0000793952false00007939522024-07-252024-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 25, 2024

Harley-Davidson, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Wisconsin | | 1-9183 | | 39-1382325 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

3700 West Juneau Avenue, Milwaukee, Wisconsin 53208

(Address of principal executive offices, including zip code)

(414) 342-4680

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| COMMON STOCK, $0.01 par value per share | | HOG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On July 25, 2024, Harley-Davidson, Inc. (the “Company”) issued a press release (the “Press Release”) announcing the Company’s second quarter results for the financial period ended June 30, 2024. A copy of the Press Release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(a)Not applicable.

(b)Not applicable.

(c)Not applicable.

(d)Exhibits. The following exhibit is being furnished herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | HARLEY-DAVIDSON, INC. |

| | | | | | |

| Date: July 25, 2024 | | | | | | /s/ Paul J. Krause |

| | | | | | Paul J. Krause |

| | | | | | Secretary |

FOR IMMEDIATE RELEASE

Harley-Davidson Delivers Second Quarter Financial Results

MILWAUKEE (July 25, 2024) – Harley-Davidson, Inc. (“Harley-Davidson,” “HDI,” or the “Company”), (NYSE: HOG) today reported second quarter 2024 results.

“Despite a challenging market, we are pleased with our second quarter performance, in which we grew our U.S. market share in a declining market, with notable unit growth of more than 11 percent in the important core category of Touring1," said Jochen Zeitz, Chairman, President and CEO, Harley-Davidson. “We continue to be focused on executing our Hardwire strategy, leveraging our innovation and product pipeline while delivering on our cost productivity goals.”

Second Quarter 2024 Highlights and Related Results

•Delivered diluted EPS of $1.63

•HDMC operating income margin of 14.7 percent

•North America motorcycle retail performance was down 1 percent, while retail sales of Touring and CVO motorcycles was up more than 12 percent in the U.S.

•Touring market share of 75 percent, up 5.3 percent in first half of the year1

•HDMC revenue up 13 percent driven by global motorcycle shipments up 16 percent

•HDFS operating income up 21 percent, and revenue was up 10 percent

•Company revises its full year 2024 financial outlook to reflect the current environment

•Today, Harley-Davidson announced plan to repurchase $1 billion of shares through 20262

Second Quarter 2024 Results

Harley-Davidson, Inc. Consolidated Financial Results

| | | | | | | | | | | |

$ in millions (except EPS) | 2nd quarter |

| 2024 | 2023 | Change |

| Revenue | $1,619 | $1,446 | 12% |

| Operating Income | $241 | $221 | 9% |

| Net Income Attributable to HDI | $218 | $178 | 23% |

| Diluted EPS | $1.63 | $1.22 | 34% |

Consolidated revenue in the second quarter was up 12 percent, driven primarily by an HDMC revenue increase of 13 percent. HDFS revenue was up 10 percent in the second quarter.

Consolidated operating income in the second quarter was up 9 percent, driven by an increase of 2 percent at HDMC, an increase of 21 percent at HDFS, and a decreased operating loss at the LiveWire segment. Consolidated operating income margin in the second quarter was 14.9 percent relative to 15.3 percent in the second quarter a year ago.

1 Source: U.S. 601+cc Street Legal Market Share for Q2 2024 from Motorcycle Industry Council (MIC).

2 See press release dated July 25, 2024

Harley-Davidson Motor Company (HDMC) – Results

| | | | | | | | | | | |

$ in millions | 2nd quarter |

| 2024 | 2023 | Change |

| Motorcycle Shipments (thousands) | 49.7 | 42.9 | 16% |

| Revenue | $1,349 | $1,198 | 13% |

| Motorcycles | $1,069 | $891 | 20% |

| Parts & Accessories | $194 | $216 | -10% |

| Apparel | $63 | $66 | -4% |

| Licensing | $6 | $5 | 7% |

| Other | $17 | $20 | -14% |

| Gross Margin | 32.1% | 34.8% | -2.7 pts. |

| Operating Income | $198 | $194 | 2% |

| Operating Margin | 14.7% | 16.2% | -1.5 pts. |

Second quarter global motorcycle shipments increased by 16 percent. Revenue was up 13 percent driven by increased shipments and improved mix, partially offset by lower pricing and foreign exchange effects. Parts & Accessories revenue was down 10 percent. Apparel was down 4 percent as the prior year’s period included a greater benefit from anniversary product apparel sales.

