false

0001218683

0001218683

2024-09-09

2024-09-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 9, 2024

Mawson Infrastructure Group Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40849 |

|

88-0445167 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 950 Railroad Avenue, Midland, Pennsylvania |

|

15059 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (412) 515-0896

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value |

|

MIGI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement

On September 9, 2024, Mawson Infrastructure Group,

Inc. (the “Company”) entered into the Third Amendment to Lease Agreement (the “Amendment”) which amended the existing

Lease Agreement, dated as of September 20, 2021, by and between the Company and Jewel Acquisition, LLC, pursuant to which the Company

leases approximately 8 acres of land and improvements located at 950 10th Street (950 Railroad Avenue), Midland (Beaver County),

Pennsylvania (the “Lease”). The Amendment extends the Lease from September 14, 2024 to September 14, 2027 and sets new rental

rates that are effective as of September 15, 2024. Future minimum lease payments for the Lease, as amended, are approximately $1,380,509,

with annual increases of 3.1%. All other terms of the Lease remain in full force and effect.

The description of the Amendment is only a summary and is qualified

in its entirety by reference to the full text of such document, which is filed as Exhibit 99.1 to this Current Report on Form 8-K and

which is incorporated herein by reference.

Item 8.01 Other Events

On September 11, 2024,

the Company entered into a Marketing Services Agreement (the “Agreement”) with Outside The Box Capital Inc. (“Box Capital”)

pursuant to which Box Capital will provide certain marketing and distribution services to the Company for a six month term in consideration

for the payment of a fee of $100,000 worth of restricted shares of the Company’s common stock, as approved by the Company’s board.

The preceding summary

of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement, a copy of which is filed

as Exhibit 99.2 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Company cautions that statements in this report

that are not a description of historical fact are forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements may be identified by the use of words referencing future events or circumstances such as “expect,”

“intend,” “plan,” “anticipate,” “believe,” and “will,” among others. Because

such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking

statements. These forward-looking statements are based upon Mawson’s current expectations and involve assumptions that may never

materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such

forward-looking statements as a result of various risks and uncertainties, which include, without limitation, the possibility of Mawson’s

need and ability to raise additional capital, the development and acceptance of digital asset networks and digital assets and their protocols

and software, the reduction in incentives to mine digital assets over time, the costs associated with digital asset mining, the volatility

in the value and prices of cryptocurrencies, and further or new regulation of digital assets. the evolution of AI and HPC market and changing

technologies, the slower than expected growth in demand for AI, HPC and other accelerated computing technologies than expected, the ability

to timely implement and execute on AI and HPC digital infrastructure, and the ability to timely complete the digital infrastructure build-out

in order to achieve its revenue expectations for the periods mentioned. More detailed information about the risks and uncertainties affecting

the Company is contained under the heading “Risk Factors” included in the Company’s Annual Report on Form 10-K filed

with the SEC on April 1, 2024, and Mawson’s Quarterly Report on Form 10-Q filed with the SEC on November 13, 2023, May 15, 2024,

and August 19, 2024, and in other filings that the Company has made and may make with the SEC in the future. One should not place undue

reliance on these forward-looking statements, which speak only as of the date on which they were made. Because such statements are subject

to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Mawson

undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they

were made, except as may be required by law.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

Mawson Infrastructure Group Inc. |

| |

|

|

| Date: September 11, 2024 |

By: |

/s/ Kaliste Saloom |

| |

|

General Counsel and Corporate Secretary |

| |

|

|

2

Exhibit 99.1

THIRD AMENDMENT TO LEASE AGREEMENT

This

THIRD AMENDMENT TO LEASE AGREEMENT (the

“Amendment”) is effective September 14, 2024 (the “Effective Date”), although made and entered into

on the dates as hereinafter set forth below, by and between JEWEL ACQUISITION, LLC, having an address of [***REDACTED***]

(the “Landlord”), and MAWSON INFRASTRUCTURE GROUP, INC (the “Tenant”), a Delaware corporation, with

its principal office and place of business at 950 Railroad Ave., Midland, PA 15059, as Party of the Second Part (Landlord and Tenant individually,

each a “Party,” and collectively, the “Parties”).

