UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 16, 2024

ARCA biopharma, Inc.

(Exact

name of Registrant as Specified in Its Charter)

| Delaware |

|

000-22873 |

|

36-3855489 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

10170 Church Ranch Way

Suite 100 |

|

|

| Westminster, Colorado |

|

80021 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s

Telephone Number, Including Area Code: (720) 940-2100

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☒ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common |

|

ABIO |

|

The Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

As

previously disclosed, on April 3, 2024, ARCA biopharma, Inc., a Delaware corporation (“ARCA”), entered into an Agreement

and Plan of Merger and Reorganization (the “Merger Agreement”) pursuant to which, among other matters, and subject

to the satisfaction or waiver of the conditions set forth in the Merger Agreement, Atlas Merger Sub Corp, a Delaware corporation and

wholly owned subsidiary of ARCA (“First Merger Sub”), will merge with and into Oruka Therapeutics, Inc. (“Oruka”),

with Oruka continuing as a wholly owned subsidiary of ARCA and the surviving corporation of the merger (the “First Merger”),

and Oruka will merge with and into Atlas Merger Sub II, LLC, a Delaware limited liability company and wholly owned subsidiary of

ARCA (“Second Merger Sub” and together with First Merger Sub, “Merger Subs”), with Second Merger

Sub being the surviving entity of the merger (the “Second Merger” and, together with the First Merger, the “Merger”).

On

August 16, 2024, ARCA issued a press release announcing that its Board of Directors has declared a special cash dividend to its stockholders

in connection with the Merger (the “Special Dividend”). The Special Dividend, which ARCA estimates to be $1.59 per

share of ARCA’s common stock, will be payable in cash to the stockholders of record as of August 26, 2024. The exact amount of

the Special Dividend will be calculated pursuant to the Merger Agreement and based on ARCA’s reasonable, good faith approximation

of the amount by which ARCA’s net cash, as determined prior to the closing of the Merger, will

exceed $5,000,000. Total actual distribution of the amount of the Special Dividend could be higher or lower than $1.59 per share and

the estimate for amount to be distributed to stockholders could change. The payment date in respect of the Special Dividend is scheduled

for August 28, 2024.

Payment of the Special Dividend is conditioned upon the approval of the

Merger by ARCA’s stockholders which ARCA’s stockholders will consider and vote upon at the special meeting of ARCA stockholders

scheduled for 9:00 a.m. MT on August 22, 2024. Closing of the Merger is expected to occur on August 29, 2024 assuming that the transaction

is approved by ARCA’s stockholders and the satisfaction or waiver of all conditions under the Merger Agreement.

A

copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Forward-Looking

Statements

This

Current Report on Form 8-K and the exhibits filed or furnished herewith contain forward-looking statements (including

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities

Act of 1933, as amended) concerning ARCA, Oruka, the proposed transactions and other matters. These forward-looking statements

include express or implied statements relating to the structure, timing and completion of the proposed Merger; the combined company’s

listing on Nasdaq after closing of the proposed Merger; expectations regarding the ownership structure of the combined company; the expected

executive officers and directors of the combined company; each company’s and the combined company’s expected cash position

at the closing of the proposed Merger (including completion of Oruka’s private placement) and cash runway of the combined company;

the expected contribution and payment of dividends in connection with the Merger, including the timing thereof; the future operations

of the combined company; the nature, strategy and focus of the combined company; the development and commercial potential and potential

benefits of any product candidates of the combined company; anticipated preclinical and clinical drug development activities and related

timelines, including the expected timing for data and other clinical results; the combined company having sufficient resources to advance

its pipeline candidates; and other statements that are not historical fact. The words “anticipate,” “believe,”

“contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “will,” “would” and similar expressions (including the negatives of these terms or variations

of them) may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects.

There can be no assurance that future developments affecting ARCA, Oruka, including the pre-closing private financing, or the Merger

will be those that have been anticipated.

