UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

|

|

[X] |

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

For the Fiscal Year Ended December 31, 2023 |

Commission File No. 1-8491

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

HECLA MINING COMPANY CAPITAL ACCUMULATION PLAN

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Hecla Mining Company

6500 North Mineral Drive, Suite 200

Coeur d'Alene, ID 83815-9408

REQUIRED INFORMATION

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the members of the Administrative Committee of the Hecla Mining Company Capital Accumulation Plan have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

HECLA MINING COMPANY CAPITAL ACCUMULATION PLAN

|

|

|

|

|

|

By: |

/s/ Russell D. Lawlar |

|

Date: |

June 18, 2024 |

|

Russell D. Lawlar, Senior Vice President |

|

|

|

|

|

and Chief Financial Officer |

|

|

|

Report of Independent Registered Public Accounting Firm

Plan Administrator and Participants

Hecla Mining Company Capital Accumulation Plan

Coeur d’Alene, Idaho

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Hecla Mining Company Capital Accumulation Plan (the “Plan”) as of December 31, 2023 and 2022, the related statements of changes in net assets available for benefits for the years then ended, and the related notes (collectively, the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by the Plan’s management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information in the accompanying Schedule H, Line 4i Schedule of Assets (Held at End of Year) as of December 31, 2023 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but included supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ BDO USA, P.C.

We have served as the Plan’s auditor since 2002.

Denver, Colorado

June 18, 2024

Hecla Mining Company Capital Accumulation Plan

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

December 31, |

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at Fair Value |

|

|

|

|

|

|

Money market fund |

|

$ |

7,194,725 |

|

|

$ |

9,063,502 |

|

Mutual funds |

|

|

119,903,630 |

|

|

|

104,718,403 |

|

Common stock |

|

|

19,335,956 |

|

|

|

21,987,389 |

|

|

|

|

|

|

|

|

Total Investments |

|

|

146,434,311 |

|

|

|

135,769,294 |

|

|

|

|

|

|

|

|

Receivables |

|

|

|

|

|

|

Employer contributions |

|

|

1,251,308 |

|

|

|

1,146,057 |

|

Notes receivable from participants |

|

|

2,475,673 |

|

|

|

2,349,709 |

|

|

|

|

|

|

|

|

Total Receivables |

|

|

3,726,981 |

|

|

|

3,495,766 |

|

|

|

|

|

|

|

|

Net Assets Available for Benefits |

|

$ |

150,161,292 |

|

|

$ |

139,265,060 |

|

See accompanying summary of significant accounting policies and notes to financial statements.

Hecla Mining Company Capital Accumulation Plan

Statements of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

Years ended December 31, |

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

Additions to Net Assets Attributed to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Income |

|

|

|

|

|

|

Interest income |

|

$ |

99,741 |

|

|

$ |

84,759 |

|

Dividend income |

|

|

4,203,293 |

|

|

|

3,494,709 |

|

Net appreciation/(depreciation) in fair value of investments |

|

|

12,751,301 |

|

|

|

(23,408,641 |

) |

|

|

|

|

|

|

|

Total Investment Income (Loss) |

|

|

17,054,335 |

|

|

|

(19,829,173 |

) |

|

|

|

|

|

|

|

Interest Income on Notes Receivable from Participants |

|

|

149,668 |

|

|

|

106,485 |

|

|

|

|

|

|

|

|

Contributions |

|

|

|

|

|

|

Participants |

|

|

7,656,159 |

|

|

|

7,492,963 |

|

Employer matching |

|

|

4,712,875 |

|

|

|

4,519,320 |

|

Rollovers |

|

|

1,310,163 |

|

|

|

448,102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Additions to Net Assets |

|

|

13,679,197 |

|

|

|

12,460,385 |

|

|

|

|

|

|

|

|

Deductions from Net Assets Attributed to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Benefits paid to participants |

|

|

(19,960,069 |

) |

|

|

(17,151,067 |

) |

Administrative expenses |

|

|

(26,899 |

) |

|

|

(25,394 |

) |

|

|

|

|

|

|

|

Total Deductions to Net Assets |

|

|

(19,986,968 |

) |

|

|

(17,176,461 |

) |

|

|

|

|

|

|

|

Net Increase (Decrease) in Net Assets Available for Benefits |

|

|

10,896,232 |

|

|

|

(24,438,764 |

) |

|

|

|

|

|

|

|

Net Assets Available for Benefits |

|

|

|

|

|

|

Beginning of year |

|

|

139,265,060 |

|

|

|

163,703,824 |

|

|

|

|

|

|

|

|

End of year |

|

$ |

150,161,292 |

|

|

$ |

139,265,060 |

|

See accompanying summary of significant accounting policies and notes to financial statements.

