false

0000827871

0000827871

2024-07-03

2024-07-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date of earliest event reported): July 3, 2024

Eagle

Pharmaceuticals, Inc.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

001-36306 |

20-8179278 |

| (State

or Other Jurisdiction |

(Commission |

(IRS Employer |

| of Incorporation) |

File Number) |

Identification No.) |

50

Tice Boulevard, Suite 315

Woodcliff Lake, NJ |

|

07677 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (201) 326-5300

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

EGRX |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On July 3, 2024 (the “Effective Date”),

Eagle Pharmaceuticals, Inc. (the “Company”) and Curia Global, Inc., f/k/a Albany Molecular Research, Inc. (“AMRI”)

and Curia New Mexico, LLC (together with AMRI, “Curia”) entered into a Settlement Agreement and Release (“Settlement

Agreement”) relating to the settlement of all their claims and counterclaims in Curia Global, Inc. v. Eagle Pharmaceuticals, Inc.,

AAA Case No. 01-23-0000-2937, American Arbitration Association (the “AAA Arbitration”), and Curia Global, Inc.

v. Eagle Pharmaceuticals, Inc., Index No. 651064/2023, Supreme Court of the State of New York, County of New York (the

“NY Court Action”) and other claims and disputes relating to these proceedings.

As previously disclosed, the AAA Arbitration

relates to disputes arising from the parties’ Vasopressin Commercial Supply Agreement, dated April 15, 2018 (“Vasopressin

CSA”), and the NY Court Action relates to disputes arising from the parties’ PEMFEXY® Master Development

and Supply Agreement, dated March 26, 2021 (the “PEMFEXY® MSA”). The Company and Curia have agreed to

a mutual release of all claims arising from or concerning the Vasopressin CSA (other than any future indemnity claims that may be asserted

related to defects or product liability), or the allegations, claims or counterclaims in the AAA Arbitration or the NY Court Action,

in addition to payment, covenants, representations and other terms, the material terms of which are summarized below. The parties’

releases are subject to the payment of the full settlement amount and the passage of a specified time period thereafter with no Events

of Default (as described below). The Settlement Agreement provides that the settlement is not an admission of liability or wrongdoing

by either party. The PEMFEXY® MSA remains in effect.

Pursuant to the Settlement Agreement, the

Company agreed to pay Curia $26.5 million in accordance with the following payment schedule: $10.0 million within one business day

of the Effective Date (paid on July 5, 2024); $10.0 million on or before February 17, 2025; and $6.5 million on or before July 7, 2025. In

addition, Curia has filed a Stipulation of Discontinuance with Prejudice in the NY Court Action pursuant to the Settlement Agreement

and the parties have agreed to take all other necessary steps to cause the prompt dismissal with prejudice of all claims in the NY

Court Action, including the withdrawal of the appeal in the NY Court Action.The parties have jointly submitted a request to the

arbitrators in the AAA Arbitration to issue a final award on consent recording the settlement.

Pursuant to the Settlement Agreement, an Event of Default occurs upon a failure by the Company to pay when due any of the settlement payments

described above, and specified bankruptcy and insolvency events with respect to the Company.

The foregoing description of the material terms

of the Settlement Agreement does not purport to be complete and is qualified in its entirety by reference to the Settlement Agreement,

which the Company intends to file with the Securities and Exchange Commission as an exhibit to the Company’s Annual Report on Form 10-K

for the year ended December 31, 2023.

Forward-Looking Statements

This current report on Form 8-K contains

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, and other

securities law. Forward-looking statements are statements that are not historical facts. Words and phrases such as “anticipated,”

“forward,” “will,” “would,” “could,” “may,” “intend,” “remain,”

“regain,” “maintain,” “potential,” “prepare,” “expected,” “believe,”

“plan,” “seek,” “continue,” “estimate,” and similar expressions are intended to identify

forward-looking statements. These statements include, but are not limited to, statements with respect to: expectations with respect to

the Settlement Agreement, including the parties’ rights and obligations, including the release of claims, pursuant thereto and compliance

therewith, and a final award consent related thereto; filings with the SEC and the timing and content thereof; the Nasdaq hearing process

and the outcome thereof, including the potential to obtain any additional extensions or stays from Nasdaq and, if obtained, the duration

thereof, and the Company’s ability to regain or maintain compliance with the Nasdaq Listing Rules or continue its listing on