Second quarter gross margin was down 2.7 points due to the impacts of pricing and sales incentives, higher manufacturing costs, and adverse impacts from foreign exchange. These effects were partially offset by higher wholesale volumes and improved mix. Second quarter operating income margin was down 1.5 points, where operating expenses increased modestly.

Harley-Davidson Retail Motorcycle Sales

| | | | | | | | | | | |

Motorcycles (thousands) | 2nd quarter |

| 2024 | 2023 | Change |

| North America | 34.8 | 35.1 | -1% |

| EMEA | 8.0 | 8.1 | -1% |

| Asia Pacific | 6.3 | 7.5 | -16% |

| Latin America | 0.8 | 0.8 | 0% |

| Worldwide Total | 50.0 | 51.5 | -3% |

Global retail motorcycle sales in the second quarter were down 3 percent versus prior year. North America retail performance was down 1 percent, with U.S. retail up slightly.

The decline in EMEA of 1 percent was driven by weakness in Central Europe, but partially offset by growth in other markets. The decline in APAC of 16 percent was driven primarily by weakness in China and Latin America was largely flat.

Harley-Davidson Financial Services (HDFS) – Results

| | | | | | | | | | | |

$ in millions | 2nd quarter |

| 2024 | 2023 | Change |

| Revenue | $264 | $240 | 10% |

| Operating Income | $71 | $59 | 21% |

HDFS operating income increased by $12 million in the second quarter, or 21 percent, driven by higher interest income and a lower provision for credit losses, partially offset by increased borrowing costs and higher operating expenses. Total quarter ending financing receivables were $8.0 billion, which was up 7 percent versus Q2 2023, primarily due to an increase in commercial finance receivables.

LiveWire – Results

| | | | | | | | | | | |

$ in millions | 2nd quarter |

| 2024 | 2023 | Change |

| Electric Motorcycle Unit Sales | 158 | 33 | 379% |

| Revenue | $6 | $7 | -8% |

| Operating Loss | ($28) | ($32) | 12% |

LiveWire revenue for the second quarter decreased by 8 percent, due to a decrease in STACYC third party branded distributor volumes, partially offset by an increase in electric motorcycle unit sales. Operating loss improved by approximately $4 million (or 12 percent) driven by overall cost reduction initiatives.

Other Harley-Davidson, Inc. 2024 Results – through end of Q2

•Generated $578 million of cash from operating activities

•Effective tax rate was 19 percent

•Paid cash dividends of $47 million

•Repurchased $200 million of shares (5.5 million shares) on a discretionary basis

•Cash and cash equivalents of $1.8 billion at the end of the quarter

2024 Financial Outlook

For the full year 2024, the Company now expects:

•HDMC: revenue down 5 to 9 percent compared to 2023 and operating income margin of 10.6 to 11.6 percent

For the full year 2024, the Company continues to expect:

•HDFS: operating income flat to up 5 percent compared to 2023

•LiveWire: electric motorcycle unit sales of 1,000 to 1,500 and operating loss of $105 to $115 million

•Harley-Davidson, Inc: capital investments of $225 to $250 million

Company Background

Harley-Davidson, Inc. is the parent company of Harley-Davidson Motor Company and Harley-Davidson Financial Services. Our vision: Building our legend and leading our industry through innovation, evolution and emotion. Our mission: More than building machines, we stand for the timeless pursuit of adventure. Freedom for the soul. Our ambition is to maintain our place as the most desirable motorcycle brand in the world. Since 1903, Harley-Davidson has defined motorcycle culture by delivering a motorcycle lifestyle with distinctive and customizable motorcycles, experiences, motorcycle accessories, riding gear and apparel. Harley-Davidson Financial Services provides financing, insurance and other programs to help get riders on the road. Harley-Davidson also has a controlling interest in LiveWire Group, Inc., the first publicly traded all-electric motorcycle company in the United States. LiveWire is the future in the making for the pursuit of urban adventure and beyond. Drawing on its DNA as an agile disruptor from the lineage of Harley-Davidson and capitalizing on a decade of learnings in the EV sector, LiveWire's ambition is to be the most desirable electric motorcycle brand in the world. Learn more at harley-davidson.com and livewire.com.