Hecla Mining Company Capital Accumulation Plan

Notes to Financial Statements

1. Description of Plan

The following descriptions and disclosures about the Hecla Mining Company Capital Accumulation Plan (“Plan”) provide only general information. Participants should refer to the most recent version of the summary Plan description and the Plan document for a more complete description of its provisions.

General

The Plan is a defined contribution plan, which originally became effective on January 1, 1986, and was most recently restated effective January 1, 2021. The Plan provides for incentive savings through investments, which qualify under the Internal Revenue Service of the United States of America (“IRS”) code section 401(a) for tax deferral status. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended.

Eligible Employees

All salaried and substantially all non-union hourly employees of Hecla Mining Company (the “Company”), and its subsidiaries, who are residents of the United States are immediately eligible to enroll in the Plan upon employment. Non-resident aliens that have no earned income from the Company within the U.S., hourly employees at the Company’s Lucky Friday Mine who are included in the United Steelworkers of America Local 5114, and employees engaged through lease arrangements are not eligible to participate in the Plan.

Contributions

The Plan allows eligible employees to contribute from 1% to 50% of their compensation on a pre-tax or Roth after-tax basis. Employees who do not affirmatively specify their instructions with regard to participation in the Plan will automatically have 3% of their compensation reduced for contribution. Participants who have attained age 50 before the end of the Plan year are eligible to make catch-up contributions. Participants may also contribute amounts to the Plan previously contributed to another qualified plan. Contributions are subject to certain IRS limitations. Annually, on January 1, participants that were automatically enrolled in the Plan have their contribution rate increased by 1% until the contribution rate is 15%.

The Company makes matching contributions equal to 100% of deferred contributions, up to 6% of the participant’s eligible compensation. Upon payment of matching contributions in common stock by the Company, the common stock is converted to shares of the Hecla Common Stock Fund in each eligible participant’s account having value equal to their matching contribution. The number of shares of the Company’s common stock paid for matching contributions and the conversion to shares of Hecla Common Stock Fund are each based on the closing prices on a day during the first week following the quarter end. The specific day used for each depends on the timing of processing. Upon receipt, participants may reallocate their investment in the Hecla Common Stock Fund into the other investment options offered by the Plan, subject to customary blackout restrictions as applicable. The Company made $4,712,875 and $4,519,320 of non-cash employer matching contributions for the years ended December 31, 2023 and 2022, respectively.

The Company may also make a discretionary profit-sharing contribution for any plan year. For the years ended December 31, 2023 and 2022, the Company did not make any discretionary profit-sharing contributions.

Participant Accounts

Individual accounts are maintained for each participant. Each participant’s account is credited with the participant’s contribution, employer’s matching contribution, earnings within the Plan and an allocation of the Company’s discretionary profit-sharing contribution, if any. Allocations of the Company’s contribution and plan earnings are based on participant account balances, as defined in the Plan document. The participant’s benefit is limited to the benefit that has accumulated in the participant’s account. Participants may direct the investment of their account balances into the investment options offered by the Plan. Participants may elect to change the amounts invested in any one or all of the individual options at any time.

Hecla Mining Company Capital Accumulation Plan

Notes to Financial Statements

All of the Plan’s assets are managed and held by Vanguard Fiduciary Trust Company, the Trustee, which operates under the direction of certain officers of the Company. Participants may invest in one or more of the various mutual funds, money market funds, and the Hecla Common Stock Fund sponsored by the Trustee.

Vesting

Participant contributions and the Company’s matching and discretionary contributions and earnings are 100% vested at all times.

Payment of Benefits

Distributions are made upon termination of employment, death, disability or retirement. Departing participants receive a notice of options with regards to their account approximately 30 days from the date of departure. Participants or their beneficiaries receive payment of benefits as follows: (a) balances of less than $1,000 in cases in which the participant or beneficiary did not take alternative action are distributed as a cash payment, (b) balances of between $1,000 and $5,000 in cases in which the participant or beneficiary did not take alternative action are automatically rolled over into an Individual Retirement Account, or (c) balances greater than $5,000 may be kept in the Plan until a determined distribution date, rolled over, or distributed in installments, as opted by the participant or beneficiary. Withdrawals from the Plan may also be made upon circumstances of financial hardship, reaching 59.5 years of age, or termination of the Plan, in accordance with provisions specified in the Plan.