WHEREAS, Landlord

owns certain real property consisting of [***REDACTED***] located at 950 10th Street Midland PA (the “Property”);

WHEREAS,

Landlord and Tenant are the current Parties to that certain commercial Lease Agreement (the “Lease”) dated September

20, 2021, with the initial term ending September 14, 2024 and subject to four (4) additional three (3) years terms by mutual agreement

(whereby Tenant is leasing from Landlord approximately 8 acres of vacant land and the ability to connect to and receive power from the

substation number 1 (the “Substation”) near the former melt shop building as shown on Exhibit A attached hereto

located in Beaver County, PA; and

WHEREAS, the Parties previously amended the Lease on

April 1, 2022 and June 1, 2023.

WHEREAS, Landlord

and Tenant have agreed to extend the term to September 14, 2027 (“First Renewal Period”) and the Parties desire to

amend the Lease to include the payments due from the Tenant during the First Renewal Period;

NOW THEREFORE,

in consideration of the mutual covenants contained herein, as well as other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, Landlord and Tenant agree to amend the Lease with this signed instrument by authorized representatives

of both Parties, as follows:

1. Recitals;

Defined Terms. The above-stated Recitals, and any defined terms set forth therein, are restated and incorporated into this Section

1 as though fully set forth herein.

2. Lease

in Full Force and Effect. Landlord and Tenant acknowledge that the Lease is in full force and effect as amended herein, the Lease

shall be construed together with and to include the provisions set forth herein, and the Lease has not been amended, modified, or supplemented

except as set forth herein and no notice of default has been given under or in connection with the Lease which has not been cured, and

Landlord has no actual knowledge of the occurrence of any other default under or in connection with the Lease. Any terms used herein that

are not defined herein shall have the same definitions as set forth in the Lease.

3. Amendment

to Section 3. Use. Tenant use of the Leased Premises may also include providing above ground digital infrastructure and related activities

necessary to implement and support these operations or services, including associated with digital assets, cryptocurrency, colocation,

and/or computing such as artificial intelligence, high performance computing and other lawful uses.

Midland Lease – Third Amendment

4. Amendment

to Section 4. Rent and Security Deposit. In Section 4 as amended the rent payable is as follows reflecting an annual rent increase

of 3.1 percent commencing September 15, 2024:

Year 1: September 15, 2024 – September 14, 2025 -

$1,380,509

Year 2: September 15, 2025 – September 14, 2026 -

$1,423,304.78

Year 3: September 15, 2026 – September 14, 2027

- $1,467,427.23

5. Amendment to Section

26. Notice. Notice shall be as follows:

| If to tenant: |

Attention Legal Department |

| |

950 Railroad Ave |

| |

Midland, PA 15059 |

| |

with an email to: legal@mawsoninc.com

and to: notice@mawsoninc.com |

| |

| If to Landlord: |

Jewel Acquisition, LLC |

|

| |

[***REDACTED***] |

| |

| With a copy to: |

|

[***REDACTED***] |

6. All

Other Lease Terms in Full Force and Effect. Except as modified by this Amendment, all of the terms, provisions, conditions, and covenants

of the Lease as previously amended shall be and remain in full force and effect, including but not limited to, all provisions relating

to the property being leased “As Is”.

7. Approval

and Authority to Sign. Each Party acknowledges that this Amendment was duly approved by each Party and each Party acknowledges that

the individual or individuals signing this Amendment are duly authorized to so sign.

IN WITNESS WHEREOF,

the Parties hereto have executed this Agreement as the day and year first above written.

| Tenant: |

|

Landlord: |

| Mawson Infrastructure Group Inc |

|

Jewel Acquisition, LLC |

| |

|

|

| By: |

|

|

By: |

|

| Name: |

Rahul Mewawalla |

|

Name: |

[***REDACTED***] |

| Title: |

CEO and President |

|

Title: |

Executive Vice President, Finance & CFO |

2

Exhibit 99.2

OUTSIDE THE BOX CAPITAL INC.

