Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

20 Junho 2024 - 10:54AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934

For the Month June, 2024

Commission File Number: 001-37668

FERROGLOBE PLC

(Name of Registrant)

13 Chesterfield Street,

London W1J 5JN, United Kingdom

+44 (0)750 130 8322

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20-F ☒Form 40-F ☐

Results of 2024 Annual General Meeting of Ferroglobe PLC

Ferroglobe PLC announces the results of its Annual General Meeting held on Tuesday, June 18, 2024. All resolutions were voted on by way of a poll and were passed. The results of the voting, including the number of votes cast for and against, are available on the Company's website and are set forth in the attached exhibit, which is being furnished herewith.

Exhibit

Reference is made to the exhibit attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | |

| Date: June 20, 2024 |

| | |

| FERROGLOBE PLC |

| |

| | |

| By: | /s/ Marco Levi |

| | Name: Marco Levi |

| | Title: Chief Executive Officer (Principal Executive Officer) |

FERROGLOBE PLC

VOTING RESULTS OF ANNUAL GENERAL MEETING

HELD ON JUNE 18, 2024

Ferroglobe PLC announces the results of its Annual General Meeting held on Tuesday, June 18, 2024. All resolutions were voted on by way of a poll and were passed.

The total number of votes received on each resolution is as follows:

| | | | | | | | | | | | | | | |

| | Resolution | | For | | % of

votes cast | | Against | | % of

votes cast | | Votes cast as

% of

Issued Share

Capital | | Withheld | |

1. | | THAT the directors’ and auditor’s reports and the accounts of the Company for the financial year ended 31 December 2023 (the “U.K. Annual Report and Accounts”) be received. | | 132,070,556 | | 99.97 | | 20,734 | | 0.02 | | 70.31 | | 18,335 | |

2. | | THAT the directors’ annual report on remuneration for the year ended 31 December 2023 (excluding, for the avoidance of doubt, any part of the Directors’ remuneration report containing the directors’ remuneration policy), as set out on pages 35 to 36 and 50 to 61 of the U.K. Annual Report and Accounts be approved. | | 128,254,660 | | 97.08 | | 3,641,441 | | 2.76 | | 70.31 | | 213,524 | |

3. | | THAT, in accordance with Part 14 of the Companies Act and in substitution for any previous authorities given to the Company (and its subsidiaries), the Company (and all companies that are subsidiary of the Company at any time during the period for which this resolution has effect) be authorized to: (i) make political donations to political parties or independent election candidates; (ii) make political donations to political organizations other than political parties, and (iii) incur political expenditure, in each case, as such terms are defined in the Companies Act, provided that with respect to each of the foregoing categories, any such donations or expenditure made by the Company, or a subsidiary of the Company, do not in the aggregate exceed £100,000. Such authority shall expire at the conclusion of the Company’s next annual general meeting. For the purposes of this resolution, the authorized sum may comprise sums in different currencies that shall be converted at such rate as the Board may in its absolute discretion determine to be appropriate. | | 131,694,220 | | 99.69 | | 389,289 | | 0.29 | | 70.31 | | 26,116 | |

4. | | THAT, for the purposes of section 694 of the Companies Act, the terms of the buyback contract to be entered into between the Company and any or all of J.P. Morgan Securities LLC, BMO Capital Markets Corp. and Santander US Capital Markets LLC, respectively (in the forms produced to this meeting and made available at the Company’s registered office for not less than 15 days ending with the date of this meeting) are approved and the Company be authorized to undertake off-market purchases (within the meaning of section 693(2) of the Companies Act) of its ordinary shares of US $0.01 pursuant to such contracts, provided that (i) the maximum aggregate number of ordinary shares hereby authorized to be purchased is 37,776,463, representing approximately 20% of the issued ordinary share capital, and (ii) additional restrictions under applicable U.S. securities laws are substantially complied with, including (but not limited to) the pricing limitations under Rule 10b-18(b)(3) of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), the volume limitations under Rules 10b-18(b)(4) and 10b18(c)(2) of the Exchange Act, the timing limitations under Rules 10b-18(b)(2) and 10b-18(c)(1) and the requirements with respect to the use of brokers or dealers under Rule 10b-18(b)(1) of the Exchange Act. Such authority shall expire at the close of business on the fifth anniversary of the passing of this resolution, but during this five year period the Company may agree to purchase ordinary shares pursuant to any such approved contract, even if such purchase would, or might, be completed or executed wholly or partly after the authority ends and the Company may purchase such ordinary shares pursuant to any such approved contract as if the authority had not ended. This authority shall apply from the conclusion of the Annual General meeting until a date which is five years from the date of the Annual General Meeting | | 109,086,770 | | 82.57 | | 22,990,733 | | 17.40 | | 70.31 | | 32,122 | |

5. | | That Javier López Madrid be re-elected as a director. | | 132,055,298 | | 99.96 | | 46,541 | | 0.04 | | 70.31 | | 7,786 | |

6. | | That Marco Levi be re-elected as a director. | | 132,061,181 | | 99.96 | | 40,558 | | 0.03 | | 70.31 | | 7,886 | |

7. | | That Marta Amusategui be re-elected as a director. | | 109,459,515 | | 82.86 | | 22,637,336 | | 17.14 | | 70.31 | | 12,774 | |

8. | | That Bruce L. Crockett be re-elected as a director. | | 102,825,317 | | 77.83 | | 29,271,133 | | 22.16 | | 70.31 | | 13,175 | |

9. | | That Stuart E. Eizenstat be re-elected as a director. | | 131,299,092 | | 99.39 | | 797,759 | | 0.60 | | 70.31 | | 12,774 | |

10. | | That Manuel Garrido y Ruano be re-elected as a director. | | 132,063,842 | | 99.97 | | 32,109 | | 0.02 | | 70.31 | | 13,674 | |

11. | | That Juan Villar-Mir de Fuentes be re-elected as a director. | | 132,065,023 | | 99.97 | | 31,928 | | 0.02 | | 70.31 | | 12,674 | |

12. | | That Belén Villalonga be re-elected as a director. | | 108,819,321 | | 82.37 | | 23,277,629 | | 17.62 | | 70.31 | | 12,675 | |

13. | | That Silvia Villar-Mir de Fuentes be re-elected as a director. | | 132,060,908 | | 99.96 | | 34,387 | | 0.03 | | 70.31 | | 14,330 | |

14. | | That Nicolas De Santis be re-elected as a director. | | 127,792,062 | | 96.73 | | 4,304,989 | | 3.26 | | 70.31 | | 12,574 | |

15. | | That Rafael Barrilero Yarnoz be re-elected as a director. | | 128,736,942 | | 97.45 | | 3,358,909 | | 2.54 | | 70.31 | | 13,774 | |

16. | | THAT KPMG be re-appointed as auditor of the Company to hold office from the conclusion of the Annual General Meeting until the conclusion of the next general meeting at which accounts are laid before the Company. | | 144,571,026 | | 99.76 | | 336,496 | | 0.23 | | 77.13 | | 14,325 | |

17. | | THAT the Audit Committee of the Board be authorized to determine the auditor’s remuneration. | | 132,042,246 | | 99.95 | | 52,204 | | 0.04 | | 70.31 | | 15,175 | |

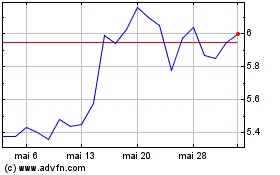

Ferroglobe (NASDAQ:GSM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ferroglobe (NASDAQ:GSM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024