Notes Receivable from Participants

Participants may borrow from their fund accounts a minimum of $1,000 up to a maximum equal to the lesser of (a) $50,000, minus the highest outstanding loan balance or balances, if any, the participant had at any one time during the one-year period ending immediately before the date of the new loan, or (b) 50% of their account balance. The loans are secured by the balance in the participant’s account and bear interest at a rate commensurate with prevailing rates as determined by the Plan administrator, which currently range from 4.25% to 9.25%. Principal and interest are repaid ratably through payroll deductions over periods ranging up to 5 years, unless the loan is for the purchase of the participant’s principal residence, in which case the Plan administrator may permit a longer repayment term up to 15 years. Each participant may have up to, but no more than, two notes outstanding at any one time.

Administrative Expenses

Certain expenses of maintaining the Plan are paid directly by the Company and are excluded from these financial statements. Certain administrative expenses are paid from Plan assets and include loan, distribution, withdrawal and other fees. Investment related expenses paid to investment advisors and others described in each fund prospectus or other published documents are deducted by the investment funds or accounts prior to the allocation of the Plan’s investment earnings activity; these expenses are therefore included in net appreciation (depreciation) in fair value of investments in the statements of changes in net assets available for benefits.

2. Summary of Accounting Policies

Basis of Accounting

The Plan financial statements are presented on the accrual basis of accounting in conformity with accounting principles generally accepted in the United States of America ("GAAP").

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of net assets available for benefits and changes therein, and disclosures of contingent assets and liabilities. Actual results could differ materially from those estimates.

Hecla Mining Company Capital Accumulation Plan

Notes to Financial Statements

Investment Valuation and Income Recognition

The Plan’s investments are reported at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Net (depreciation)/appreciation in fair value of investments consists of realized gains and losses and unrealized appreciation and depreciation on investments. Realized and unrealized (depreciation)/appreciation in the fair value of investments is based on the difference between the fair value of the assets at the beginning of the year, or at the time of purchase for assets purchased during the year, and the related fair value on the day investments are sold with respect to realized appreciation (depreciation), or on the last day of the year for unrealized appreciation (depreciation). Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

Notes Receivable from Participants

Notes receivable from participants are valued at their unpaid principal balance plus accrued interest. The Plan considers all notes receivable from participants at the end of a calendar quarter, following a calendar quarter for which there is any outstanding payment due, as in default. Defaulted notes receivable from participants are deemed distributed and recorded as benefits paid to participants in the statements of changes in net assets available for benefit.

Contributions

Participant deferral contributions and related discretionary matching contributions are recognized in the plan year during which the Company makes the respective payroll deduction from the participant’s compensation. Discretionary employer non-elective contributions, if any, are recognized in the plan year to which the participant’s compensation relates.

Payment of Benefits

Benefits are recorded when paid.

Risks and Uncertainties

The Plan invests in funds that invest in a combination of stocks, bonds, fixed income securities and other investment securities. Investment securities are exposed to various risks, such as interest rate, market and credit. Due to the level of risk associated with certain investment securities and the level of uncertainty related to changes in the value of investment securities, it is at least reasonably possible that changes in risks in the near term would materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits and the statements of changes in net assets available for benefits.

The fair value of the Plan’s investment in the Hecla Common Stock Fund amounted to $19,335,956 and $21,987,389, including money market funds of $95,958 and $45,724, as of December 31, 2023 and 2022, respectively. Such investments represented 12.9% and 15.8% of the Plan’s total net assets available for Plan benefits as of December 31, 2023 and 2022, respectively. For risks and uncertainties regarding the Company, participants should refer to the December 31, 2023, Form 10-K of Hecla Mining Company filed with the Securities and Exchange Commission (“SEC”) on February 15, 2024.

3. Plan Termination

Although it has not expressed intent to do so, the Company has the right, under the Plan, to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. All assets remaining in the Plan after payment of any expenses properly chargeable against the Plan shall be paid to participants in such a manner as the Plan administrator shall determine.