2202 Green Orchard Place.

Oakville ON L6H 4V4

Canada

September 11th, 2024

CONFIDENTIAL

Mawson Infrastructure Group Inc.

950 Railroad Avenue

Midland, PA 15059 United States

legal@mawsoninc.com

Attention:

Re: Marketing Services Agreement

Dear Sirs/Mesdames:

Outside

The Box Capital Inc. (“Outside The Box Capital”) is pleased to provide marketing and distribution services to Mawson

Infrastructure Group Inc. (the “Company”), as more fully described in this letter agreement (the “Agreement”).

This Agreement sets forth the terms and conditions pursuant to which the Company engages Outside The Box Capital to provide such services.

(a) Outside

The Box Capital’s services to the Company will commence on September 11, 2024 (“Effective Date”) and end on March

11, 2025 (“Ending Date”) overall being the Initial Period (“Initial Period). Outside The Box Capital will

provide marketing and distribution services to communicate information about the Company (‘‘Marketing Services’’), including, but not

limited to:

| ● | Initial planning and strategy call with ongoing checkpoints

to cover feedback, advice, and other strategic matters of the campaign |

| ● | Assist in social media and other community-driving mediums,

with the goal of creating more company awareness and engagement. |

| ● | Distribute company approved messaging, press releases, and

other approved company materials across social channels, including, but not limited to, [***REDACTED***]. |

| ● | Spread company insights and announcements to new communities

with hopes of creating more company awareness and engagement. |

| ● | Featuring the Company in different influencer-based videos,

driving more engagement to the Company’s story. |

| ● | Craft and disseminate engaging content to spread company

insights and announcements, targeting both existing communities and new audiences. |

| ● | Draft and launch [***REDACTED***] alongside at least [***REDACTED***],

aiming to maximize brand exposure and audience reach daily. |

| ● | Deliver a [***REDACTED***] across key social platforms, ensuring

daily interaction and sustained engagement with the audience. |

| ● | Plan and launch a [***REDACTED***] in collaboration with

the Company, ensuring alignment with marketing objectives and brand

voice. |

| ● | An occasional Q&A or highlight video surrounding recent

company news to be posted on the Company’s YouTube channel and/or other company mediums |

| ● | Outside The Box Capital’s services under this Agreement

may be modified or supplemented in schedules to this Agreement, mutually agreed upon in writing by Outside The Box Capital and Company. |

(b) Outside

The Box Capital will not participate in discussions or negotiations with potential clients or investors. Outside The Box Capital will

not solicit orders, make recommendations or give investment advice. Outside The Box Capital will not affect transactions of securities

for potential investors or anyone else. Outside The Box Capital and the Company agree that Outside The Box Capital is not being engaged

for, and is not permitted to engage in, activities that would give rise to Outside The Box Capital being required to register as a broker-dealer

under applicable securities laws, the U.S. Exchange Act, or with FINRA. To the extent, a financial intermediary expresses interest in

the Company, Outside The Box Capital will refer the intermediary to the Company. In providing services under this Agreement, Outside The

Box Capital agrees to comply with all applicable U.S. and other securities laws.

(c) The

Company acknowledges that Outside The Box Capital is the sole and exclusive owner of any and all databases developed by it. Outside The

Box Capital may access third- party databases in order to increase the efficiency of its marketing outreach.

(d) It

is hereby acknowledged and agreed that Outside The Box Capital shall be entitled to communicate with and shall rely upon the immediate

advice, direction, and instructions of the Company’s representative in order to initiate, coordinate and implement the Marketing

Services as contemplated herein.

