false000092628200009262822024-08-272024-08-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 27, 2024 |

ADTRAN Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41446 |

87-2164282 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

901 Explorer Boulevard |

|

Huntsville, Alabama |

|

35806-2807 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 256 963-8000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, Par Value $0.01 per share |

|

ADTN |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 27, 2024, Adtran Networks SE (“Adtran Networks”), a majority-owned subsidiary of ADTRAN Holdings, Inc. (the “Company”), entered into an amendment (the “Dopfer Amendment”) to its employment agreement with Ulrich Dopfer, the Chief Financial Officer of the Company and a member of the management board of Adtran Networks. On the same day, Adtran Networks also amended its employment agreement (together with the “Dopfer Amendment”, the “Amendments”) with Christoph Glingener, the Company’s Chief Technology Officer (“CTO”) and the CTO and a member of the management board of Adtran Networks (together with Mr. Dopfer, the “Executives”). The Amendments extend the term of each Executive’s employment agreement through December 31, 2025. In addition, as previously disclosed in the Company’s Form 8-K filed on December 5, 2023, Adtran Networks temporarily decreased the Executives’ salaries by 25% from November 1, 2023 through July 31, 2024, in connection with the Company’s previously announced Business Efficiency Program. While other employees received stock options at the time that the Company implemented salary reductions across much of the workforce, the Company was unable to grant the Executives stock options as a result of certain German law considerations. As a result, and as reflected in the Amendments, Adtran Networks has elected to reverse the effect of the prior salary reductions, which amounted to a total of $76,875 for Mr. Dopfer ($17,083 during the last two months of 2023, plus $59,792 during the first seven months of 2024) and a total of €62,771 for Mr. Glingener (€13,625 during the last two months of 2023, plus €49,146 during the first seven months of 2024). This reversal will result in Mr. Dopfer and Mr. Glingener receiving a total salary in 2024 of $427,083 and €350,625, respectively. The portion of the increase in the Executives’ base salaries attributable to the reversal of the reduction in salary during last two months of 2023 will not apply in fiscal 2025 or beyond, with the annual base salaries consequently reverting to $410,000 for Mr. Dopfer and €337,000 for Mr. Glingener beginning on January 1, 2025. The Amendments further provide that the Executives will each continue to be eligible to receive an annual grant of an incentive cash bonus award tied to the Company’s total revenue and adjusted earnings before interest and taxes (“Adjusted EBIT”), as well as annual grants of time-based restricted stock units (“RSUs”) and performance stock units based on the Company’s relative total shareholder return (“relative TSR”) compared to the Nasdaq Telecommunications Index (the “market-based PSUs”), with the targeted size of the annual RSU grant and market-based PSU grant to equal, in each case, 40% of the Executive’s base salary. The Amendments provide, however, that, with respect to the RSUs and market based PSUs granted to the Executives on January 26, 2024, there was a downward adjustment from the targeted amounts due to the number of shares then available under the Company’s 2020 Employee Stock Incentive Plan, with Mr. Dopfer receiving grants of 13,321 RSUs and 13,321 market-based PSUs, and Mr. Glingener receiving grants of 12,044 RSUs and 12,044 market-based PSUs. The RSUs, which are settled in shares of common stock, are scheduled to vest ratably over four years from the date of grant, subject to the Executive continuing to be employed on the applicable vesting date. With respect to the market-based PSUs granted in 2024, the Executives may earn shares ranging from 0% to 150% of the target number of market-based PSUs based on the Company’s relative TSR performance compared to its peer group over a three-year performance period, with no shares earned where relative TSR performance is less than the 30th percentile of the peer group and 150% of the target number of shares earned if TSR performance equals or exceeds the 80th percentile of the peer group (with interpolation between such levels of performance as set forth in the Amendments). The market-based PSUs are, however, subject to a 100% payout cap in the event that the Company’s relative TSR out-performs the Nasdaq Telecommunications Index, but the Company’s TSR is negative. The Executives receive dividend credits in connection with their market-based and three-year performance-based PSUs (as defined below and, together with the market-based PSUs, the “PSUs”)), provided that dividends are declared and paid to the Company’s stockholders, which credits are distributed in cash upon issuance of the shares that are earned pursuant to the relevant PSU award.

The Amendments also reflect the prior grant to the Executives on May 24, 2023 of (i) performance-based PSU awards based on the Company’s Adjusted EBIT over a performance period beginning on the date of grant and ending on December 31, 2025 (the “three-year performance-based PSUs”) and (ii) a one-time integration award, comprised of performance-based PSUs and cash bonus award amounts, based on the achievement of cost savings and individual goals during the period beginning on the grant date and ending on December 31, 2024 (the “integration award”). The three-year performance-based PSUs and the integration awards are described in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on March 27, 2024.

