0001008654false00010086542024-09-172024-09-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

September 17, 2024

Date of Report (Date of earliest event reported)

TUPPERWARE BRANDS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 1-11657 | 36-4062333 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | |

| 14901 South Orange Blossom Trail | Orlando | FL | 32837 |

| (Address of principal executive offices) | (Zip Code) |

407 826-5050

Registrant's telephone number, including area code

_________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |

| Common Stock, $0.01 par value | TUP | New York Stock Exchange | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.03 Bankruptcy or Receivership.

On September 17, 2024 (the “Petition Date”), Tupperware Brands Corporation (the “Corporation”) and certain of its direct and indirect subsidiaries (together with the Corporation, the “Debtors”) filed voluntary petitions to commence proceedings under chapter 11 (the “Chapter 11 Cases”) of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). The Debtors have requested that the Chapter 11 Cases be jointly administered under the caption “In re Tupperware Brands Corporation, et al.” The Debtors will seek to continue to operate their businesses and manage their properties as “debtors in possession” while undertaking a sale process for the Debtors’ businesses under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and the orders of the Bankruptcy Court. To this end, the Debtors are seeking approval of certain operational and administrative motions containing customary first-day relief intended to minimize the effect of bankruptcy on the Debtors’ employees, vendors, and other stakeholders, including motions seeking authority to pay employee wages and benefits, to pay certain vendors and suppliers for goods and services provided both before and after the Petition Date, and to continue honoring insurance and tax obligations as they come due. In addition, the Debtors filed with the Bankruptcy Court a motion seeking approval for the use of cash collateral.

Additional information about the Chapter 11 Cases, including access to Bankruptcy Court documents, is available online at https://dm.epiq11.com/Tupperware, a website administered by Epiq Corporate Restructuring, LLC, a third-party bankruptcy claims and noticing agent (“Epiq”), or by contacting Epiq at Tupperware@epiqglobal.com or by calling toll-free at (888) 994-6318 or +1 (971) 314‑6017 for calls originating outside of the U.S. The documents and other information on this website are not part of this Current Report and shall not be incorporated by reference herein.

Item 2.04. Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

The filing of the Chapter 11 Cases constitutes an event of default that automatically accelerated and, as applicable, increased certain obligations under the following debt instruments and agreements (collectively, the “Debt Instruments,” and each individually, a “Debt Instrument”):

•Credit Agreement, dated as of November 23, 2021 (as amended by that certain First Amendment to Credit Agreement, dated as of August 1, 2022, that certain Second Amendment to Credit Agreement, dated as of December 21, 2022, that certain Third Amendment to Credit Agreement, dated as of February 22, 2023, that certain Fourth Amendment to Credit Agreement and Limited Waiver of Borrowing Conditions, dated as of May 5, 2023, that certain Debt Restructuring Agreement, dated as of August 2, 2023, that certain Fifth Amendment to Credit Agreement dated as of October 5, 2023, that certain Sixth Amendment to Credit Agreement, dated as of December 22, 2023 and that certain Seventh Amendment to Credit Agreement and Third Amendment to Forbearance Agreement, dated as of August 12, 2024), by and among the Corporation, Tupperware Products AG, the lenders party thereto, and Wells Fargo Bank, National Association, as administrative agent.

•Bridge Loan Credit Agreement, dated as of August 12, 2024, by and among the Corporation, the guarantors party thereto, the lenders party thereto, GLAS USA LLCA, as administrative agent, and GLAS Americas LLC, as collateral agent.

Item 7.01. Regulation FD Disclosure.

Press Release

On September 17, 2024, the Corporation issued a press release in connection with the filing of the Chapter 11 Cases. A copy of the press release is attached to this Current Report as Exhibit 99.1 and is incorporated herein by reference.

Additional Information on the Chapter 11 Cases

Court filings and information about the Chapter 11 Cases can be found at a website maintained by Epiq at https://dm.epiq11.com/Tupperware or by contacting Epiq at Tupperware@epiqglobal.com or by calling toll-free at (888) 994-6318 or +1 (971) 314-6017 for calls originating outside of the U.S. The documents and other information available via website or elsewhere are not part of this Current Report and shall not be deemed incorporated herein.

The information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

Cautionary Note Regarding the Corporation’s Securities

The Corporation cautions that trading in its securities (including, without limitation, the Corporation’s common stock) during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Corporation’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Corporation’s securities in the Chapter 11 Cases. The Corporation expects that holders of shares of the Corporation’s common stock could experience a significant or complete loss on their investment, depending on the outcome of the Chapter 11 Cases.

Cautionary Statement Concerning Forward-Looking Statements

Statements in this Current Report that are not historical are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to: statements regarding the Debtors’ continued operation of the business as “debtors in possession”; the Corporation’s ability to pay for continuing obligations, including, but not limited to, employee wages, vendors, suppliers for goods, services, taxes, and insurance; and any assumptions underlying any of the foregoing. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” and “will” and variations of such words and similar expressions are intended to identify such forward-looking statements.