Webcast

Harley-Davidson will discuss its financial results and outlook on an audio webcast at 8:00 a.m. CDT today. The webcast login and supporting slides can be accessed at http://investor.harley-davidson.com/news-and-events/events-and-presentations. The audio replay will be available by approximately 10:00 a.m. CDT.

Cautionary Note Regarding Forward-Looking Statements

The company intends that certain matters discussed in this press release and our associated comments are “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements can generally be identified as such because the context of the statement will include words such as the company “believes,” “anticipates,” “expects,” “plans,” “may,” “will,” “estimates,” “targets,” “intends,” “forecasts,” “is on track,” “sees,” “feels,” or words of similar meaning. Similarly, statements that describe or refer to future expectations, future plans, strategies, objectives, outlooks, targets, guidance, commitments, or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially, unfavorably or favorably, from those anticipated as of the date of this press release. Certain of such risks and uncertainties are described below. Shareholders, potential investors, and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this press release are only made as of the date of this press release, and the company disclaims any obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

Important factors that could affect future results and cause those results to differ materially from those expressed in the forward-looking statements include, among others, the Company's ability to: (a) execute its business plans and strategies, including The Hardwire, each of the pillars, and the evolution of LiveWire as a standalone brand, which includes the risks noted below; (b) manage supply chain and logistics issues, including quality issues, unexpected interruptions or price increases caused by supplier volatility, raw material shortages, inflation, war or other hostilities, including the conflict in Ukraine and the Red Sea conflict, or natural disasters and longer shipping times and increased logistics costs; (c) accurately analyze, predict and react to changing market conditions and successfully adjust to shifting global consumer needs and interests; (d) maintain and enhance the value of the Harley-Davidson brand; (e) realize the expected business benefits from LiveWire operating as a separate public company, which may be affected by, among other things: (i) the ability of LiveWire to execute its plans to develop, produce, market and sell its electric vehicles; (ii) the demand for and consumer willingness to adopt two- and three-wheeled electric vehicles; and (iii) other risks and uncertainties indicated in documents filed with the SEC by the Company or LiveWire Group, Inc., including those risks and uncertainties noted in Risk Factors under Item 1.A of LiveWire Group Inc.'s Annual Report on Form 10-K for the year ended December 31, 2023; (f) successfully access the capital and/or credit markets on terms that are acceptable to the Company and within its expectations; (g) successfully carry out its global manufacturing and assembly operations; (h) develop and introduce products, services and experiences on a timely basis that the market accepts, that enable the Company to generate desired sales levels and that provide the desired financial returns, including successfully implementing and executing plans to strengthen and grow its leadership position in Grand American Touring, large Cruiser and Trike, and grow its complementary businesses; (i) perform in a manner that enables the Company to benefit from market opportunities while competing against existing and new competitors; (j) manage through changes in general economic and business conditions, including changing capital, credit and retail markets, and the changing domestic and international political environments, including as a result of the conflict in Ukraine and the Red Sea conflict; (k) manage the impact that prices for and supply of used motorcycles may have on its business, including on retail sales of new motorcycles; (l) prevent, detect and remediate any issues with its motorcycles or any issues associated with the manufacturing processes to avoid delays in new model launches, recall campaigns, regulatory agency investigations, increased warranty costs or litigation and adverse effects on its reputation and brand strength, and carry out any product programs or recalls within expected costs and timing; (m) successfully manage and reduce costs throughout the business; (n) manage risks related to a resurgence of the COVID-19 pandemic, emergence of a new pandemic, epidemic, disease outbreak or other public health crises, such as supply chain disruptions, its ability to carry out business as usual, and government actions and restrictive measures implemented in response; (o) continue to develop the capabilities of its distributors and dealers, effectively implement changes relating to its dealers and distribution methods, including the Company’s dealership footprint, and manage the risks that its dealers may have difficulty obtaining capital and managing through changing economic conditions and consumer demand; (p) successfully appeal: (i) the revocation of the Binding Origin Information (BOI) decisions that allowed the Company to supply its European Union (EU) market with certain of its motorcycles produced at its Thailand operations at a reduced tariff rate and (ii) the denial of the Company’s application for temporary relief from the effect of the revocation of the BOI decisions; (q) manage the quality and regulatory non-compliance issues relating to the brake hose assemblies provided to the Company by Proterial Cable America, Inc. in a manner that avoids future quality or non-compliance issues and additional costs or recall expenses that are material; (r) maintain a productive relationship with Hero MotoCorp as a distributor and licensee of the Harley-Davidson brand name in India; (s) manage and predict the impact that new, reinstated or adjusted tariffs may have on the Company’s ability to sell products