Finally, the Amendments provide that each of the Executives’ total annual remuneration is capped at €2,800,000.

The foregoing description of the Amendments is not complete and is qualified in their entirety by each of the Amendments, which are attached hereto as Exhibits 10.1 and 10.2 and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ADTRAN Holdings, Inc. |

|

|

|

|

Date: |

August 30, 2024 |

By: |

/s/ Ulrich Dopfer |

|

|

|

Ulrich Dopfer

Chief Financial Officer |

EXHIBIT 10.1

* CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS NOT MATERIAL AND IS THE TYPE OF INFORMATION THE REGISTRANT CUSTOMARILY AND ACTUALLY TREATS AS PRIVATE AND CONFIDENTIAL. REDACTED INFORMATION IS INDICATED BY [***].

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

|

|

AMENDMENT TO OFFICER`S EMPLOYMENT AGREEMENT |

DIENSTVERTRAGSÄNDERUNG VORSTANDSMITGLIED |

Adtran Networks SE, Martinsried/Meiningen |

- hereinafter the "Company" – |

- im Folgenden die "Gesellschaft" - |

represented by the Supervisory Board |

vertreten durch den Aufsichtsrat |

And |

und |

Mr./Herrn Dr. Christoph Glingener Sandweg 7 26349 Jade |

- hereinafter: the "Officer" - |

- im Folgenden: das "Vorstandsmitglied" – |

|

|

|

|

The Officer has been a Chief Officer of the Company since January 1, 2007. The existing Officer’s Employment Agreement is limited in time and will end on December 31, 2024. |

Das Vorstandsmitglied ist seit 1. Januar 2007 Mitglied des Vorstands der Gesellschaft. Der bestehende Dienstvertrag mit dem Vorstandsmitglied ist befristet und endet mit Ablauf des 31. Dezember 2024. |

In its meeting on February 13, 2024, the Supervisory Board resolved to extend the appointment as Chief Officer of the Company until December 31, 2025 and to amend his remuneration. |

In seiner Sitzung vom 13. Februar 2024 hat der Aufsichtsrat beschlossen, die Bestellung als Mitglied des Vorstands bis zum 31. Dezember 2025 zu verlängern und seine Vergütung anzupassen. |

|

2.Verlängerung der Laufzeit |

2.1In accordance with the above-mentioned resolution of the Supervisory Board, the Officer’s Employment Agreement shall be extended until December 31, 2025. |

2.1Dem oben erwähnten Beschluss des Aufsichtsrats entsprechend wird der Dienstvertrag mit dem Vorstandsmitglied hiermit bis zum 31. Dezember 2025 verlän�gert. |

2.2The Employment Agreement will end with the expiry of December 31, 2025, without any formal notice being necessary. |

2.2Der Dienstvertrag endet, ohne dass es einer Erklärung einer der Vertragsparteien bedarf, mit Ablauf des 31. Dezember 2025. |

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

|

|

|

|

|

|

Section 3.1 b) of the Employment Agreement is amended and restated as follows: |

Ziffer 3.1 b) des Dienstvertrags wird wie folgt geändert und neu formuliert: |

3.1 |

3.1 |

b)Commencing January 1, 2024, the Officer shall receive annual and/or long-term fixed and/or variable bonuses, as well as certain equity or equity-based awards as set out in the attached Exhibit 1 or as set out by separate resolutions of the Supervisory Board. |

b)Ab dem 1. Januar 2024 erhält das Vorstandsmitglied jährliche und/oder langfristige feste und/oder variable Boni sowie bestimmte Aktien oder aktienkursbasierte Prämien, wie in der beigefügten Anlage 1 oder wie in separaten Beschlüssen des Aufsichtsrats dargelegt. |

|

|

4.1Nothing in the Employment Agreement, as amended, shall be construed to prohibit the Officer from having reported or reporting possible violations of federal law or regulation or having filed or filing a charge or complaint with any governmental agency or entity, including, but not limited to the Department of Justice, Equal Employment Opportunity Commission, National Labor Relations Board, the Occupational Safety and Health Administration, the Securities and Exchange Commission, Congress, the Inspector General or any federal, state or local governmental agency or commission (each, a “Government Agency”). This Employment Agreement does not limit the Officer’s ability to communicate with any Government Agency or otherwise participate in any investigation or proceeding that may be conducted by any Government Agency, including providing documents or other information, without notice to the Company. |