Hecla Mining Company Capital Accumulation Plan

Notes to Financial Statements

4. Related Party, Participant Loans and Party-in-Interest Transactions

Certain Plan investments are shares of mutual funds and a money market fund managed by the Trustee, and therefore, these transactions qualify as party-in-interest transactions. Participant loan and distribution processing fees are paid to Vanguard by participants. The Plan also issues loans to participants which are secured by the vested balance of the participants' accounts. As described in Note 1, the Plan paid certain expenses related to Plan operations and investment activity to various service providers. Certain Plan investments are shares of Hecla Mining Company common stock; therefore, these transactions also qualify as party-in-interest transactions. For the years ended December 31, 2023 and 2022, total purchases of shares of Hecla Mining Company common stock were $7,295,132 and $10,607,166, respectively, and total sales of shares of Hecla Mining Company common stock were $7,365,418 and $16,808,282, respectively. These transactions are party-in-interest transaction, which are exempt from prohibited transaction rules.

5. Income Tax Status

The Plan uses a prototype plan and trust document created by the Vanguard Group. The Vanguard Group received a Opinion letter from the IRS dated June 30, 2020, informing it that the prototype plan and trust document are qualified and exempt under Section 401(a) of the Internal Revenue Code (“IRC”). Although the Plan has been amended since receiving the Vanguard Group opinion letter, management of the Company and the Plan Administrator believe the Plan is designed, and is currently being operated, in compliance with the applicable requirements of the IRC. Therefore, the Company and the Plan Administrator believe that the Plan is qualified, and the related trust is tax-exempt.

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2023 and 2022, there are no uncertain positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

6. Fair Value Measurement

The framework for measuring fair value provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (level 1 measurements) and the lowest priority to unobservable inputs (level 3 measurements). The three levels of the fair value hierarchy are described below:

Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted net assets and liabilities;

Level 2: Quoted prices in markets that are not considered to be active or financial instruments for which all significant inputs are observable, either directly or indirectly;

Level 3: Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

The asset or liability's fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques maximize the use of relevant observable inputs and minimize the use of unobservable inputs. The following is a description of the valuation methodologies used for Plan assets, as well as the general classification of such items pursuant to the fair value hierarchy:

Mutual Funds and Money Market Fund — Valued at the daily closing price as reported by the fund. Mutual funds and money market fund held by the Plan are open-end mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value (NAV) and to transact at that price. The mutual funds and money market fund held by the Plan are deemed to be actively traded.

Hecla Mining Company Capital Accumulation Plan

Notes to Financial Statements

Hecla Common Stock Fund — The fair value of the Hecla Common Stock Fund is determined through a combination of the quoted share price on an active market for the common stock of Hecla Mining Company and the valuation of cash equivalents held in the fund. The Hecla Common Stock Fund is a unitized fund and is included in Level 1 of the fair value hierarchy.

There have been no changes in the methodology used at December 31, 2023 and 2022. The Plan held no assets as of December 31, 2023 and 2022 included in Level 3 of the fair value hierarchy.

The tables below set forth the Plan’s assets that were accounted for at fair value as of December 31, 2023 and 2022, and the fair value calculation input hierarchy level that applies to each asset category.

|

|

|

|

|

|

|

|

Description

|

|

Balance at December 31, 2023 |

|

Quoted prices in active market for identical assets (Level 1) |

|

Mutual Funds |

|

$ |

119,903,630 |

|

$ |

119,903,630 |

|

Money Market Funds |

|

|

7,194,725 |

|

|

7,194,725 |

|

Common Stock |

|

|

19,335,956 |

|

|

19,335,956 |

|

Total |

|

$ |

146,434,311 |

|

$ |

146,434,311 |

|

|

|

|

|

|

|

|

|

|

Description

|

|

Balance at December 31, 2022 |

|

|

Quoted prices in active market for identical assets (Level 1) |

|

Mutual Funds |

|

$ |

104,718,403 |

|

|

$ |

104,718,403 |

|

Money Market Funds |

|

|

9,063,502 |

|

|

|

9,063,502 |

|

Common Stock |

|

|

21,987,389 |

|

|

|

21,987,389 |

|

Total |

|

$ |

135,769,294 |

|

|

$ |

135,769,294 |

|

Hecla Mining Company Capital Accumulation Plan

Schedule H, Line 4i Schedule of Assets (Held at End of Year) as of December 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EIN: 77-0664171 |

|

|

|

|

|

|

|

Plan Number: 004 |

|

|

|

|

|

|

|

Form: 5500 |

|

(a) |

|

(b)

Identity of Issuer, Borrower,

Lessor or Similar Party |

|

(c)

Description of Investment

Including Maturity Date,

Rate of Interest, Collateral,

Par or Maturity Value |

|

(d)

Cost |

|

(e)