Nasdaq, the Company’s internal control over financial reporting and disclosure controls and procedures and related remediation,

the expected restatement of financial statements, the time and effort required to complete the Company’s financial statements, and

the Company’s expectations regarding its financial results. All of such statements are subject to certain risks and uncertainties,

many of which are difficult to predict and generally beyond the Company’s control, that could cause actual results to differ materially

from those expressed in, or implied or projected by, the forward-looking information and statements. All of such statements are subject

to certain risks and uncertainties, many of which are difficult to predict and generally beyond the Company’s control, that could

cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements.

Such risks and uncertainties include, but are not limited to: the completion of the review and preparation of the Company’s financial

statements and internal control over financial reporting and disclosure controls and procedures and the timing thereof; the discovery

of additional information; further delays in the Company’s financial reporting, including as a result of unanticipated factors;

the Company’s ability to comply with its obligations under its credit agreement or obtain further amendments or waivers thereto;

the possibility that the Company will be unable to regain compliance with, or thereafter continue to comply with, the Nasdaq Listing Rules,

or experience violations of additional Nasdaq Listing Rules; the possibility that Nasdaq may suspend and delist the Company’s securities;

the Company’s ability to remediate material weaknesses in its internal control over financial reporting; the Company’s ability

to recruit and hire a new Chief Executive Officer and new Chief Financial Officer; the ability of the Company to realize the anticipated

benefits of its plan designed to improve operational efficiencies and realign its sales and marketing expenditures and the potential impacts

thereof; the impacts of the post- COVID-19 environment and geopolitical factors such as the conflicts between Russia and Ukraine and Hamas

and Israel; delay in or failure to obtain regulatory approval of the Company’s or its partners’ product candidates and successful

compliance with Federal Drug Administration, European Medicines Agency and other governmental regulations applicable to product approvals;

changes in the regulatory environment; the uncertainties and timing of the regulatory approval process; whether the Company can successfully

market and commercialize its products; the success of the Company's relationships with its partners; the outcome of litigation; the strength

and enforceability of the Company’s intellectual property rights or the rights of third parties; competition from other pharmaceutical

and biotechnology companies and competition from generic entrants into the market; unexpected safety or efficacy data observed during

clinical trials; clinical trial site activation or enrollment rates that are lower than expected; the risks inherent in drug development

and in conducting clinical trials; risks inherent in estimates or judgments relating to the Company’s critical accounting policies,

or any of the Company’s estimates or projections, which may prove to be inaccurate; unanticipated factors in addition to the foregoing

that may impact the Company’s financial and business projections and guidance and may cause the Company’s actual results and

outcomes to materially differ from its estimates, projections and guidance; and those risks and uncertainties identified in the “Risk

Factors” sections of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the

SEC on March 23, 2023, the Company’s Quarterly Reports on Form 10-Q for the quarter ended March 31, 2023, filed with

the SEC on May 9, 2023, and for the quarter ended June 30, 2023, filed with the SEC on August 8, 2023, and its subsequent

filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements. All forward-looking statements

contained in this current report on Form 8-K speak only as of the date on which they were made. Except to the extent required by

law, the Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the

date on which they were made.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date:

July 10, 2024

| |

EAGLE PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Michael Graves |

| |

|

Michael Graves |

| |

|

Interim Principal Executive Officer |

v3.24.2

Cover

|

Jul. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 03, 2024

|

| Entity File Number |

001-36306

|

| Entity Registrant Name |

Eagle

Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0000827871

|

| Entity Tax Identification Number |

20-8179278

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

50

Tice Boulevard

|

| Entity Address, Address Line Two |

Suite 315

|

| Entity Address, City or Town |

Woodcliff Lake

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07677

|

| City Area Code |

201

|

| Local Phone Number |

326-5300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

EGRX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

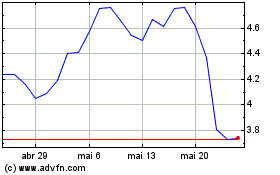

Eagle Pharmaceuticals (NASDAQ:EGRX)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Eagle Pharmaceuticals (NASDAQ:EGRX)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024