Castellum, Inc. Announces Higher Sequential Revenue, Positive Adjusted EBITDA, and Smaller Net Loss for Q2 2024

09 Agosto 2024 - 7:45AM

Castellum, Inc. ("Castellum" or the "Company") (NYSE-American:

CTM), a cybersecurity, electronic warfare, and software services

company focused on the federal government, announces highlights of

its operating results for its second quarter ended June 30, 2024.

Revenue for the second quarter of 2024 was $11.5

million, up sequentially from $11.3 million during the first

quarter of 2024. Gross profit was $4.7 million compared to $4.5

million during the first quarter of 2024. Operating (loss),

inclusive of all non-cash and non-recurring charges, was $(1.6)

million compared to $(2.7) million in the first quarter of

2024.

Management uses a Non-GAAP measure, Adjusted

EBITDA, as an important measure of the Company's operating

performance. Adjusted EBITDA was $0.3 million for the second

quarter and excludes non-cash charges, such as stock-option and

warrants expense of $1.3 million, and depreciation and amortization

of $0.6 million, compared to $(0.1) million for the first quarter

of 2024 and $0.1 million for the second quarter of 2023. See the

reconciliation to GAAP in the chart below.

Castellum's full financial results for the three

and six months ended June 30, 2024, are expected to be filed on or

before August 14, 2024, on Form 10-Q, available at www.sec.gov.

"We made some important financial progress in the

second quarter of 2024," said Glen Ives, President and Chief

Executive Officer of the Company. "We showed sequentially higher

revenue, a smaller loss, and positive cash flow from operations

during the quarter. We have more work to do, especially with

growing revenue; however, this was a solid quarter. Our steady

progress reflects directly on our most important asset, our

world-class team of the most talented and hardest working

professionals continuing to provide the very best in key technology

services and solutions to our government customers and our shared

vital mission supporting our national security."

About Castellum,

Inc. (NYSE-American:

CTM):

Castellum, Inc. is a cybersecurity, electronic

warfare, and software engineering services company focused on the

federal government - http://castellumus.com.

Forward-Looking Statements:

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 2lE of the Securities Exchange Act of 1934, as

amended. These forward-looking statements represent the Company's

expectations or beliefs concerning future events and can generally

be identified by the use of statements that include words such as

"estimate," "project," "believe," "anticipate," "shooting to,"

"intend," "in a position," "looking to," "pursue," "positioned,"

"will," "likely," "would," or similar words or phrases.

Forward-looking statements include, but are not limited to,

statements regarding the Company's expectations for revenue growth,

Non-GAAP Adjusted EBITDA growth, and new customer opportunities,

improvements to cost structure, and profitability. These

forward-looking statements are subject to risks, uncertainties, and

other factors, many of which are outside of the Company's control,

that could cause actual results to differ (sometimes materially)

from the results expressed or implied in the forward-looking

statements, including, among others: the Company's ability to

compete against new and existing competitors; its ability to

effectively integrate and grow its acquired companies; its ability

to identify additional acquisition targets and close additional

acquisitions; the impact on the Company's revenue due to a delay in

the U.S. Congress approving a federal budget; and the Company's

ability to maintain the listing of its common stock on the NYSE

American LLC. For a more detailed description of these and other

risk factors, please refer to the Company's Annual Report on Form

10-K and its Quarterly Reports on Form 10-Q and other filings with

the Securities and Exchange Commission ("SEC") which can be viewed

at www.sec.gov. All forward-looking statements are inherently

uncertain, based on current expectations and assumptions concerning

future events or the future performance of the Company. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which are only predictions and speak only as of the

date hereof. The Company expressly disclaims any intent or

obligation to update any of the forward-looking statements made in

this release or in any of its SEC filings except as may be

otherwise stated by the Company.

Non-GAAP Financial Measures and Key

Performance Metrics

This press release contains Non-GAAP Adjusted

EBITDA, a Non-GAAP financial measure used by management to measure

the Company's operating performance. A reconciliation of this

measure to the most directly comparable GAAP financial measure is

contained herein. To the extent required, statements disclosing

this measure's definition, utility, and purpose are also set forth

herein.

Definition:

Adjusted EBITDA is a Non-GAAP measure, calculated

as the Company's earnings before (not including expenses related

to) interest, taxes, depreciation, and amortization, also adjusted

for other non-cash items such as stock-based compensation and other

non-recurring, cash items, such as expenses for a one-time policy

change.

Utility and Purpose:

The Company discloses Non-GAAP Adjusted EBITDA

because this Non-GAAP measure is used by management to evaluate our

business, measure its operating performance, and make strategic

decisions. We believe NonGAAP Adjusted EBITDA is useful for

investors and others in understanding and evaluating our operating

results in the same manner as its management. However, Non-GAAP

Adjusted EBITDA is not a financial measure calculated in accordance

with GAAP and should not be considered as a substitute for GAAP

operating loss or any other operating performance measure

calculated in accordance with GAAP. Using this Non-GAAP measure to

analyze our business would have material limitations because the

calculations are based on the subjective determination of

management regarding the nature and classification of events and

circumstances that investors may find significant. In addition,

although other companies in our industry may report a Non-GAAP

Adjusted EBITDA measure, this measure may be calculated differently

from how we calculate this Non-GAAP financial measure, reducing its

overall usefulness as a comparative measure. Because of these

inherent limitations, you should consider Non-GAAP Adjusted EBITDA

alongside other financial performance measures, including net loss

and our other financial results presented in accordance with

GAAP.

|

|

|

|

|

|

Castellum, Inc. Reconciliation of

unaudited Non-GAAP Adjusted EBITDA to Net

Income/ (Loss) Three Months

Ended June 30,

2024 |

|

|

|

|

|

|

Revenues |

$ |

11,522,388 |

|

|

Gross profit |

|

4,673,208 |

|

|

Net Loss |

|

(1,846,735 |

) |

|

|

|

|

Add back: |

|

|

Interest expense |

|

211,997 |

|

|

Taxes |

|

120,531 |

|

|

Depreciation and amortization |

|

569,046 |

|

|

|

|

|

Adjust for non-cash and one-time charges: |

|

|

Change in derivative liability |

|

(56,000 |

) |

|

Stock based compensation |

|

1,271,905 |

|

|

Accounting and legal fees |

|

20,000 |

|

|

Total non-cash charges |

|

2,137,479 |

|

|

|

|

|

Non-GAAP Adjusted EBITDA |

$ |

290,743 |

|

|

|

|

|

|

Contact:

Glen Ives, President and Chief Executive Officer

Phone: (703) 752-6157 info@castellumus.com

http://castellumus.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/b95b85ae-0f21-4491-8b73-4ffdad3a8ae0

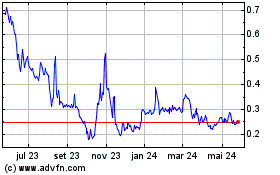

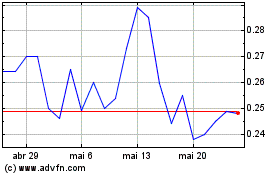

Castellum (AMEX:CTM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Castellum (AMEX:CTM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024