4.1Keine Bestimmung des Dienstvertrages in seiner geänderten Fassung ist so auszulegen, dass sie es dem Vorstandsmitglied verbietet, mögliche Verstöße gegen Bundesgesetze oder -vorschriften zu melden oder eine Anzeige oder Beschwerde bei einer Regierungsbehörde oder -stelle einzureichen, einschließlich, aber nicht beschränkt auf das Justizministerium, die Equal Employment Opportunity Commission, das National Labor Relations Board, die Occupational Safety and Health Administration, die Securities and Exchange Commission, den Kongress, den Generalinspektor oder eine Regierungsbehörde oder -kommission auf Bundes-, Landes- oder Kommunalebene (jeweils eine "Regierungsbehörde"). Dieser Dienstvertrag schränkt die Fähigkeit des Vorstandsmitglieds nicht ein, mit einer Regierungsbehörde zu kommunizieren oder anderweitig an einer Untersuchung oder einem Verfahren teilzunehmen, das von einer Regierungsbehörde durchgeführt wird, einschließlich der Bereitstellung von Dokumenten oder anderen Informationen, ohne dass die Gesellschaft davon in Kenntnis gesetzt wird. |

4.2In addition to the Adtran Holdings, Inc. (“Adtran”) Policy for the Recovery of Erroneously Awarded Compensation agreed on November 27, 2023 / December 4, 2023, the malus and clawback clauses provided in Section 5 of the Management Board remuneration system approved by the Annual General Meeting on June 28, 2024 ("Remuneration System") also apply. |

4.2Neben der am 27. November 2023 / 4. Dezember 2023 vereinbarten Adtran Holdings, Inc. (“Adtran”) Policy for the Recovery of Erroneously Awarded Compensation gelten auch die in Ziff. 5 des Vorstandsvergütungssystems, das von der Hauptversammlung am 28. Juni 2024 gebilligt worden ist ("Vergütungssystem"), vorgesehenen Einbehaltungs- und Rückforderungsklauseln. |

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

|

|

|

|

4.3In the event of termination of Management Board contracts, the principles set out in Section 8 of the Remuneration System must be observed with regard to severance payments. |

4.3Bei Beendigung von Vorstandsverträgen sind in Hinblick auf Abfindungen die in Ziff. 8 des Vorstandsvergütungssystems festgelegten Grundsätze zu beachten. |

4.4All other provisions of the existing Employ�ment Agreement, including all subsequent amendments, shall apply without change. |

4.4Im Übrigen findet der bestehende Dienstvertrag einschließlich aller nachfolgenden Änderungen und Ergänzungen unverändert Anwendung. |

4.5Modifications of this Agreement require written form. This shall also apply to the amendment of this clause requiring written form. |

4.5Änderungen dieses Vertrages bedürfen der Schriftform. Dies gilt auch für die Abänderungen dieser Schriftformklausel. |

4.6The German version will be authoritative for the interpretation of this Amendment. |

4.6Für die Auslegung dieses Vertrages ist die deutsche Fassung maßgeblich. |

[Signature Page follows]

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

|

|

|

|

München, 27. August 2024 |

|

/s/ Dr. Eduard Scheiterer |

/s/ Dr. Christoph Glingener |

Dr. Eduard Scheiterer |

Dr. Christoph Glingener |

Chairman of the Supervisory Board |

|

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

Exhibit 1 / Anlage 1

Officer’s Remuneration

The Officer’s Base Salary is EUR 337.000 (see Section 3.1 a) of the Amendment of the Officer’s Employment Agreement dated March 28, 2023) (“Base Salary”).

A 25% reduction of the Base Salary for the period between November 1, 2023 and July 31, 2024 (“Base Salary Reduction”) was implemented in order to support cost improvement initiatives. The Compensation Committee of Adtran proposed a mitigating equity grant for the Officer; however, such grant of stock options to the Officer was not possible due to German law. Consequently, the 25% salary reduction in the Officer’s Base Salary was reversed in 2024. The total Base Salary compensation to be paid in 2024 is EUR 350,625, inclusive of the EUR 337.000 Base Salary and EUR 13.625 for the November and December 2023 true-up. For clarification, the 2024 Base Salary true up in an amount of EUR 13.625 will not be applicable for the year 2025 or thereafter.

2.Annual Target Incentive Cash Bonus:

An Annual Target Incentive Cash Bonus (“Annual Cash Bonus”) in amount of 60% of the Base Salary of EUR 337.000 that amounts to EUR 202.200 (USD 222,420). This Annual Cash Bonus is calculated based on the achievement of two Company Performance Measurements (“CPM”): 1) Total Company Revenue of Adtran and 2) Total Company Adjusted Earnings before Interest and Taxes ("Adjusted EBIT") of Adtran, each CPM comes with a minimum threshold for payout, a "target", and a maximum, with linear increase for the payout percentage that will be interpolated up to the Maximum based on actual achievement of each CPM and subject to Adtran’s specific terms of the Annual Cash Bonus. The actual payout may be between 0% to 200% of target based on achievement.