The

forward-looking statements contained in this communication are based on current expectations and beliefs concerning future developments

and their potential effects and therefore subject to other risks and uncertainties. These risks and uncertainties include, but are not

limited to, risks associated with the possible failure to satisfy the conditions to the closing or consummation of the Merger, including

ARCA’s failure to obtain stockholder approval for the Merger, risks associated with the potential failure to complete the financing

transaction in a timely manner or at all, risks associated with the uncertainty as to the timing of the consummation of the Merger and

the ability of each of ARCA and Oruka to consummate the transactions contemplated by the Merger, risks associated with ARCA’s continued

listing on Nasdaq until closing of the Merger, the failure or delay in obtaining required approvals from any governmental or quasi-governmental

entity necessary to consummate the Merger; the occurrence of any event, change or other circumstance or condition that could give rise

to the termination of the Merger prior to the closing or consummation of the Merger, risks associated with the possible failure to realize

certain anticipated benefits of the Merger, including with respect to future financial and operating results; the effect of the completion

of the Merger on the combined company’s business relationships, operating results and business generally; risks associated with

the combined company’s ability to manage expenses and unanticipated spending and costs that could reduce the combined company’s

cash resources; risks related to the combined company’s ability to correctly estimate its operating expenses and other events;

changes in capital resource requirements; risks related to the inability of the combined company to obtain sufficient additional capital

to continue to advance its product candidates or its preclinical programs; the outcome of any legal proceedings that may be instituted

against the combined company or any of its directors or officers related to the Merger Agreement or the transactions contemplated thereby;

the ability of the combined company to obtain, maintain and protect its intellectual property rights, in particular those related to

its product candidates; the combined company’s ability to advance the development of its product candidates or preclinical activities

under the timelines it anticipates in planned and future clinical trials; the combined company’s ability to replicate in later

clinical trials positive results found in preclinical studies and early-stage clinical trials of its product candidates; the combined

company’s ability to realize the anticipated benefits of its research and development programs, strategic partnerships, licensing

programs or other collaborations; regulatory requirements or developments and the combined company’s ability to obtain necessary

approvals from the U.S. Food and Drug Administration or other regulatory authorities; changes to clinical trial designs and regulatory

pathways; competitive responses to the Merger and changes in expected or existing competition; unexpected costs, charges or expenses

resulting from the Merger; potential adverse reactions or changes to business relationships resulting from the completion of the Merger;

legislative, regulatory, political and economic developments; and those risks and uncertainties and other factors more fully described

in filings with the Securities and Exchange Commission (“SEC”), including reports filed on Form 10-K, 10-Q and 8-K,

in other filings that ARCA makes and will make with the SEC in connection with the proposed Merger, including the Proxy Statement/Prospectus

described below under “Important Additional Information About the Proposed Transaction Filed with the SEC,” and in other

filings made by ARCA with the SEC from time to time and available at www.sec.gov. These forward-looking statements are based on current

expectations, and with regard to the proposed transaction, are based on ARCA’s current expectations, estimates and projections

about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s

beliefs and certain assumptions made by ARCA, all of which are subject to change. Such forward-looking statements are made as of the

date of this release, and the parties undertake no obligation to update such statements to reflect subsequent events or circumstances,

except as otherwise required by securities and other applicable law.

No

Offer or Solicitation

This

Current Report on Form 8-K and the exhibits filed or furnished herewith are not intended to and do not constitute (i) a solicitation

of a proxy, consent or approval with respect to any securities or in respect of the proposed transactions (the “Proposed Transactions”)

between ARCA and Oruka or (ii) an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase

or subscribe for any securities pursuant to the Proposed Transactions or otherwise, nor shall there be any sale, issuance or transfer

of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus

meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom. Subject to certain exceptions to be approved

by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any

jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or

instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce,

or any facility of a national securities exchange, of any such jurisdiction.

NEITHER

THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS CURRENT REPORT ON FORM

8-K AND THE EXHIBITS FILED OR FURNISHED HEREWITH ARE TRUTHFUL OR COMPLETE.

