0001877939False00018779392024-01-242024-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934

Date of Report (Date of earliest event reported): July 17, 2024

CASTELLUM, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Nevada | | 001-41526 | | 27-4079982 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1934 Old Gallows Road, Suite 350

Vienna, VA 22182

(Address of principal executive offices, including zip code)

703-752-6157

(Registrant’s telephone number, including area code)

Check the appropriate box below if the 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13(c)). |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | CTM | | NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 8.01 Other Events.

On July 17, 2024, the Company issued a letter to its shareholders. The full text of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Exhibit Title |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | CASTELLUM, INC. | | |

| | | | | |

| Date: July 17, 2024 | | By: | /s/ Glen R. Ives | |

| | Name: | Glen R. Ives | |

| | Title: | Chief Executive Officer (Principal Executive Officer) |

VIENNA, Va., July 17, 2024 (GLOBE NEWSWIRE) -- Castellum, Inc. (the "Company" or "Castellum") (NYSE-American: CTM), a cybersecurity, electronic warfare, and software services company focused on the federal government, releases this letter to shareholders from Chief Executive Officer ("CEO"), Glen Ives.

Dear Fellow Shareholders:

This letter represents my first formal communication with you since I was appointed CEO by the Board of our Company earlier this month. I am greatly honored by the appointment and feel very humble to take on the responsibility of serving our employees and you, our shareholders. Let me start by introducing myself and then sharing a few thoughts about where I would like to lead us over the coming months and years.

I grew up as an Army brat before attending and graduating from the U.S. Naval Academy at Annapolis. I served 34 years in the Navy, where I met my wife (also a Naval Academy graduate and a member of the first class of women to enter the Academy and a far more accomplished graduate than me). Initially, I was a pilot, flying Navy helicopters from destroyers and carriers, and I flew many different aircraft later as a test pilot. I served on several senior joint staffs and in major acquisition roles. During my final Navy tour, I served as Commanding Officer of the world's finest Naval Air Station Patuxent River, where I developed many long-term friendships and became intimately involved in the local community. Patuxent River is a key Research, Development, Test, and Evaluation military base where approximately $45 billion of contracts are executed yearly. In 2008, I retired from the Navy and transitioned to industry with a government contractor, Sabre Systems. I helped build that company as President, bringing together a strong team and overseeing a more than doubling of its revenue during my tenure and transforming the company into a leading-edge technology solutions and services company with numerous prime contracts and new capabilities in Full Spectrum Offensive and Defensive Cyber, AI/ML, Enterprise Data Management, Advanced Communications Technologies and Digital Transformation. In 2021, I joined Castellum to help build its Navy Division. I then became Chief Operating Officer prior to my recent appointment as CEO.

In my view, Castellum has tremendous potential as a company. As I write this, we have 254 tremendous employees. Through their unparalleled dedication, world-class professionalism, knowledge, experience, and talents, we can provide critically important services and technology solutions to our mission customers, who are directly responsible for many vital aspects of our nation's security and well-being. We could not be more honored and prouder of our role and mission. We have numerous contracts, including some very important prime contracts. We have strong and relevant capabilities, past performance, and solid relationships based on trust and mutual respect with our government customers. We have good teaming partners and a top-notch protégé company. Castellum and our four subsidiary companies, Corvus Consulting, LLC, Mainnerve Federal Services, Inc., Specialty Systems, Inc., and Global Technology and Management Resources, Inc., is a well-grounded platform and rock-solid business poised for real growth.

Over the next two years, I would like to see Castellum grow organically faster than we have previously. We have a good pipeline of opportunities that we are building even stronger, and we need to convert that pipeline into revenue and profit growth. At a minimum, I would like to see us grow organically 25% over the next two years and 40% over the next three years. This would take us above $56 million in annualized revenue by mid-2026 and $63 million in annualized revenue by mid-2027. I would like to see us get to $5 million a year in adjusted earnings before interest depreciation and amortization ("EBITDA") and U.S. GAAP net income positive during that time. While we are not currently under a letter of intent with any acquisitions, I would like to return to making selective acquisitions as our balance sheet strengthens. I believe we are one good acquisition away from really accelerating our growth.