3.Annual Grant time-based RSUs:

An annual grant of time-based restricted stock units (“RSUs”) in a target amount of 40% of Base Salary of EUR 337.000 that amounts to EUR 134.800 (USD 148,2801) (“Annual RSU Grant”) with 25% vesting on each of the first four anniversaries of the grant date settled through delivery of one Adtran share of common stock for each vested RSU conditioned upon an existing employment relationship on the applicable vesting date. The grants are subject to Adtran’s specific terms of the Annual RSU Grant, and an exercise profit limitation (Cap) in case of a value increase to 300%

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

between disbursement and conversion, taking into consideration all RSUs allocated within the grant for Officer of EUR 404.400.

The Annual RSU Grant for 2024 granted on January 26, 2024 (Employee Grant Number 5800) by Adtran has been adjusted in full due to available equity from 20,312 RSUs down to 12,044 RSUs. Details of this adjustment can be found in the minutes of Company’s Compensation and Nomination Committee and of Company’s Supervisory Board meetings.

4.Annual Grant market-based PSUs:

An annual grant of market-based performance stock units (“PSU”) in a target amount of 40% of Base Salary of EUR 337.000 that amounts to EUR 134.800 (USD 148,2801) with payout based on Adtran’s relative Total Shareholder Return (“TSR”) performance compared to the Nasdaq Telecommunications Index over a 3-year performance period from January 26, 2024, to January 26, 2027 ("Annual PSU Grant”). Depending on Adtran’s relative TSR over the performance period, Officer may earn from 0% of the target number of market-based PSUs if the relative TSR performance is not at least equal to the 30th percentile of the peer group, and 150% of the target number of market-based PSUs if the relative TSR performance of Adtran equals or exceeds the 80th percentile of the peer group, based on the sliding scale where approximately 4.0% of the target award is earned for each 1 percentile increase up to 100% of the target award and then approximately 2.0% of the target award is earned for each 1 percentile increase up to 150% of the grant. However, there is a 100% payout cap when Adtran’s TSR out-performs the NASDAQ Telecommunications Index, but Adtran’s TSR is negative. The recipients of the market-based PSUs receive dividend credits, provided dividends are declared and paid to shareholders, in cash based on the shares of common stock underlying the market-based PSUs. The grants are subject to an exercise limitation in case of achievement of the 150% maximum target and a share value increase to 200% between disbursement and conversion, taking into consideration all market-based PSUs allocated within the grant (Cap) for Officer of EUR 404.400.

The Annual PSU Grant for 2024 granted on January 26, 2024 (Employee Grant Number 5816) by Adtran has been adjusted in full due to available equity from 20,312 RSUs down to 12,044 RSUs. Details of this adjustment can be found in the minutes of Company’s Compensation and Nomination Committee and of Company’s Supervisory Board meetings.

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

5.Ongoing 3-Year Performance-Based PSUs (for the period ending 31 December 2025):

On May 24, 2023, performance-based performance stock units (“performance-based PSUs”) in a target amount of EUR 934.579 (USD 1,000,000) or 60,205 shares were granted to Officer by Adtran (Employee Grant Number 5220). Pursuant to the terms of the award, shares are eligible to be earned at the end of the 3-year performance period ending on December 31, 2025 based on achievement of Adtran’s Adjusted EBIT of USD[***] during such performance period. The recipients of the performance-based PSUs also receive dividend credits, provided dividends are declared and paid to shareholders, in cash based on the shares of common stock underlying the performance-based PSUs. The grants are subject to an exercise limitation in case of a share value increase to 200% of the originally allocated PSUs between disbursement and conversion, taking into consideration all performance-based PSUs originally allocated (Cap) for Officer’s grant of USD 2,000,000.

6.Ongoing 2-Year Integration One-Time Bonus (for the period ending 31 December 2024):

A 2-Year-Integration One-Time Bonus in which Officer is eligible to earn 0%, 33%, or 66% of the 2023 Base Salary of EUR 327.000 (USD 350,0002) in performance-based PSUs (a max of 66% of the 2023 Base Salary) as well as between 0% and 66% of the 2023 Base Salary in cash (a max of 66% of the 2023 Base Salary), leading to a combined payout between 0% and 132% max of the 2023 Base Salary depending on synergy savings thresholds/targets and related individual goals. Pursuant to the terms of the award, Adtran pays the cash award, if any, and issues one share of common stock for every earned performance-based PSU, if any, to the Officer after the level of achievement of the performance goal is certified. As a result, Adtran granted the Officer a target amount of 13,907 performance-based PSUs (Employee Grant Number 5213) and a target cash bonus of EUR 215,820 (USD 231,0002) on May 24, 2023. The grants are subject to the Integration Bonus Plan and the below individual objectives, as well as an exercise limitation of the maximum target and a share value increase to 200% between disbursement and conversion (Cap) for Officer’s grant beyond USD 924,000.

