UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

August, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20241-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras starts reactivation

process for fertilizer plant in Araucária (Paraná state)

—

Rio de Janeiro, August 15,

2024 – Petróleo Brasileiro S.A. – Petrobras following up on the release disclosed on 06/06/2024, informs that it

will invest R$870 million to restart operating activities at the Araucária Nitrogenados S.A (ANSA) fertilizer plant, a wholly-owned

subsidiary of the company. The plant, located in the state of Paraná, has been mothballed since 2020 and had its reopening approved

in June 2024. Production is expected to begin in the second half of 2025.

The studies that preceded the

decision to resume the unit's activities proved the technical and economic viability of the investment. The project is in line with the

company's strategic guidelines approved last year, under which investment in fertilizer production once again became part of Petrobras'

portfolio, according to the Strategic Plan 2024-2028.

The plant is currently in the

process of contracting services and acquiring materials, with local content expected to exceed 85%. Once this stage is complete, the service

and equipment maintenance contracts will be mobilized to begin operations.

Former employees of the plant

have now resumed their work activities, following an agreement proposed by the Labor Prosecutor's Office and ratified by the Superior

Labor Court (TST) in June.

Located next to the Presidente

Getúlio Vargas Refinery - REPAR, ANSA has a production capacity of 720,000 tons/year for urea, which corresponds to 8% of the market;

475,000 tons/year for ammonia, and 450,000 m³/year of Automotive Liquid Reducing Agent (ARLA 32)

Investments in REPAR

Petrobras plans to invest R$3.2

billion, as included in the Strategic Plan 2024-2028 horizon, for maintenance stoppages and investment projects at REPAR. Among the projects

is the implementation of a new hydrotreating unit (HDT), which aims to increase the production of S-10 diesel, as well as projects to

improve energy efficiency, aiming to reduce the carbon footprint of operations and increase the distillation capacity, to increase the

production of fuels and meet market demands.

REPAR is a pioneer in the production

of Diesel R, a fuel produced through co-processing oil products (the mineral part) with renewable raw materials, such as soybean oil.

This new fuel is a sustainable alternative in the diesel market, as the reduction in emissions associated with the renewable portion is

at least 60% compared to mineral diesel and can be even greater depending on the renewable raw material used.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

Email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9th floor –

20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 15, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Fernando Sabbi Melgarejo

______________________________

Fernando Sabbi Melgarejo

Chief Financial Officer and Investor Relations

Officer

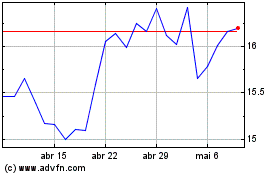

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Jul 2024 até Ago 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Ago 2023 até Ago 2024