adobe (NASDAQ:ADBE)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024