2 EUR base converted with 1.07fx rate

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

Individual Objectives for Officer:

|

|

|

|

|

Exhibit B ADTRAN Holdings, Inc. Integration Bonus Objectives – Christoph Glingener |

Key Objective |

Measures |

Target |

Definition / Data Source |

Percentage of Target Bonus |

Fully integrated IT landscape (PDM) and way-of- working in the CTO team (processes and tools) |

[***] |

[***] |

Acknowledgment of achievement by the overall IT project lead |

34% |

|

|

|

|

|

Keep the technology team engaged and motivated |

[***] |

[***] |

NPS Survey results of full team in 2H ‘24 |

33% |

|

|

|

|

|

Consolidate engineering sites and related spend |

[***] |

[***] |

Compare with amount of sites of January 2023 provided by finance |

33% |

7.Annual Maximum Remuneration Cap:

The Jährliche Maximalvergütung/Annual maximum remuneration cap for the Officer is EUR 2.800.000.

The term "Adjusted EBIT" is Adtran’s earnings before interest and taxes shown in the audited financial statements of Adtran, adjusted by restructuring costs, acquisition-related costs, amortizations of intangible assets, costs for share-based compensation, non-cash changes in the value of investments within the framework of the Deferred Compensation Plan, and other exceptions established in the individual case. However, according to the VICC, other key figures can also be used as performance criteria.

The variable remuneration described in this document is subject to Adtran’s calculations, descriptions, terms of the applicable plans and programs of Adtran, including, without limitation, the ADTRAN HOLDINGS, INC. AMENDED AND RESTATED VARIABLE INCENTIVE COMPENSATION PLAN (VICC), the ADTRAN HOLDINGS, INC. AMENDED AND RESTATED CLAWBACK POLICY, the ADTRAN HOLDINGS, INC. POLICY FOR THE RECOVERY OF ERRONEOUSLY AWARDED INCENTIVE BASED COMPENSATION (“Clawback Policy”), the ADTRAN HOLDINGS, INC. 2024 EMPLOYEE STOCK INCENTIVE PLAN, and subject to Officers’ express approval that will not be unreasonably withheld any other current or future plan and its respective amendments where applicable.

EXHIBIT 10.2

* CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS NOT MATERIAL AND IS THE TYPE OF INFORMATION THE REGISTRANT CUSTOMARILY AND ACTUALLY TREATS AS PRIVATE AND CONFIDENTIAL. REDACTED INFORMATION IS INDICATED BY [***].

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

|

|

AMENDMENT TO OFFICER`S EMPLOYMENT AGREEMENT |

DIENSTVERTRAGSÄNDERUNG VORSTANDSMITGLIED |

Adtran Networks SE, Martinsried/Meiningen |

- hereinafter the "Company" – |

- im Folgenden die "Gesellschaft" - |

represented by the Supervisory Board |

vertreten durch den Aufsichtsrat |

and |

und |

Mr./Herrn Ulrich Dopfer 1710 Bucks Club Drive, Alpharetta, Georgia, 30005 USA |

- hereinafter: the "Officer" - |

- im Folgenden: das "Vorstandsmitglied" – |

|

|

|

|

The Officer has been a Chief Officer of the Company since January 1, 2015. The existing Officer’s Employment Agreement is limited in time and will end on December 31, 2024. |

Das Vorstandsmitglied ist seit 1. Januar 2015 Mitglied des Vorstands der Gesellschaft. Der bestehende Dienstvertrag mit dem Vorstandsmitglied ist befristet und endet mit Ablauf des 31. Dezember 2024. |

In its meeting on February 13, 2024, the Supervisory Board resolved to extend the appointment as Chief Officer of the Company until December 31, 2025 and to amend his remuneration. |

In seiner Sitzung vom 13. Februar 2024 hat der Aufsichtsrat beschlossen, die Bestellung als Mitglied des Vorstands bis zum 31. Dezember 2025 zu verlängern und seine Vergütung anzupassen. |

|

2.Verlängerung der Laufzeit |

2.1In accordance with the above-mentioned resolution of the Supervisory Board, the Officer’s Employment Agreement shall be extended until December 31, 2025. |

2.1Dem oben erwähnten Beschluss des Aufsichtsrats entsprechend wird der Dienstvertrag mit dem Vorstandsmitglied hiermit bis zum 31. Dezember 2025 verlän�gert. |

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

|

|

2.2The Employment Agreement will end with the expiry of December 31, 2025, without any formal notice being necessary. |

2.2Der Dienstvertrag endet, ohne dass es einer Erklärung einer der Vertragsparteien bedarf, mit Ablauf des 31. Dezember 2025. |

|

|

Section 3.1 b) of the Employment Agreement is amended and restated as follows: 3.1 |