These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but not limited to: the Corporation’s ability to fund its planned operations and its ability to continue as a going concern; the adverse impact of the Chapter 11 Cases on the Corporation’s business, financial condition, and results of operations; the Corporation’s ability to improve its liquidity and long‑term capital structure and to address its debt service obligations; the Corporation’s ability to maintain relationships with customers, employees, and other third parties as a result of the Chapter 11 Cases; the effects of the Chapter 11 Cases on the Corporation and the interests of various constituents, including holders of the Corporation’s common stock; the Corporations’ ability to obtain court approvals with respect to motions filed or other requests made to the Bankruptcy Court throughout the course of the Chapter 11 Cases; the length of time that the Corporation will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of the Chapter 11 Cases; risk associated with third-party motions in the Chapter 11 Cases; the Corporation’s ability to maintain the listing of its common stock on The New York Stock Exchange, and the resulting impact of either (i) a delisting or (ii) remedies taken to prevent a delisting on the Corporation’s results of operations and financial condition; and other risks and uncertainties described from time to time in the Corporation’s filings with the SEC.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward‑looking statements. Accordingly, you are cautioned not to rely on these forward-looking statements, which speak only as of the date they are made. The Corporation expressly disclaims any current intention, and assumes no duty, to update publicly any forward-looking statement after the distribution of this Current Report, whether as a result of new information, future events, changes in assumptions, or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | TUPPERWARE BRANDS CORPORATION |

| | |

| | | |

| Date: | September 18, 2024 | By: | /s/ Karen M. Sheehan |

| | | Karen M. Sheehan |

| | | Executive Vice President, Chief Legal Officer & Secretary |

| | | |

Tupperware Voluntarily Initiates Chapter 11 Proceedings Company Intends to Continue Providing Customers with Award-Winning, Innovative Products through Tupperware Sales Consultants, Retail Partners and Online at Tupperware.com ORLANDO, Fla., September 17, 2024 – Tupperware Brands Corporation (“Tupperware” or the “Company”) (NYSE: TUP), an iconic global brand, today announced that the Company and certain of its subsidiaries have voluntarily initiated Chapter 11 proceedings in the United States Bankruptcy Court for the District of Delaware (the “Court”). Tupperware will seek Court approval to continue operating during the proceedings and remains focused on providing its customers with its award-winning, innovative products through Tupperware sales consultants, retail partners and online. The Company will also seek Court approval to facilitate a sale process for the business in order to protect its iconic brand and further advance Tupperware's transformation into a digital-first, technology-led company. Following the appointment of a new management team within the last year, Tupperware has implemented a strategic plan to modernize its operations, bolster omnichannel capabilities and drive efficiencies to ignite growth. The Company has made significant progress and intends to continue this important transformation work. “Whether you are a dedicated member of our Tupperware team, sell, cook with, or simply love our Tupperware products, you are a part of our Tupperware family. We plan to continue serving our valued customers with the high-quality products they love and trust throughout this process,” said Laurie Ann Goldman, President and Chief Executive Officer of Tupperware. “Over the last several years, the Company’s financial position has been severely impacted by the challenging macroeconomic environment. As a result, we explored numerous strategic options and determined this is the best path forward. This process is meant to provide us with essential flexibility as we pursue strategic alternatives to support our transformation into a digital-first, technology-led company better positioned to serve our stakeholders,” added Goldman. Additional Information There are no current changes to Tupperware’s independent sales consultant agreements. The Company will file certain customary motions seeking Court approval to support its operations during the process, including the continued payment of employee wages and benefits as well as compensating vendors and suppliers under normal terms for goods and services provided on or after the filing date. Additional information and other documents related to the proceedings are available online at https://dm.epiq11.com/Tupperware or by contacting the Company's claims agent, Epiq, at Tupperware@epiqglobal.com or by calling toll-free at (888) 994-6318 or +1 (971) 314-6017 for calls originating outside of the U.S. Kirkland & Ellis LLP is serving as legal advisor to Tupperware, Moelis & Company LLC is serving as the Company’s investment banker, and Alvarez & Marsal is serving as the Company’s financial and restructuring advisor. Cautionary Statement Concerning Forward-Looking Statements Statements in this Press Release that are not historical are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements include but are not limited to: statements regarding the Company’s continued operation of the business; the Company’s ability to pay for continuing obligations, including, but not limited to, employee wages, Exhibit 99.1

vendors, suppliers for goods, services, taxes, and insurance; and any assumptions underlying any of the foregoing. Words such as “anticipate,” “continue,” “intend,” “may,” “plan,” “should,” and “will” and variations of such words and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but are not limited to: the Company’s ability to fund its planned operations and its ability to continue as a going concern; the adverse impact of the Chapter 11 cases on the Company’s business, financial condition, and results of operations; the Company’s ability to improve its liquidity and long-term capital structure; the Company’s ability to maintain relationships with customers, employees, and other third parties as a result of the Chapter 11 cases; the effects of the Chapter 11 cases on the Company and the interests of various constituents, including holders of the Company’s common stock; the Company’s ability to obtain court approvals with respect to motions filed or other requests made to the Bankruptcy Court throughout the course of the Chapter 11 cases; risk associated with third-party motions in the Chapter 11 cases; and other risks and uncertainties described from time to time in the Company’s filings with the SEC. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to rely on these forward-looking statements, which speak only as of the date they are made. The Company expressly disclaims any current intention, and assumes no duty, to update publicly any forward-looking statement after the distribution of this Press Release, whether as a result of new information, future events, changes in assumptions, or otherwise. About Tupperware Brands Corporation Tupperware Brands Corporation, the company that invented a solution to food waste, empowers female entrepreneurship through social selling and made the home party famous, is as relevant today as when it was founded in 1946. Tupperware is a leading designer, manufacturer, and distributor of authentic, high- quality and ingeniously innovative products that people love and trust. The Tupperware® brand became a part of the fabric of Americana and is famous around the globe. For more information, visit Tupperwarebrands.com or follow Tupperware on Facebook, Instagram, LinkedIn and Twitter. Media Contacts: Tupperware media@Tupperware.com Edelman Smithfield TupperwareBrands@EdelmanSmithfield.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

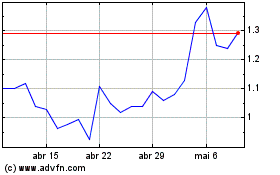

Tupperware Brands (NYSE:TUP)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Tupperware Brands (NYSE:TUP)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025