internationally, and the cost of raw materials and components, including the temporary lifting of the incremental tariffs on motorcycles imported into the EU from the U.S., which was extended to March 31, 2025; (t) accurately predict the margins of its segments in light of, among other things, tariffs, inflation, foreign currency exchange rates, the cost associated with product development initiatives and the Company’s complex global supply chain; (u) successfully maintain a manner in which to sell motorcycles in China and the Company's Association of Southeast Asian Nations (ASEAN) countries that does not subject its motorcycles to incremental tariffs; (v) manage its Thailand corporate and manufacturing operation in a manner that allows the Company to avail itself of preferential free trade agreements and duty rates, and sufficiently lower prices of its motorcycles in certain markets; (w) retain and attract talented employees, and eliminate personnel duplication, inefficiencies and complexity throughout the organization; (x) accurately estimate and adjust to fluctuations in foreign currency exchange rates, interest rates and commodity prices; (y) manage the credit quality, the loan servicing and collection activities, and the recovery rates of Harley-Davidson Financial Services' loan portfolio; (z) prevent a ransomware attack or cybersecurity breach involving consumer, employee, dealer, supplier, or Company data and respond to evolving regulatory requirements regarding cybersecurity and data privacy; (aa) adjust to tax reform, healthcare inflation and reform and pension reform, and successfully estimate the impact of any such reform on the Company’s business; (bb) manage through the effects inconsistent and unpredictable weather patterns may have on retail sales of motorcycles; (cc) implement and manage enterprise-wide information technology systems, including systems at its manufacturing facilities; (dd) manage changes, prepare for, and respond to evolving requirements in legislative and regulatory environments related to its products, services and operations, including increased environmental, safety, emissions or other regulations; (ee) manage its exposure to product liability claims and commercial or contractual disputes; (ff) continue to manage the relationships and agreements that the Company has with its labor unions to help drive long-term competitiveness; (gg) achieve anticipated results with respect to the Company’s preowned motorcycle program, Harley-Davidson Certified, the Company’s H-D1 Marketplace, and Apparel and Licensing; and (hh) optimize capital allocation in light of the Company's capital allocation priorities.

The Company’s ability to sell its motorcycles and related products and services and to meet its financial expectations also depends on the ability of the Company’s dealers to sell its motorcycles and related products and services to retail customers. The Company depends on the capability and financial capacity of its dealers to develop and implement effective retail sales plans to create demand for the motorcycles and related products and services they purchase from the Company. In addition, the Company’s dealers and distributors may experience difficulties in operating their businesses and selling Harley-Davidson motorcycles and related products and services as a result of weather, economic conditions, or other factors.

HDFS’ retail credit losses have normalized in recent quarters to higher levels after a period of historically low levels of credit losses. Further, the Company believes that HDFS's retail credit losses will continue to change over time due to changing consumer credit behavior, macroeconomic conditions, including the impact of inflation and HDFS's efforts to increase prudently structured loan approvals to sub-prime borrowers. In addition, HDFS’s efforts to adjust underwriting criteria based on market and economic conditions and the actions that the Company has taken and could take that impact motorcycle values may impact HDFS's retail credit losses.

The Company's operations, demand for its products, and its liquidity could be adversely impacted by work stoppages, facility closures, strikes, natural causes, widespread infectious disease, terrorism, war or other hostilities, including the conflict in Ukraine and the Red Sea conflict, or other factors. Refer to “Risk Factors” under Item 1.A of the Company's Annual Report on Form 10-K for the year ended December 31, 2023 for a discussion of additional risk factors and a more complete discussion of some of the cautionary statements noted above.