(a)

The Company will make available to Outside The Box Capital on a timely basis relevant information pertaining to the Company. The Company

also agrees to provide Outside The Box Capital with timely access to appropriate personnel. Outside The Box Capital will only use the

information provided by the Company. The Company hereby grants Outside The Box Capital the right to use the name and service marks of

the Company in its Marketing Services as long as this Agreement is continuing under the Initial Period (as defined below) or any Renewal

Term (as defined below) and has not been terminated in accordance with the provisions hereof.

(b)

Outside The Box Capital will be entitled to rely upon the information provided by the Company and all other information that the Company

files with applicable regulators. Outside The Box Capital will be under no obligation to verify independently any such information. Outside

The Box Capital will also be under no obligation to determine whether there have been, or to investigate any changes in, such information.

However, any marketing materials shall be provided to the Company for review and approval prior to such marketing materials being published

or disseminated to anyone.

The

term of this Agreement shall commence on the Effective Date until the End Date overall being the Initial Period. During the Initial

Period, the parties may terminate this Agreement by mutual consent and either may terminate this Agreement if the other party files

for bankruptcy or becomes insolvent under U.S. or Canadian law, or is in material breach of this Agreement. The Company shall pay

Outside The Box Capital for all services performed up to and including the effective date of termination. Within ten (10) days after

the termination or expiration of this Agreement, each party shall return to the other all Proprietary or Confidential Information

(defined below) of the other party (and any copies thereof) in the party’s possession or, with the approval of the party, destroy

all such Proprietary or Confidential Information.

The parties agree to hold each

other’s Proprietary or Confidential Information in strict confidence. “Proprietary or Confidential Information” shall include,

but is not limited to, written or oral contracts, trade secrets, know-how, business methods, business policies, memoranda, reports, records,

computer-retained information, notes, or financial information. Proprietary or Confidential Information shall not include any information

which: (i) is or becomes generally known to the public by any means other than a breach of the obligations of the receiving party; (ii)

was previously known to the receiving party or rightly received by the receiving party from a third party that was not subject to a duty

of confidentiality to the disclosing party; (iii) is independently developed by the receiving party as shown by the receiving party’s

then-contemporaneous written files and records kept in the ordinary course of business; or (iv) is subject to disclosure under a court

order or other lawful processes. The parties agree not to make each other’s Proprietary or Confidential Information available in any form

to any third party or to use each other’s Proprietary or Confidential Information for any purpose other than as specified in this Agreement.

Each party’s Proprietary or Confidential Information shall remain the sole and exclusive property of that party. The parties agree that

in the event of use or disclosure by the other party other than as specifically provided for in this Agreement, the non-disclosing party

may be entitled to equitable relief. Notwithstanding termination or expiration of this Agreement, Outside The Box Capital and the Company

acknowledge and agree that their obligations of confidentiality with respect to Proprietary or Confidential Information shall survive

termination of this Agreement.

Outside The Box Capital hereby covenants to comply with

all applicable laws and regulations, including the United States, and including SEC and FTC regulations.

Outside The Box Capital shall hereby agrees to indemnify,

defend and hold harmless the Company and its respective Affiliates, officers, directors, agents and employees from and against any and

all losses, liabilities, damages, liens, claims, obligations, judgments, penalties, deficiencies, costs and expenses (including reasonable

attorneys’ fees and court costs) to the extent resulting from or arising out of any negligence or breach or omission of performance

by Outside The Box Capital of any of the representations, covenants, warranties, or otherwise.

For the Initial Term, Company agrees to pay Outside

The Box Capital the compensation set forth in Schedule A attached hereto, which Schedule A forms part of this Agreement.

In

the occasion where the Company requests Outside The Box Capital to travel, outside of the agreement, upon mutual agreement outside

of this agreement Outside The Box Capital shall also be reimbursed for all direct, pre-approved, and reasonable expenses actually

and properly incurred by Outside The Box Capital in performing the Marketing Services (collectively, the

“Expenses”); and which Expenses, it is hereby acknowledged and agreed, shall be payable by the Company to the

order, direction and account of Outside The Box Capital as Outside The Box Capital may designate in writing, from time to time, in

Outside The Box Capital’ sole and absolute discretion, as soon as conveniently possible after the prior delivery by Outside

The Box Capital to the Company of written substantiation on account of each such pre-approved reimbursable Expense.