Financially, we need to continue to pay down debt and build financial muscle. We recently announced that we have retired our Live Oak Banking Company term loan. We plan to retire the $2.4 million Buckhout Charitable Remainder Trust note over the next two years (by August 2026) and reduce our other debt as well. As you know, retiring debt strengthens our balance sheet, gives us financial flexibility to potentially make acquisitions, reduces financial risk to our Company, and, someday, will allow us to return capital to our shareholders. Ideally, we are looking to get our debt below 15% of revenue and 2.5x adjusted EBITDA. We could be there in less than a year with just some growth and steady debt retirement.

If we can achieve these goals, we, the shareholders, will benefit. I am acutely aware that our stock price has not done well over the past 20 months. However, if we execute our plan, I am confident that the next 20 months will be quite different from the past 20 months to all of our benefit.

In closing, I'd like to say again I could not be more honored, encouraged, and committed as your CEO. I'm grateful to have our world-class team here at Castellum and our exceptional government customers with vital missions we share. I know and appreciate that we will all work, serve, and pull together with trust, respect, honesty, and faith in one another and our mission to achieve our success. I know we can, and I know we will because, quite simply, that is our character, individually and as a team. I believe that there is nothing we cannot do and achieve together as we commit and work to build and institutionalize a true winning culture here at Castellum for all of us.

I sincerely welcome and encourage your thoughts, ideas, and help as we build our Company over the coming quarters, and I look forward to serving you and leading Castellum to many good things ahead.

Sincerely,

Glen Ives, CEO

About Castellum, Inc.

Castellum, Inc. is a cybersecurity, electronic warfare, and software engineering services company focused on the federal government - http://castellumus.com.

Forward-Looking Statements:

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements represent the Company's expectations or beliefs concerning future events and can generally be identified by the use of statements that include words such as "expected," "estimate," "project," "believe," "anticipate," "shooting to," "intend,"

"in a position," "looking to," "pursue," "positioned," "will," "likely," "would," or similar words or phrases. Forward-looking statements include, but are not limited to, statements regarding the Company's expectations for revenue growth, building value, serving our shareholders, and profitability. These forward-looking statements are subject to risks, uncertainties, and other factors, many of which are outside of the Company's control, that could cause actual results to differ (sometimes materially) from the results expressed or implied in the forward-looking statements, including, among others: the Company's ability to compete against new and existing competitors; its ability to effectively integrate and grow its acquired companies; its ability to identify additional acquisition targets and close additional acquisitions; and the Company's ability to maintain the listing of its common stock on the NYSE American LLC. For a more detailed description of these and other risk factors, please refer to the Company's Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission ("SEC") which can be viewed at www.sec.gov. All forward-looking statements are inherently uncertain, based on current expectations and assumptions concerning future events or the future performance of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. The Company expressly disclaims any intent or obligation to update any of the forward-looking statements made in this release or in any of its SEC filings except as may be otherwise stated by the Company.

Contact:

info@castellumus.com

Glen R. Ives, Chief Executive Officer

(703) 752-6157

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/18416872-8fb1-45dd-8c96-b2b92c5647e9

v3.24.2

Cover

|

Jan. 24, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 17, 2024

|

| Entity Registrant Name |

CASTELLUM, INC.

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-41526

|

| Entity Tax Identification Number |

27-4079982

|

| Entity Address, Address Line One |

1934 Old Gallows Road, Suite

|

| Entity Address, City or Town |

Vienna

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22182

|

| City Area Code |

703

|

| Local Phone Number |

-6157

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

CTM

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

true

|

| Entity Central Index Key |

0001877939

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

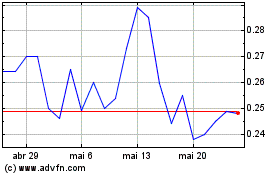

Castellum (AMEX:CTM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Castellum (AMEX:CTM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024