Media Contact:

Jenni Coats

jenni.coats@Harley-Davidson.com

414.343.7902

Financial Contact:

Shawn Collins

shawn.collins@Harley-Davidson.com

414.343.8002

### (HOG-Earnings)

Harley-Davidson, Inc.

Condensed Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Three months ended | | Six months ended |

| June 30,

2024 | | June 30,

2023 | | June 30,

2024 | | June 30,

2023 |

| HDMC Revenue | $ | 1,348,906 | | | $ | 1,198,136 | | | $ | 2,825,012 | | | $ | 2,755,965 | |

| Gross profit | 433,126 | | | 417,474 | | | 894,196 | | | 974,500 | |

| Selling, administrative and engineering expense | 235,221 | | | 223,137 | | | 457,845 | | | 444,427 | |

| | | | | | | |

| Operating income from HDMC | 197,905 | | | 194,337 | | | 436,351 | | | 530,073 | |

| | | | | | | |

| LiveWire revenue | 6,448 | | | 7,026 | | | 11,152 | | | 14,788 | |

| Gross loss | (1,784) | | | (2,940) | | | (5,725) | | | (1,676) | |

| Selling, administrative and engineering expense | 26,382 | | | 29,044 | | | 51,682 | | | 54,855 | |

| Operating loss from Livewire | (28,166) | | | (31,984) | | | (57,407) | | | (56,531) | |

| | | | | | | |

| HDFS revenue | 263,539 | | | 240,361 | | | 512,336 | | | 463,456 | |

| HDFS expense | 192,176 | | | 181,376 | | | 387,098 | | | 346,051 | |

| | | | | | | |

| Operating income from HDFS | 71,363 | | | 58,985 | | | 125,238 | | | 117,405 | |

| | | | | | | |

| Operating income | 241,102 | | | 221,338 | | | 504,182 | | | 590,947 | |

| Other income, net | 15,879 | | | 7,226 | | | 36,443 | | | 27,322 | |

| Investment income | 14,811 | | | 11,151 | | | 29,215 | | | 21,176 | |

| Interest expense | (7,680) | | | (7,696) | | | (15,359) | | | (15,416) | |

| Income before income taxes | 264,112 | | | 232,019 | | | 554,481 | | | 624,029 | |

| Income tax provision | 48,706 | | | 58,189 | | | 106,842 | | | 148,370 | |

| Net income | $ | 215,406 | | | $ | 173,830 | | | $ | 447,639 | | | $ | 475,659 | |

| Less: Loss attributable to noncontrolling interests | 2,863 | | | 4,209 | | | 5,571 | | | 6,470 | |

| Net income attributable to Harley-Davidson, Inc. | $ | 218,269 | | | $ | 178,039 | | | $ | 453,210 | | | $ | 482,129 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 1.64 | | | $ | 1.24 | | | $ | 3.36 | | | $ | 3.33 | |

| Diluted | $ | 1.63 | | | $ | 1.22 | | | $ | 3.34 | | | $ | 3.27 | |

| | | | | | | |

| Weighted-average shares: | | | | | | | |

| Basic | 133,412 | | | 143,414 | | | 134,759 | | | 144,724 | |

| Diluted | 134,108 | | | 145,787 | | | 135,513 | | | 147,351 | |

| | | | | | | |

| Cash dividends per share: | $ | 0.1725 | | | $ | 0.1650 | | | $ | 0.3450 | | | $ | 0.3300 | |

LiveWire results presented in the Company's financial statements represent the LiveWire reportable segment as determined in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 280 Segment Reporting which may differ from LiveWire Group, Inc. results.

Harley-Davidson, Inc.

Condensed Consolidated Balance Sheets

(In thousands) | | | | | | | | | | | | | | | | | |

| (Unaudited) | | | | (Unaudited) |

| June 30,

2024 | | December 31,

2023 | | June 30,

2023 |

| ASSETS | | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 1,849,159 | | | $ | 1,533,806 | | | $ | 1,521,940 | |