Notices under this Agreement

are sufficient if given by nationally recognized overnight courier service, certified mail (return receipt requested), or personal delivery

to the other party at the addresses first set out above along with a copy via email to legal@mawsoninc.com.

All disputes arising under this

Agreement which cannot amicably be resolved between the parties, shall be submitted to arbitration in the State of Pennsylvania of the

United States before a single arbitrator of the American Arbitration Association (“AAA”). The arbitrator shall be selected

by application of the rules of the AAA, or by mutual agreement of the parties. Nothing contained herein shall prevent the Party from seeking

or obtaining an injunction in a court of the Relevant Jurisdiction. No Party to this Agreement will challenge the jurisdiction or venue

provisions as provided in this Agreement. EACH PARTY HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY

IN ANY ACTION, SUIT, PROCEEDING OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY,

WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY.

| 11. | Choice of Law and Jurisdiction |

This Agreement

shall be governed by and interpreted and enforced in accordance with the laws of the State of Pennsylvania of the United States.

The failure of any party to seek

redress for violation of or to insist upon the strict performance of any agreement, covenant, or condition of this Agreement shall not

constitute a waiver with respect thereto or with respect to any subsequent act.

Except as may be necessary for

the rendition of the services as provided herein, neither Outside The Box Capital nor Company may assign any part or all of this Agreement,

or subcontract or delegate any of their respective rights or obligations under this Agreement, without the other party’s prior written

consent. Any attempt to assign, subcontract, or delegate in violation of this paragraph is void in each instance.

[the rest of this page intentionally

left blank]

This Agreement and the schedules

attached constitute the agreement between Outside The Box Capital and Company relating to the subject matter hereof and supersede any

prior agreement or understanding between them. This Agreement may not be modified or amended unless such modification or amendment is

agreed to in writing by both Outside The Box Capital and the Company.

This Agreement may be executed

in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

Photocopied, electronic, or digital copies of signatures shall be deemed to be originals for purposes of the effectiveness of this Agreement.

Please confirm that the foregoing

is in accordance with Company’s understanding by signing and returning this Agreement, which will thereupon constitute a binding

Agreement between Outside The Box Capital Inc. and Company. This Agreement may be executed in counterparts and with electronic or facsimile

signatures.

| Yours very truly, |

|

| |

|

|

| Outside The Box Capital Inc. |

|

| |

|

| By: |

/s/ Jason Coles |

|

| Name: |

Jason Coles |

|

| Title: |

CEO |

|

The foregoing is in accordance with our understanding

and is accepted and agreed upon by us as of the date first written above.

| Mawson Infrastructure Group Inc. |

|

| | |

|

| By: | /s/ Kaliste Saloom |

|

| | Name: |

Kaliste Saloom |

|

| Title: |

General Counsel |

|

SCHEDULE

“A”

COMPENSATION

For the Initial Period, in

consideration of the performance of the services by Outside The Box Capital pursuant to the Agreement to which this Schedule A

is attached, the Company hereby agrees to compensate Outside The Box Capital as follows:

$100,000 USD worth of shares; with

the payment due within 30 days from the Effective Date. The number of shares issued will be determined based on the closing price of the

Effective Date. Such shares may have Rule 144 or such applicable rules applied, including customary holding period(s), as determined by

the Issuer.

Pursuant to Section 3 related to

Term and Termination of the Agreement, in the event this Agreement terminates early, Outside the Box Capital shall return or forfeit pro-rata

number of shares.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

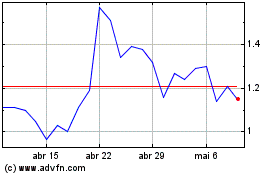

Mawson Infrastructure (NASDAQ:MIGI)

Gráfico Histórico do Ativo

De Out 2024 até Out 2024

Mawson Infrastructure (NASDAQ:MIGI)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024