Die Ziffer 3.1 b) des Dienstvertrags wird wie folgt geändert und neu formuliert: 3.1 |

b)Commencing January 1, 2024, the Officer shall receive annual and/or long-term fixed and/or variable bonuses, as well as certain equity or equity-based awards as set out in the attached Exhibit 1 or as set out by separate resolutions of the Supervisory Board. |

b)Ab dem 1. Januar 2024 erhält das Vorstandsmitglied jährliche und/oder langfristige feste und/oder variable Boni sowie bestimmte Aktien oder aktienkursbasierte Prämien, wie in der beigefügten Anlage 1 oder wie in separaten Beschlüssen des Aufsichtsrats dargelegt. |

|

|

4.1Nothing in the Employment Agreement, as amended, shall be construed to prohibit the Officer from having reported or reporting possible violations of federal law or regulation or having filed or filing a charge or complaint with any governmental agency or entity, including, but not limited to the Department of Justice, Equal Employment Opportunity Commission, National Labor Relations Board, the Occupational Safety and Health Administration, the Securities and Exchange Commission, Congress, the Inspector General or any federal, state or local governmental agency or commission (each, a “Government Agency”). This Employment Agreement does not limit the Officer’s ability to communicate with any Government Agency or otherwise participate in any investigation or proceeding that may be conducted by any Government Agency, including providing documents or other information, without notice to the Company. |

4.1Keine Bestimmung des Dienstvertrages in seiner geänderten Fassung ist so auszulegen, dass sie es dem Vorstandsmitglied verbietet, mögliche Verstöße gegen Bundesgesetze oder -vorschriften zu melden oder eine Anzeige oder Beschwerde bei einer Regierungsbehörde oder -stelle einzureichen, einschließlich, aber nicht beschränkt auf das Justizministerium, die Equal Employment Opportunity Commission, das National Labor Relations Board, die Occupational Safety and Health Administration, die Securities and Exchange Commission, den Kongress, den Generalinspektor oder eine Regierungsbehörde oder -kommission auf Bundes-, Landes- oder Kommunalebene (jeweils eine "Regierungsbehörde"). Dieser Dienstvertrag schränkt die Fähigkeit des Vorstandsmitglieds nicht ein, mit einer Regierungsbehörde zu kommunizieren oder anderweitig an einer Untersuchung oder einem Verfahren teilzunehmen, das von einer Regierungsbehörde durchgeführt wird, einschließlich der Bereitstellung von Dokumenten oder anderen Informationen, ohne dass die Gesellschaft davon in Kenntnis gesetzt wird. |

4.2In addition to the Adtran Holdings, Inc. (“Adtran”) Policy for the Recovery of Erroneously Awarded Compensation agreed on November 27, 2023 / December 4, 2023, the malus and clawback clauses provided in Section 5 of the Management Board |

4.2Neben der am 27. November 2023 / 4. Dezember 2023 vereinbarten Adtran Holdings, Inc. (“Adtran”) Policy for the Recovery of Erroneously Awarded Compensation gelten auch die in Ziff. 5 des Vorstandsvergütungssystems, das von der |

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

|

|

remuneration system approved by the Annual General Meeting on June 28, 2024 ("Remuneration System") also apply. |

Hauptversammlung am 28. Juni 2024 gebilligt worden ist ("Vergütungssystem"), vorgesehenen Einbehaltungs- und Rückforderungsklauseln. |

4.3In the event of termination of Management Board contracts, the principles set out in Section 8 of the Remuneration System must be observed with regard to severance payments. |

4.3Bei Beendigung von Vorstandsverträgen sind in Hinblick auf Abfindungen die in Ziff. 8 des Vorstandsvergütungssystems festgelegten Grundsätze zu beachten. |

4.4All other provisions of the existing Employ�ment Agreement, including all subsequent amendments, shall apply without change. |

4.4Im Übrigen findet der bestehende Dienstvertrag einschließlich aller nachfolgenden Änderungen und Ergänzungen unverändert Anwendung. |

4.5Modifications of this Agreement require written form. This shall also apply to the amendment of this clause requiring written form. |

4.5Änderungen dieses Vertrages bedürfen der Schriftform. Dies gilt auch für die Abänderungen dieser Schriftformklausel. |

4.6The German version will be authoritative for the interpretation of this Amendment. |

4.6Für die Auslegung dieses Vertrages ist die deutsche Fassung maßgeblich. |

[Signature Page follows]

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

|

|

|

|

München, 27. August 2024 |

|

/s/ Dr. Eduard Scheiterer |

/s/ Ulrich Dopfer |

Dr. Eduard Scheiterer |

Ulrich Dopfer |

Chairman of the Supervisory Board |

|

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

Exhibit 1 / Anlage 1

Officer’s Remuneration

The Officer’s Base Salary is USD 410,000 (see Section 3.1 a) of the Amendment of the Officer’s Employment Agreement dated May 26, 2023) (“Base Salary”).

