Meta Platforms (NASDAQ:META) – Meta could face

a significant fine from the European Union for attempting to

dominate the classifieds ad market. Regulators allege the company

links its Marketplace services to Facebook to disadvantage

competitors. The decision may be announced next month, under the

supervision of Margrethe Vestager. Additionally, Meta is

introducing privacy controls for Instagram accounts of users under

18, making them private by default. Only followed accounts can

interact, and users under 16 will need parental permission to

change settings. Usage limits and notifications will also be

implemented. Shares fell 0.2% in pre-market trading after closing

up 0.6% on Tuesday.

Snap Inc (NYSE:SNAP) – Snap launched an updated

version of its augmented reality glasses, Spectacles, betting that

wearable devices will be the next technological frontier. The new

generation, equipped with Snap OS, enhances user interaction and

will initially be available to developers for $99 per month.

Meanwhile, the company faces challenges in the digital advertising

market but believes augmented reality can create new demand.

Additionally, Snap revamped its Snapchat app, introducing a new

algorithm to rank and recommend video content, aiming to compete

with TikTok and Instagram. The update unifies video feeds and

highlights the camera and messaging. According to Bloomberg, the

company is investing $1.5 billion in artificial intelligence

technologies to enhance user experience. Shares closed down 2.3% on

Tuesday.

Alphabet (NASDAQ:GOOGL) – Google overturned a

$1.7 billion (€1.5 billion) European Union fine for

anti-competitive practices in online ads, after the EU’s General

Court found regulatory errors in the investigation. This decision,

however, may be appealed. The victory follows Google’s recent

defeat in a separate antitrust case, where it was fined €2.4

billion. Shares rose 0.5% in pre-market trading after closing up

0.8% on Tuesday.

Amazon (NASDAQ:AMZN) – Amazon appointed Samir

Kumar as its new head in India, replacing Manish Tiwary, who

stepped down after eight years. Kumar, a company veteran, will take

over on October 1st and will also lead consumer businesses in

several regions. The change comes as Amazon plans to invest $26

billion in India by 2030, facing a challenging regulatory

environment. Shares fell 0.1% in pre-market trading after closing

up 1.1% on Tuesday.

Nvidia (NASDAQ:NVDA) – Nvidia shares dropped 1%

on Tuesday despite strong demand signals for its next-generation

chips in the Asian supply chain. The decline followed disappointing

sales guidance last month, although analysts remain optimistic

about growth potential with the new NV systems. Shares fell 0.4% in

pre-market trading.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – TSMC’s new chip factories in Kyushu drove the biggest

land price increases in Japan for the second consecutive year. In

Ozu, near the factories, prices rose 33.3%, far above the national

average of 3.4%. The increase reflects Japan’s economic recovery.

Shares rose 0.3% in pre-market trading after closing down 1% on

Tuesday.

Electronic Arts (NASDAQ:EA) – Electronic Arts

(EA) unveiled its annual bookings forecast and announced a new

“Battlefield” title, returning to modern settings. The company

expects bookings between $7.30 billion and $7.70 billion for 2025

and will launch an “EA Sports” app to engage fans. EA will also

produce a film based on “The Sims.” Shares were little changed in

pre-market trading after closing down 2.7% on Tuesday.

Sony Group (NYSE:SONY) – Sony is exploring

blockchain technology with the launch of Soneium, a digital ledger

to power applications in gaming, music, and film. Other Japanese

companies, such as Toyota and Mitsubishi UFJ, are also investing in

the technology. However, Japan’s strict regulation poses a

challenge for the sector. Shares closed down 2.8% on Tuesday.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media & Technology Group shares fell 6.6% on Tuesday

ahead of the expiration of insider trading restrictions. The stock

had jumped 12% on Friday after Trump stated he wouldn’t sell his

$1.9 billion stake. The company’s market capitalization is $3.19

billion, with shares worth about $16.14, down about 75% since

March. Shares rose 1.7% in pre-market trading.

AT&T (NYSE:T) – AT&T agreed to pay $13

million to settle a Federal Communications Commission (FCC)

investigation into a data breach affecting 8.9 million customers.

The company pledged to improve its data governance practices after

exposing account information, though sensitive data was not

compromised. Shares fell 0.3% in pre-market trading after closing

down 2.2% on Tuesday.

Uber Technologies (NYSE:UBER) – Uber is

introducing features to enhance driver safety, including a

“verified” badge on passenger profiles and the option to record

audio and video during rides using smartphones, eliminating the

need to buy vehicle cameras. The company is also testing a feature

allowing drivers to block passengers who rate them 2 or 3 stars

while maintaining its policy of not matching drivers with

passengers rated 1 star. Shares rose 0.1% in pre-market trading

after closing up 1.8% on Tuesday.

Intuitive Machines (NASDAQ:LUNR) – Intuitive

Machines secured a contract worth up to $4.82 billion with NASA for

communication and navigation services in space missions. The

contract includes deploying lunar satellites to support the Artemis

campaign, which aims to send astronauts to the Moon. Shares jumped

42.8% in pre-market trading after closing down 5.6% on Tuesday.