Important

Additional Information About the Proposed Transaction Filed with the SEC

This

Current Report on Form 8-K and the exhibits filed or furnished herewith are not substitutes for the registration statement on Form S-4

or for any other document that ARCA has filed or may file with the SEC in connection with the Proposed Transactions. In connection with

the Proposed Transactions, ARCA has filed with the SEC a registration statement on Form S-4, which contains a proxy statement/prospectus

of ARCA. ARCA URGES INVESTORS AND STOCKHOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, PROXY STATEMENT/PROSPECTUS AND ANY OTHER

RELEVANT DOCUMENTS THAT ARE OR MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND

IN THEIR ENTIRETY, BECAUSE THEY DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT ARCA, ORUKA, THE PROPOSED TRANSACTIONS AND RELATED MATTERS.

Investors and stockholders can obtain free copies of the proxy statement/prospectus and other documents filed by ARCA with the SEC through

the website maintained by the SEC at www.sec.gov. Stockholders are urged to read the proxy statement/prospectus and the other relevant

materials filed with the SEC before making any voting or investment decision with respect to the Proposed Transactions. In addition,

investors and stockholders should note that ARCA communicates with investors and the public using its website (https://arcabio.com/investors/).

Participants

in the Solicitation

ARCA,

Oruka and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders

in connection with the Proposed Transactions. Information about ARCA’s directors and executive officers including a description

of their interests in ARCA is included in the proxy statement/prospectus relating to the Proposed Transactions and ARCA’s most

recent Annual Report on Form 10-K, including any information incorporated therein by reference, each as filed with the SEC.

Information about ARCA’s and Oruka’s respective directors and executive officers and their interests in the Proposed Transactions

is included in the proxy statement/prospectus relating to the Proposed Transactions filed with the SEC.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

ARCA biopharma, Inc.

(Registrant) |

| |

|

|

| Date: August 16, 2024 |

By: |

/s/ C. Jeffrey Dekker |

| |

|

Name: |

C. Jeffrey Dekker |

| |

|

Title: |

Chief Financial Officer |

4

Exhibit 99.1

ARCA biopharma Declares Special Dividend in

Connection with the Proposed Merger with Oruka Therapeutics

Special dividend estimated to be $1.59 per

share

Payment of special dividend conditioned upon

ARCA stockholder approval of the Proposed Merger with Oruka

Westminster, CO, August 16, 2024 – ARCA biopharma,

Inc. (NASDAQ: ABIO) (“ARCA”) today announced that its Board of Directors has declared a special cash dividend (the “Special

Dividend”) in connection with the previously announced merger (the “Merger”) with Oruka Therapeutics, Inc. (“Oruka”)

pursuant to the Agreement and Plan of Merger and Reorganization, dated April 3, 2024 (the “Merger Agreement”).

The Special Dividend, which ARCA estimates will be $1.59 per share

of ARCA’s common stock, will be payable in cash to the stockholders of record as of August 26, 2024. The exact amount of the Special

Dividend will be calculated pursuant to the Merger Agreement and based on ARCA’s reasonable, good faith approximation of the amount

by which ARCA’s net cash, as determined prior to the closing of the Merger, will exceed $5,000,000.

Total actual distribution of the amount of the Special Dividend could be higher or lower than $1.59 per share and the estimate for amount

to be distributed to stockholders could change. The payment date in respect of the Special Dividend is scheduled for August 28, 2024.

Payment of the Special Dividend is conditioned upon approval by the

ARCA stockholders of the Merger, which ARCA’s stockholders will consider and vote upon at the special meeting of ARCA stockholders

scheduled for 9:00 a.m. MT on August 22, 2024. Closing of the Merger is expected to occur on August 29, 2024 assuming

that the transaction is approved by ARCA’s stockholders and the satisfaction or waiver of all conditions under the Merger Agreement.

If you need assistance in voting your shares

or have questions regarding the special meeting of ARCA’s stockholders, please contact ARCA’s proxy solicitor, Innisfree

M&A Incorporated at (877) 750-8310 (toll-free).

