Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

18 Julho 2024 - 5:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box: | | | | | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☒ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

Ashford Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

The following contains a mailer that was mailed on or around July 18, 2024, to certain stockholders of Ashford Inc., who held common stock as of the record date of June 20, 2024.

Additional Information and Where to Find It

THIS COMMUNICATION IS ONLY A BRIEF DESCRIPTION OF THE PROPOSED TRANSACTION. IT IS NOT A REQUEST FOR OR SOLICITATION OF A PROXY OR AN OFFER TO ACQUIRE OR SELL ANY SHARES OF COMMON STOCK. THE COMPANY INTENDS TO FILE A PROXY STATEMENT AND OTHER REQUIRED MATERIALS, INCLUDING A SCHEDULE 13E-3, WITH THE SEC CONCERNING THE PROPOSED TRANSACTION. A COPY OF ALL FINAL PROXY MATERIALS WILL BE SENT TO STOCKHOLDERS PRIOR TO A SPECIAL MEETING OF STOCKHOLDERS AT WHICH THE COMPANY’S STOCKHOLDERS WILL BE ASKED TO VOTE ON THE PROPOSALS DESCRIBED IN THE MATERIALS PROVIDED BY THE COMPANY. THE COMPANY URGES ALL STOCKHOLDERS TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE, AS WELL AS ALL OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THOSE DOCUMENTS WILL INCLUDE IMPORTANT INFORMATION. A FREE COPY OF ALL MATERIALS THE COMPANY FILES WITH THE SEC, INCLUDING THE COMPANY’S SCHEDULE 13E-3 AND PROXY STATEMENT, WILL BE AVAILABLE AT NO COST ON THE SEC’S WEBSITE AT WWW.SEC.GOV. WHEN THOSE DOCUMENTS BECOME AVAILABLE, THE PROXY STATEMENT AND OTHER DOCUMENTS FILED BY THE COMPANY MAY ALSO BE OBTAINED WITHOUT CHARGE BY DIRECTING A REQUEST TO ASHFORD INC., 14185 DALLAS PARKWAY, SUITE 1200, DALLAS, TEXAS 75254, ATTENTION: SECRETARY.

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the Proposed Transaction. Information concerning such participants will be set forth in the proxy statement to be filed by the Company in connection with the special meeting of stockholders to vote on the Proposed Transaction. To the extent that holdings of the Company’s securities by the Company’s directors and executive officers have changed since the amounts to be printed in the Company’s proxy statement, such changes will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such participants in the solicitation of proxies in connection with the Proposed Transaction will be included in the proxy statement to be filed by the Company with the SEC in connection with the Proposed Transaction.

The Company’s Chief Executive Officer and Chairman of the Board, Monty J. Bennett, and other members of senior management of the Company may purchase or sell shares of common stock of the Company in the open market following the public announcement of the Proposed Transaction. Any such purchases or sales will be reported on Form 4 and Schedule 13D as required by law. These purchases and sales may increase or decrease the price of the Company’s common stock.

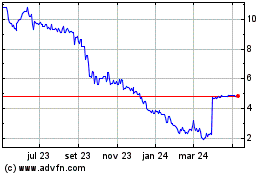

Ashford (AMEX:AINC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

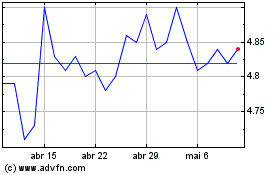

Ashford (AMEX:AINC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025