| | | | | |

| Accounts receivable, net | 321,285 | | | 267,200 | | | 329,487 | |

| Finance receivables, net | 2,472,784 | | | 2,113,729 | | | 1,979,645 | |

| Inventories, net | 668,924 | | | 929,951 | | | 846,033 | |

| Restricted cash | 137,486 | | | 104,642 | | | 135,618 | |

| Other current assets | 188,002 | | | 214,401 | | | 201,702 | |

| 5,637,640 | | | 5,163,729 | | | 5,014,425 | |

| Finance receivables, net | 5,545,780 | | | 5,384,536 | | | 5,530,221 | |

| Other long-term assets | 1,576,822 | | | 1,592,289 | | | 1,470,915 | |

| $ | 12,760,242 | | | $ | 12,140,554 | | | $ | 12,015,561 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | |

| Current liabilities: | | | | | |

| Accounts payable and accrued liabilities | $ | 1,038,234 | | | $ | 996,021 | | | $ | 950,110 | |

| Short-term deposits, net | 206,972 | | | 253,309 | | | 216,293 | |

| Short-term debt | 497,792 | | | 878,935 | | | 695,356 | |

| Current portion of long-term debt, net | 2,021,344 | | | 1,255,999 | | | 604,700 | |

| 3,764,342 | | | 3,384,264 | | | 2,466,459 | |

| Long-term debt, net | 4,949,871 | | | 4,990,586 | | | 5,765,246 | |

| Other long-term liabilities | 612,713 | | | 513,409 | | | 594,000 | |

| | | | | |

| Shareholders’ equity | 3,433,316 | | | 3,252,295 | | | 3,189,856 | |

| $ | 12,760,242 | | | $ | 12,140,554 | | | $ | 12,015,561 | |

Harley-Davidson, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| | | |

| Six months ended |

| | June 30,

2024 | | June 30,

2023 |

| Net cash provided by operating activities | $ | 577,642 | | | $ | 410,520 | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (87,835) | | | (86,526) | |

| Finance receivables, net | (308,988) | | | (259,520) | |

| Other investing activities | (206) | | | 850 | |

| Net cash used by investing activities | (397,029) | | | (345,196) | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of medium-term notes | 495,856 | | | 1,446,304 | |

| Repayments of medium-term notes | — | | | (1,056,680) | |

| Proceeds from securitization debt | 547,618 | | | 547,706 | |

| Repayments of securitization debt | (506,489) | | | (645,377) | |

| Net decrease in unsecured commercial paper | (379,743) | | | (75,229) | |

| | | |

| Borrowings of asset-backed commercial paper | 351,429 | | | 33,547 | |

| Repayments of asset-backed commercial paper | (125,654) | | | (129,961) | |

| Net increase in deposits | 56,007 | | | 122,288 | |

| | | |

| Dividends paid | (47,359) | | | (48,193) | |

| Repurchase of common stock | (209,675) | | | (169,645) | |

| Other financing activities | 8 | | | 76 | |

| Net cash provided by financing activities | 181,998 | | | 24,836 | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (10,821) | | | (490) | |

| Net increase in cash, cash equivalents and restricted cash | $ | 351,790 | | | $ | 89,670 | |

| | | |

| Cash, cash equivalents and restricted cash: | | | |

| Cash, cash equivalents and restricted cash, beginning of period | $ | 1,648,811 | | | $ | 1,579,177 | |

| Net increase in cash, cash equivalents and restricted cash | 351,790 | | | 89,670 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 2,000,601 | | | $ | 1,668,847 | |

| | | |

| Reconciliation of cash, cash equivalents and restricted cash on the Consolidated balance sheets to the Consolidated statements of cash flows: | | | |

| Cash and cash equivalents | $ | 1,849,159 | | | $ | 1,521,940 | |

| Restricted cash | 137,486 | | | 135,618 | |

| Restricted cash included in Other long-term assets | 13,956 | | | 11,289 | |

| Cash, cash equivalents and restricted cash per the Consolidated statements of cash flows | $ | 2,000,601 | | | $ | 1,668,847 | |