Boeing (NYSE:BA) – Boeing and its largest union

will resume negotiations on Wednesday with mediators after failing

to agree on wages and pensions. The union is demanding a 40% pay

raise over four years, rejecting Boeing’s offer of 25%. The strike

has halted production of key jet models. Shares remained flat in

pre-market trading after closing up 0.5% on Tuesday.

Southwest Airlines (NYSE:LUV) – Elliott

Investment Management, which owns 10% of Southwest Airlines shares,

is seeking to replace CEO Robert Jordan and Chairman Gary Kelly,

despite the carrier announcing board changes. According to Reuters,

the investor met with the mechanics’ union, insisting on new

leadership to improve the airline’s competitiveness.

Alaska Air Group (NYSE:ALK), Hawaiian

Holdings (NASDAQ:HA) – The U.S. Department of

Transportation approved Alaska Airlines’ $1.9 billion acquisition

of Hawaiian Airlines, provided both maintain key routes and

consumer protections. The deal, which aims to preserve passenger

rewards and competitive access, will close on Wednesday after

detailed negotiations.

General Motors (NYSE:GM) – Canadian union

Unifor extended its negotiations deadline with General Motors,

avoiding a strike at the Ingersoll, Ontario plant that produces

electric vehicles and batteries. Though 97% of members were willing

to strike, the union did not disclose a new deadline but said talks

are ongoing.

Stellantis (NYSE:STLA) – The United Auto

Workers union plans to vote on strike authorization at Stellantis

units, which could cause significant disruptions. President Shawn

Fain criticized the company for failing to meet previous

commitments. Stellantis faces complaints about Dodge Durango

production and delays in a battery investment. CEO Carlos Tavares

said the company is taking steps to avoid factory closures, as

Volkswagen faces. He emphasized unpopular decisions were made to

sell electric vehicles at similar prices to gasoline models.

Stellantis has already cut nearly 20,000 jobs in Europe since its

formation in 2021. Shares rose 0.9% in pre-market trading after

closing down 0.6% on Tuesday.

Carvana (NYSE:CVNA) – BofA Securities analysts

gave a buy rating for Carvana shares, predicting sustainable growth

in the $800 billion used car market. They expect supply recovery

and lower interest rates to boost sales, setting a price target of

$185. However, risks include the company’s high debt and heavy

investment needs. Carvana shares have nearly tripled this year,

outperforming the S&P 500.

Blink Charging (NASDAQ:BLNK) – Blink Charging

announced layoffs of about 14% of its global workforce to cut costs

due to weak demand for electric vehicle chargers. The layoffs,

expected to save about $9 million annually, will be completed by

the first quarter of 2025. Shares rose 5% on Tuesday.

SolarEdge (NASDAQ:SEDG) – SolarEdge faces

competition and leadership challenges, as noted by Jefferies. After

the RE+ 24 event, the company was downgraded from “Hold” to

“Underperform,” with the price target lowered from $27 to $17. The

lack of clear leadership and strong competition are concerns.

Shares have fallen 76% this year. Shares fell 0.3% in pre-market

trading after closing up 2.6% on Tuesday.

US Steel (NYSE:X) – The U.S. national security

panel delayed a decision on Nippon Steel’s $14.9 billion bid for US

Steel, allowing the companies to resubmit the approval request.

This extension provides hope amid national security and steel

supply chain concerns. The new review could take up to 90 days,

beyond the November elections. Shares rose 3.2% in pre-market

trading after closing down 0.4% on Tuesday.

Chevron (NYSE:CVX) – Chevron CEO Michael Wirth

criticized the Biden administration’s policies, saying they target

the natural gas industry. Wirth defended the critical role of

Permian gas in meeting the growing energy demand from artificial

intelligence, emphasizing that replacing coal with gas could

significantly reduce carbon emissions.

Diamondback Energy (NASDAQ:FANG) – Diamondback

Energy is considering using some of its natural gas to generate

electricity for drilling and hydraulic fracturing. The company is

exploring alternatives to grid electricity, which can be unstable.

Additionally, it signed a deal with Oklo to explore small nuclear

reactors for its electricity needs.

Nucor (NYSE:NUE) – Nucor expects a profit

decline for the third quarter, forecasting earnings between $1.30

and $1.40 per share, down from $2.68 in the second quarter. This

reduction is driven by lower average steel prices. Nucor’s shares

have fallen 17% this year.

Newmont Corp. (NYSE:NEM) – Newmont plans to

raise up to $2 billion by selling smaller mines and projects.

Following its acquisition of Newcrest Mining, the company is

focusing on high-performing assets like the Akyem mine in Ghana,

which is already in advanced stages of sale. Shares fell 0.2% in

pre-market trading after closing down 0.04% on Tuesday.