Value |

|

|

|

|

|

|

|

|

|

|

|

Money Market |

|

|

|

|

|

|

|

|

|

* |

|

Vanguard |

|

Federal Money Market |

|

** |

|

$ |

7,194,725 |

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds |

|

|

|

|

|

|

|

|

|

American Funds |

|

Growth Fund of America; R-4 Class |

|

** |

|

|

5,682,468 |

|

|

|

Artisan |

|

International Fund, Investor Class |

|

** |

|

|

1,227,307 |

|

* |

|

Vanguard |

|

500 Index Fund Investor Shares |

|

** |

|

|

7,000,601 |

|

* |

|

Vanguard |

|

Growth and Income Fund Investor Shares |

|

** |

|

|

4,641,028 |

|

* |

|

Vanguard |

|

Small-Cap Value Index Fund Admiral |

|

** |

|

|

1,279,926 |

|

* |

|

Vanguard |

|

Strategic Equity Fund |

|

** |

|

|

2,942,248 |

|

* |

|

Vanguard |

|

Target Retirement 2020 Fund |

|

** |

|

|

3,437,102 |

|

* |

|

Vanguard |

|

Target Retirement 2025 Fund |

|

** |

|

|

16,097,842 |

|

* |

|

Vanguard |

|

Target Retirement 2030 Fund |

|

** |

|

|

12,622,362 |

|

* |

|

Vanguard |

|

Target Retirement 2035 Fund |

|

** |

|

|

16,570,141 |

|

* |

|

Vanguard |

|

Target Retirement 2040 Fund |

|

** |

|

|

10,996,074 |

|

* |

|

Vanguard |

|

Target Retirement 2045 Fund |

|

** |

|

|

11,399,753 |

|

* |

|

Vanguard |

|

Target Retirement 2050 Fund |

|

** |

|

|

11,191,789 |

|

* |

|

Vanguard |

|

Target Retirement 2055 Fund |

|

** |

|

|

3,901,871 |

|

* |

|

Vanguard |

|

Target Retirement 2060 Fund |

|

** |

|

|

2,460,057 |

|

* |

|

Vanguard |

|

Target Retirement 2065 Fund |

|

** |

|

|

789,445 |

|

* |

|

Vanguard |

|

Target Retirement 2070 Fund |

|

** |

|

|

13,757 |

|

* |

|

Vanguard |

|

Target Retirement Income |

|

** |

|

|

1,983,813 |

|

* |

|

Vanguard |

|

Total Bond Market Index Fund Investor Shares |

|

** |

|

|

1,520,050 |

|

* |

|

Vanguard |

|

Total International Bond Index Fund Investor Share |

|

** |

|

|

104,062 |

|

* |

|

Vanguard |

|

Total Stock Market Index Fund Admiral Shares |

|

** |

|

|

2,204,606 |

|

* |

|

Vanguard |

|

Windsor II Fund Investor Shares |

|

** |

|

|

1,837,328 |

|

|

|

|

|

|

|

|

|

|

|

Total Mutual Funds |

|

|

|

|

|

|

119,903,630 |

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

|

|

|

|

|

* |

|

Hecla Mining Co. |

|

3,999,686 shares of common stock |

|

** |

|

|

19,335,956 |

|

|

|

|

|

|

|

|

|

|

|

Participant Loans |

|

|

|

|

|

|

|

* |

|

Participant loans |

|

Interest rates ranging from 4.25% to 9.50% |

|

- |

|

|

2,475,673 |

|

|

|

|

|

|

|

|

|

|

|

Total Investments |

|

|

|

|

|

$ |

148,909,984 |

|

* Represents party-in-interest to the Plan

** The cost of participant directed investments is not required to be disclosed.

Consent of Independent Registered Public Accounting Firm

Hecla Mining Company Capital Accumulation Plan

Coeur d’Alene, Idaho

We hereby consent to the incorporation by reference in the Registration Statement on Form S-8 (333-229840) of Hecla Mining Company of our report dated June 18, 2024, relating to the financial statements and supplemental schedule of Hecla Mining Company Capital Accumulation Plan which appear in this Form 11-K for the year ended December 31, 2023.

/s/ BDO USA, P.C.

Denver, Colorado

June 18, 2024

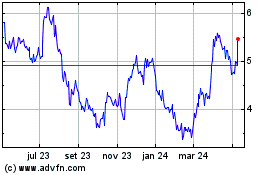

Hecla Mining (NYSE:HL)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

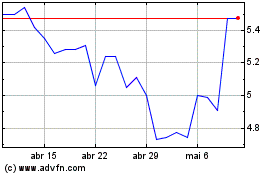

Hecla Mining (NYSE:HL)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024