A 25% reduction of the Base Salary for the period between November 1, 2023 and July 31, 2024 (“Base Salary Reduction”) was implemented in order to support cost improvement initiatives. The Compensation Committee of Adtran proposed a mitigating equity grant for the Officer; however, such grant of stock options to the Officer was not possible due to German law. Consequently, the 25% salary reduction in the Officer’s Base Salary was reversed in 2024. The total Base Salary compensation to be paid in 2024 is USD 427,083, inclusive of the USD 410,000 Base Salary and USD 17,083 for the November and December 2023 true-up. For clarification, the 2024 Base Salary true up in an amount of USD 17,083 will not be applicable for the year 2025 or thereafter.

2.Annual Target Incentive Cash Bonus:

An Annual Target Incentive Cash Bonus (“Annual Cash Bonus”) in amount of 60% of the Base Salary of USD 410,000 that amounts to USD 246,000 (EUR 223.636). This Annual Cash Bonus is calculated based on the achievement of two Company Performance Measurements (“CPM”): 1) Total Company Revenue of Adtran and 2) Total Company Adjusted Earnings before Interest and Taxes ("Adjusted EBIT") of Adtran, each CPM comes with a minimum threshold for payout, a "target", and a maximum, with linear increase for the payout percentage that will be interpolated up to the Maximum based on actual achievement of each CPM and subject to Adtran’s specific terms of the Annual Cash Bonus. The actual payout may be between 0% to 200% of target based on achievement.

3.Annual Grant time-based RSUs:

An annual grant of time-based restricted stock units ("RSUs”) in a target amount of 40% of Base Salary of USD 410,000 that amounts to USD 164,000 (EUR 149.0911) (“Annual RSU Grant”) with 25% vesting on each of the first four anniversaries of the grant date settled through delivery of one Adtran share of common stock for each vested RSU conditioned upon an existing employment relationship on the applicable vesting date. The grants are subject to Adtran’s specific terms of the Annual RSU Grant, and an exercise profit limitation (Cap) in case of a value increase to 300%

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

between disbursement and conversion, taking into consideration all RSUs allocated within the grant for Officer of USD 492,000.

The Annual RSU Grant for 2024 granted on January 26, 2024 (Employee Grant Number 5801) by Adtran has been adjusted in full due to available equity from 22,466 RSUs down to 13,321 RSUs. Details of this adjustment can be found in the minutes of Company’s Compensation and Nomination Committee and of Company’s Supervisory Board meetings.

4.Annual Grant market-based PSUs:

An annual grant of market-based performance stock units (“market-based PSU”) in a target amount of 40% of Base Salary of USD 410,000 that amounts to USD 164,000 (EUR 149.0911) with payout based on Adtran’s relative Total Shareholder Return (“TSR”) performance compared to the Nasdaq Telecommunications Index over a 3-year performance period from January 26, 2024, to January 26, 2027 ("Annual PSU Grant”). Depending on Adtran’s relative TSR over the performance period, Officer may earn from 0% of the target number of market-based PSUs if the relative TSR performance is not at least equal to the 30th percentile of the peer group, and 150% of the target number of market-based PSUs if the relative TSR performance of Adtran equals or exceeds the 80th percentile of the peer group, based on the sliding scale where approximately 4.0 % of the target award is earned for each 1 percentile increase up to 100% of the target award and then approximately 2.0% of the target award is earned for each 1 percentile increase up to 150% of the grant. However, there is a 100% payout cap when Adtran’s TSR out-performs the NASDAQ Telecommunications Index, but Adtran’s TSR is negative. The recipients of the market-based PSUs receive dividend credits, provided dividends are declared and paid to shareholders, in cash based on the shares of common stock underlying the market-based PSUs. The grants are subject to an exercise limitation in case of achievement of the 150% maximum target and a share value increase to 200% between disbursement and conversion, taking into consideration all market-based PSUs allocated within the grant (Cap) for Officer of USD 492,000.

The Annual PSU Grant for 2024 granted on January 26, 2024 (Employee Grant Number 5817) by Adtran has been adjusted in full due to available equity from 22,466 RSUs down to 13,321 RSUs. Details of this adjustment can be found in the minutes of Company’s Compensation and Nomination Committee and of Company’s Supervisory Board meetings.