BlackRock (NYSE:BLK),

Microsoft (NASDAQ:MSFT) – BlackRock and Microsoft

plan to create a fund exceeding $30 billion to invest in artificial

intelligence infrastructure, including data centers and energy

projects. The Global AI Infrastructure Investment Partnership aims

to strengthen AI supply chains and mobilize up to $100 billion in

total investments. Microsoft shares rose 0.3% in pre-market trading

after closing up 0.9% on Tuesday.

JPMorgan Chase (NYSE:JPM),

Apple (NASDAQ:AAPL) – JPMorgan Chase is in talks

with Apple to become the new credit card partner, replacing Goldman

Sachs. Discussions, which began earlier this year, have progressed,

but an agreement could take months. Additionally, JPMorgan CEO

Jamie Dimon plans to travel to Africa in October to expand the

bank’s presence there, marking his first visit in seven years.

JPMorgan shares rose 0.1% in pre-market trading, while Apple shares

fell 0.3%.

KKR & Co. (NYSE:KKR) – KKR & Co. led a

$1.4 billion private credit financing for USIC Holdings, allowing

the company to repay broadly syndicated debt. The deal included a

term loan, a delayed draw loan, and a revolving loan, with leverage

of around 7 times.

Bausch Health Cos. (NYSE:BHC),

Jefferies (NYSE:JEF) – Bausch Health is

collaborating with Jefferies Financial Group to refinance part of

its debt, aiming to facilitate the anticipated spinoff of Bausch +

Lomb. The refinancing could help overcome obstacles delaying the

separation, while Bausch + Lomb is also considering a sale,

attracting interest from private equity investors.

Starbucks (NASDAQ:SBUX) – Brazilian restaurant

operator Zamp SA plans to expand Starbucks to 1,000 stores in

Brazil, significantly increasing from the current 128 locations.

Supported by Mubadala Capital, Zamp will begin the expansion in two

years, focusing on major cities and airports. The company acquired

Starbucks’ rights after SouthRock Capital’s bankruptcy. Shares fell

0.4% in pre-market trading after closing up 0.1% on Tuesday.

Philip Morris International (NYSE:PM) – Philip

Morris International (PMI) announced the sale of its asthma inhaler

manufacturer Vectura Group to Molex Asia Holdings for approximately

$198 million. CEO Jacek Olczak stated that Molex is better

positioned to lead Vectura.

Walmart (NYSE:WMT) – Walmart’s Sam’s Club

announced it would raise the average hourly wage for nearly 100,000

employees ahead of the holiday season. Starting wages will increase

from $15 to $16, with the average wage expected to exceed $19. The

new plan will take effect on November 2. Shares rose 0.1% in

pre-market trading after closing down 2.4% on Tuesday.

Kroger (NYSE:KR), Albertsons

(NYSE:ACI) – The trial over Kroger’s $25 billion proposed

acquisition of Albertsons concludes Tuesday, but legal challenges

are just beginning, with two more trials scheduled. Regulators

argue that the merger will raise prices and reduce options, while

Kroger defends that it will result in lower prices and higher

wages.

Tupperware Brands (NYSE:TUP) – Tupperware

filed for Chapter 11 bankruptcy after facing years of declining

sales and growing competition. The company, with assets between

$500 million and $1 billion, aims to sell the business while

continuing operations during the bankruptcy process. Since 2020,

Tupperware has warned of its viability in the market.

Deckers Outdoor (NYSE:DECK) – Deckers

Outdoor shares dropped on Tuesday following a six-for-one stock

split. The split was approved on September 13 and is aimed at

increasing the liquidity of the stock.

Workday (NASDAQ:WDAY) – Workday announced

the acquisition of Evisort, a document intelligence company,

allowing its clients to use AI to analyze data within its finance

and HR solutions. While the price was not disclosed, the

transaction is expected to close by October 31. Shares rose 0.3% in

pre-market trading after closing down 0.4% on Tuesday.

Novo Nordisk (NYSE:NVO) – Danish

pharmaceutical company Novo Nordisk believes its diabetes drug

Ozempic is “very likely” to be included in the U.S. government’s

price negotiations by 2027. The Inflation Reduction Act of 2022

allows Medicare to negotiate the prices of expensive drugs,

benefiting millions of Americans. Senator Bernie Sanders announced

that major generic drug companies confirmed they could sell Ozempic

alternatives for less than $100 per month. Novo Nordisk CEO Lars

Jorgensen will testify next week about the high drug prices. Shares

rose 0.4% in pre-market trading after closing down 3.6% on

Tuesday.

23andMe (NASDAQ:ME) – 23andMe’s

independent directors resigned after not receiving a satisfactory

acquisition offer from CEO Anne Wojcicki. She proposed $0.40 per

share, but the directors deemed the offer insufficient and not

feasible. A special committee rejected the bid, and Wojcicki is now

open to third-party proposals. Shares dropped 6.8% in pre-market

trading after closing down 0.3% on Tuesday.

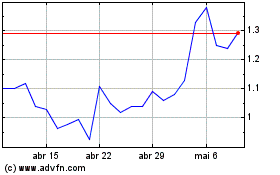

Tupperware Brands (NYSE:TUP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Tupperware Brands (NYSE:TUP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024