About ARCA biopharma

ARCA biopharma is dedicated to developing

genetically and other targeted therapies for cardiovascular diseases through a precision medicine approach to drug development. For more

information, please visit www.arcabio.com or follow the company on LinkedIn.

About Oruka Therapeutics

Oruka Therapeutics is developing novel biologics

designed to set a new standard for the treatment of chronic skin diseases. Oruka’s mission is to offer patients suffering from

chronic skin diseases like plaque psoriasis the greatest possible freedom from their condition by achieving high rates of complete disease

clearance with dosing as infrequently as one or twice a year. Oruka is advancing a proprietary portfolio of potentially best-in-class antibodies

that were engineered by Paragon Therapeutics and target the core mechanisms underlying plaque psoriasis and other dermatologic and inflammatory

diseases. For more information, visit www.orukatx.com.

Forward-Looking Statements

This communication contains forward-looking

statements (including within the meaning of Section 21E of the Exchange Act and Section 27A of the Securities Act) concerning

ARCA, Oruka, the proposed transactions and other matters. These forward-looking statements include express or implied statements relating

to the structure, timing and completion of the proposed Merger; the combined company’s listing on Nasdaq after closing of the proposed

Merger; expectations regarding the ownership structure of the combined company; the expected executive officers and directors of the

combined company; each company’s and the combined company’s expected cash position at the closing of the proposed Merger

(including completion of Oruka’s private placement) and cash runway of the combined company; the expected contribution and payment

of dividends in connection with the Merger, including the timing thereof; the future operations of the combined company; the nature,

strategy and focus of the combined company; the development and commercial potential and potential benefits of any product candidates

of the combined company; anticipated preclinical and clinical drug development activities and related timelines, including the expected

timing for data and other clinical results; the combined company having sufficient resources to advance its pipeline candidates; and

other statements that are not historical fact. The words “anticipate,” “believe,” “contemplate,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “will,” “would” and similar expressions (including the negatives of these terms or variations

of them) may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects.

There can be no assurance that future developments affecting ARCA, Oruka, including the pre-closing private financing, or the Merger

will be those that have been anticipated.

The forward-looking statements contained

in this communication are based on current expectations and beliefs concerning future developments and their potential effects and therefore

subject to other risks and uncertainties. These risks and uncertainties include, but are not limited to, risks associated with the possible

failure to satisfy the conditions to the closing or consummation of the Merger, including ARCA’s failure to obtain stockholder

approval for the Merger, risks associated with the potential failure to complete the financing transaction in a timely manner or at all,

risks associated with the uncertainty as to the timing of the consummation of the Merger and the ability of each of ARCA and Oruka to

consummate the transactions contemplated by the Merger, risks associated with ARCA’s continued listing on Nasdaq until closing

of the Merger, the failure or delay in obtaining required approvals from any governmental or quasi-governmental entity necessary to consummate

the Merger; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Merger

prior to the closing or consummation of the Merger, risks associated with the possible failure to realize certain anticipated benefits

of the Merger, including with respect to future financial and operating results; the effect of the completion of the Merger on the combined

company’s business relationships, operating results and business generally; risks associated with the combined company’s

ability to manage expenses and unanticipated spending and costs that could reduce the combined company’s cash resources; risks

related to the combined company’s ability to correctly estimate its operating expenses and other events; changes in capital resource

requirements; risks related to the inability of the combined company to obtain sufficient additional capital to continue to advance its

product candidates or its preclinical programs; the outcome of any legal proceedings that may be instituted against the combined company

or any of its directors or officers related to the Merger Agreement or the transactions contemplated thereby; the ability of the combined

company to obtain, maintain and protect its intellectual property rights, in particular those related to its product candidates; the

combined company’s ability to advance the development of its product candidates or preclinical activities under the timelines it

anticipates in planned and future clinical trials; the combined company’s ability to replicate in later clinical trials positive

results found in preclinical studies and early-stage clinical trials of its product candidates; the combined company’s ability

to realize the anticipated benefits of its research and development programs, strategic partnerships, licensing programs or other collaborations;

regulatory requirements or developments and the combined company’s ability to obtain necessary approvals from the U.S. Food and