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

5.Ongoing 3-Year Performance-Based PSUs (for the period ending 31 December 2025):

On May 24, 2023, performance-based performance stock units (“performance-based PSUs”) in a target amount of USD 1,000,000 (EUR 934.579) or 60,205 shares were granted to Officer by Adtran (Employee Grant Number 5220). Pursuant to the terms of the award, shares are eligible to be earned at the end of the 3-year performance period ending on December 31, 2025 based on achievement of Adtran’s Adjusted EBIT of USD[***] during such performance period. The recipients of the performance-based PSUs also receive dividend credits, provided dividends are declared and paid to shareholders, in cash based on the shares of common stock underlying the performance-based PSUs. The grants are subject to an exercise limitation in case of a share value increase to 200% of the originally allocated PSUs between disbursement and conversion, taking into consideration all performance-based PSUs originally allocated (Cap) for Officer’s grant of USD 2,000,000.

6.Ongoing 2-Year Integration One-Time Bonus (for the period ending 31 December 2024):

A 2-Year-Integration One-Time Bonus in which Officer is eligible to earn 0%, 33%, or 66% of the Base Salary of USD 410,000 (EUR 372.727) in performance-based PSUs (a max of 66% of the Base Salary), as well as between 0% and 66% of the Base Salary in cash (a max of 66% of the Base Salary), leading to a combined payout between 0% and 132% max of the Base Salary depending on synergy savings thresholds/targets and related individual goals. Pursuant to the terms of the award, Adtran pays the cash award, if any, and issues one share of common stock for every earned performance-based PSU, if any, to the Officer after the level of achievement of the performance goal is certified. As a result, Adtran granted the Officer a target amount of 16,291 performance-based PSUs (Employee Grant Number 5214) and a target cash bonus of USD 270,600 on May 24, 2023. The grants are subject to the Integration Bonus Plan and the below individual objectives, as well as an exercise limitation of the maximum target and a share value increase to 200% between disbursement and conversion (Cap) for Officer’s grant beyond USD 820,000.

Amendment to Officer’s Employment Agreement – Dienstvertragsänderung für Vorstandsmitglied

Individual Objectives for Officer:

|

|

|

|

|

Exhibit B ADTRAN Holdings, Inc. Integration Bonus Objectives – Uli Dopfer |

Key Objective |

Measures |

Target |

Definition / Data Source |

Percentage of Target Bonus |

HCM implementation with go-live by May 2023 |

[***] |

[***] |

Workday |

34% |

|

|

|

|

|

Implement SAP Central Finance and Group Consolidation to become the central tools for external financial reporting and consolidation as per defined plan |

[***] |

[***] |

SAP |

33% |

|

|

|

|

|

Human Resources – NPS for employee satisfaction and engagement improved over integration period |

[***] |

[***] |

Documented survey results |

33% |

7.Annual Maximum Remuneration Cap:

The Jährliche Maximalvergütung/Annual maximum remuneration cap for the Officer is EUR 2.800.000.

The term "Adjusted EBIT" is Adtran’s earnings before interest and taxes shown in the audited financial statements of Adtran, adjusted by restructuring costs, acquisition-related costs, amortizations of intangible assets, costs for share-based compensation, non-cash changes in the value of investments within the framework of the Deferred Compensation Plan, and other exceptions established in the individual case. However, according to the VICC, other key figures can also be used as performance criteria.

The variable remuneration described in this document is subject to Adtran’s calculations, descriptions, terms of the applicable plans and programs of Adtran, including, without limitation, the ADTRAN HOLDINGS, INC. AMENDED AND RESTATED VARIABLE INCENTIVE COMPENSATION PLAN (VICC), the ADTRAN HOLDINGS, INC. AMENDED AND RESTATED CLAWBACK POLICY, the ADTRAN HOLDINGS, INC. POLICY FOR THE RECOVERY OF ERRONEOUSLY AWARDED INCENTIVE BASED COMPENSATION (“Clawback Policy”), the ADTRAN HOLDINGS, INC. 2024 EMPLOYEE STOCK INCENTIVE PLAN, and subject to Officers’ express approval that will not unreasonably withheld any other current or future plan and its respective amendments where applicable.

v3.24.2.u1

Document And Entity Information

|

Aug. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 27, 2024

|

| Entity Registrant Name |

ADTRAN Holdings, Inc.

|

| Entity Central Index Key |

0000926282

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-41446

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

87-2164282

|

| Entity Address, Address Line One |

901 Explorer Boulevard

|

| Entity Address, City or Town |

Huntsville

|

| Entity Address, State or Province |

AL

|

| Entity Address, Postal Zip Code |

35806-2807

|

| City Area Code |

256

|

| Local Phone Number |

963-8000

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.01 per share

|

| Trading Symbol |

ADTN

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

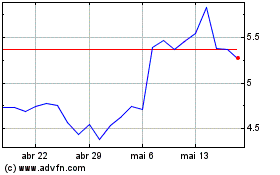

ADTRAN (NASDAQ:ADTN)

Gráfico Histórico do Ativo

De Ago 2024 até Set 2024

ADTRAN (NASDAQ:ADTN)

Gráfico Histórico do Ativo

De Set 2023 até Set 2024