HDMC Revenue and Motorcycle Shipment Data

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three months ended | | Six months ended |

| June 30,

2024 | | June 30,

2023 | | June 30,

2024 | | June 30,

2023 |

| HDMC REVENUE (in thousands) | | | | | | | |

| Motorcycles | $ | 1,068,693 | | | $ | 890,919 | | | $ | 2,290,233 | | | $ | 2,193,297 | |

| Parts & Accessories | 193,865 | | | 215,520 | | | 360,058 | | | 383,192 | |

| Apparel | 63,393 | | | 66,356 | | | 127,504 | | | 137,747 | |

| Licensing | 5,485 | | | 5,116 | | | 14,414 | | | 11,326 | |

| Other | 17,470 | | | 20,225 | | | 32,803 | | | 30,403 | |

| $ | 1,348,906 | | | $ | 1,198,136 | | | $ | 2,825,012 | | | $ | 2,755,965 | |

| | | | | | | |

| HDMC U.S. MOTORCYCLE SHIPMENTS | 32,334 | | | 24,229 | | | 73,911 | | | 66,817 | |

| | | | | | | |

| HDMC WORLDWIDE MOTORCYCLE SHIPMENTS | | | | | | | |

Grand American Touring(a) | 29,345 | | | 20,270 | | | 64,701 | | | 52,489 | |

| Cruiser | 14,410 | | | 15,476 | | | 30,101 | | | 36,734 | |

| Sport and Lightweight | 4,094 | | | 6,161 | | | 9,057 | | | 12,746 | |

| | | | | | | |

| Adventure Touring | 1,811 | | | 1,027 | | | 3,473 | | | 3,202 | |

| 49,660 | | | 42,934 | | | 107,332 | | | 105,171 | |

(a)Includes Trike

| | | | | | | | | | | | | | | | | | | | | | | |

| LiveWire Motorcycle Shipments | 158 | | | 33 | | | 275 | | | 96 | |

HDMC Gross Profit

(Unaudited)

The estimated impact of significant factors affecting the comparability of gross profit from the second quarter of 2023 to the second quarter of 2024 were as follows (in millions):

| | | | | | | | | | | | | |

| Three months ended | | Six months ended | | |

| 2023 gross profit | $ | 417 | | | $ | 975 | | | |

| Volume | 40 | | | 9 | | | |

| Price and sales incentives | (45) | | | (92) | | | |

| Foreign currency exchange rates and hedging | (14) | | | (18) | | | |

| Shipment mix | 51 | | | 58 | | | |

| Raw material prices | 8 | | | 9 | | | |

| Manufacturing and other costs | (24) | | | (47) | | | |

| 16 | | | (81) | | | |

| 2024 gross profit | $ | 433 | | | $ | 894 | | | |

HDFS Receivables Allowance for Credit Losses

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three months ended | | Six months ended |

| June 30,

2024 | | June 30,

2023 | | June 30,

2024 | | June 30,

2023 |

| Balance, beginning of period | $ | 380,361 | | | $ | 358,431 | | | $ | 381,966 | | | $ | 358,711 | |

| Provision for credit losses | 56,030 | | | 57,278 | | | 117,040 | | | 109,642 | |

| Charge-offs, net of recoveries | (42,874) | | | (33,929) | | | (105,489) | | | (86,573) | |

| Balances, end of period | $ | 393,517 | | | $ | 381,780 | | | $ | 393,517 | | | $ | 381,780 | |

Worldwide Retail Sales of Harley-Davidson Motorcycles(a)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Six months ended |

| June 30,

2024 | | June 30,

2023 | | June 30,

2024 | | June 30,

2023 |

| United States | 32,258 | | | 32,161 | | | 57,984 | | | 56,438 | |

| Canada | 2,579 | | | 2,899 | | | 4,339 | | | 4,643 | |

| Total North America | 34,837 | | | 35,060 | | | 62,323 | | | 61,081 | |

| EMEA | 8,015 | | | 8,120 | | | 13,279 | | | 14,037 | |

| Asia Pacific | 6,322 | | | 7,525 | | | 12,356 | | | 14,406 | |

| Latin America | 824 | | | 821 | | | 1,445 | | | 1,427 | |

| Total worldwide retail sales | 49,998 | | | 51,526 | | | 89,403 | | | 90,951 | |

(a)Data source for retail sales figures shown above is new sales warranty and registration information provided by dealers and compiled by the Company. The Company must rely on information that its dealers supply concerning new retail sales, and the Company does not regularly verify the information that its dealers supply. This information is subject to revision.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

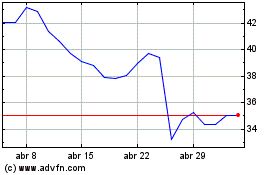

Harley Davidson (NYSE:HOG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Harley Davidson (NYSE:HOG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024