Drug Administration or other regulatory authorities; changes to clinical trial designs and regulatory pathways; competitive responses

to the Merger and changes in expected or existing competition; unexpected costs, charges or expenses resulting from the Merger; potential

adverse reactions or changes to business relationships resulting from the completion of the Merger; legislative, regulatory, political

and economic developments; and those risks and uncertainties and other factors more fully described in filings with the Securities and

Exchange Commission (“SEC”), including reports filed on Form 10-K, 10-Q and 8-K, in other

filings that ARCA makes and will make with the SEC in connection with the proposed Merger, including the Proxy Statement/Prospectus

described below under “Important Additional Information About the Proposed Transaction Filed with the SEC,” and in other

filings made by ARCA with the SEC from time to time and available at www.sec.gov. These forward-looking statements are based on current

expectations, and with regard to the proposed transaction, are based on ARCA’s current expectations, estimates and projections

about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s

beliefs and certain assumptions made by ARCA, all of which are subject to change. Such forward-looking statements are made as of the

date of this release, and the parties undertake no obligation to update such statements to reflect subsequent events or circumstances,

except as otherwise required by securities and other applicable law.

No Offer or Solicitation

This communication is not intended to and

do not constitute (i) a solicitation of a proxy, consent or approval with respect to any securities or in respect of the proposed

transactions (the “Proposed Transactions”) between ARCA and Oruka or (ii) an offer to sell or the solicitation

of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities pursuant to the Proposed Transactions

or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended,

or an exemption therefrom. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained,

the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of

the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission,

telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

NEITHER THE SEC NOR ANY STATE SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS COMMUNICATION IS TRUTHFUL OR COMPLETE.

Important Additional Information About

the Proposed Transaction Filed with the SEC

This communication is not a substitute for

the registration statement on Form S-4 or for any other document that ARCA has filed or may file with the SEC in connection with the

Proposed Transactions. In connection with the Proposed Transactions, ARCA has filed with the SEC a registration statement on Form S-4, which

contains a proxy statement/prospectus of ARCA. ARCA URGES INVESTORS AND STOCKHOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4,

PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE OR MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT ARCA, ORUKA, THE PROPOSED

TRANSACTIONS AND RELATED MATTERS. Investors and stockholders can obtain free copies of the proxy statement/prospectus and other documents

filed by ARCA with the SEC through the website maintained by the SEC at www.sec.gov. Stockholders are urged to read the proxy statement/prospectus

and the other relevant materials filed with the SEC before making any voting or investment decision with respect to the Proposed Transactions.

In addition, investors and stockholders should note that ARCA communicates with investors and the public using its website (https://arcabio.com/investors/).

Participants in the Solicitation

ARCA, Oruka and their respective directors

and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the Proposed

Transactions. Information about ARCA’s directors and executive officers including a description of their interests in ARCA is included

in the proxy statement/prospectus relating to the Proposed Transactions and ARCA’s most recent Annual Report on Form 10-K, including

any information incorporated therein by reference, each as filed with the SEC. Information about ARCA’s and Oruka’s respective

directors and executive officers and their interests in the Proposed Transactions is included in the proxy statement/prospectus relating

to the Proposed Transactions filed with the SEC.

ARCA biopharma Investor & Media Contact:

Jeff Dekker

720.940.2122

ir@arcabio.com

Oruka Therapeutics Investor Relations Contact:

Alan Lada

650.606.7911

Alan.lada@orukatx.com

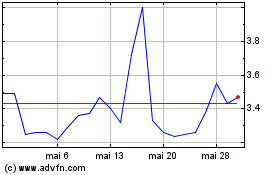

ARCA Biopharma (NASDAQ:ABIO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

ARCA Biopharma (NASDAQ:ABIO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025